This Visibility Leaders project takes a detailed look at B2C online retail. This report, one of four, includes analysis of the four winning directories – great blueprints for success. This report, by sector expert Callum Lockwood, also covers latest trends in search and includes a take-away report.

- Summary analysis of winning content in the UK retail sector

- Retail and SEO

- The Winners - ‘Do’

- SkateHut.co.uk - maximising visibility for skates

- NaturalisticProducts.co.uk - winning across their entire range

- The Winners - ‘Know’

- Notonthehighstreet.com - wining with their gifting approach

- PoetryBooks.co.uk - a curated approach to success

- Summary & additional interesting observations

- Category coverage is still key for retail, for now…

- Changing user behaviour in search

- The impact of this on SEO strategy

- Specialised retailers & topical authority

- Blurring of commercial and informational intents

- Additional reports in this issue of Visibility Leaders

Summary analysis of winning content in the UK retail sector

Before we get into the detail, here’s a summary based on the data and expert experience in the sector.

Winning content directories:

- skatehut.co.uk/skates/ – VI 1.573 in the DO category.

- naturalisticproducts.co.uk/collections/ – VI 0.313 in the DO category

- notonthehighstreet.com/gifts/ – VI 8.587 in the KNOW category

- poetrybooks.co.uk/collections/ VI 0.262 in the KNOW category

Highlights detailed in the analyses below:

- Category coverage is still key for retail, for now…

- Changing user behaviour in search

- The impact of this on SEO strategy

- Specialised retailers & topical authority

- Blurring of commercial and informational intents

Retail and SEO

Over the past year in retail we have seen even more evidence to suggest that the way we shop in search is changing. Even more specifically, Google is changing the way users shop in search.

Google Organic Product Grids and AI overviews both appear to be increasing in prominence across the UK and Europe. Both of these features are having an impact on the way users interact with the search results.

Organic Product Grids allow users to be closer to conversion by providing a product browsing experience for previously ambiguous searches like “roller blades” and “blue disco light”.

Meanwhile, AI overviews 2 are cutting out the middleman when it comes to purchasing research by answering common questions and providing product tiles all in one place. The latter has predominantly been observed within the United States, but will likely continue to roll out across the UK and Europe.

Typically we have seen product listing pages drive the lion’s share of revenue and traffic for retail websites through organic search. This is still the case for a lot of websites, but we are already seeing a rise in organic traffic directly to product detail pages. These changes will likely result in; lower visibility and less traffic but potentially a higher conversion rate. The more Google satisfies users’ product browsing experience in the SERPs, the more you will see the aforementioned metrics change.

That’s all without touching on Reddit, with its ever growing visibility within the research stage of purchasing.

The Winners – ‘Do’

This time around we noticed that a lot of the high performance content formats were showing in search results for a variety of intent. This is largely due to the ambiguous nature of some of the head terms at the start of the user journey like “running shoes” — which could lead to both informational and commercial journeys.

Any winner for the ‘Do’ intent needed more than 30% of their keywords in that directory to be tagged as ‘Do’ in the SISTRIX database.

The full list of searchable and sortable directories is available on the Visibility Leaders overview page for retail.

SkateHut.co.uk – maximising visibility for skates

The large winner for ‘do’ keywords in retail is SkateHut.co.uk with their /skates/ directory. They are a retailer that sells skateboards, scooters, skates and a wide range of associated products like protective equipment. Their /skates/ directory covers everything from roller skates to ice skates and everything in between.

This directory ranks for a wide range of non-branded head terms and some more niche queries, including some “best” type searches such as “best roller skates for girls”. It’s considered atypical for a retailer to rank for terms like this, where you would usually expect to see product review sites and now AI overviews.

