Brands, foods, recipes, clothes, household, information, finance, banking. While it might say Tesco on the domain, evaluating search marketing success across supermarket brands is difficult. You can take a high level domain vs domain comparative approach, or, for a better view of the competitive environment, use a targeted basket of searches. In this article we expose the real competitors. Spoiler alert: The Big Four aren’t what you think they are. Latest update: Sept 2024.

- What is the 'supermarket sector'?

- UK supermarket brands listed by Visibility Index and growth

- Sector growth

- Winning and losing supermarket domains over 12 months

- Sainsburys increase by 20.8%

- Tesco - A complex marketplace. Down 8.2%

- User desires

- User intent 1: The generic RPI basket

- User intent 2: The online shopping search intent

- User intent 3: The groceries delivery basket

- What do people in the UK really want delivered?

- Your take-away

- Search volume history for delivery

What is the ‘supermarket sector’?

As with many ‘sector’ categorisations, it isn’t optimal to group the traditional supermarket brands together. Not only do their offerings change over time, but in the online world there are niche, hidden champions and non-UK competitors that you must consider in the digital high-street. You will see this clearly in the reports below.

While Sainsburys have a bank, Nectar points and other retail operations, the main domain is well-focused on food, clothing and home products. Marks and Spencer, on the other hand, don’t deal directly with groceries. The Co-Op hosts their Funeralcare services on their main domain and at Tesco there’s a range of services including Clubcard, recipes, a monthly magazine and a mobile phone service provider.

The BBC brand and US-owned Good Housekeeping domains are vying for your research clicks too so whatever anyone says about bricks-and-mortar, remember that it doesn’t apply in the eCommerce world.

Having said that, the trade press still (mostly) gathers around a core set of brands and for the first part of this report we’ll do the same. Later in the report we’ll take a more revealing view.

UK supermarket brands listed by Visibility Index and growth

Here are the supermarket brand domains listed along with their digital footprint size in search – the Visibility Index.

| Domain | 2024-09-16 | 2023-09-17 | VI change | Percent change |

|---|---|---|---|---|

| tesco.com | 94.3269 | 102.7898 | -8.4629 | -8.2% |

| marksandspencer.com | 90.5162 | 83.1869 | 7.3293 | 8.8% |

| asda.com | 66.9815 | 62.7046 | 4.2769 | 6.8% |

| sainsburys.co.uk | 57.5132 | 47.6068 | 9.9064 | 20.8% |

| morrisons.com | 12.0979 | 14.6005 | -2.5026 | -17.1% |

| bmstores.co.uk | 12.0042 | 21.1747 | -9.1705 | -43.3% |

| waitrose.com | 8.08 | 11.4509 | -3.3709 | -29.4% |

| coop.co.uk | 7.4425 | 6.1368 | 1.3057 | 21.3% |

| costco.co.uk | 6.1845 | 11.2632 | -5.0787 | -45.1% |

| ocado.com | 5.1426 | 7.4469 | -2.3043 | -30.9% |

| iceland.co.uk | 2.4876 | 5.6386 | -3.151 | -55.9% |

| aldi.co.uk | 2.1121 | 5.2015 | -3.0894 | -59.4% |

| lidl.co.uk | 1.058 | 1.3796 | -0.3216 | -23.3% |

| booths.co.uk | 0.7864 | 0.9766 | -0.1902 | -19.5% |

| spar.co.uk | 0.6815 | 0.8289 | -0.1474 | -17.8% |

| premier-stores.co.uk | 0.5516 | 0.4711 | 0.0805 | 17.1% |

| onestop.co.uk | 0.405 | 0.2495 | 0.1555 | 62.3% |

| safeway.co.uk | 0.1992 | 0.2213 | -0.0221 | -10.0% |

| heronfoods.com | 0.197 | 0.0964 | 0.1006 | 104.4% |

| nisalocally.co.uk | 0.1861 | 0.093 | 0.0931 | 100.1% |

| carrefour.com | 0.12 | 0.1326 | -0.0126 | -9.5% |

| costcutter.co.uk | 0.0808 | 0.0641 | 0.0167 | 26.1% |

| farmfoods.co.uk | 0.0075 | 0.0432 | -0.0357 | -82.6% |

One might question the inclusion of BM Stores and some of the local and convenience stores that generally don’t have online sales but by leaving it out you would be missing the important overlap in keyword rankings for food and household goods. In fact, in the online world, BM Stores has more to do with Supermarkets than Marks and Spencer, who’s domain belongs in the fashion sector, not the supermarket sector. Aldi, number 4 in the sector by revenue, has little to do with groceries online.

