Visibility Leaders, Q4 2024, brings you detailed and extensive analysis of the retail sector in the UK search channel. You’ll find a list of successful content projects that Google loves, keyword lists and trends and detailed analysis of the winning directories in the sector. This research takes a user-first approach with carefully curated keyword lists in the informational and commercial search intent categories.

We start by celebrating the four winners of the 2024 study across Do and Know categories of content intent.

The complete set of high-performance directories has been published in a searchable table here.

The fours reports available with this issue of visibility leaders are: This overview, the analysis of the winning directories, a special trend analysis and the targeted report on the smartphone sector – one of the biggest sub-categories in retail.

Top domain trackers

The top 10 domains, based on the keyword lists used in this project, are shown below. They update once a week. The first tracker shows top domains for the commercial, DO keyword set.

The second tracker shows the domains for the informational, KNOW keyword set.

The trackers above were added in March 2025.

Commercial search volume is shown below, from the DO keyword list.

Informational search volumes from the KNOW keyword list are shown below.

Retail UK. What’s happening in the search channel?

Following on from the very interesting look at Women’s Fashion in April 2024, we circle around to retail again, a category that extends across, well, Amazon to be honest. The Amazon ‘elephant’ shows just how wide the topic can be, and that’s without being an expert in anything it sells.

It’s important to understand here that we’re not looking down a real-life UK high street and using that as a starting point. Visibility Leaders starts with the user, and the analysis is based on carefully crafted sets of keywords.

This ‘what users want’ approach is the only way to show the real competitors in search, including the digital-only players, hidden champions and rising stars.

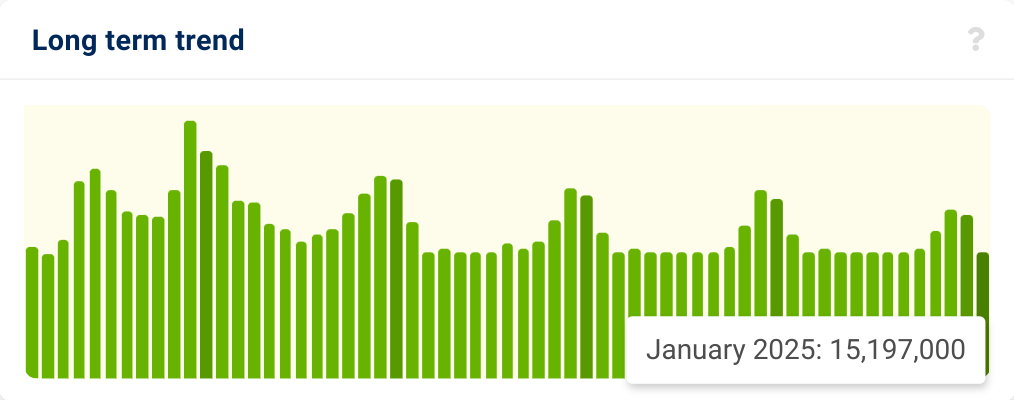

The combined keyword set (all intents, 1157 keywords, at initial date of publishing) that we have used for this study represents 20622264 (over 20 million) searches in Google UK per month on average over the year. The peaks, November to January are significant. Ignoring the COVID and post-COVID effects, the last three years have been very similar.

The top 10 searches in UK retail

The top keywords by search volume that formed part of our curated list are shown below.

- apple watch

- air up

- ipad

- tommy hilfiger

- iphone

- ring doorbell

- under armour

- birkenstock

- mamas and papas

- washing machine

Apple are well represented there but at number four we have a fashion and perfume brand that’s also a VIP. This type of crossover also occurs with brands that commonly used terms. Hoover and Jakuzzi are good examples.

Birkenstock has been growing, thanks to clogs and the ring doorbell (Amazon) is a popular search term in Google Search too.