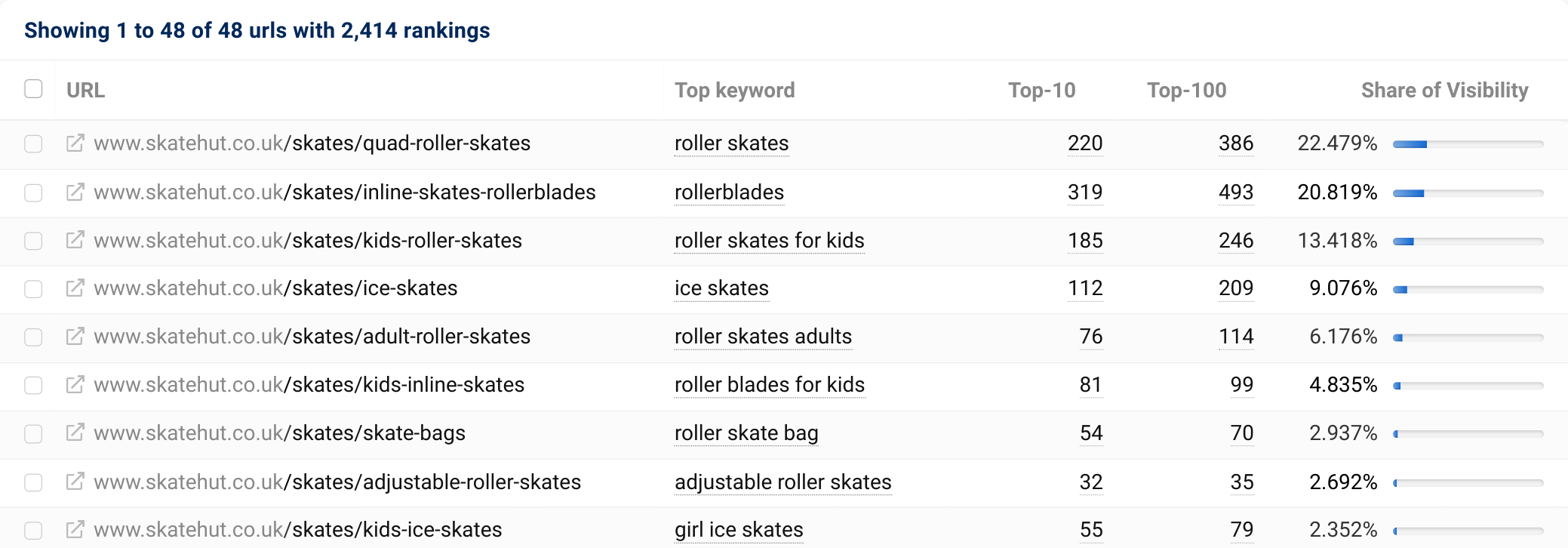

Their /skates/ directory ranks for 2,209 keywords, with 57% of these keywords holding a first page position. It’s estimated that this drives around 25,000 clicks per month to their site through their 48 ranking URLs.

For SkateHut, their winning directory is made up entirely of product listing pages, they combine their product lists with extensive FAQs to provide as much value to customers as possible.

Quad roller skates and inline skates are their 2 key category pages, driving almost half of the overall visibility for this high performing content format. The rest of their visibility is made up from more niche and less popular product collections.

So, what are SkateHut doing to hold the top spot for share of search in this keyword universe?

- They have a complete category coverage for their product offering within skates. In SkateHut’s case, they have achieved this by using static URLs for each PLP. This can also be achieved through indexing your faceted navigation and using dynamic content.

- Internal linking – SkateHut does this well through a quick linking module on “parent” categories like “Quad Roller Skates”. They also manage to have all valuable categories on their main navigation as the requirement for their category depth is quite low.

- The fact they are a specialised retailer, allows for greater topical authority when it comes to all things skates. This allows them to be deemed as more relevant for a wider range of queries due to a wider product range.

- They satisfy user intent through an immense product selection, allowing them to provide a product for every type of customer, from beginner to enthusiasts. This is re-enforced by a high amount of customer reviews on their popular products.

