It’s been two years since the last travel industry Visibility Leaders report. In the last analysis piece I called out two interesting observations; real world experience and expert knowledge missing from sites performing for “Know” (informational) intent searches and the use of dynamic content to grow at scale for “Do” (commercial) intent searches. Read the analysis of the 2025 winners below.

- Visibility Leaders Travel 2025 - Summary

- The Winners - ‘Do’

- Booking.com - winning with the best hotel deals

- RailEurope.com - winning in European rail travel

- The Winners - ‘Know’

- NewZealand.com - winning with NewZealand tourism information

- ABTA.com - winning by resolving travellers issues

- Summary & additional interesting observations

- Category coverage for commercial content is still key

- Putting users first is no longer a ‘warning’ - it’s the reality

- Specialised sites starting to challenge broad aggregators

- Segmentation of intent: a Google course correction?

- Additional reports in this issue of Visibility Leaders

The 14-day SISTRIX Free Trial will allow you to start your own Amazon and Google brand, product and domain research with SISTRIX data.

All our travel-related data, reports and trackers can be found on our travel pages.

Visibility Leaders Travel 2025 – Summary

The four winning directories in this issue of Visibility Leaders are:

- Booking.com – winning with the best hotel deals

- RailEurope.com – winning in European rail travel

- NewZealand.com – winning with NewZealand tourism information

- ABTA.com – winning by resolving travellers issues

Highlights from the analysis below:

- Category coverage for commercial content is still key

- Putting users first is no longer a ‘warning’ – it’s the reality

- Specialised sites starting to challenge broad aggregators

- Segmentation of intent: a Google course correction?

In the 2023 report I predicted that, at some point, if no changes were made to the content quality of these sites they would no longer perform at the same level. This has now happened, and the informational space is now dominated by topical experts (and Reddit).

The use of dynamic content still works incredibly well for commercially focused sites such as hotel and flight aggregators. They use this strategy to create landing pages at scale, usually for locations at a niche level based on the available offering and search demand.

When we look at how Google has changed over the past two years, the fundamental impact we’re seeing is that zero-click is rising. AI overviews now appear for certain informational searches and Google Hotels & Flights continue to keep the organic results out of sight for the majority of commercial searches.

Holiday booking in general is now being empowered by AI, the savvy customers are now using answer engines to plan out their travels — that being said there are still thousands of traditional searches for travel agents every week. It does make it entirely possible that Google itself will eventually become the go-to holiday booking assistant complete with hotel and flight comparisons (DMA regulation dependent of course).

The Winners – ‘Do’

This section analyses the winning directories from domains that are ranking mainly for commercial intent keywords, justified by matching the ‘Do’ intent within SISTRIX. As always, we have two winners for each category (do and know) — split by large and small.

The full list of searchable and sortable directories is available on the Visibility Leaders overview page.

Booking.com – winning with the best hotel deals

The large High Performance Content Format (HPCF) winner for ‘do’ keywords is Booking.com with their /budget/ directory. They also won this category back in 2023 with the same directory, so they must be doing something right!

Booking.com is an online travel agency (OTA) providing everything from hotels and car rentals to flights and useful travel information. Their winning directory, budget, is predominantly set up to target searches for cheap hotels + location (e.g. cheap hotels in Dubai).

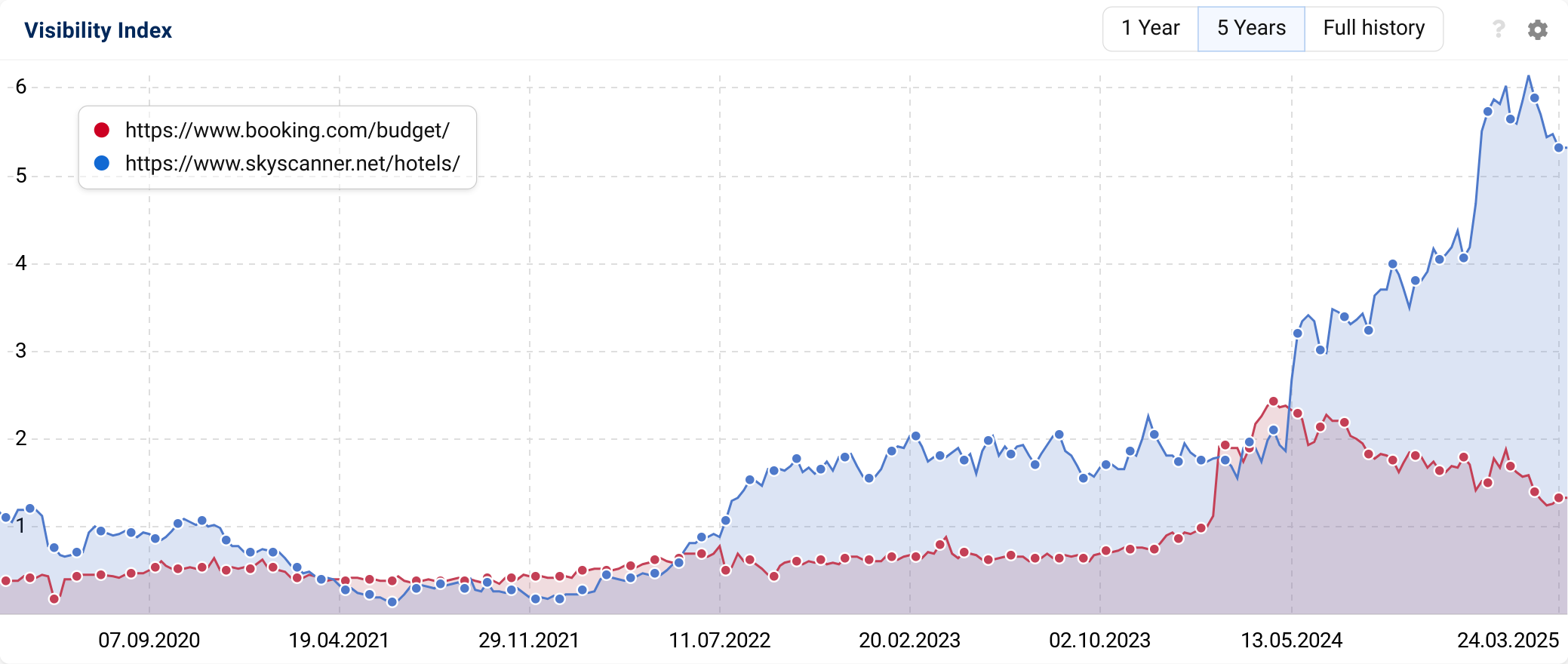

Since 2023, when we last looked at booking.com/budget/, their visibility for this directory has grown quite a bit despite increasing pressures from competitors. One competitor that stands out is SkyScanner, who appear to be predominantly going after budget hotel related queries and have grown a lot since 2023 with their hotels structure.

