These new, developing trends come from various data sources and analyses that we have performed for this issue of Visibility Leaders. Trend data can help to keep content strategies ahead of the curve and ahead of AI models and can be useful for brand managers.

Outlet Shopping

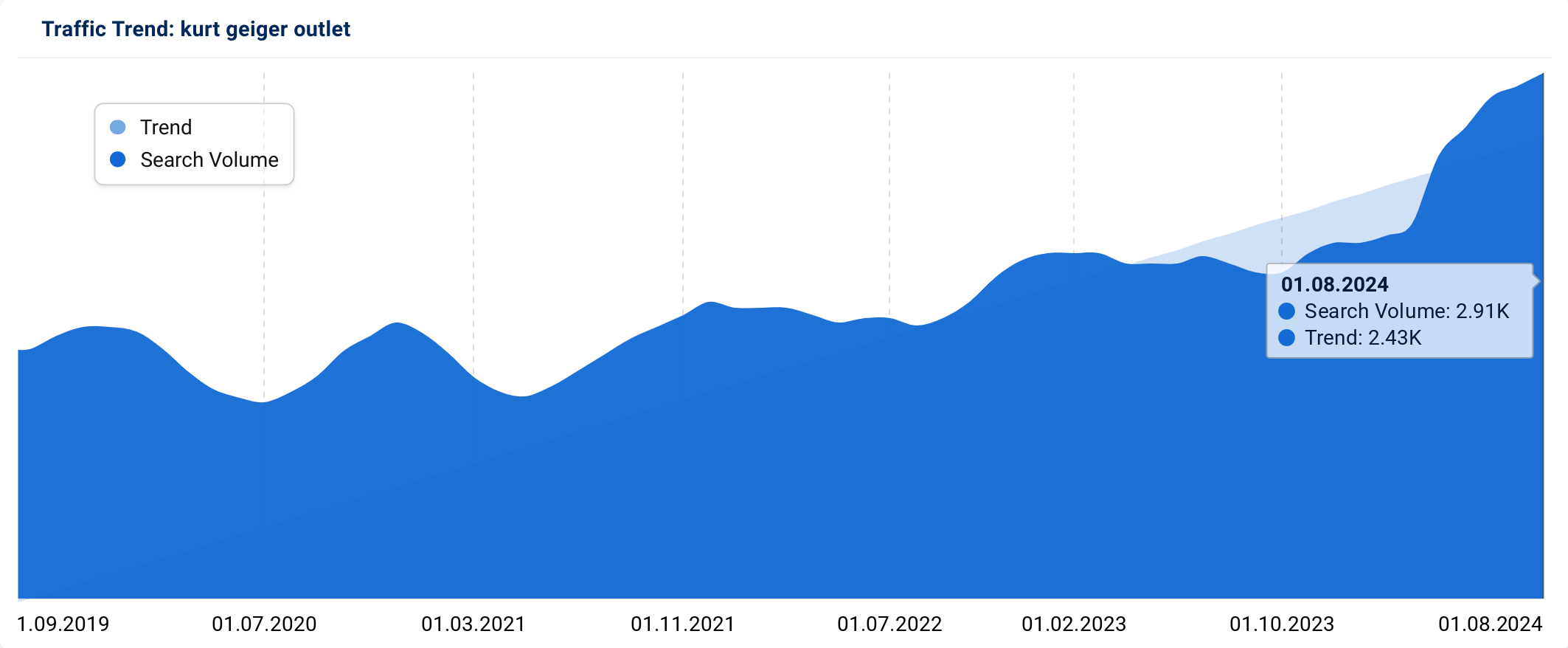

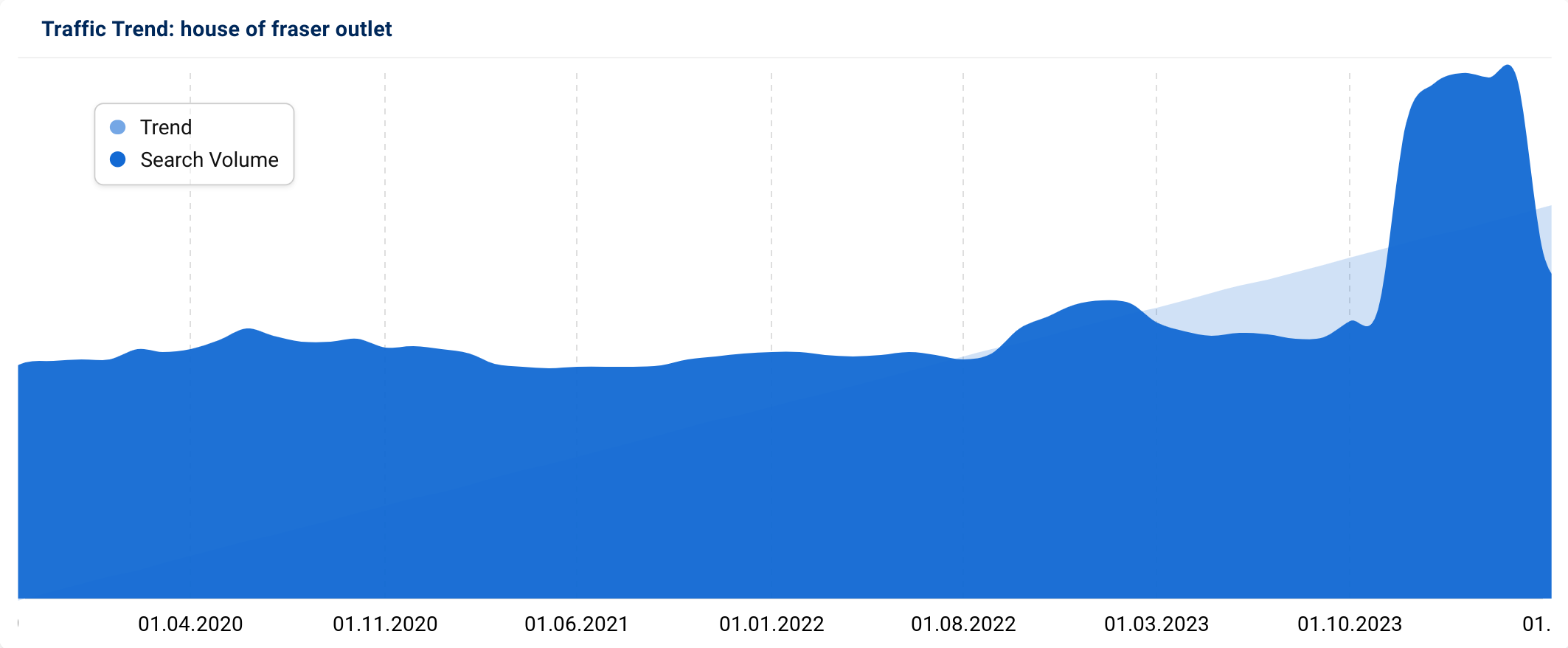

The retail landscape in the UK is witnessing a notable shift as both House of Fraser and Kurt Geiger outlets gain traction among consumers. House of Fraser outlets are trending primarily due to significant sales promotions and a strategic rebranding to “Frasers,” which aims to consolidate its offerings and enhance its digital presence. This transformation is evident in locations like the Birmingham outlet, which has transitioned from a traditional department store to a more streamlined outlet format, reflecting the brand’s commitment to evolving its physical portfolio.

Kurt Geiger, which has been expanding its outlet presence in recent years, is responding to inventory management needs and changing economic conditions. By offering high-quality fashion at discounted prices, both brands are effectively catering to the growing consumer demand for value, making their outlet stores increasingly popular destinations for savvy shoppers.