SkateHut are operating in a relatively unique space where you tend to see more specialised retailers appearing in search results, rather than large retailers like Smyths, Argos and Decathlon. This slightly lowers the bar for competition but also allows those who nail the basics of SEO (like SkateHut), to win. It’s likely the reason for this gap in large retailers appearing for these search terms is because the products that they stock are typically considered a “beginner” product. Whereas specialist skate and skateboard retailers cater to a much wider audience of enthusiasts that know what they want out of their purchase.

NaturalisticProducts.co.uk – winning across their entire range

NaturalisticProducts.co.uk is our small winner for ‘do’ keywords with their /collections/ directory – this directory contains all of their product listing pages. Naturalistic Products is an online retailer specialising in hair care products for curly, coily, and wavy hair, offering a wide range of natural, vegan, and cruelty-free brands, along with accessories and skincare items.

This directory on NaturalisticProduct ranks for just over 2,000 keywords in the UK with 39% of those on page one. It’s estimated to generate about 15k clicks each month through organic search.

They have 165 ranking URLs within this directory with the visibility largely being driven by the top 20% – which is something we commonly see when analysing the HPCFs (High Performance Content Formats). Their top pages are a mix of brand collection pages such as “Camille Rose” and product type categories such as “leave-in conditioners”.

NaturalisticProducts is a great example of a “smaller” site taking on larger retailers in the SERPs. When we look at their top performing keyword set, they’re commonly appearing against sites like LookFantastic, Boots and Superdrug! Some of the reasons for this are:

- Without sounding like a broken record at this point, category coverage is something they do well. It’s a common trait of all the winners in retail, there are many approaches and Naturalistic Products have gone down the route of having static categories for a variety of shopping journeys. For example; shop by concern, ingredients or hair type.

- They also have an extensive product range for each of the brands they stock, this is likely what’s allowing them to be competitive with the likes of Boots. Whereas other smaller competitors stocking similar products from a brand like “Flora & Curl” don’t necessarily support the full range.

- User experience & topical relevance combined – they are a one stop shop for their customer type stocking a specific range of curated products to solve a solution. Which gives a great experience to their customers and re-enforces them as the go to shop for any of their potential customers.

- Their extensive category coverage, vast product range and well targeted category pages are wrapped up into large but easy to use main navigation. Providing search engines with site-wide links to all of their key categories.

The Winners – ‘Know’

Now we’re going to talk about the ‘know’ winners. In this section, we have highlighted one large and one small winner. Each of which is actually a retailer and their winning directories both contain product listing pages.

This is interesting as it shows the blend of intents can be much more nuanced than simply commercial and informational. In the case of both of these winners, the “informational” element to their keyword positions largely comes from a desire to find inspiration for a purchase. It’s entirely possible that Google Organic Product Grids will eventually fulfil this user need directly in the SERPs.

As with the ‘Do’ keyword winners, the criteria to be classified as ‘know’ was to have more than 30% of ranking keywords returning as ‘know’ intent in SISTRIX.

