This month, SectorWatch is looking to unlock the data as we explore the UK search market for smartphones. We’re finding which brands are ringing in search success and the content that gets readers scrolling.

Whose content is dialling up some top rankings? And who hasn’t got any signal? Get ready to swipe up as we see who is charging ahead and who needs an upgrade.

- The top domains in the UK for smartphone

- Top 20 domains for shopping (‘do’) searches for smartphones:

- Top 20 domains for informational (‘know’) searches for smartphones:

- What’s trending in the smartphone search market?

- The top URLs for smartphones

- Content examples: What type of content is performing?

- High-performance content examples

- High-performance know content

- Summary

- Keyword research in the smartphone sector

- Our SectorWatch process

- Curated keyword set and sector click potential

The smartphone, or at least the mobile phone, is perhaps the defining consumer technology of current times.

Phones are the devices we reach for most often, and the smartphone market is the UK’s most profitable consumer electronics category, with an expected revenue of almost £10 billion in 2024.

No other device matches a phone’s versatility. Our smartphones combine a camera, notebook and pen torch, music player, watch, wallet and of course phone into a single portable supercomputer that (sort of) sits in your pocket.

A remarkable 98% of UK adults own a smartphone, and a Uswitch study found that the average spend on a mobile contract in 2022/23 was £903.48 per year.

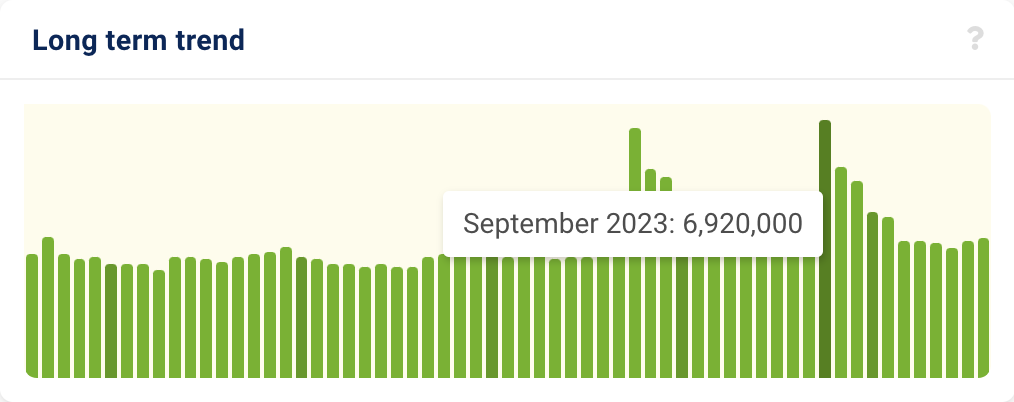

While more of us than ever want to keep our phones for multiple years, the smartphone industry is powered by the now-familiar release cycle of fresh models each year, leading to a new pattern of increased search demand each September:

The smartphone market is fiercely competitive as a result, with manufacturers, networks and retailers all competing for their portion of your money.

So it’s no surprise that the defining method of online navigation – search – is also extremely competitive when it comes to mobile phones.

The top domains in the UK for smartphone

So, who’s got their content fully charged and leading the smartphone rankings? We’ve conducted research to identify the standout domains in a sample of ‘do’ (action/transactional) searches and ‘know’ (informational) searches in the smartphone market:

Do searches:

- mobilephonesdirect.co.uk

- carphonewarehouse.com

- tescomobile.com

Know searches:

- techradar.com

- samsung.com

- apple.com

Top 20 domains for shopping (‘do’) searches for smartphones:

| Domain | Project Visibility Index |

|---|---|

| mobilephonesdirect.co.uk | 497.63 |

| carphonewarehouse.com | 487.92 |

| tescomobile.com | 460.44 |

| amazon.co.uk | 450.28 |

| uswitch.com | 422.61 |

| samsung.com | 398.61 |

| o2.co.uk | 375.17 |

| moneysupermarket.com | 319.7 |

| currys.co.uk | 302.28 |

| ee.co.uk | 285.68 |

| argos.co.uk | 274.63 |

| vodafone.co.uk | 251.17 |

| moneysavingexpert.com | 217.08 |

| mobiles.co.uk | 172.27 |

| fonehouse.co.uk | 158.72 |

| three.co.uk | 153.83 |

| affordablemobiles.co.uk | 141.76 |

| apple.com | 128.46 |

| techradar.com | 105.34 |

| buymobiles.net | 103.16 |

Top 20 domains for informational (‘know’) searches for smartphones:

| Domain | Project Visibility Index |

|---|---|

| techradar.com | 583.07 |

| samsung.com | 348.01 |

| apple.com | 343.51 |

| reddit.com | 283.07 |

| tomsguide.com | 269.86 |

| youtube.com | 236.27 |

| zdnet.com | 218.45 |

| cnet.com | 206.27 |

| pcmag.com | 189.86 |

| google.com | 183.3 |

| wired.com | 168.27 |

| techadvisor.com | 148.57 |

| gsmarena.com | 142.78 |

| wikipedia.org | 133.66 |

| androidauthority.com | 128.49 |

| currys.co.uk | 112.61 |

| amazon.co.uk | 108.71 |

| trustedreviews.com | 105.26 |

| phonearena.com | 103.58 |

| androidpolice.com | 91.32 |

What’s trending in the smartphone search market?

Within our keyword list – and our TrendWatch data – we can spot trending phone queries. The searches that have gained in popularity in recent months:

- iphone 16

- iphone 16 release date

- samsung s24

- samsung a15

- Samsung galaxy

- best mobile phone deals uk

- google pixel

- iphone se 4

- how to record screen on iphone

- how to turn off private browsing on iphone

- how to clear cookies on iphone

- how to clean iphone charging port

- how to find my phone on samsung

If you’d like insight into even more search trends, and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for smartphones

To create the data for this research – and to find our winning domains – we built keyword lists in SISTRIX for each of our keyword sets. We created one list of keywords for ‘do’ searches (with 1951 keywords) and another for (1064) ‘know’ searches.