Source: retailgazette.co.uk

Greggs Outlet

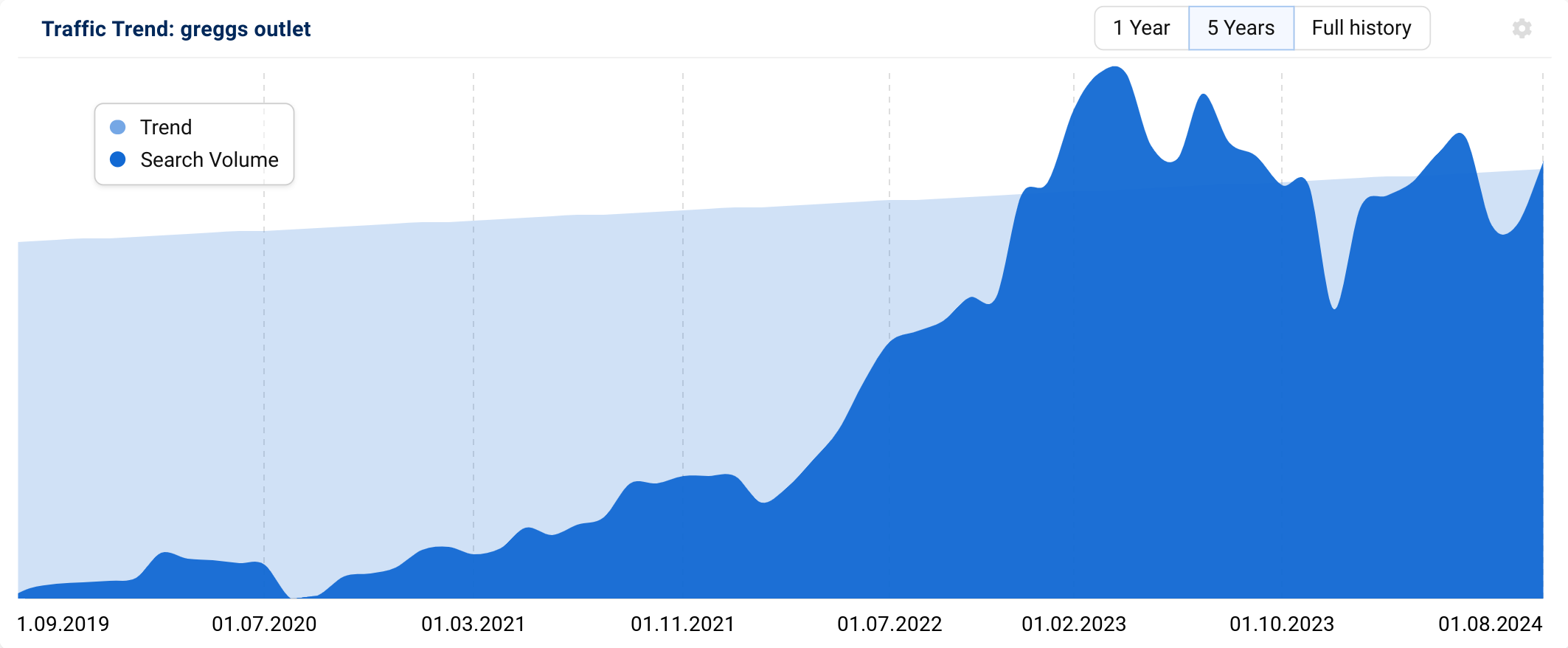

Last month, I had my first Greggs sausage roll, and it was so sinful I felt like I was committing a culinary crime! It was like biting into a flaky pastry pillow filled with all the guilty pleasures of the universe. They’ve recently expanded their outlet store initiative as a strategic response to tightening pocketbooks, particularly focusing on reducing food waste and addressing food poverty in underserved communities. The decision to open these outlets is rooted in the brand’s commitment to sustainability and community support.

Greggs produces fresh food daily, which can lead to significant waste if unsold products are discarded. By redistributing day-old items at discounted prices, Greggs not only minimizes waste but also provides affordable food options for families in areas of social deprivation. As Roisin Currie, Greggs’ chief executive, stated, “As a leading