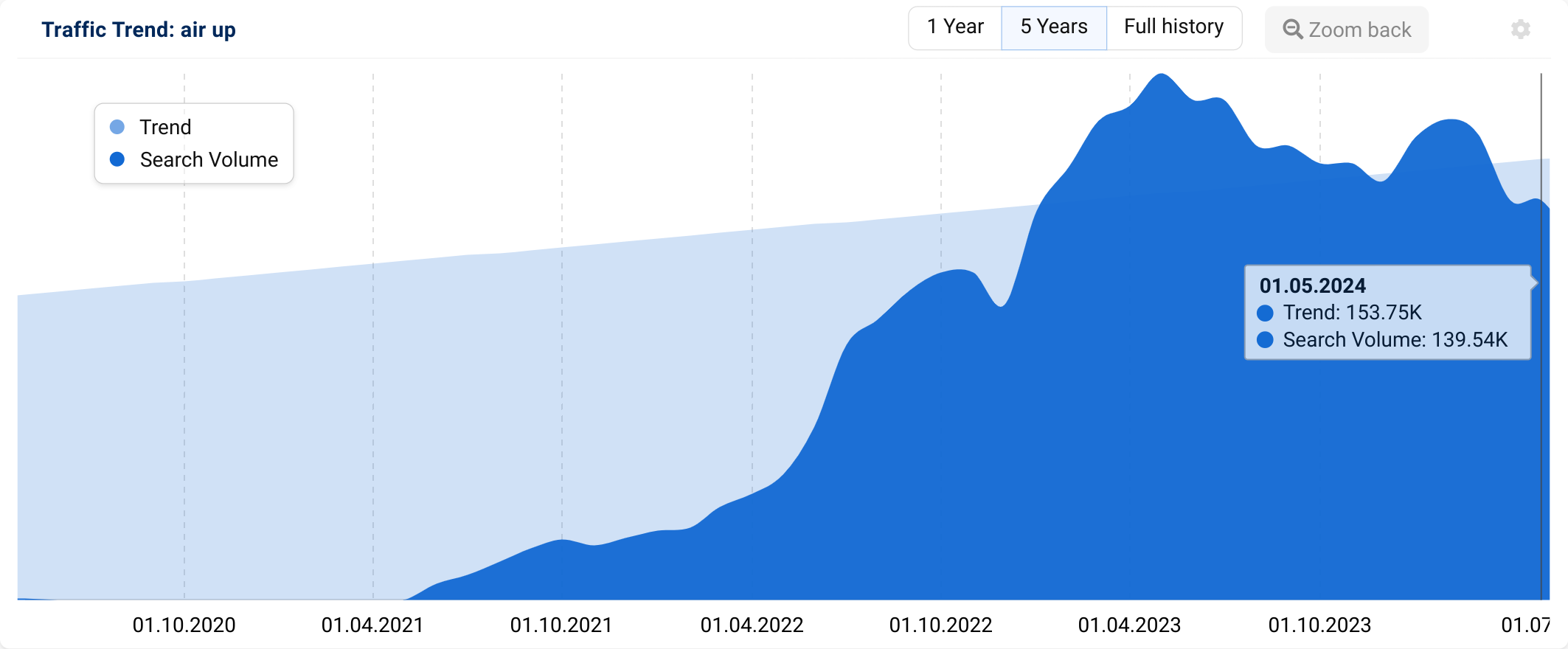

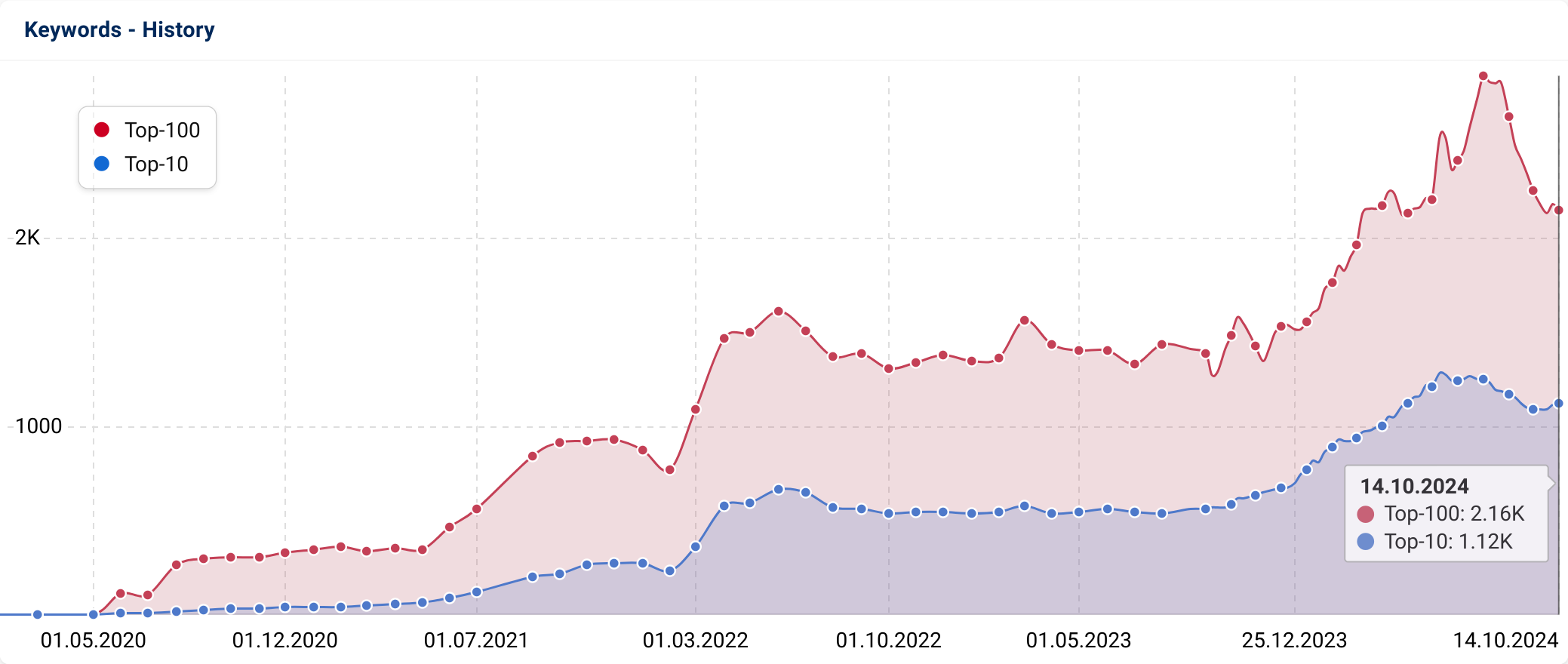

Last time we did this study it was the air fryer that was the big trend. That trend has tailed off and there is a new air in town. Air up.

For more trends, including another drinks container, see our special retail edition of TrendWatch.

The aim of Visibility Leaders is to provide SEOs with a list of high performance directories. Why directories? Because directories are often focused on a particular intent and topic. The UK car recovery service, The AA, for example, uses a domain that covers many services and uer intents – breakdown recovery, sales, rental, finance, insurance, training, traffic news, route-planning and an information library are all hosted under the domain. The /driving-advice/ directory, however, is a good example of successful informational content in the auto industry.

These high-performance content formats are the best place to look for SEO inspiration. Learn about content style, UX, brand and voice. The full list of all Visibility Leaders is available here.

Leading directories

Here are a handful of examples of SEO best-practice.

https://www.moss.co.uk/suits – ranks for a mix of KNOW and DO intents with a ratio of 60.6% of keyword rankings on page 1 of search results.

https://www.sportsdirect.com/football-shirts Is growing, and clear of any obvious reactions to Google updates. 45.7% of the ranking keywords are on page 1 of the search results

https://www.beermerchants.com/browse has had a growing presence over the last 5 years. 47% of keyword rankings are on page 1.

All leading directories are listed in the Database of High Performance SEO Content.

Amazon data

Visibility Leaders focuses on Google, but as a teaser of what could come in future Visibility Leaders reports, here’s a first look at some Amazon search volume data.

Over 50% of product searches start on Amazon – said a study in 2016 that is no longer available to view. Is it true? Here’s a non-scientific comparison.

