As part of the Visibility Leaders project, SectorWatch is ready for takeoff. In this report we explore the search market for popular travel products. We’re mapping out the search result terrain to spot brands whose SEO approach is taking flight. Who’s jetting ahead to claim top rankings? And who’s stuck on the runway, missing their connection to success? Fasten your seatbelts as we unpack who is cruising to success, and who needs to rethink before boarding.

- The top domains in the UK for travel products

- Top 20 domains for commercial/transactional (‘do’) searches for travel products:

- Travel Products Leaders Tracker

- What’s trending in the popular travel products search market?

- The top URLs for travel products

- Content examples: What type of content is performing?

- High-performance content examples

- Summary

- Keyword research in the travel products sector

- Our SectorWatch process

- Curated keyword set and sector click potential

The 14-day SISTRIX Free Trial will allow you to start your own Amazon and Google brand, product and domain research with SISTRIX data.

All our travel-related data, reports and trackers can be found on our travel pages.

According to ABTA’s Holiday Habits survey, more than 84% of Britons embarked on at least one holiday in 2023, with more than half of those trips heading abroad.

UK residents made 55.5 million holiday trips in 2023. With the UK showing such wanderlust, it’s no surprise that the online market for travel products is huge.

The UK luggage market alone was valued at around $1.3 billion in 2024 (a rise of nearly 8%), boosted by consumers eager to update everything from carry-ons to beach gear. An estimated 54% of all UK luggage and bag retail sales occur online, with the humble suitcase even becoming a fashion must-have a couple of years ago. Much of this demand is met online, making it a competitive sector.

As we approach peak holiday season in the UK and start planning what we need, which domains are going places and who has forgotten their passport to ranking?

The top domains in the UK for travel products

We’ve analysed over 2,000 UK search results for popular travel products. These are a representative sample of searches made in the transactional part of the search journey.

So, whose content is travelling first-class? Based on our sample of some of the most popular ‘do’ (transactional or commercial) searches in the travel products search market, here are the winning domains:

Do searches:

- amazon.com

- argos.co.uk

- boots.com

Top 20 domains for commercial/transactional (‘do’) searches for travel products:

| # | Domain | Project Visibility Index |

|---|---|---|

| 1 | amazon.co.uk | 1140.95 |

| 2 | argos.co.uk | 309.9 |

| 3 | boots.com | 277.52 |

| 4 | johnlewis.com | 236.17 |

| 5 | ebay.co.uk | 209.32 |

| 6 | travelandleisure.com | 193.29 |

| 7 | itluggage.com | 176.49 |

| 8 | superdrug.com | 146.4 |

| 9 | katieloxton.com | 133.74 |

| 10 | nytimes.com | 125.5 |

| 11 | tkmaxx.com | 119.95 |

| 12 | telegraph.co.uk | 119.94 |

| 13 | etsy.com | 117.8 |

| 14 | reddit.com | 117.15 |

| 15 | tripp.co.uk | 104.79 |

| 16 | luggagesuperstore.co.uk | 89.93 |

| 17 | next.co.uk | 88.81 |

| 18 | antler.co.uk | 88.55 |

| 19 | asos.com | 86.73 |

| 20 | sportsdirect.com | 82.3 |

Travel Products Leaders Tracker

The sector visibility tracker is evaluated using the keyword set in this report. The chart updates automatically every week.

What’s trending in the popular travel products search market?

By diving into our curated keywords and TrendWatch data, we can track the pulse of travel product search demand. With our compass set for seasonal trends, we’re charting the rising tides of queries trending up in demand over recent months or multi-year horizons.

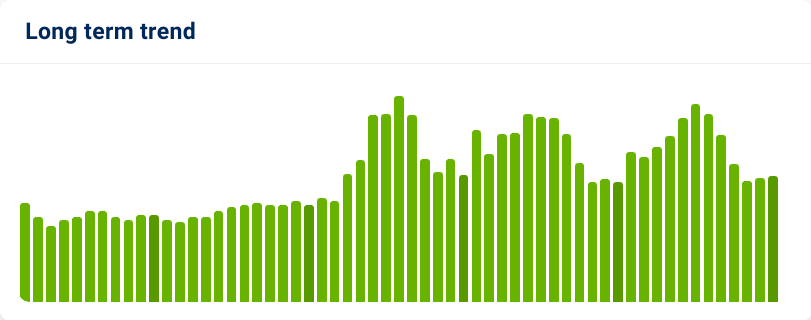

We can see from the trend data for our keyword set that searches for popular holiday products are becoming more common. There’s a light upward trend:

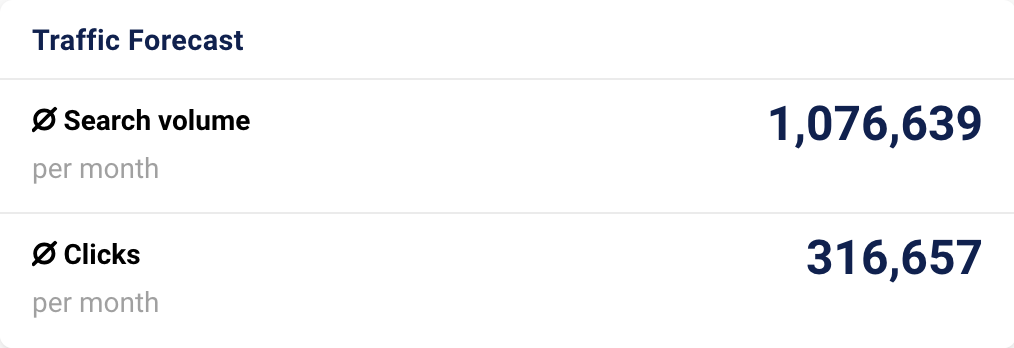

Monthly average search volume for the keyword set (12 months to April 2025) is 1042464 with peaks at over 1.4m.

AI Overview boxes appear in the search for 0.3 percent of the selected keywords, which is an indication of the strong commercial intent for this keyword set. Over 60% of SERPs for the keywords in the set are currently showing a products box.

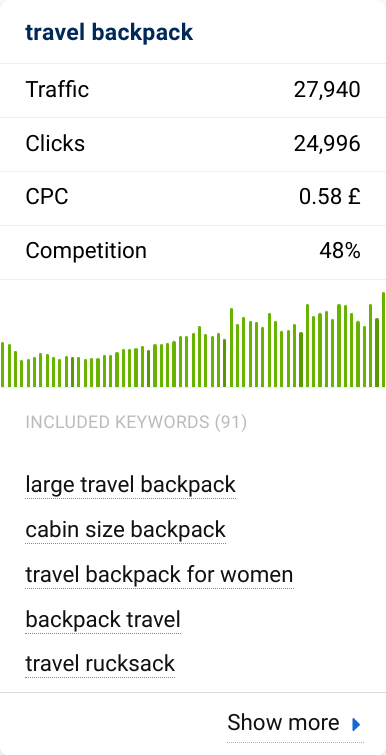

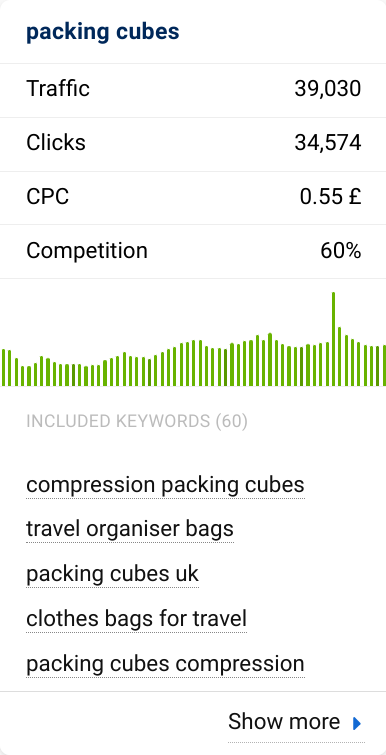

Here are some of the queries contributing most to that upwards trend:

- flight socks

- cabin bag / cabin bags (and multiple variants such as ‘wheel cabin bag’)

- travel backpack

- luggage straps for suitcases/luggage straps

- neck support pillow

- euro to uk adaptor plug

- us to uk plug adapter

- under-seat cabin bag / under-seat bag

- beach bag with zip

- travel pillows uk

- travel bag with vacuum

- traveller luggage

- american plug adapter

- packing cubes compression

Many of these topics have multiple keyword variants trending upwards recently with the same user intent. If you’d like insight into more search trends and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for travel products

To chart the digital terrain of travel products, we packed our SEO suitcase with a comprehensive SISTRIX keyword list. We curated 2,131 keywords with a ‘do’ (commercial or transactional) intent, mapping out some of the top products travellers search to buy.