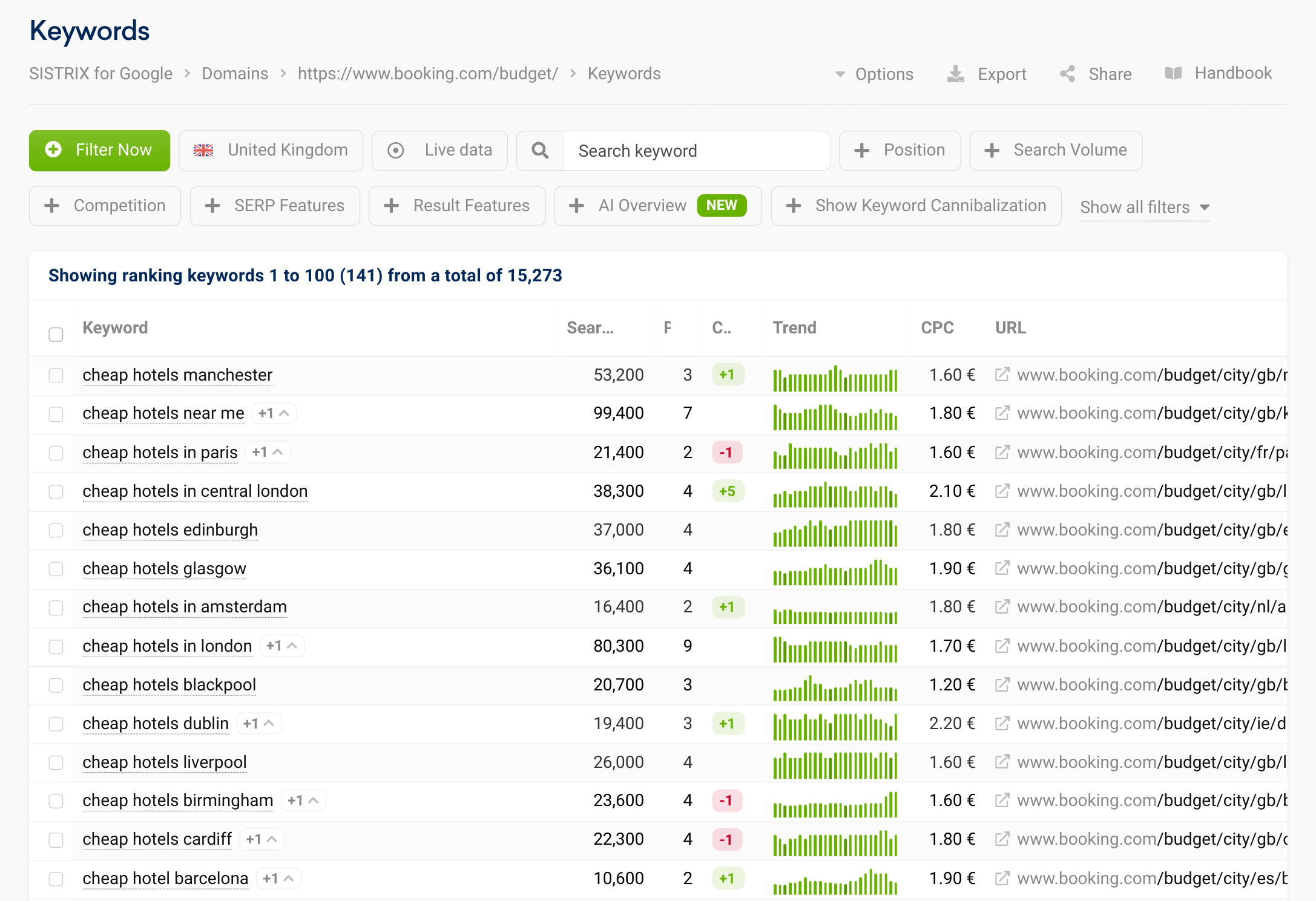

In terms of Booking.com’s own performance, back in 2023 /budget/ ranked for just over 5,000 keywords — since then they have more than tripled their ranking terms to 15,273 keywords!

