The SEO industry has experienced an eventful second quarter of 2023. We have been actively preparing for the sunsetting of Universal Analytics, while also exploring the potential of Search Generative Experience (SGE) alongside our colleagues in the USA (thank goodness for VPNs!).

We cannot overlook the April Product Review Update and the usual algorithmic fluctuations but has been a rare quarter in that there have been no Core Updates.

So, what exactly has been unfolding? We have curated a list of 8 prominent domains that have seen notable shifts, reflecting on sites which have experienced both positive and negative changes in their search visibility.

Highlights

- Telling the time. While Google has it’s own search feature for telling you the time, there are still opportunities out there.

- Kaspersky’s increase of 49.2% is largely because of their informative content

- Familydoctor.org is a US site having some success in the UK search market

- B&Q (diy.com, Kingfisher) are still growing. They appeared as a winner in IndexWatch 2022 too so clearly their strategy is working.

- Cancer.org is dropping…but there’s an international SEO aspect causing this.

- There’s something to learn from the Corporate Finance Institute as they lose visibility.

- Matalan and Ernest Jones retailers appear in the losers list with losses of over 30% in Q1 2023

Top 25 lists are shown below for winners and losers.

Search winners in Q2 2023

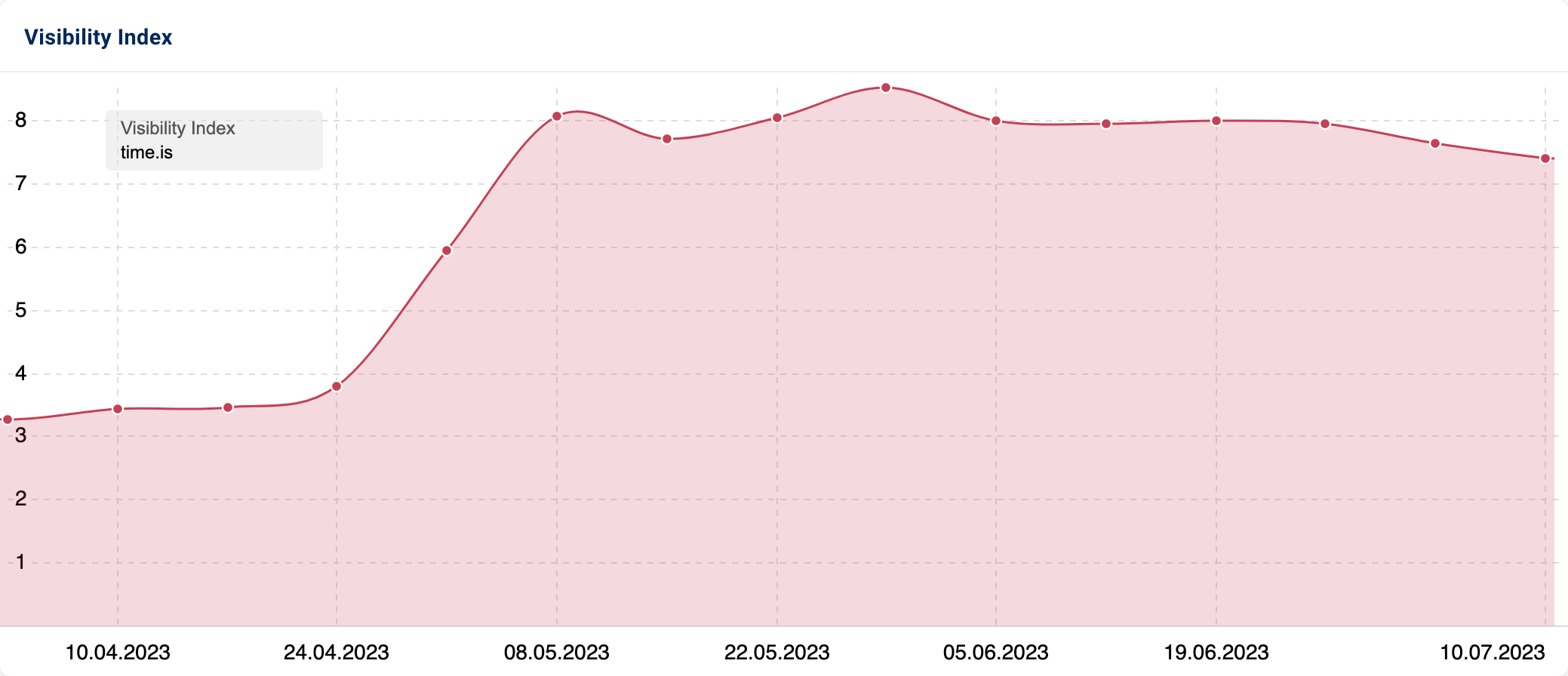

Time.is

Our biggest SERP visibility winner for the quarter is a very interesting one. Out of all the websites that we track, the one which has seen the most prominence is Time.is.