The list below shows the Google and Amazon search volume for a set of leading retail product search terms.

| Keyword | Google UK MSV | Amazon UK MSV |

|---|---|---|

| air up | 361000 | 28400 |

| air up pods | 64,400 | 17600 |

| washing machine | 178000 | 7550 |

| dishwasher | 66200 | 8150 |

| dishwasher tablets | 7900 | 96800 |

| ring doorbell | 170000 | 141000 |

| birkenstock | 165000 | 3200 |

| air fryer | 245000 | 210000 |

| air fryer liners | 9700 | 105000 |

| aa batteries | 6000 | 182000 |

| ironing boards | 2500 | 29800 |

| fake plant | 1950 | 2450 |

| protein powder | 69700 | 135000 |

| water bottle | 41100 | 179000 |

| cat litter | 4100 | 107000 |

| suitcase | 94500 | 73500 |

| multimeter | 6750 | 11900 |

| desk fan | 5300 | 16400 |

| gaming pc | 88500 | 77700 |

| garden chairs | 24000 | 8350 |

| e14 led light bulb | 30 | 3700 |

| best hair dryer | 4350 | 350 |

| hair dryer with diffuser for curly hair | 70 | 2400 |

| best hair dryer with diffuser for curly hair | 100 | 20 |

| extension lead | 11400 | 122000 |

| cooking set | 150 | 600 |

| mop head | 1550 | 3100 |

| mop | 17200 | 49200 |

| new york hotel | 1150 | not found |

| shilajit | 58400 | 60200 |

A clear separation occurs when you look at the difference between searches for “dishwasher” and “dishwasher tablets”. The same is true of the air fryer searches in the list above.

Users rarely search on Google for an “e14 led light bulb” and yet they might start their search for a new hair dryer there.

It might be true that there’s more search volume for mass-market and regular purchases on Amazon. It’s also true that purchases that might demand a little more thought or financial commitment will occur on Google.

Since September 2024 our Amazon data is included in all new SISTRIX accounts alongside the Google data. We’ll bring more insights to that data set over time through our data journalism team.

Presentation Slides

The following presentation was made at BrightonSEO in October 2024.

BrightonSEO Presentation recording

Do your own leaders analysis. Find leading competitors

Our data engineers have processed billions of data points to bring you the leading content directories, but that doesn’t mean you can’t do some research for your own sector. The SISTRIX keyword list analysis features allow you to quickly and easily find leading domains and URLs and then analyse them for visibility leaders. New features such as traffic history, top URLs and clustering will help you make decisions about priorities in your content projects.

Methodology and source data

We’re always transparent about where our data comes from. We don’t synthesise anything, we just take ‘what Google says’ at scale and present it in ways that help SEOs, for all domains.

The results are based on two stages of analysis.

In stage 1 we use our keyword and SERP database to curate relevant B2C examples into buckets of keywords. The keywords were filtered into intent buckets using our keyword list features. The list was also curated by hand to remove any obvious errors and outliers.

Based on this list we can produce a tailored Visibility Index. Again, we use our list features for this and uncover high-ranking URLs within the keyword list. We then traverse this list and look for directories that are 1) Established with a significant level of Visibility Index. 2) Contain more than 10 URLs 3) Have a high percentage of rankings on page 1. The end results is an initial list of HPCF directories. You can read more about HPCF here.

Finally we double-check the directories by hand and tag the results with intent and sector information. Four winners are chosen by the analyst in the informational and commercial categories.

The final list is added to the HPCF database that you can view, filter and sort here.

All data is available in a Google Sheet. Feel free to take a copy for your own use.

Other publications in this issue of Visibility Leaders

- Database of high performance SEO directories. Search through to find inspiration from many categories

- Overview – Trends, lists and take-aways from our 2024 retail sector analysis. (This article.)

- Winning SEO directories – Deep analysis by Callum Lockwood.

- TrendWatch – 10 trends from the retail sector analysed by Nicole Scott.

- SectorWatch – A deep look at leading domains in the smartphone sector by Charlie Williams.