One might also question why Amazon are not included. They are indeed the elephant in the room and we’ll see Amazon later in this report when we look at a basket of keywords.

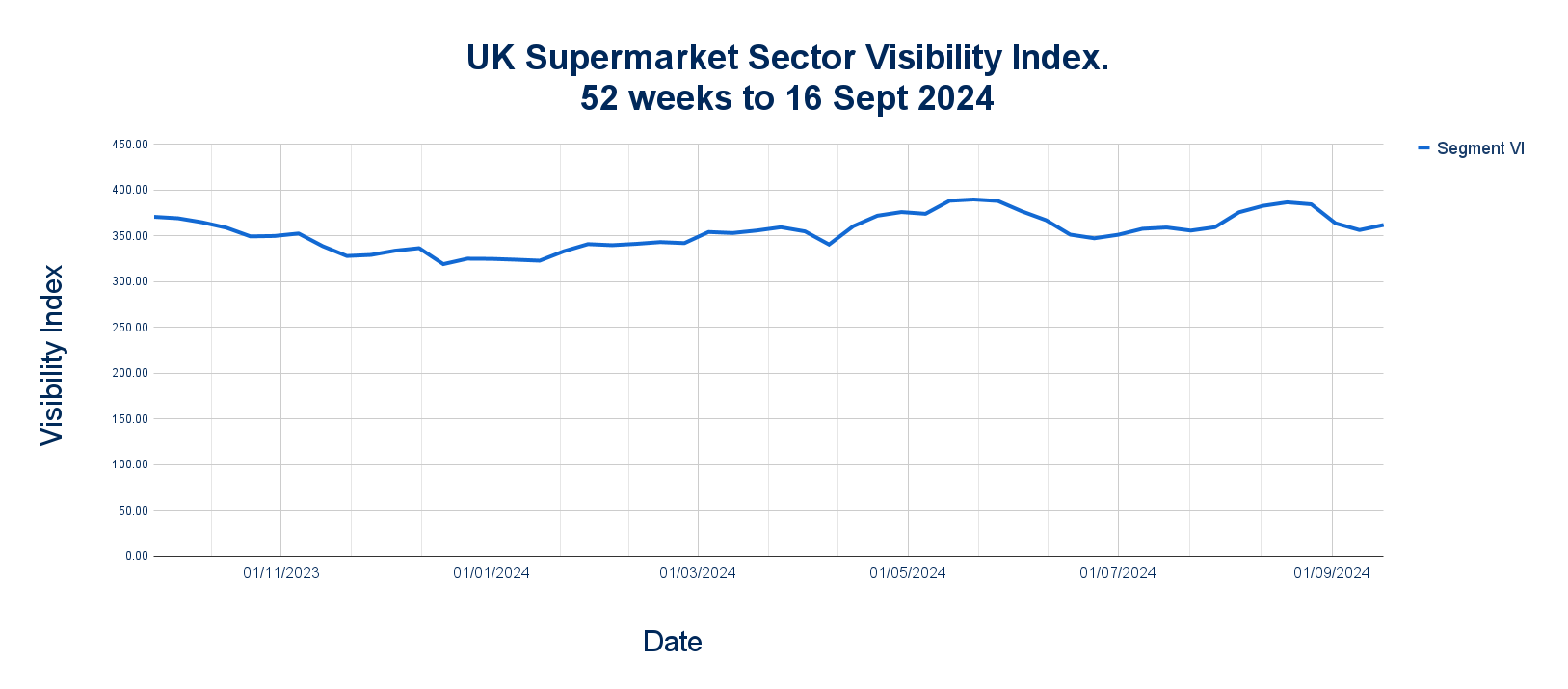

Sector growth

The 12 months to Sept 2024 was relatively stable and this can be seen in the aggregate VI value over 52 weeks.

Winning and losing supermarket domains over 12 months

Updated Sept 2024.