food-on-the-go retailer in the UK, it’s important that we do our bit to put an end to food waste and help to tackle poverty, hunger, and deprivation across all the communities we operate in.” This initiative reflects Greggs’ long-standing dedication to social responsibility, with profits from the outlets partially supporting the Greggs Foundation, which funds local community initiatives. With plans to open 50 outlet stores by 2025, Greggs is reinforcing its role as a socially conscious retailer committed to making a positive impact in the communities it serves.

Source: Retail-Week, chroniclelive.co.uk

Yayoi Kusama Artwork

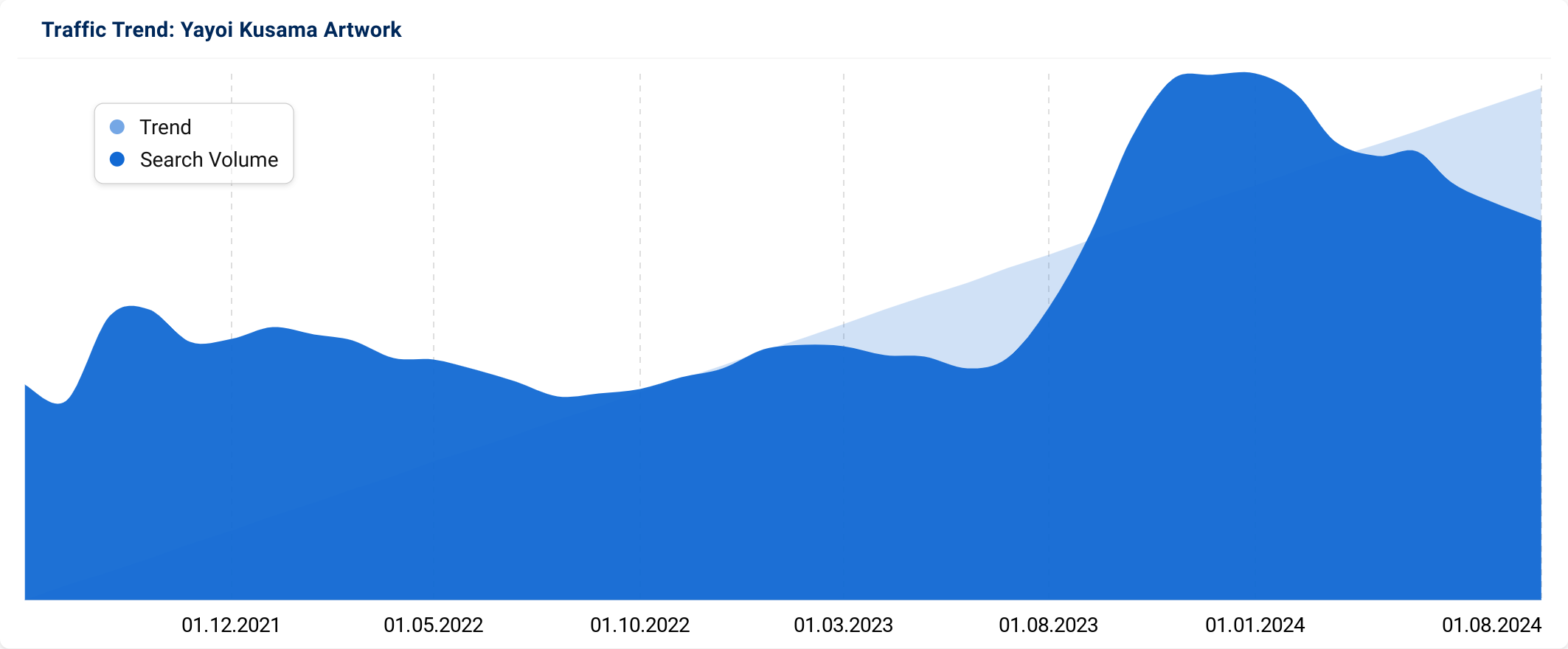

Yayoi Kusama, a renowned Japanese contemporary artist, is known for her bold, repetitive patterns and vibrant colours. She is known for creating interactive installations using her patterns. These immersive installations have inspired retailers to create unique and engaging shopping experiences.