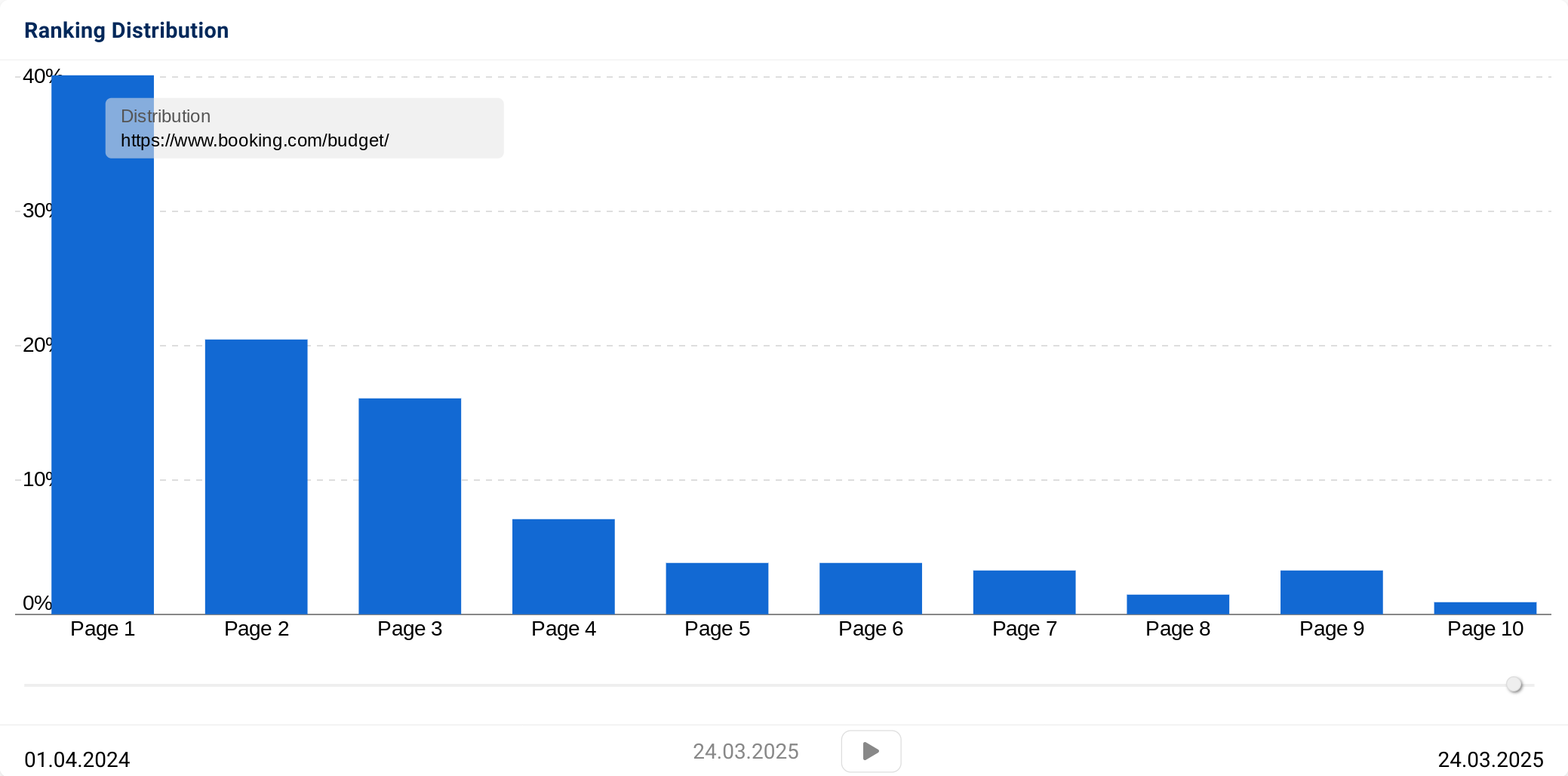

40% of keywords in the /budget/ directory are currently ranking on the first page. This is down a bit compared to 2023, but still incredibly impressive for this industry — it’s also expected with the dramatic increase in total ranking terms.

What has Booking.com done since 2023 and what do they continue to do well?

- Scalable content, a strategy that can grow with demand: The biggest strength of Booking.com’s /budget/ directory (and a lot of their site) is the ability to scale content strategically and efficiently. The directory has grown from 5,000 keywords to covering 15,000 — which is directly proportional to their URL coverage growth. It’s worth mentioning that some of this has come from merging their /cheap/ sub-folder into /budget/… more on that later!

- Total coverage, dominating all relevant variants: The comprehensive nature of their coverage is key for performance. Their directory doesn’t just cover major destinations, it reaches into smaller, more niche locations. It’s essentially the “Amazon” approach to category coverage, with content quality being enhanced by populating these pages with location relevant data and supporting internal links.

- Strategic redirects, reducing cannibalisation and capitalising on growth: One strategic move that has had a positive impact on this directory was the consolidation of /cheap/ into /budget/. While both served similar intents, the merge brings multiple benefits; consolidated authority, cleaner site structure, and improved user experience. This kind of SEO hygiene can often be overlooked but can play a significant role in long term growth and performance.

- Content templates and on-page structure: Anothe cornerstone of Booking.com’s success is the effective, templated page layouts for their site sections. This allows them to be replicated at scale without sacrificing quality. Each /budget/ landing page follows a proven structure that includes; topical relevance through dynamic H2s e.g. “Most booked hotels in X”, FAQ modules, maps, highlighted reviews, and links to relevant content.

RailEurope.com – winning in European rail travel

RailEurope.com is the small High Performance Content Format winner for ‘do’ keywords with their /en-gb/ directory. Rail Europe is an online platform that provides access to train tickets and rail passes from hundreds of train operators across Europe.