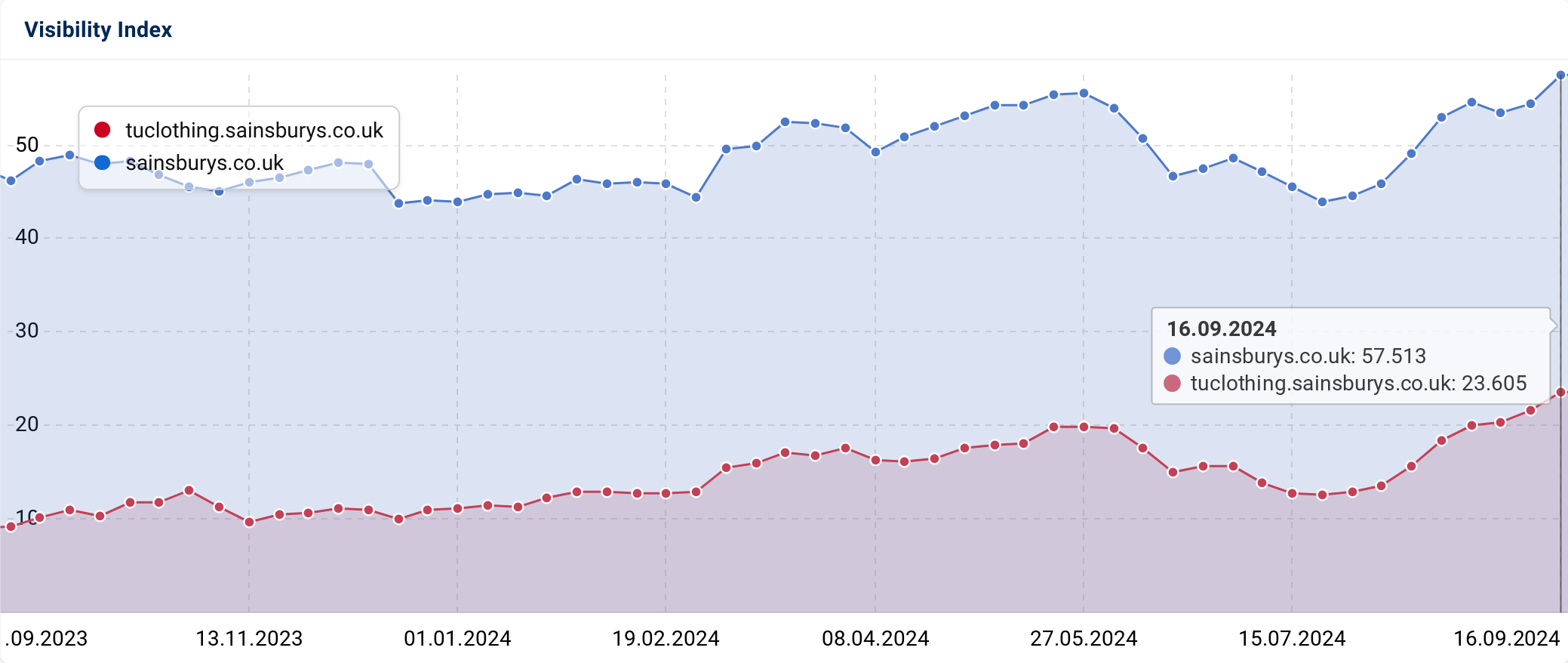

Sainsburys increase by 20.8%

Importantly, there’s no rising trend here. Our starting point, the 18th of September 2023 was slightly depressed compared to the peak of today. Over 2 years the domain has been volatile but there are no signs of being affected by algorithm updates or the onset of a downward trend.

The domain is a complex arrangement of directories and hosts though. These are likely to be run under different departments of the business. TU Clothing, for example, has a separate subdomain and if we take a look at that we can see where the volatility, and that growth, is coming from.

This is a good example of a supermarket brand that is growing through fashion and a good example of why competitors must not be assumed. The top 5 competitors for this part of the Sainsbury domain are Amazon, Next, Marks and Spencer, Ebay and H&M.

Tesco – A complex marketplace. Down 8.2%

Tesco launched a marketplace in June 2024, which follows the trend of offering visibility for third parties through a marketplace. Occado, diy.com (B&Q) are large examples of brands that are offering their piggyback services. Is it working?

Unfortunately, Tesco have merged all the marketplace products into their standard URL structure and while there are certain marketplace landing pages, it’s not easy to analyse the progress of the marketplace in terms of online visibility.

By applying a Visibility Index Segmentation filter we can re-assess the domain for a carefully curated set of commercial retail keywords. The keyword set was developed for our Visibility Leaders Retail study and can be downloaded and analysed.