When you build keyword sets in SISTRIX, the toolbox also gives you data insights. These include the top competitors (above), forecasts (see below) and the best-performing URLs. We’ve included both of our sets’ ten most successful pages here, so you can see some of the best-performing content.

| URL | Top Keyword |

|---|---|

| https://www.uswitch.com/mobiles/ | mobile phone deals |

| https://www.mobilephonesdirect.co.uk/deals/new-contract | mobile phone deals |

| https://www.o2.co.uk/shop/phones | mobile phone deals |

| https://www.samsung.com/uk/smartphones/ | mobile phone deals |

| https://www.tescomobile.com/shop/pay-monthly | mobile phone deals |

| https://www.carphonewarehouse.com/mobiles/sim-free | samsung phone |

| https://ee.co.uk/mobile/pay-monthly-phones-gallery | mobile phone deals |

| https://www.carphonewarehouse.com/mobiles/pay-monthly | phone contracts |

| https://www.currys.co.uk/phones/mobile-phones/mobile-phones | mobile phone deals |

| https://www.moneysupermarket.com/mobile-phones/ | mobile phone deals |

| URL | Top Keyword |

|---|---|

| https://www.techradar.com/uk/news/best-phone | smartphone |

| https://www.techradar.com/uk/best/best-cheap-phones | best budget smartphone |

| https://www.zdnet.com/article/best-phone/ | smartphone |

| https://www.techadvisor.com/article/724318/best-smartphone.html | best android phone 2023 |

| https://www.tomsguide.com/best-picks/best-phones | smartphone |

| https://www.telegraph.co.uk/recommended/tech/best-smartphones/ | best android phone 2023 |

| https://www.apple.com/uk/iphone/compare/ | iphone models |

| https://www.techradar.com/news/best-samsung-phones | latest samsung phone |

| https://www.samsung.com/uk/smartphones/ | latest samsung phone |

| https://www.stuff.tv/features/best-smartphone/ | latest samsung phone |

Content examples: What type of content is performing?

A look at the top-performing domains for our sample set of keywords leads to some interesting observations:

- For transactional searches, specialist online retailers (Mobile Phones Direct, owned by AO), comparison sites (Uswitch), traditional phone retailers (Carphone Warehouse), the networks (Tesco Mobile, O2, Vodafone, EE), and of course Amazon, just edge out the main manufacturers (Samsung and Apple)

- Mobile-focussed retailers take our top three spots, with five of the top ten and thirteen of the top 25 sites either dedicated to phones or a manufacturer

- It appears that niche focus can be a big benefit, either through specialisation or perhaps earning strong brand or trust signals in the space

- We also see price-comparison sites such as Uswitch, Money Supermarket and Money Saving Expert. These sites have mastered the art of roundup articles for everything a household buys, so its no surprise to see them here

- The top ‘do’ domains are all consistently high ranking, with most ranking on page one for over a third of our keywords (the lowest, Samsung, is at 24.95%, which is good considering all of the contract and iPhone terms are irrelevant!)

- This indicates that many of our keywords are close synonyms, that Google really likes these sites in this sector, or that they have all put a lot of effort into their structure and optimisation

- It might be a surprise to see Apple at only 18. After all, many of our most popular keywords are for their product

- For example, iphone 15 (276000 searches a month on average), iphone 14 (223,000) and iphone (200,000). In fact, seven of the top eight most popular keywords are Apple devices

- However, many of our keywords are on other brands (Android, Samsung, Pixel, Huawei, Nothing, etc.) plus it is very common for customers to search for a phone with a contract or for “deals”. Apple doesn’t offer these, meaning their potential footprint for our keyword list is smaller

- Manufacturers’ brand sites are right at the top when it comes to our ‘know’ keywords, with Apple and Samsung at two and three in the rankings, plus Google at ten

- With so many searches for ‘how to use’ phone questions, their help sections regularly appear, and we see many searches around product lines, release dates and more. All of which are well-answered by the big manufacturers

- Reddit appears at five, continuing the trend we see of its incredible growth for any informational search looking for advice or recommendations

- After this though, tech review sites dominate. TechRadar, Tom’s Guide, Cnet, ZDNet and PC Mag are all huge online publications, often part of big publication houses, and do well for both the ‘how to’ queries and especially the wide variety of ‘best of’ queries with their roundup articles

- The top-ranking domains are either dedicated tech-focused sites or authoritative sources (official brands), which signals that users prefer reliable, in-depth content when looking for guidance

High-performance content examples

Having downloaded the winning domains, it’s time to answer the question ‘How do these sites power up their rankings?’.

We are looking for high-performing content formats. These pages, templates or sections rank on page one for a good percentage of their keywords. Content that Google consistently wants to rank for their target smartphone terms.

These are examples we want to learn from.

If our winning domains add a new page on a relevant subject using one of these high-performance formats, they can expect to rank competitively for many of their target keywords. We can hypothesise what Google wants to reward if we find such examples.

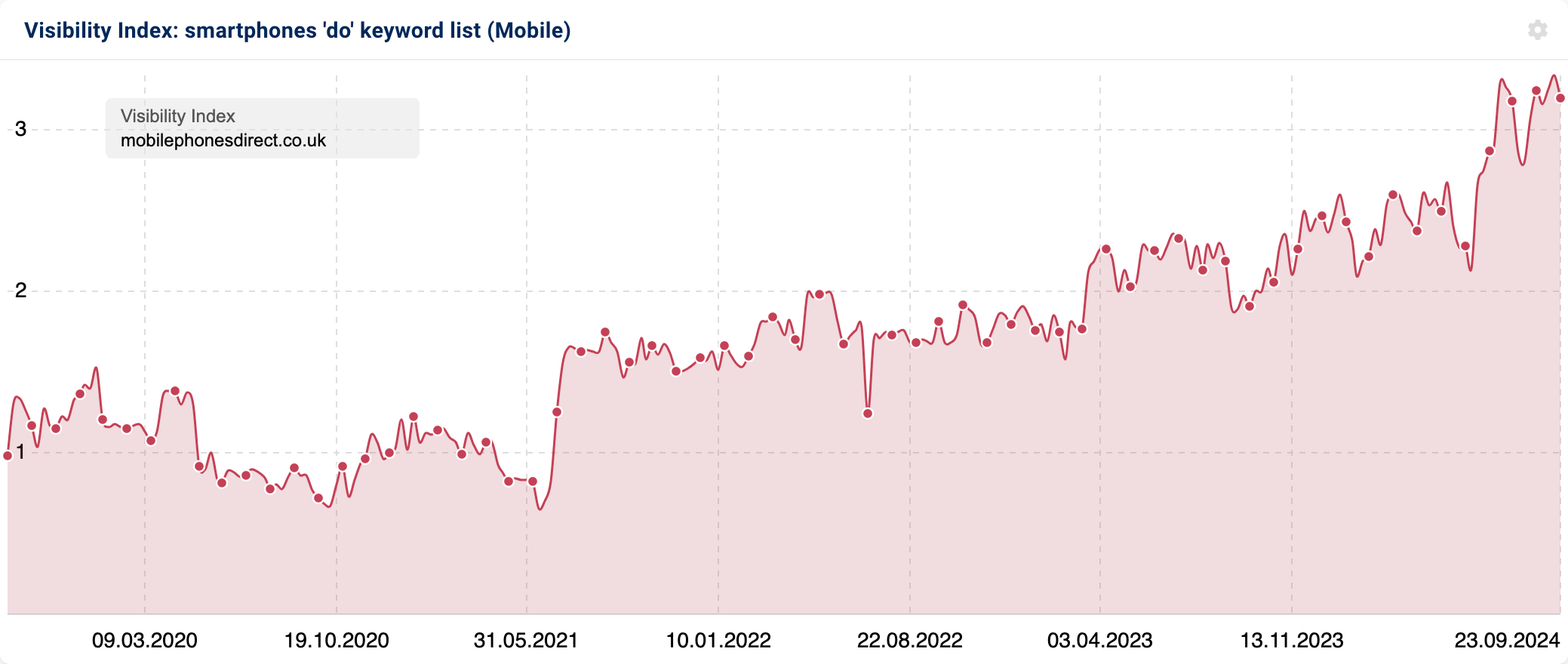

With full bars at the top of our ‘do’ commercial rankings is Mobile Phone Direct, the online-only phone store.