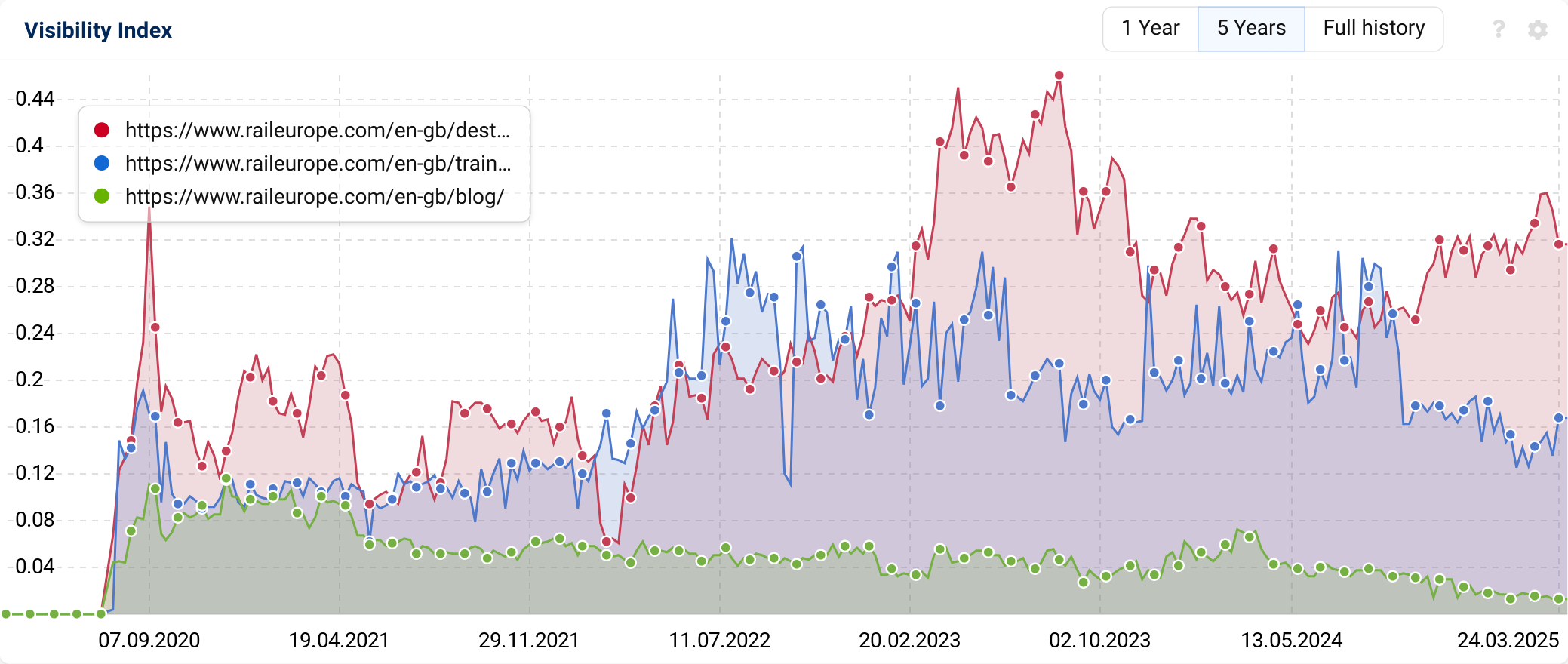

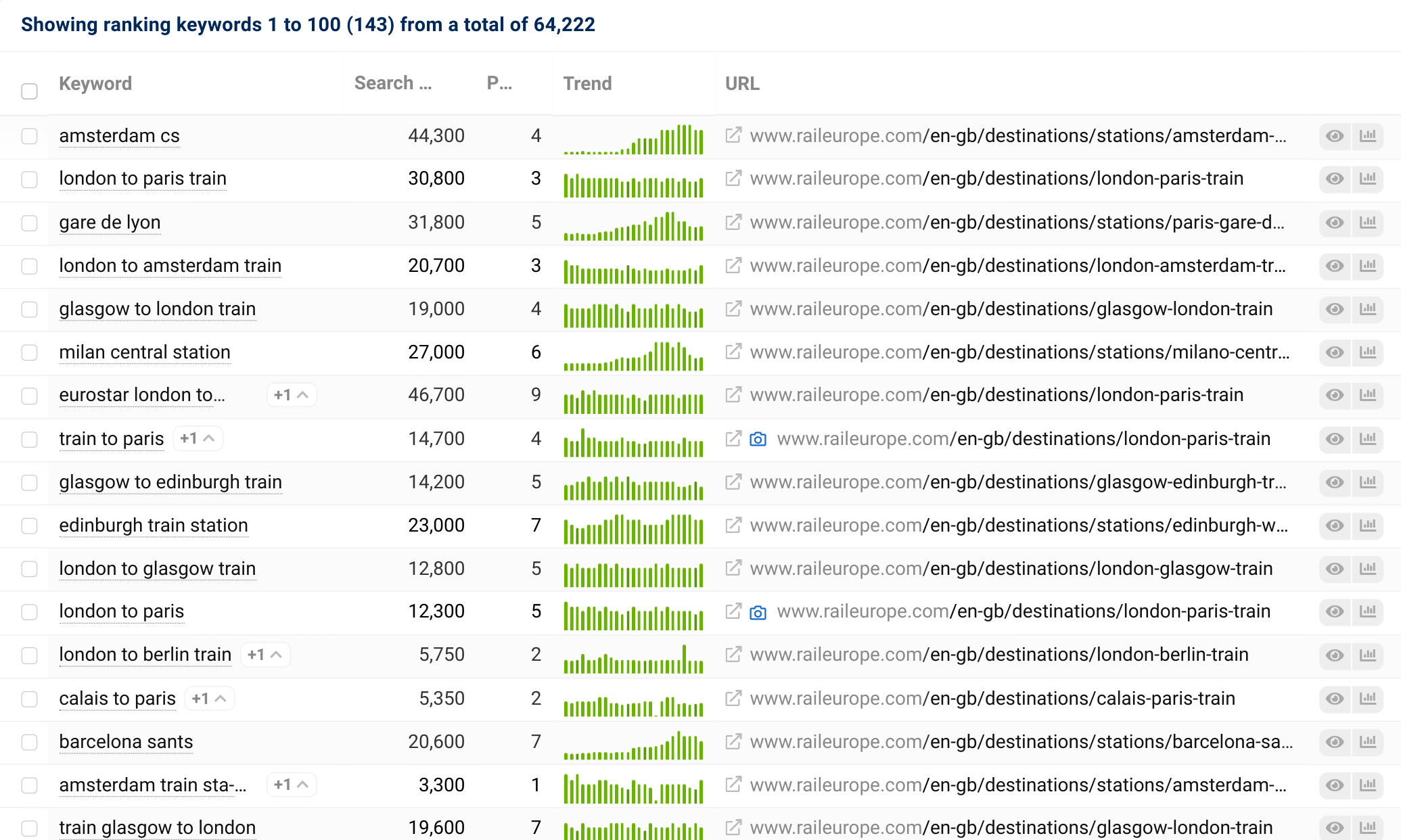

Technically, this is their entire site under a country language sub-folder, however their site is largely made up of two folders — which independently are both classified as HPCFs. The two directories driving this performance are /destinations/ and /trains/ — which are pretty self explanatory. Their destinations directory is built to support both stations and journeys, ranking for terms such as ‘London to Paris train’ and ‘Milan central station’. Their /trains/ sub-folder is essentially a directory of the different types of trains available for travel ranking for terms like ‘Eurostar’ and ‘TGV’.