Time Is…is an online clock! Based on your location, it provides you with your local time. It also shows the current time in key cities across the world, including Los Angeles, New York & Beijing.

The website belongs to Currency World, an online currency conversion tool, and has seen 134.23% visibility growth.

Further inspection of the domain confirms that time.is has country-level subfolders. Yet, more recent growth has stemmed from a subfolder called “/sound”. And yes, you are right, this particular URL adds a tick for every second that passes!

A deeper exploration confirms that “/sound” URLs exist for places, including Bournemouth, Munich & Cork. But these keywords are not limited to this subfolder. The entire site has obtained increased and new rankings for time-relevant queries (e.g. “Munich time now”, “egypt time now” & “what time is it in Australia”).

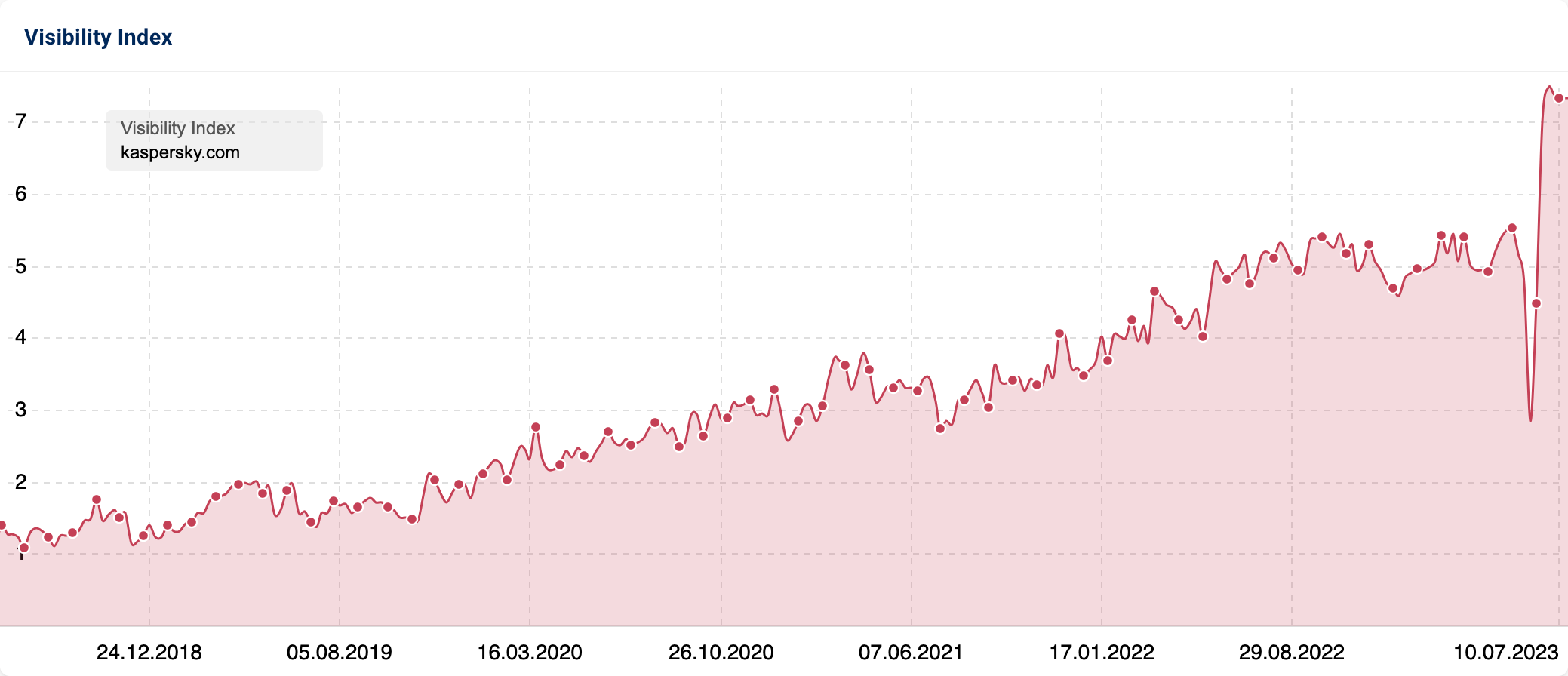

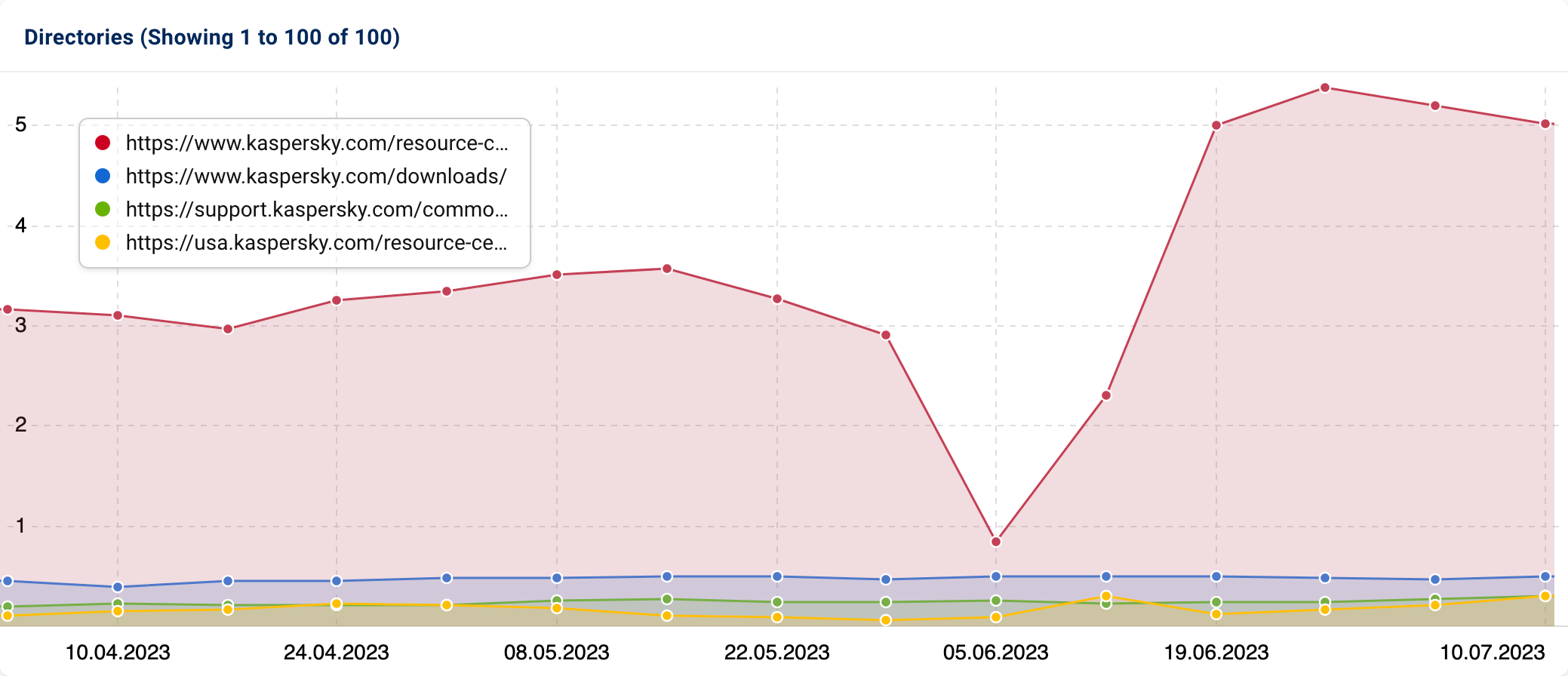

Kaspersky

Leading cyber security business, Kaspersky, experienced organic wins in Q2. During this period, its visibility grew by 49.2%.

Over time, kaspersky.com’s journey to SEO prominence has been incremental. However, in mid-June 2023, the site experienced a sudden dip before spiking to its all-time highest visibility.

Examining the directories reveals that the “/resource-center” was responsible for this extreme activity. The drop times with news of several iPhones on Kaspersky’s corporate network being hacked. Could there have been a temporary technical shutdown to protect further devices & systems?