Retailers have created immersive environments inspired by Kusama’s work, such as polka-dot themed rooms or mirrored infinity spaces. These installations not only attract customers seeking unique experiences, while providing a striking backdrop for products. Incorporating interactive elements, like touchscreens or augmented reality displays, further engages customers they want to share on social media.

Art-inspired window displays featuring large-scale reproductions of Kusama’s works have been drawing customers into the physical retail locations. By hosting events or workshops inspired by her art, retailers can create a sense of community and cultural engagement, attracting customers who appreciate creativity and artistic expression.

Source: L’officiel

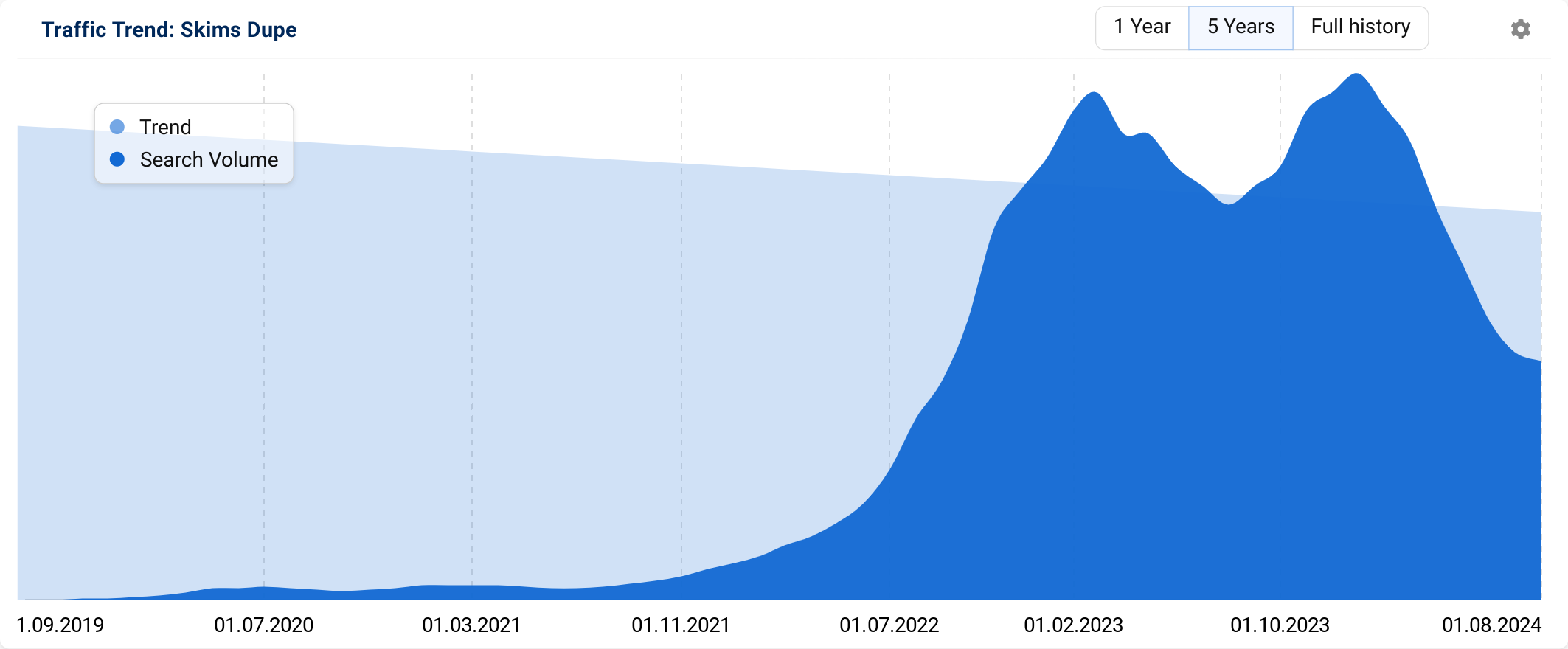

Skims Dupe

A “dupe” refers to a duplicate or imitation of a more expensive or high-end product, often marketed as a more affordable alternative. This trend has gained significant traction, particularly among younger consumers, who seek budget-friendly options without sacrificing style or quality. During economic downturns, consumers become increasingly price-sensitive due to reduced disposable income and heightened financial uncertainty. Many turn to dupes as a way to maintain their lifestyle and fashion preferences while managing their budgets more effectively.

TikTok has popularized “dupes” — affordable alternatives to luxury products. Many consumers, especially younger generations, view dupes as a smart way to access luxury aesthetics at a lower cost. This trend reflects a broader shift towards value and accessibility during economic challenges, allowing people to engage with fashion despite financial constraints. The dupe culture is likely to persist and evolve with market conditions.