Their /en-gb/ directory ranks for over 66,000 keywords in the UK, with 62,000 of these rankings coming from /destinations/. 33% of their overall rankings are on the first page of Google, with that increasing to 35% for the /destinations/ folder specifically.

RailEurope has a unique advantage in their specific niche, they’re clearly set up from a tourism and leisure first perspective, giving them an advantage for related searches such as “trains to Paris”. Where most UK rail ticket resellers are perceived as providing predominantly domestic travel. This is despite their competitors, such as MyTrainPal and Trainline also selling tickets for European train operators.

Their visibility is relatively well split over the top 5% of their 15,000 URLs, but the highest volume of traffic tends to come from route related searches like ‘London to Amsterdam’. As such, their top 5% of performing URLs are made up largely of popular routes.

Breaking their performance down further into what they’re actually doing well, we can see:

- Internal linking that’s mapped to search demand: RailEurope has implemented a researched internal linking strategy that prioritises popular train routes. This approach is clear from their block of homepage links to high search demand routes (e.g. London to Paris) and the subsequent links to lesser priority pages from these popular route pages. It may seem like a simple tactic, but very few get this right.

- On-page content that’s prioritised by route importance: Not all pages on RailEurope are created equal, and that’s a good thing for them. The depth of their content varies based on the available organic opportunity, which is clear that they have aligned their content investment with organic search value. The high performing/high search demand pages feature in-depth information including all relevant FAQs, detailed train service information, booking tips, and multiple CTAs.

- A site structured built around user demand: It’s obvious that RailEurope hasn’t just built their content structure around train routes — they’ve built it around the way people search for them. Their site structure prioritises the most popular content from a user perspective. This results in a clear information architecture which is beneficial to SEO.

- A clear subject matter authority, European rail travel from the UK: One of their big advantages, especially in the current SEO climate, is their niche positioning. While many competitors offer both domestic and international rail options, RailEurope is predominantly geared towards European rail travel from a leisure and tourism perspective.

The Winners – ‘Know’

Now, we’re going to change the focus from ‘do’ to ‘know’ – informational content. As always, there are two winners — one large and one small.

The biggest change for the high performing content formats in travel is that there are a lot less OTAs and comparison sites performing consistently well for informational content. Instead, we are seeing the sites being served in Google to be more typically informational in nature, such as national travel organisations and topic specific blogs.

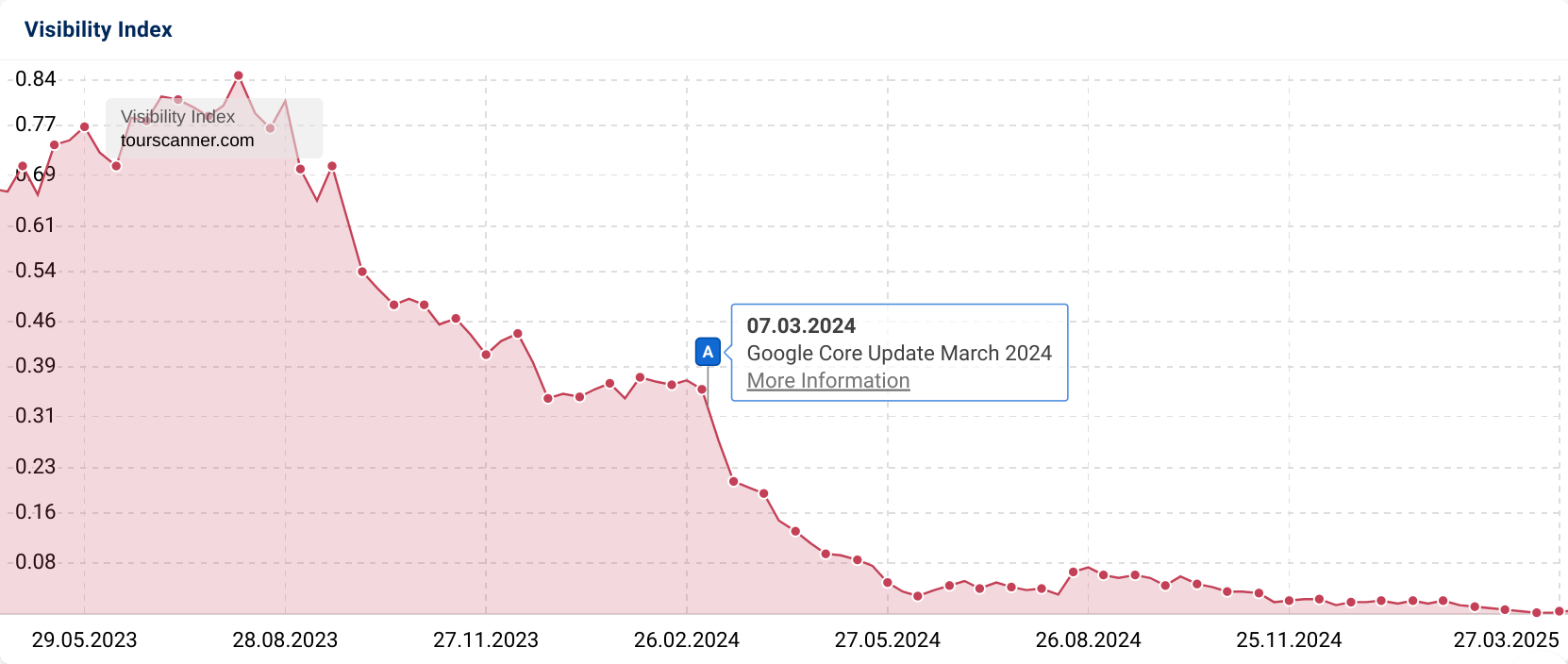

This most drastic change happened in March 2024 when Helpful Content became part of the core algorithm. In the 2023 travel analysis piece I highlighted how certain sites, although performing well at the time, would need to improve content quality to survive. One unfortunate example of this is TourScanner — a previous winner of Visibility Leaders that was hit heavily by the changes in Google:

Now onto the winners this year!