As for the sudden peak, the website’s design and structure alone do not give many clues to the “why”. However, we can see that existing rankings improved for 3.57K of the subfolder’s target keywords. “/resources-center” also obtained rankings for 4,516 additional terms (5th vs 26th June).

Close competitors – avast.com, avg.com & malwarebytes.com – have also seen visibility improvement, but not as drastic as kaspersky.com. This begs the question…were SEO-beneficial technical changes deployed following a system outage? Did this then aid the crawlability and indexability of their resource content?

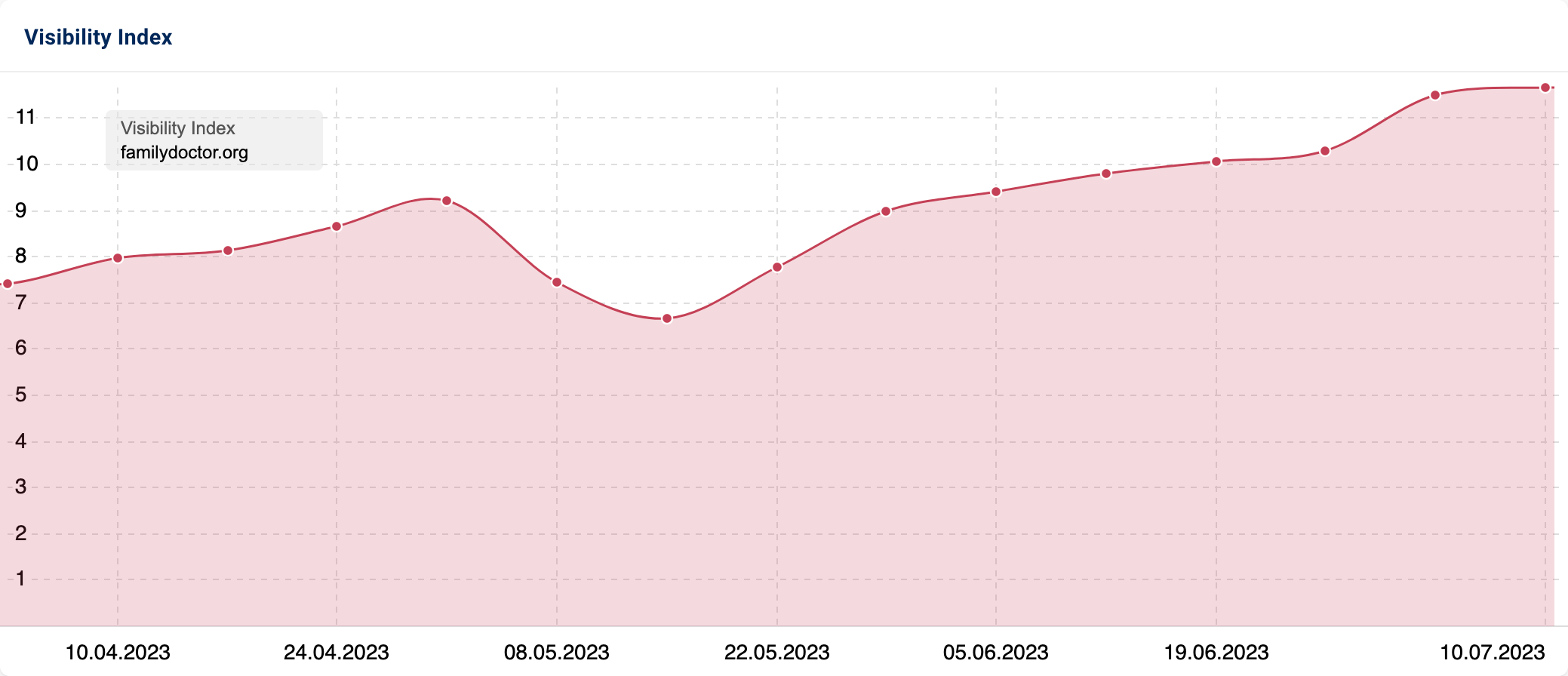

Family Doctor

Familydoctor.org is a trusted medical advice website run by the American Academy of Family Physicians. Created for American citizens, its expertise, trust and authority have led to it also becoming more accessible to a UK audience via Google search. Over the 3 month period, its visibility improved by 55%.