SISTRIX’s keyword reports are like a GPS for digital marketers, providing a roadmap of insights. These reports reveal the top-performing competitors, traffic forecasts (both of which we’ll unpack later in the article), and the standout individual pages that are navigating the search rankings with precision. Here’s a list of the top digital luggage sites are using to reach these customers:

| # | URL | Top Keyword | Top 10 |

|---|---|---|---|

| 1 | https://www.tkmaxx.com/uk/en/home/hobbies+leisure/luggage+travel-accessories/travel-bags/c/04100202 | travel bag | 140 |

| 2 | https://katieloxton.com/bags/weekend-bags | weekend bag | 79 |

| 3 | https://www.johnlewis.com/browse/sport-leisure/suitcases-bags-accessories/holdalls/_/N-et8 | weekend bag | 98 |

| 4 | https://www.asos.com/women/bags-purses/travel-bags/cat/?cid=15722 | travel bag | 85 |

| 5 | https://www.telegraph.co.uk/recommended/leisure/travel/best-travel-pillow/ | neck pillow | 61 |

| 6 | https://www.argos.co.uk/browse/sports-and-leisure/bags-luggage-and-travel/cabin-luggage/c:30492/ | cabin suitcase | 84 |

| 7 | https://itluggage.com/ | luggage | 60 |

| 8 | https://katieloxton.com/travel/passport-covers-holders | passport cover | 53 |

| 9 | https://www.telegraph.co.uk/recommended/leisure/travel/best-carry-on-luggage/ | cabin suitcase | 85 |

| 10 | https://itluggage.com/collections/cabin-luggage | cabin suitcase | 43 |

Content examples: What type of content is performing?

After thoroughly touring the Google search results and checking into the top travel product performers, we’ve uncovered some immediate insights on who is cleared for takeoff:

- The top performers reflect established, trusted retailers (both online and omnichannel) and specialist brands dedicated to travel gear

- Major retailers dominate rankings: it’s clear, and unsurprising, that huge online marketplaces and large multi-category retailers dominate our sample of popular travel product keywords. E-commerce giants – those offering extensive product ranges and convenient shipping – rank well, capturing consumers who are likely searching for anything from cabin luggage to travel gadgets in one go

- Amazon ranks for around 98% of our sample keyword set, and on page one for an impressive 88.98%

- eBay also ranks 89% of our keywords, showing the strength these aggregator platforms have through their breadth of choice

- Omnichannel retailers who offer a lot of the products we’ve chosen also do well. John Lewis appears for 77.2% of our keywords, and Argos for 61.4%

- Specialist luggage brands do well: Close behind are the specialist travel-luggage brands, which leverage their reputations for quality and durability. Their official websites frequently appear for generic terms, indicating good SEO execution to appear for generic searches in this space

- Despite only being able to rank for luggage and travel bag terms, it Luggage appears for 29% of our keywords and on page one 13% of the time. Competitors Tripp and Samonsite also appear regularly (33.4% and 37.95% respectively)

- Similarly, ASOS are relevant only some of the time for our keyword set, but when it is, it does well, appearing for 22.37% of our keywords and on page one for almost 8.5%

- Some space for publishers and affiliates: Despite our keyword set being very transaction-focused, Google clearly likes to include some round-up articles and reviews amongst the retailers. Noted publishers such as the New York Times and The Telegraph, or travel publications like CN Traveller, offer in-depth knowledge and trustworthy reviews. These sites succeed with buying guides and comparison lists, which can be especially useful for shoppers still looking for extra information before settling on their perfect travel gear.

- The NY Times, Telegraph and Independent each appear for over 800 of our keywords, showing how targeting commercial research topics can still get you traffic for transactional queries

High-performance content examples

Locating the winning domains is only part of the story. We want to unpack their secrets to success. We’ve scanned the travel search terrain to reveal the map to content success.

We’re diving into the most exciting part: tracking down the high-performing content formats that are jet-setting to Google’s first page. These are content examples such as pages, directories or templates which consistently rank on page one, proving they’re the real deal across our curated list and the wider search market.

By breaking down these star performers, we’ll uncover what content we can make that will take flight with Google’s algorithm.

It won’t surprise anyone to find Amazon at the top of our leaderboard.

This sector – popular travel products – consists of a broad range of product types. As Amazon offers all of them, from cabin luggage to travel sickness remedies, they can rank for all the keywords in our sample set.

Other sites with a comprehensive range of products, such as Argos and John Lewis, also have sky-high visibility. Their vast inventory gives them a near-ubiquitous presence in the rankings for these travel necessities.

Argos, the British omnichannel retailer which operates both online and via over 700 stores, is often touted as the best-placed UK business to challenge Amazon. It can’t do this directly, but with its store and delivery network, large product range and scale, it offers a viable alternative for UK shoppers.

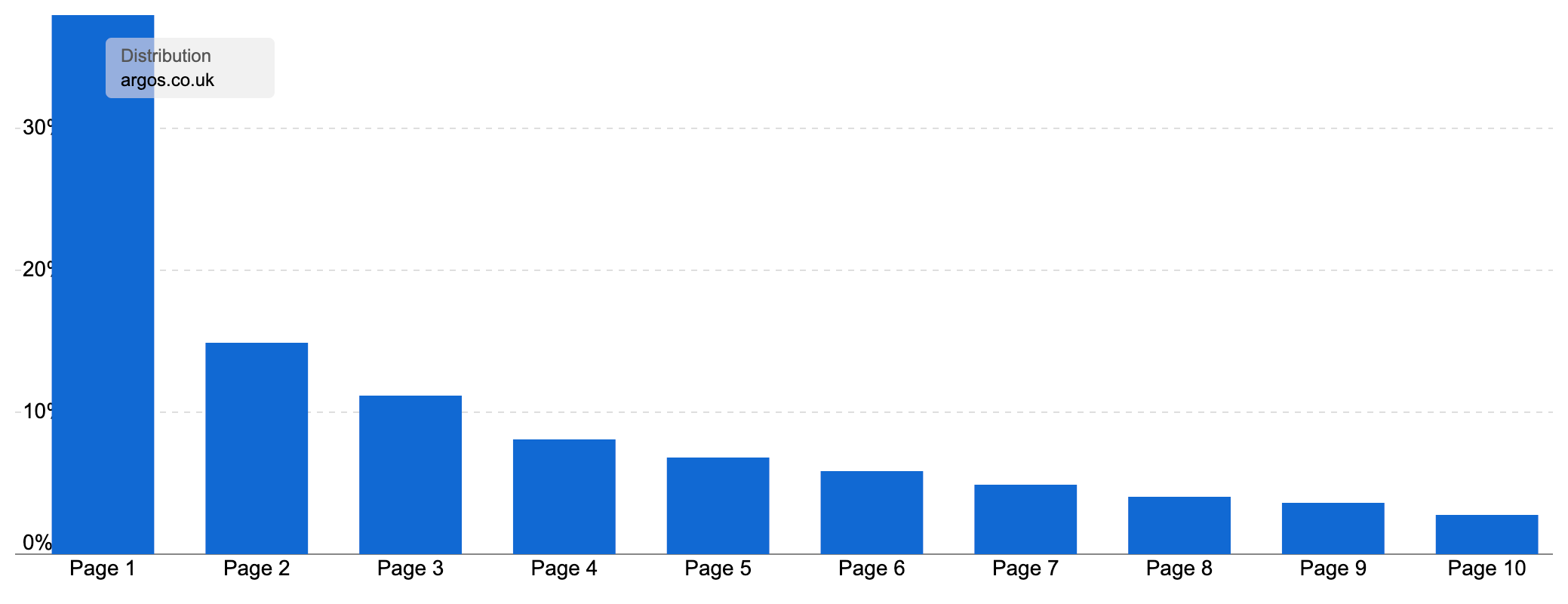

And it is certainly competing for our travel product keywords, ranking for 61.4% of them (1,309 keywords) and on page one 32.5% of the time (693 page one rankings).

While Argos doesn’t sell every product we’ve chosen for our sample list, it offers most of them. Google trusts the brand and its shopping experience, putting it on page one a third of the time.

This isn’t the first time we’ve seen Argos doing well. They’ve appeared on the podium in multiple sectors we’ve studied, including TVs and fitness trackers. They’ve also regularly been in the top twenty for a veritable bucket of ecommerce topics.