So where did the loss come from. Groceries, clothing or something else?

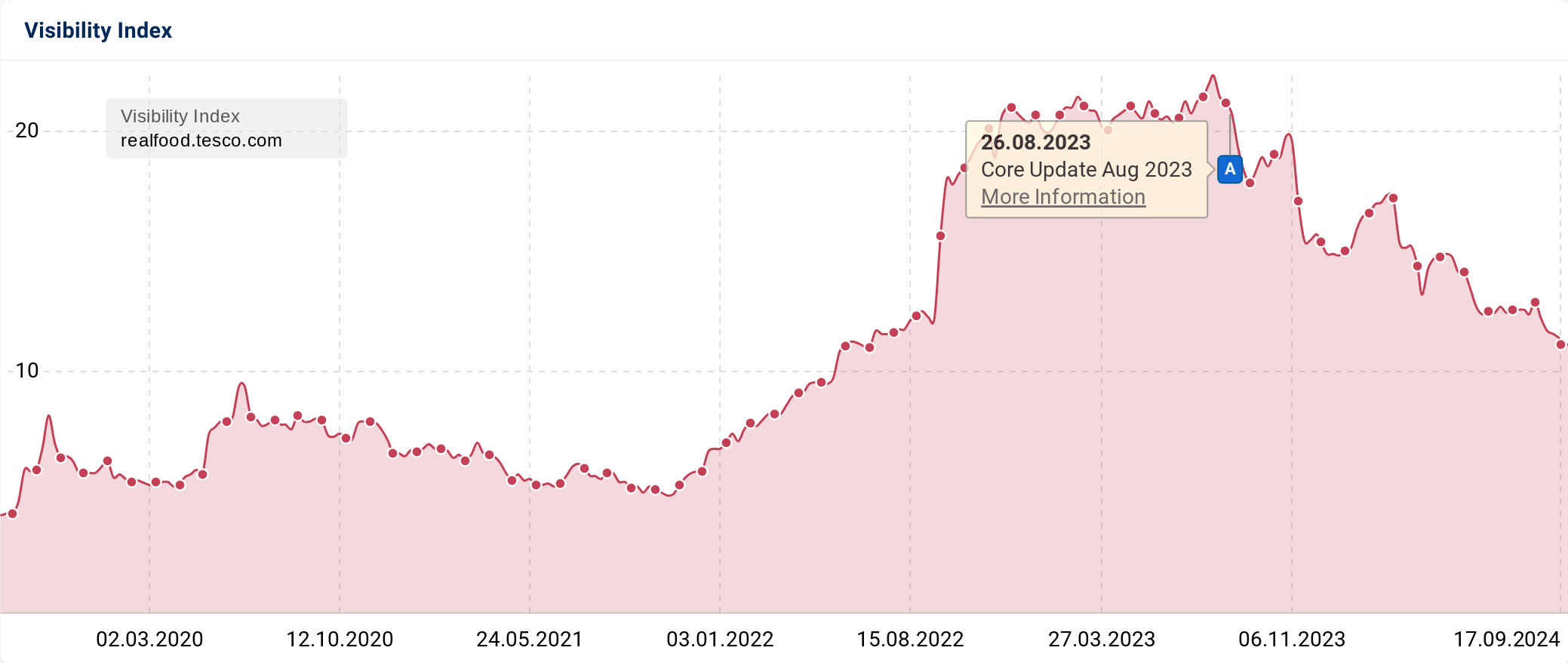

In a 2021 study we looked at ‘made-for-know’ content. At Tesco it’s called Realfood, where Jamie Oliver plays a big part as the lead ambassador.

Since August 2023 this magazine has seen losses – 9.59 VI points since the August 2023 Core Update.