The business was purchased by AO in 2018, with the aim of becoming the UK’s largest online-only phone retailer, and based on our research, they look well on their way. They outperform huge names like Amazon, Tesco and Apple.

The site ranks for 73.8% of our ‘do’ keywords (1,441), with 805 page one rankings (41.2%), just pipping Carphone Warehouse to the top slot.

If we take a look at their overall visibility performance, and filter it just for our ‘do’ keyword set, we see that they have continuously improved over the past several years, including some big jumps around major Google updates.

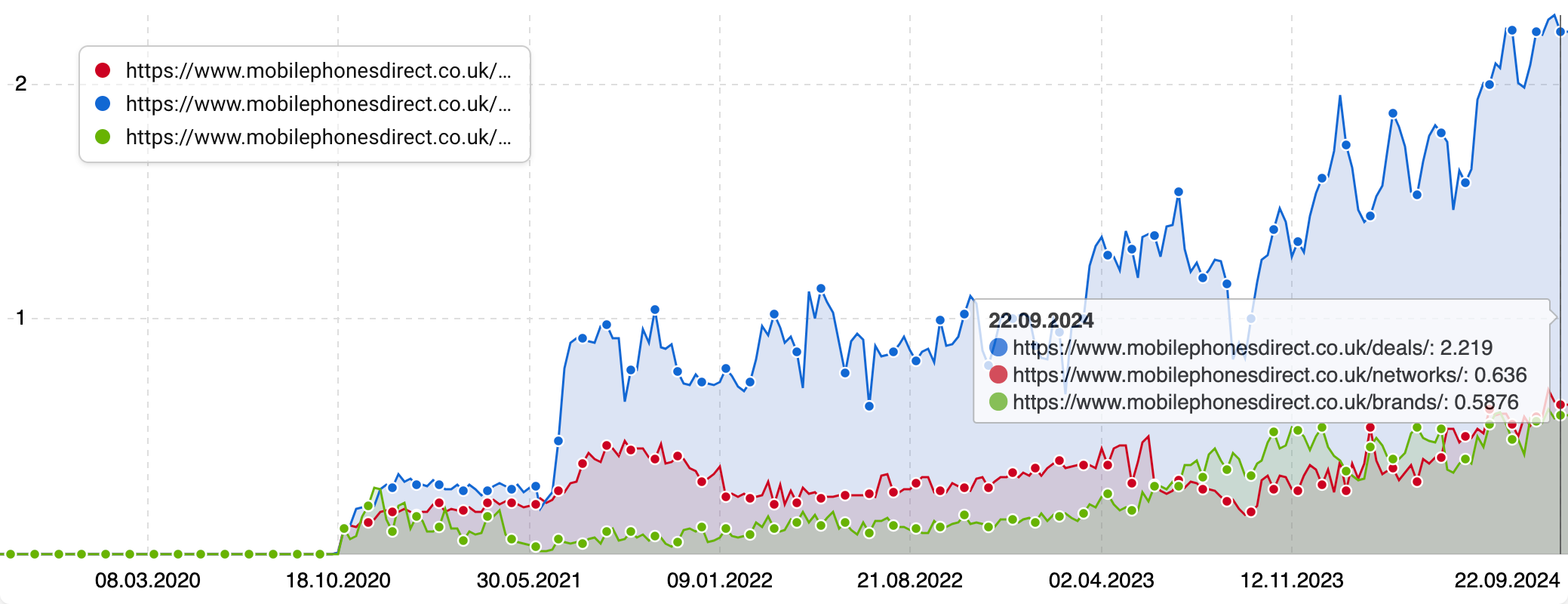

Mobile Phone Direct is ranking with content from several different sections – /deals/, /brands/ and /networks/, and if we review their performance, they are all examples of high-performance content!