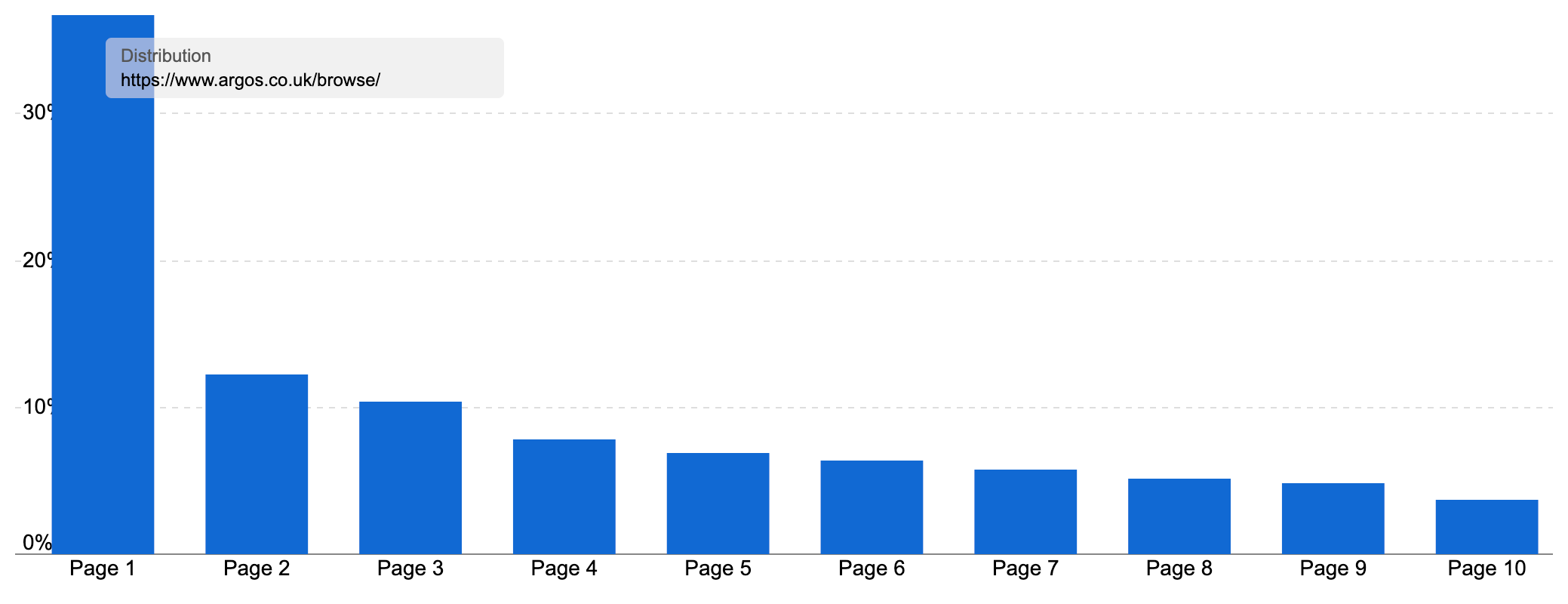

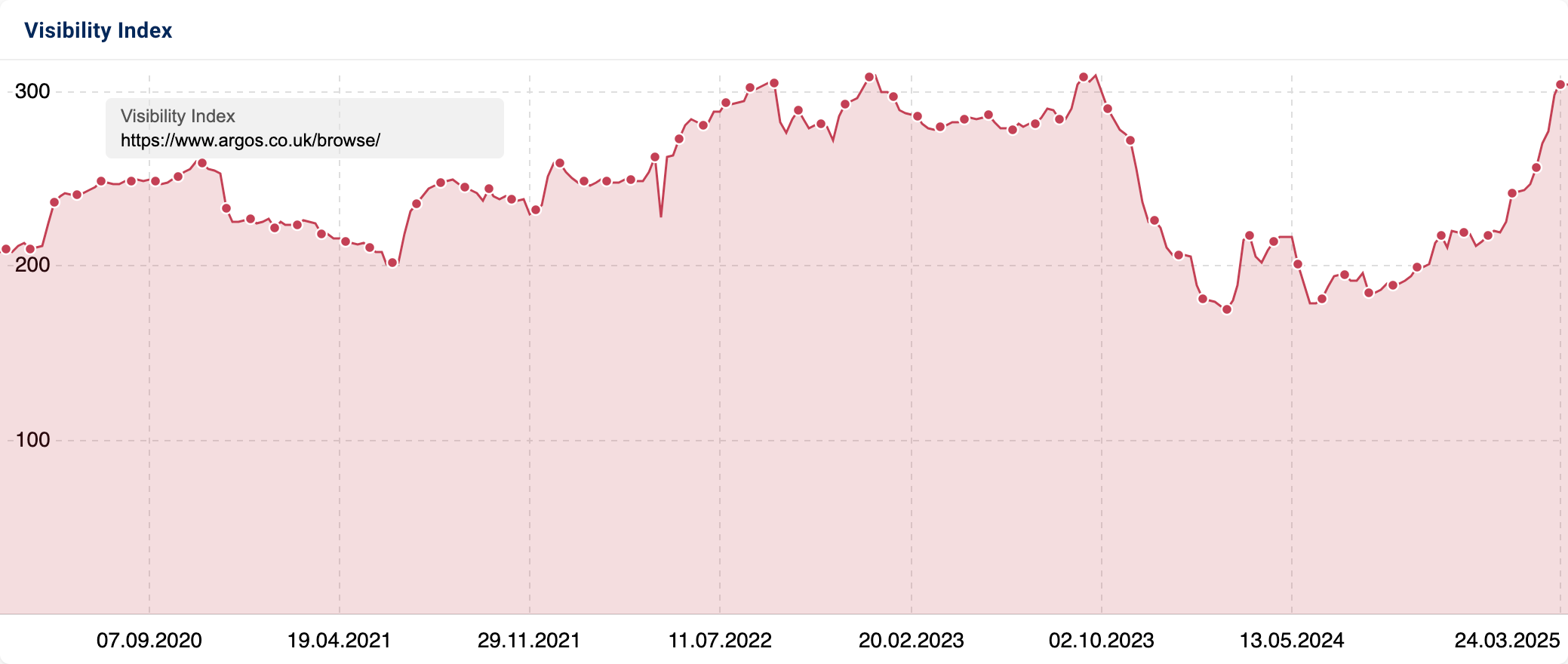

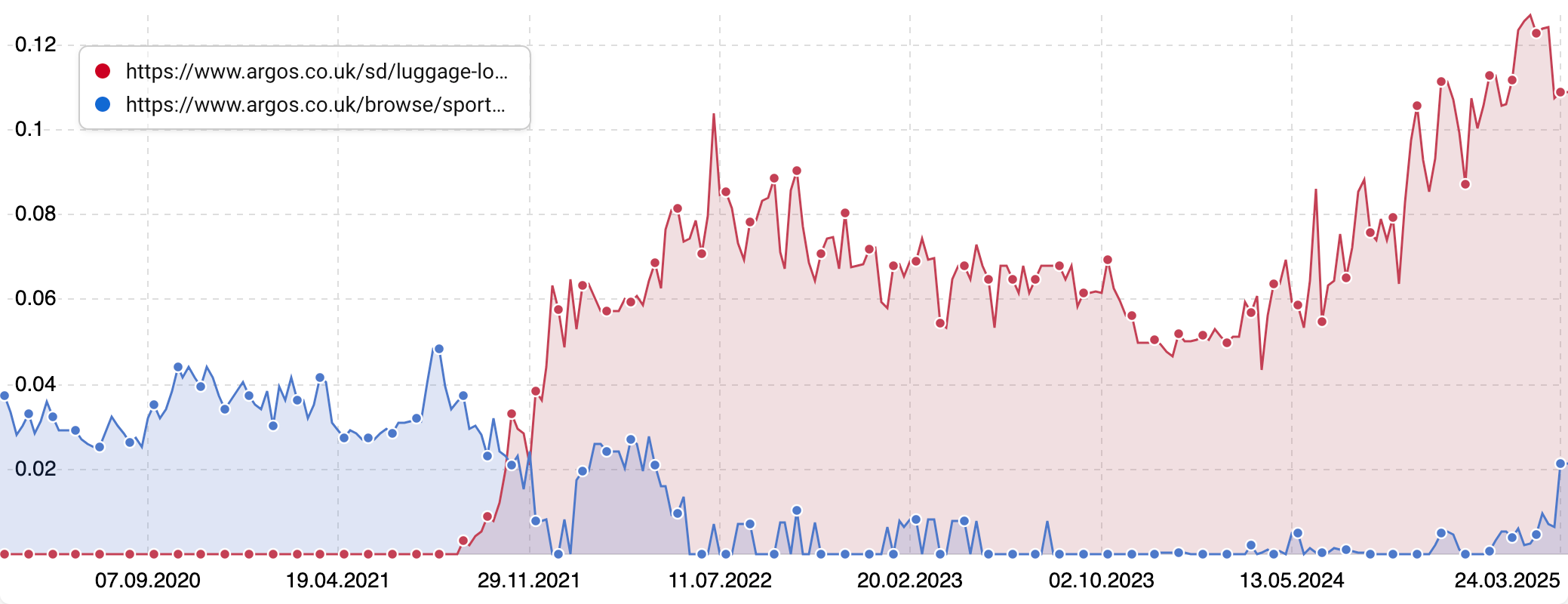

Argos ranks with pages from two directories – /browse/ and /sd/.