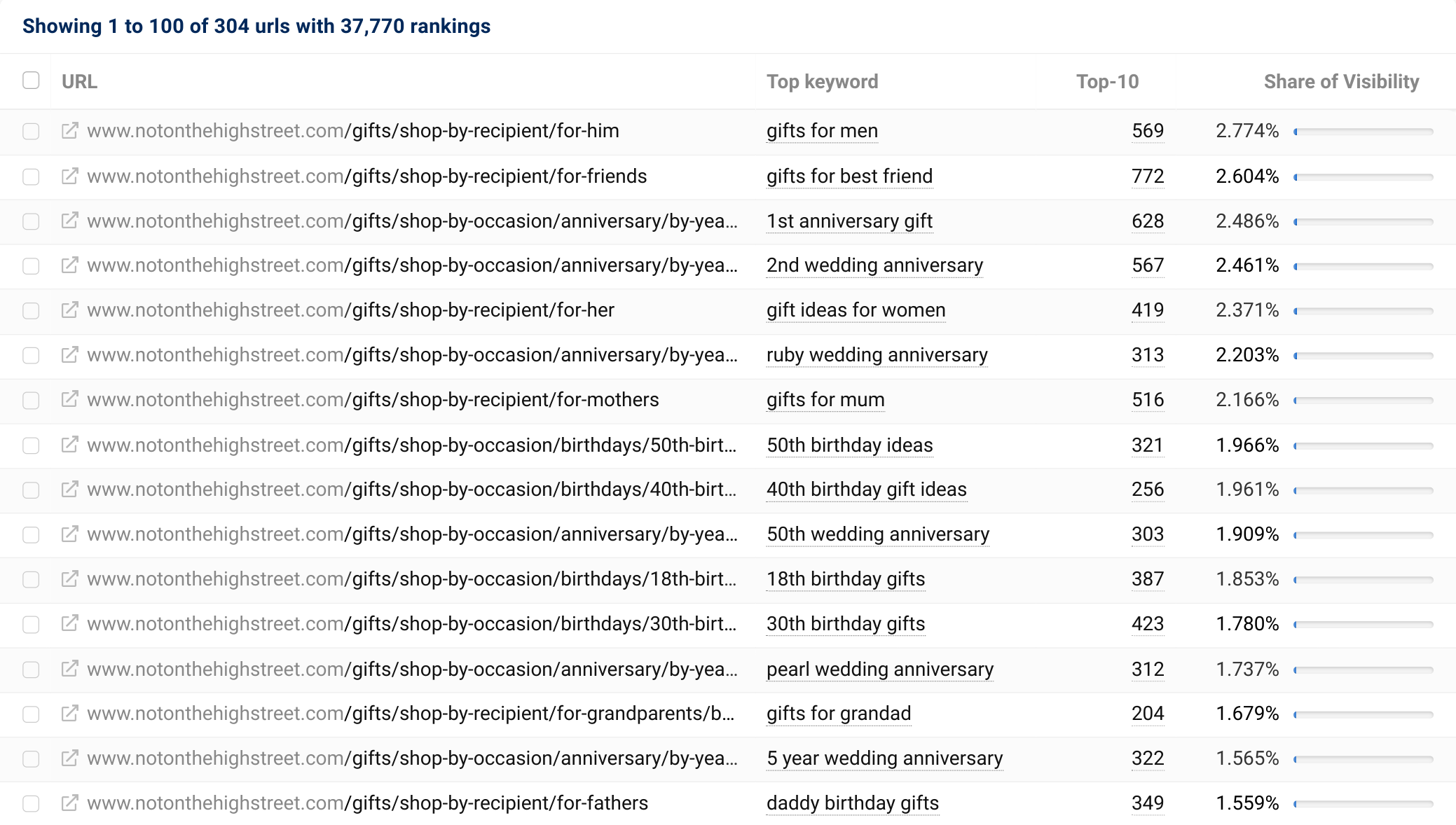

Notonthehighstreet.com – wining with their gifting approach

Notonthehighstreet.com is our large winner for ‘know’ keywords with their /gifts/ directory. They are an online marketplace that offers unique, personalised gifts and products for a variety of occasions from birthdays to weddings.

The fact that Not on the High Street is winning for “informational” intent keywords is, I think, largely to do with how the site can be used. We all know the feeling of being completely lost when it comes to gifting for a birthday or special event. In that event, you may have used ChatGPT as your personal shopper or you may have just googled “21st birthday gift ideas”. In which case you may have ended up on this landing page for 21st Birthday Gifts & Ideas.

An argument could be made that this page is serving multiple intents. For example, you could be looking to purchase a personalised gift for a 21st birthday or you could simply want some inspiration.