Source: LSN Global

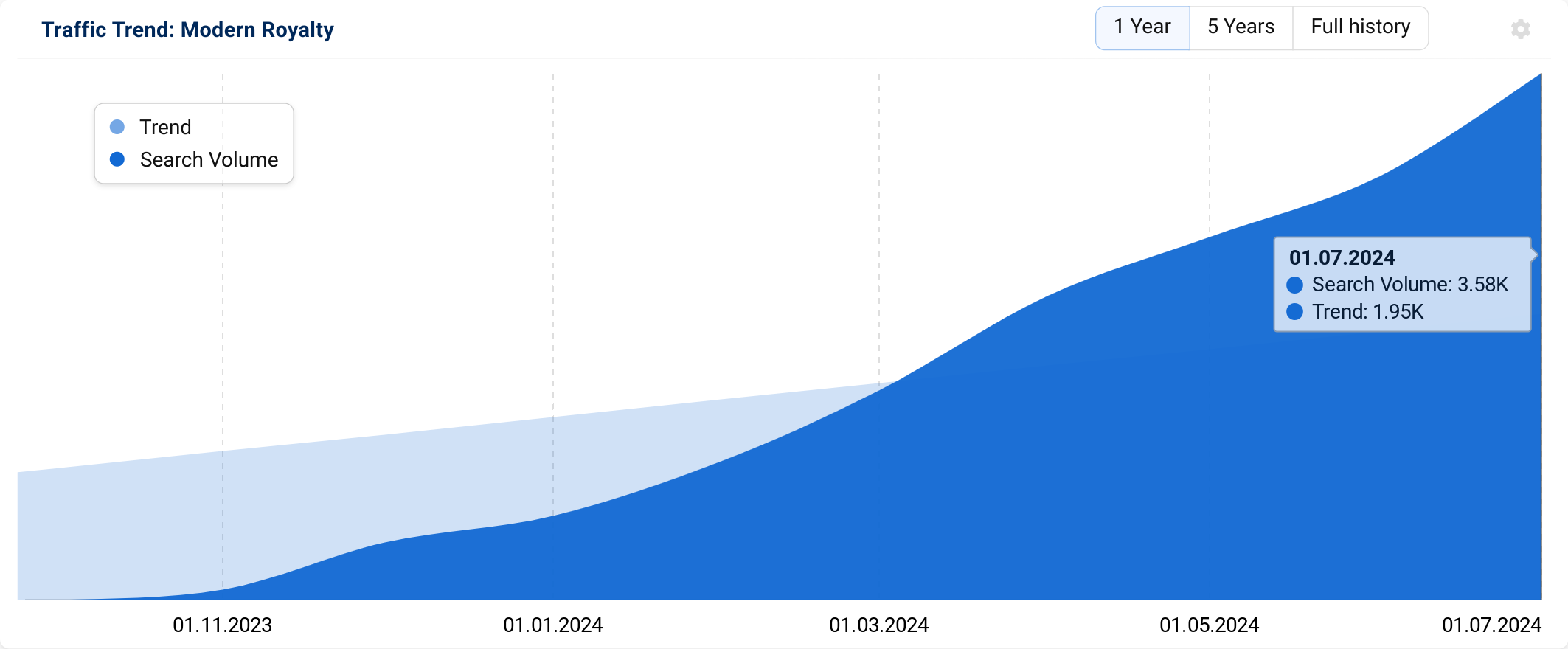

Modern Royalty

The fashion choices of royals like Kate Middleton and Meghan Markle are driving consumer demand and influencing buying behaviour. It’s made them powerful influencers in the industry.

Royals can significantly boost sales and brand awareness simply by wearing a particular item. When Kate wore a Reiss dress in 2011, the brand’s website crashed due to overwhelming traffic. This demonstrates the direct correlation between royal fashion choices and consumer purchasing power.

We have started to see influencers on TikTok and Instagram post links to items worn by royals and photos of them wearing them to generate affiliate sales. Retailers also collaborate with royals to create exclusive collections. Marks & Spencer has collaborated with Kate Middleton on several lines. These partnerships can help retailers stay ahead of trends and attract new customers.

The growing trend of royals opting for sustainable fashion choices is influencing consumer preferences. This shift towards ethical and environmentally conscious shopping has created new opportunities to offer sustainable products and align with consumer values.