The /browse/ directory is home ot Argos’ product listing pages or PLPs. These are often the most powerful pages for ecommerce stores, ranking for product type queries such as ‘cabin size luggage’ (searched for 900 times a month on average in the UK).

Overall, the /browse/ directory ranks for 2.17m keywords, bringing in 10.97m organic visits a month (18.4m at peak) from Google. This traffic is worth an estimated £5.59m (if you were to try and buy it via Google Ads) and up to £9.4m at peak times.

The directory manages this as 36.72% of those keyword rankings are on page one.

This one directory has a Visibility Index score of 304.59! That would make it the 27th largest domain in the UK if it were a separate site.

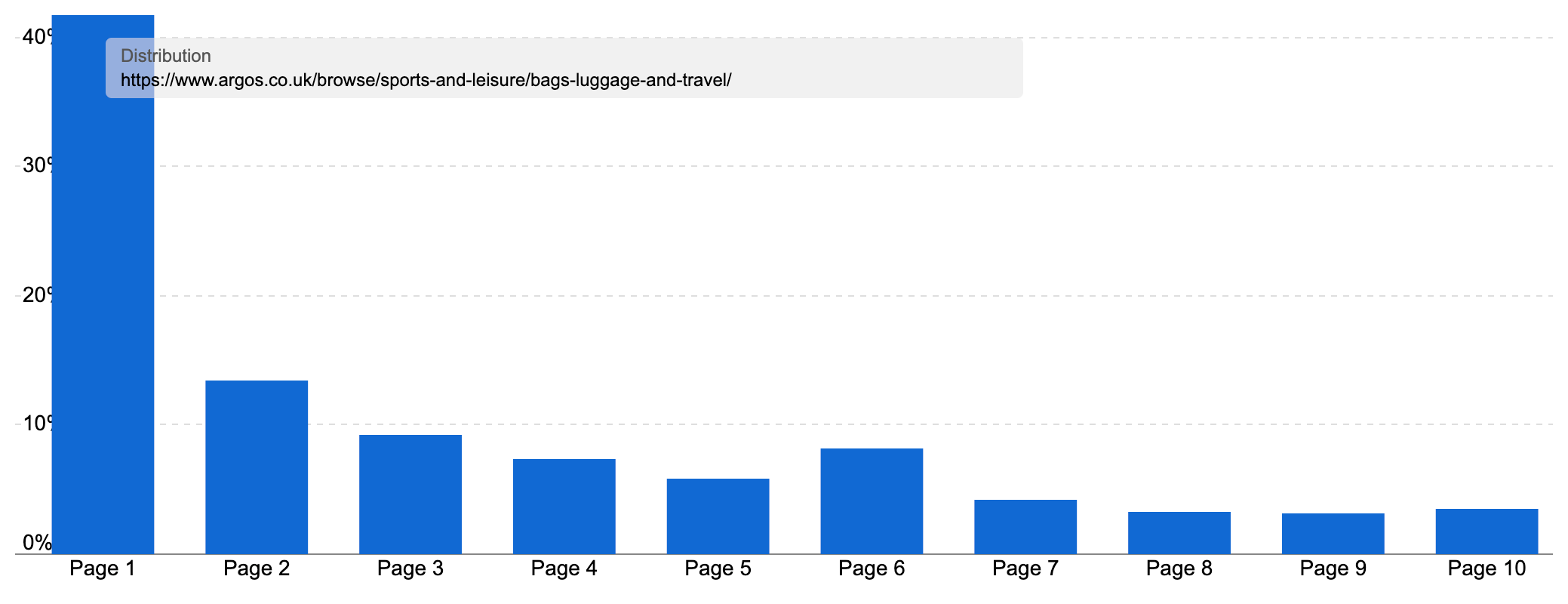

The directory has 19,788 URLs ranking for at least one keyword in the UK today at the time of writing. A strong example is the /browse/sports-and-leisure/bags-luggage-and-travel/ directory. Pages from this directory appear five times in our top 100 most visible pages for our keyword set.

Overall, this directory has a Visibility Index of 3.47, ranking for 19k keywords. 41.73% of those rankings are on page one. It brings in 138k organic visits a month, traffic worth £57k.

Recently, this directory has seen a boost before and during Google’s March 2025 Core Update, a pattern also reflected in the rest of the /browse/ directory.

The directory has 234 pages, covering every type of bag from suitcases and holdalls to gym bags.

Argos gets clever with its structure, though:

- As well as PLPs for the main product types, Argos also has pages for closely related products, such as travel adapters and luggage locks (both in our product list)

- For each main subcategory, such as suitcases or backpacks, Argos offers indexable PLPs based on important (and popular) attributes

- For example, there are 41 pages on cabin luggage, including dedicated PLPs for small cabin luggage, pink cabin luggage, cabin luggage with four wheels and cabin luggage by brand

- Argos also has indexable pages combining these attributes, such as /browse/sports-and-leisure/bags-luggage-and-travel/cabin-luggage/c:30492/brands:it-luggage/size:small/, which is an indexable PLP for small cabin luggage by IT Luggage

- Argos then repeat this across all the bag types. This structure helps Argos rank for a wide range of long-tail keywords across the topic

- We should also note that Argos have a ‘Luggage & Travel’ section in their main navigation under ‘Sports & Leisure’, offering prominent site-wide links to key pages such as suitcases, cabin luggage and holdalls