NewZealand.com – winning with NewZealand tourism information

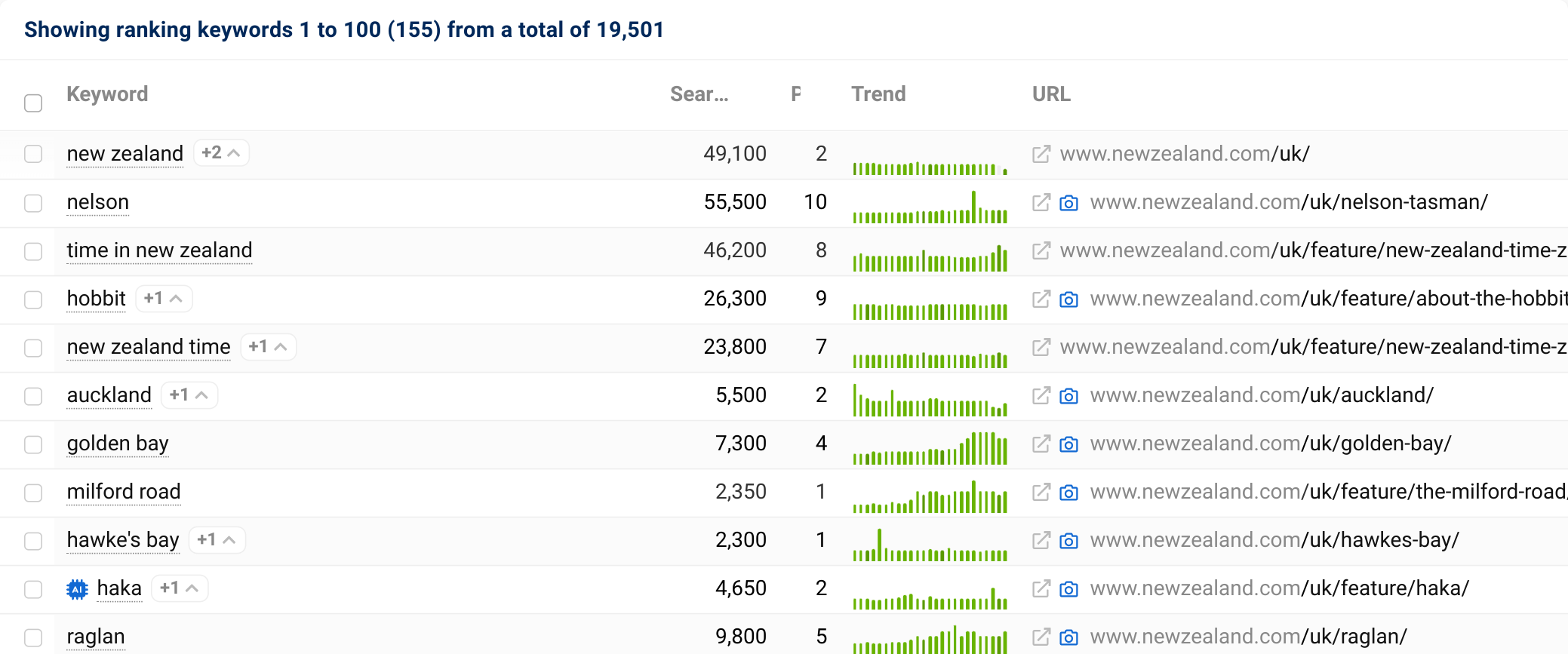

NewZealand.com is the large HPCF winner for informational content with their country targeting folder /uk/. This is the official UK website for Tourism New Zealand, providing comprehensive travel information and resources to help UK travelers plan holidays to New Zealand.

A little bit off topic for Visibility Leaders, but this specific domain has some interesting history which I discovered whilst doing the analysis. The domain was originally privately owned and sold to the New Zealand government in 2002 for $500,000. The government then came into question as to whether the investment was worth the cost.

This analysis won’t solve that question, but what I can tell you is that they massively benefited from the March 2024 core algorithm update which saw many other travel sites punished.