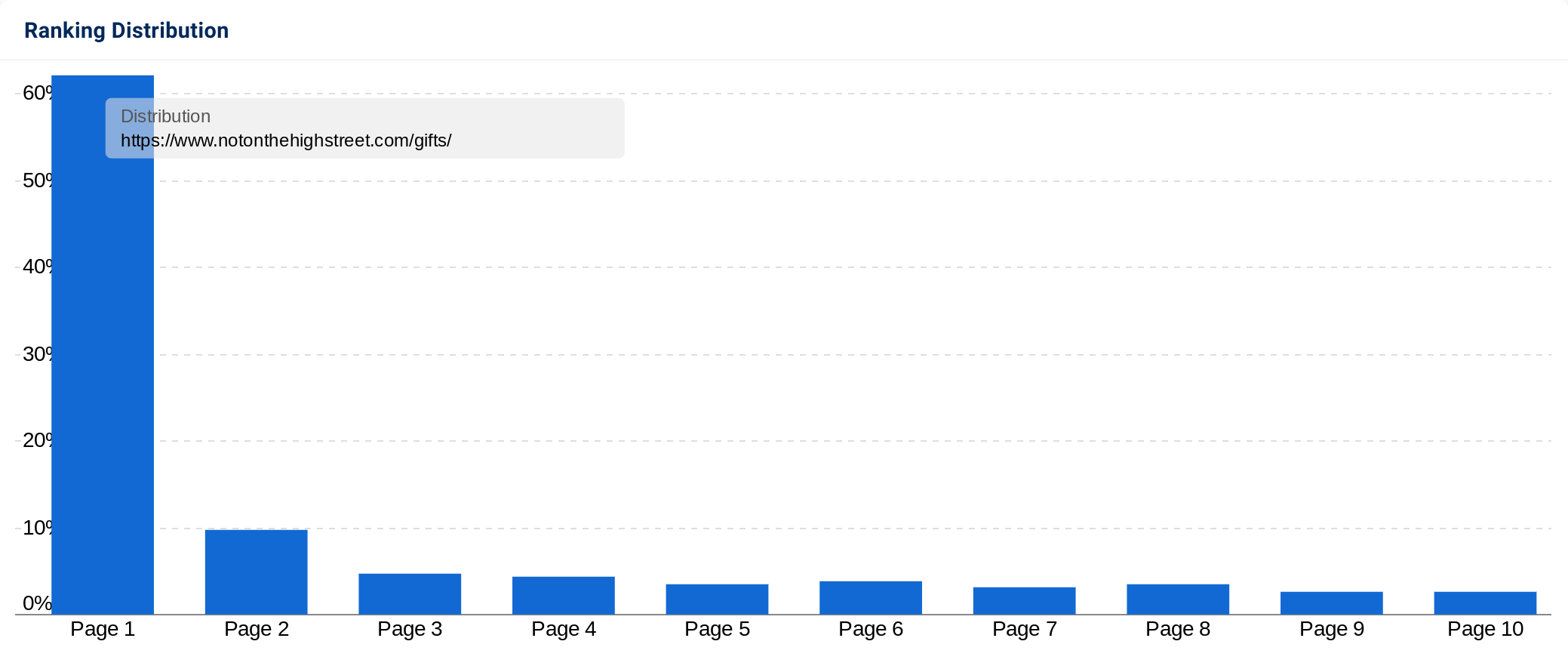

In terms of performance, their /gifts/ directory ranks for a whopping 37,392 keywords in the UK with over 60% of those appearing on the first page of Google. This brings in an estimated 481,000 clicks per month!

This directory contains just over 300 URLs and is largely made up of either gifts for an occasion (e.g. birthdays) or gifts for a recipient (e.g. daughter). As with most winners, their visibility is largely held within the top 20% of their URLs.

In terms of the intent crossover, Not on the High Street seem to be aware of user behaviour – setting some page titles and H1’s to include “Gifts & Ideas”. This is likely contributing to their success as not only do they help you pick a gift, you can buy right there with free UK delivery on a lot of products.

They are also adhering to a lot of SEO best practices that are contributing to this success:

- Internal linking, they have a lot of internal links through their gifting taxonomy. Firstly their site wide links from the main nav are extensive, and probably the largest out of all of our winners, some of these could probably be buried within parent categories. They then re-enforce internal links to key categories through internal linking modules on product listing pages.

- They have landing pages mapped to search intent, they understand that users can be looking for inspiration and reflect this in their on-page copy.