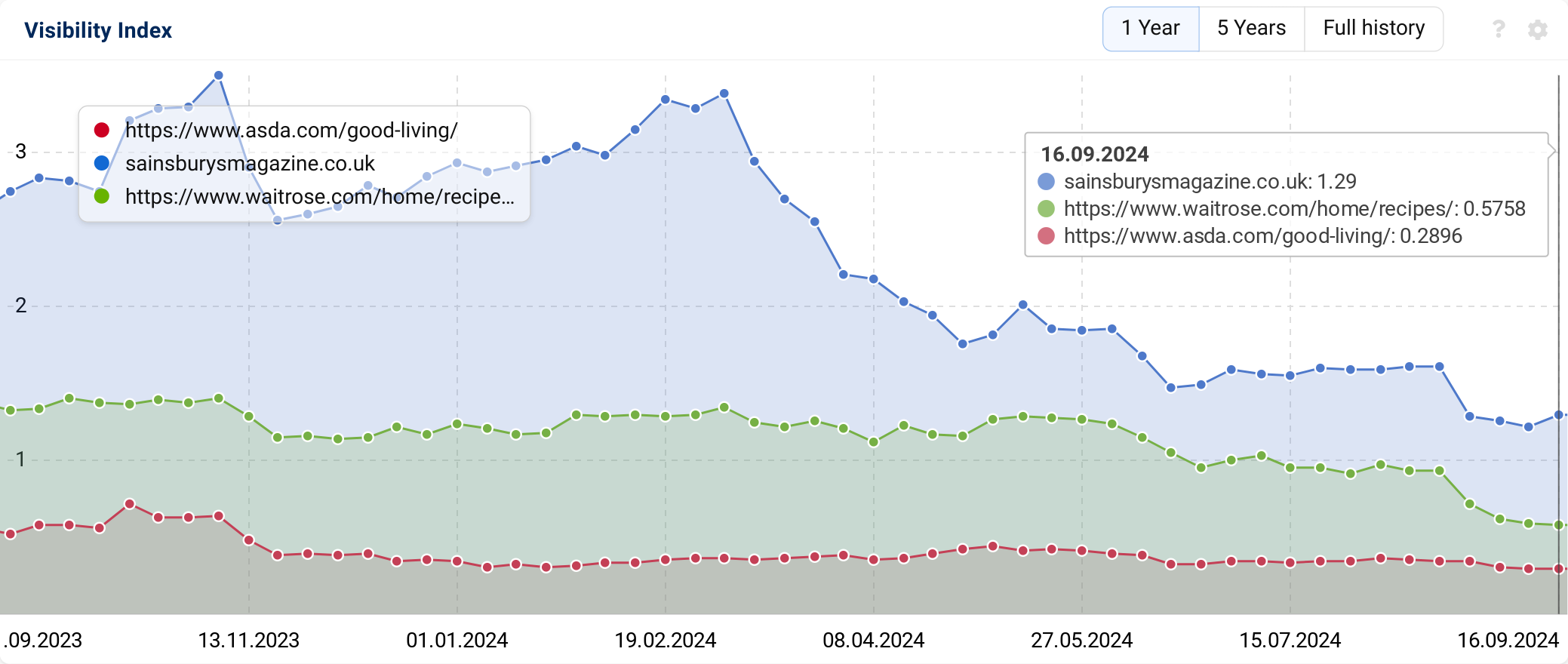

Is this a trend across all supermarket magazines? Here’s an overlay graphic of the main competition for Tesco in this sector.

It’s clear to see that all the main players here are losing visibility in this informational and recipe focused strategy.

User desires

Search terms often have an implied intent, which Google uses to present what it thinks are the most useful links and features in the search result. Google mentions 5 major intent types which include the important ‘Do’, for a user that is close to buying, downloading or closing some sort of action. That action might have been started by a ‘Know’ intent search – the users’ first journey into a topic where information, reviews and opinions will play an important role. User intent can be used to evaluate competitors.

In a previous SectorWatch, our regular dive into eCommerce sectors, we covered the retail price index and the ‘basket of goods’ used to calculate it. These keywords were modified and analysed to produce a list of domains leading in the share of search results. We have updated this Online Grocery Analysis below. 75 results are included below but a full analysis using SISTRIX keyword lists can lead to hundreds of competitors.

User intent 1: The generic RPI basket

A curated keyword list of keywords based on the UK Retail Price Index list of products shows the following top 20 domains in search visibility.

| Domain | Project Visibility Index |

|---|---|

| tesco.com | 819.09 |

| wikipedia.org | 770.37 |

| bbcgoodfood.com | 558.23 |

| sainsburys.co.uk | 339.08 |

| amazon.co.uk | 255.41 |

| asda.com | 239.48 |

| bbc.co.uk | 171.95 |

| healthline.com | 152.29 |

| allrecipes.com | 134.95 |

| recipetineats.com | 128.94 |

| rhs.org.uk | 115.84 |

| webmd.com | 113.64 |

| britannica.com | 96.82 |

| morrisons.com | 96.23 |

| medicalnewstoday.com | 89.11 |

| loveandlemons.com | 64.9 |

| iceland.co.uk | 55.93 |

| waitrose.com | 51.44 |

| deliaonline.com | 50.98 |

| thespruceeats.com | 44.38 |

The elephants are in the building! Big information providers compete too but there’s one type of information provider missing – the manufacturer.