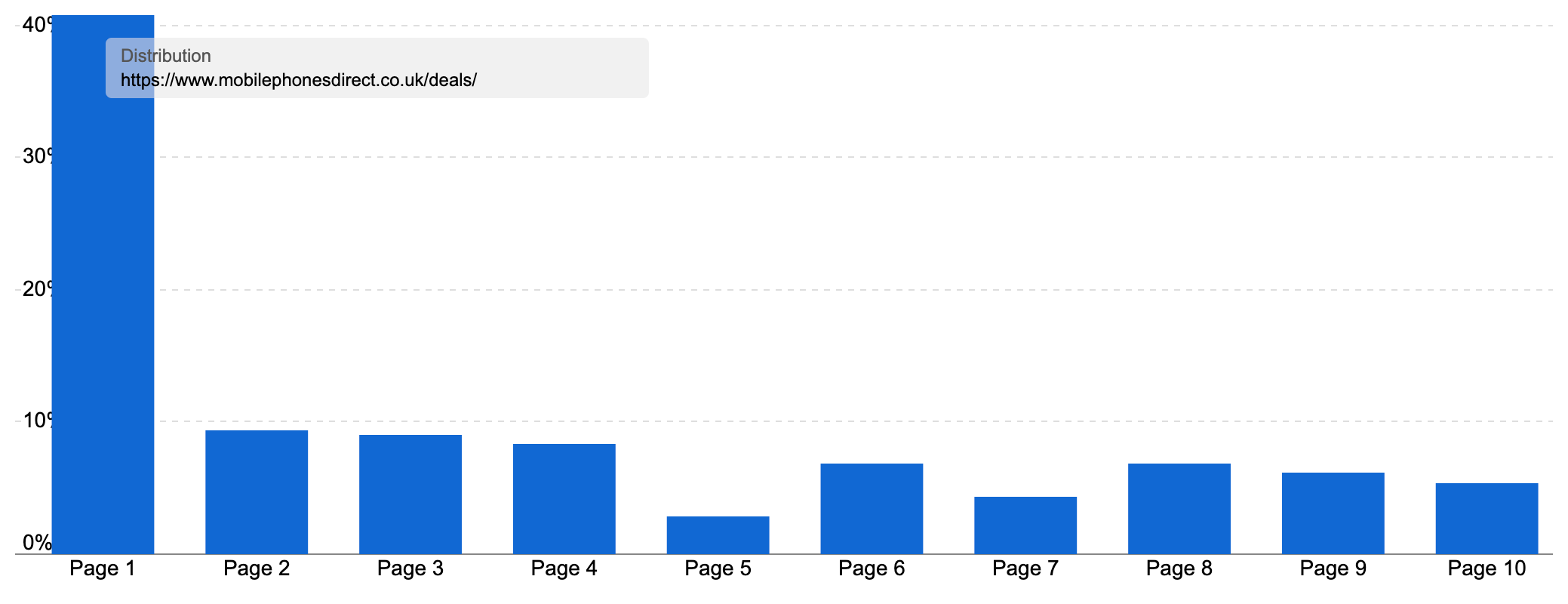

The deals section overall ranks for 10,273 keywords in the UK, and on page one for 40.8% of the most important.

It does this across 38 different URLs, covering all the most common ‘deal’ smartphone subtopics. For example, there are dedicated pages for sim-only deals, iPhone deals, Vodafone deals and more. The most popular of their pages for our keywords is the one on new contract deals, which ranks on page one for 203 of our keywords.

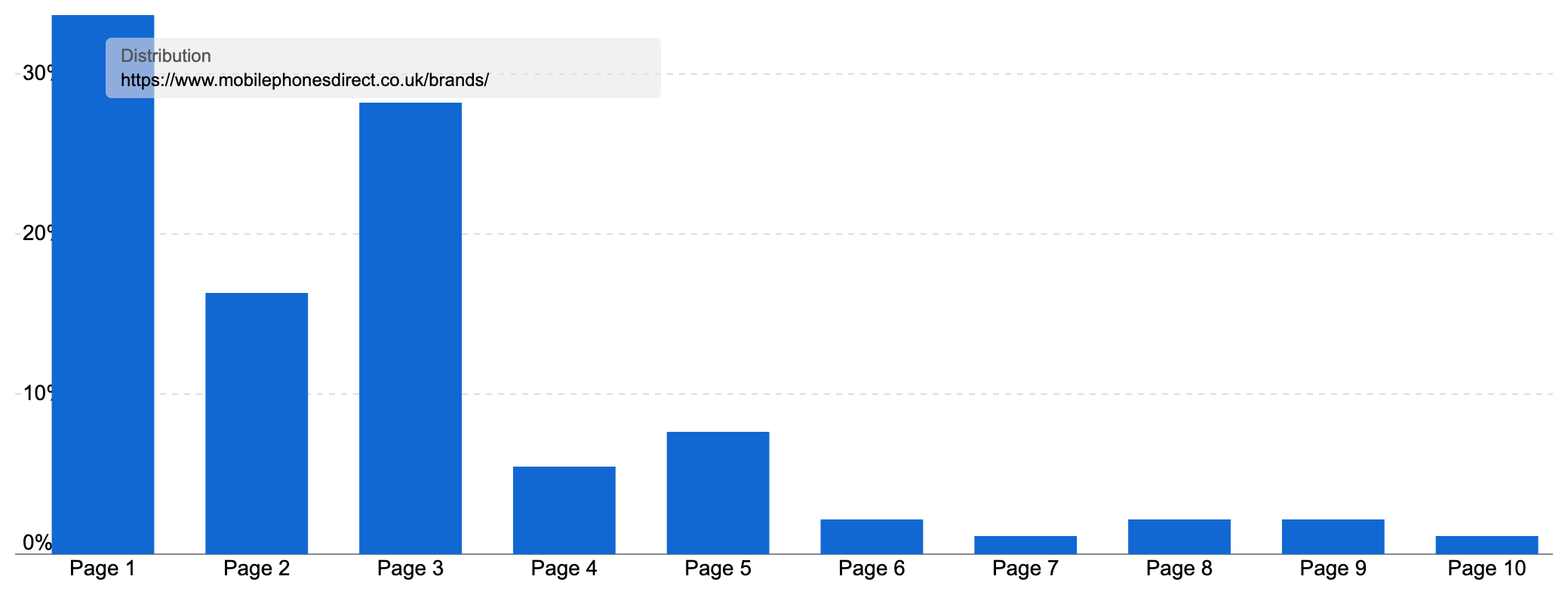

Meanwhile, the /brands/ section ranks for 2,565 keywords in the UK, and on page one for 33.7% of the most popular ones:

As you’d expect, here you’ll find dedicated product listing pages (PLPs) for all the major brands. We can see pages based on Apple, Samsung, Google, Nokia and Sony all ranking.