Source: TalkPal, HarpersBazaar

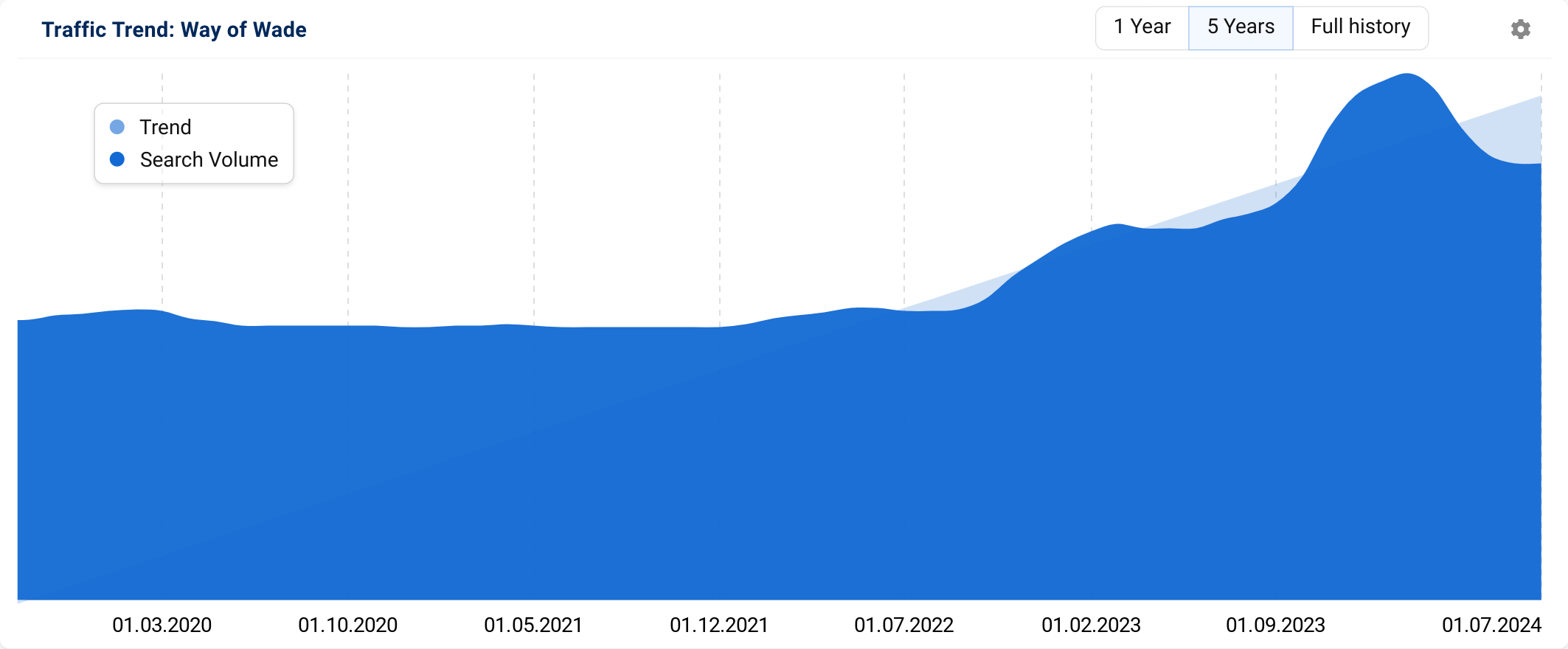

Way of Wade

NBA legend Dwyane Wade started “Way of Wade” a fashion house by partnering with Chinese sportswear giant Li-Ning. This collaboration reflects a new era where partnerships go beyond mere endorsements, representing a more balanced and equal approach.

Wade’s decision to partner with Li-Ning, rather than releasing a limited edition line like most sports stars with Nike or Adidas, was driven by a desire for creative autonomy. The “Way of Wade” is more than just a shoe line; it’s a brand that embodies Wade’s personal style, values, and vision for innovative sportswear. This partnership allows Wade to blend performance with fashion, experimenting with unique designs and materials that might not have been possible within the constraints of larger, more traditional brands.

The success of the Way of Wade brand is a good example of a growing trend of Chinese companies standing shoulder-to-shoulder with their Western counterparts. Li-Ning’s willingness to offer Wade creative control and a lifetime deal reflects their ambition to expand its global footprint, particularly in the lucrative U.S. market. This partnership model, where Western celebrities are treated as true collaborators rather than just faces for marketing, is reshaping how global brands approach international markets.

We’re seeing similar partnerships across various sectors of the fashion industry. With the right partnerships, brands can transcend geographical boundaries and appeal to a diverse audience. As more celebrities and athletes follow Wade’s lead, the fashion landscape is becoming more globally integrated, blurring the lines between East and West in innovative ways.