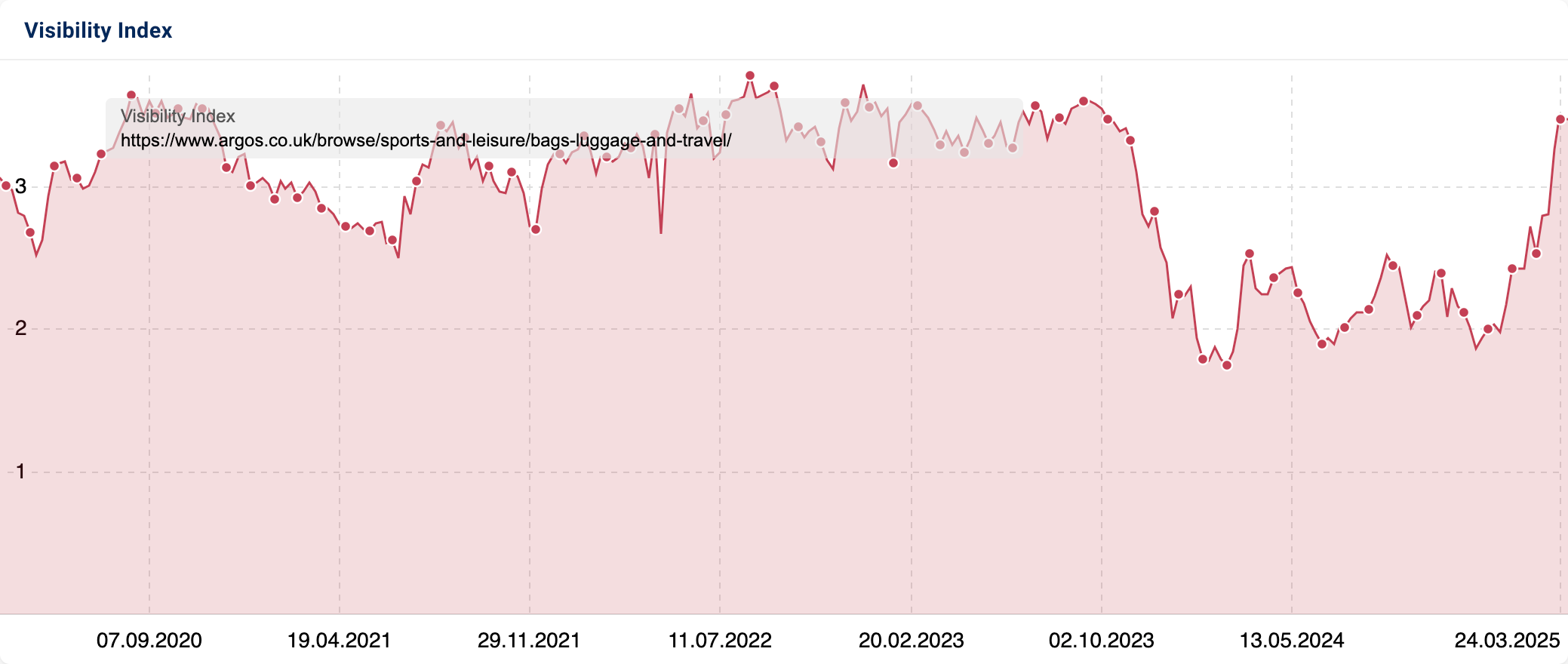

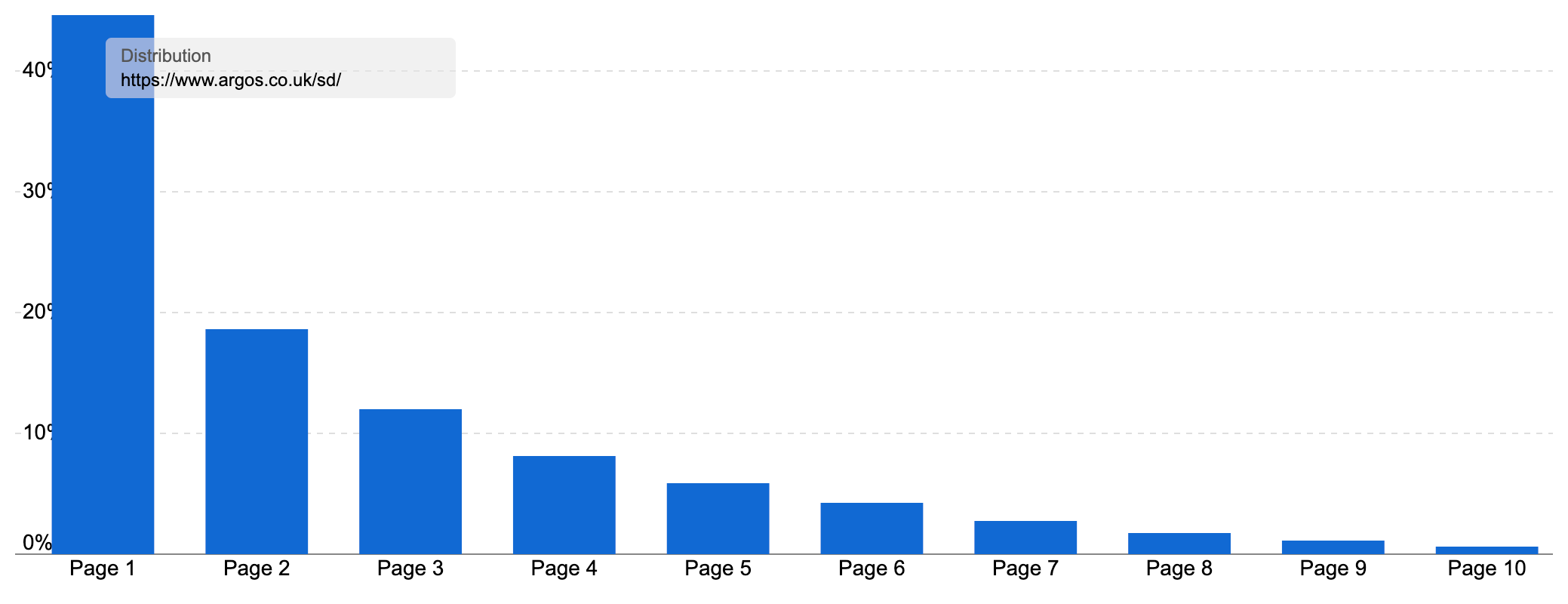

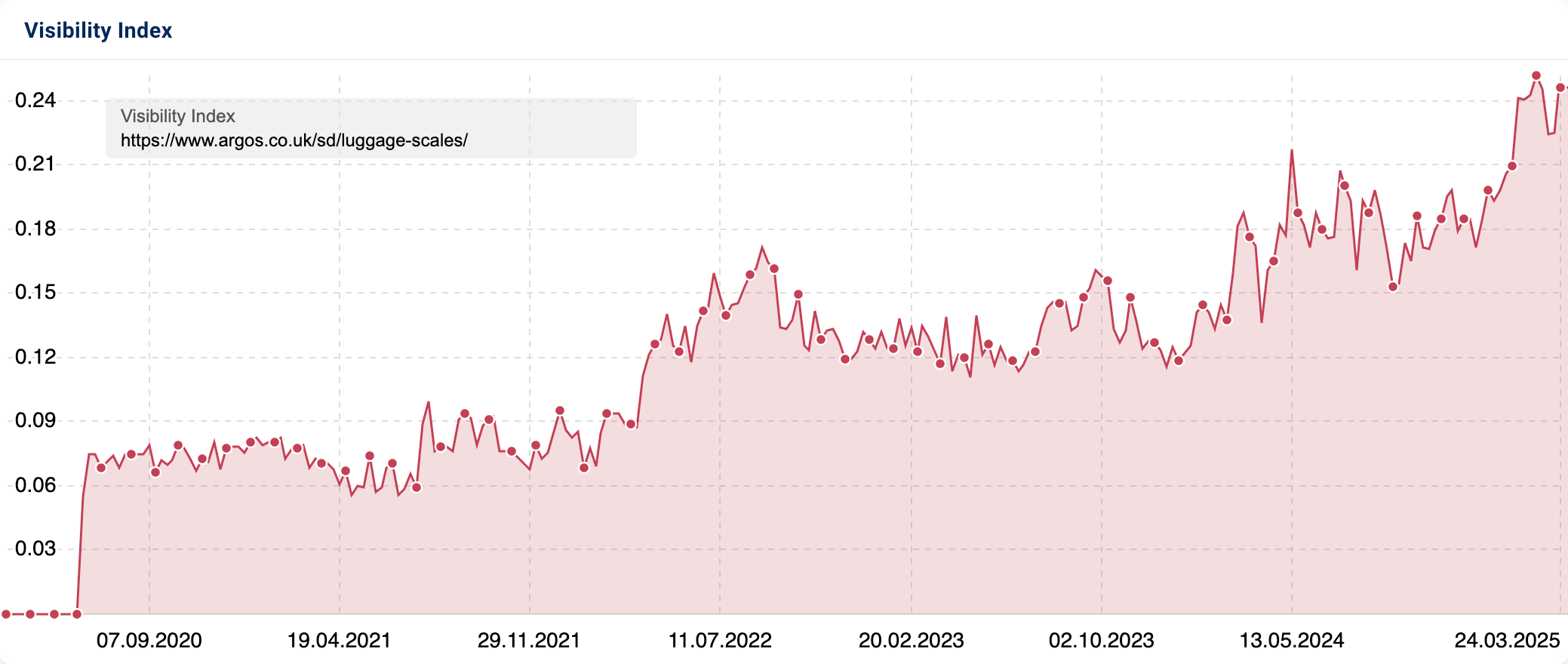

It is not only the /browse section doing well – the /sd/ directory is also huge.

This ranks for 1.1 million keywords and on page one over 40% of the time, bringing in over 4.5m visits a month, worth over £1.78m. 15,113 URLs from the directory are ranking for at least one keyword today.

If we look at our sample set, we see only a couple of pages among our top 200 URLs. However, they are notably successful in ranking within their niche.

This page on luggage scales ranks on page one over 73% of the time, including for all 36 keywords it ranks for in our sample keyword set.

The page on luggage locks follows the same pattern, also doing very well. Compared to the luggage locks page in the /browse/ directory, it’s doing much, much better.

The /sd/ directory is Argos’ search results.

Indexing search results isn’t always SEO best practice, but it can be an effective strategy when you can provide value with the results pages. Whether Argos should approach it this way, or if the /sd/ directories are taking traffic that would otherwise be fulfilled by /browse/ URLs, needs to be the subject of another article!

These two directories power the majority of Argos’ organic traffic. Overall, it is quite a success story, with Argos the 17th most visible domain in the UK, and the top bricks-and-mortar commercial organisation.

Impressively, the domain is high-performing content. When it ranks, it appears on page one 37.96% of the time!