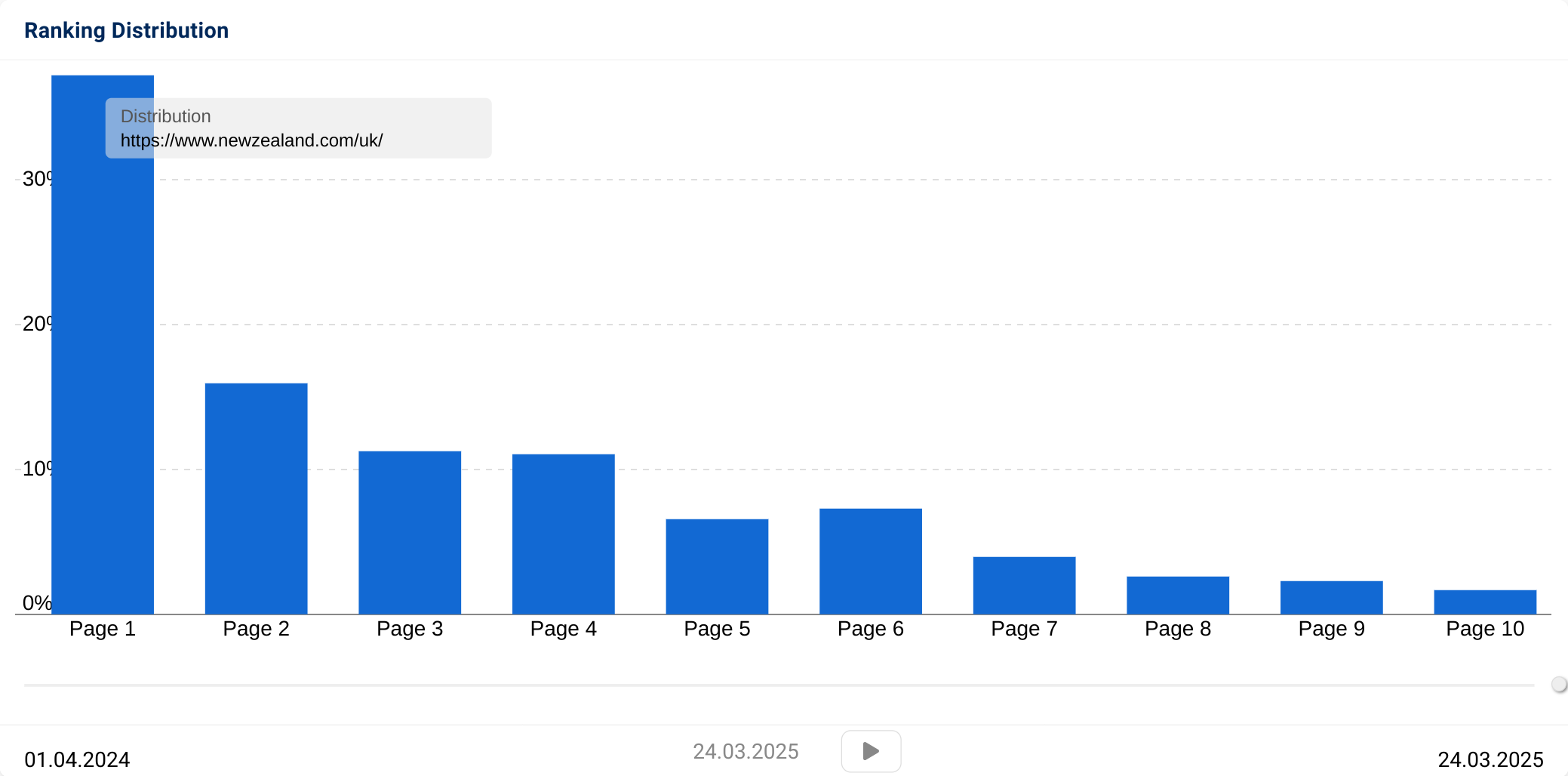

Their /uk/ directory ranks for over 19,000 keywords in the UK with over 35% of those rankings on the first page of Google. The UK country directory itself contains multiple high performance content formats, such as /feature/ and /plan/.

Their /feature/ folder is a directory of things to do and ranks for keywords like ‘Arthur’s Pass New Zealand’ and ‘Southern lights aurora’. The /plan/ folder functions as a jumping off point where travellers visiting New Zealand can book activities, ranking for keywords like ‘Queenstown bungy jump’ and ‘Hobbiton’.

NewZealand.com completely fits the bill for ‘Helpful Content’ which definitely contributes greatly to their performance. They provide just the right amount of content and none of the copy feels like ‘SEO content’. They answer all the key questions and provide links to any relevant additional content. It certainly feels like this site is exactly the kind of content that Google is aiming to serve with the Helpful Content update.

When looking a bit deeper into why they’re performing so well, it generally fits into the following:

- Content quality – no fluff, just helpful information: A major strength of NewZealand.com is that its content is concise, well structured, and avoids unnecessary padding. They write to provide actual answers, not to just hit a word count.

- Putting the user first with key information highlights: The site feels like it’s built with the end user in mind, making it the most user-friendly travel resource available specifically for New Zealand tourism. A great example of their content templates is the Hot Water Beach page. This page presents the most important details in a highlight upfront, the visuals are all high quality and relevant, and it also offers practical advice around the best times to visit due to tides.

- Clear and simple site structure: A well organised content structure is critical for both user experience and SEO, NewZealand.com excels at this with their logical navigation, clear content hierarchy, and strong internal linking.

- Topical relevance and authoritative advantage: They benefit from a natural advantage due to their official status as the country’s tourism board. This gives it a huge credibility boost and stronger trust signals, resulting in better visibility. It’s perfectly aligned to Google’s Helpful Content standards — explaining why they saw a boost after the March 2024 core update.

ABTA.com – winning by resolving travellers issues

ABTA.com is the small winner for informational content with their /help-and-complaints/ directory. They are a travel association in the UK that provides consumer protection, travel advice, and industry standards for travel agents and tour operators.

Unlike NewZealand.com, they did not see any dramatic change following the March 2024 core update. But this is another great example of content ranking which has the end users’ best interest in mind. I don’t want to shine a spotlight on any specific sites, but I did check a selection of privately owned companies that offer similar advice for a hefty fee and, on average, they consistently dropped in visibility last year.