More trends to consider

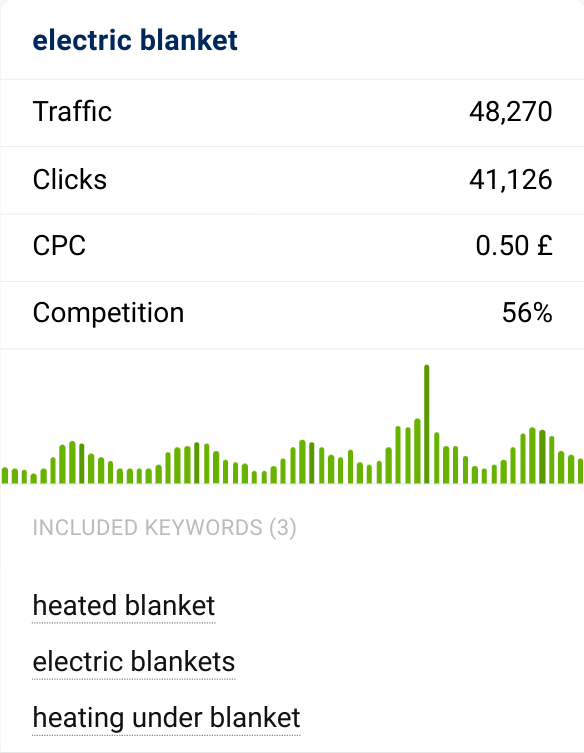

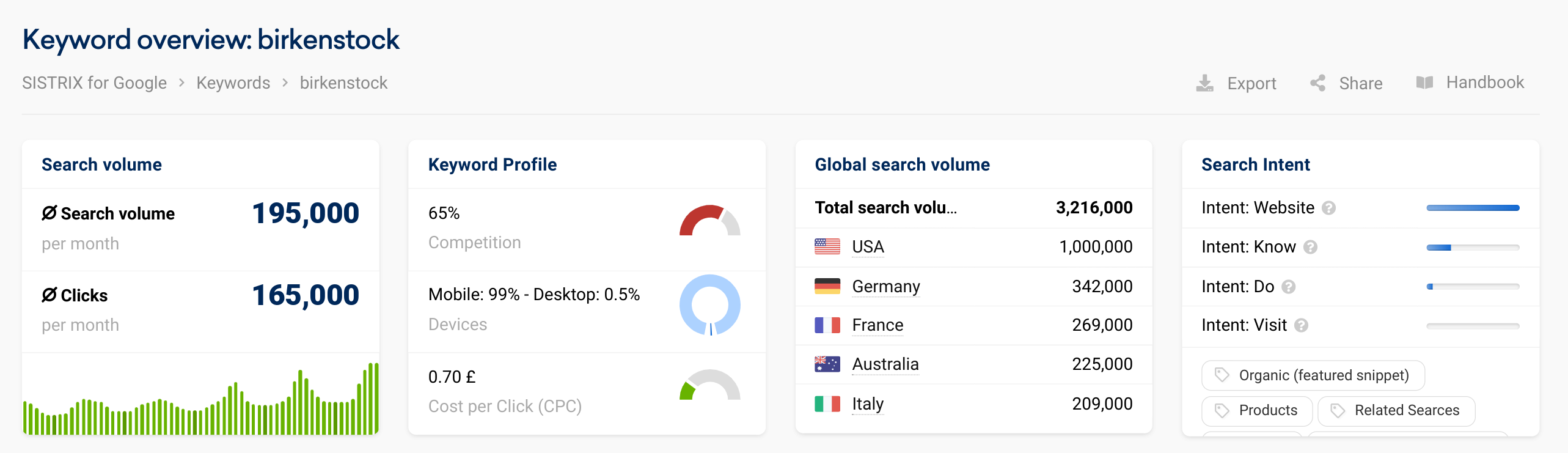

During our keyword research we are always keeping our eye on the search volume history graphics and we start here with an interesting peak, which could happen again. In December 2022 two events, possibly three, combined to create the perfect buying conditions for electric blankets in the UK. Firstly, the invasion of Ukraine pushed up energy prices. Secondly, the beginning of December 2022 was extremely cold. Playing into this was the Christmas peak which resulted in an extremely high search volume for electric blankets.

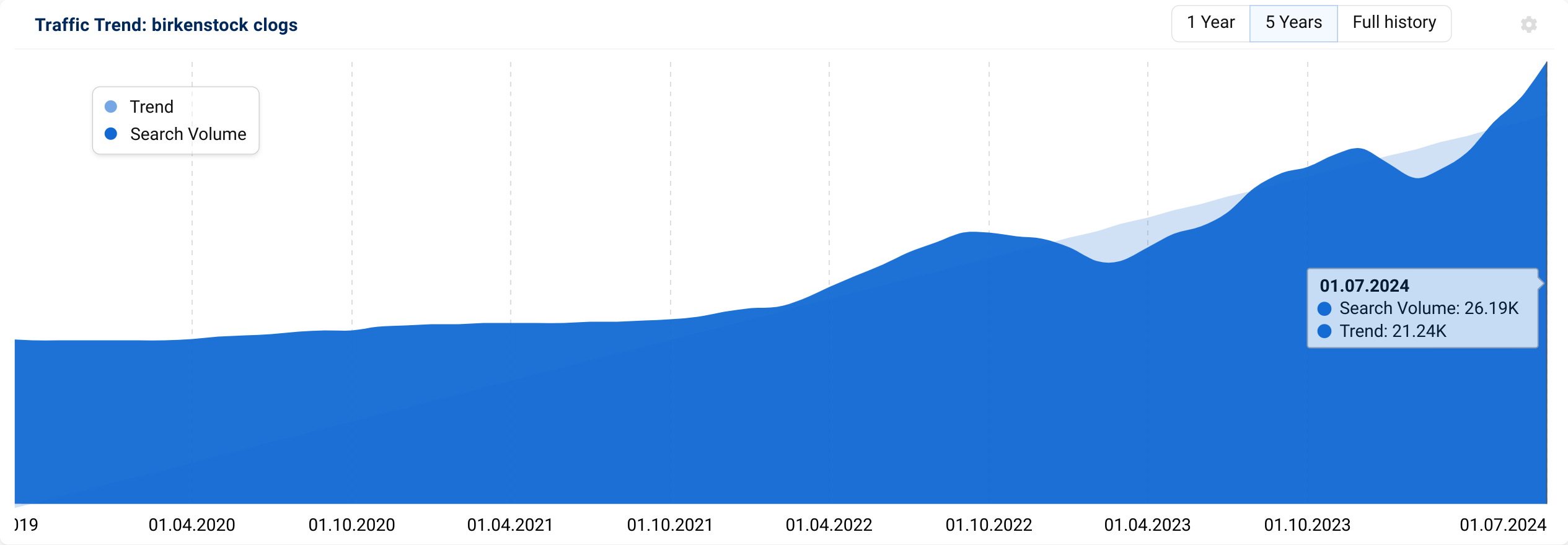

Here’s an interesting one. Who would have thought that clogs would become a trend? Birkenstock, the German shoemaker, has been rising for a while. The peaks occur in summer when their trademark sandals become popular. That peak has been growing over the last 5 years.