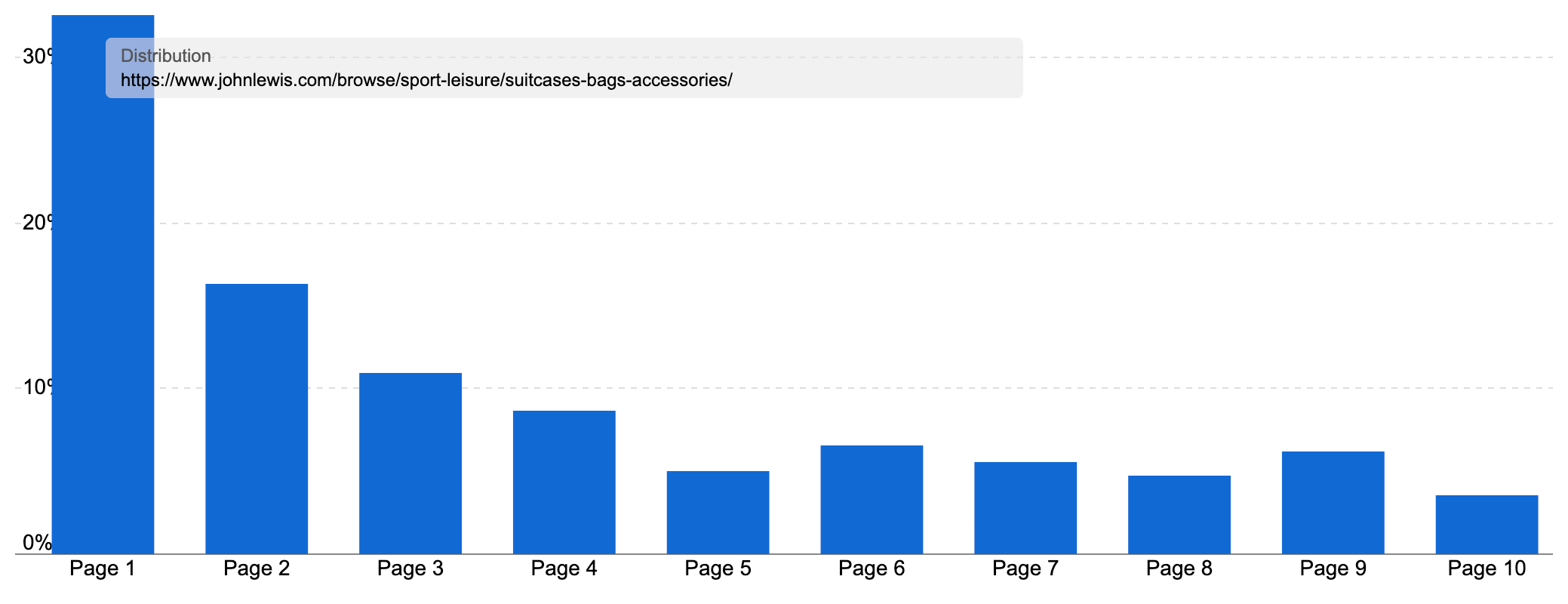

Another omnichannel retailer doing well is John Lewis, the British department store chain founded in 1864.

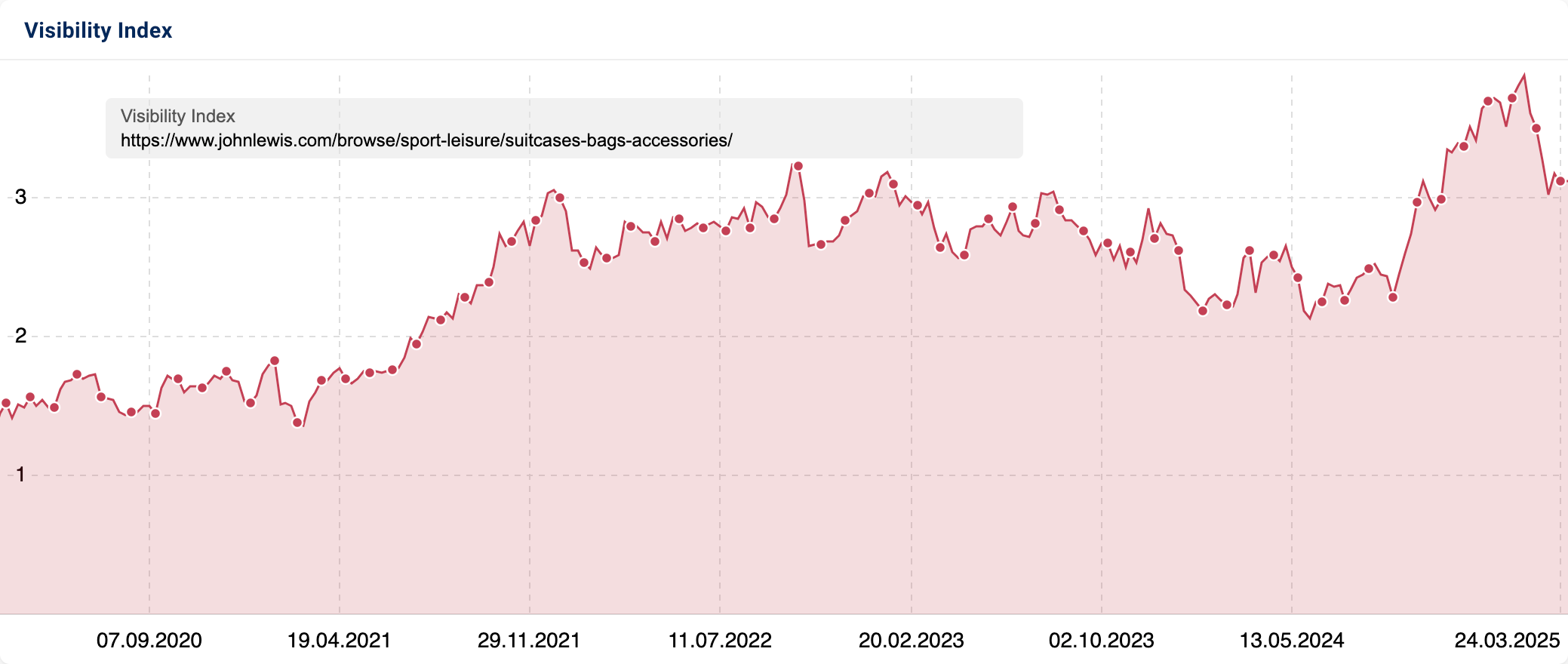

John Lewis ranks for 77.2% of our keywords and on page one 25% of the time. For our keyword set, the top directory is their directory of suitcases, bags and accessories, which also appears 5 times in our top 100 URLs.

This directory is another example of high-performing content. Overall, it ranks for 18k keywords in the UK, with 32.54% of those rankings on page one. Together, the 889 pages in this directory generate 116,387 organic visits from Google. This traffic is worth an estimated £63k.

John Lewis has PLPs for every popular bag type and attribute combination, such as roll-top backpacks, Samsonite suitcases or leather holdalls.

These PLPs are well optimised with targeted H1s and title tags, clear listings and intro copy for the more popular subcategories.

It is also worth noting the high performance of some of the more specialised retailers.

Boots, the British health and beauty retailer and pharmacy chain, is another omnichannel retailer doing well, ranking third for our sample list of keywords.

While Boots offers many of the product types we’ve examined, they certainly don’t sell all of them, including the important luggage and bags category.

Instead, Boots’ success is from an impressive ecommerce proposition for the subcategories they do offer.

The domain ranks for 38.18% of our keywords, but on page one for 22% (ranking on page one 57.6% of the time). When they have a relevant product, Boots appears in the top 10 results over half of the time in our sample set.