There’s no evidence of Nestle, Unilever, Danone, Kellogs or any other food brand in the top 25.

User intent 2: The online shopping search intent

By modifying the RPI product search to include the common search modifier “online”, we move towards a different searcher intent. Here are the top 20 domains.

| Domain | Project Visibility Index |

|---|---|

| amazon.co.uk | 54.04 |

| snacksonline.co.uk | 36.71 |

| onlinefruitandveg.com | 35.68 |

| onepoundsweets.com | 32.53 |

| bettys.co.uk | 32.25 |

| realfoods.co.uk | 27.21 |

| donaldrussell.com | 24.39 |

| bradleysfish.com | 21.92 |

| frozenfish.direct | 20.55 |

| finefoodspecialist.co.uk | 20.45 |

| mediterraneandirect.co.uk | 19.55 |

| nutspick.co.uk | 18.49 |

| swaledale.co.uk | 18.15 |

| thecornishfishmonger.co.uk | 15.07 |

| desicart.co.uk | 14.99 |

| kimbersfarmshop.co.uk | 14.73 |

| ocado.com | 14.44 |

| eatgreatmeat.co.uk | 14.39 |

| orientalmart.co.uk | 14.36 |

| wholesalesweets.co.uk | 14.32 |

The supermarket’ domains we listed above are few and far between in this list of specialists.

User intent 3: The groceries delivery basket

Here are the top 20 domains for users searching for groceries delivery. For this list we harvested related keywords for groceries delivery – 2144 keywords.

| Domain | Project Visibility Index |

|---|---|

| sainsburys.co.uk | 638.77 |

| tesco.com | 540.12 |

| morrisons.com | 330.78 |

| asda.com | 285.16 |

| ocado.com | 281.95 |

| ubereats.com | 217.76 |

| deliveroo.co.uk | 196.12 |

| coop.co.uk | 195.67 |

| just-eat.co.uk | 188.09 |

| beelivery.com | 170.31 |

| chopchopapp.co.uk | 128.42 |

| reddit.com | 85.46 |

| waitrose.com | 83.55 |

| amazon.co.uk | 82.53 |

| moneysavingexpert.com | 72.55 |

| yell.com | 65.73 |

| snappyshopper.co.uk | 57.09 |

| londongrocery.net | 52.82 |

| yelp.co.uk | 48.09 |

| iceland.co.uk | 47.3 |

As we focus the intent, the domain landscape changes with it. The top 5 positions are unsurprising but there are interesting elements here that show a local intent, instant delivery intent and informational intent.

What do people in the UK really want delivered?

We used the top domains from above and harvested thousands of “delivery” keywords. After curating the list to brands and products, here are the top 20 delivery desires in the UK for September 2024.