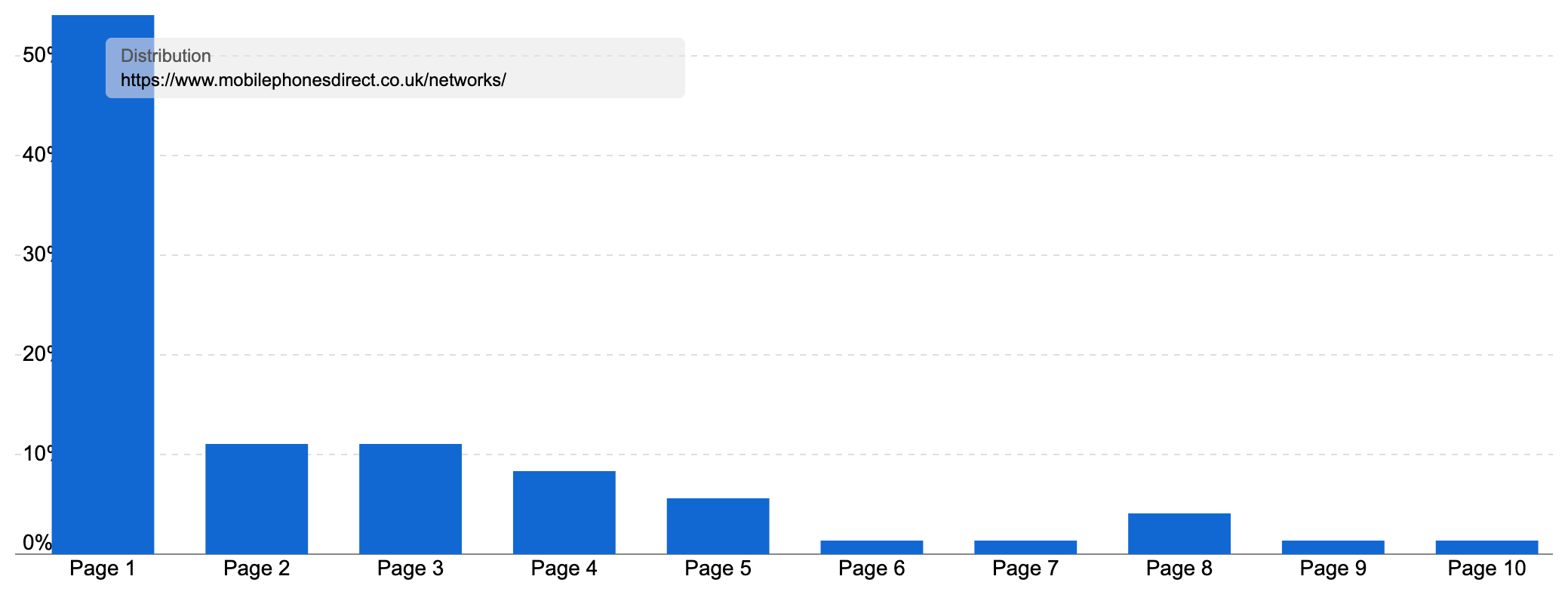

Finally, there is the networks section, which works similarly, with pages for each of the UK networks they carry, plus some upgrade subpages for them.

This section ranks for 4,645 keywords in the UK, and on page one for an incredible 54.17% of them:

With this granular breakdown, Mobile Phones Direct has dedicated PLPs for the most common ways we search for new phones and phone contact deals.

Should they expand their catalogue, such as carrying more brands or more networks, they can create a new page in the relevant directory, and be confident that it should perform well.

Why does Google like these pages so much?

They provide a great shopping experience:

- A big range of products for customers to find the perfect option

- Filters that are bespoke for smartphone shopping – upfront cost, monthly bill, network etc.

- Good detail for each product listing, including costs, key features (the benefits of this option), colour choices and special offers

- And the main navigation has quick links to all the popular networks, brands and models as well as sim-free options

But, notably, the Apple page could be better optimised:

- The H1 tag is ‘About Apple’, which isn’t a description of the page’s content

- The title tag is over-long and repeats the brand name twice

- The meta description is overly long

- The ‘intro copy’ is at the bottom of the page (where users will likely rarely see it), and while it does feature good internal links it isn’t particularly helpful and includes references to phones from five years ago

But we can’t argue with the results – these pages are doing very well, and Mobile Phone Direct is in a great position to build on this success.

They are using their product range to create tailored content journeys for their audience. For most head and medium-tail smartphone searches with big search demand, they have a specific page showing customers exactly what they are looking for.

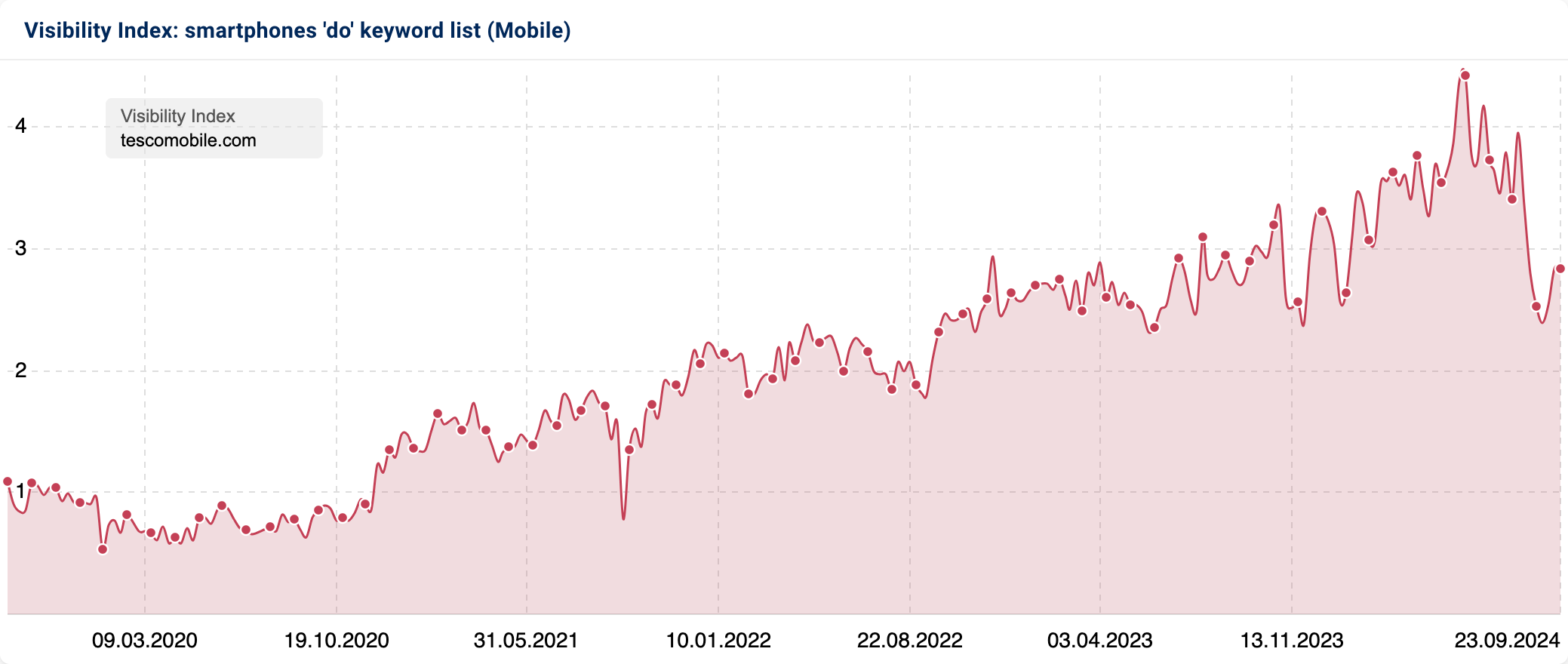

Another surprise entry for many will be Tesco Mobile in third place.

We thought we might have biased the list through too many ‘tesco’ keywords as one of the networks. But, in fact, only 32 of our 1,951 keywords are branded this way!

The site ranks for 81.7% of our commercial keywords, and on page one for 47.54% of them.

That’s even more impressive when you remember that they won’t rank well for any of the keywords in our set that mention another network, nor for brands and models they don’t stock.