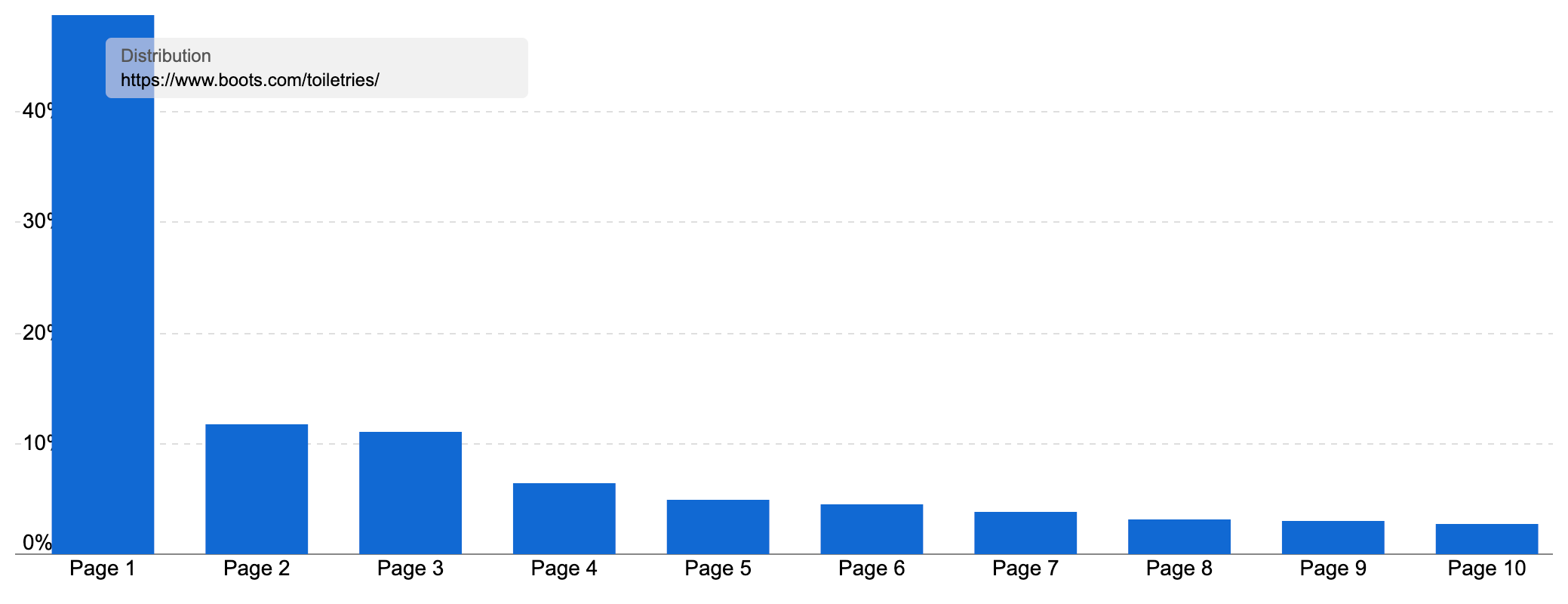

Boots ranks with URLs in the /toiletries/, /holidays/ and /beauty/ directories. All of these use the sample templates, and all are high-performing content.

The /toiletries/ directory ranks for 18.7k keywords in the UK, and it appears on page one 48.74% of the time. These rankings lead to an estimated 205,476 visits a month, worth £157k.

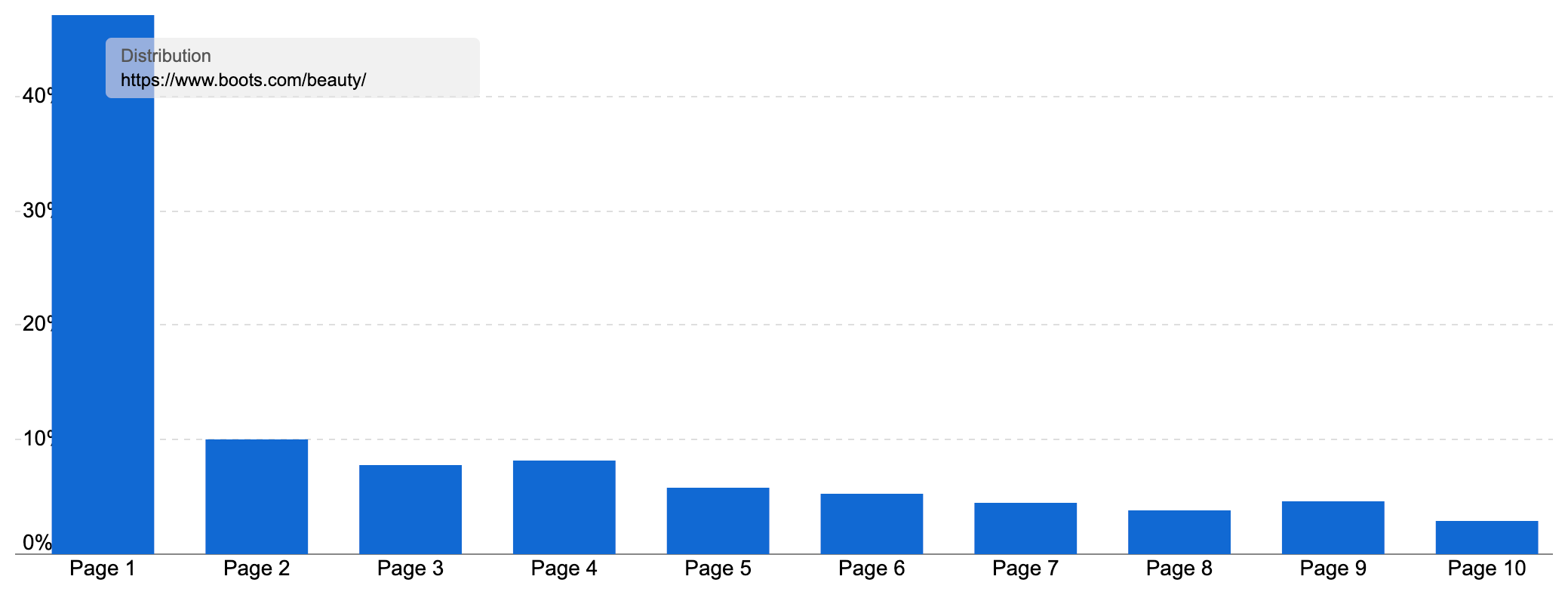

The /beauty/ directory has 548 pages, including one dedicated to travel-size makeup items, which ranks on page one all but once for our keyword set. In total, this directory ranks for over 106k keywords, bringing in close to 1 million organic visits a month (worth an estimated £561k).

This directory has grown in strength, including a big rise in recent weeks, highlighting Boots’ strength in this sector. In our recent analysis of makeup search results, this brand ranked second for commercial-intent search queries.

Finally, we have it Luggage, the UK-based luggage manufacturer. They are in the opposite situation to Boots, only able to rank for luggage and bag terms.

Despite the limited product categories they can appear for, they rank 7 in our winning domains, ranking for 29% of our keywords. This includes a credible 13.04% on page one.