| Keyword | Search-Volume |

|---|---|

| tesco delivery | 104000 |

| asda delivery | 103000 |

| morrisons delivery | 41500 |

| nandos delivery | 36500 |

| sainsburys delivery | 33300 |

| cake delivery | 8800 |

| breakfast delivery near me | 8250 |

| milk delivery near me | 5850 |

| starbucks delivery | 5450 |

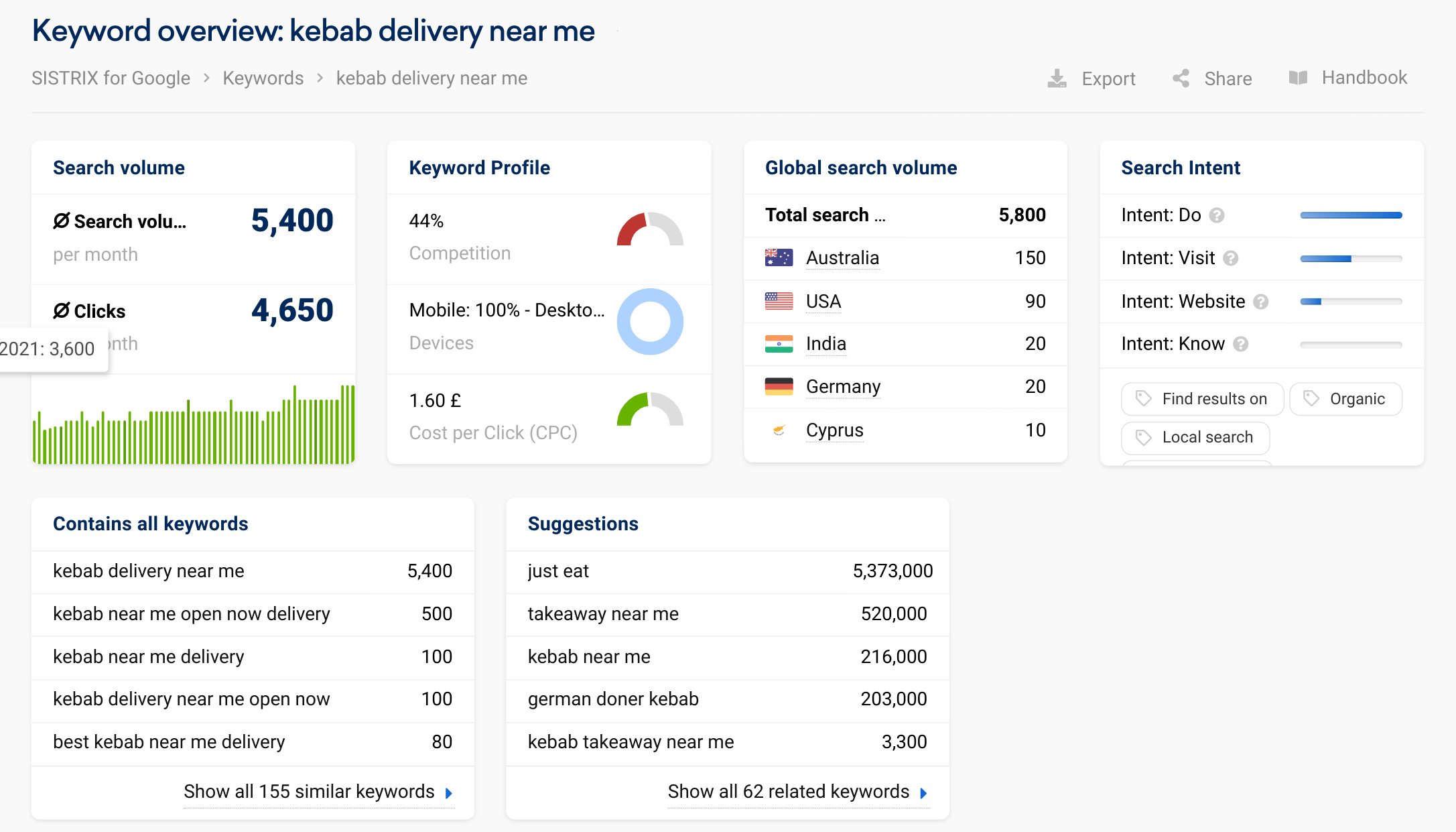

| kebab delivery near me | 5400 |

| iceland online delivery | 5350 |

| next day flower delivery | 4200 |

| alcohol delivery | 4150 |

| uber delivery | 4050 |

| pizza express delivery | 4050 |

| aldi home delivery | 3550 |

| fish and chips delivery | 3300 |

| one delivery | 3200 |

| chinese near me delivery | 3050 |

| wine delivery | 3000 |

The rising star in that list? Kebab delivery.

Your take-away

Measuring competition using the Visibility Index is a critical part of digital marketing that exposes the true competitors for content projects in the important Google Search channel.

These highly visible competitors will expose keywords, content strategies and brands that you can learn from.

Despite the advantages of the customer-and-keyword-first approach it appears that sector analyses by research and media companies remain largely biased towards real-world shops – a flawed approach.

SectorWatch is a regular monthly report focusing on a single sector. It uses the customer-first approach with keyword buckets to expose leading content and domains. You can see all SectorWatch reports here.

Search volume history for delivery

Thanks to new search history data available in the toolbox we have been able to calculate the search volume history for the basket of “delivery” keywords used above. It’s clear to see the UK lock-down period but the last 18 months have been stable.

More information about keyword search volume history in SISTRIX is available.