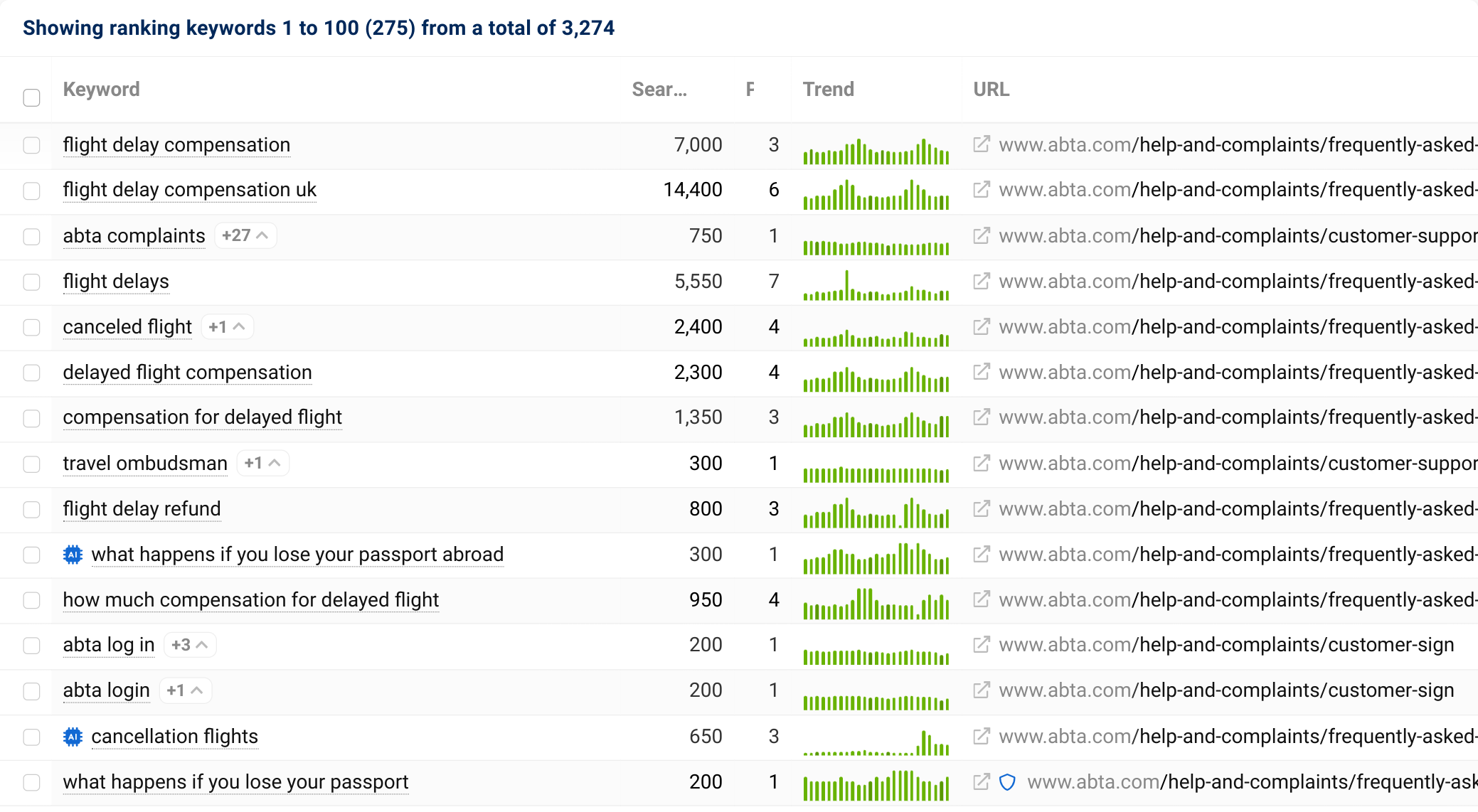

The Help and Complaints directory on ABTA ranks for just over 3,000 keywords with 34% of those appearing on the first page of Google. They rank predominantly for keywords around compensation for flight delays and cancellations as well as complaints for anything travel and tourism related.

The structure of this content format generally comes under one of two categories, either answering common questions (FAQs) or understanding how ABTA can help you with your issue. Their visibility is heavily weighted towards cancelled or delayed flights, with around 35% of their total visibility for this directory coming from related searches.

Taking a deeper look into ABTA’s performance for this directory, we can see some common themes emerging for travel SEO in 2025:

- Content quality – No ‘SEO content’ just genuine help: One of the biggest factors behind ABTA’s strong organic performance is the authenticity and utility of its content. Unlike some of their competitors, ABTA’s content is direct, concise, and genuinely useful. Not over-optimised or packed with fluff to hit arbitrary word counts.

- Prioritisation through internal linking: Their site structure for this section is built around prioritising the most common traveler issues, making it exceptionally easy for users (and Google) to find relevant answers. This is clear when looking at their FAQ page (under /help-and-complaints/).

- The ‘brand boost’ authority advantage: ABTA does have a bit of an advantage over privately owned travel assistance sites as it’s an industry standard organisation with strong brand trust.

- Completely pro-user, with no commercial bias: ABTA makes its money through industry memberships so there’s little need to monetise the end customer. This also gives them an advantage over their competitors that tend to charge fees for assistance.

Summary & additional interesting observations

Category coverage for commercial content is still key

Despite changes in the Google algorithm and increasing competition, one thing remains clear — having comprehensive category coverage is still a key driver of success for commercially focused sites. Those that successfully expand their coverage while maintaining strong internal linking structures continue to perform well (like Booking.com and RailEurope.com).

It’s worth noting that it’s not just about volume, the quality of that coverage matters now more than ever before. Aligning your landing pages with search intent and the actual availability of offerings is key for making this work. The scalability of using dynamic content still remains a crucial tool for achieving this, as long as it’s fed the right data.

Putting users first is no longer a ‘warning’ – it’s the reality

In the 2023 analysis, we predicted that informational travel sites that lacked real-world expertise would struggle to maintain rankings. That shift has now fully materialised. The March 2024 core update significantly reshaped the informational search landscape for travel, favouring trusted sources from experts that want to provide a user centric experience.

One of the most notable casualties from this analysis, TourScanner, saw major declines. Meanwhile, more specialised and authoritative sites like NewZealand.com and ABTA.com emerged as winners, largely because they offer credible content which puts their users first.

Specialised sites starting to challenge broad aggregators

Specialised sites are starting to challenge broad aggregators is a trend we’ve seen in other industries like retail. It appears to be an emerging trend in travel now as well. Niche travel sites that focus on specific regions, travel types, or customer needs are starting to challenge and even outperform broader OTAs and aggregators (e.g. NewZealand.com for NZ tourism or RailEurope for European rail travel from the UK).

This trend seems to have been accelerated by Google’s push for “Helpful Content”, but there’s also another factor at play — user trust.

Segmentation of intent: a Google course correction?

One of the more surprising developments in travel SEO over the past two years is something I am going to dare to call the “re-segmentation of search intent”. Previously, we observed a trend where OTAs and aggregators were successfully blending commercial and informational content — for example, publishing travel guides within their sites to capture ‘know’ intent traffic.

However, Google appears to have course-corrected in a way that suggests informational and commercial content should remain separate, at least in travel. Informational queries are now generally being dominated by purely informational sources or,at least, largely informational leaning sources.

Additional reports in this issue of Visibility Leaders

- Database of high performance SEO directories. Search through to find inspiration from many categories

- Travel overview – Trends, lists and take-aways from all of travel sector analysis

- Winning SEO directories – Deep analysis by Callum Lockwood. (This article.)

- TrendWatch – Trends from the retail sector analysed by Nicole Scott

- SectorWatch – A deep look at leading domains and content in the travel products sector by Charlie Williams

The 14-day SISTRIX Free Trial will allow you to start your own Amazon and Google brand, product and domain research with SISTRIX data.