- Their coverage of category pages is vast, as to be expected from a winner in this space.

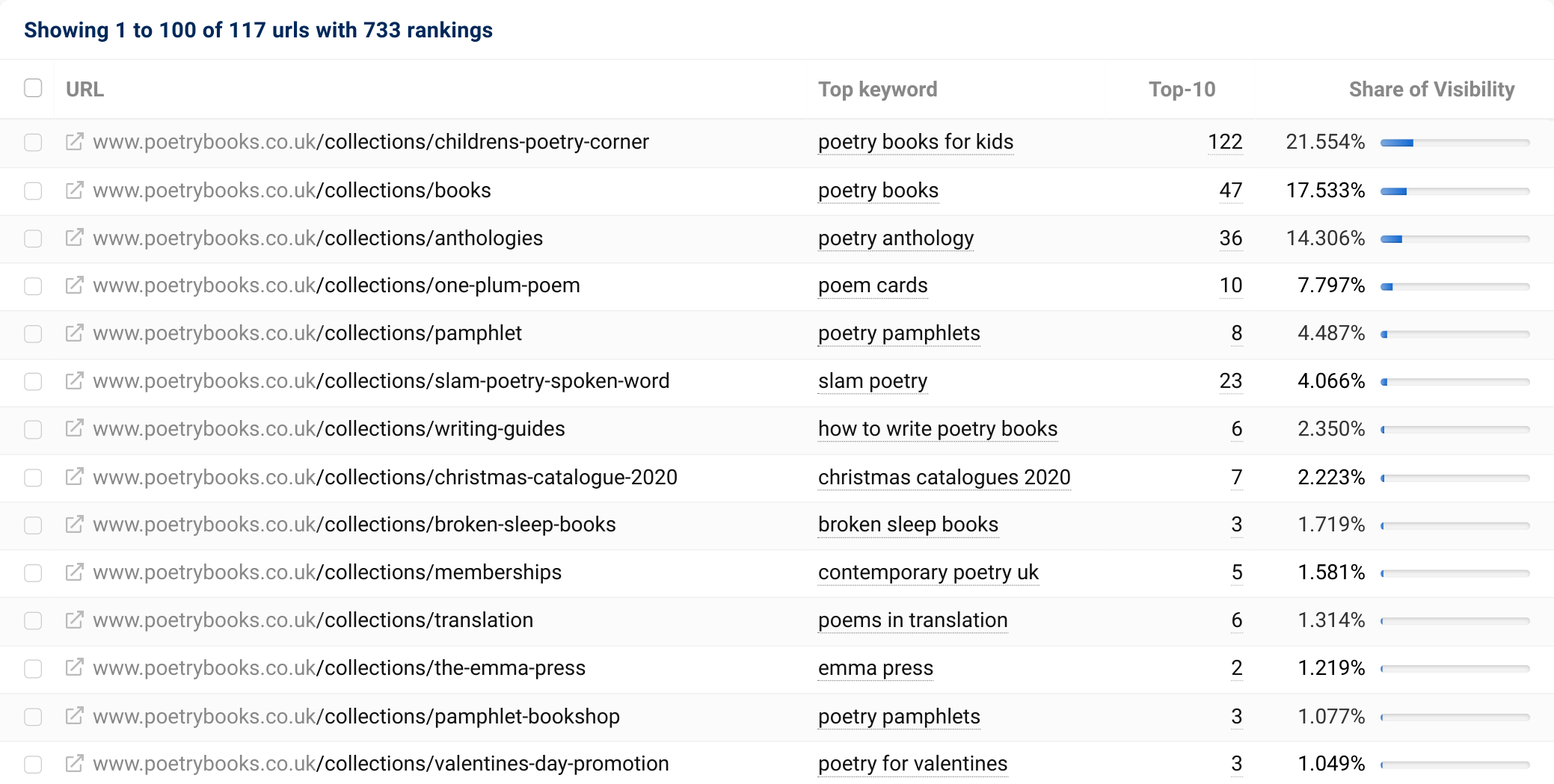

PoetryBooks.co.uk – a curated approach to success

The small HPCF (High Performance Content Format) winner for ‘know’ keywords is Poetry Books with their /collections/ directory. Poetry Books, believe it or not, sell poetry books – they offer a membership or you can buy individual books from their collection.