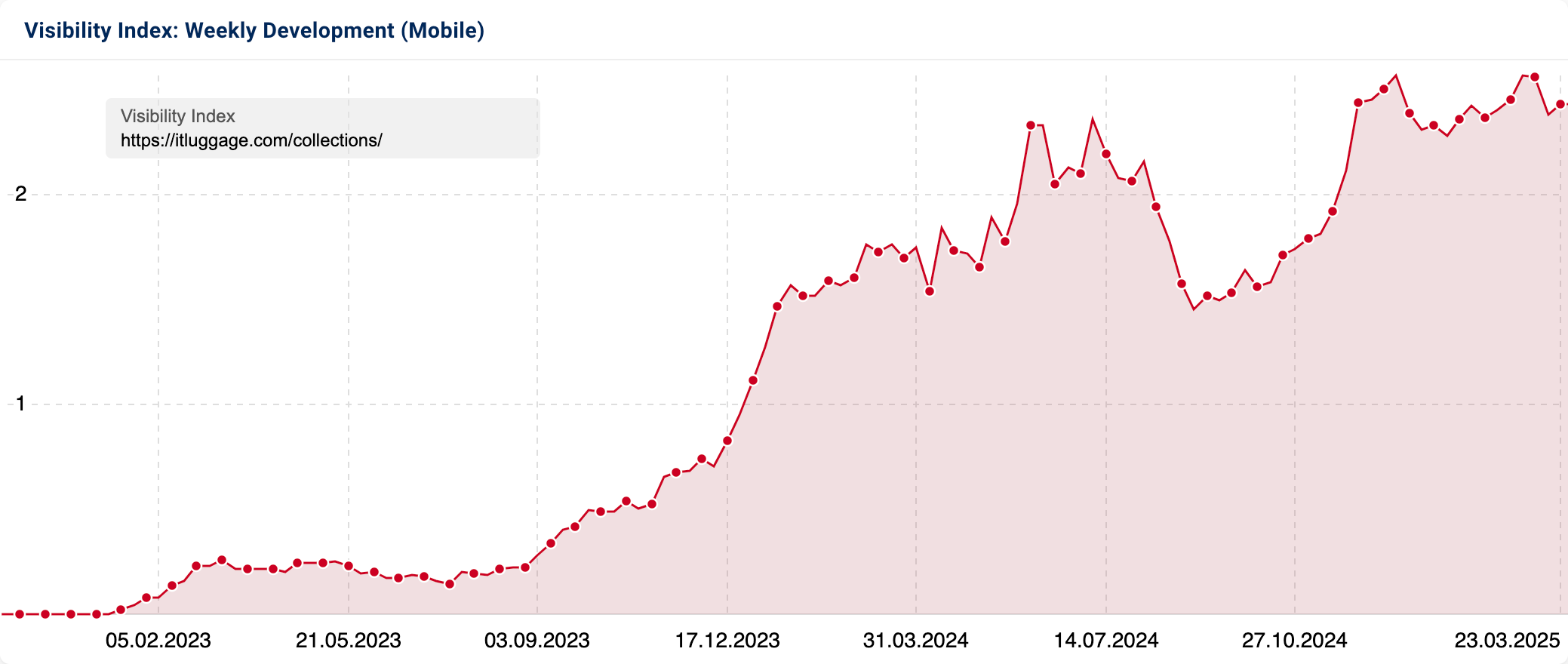

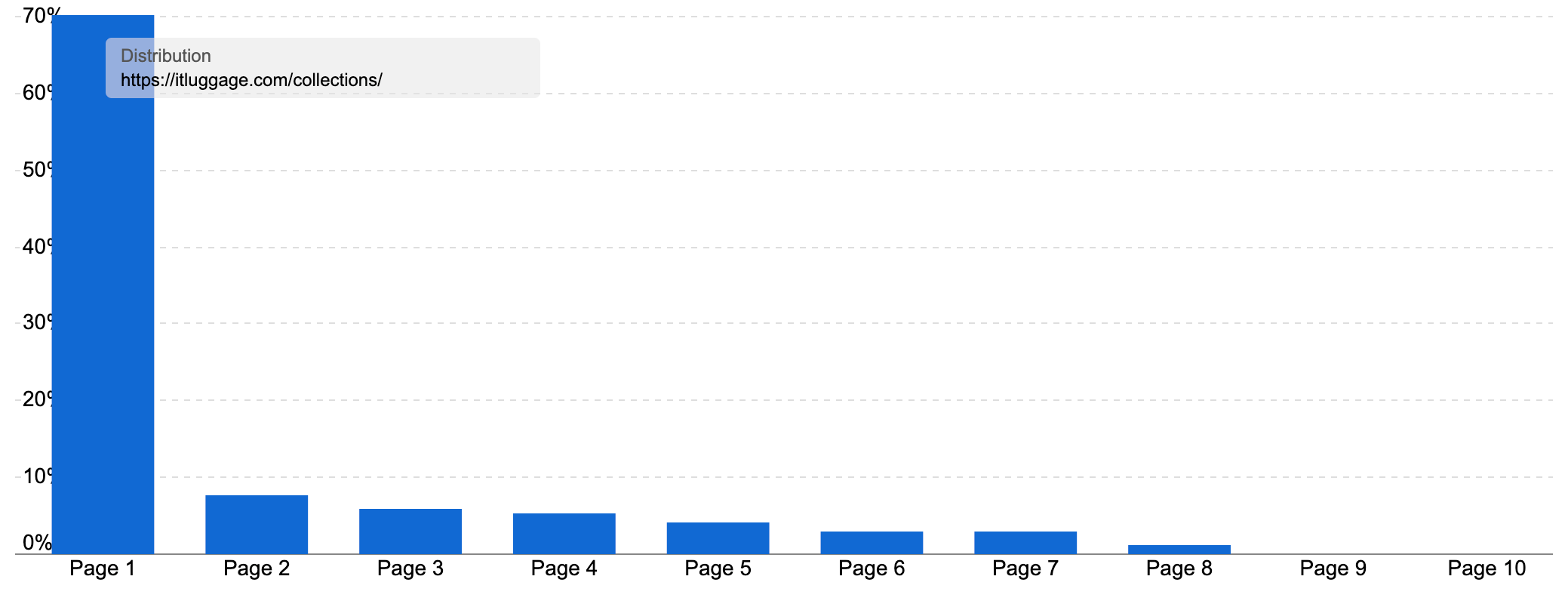

The whole site continues this strong performance. Built in Shopify, the site uses that platform’s standard /collections/ directory for PLPs. Since launching the Shopify site just over 2 years ago and selling direct to customers, it has seen a big jump in organic performance.

The /collections/ directory has 115 URLs ranking for at least one keyword, with dedicated PLPs for all the main luggage and travel bag subcategories.

It now ranks for 3597 keywords and on page one for a huge 70.18% of them.

Together, these rankings bring in an estimated 132k visits a month from Google, worth £62k.

It Luggage has a smart SEO strategy, creating optimised PLPs for a wide range of subtopics that even some of the biggest competitors miss. For example, they have dedicated PLPs for underseat luggage, expandable suitcases, hard shell suitcases and travel backpacks.

It certainly appears their knowledge of their audience’s needs helps them identify medium to long-tail subcategory options with decent search demand. For example, the UK searches using the query ‘underseat luggage’ 1,400 times a month on average in the UK, and ‘underseat cabin bag’ another 1,950 times.

Summary

After mapping the popular travel products search market, here are our top insights to help you set sail:

- Use PLPs as SEO engines: If you’re in the ecommerce sector, your PLPs are key to driving traffic for commercial product type queries. These can rank impressively for transactional queries when properly optimised

- Make the most of category and subcategory pages: Develop directories that target specific product subcategories and variants. Creating subcategories, such as “small cabin luggage” or “leather holdalls”, helps you capture traffic by creating highly relevant pages for the mid to long-tail of your sector. Whether you create dedicated category pages or use filtered versions of parent category pages doesn’t matter, as long as you get internal links to them and the optimisation beach-body ready

- Relate to real customers and their queries: To help find your subcategories, you can rely on the attributes in your faceted navigation for clues, plus keyword research tools, of course. But you should also seek to understand your customers and how they might search or define your products. Sites that align their content with specific consumer needs, such as e.g., “underseat bag”, do well. These often aren’t ‘types’ or subcategories of your product, but use-cases or scenario-based searches. Another great example is “party dresses”

- Be aware of what’s coming next: Speaking of knowing your customers, track rising product search trends to build PLPs before anyone else

- Build intelligent internal links: Not just with your main navigation – Use submenus, intro copy and more to build links to key subcategory PLPs

- Harness brand trust: Consumers and search engines like names they know. Established retailers like John Lewis or Boots can outrank rivals even if they don’t carry every product. Solid brand reputation plus well-organized content is a powerful ranking formula.

- Don’t always follow the playbook: Argos is ranking for over a million keywords with their internal search results pages. This probably goes against most ecommerce SEO advice. Whether by design or accident, if you find an advantage by doing something different, work on maximising the potential to create better shopping experiences

- Don’t give up if you don’t sell directly: Publishers like the New York Times and CN Traveller successfully rank by providing in-depth reviews

Keyword research in the travel products sector

To find the sites packing a punch, we curated a large list of sample keywords representing some of the UK public’s most popular ‘travel product’ searches.

When researching our SectorWatch search topics, we always define our keywords by their search intent. Grouping search queries by the type of intent means we can compare content aimed at the same customers and stages of the buying cycle. Google wants to provide the right content for each searcher, so clustering our sample keywords by intent helps us pinpoint which content formats and styles Google rewards in this sector.

For this Visibility Leaders study, we have one large list of prevalent ‘do’ keywords, representing popular transactional searches. As you’d expect, there are many holiday products to consider, so we’ve included a selection of the popular types:

- Suncreams and sunscreens

- Travel bags, beach bags and cabin luggage

- Travel pillows

- Plus travel wallets, toiletries and passport holders and plenty more

Examples include beach bag, which has an average of 32,600 searches a month in the UK but sees a large spike in demand of over 60k searches each summer. Another popular query is sun cream, which has an average search demand of 5,350 in the UK, but regularly sees a jump to over 16k when the weather gets hot.

Other examples from our list include packing cubes (22,000 on average), travel bag (20,000 searches), plug travel adaptors (3,300), carry on luggage (4,800) and luggage tags (5,350).

We’ve avoided some subjects as they are large enough for their own SectorWatch study – for example, sunglasses.

The full list of keywords used for this study is available in a shared Google Sheet.

We have a detailed, step-by-step article on keyword research with SISTRIX tools and data, in which you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of travel product keyword discovery tables. We selected highly targeted keywords with either a ‘do‘ intent or a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent, so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic results.

Curated keyword set and sector click potential

Core keywords: luggage, travel bag, sun cream, luggage tags, travel pillow, travel toiletries, passport holder and beach bag.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and traffic forecasts.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.

The 14-day SISTRIX Free Trial will allow you to start your own Amazon and Google brand, product and domain research with SISTRIX data.