There’s a sub-category, however, that’s driving some of that growth though. Look at the 5 year trend for birkenstock clogs. We’ve spoken to a few experts on this. The first idea is Barbie. The 2023 film included a scene with Birkestocks, but not clogs.

The second, and more likely cause is recommendations and VIPs.

And what URLs are the most visible for the product? Office and Schuh are fighting it out. Birkenstock come in third.

Additional retail trends in 2024

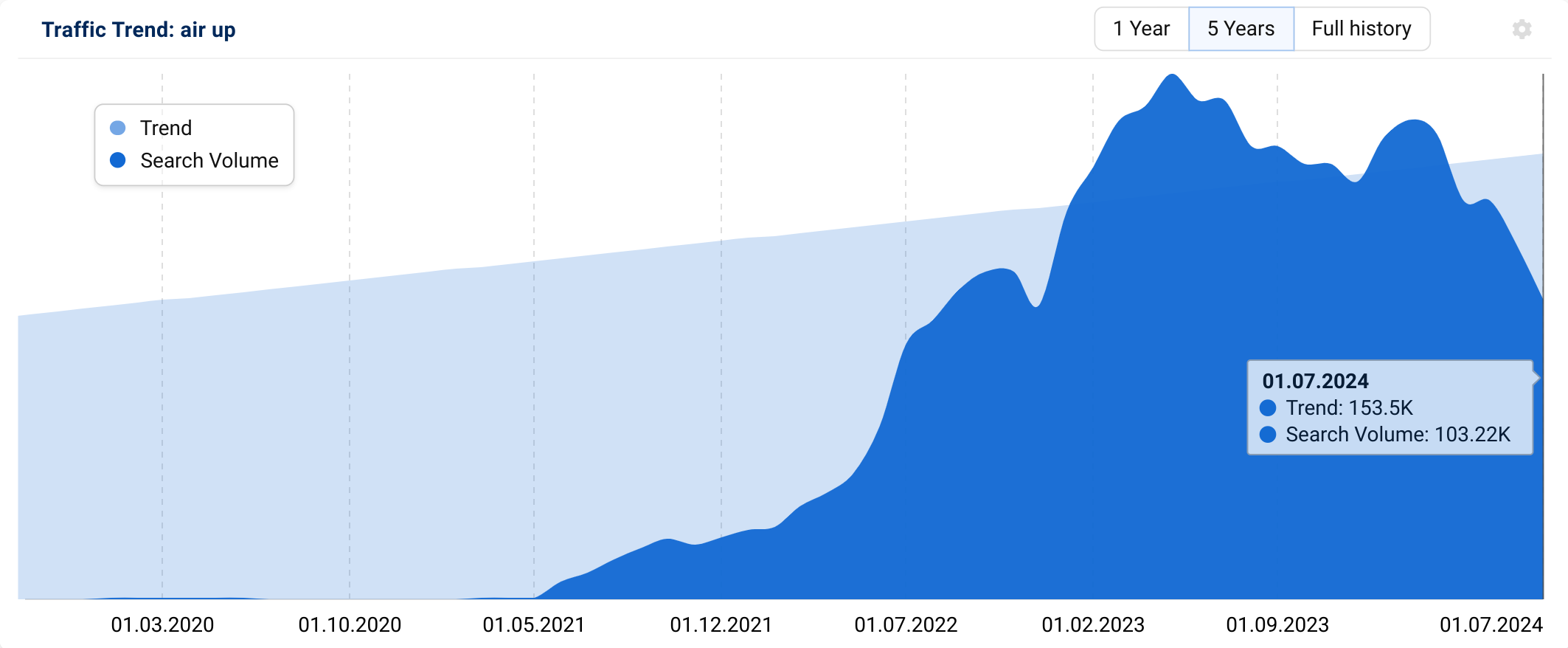

Additional trends found during our research include adidas campus, P6000, peroni capri, asics novablast, pistachio paste, garmin vivoactive 5, lumi ice bath, owala water bottle, lions mane (mushroom, growing, powder) and, a huge trend that might be waning now, air up.

Subscribe to the TrendWatch monthly newsletter for more trend stories

TrendWatch is created by the data journalism team at SISTRIX. Every month TrendWatch brings you the backstory to interesting and sometimes humorous keywords that have been developing over time. Search volumes are for the most recent full month in the SISTRIX data. Sign up here.

Other publications in this issue Visibility Leaders:

- Database of high performance SEO directories. Search through to find inspiration from many categories

- Summary report – Trends, lists and take-aways from our 2024 retail sector analysis

- Winning SEO directories – Deep analysis by Callum Lockwood

- TrendWatch – 10 trends from the retail sector analysed by Nicole Scott. (This article)

- SectorWatch – A deep look at leading domains in the smartphone sector by Charlie WIlliams.