If we look at their visibility for our keyword set, we see that despite a downturn during the recent August 2024 Core Update, the site has overall done a great job expanding its footprint for our transactional keywords:

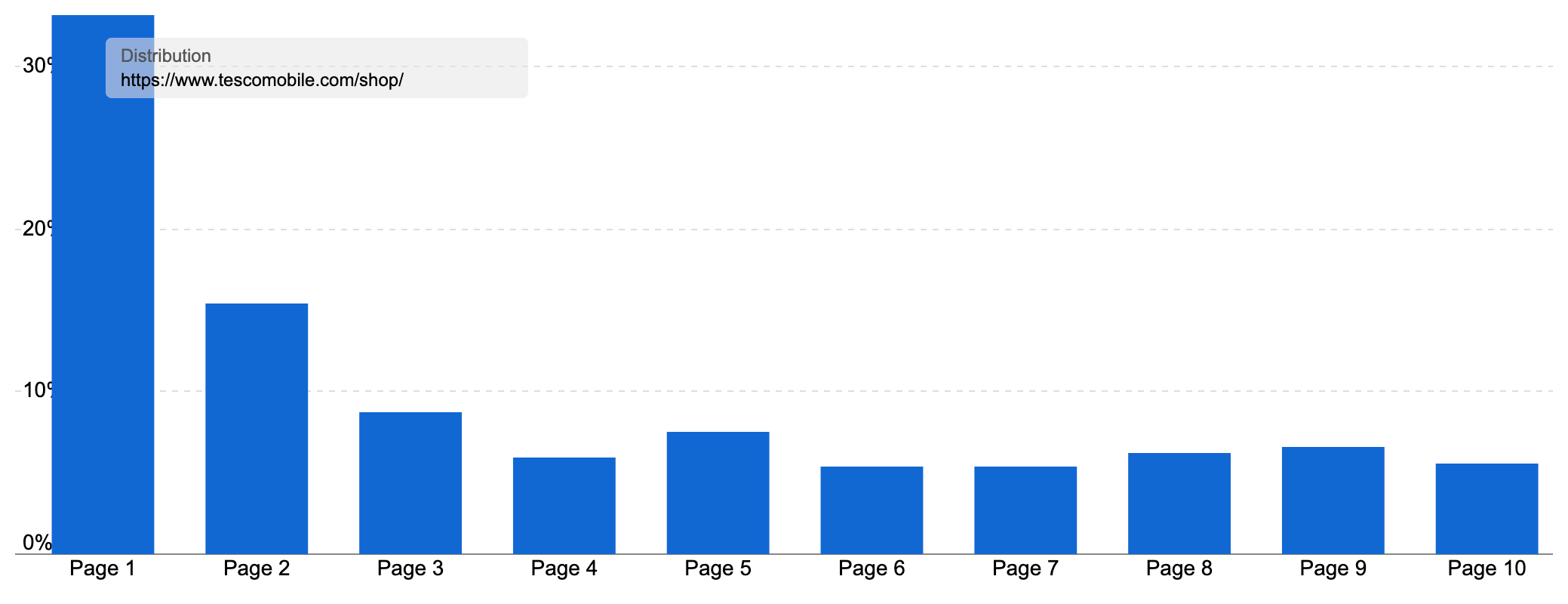

The site’s biggest directory is /shop/ which contains Tesco Mobile’s pages for shopping by brand (such as /shop/samsung), contract type (such as /shop/pay-as-you-go) and device (eg: /shop/apple/iphone-16).

Tesco also gets more granular – as well as having a subcategory for each brand that contains all the individual products and bundles, there are also niche pages under each contract type, such as pages by brand (/shop/pay-as-you-go/apple) or by other key feature (such as /shop/pay-as-you-go/budget).

Tesco also has top-level pages for important options such as https://www.tescomobile.com/sim-free to create a more comprehensive coverage of the most popular ways to shop for phones online.

Overall, the /shop/ directory has 147 pages ranking for at least one keyword in the UK. Together, they rank for 32,429 keywords, bringing in just shy of 200k organic visits each month, worth an estimated £304k in search traffic.

The directory ranks on page one for an impressive 33.19% of the most popular keywords, charging up that overall visibility we see above.

Of course, Tesco’s enormous brand signals will no doubt be helping power the site’s success. However, we have to bear in mind that the site isn’t on tesco.com – it’s on its domain, meaning it has to at least partly earn its signals.

One way it does this is by applying some of Tesco’s expertise on shopping experiences to the site. Compared to the Mobile Phoe Direct equivalent, Tesco Mobile’s page for Apple phones has some advantages.

It has better on-page SEO, such as the main heading and title tag, more filtering options, intro copy positioned at the top of the page (behind an accordion), better copy at the foot of the page and a set of FAQs within more accordions.

High-performance know content

Top of our pile is TechRadar, an online publication owned by Future Publishing, who run a catalogue of successful sites in the UK such as Go Compare, Homes & Gardens and Marie Claire.

The site ranks for 74.7% of our ‘know’ keywords, including on page one 40.5% of the time.