PoetryBooks is also a retailer ranking for what we would consider informational search terms, such as “poets for children”, with product listing pages. Largely it satisfies the same intent as Not on the High Street with its gifting pages. Looking at the SERPs for their top keywords we can see a mix of retailers, publications, and informationally-led SERP features.

Potential customers may simply be looking for inspiration to add new books to their reading list, or they could be closer to purchasing.

The /collections/ directory on Poetry Books contains all the product listing and product detail pages that sit within their “bookshop”. It currently ranks for just over 700 keywords in the UK and over 45% of those keywords are on the first page. Their visibility is largely driven by their top four URLs, the largest of which is “poetry books for kids”.

Poetry Books is another example of a smaller, specialist site, competing successfully with larger and broader retailers. They frequently appear next to or above the likes of Waterstones and Amazon. Some of the reasons for this are:

- Topical relevance — their entire site and online presence is heavily focused on poetry. They showcase curated collections and have a clear understanding of their target audience.

- They cover off expertise and authority from E-E-A-T by having a team of expert poetry book selectors that help curate their collections and monthly subscription bundles. They also partner with a poetry podcast, all of this plants them firmly in the expert camp when it comes to poetry.

- Satisfying user intent — they offer a simple and easy-to-navigate category page displaying an extensive collection of poetry books categorised by common search terms. This is all presented in a clear and easy-to-understand format, with no confusing department pages or other book types included.

Summary & additional interesting observations

Category coverage is still key for retail, for now…

This always comes up when we look at winning sites within retail — well-thought-out and implemented category coverage is the foundation for success. It allows your SEO strategy to scale if done correctly. What we are seeing though, at least in this data set, is category pages facilitating the user experience of product browsing – the ideal intent for your product categories. With that being said, Google looks to be aiming to replicate this user experience directly in the SERPs through organic product grids.

Changing user behaviour in search

Carrying on that thought, the rise of Google’s Organic product and AI overviews is transforming how consumers engage with search results. These innovations shift users closer to conversions within the search engine results pages, reducing the need for users to click through to traditional product listing pages. This trend reflects Google’s growing role as a product discovery platform, which poses both challenges and opportunities for eCommerce retailers.

The impact of this on SEO strategy

It’s clear product listing pages are still key to retail success, as shown by the above winners. But, the changes happening within Google suggest retailers also need to focus on optimising Product Display Pages. We are starting to see an increase in traffic toward product detail pages (PDPs) and potentially higher conversion rates. Retailers need to focus on optimising PDPs, improving content relevancy, and leveraging customer insights to maintain a competitive edge.

Specialised retailers & topical authority

Specialised retailers like SkateHut and Poetry Books demonstrate the advantage of topical authority. Their ability to focus on a specific niche allows them to outcompete larger, generalist retailers. By offering expertise, detailed content, and curated products, these niche retailers are better positioned to dominate search results in their respective categories.

Blurring of commercial and informational intents

The blending of “do” and “know” intents in search behaviour reflects the complexity of modern consumer journeys. Retailers like Notonthehighstreet.com have capitalised on this by creating content that serves both as a purchase guide and an inspiration source. This hybrid approach mirrors Google’s strategy with its product grids, showing that search results are not strictly divided between informational and transactional intents.

Additional reports in this issue of Visibility Leaders

- Database of high performance SEO directories. Search through to find inspiration from many categories

- Summary report – Trends, lists and take-aways from our 2024 retail sector analysis

- Winning SEO directories – Deep analysis by Callum Lockwood. (This article.)

- TrendWatch – 10 trends from the retail sector analysed by Nicole Scott

- SectorWatch – A deep look at leading domains in the smartphone sector by Charlie Williams