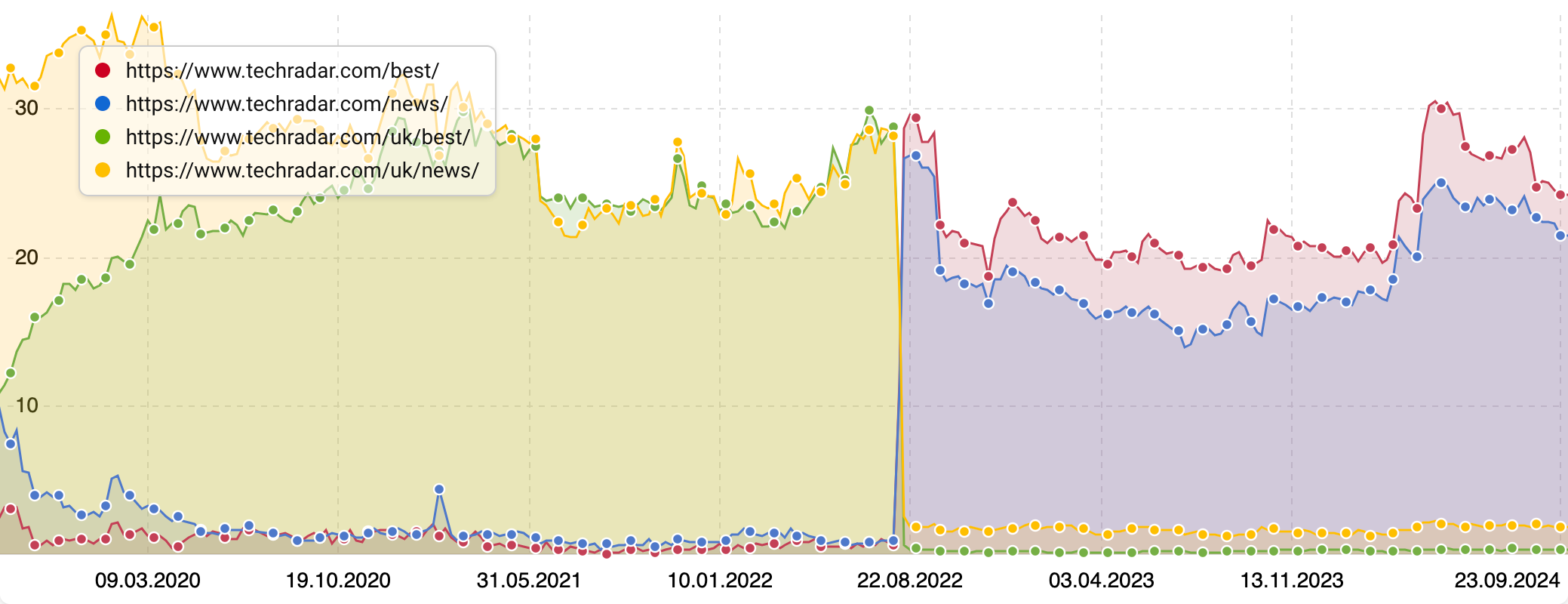

The most successful sections for our keywords are the /uk/news/ and /uk/best/ directories. However, these sections actually migrated to the /news/ and /best/ directories in June 2022, apart from a few guides that remain UK-specific.

Both directories are home to TechRadar’s roundup articles – both using the same article format – and it is with these that they get most of their rankings for our keyword set.

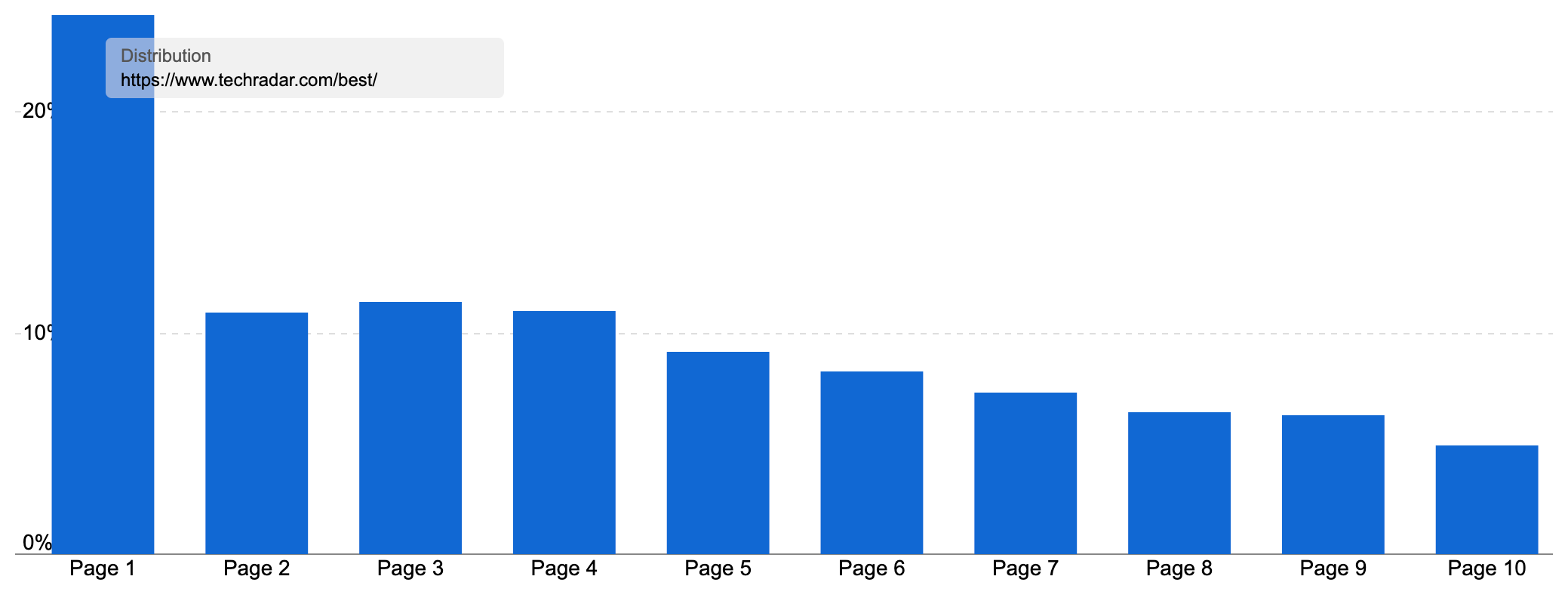

Overall, the /uk/best/ section ranks for 5,725 keywords in the UK across 19 URLs covering big consumer products such as smartphones, pillows and the best Netflix shows. 20% of those on page one powering 24,047 organic visits a month.

The overall (non-UK) /best/ directory ranks for a whopping 175.4k keywords in the UK, driving 409k visits a month worth £870k in search traffic. It achieves this thanks to page one rankings for 24.38% of those 175.4k keywords.

The /uk/news/ section ranks for 6,830 keywords in the UK, with 26.85% on page one.

No matter which part of the site we’re looking at, the roundups all use the same format – a format that Future uses across its site portfolio.

Fine-tuned to follow all of Google’s best practices for product reviews, these roundups tick many of the boxes when it comes to a comprehensive guide:

- A named author with a bio detailing their expertise in relevant subject matter, links to social profiles, plus a link to an author page which also shows all their articles

- A contents index with jump links to all the different sections

- Clear notification of the affiliate links, complete with a link to a page with more information

- A dedicated section on how they test phones

- A range of options for different circumstances. For the guide to the best phones, there are options for:

- The best phone for most people

- The best iPhone

- Best Samsung

- Best Pixel

- Best budget

- Best value

- Best alternative flagship phone

- There’s a quick summary of the top phones near the top of the page for those who just want a list

- And a FAQ section, which in this case only has two questions, but there’s space for more if they find more common questions to answer

- Each listing has plenty of detail, including:

- Rating

- Specifications

- Best deals (a range of affiliate links)

- Pros and Cons

- A good overview section

- A link to the full review for those that want to see more

- And helpful ‘buy it if’ and ‘don’t buy it if’ sections which act as great ‘advice’ within the summary each listing provides

Another strong site in our list is Tom’s Guide, which ranks for 68.3% of our keywords, and on page one for 28%.

Coincidentally, Tom’s Guide is also published by Future, and if you look at its guide to the best smartphones, it looks rather familiar:

That doesn’t stop the page from performing well – it ranks for 96 of our ‘know’ keywords (the fourth most successful page for our keyword set), and on page one for 70 of them – that’s 72.9% of their rankings.

There are some nice additions to the template, such as a breakdown and rating by attribute, such as for price, camera and battery life. All important criteria for UK shoppers.

Overall the /best-picks/ directory ranks for 94.8k keywords in the UK, earning around 127k organic visits a month. It’s not the best example of high-performance content as only 16.7% of its rankings are on page one, but a look at its visibility over time shows how it has been very strong in the past, and has some upward momentum from recent Google updates.

Summary

- Specialisation can drive success. For both commercial and informational searches, specialists can compete with the biggest brands on the internet, if they can offer a strong content or shopping experience

- While Amazon, Reddit and other giants appear, it is specialist retailers and tech review sites at the top of our rankings

- Different models have success for smartphones. We’ve got publications, online-only ecommerce sites, price comparison sites, traditional high-street phone retailers, community suites (Reddit) and manufacturers all able to rank despite the different business models. All these sites can succeed if they serve the intent of the searches, and follow the online axioms of the sector

- No matter your business model, the key ingredient to search success is your content format. High-performing in both transactional and informational searches follows structured, detailed formats that cater to user intent. Pages offering well-organized product listings, reviews, and helpful guides (with clear calls to action, pricing, and features) perform well

- Trending searches reflect brand popularity – our most popular searches are usually tied to specific product lines or manufacturers, such as iPhone 16 or Samsung Galaxy and release dates are a bigger indication of demand spikes than holidays like Christmas

- Google continues to show Reddit for most ‘question’ searches

Keyword research in the smartphone sector

To build data for our research, we curated two sets of keywords to form a representative sample of popular smartphone searches by the UK public.

When compiling our research, we always categorise our keywords by their search intent in this way. This helps build a picture of the common searches within a sector. And means we compare similar searches and the content aiming to rank for those searches. We’re comparing the success of content looking to solve the same problem types and appeal to the same stage of the smartphone buying or information cycle.

We have two lists – what we classify as ‘do’ keywords and ‘know’ keywords.

‘Do’ searches are those where someone is looking to buy, hire, download or convert in some way. For smartphones, that ‘do’ is someone buying a phone. Therefore, you might call these transactional or ‘shopping’ searches with a conversion intent. For many sites in the sector, these are among the most desirable to rank for.

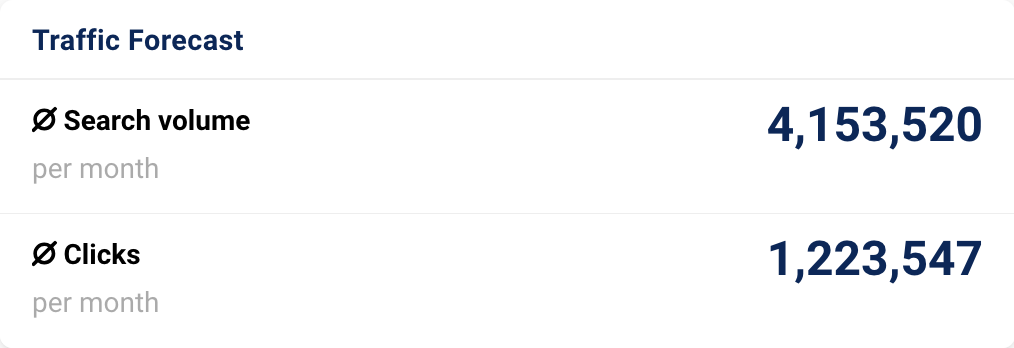

We have almost 2,000 ‘do’ keywords, which represent over 4 million searches on average each month, with peaks each September as we noted earlier.

We’ve included keywords like iphone 15 (276,000 searches a month on average in the UK), mobile phone deals (56,700 searches a month), google pixel (54,100), giffgaff phones (46,800) and cheap mobile phone (750).

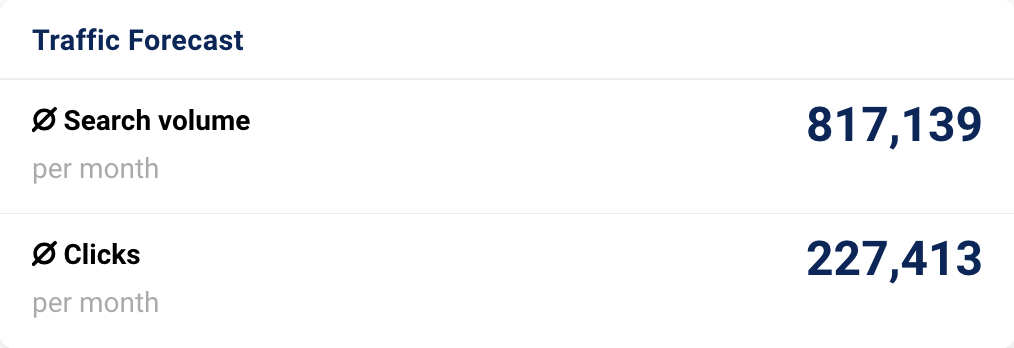

Our second set is our ‘know’ keywords, where someone is making an informational search. For smartphones, we have a lot of searches around finding the ‘best’ option in the market as well as release dates, and common phone questions such as how to clear the cache or how to take a screenshot.

Examples include new iphone (16,100 searches a month in the UK on average) and how to backup iphone (8,750). We’ve also included common commercial research searches such as best camera phone (3,650 searches a month), compare iphones (3,550) and best budget smartphone (3,450).

We excluded searches with a retailer’s name as these are navigational searches and not a level playing field to rank for. Although often navigational, we kept searches with brand names in, and most retailers and networks sell many of the most popular brands. We also only included searches for phones or phones with contracts, excluding searches for sim-only phone plans or other queries which weren’t specifically about buying a phone.

There’s a growing market for second-hand and refurbished phones – big enough for its own article! However, we haven’t included such searches or those on phone trade-ins in this study. We have a detailed step-by-step article on keyword research with SISTRIX tools and data where you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of smartphone keyword discovery tables. We chose a selection of highly targeted keywords with a ‘do‘ intent and a ‘know’ intent. From these, we harvest all the ranking keywords for the top-performing URLs in the SERPs. We call this the Keyword Environment. Many SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic rankings.

Curated keyword set and sector click potential

Core keywords: smartphone, mobile phone, iphone, apple phones, samsung phones, android phones, contract phone, best phone, compare phones, phone reviews.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and the traffic forecast you can see below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here.

Other publications in this issue Visibility Leaders:

- Database of high performance SEO directories. Search through to find inspiration from many categories

- Summary report – Trends, lists and take-aways from our 2024 retail sector analysis

- Winning SEO directories – Deep analysis by Callum Lockwood

- TrendWatch – 10 trends from the retail sector analysed by Nicole Scott

- SectorWatch – A deep look at leading domains in the smartphone sector by Charlie WIlliams. (This article.)