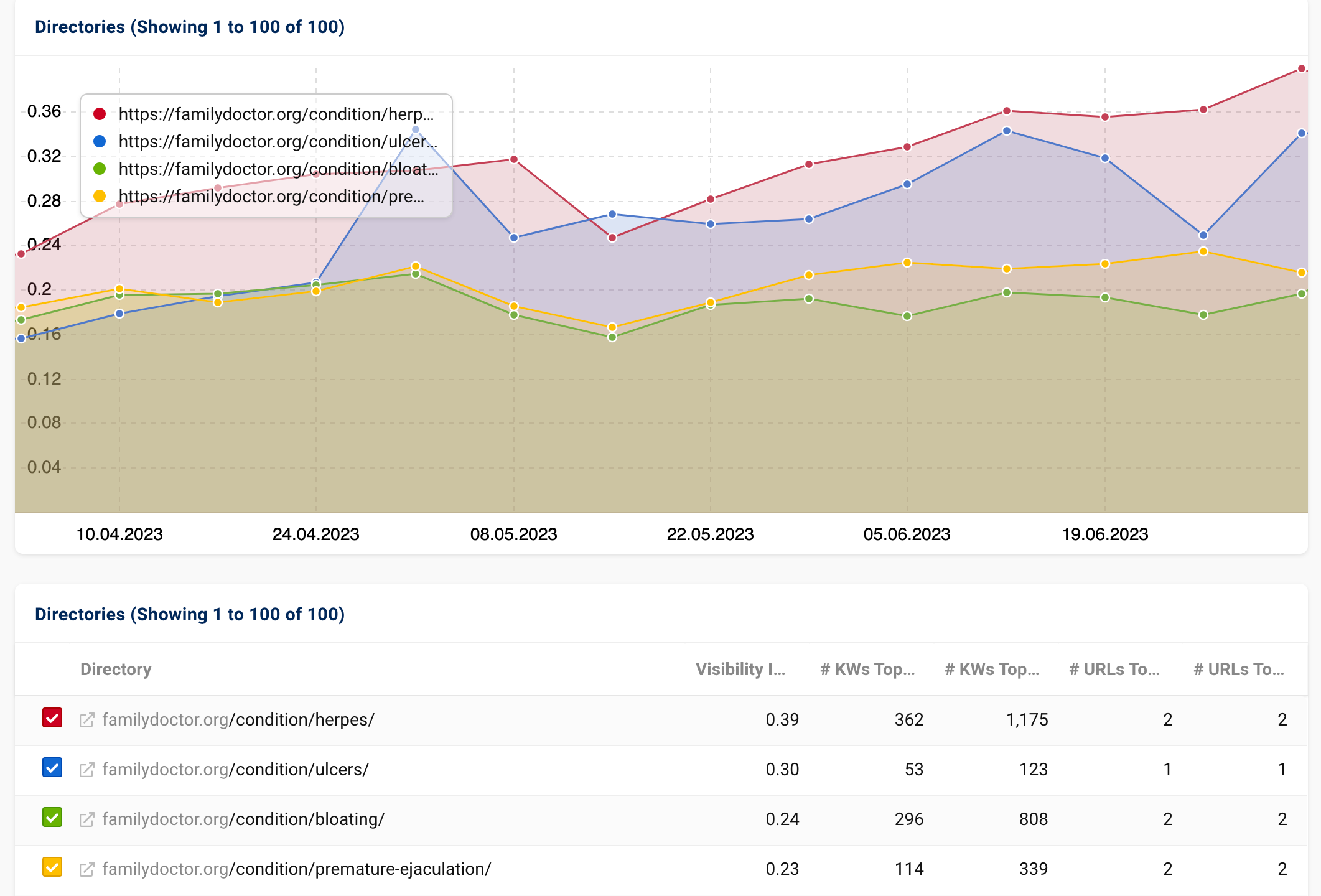

So what information has performed particularly well on Google UK? The site’s directory data confirms that the “/condition” subfolder has experienced notable growth. The VI score for this particular section has increased from 6.587 to 8.159.

URL path data highlights that pages for medical issues, including ulcers & bloating – and a few more awkward ones(!), have seen the most improvement.

During the quarter, the directory obtained new 20,557 keyword rankings. Positions also improved for 46,809 existing keywords.

Reviewing some of these pages vs February, it is clear that medical experts have recently reviewed the information. Some of the cited sources have also changed.

Before:

Now:

The updated information & sources have increased content freshness & relevance. The association of highly-qualified medical professionals with the content also helps emphasise expertise, authority & trust. These elements combined are likely to have caused the performance uptick.

B&Q

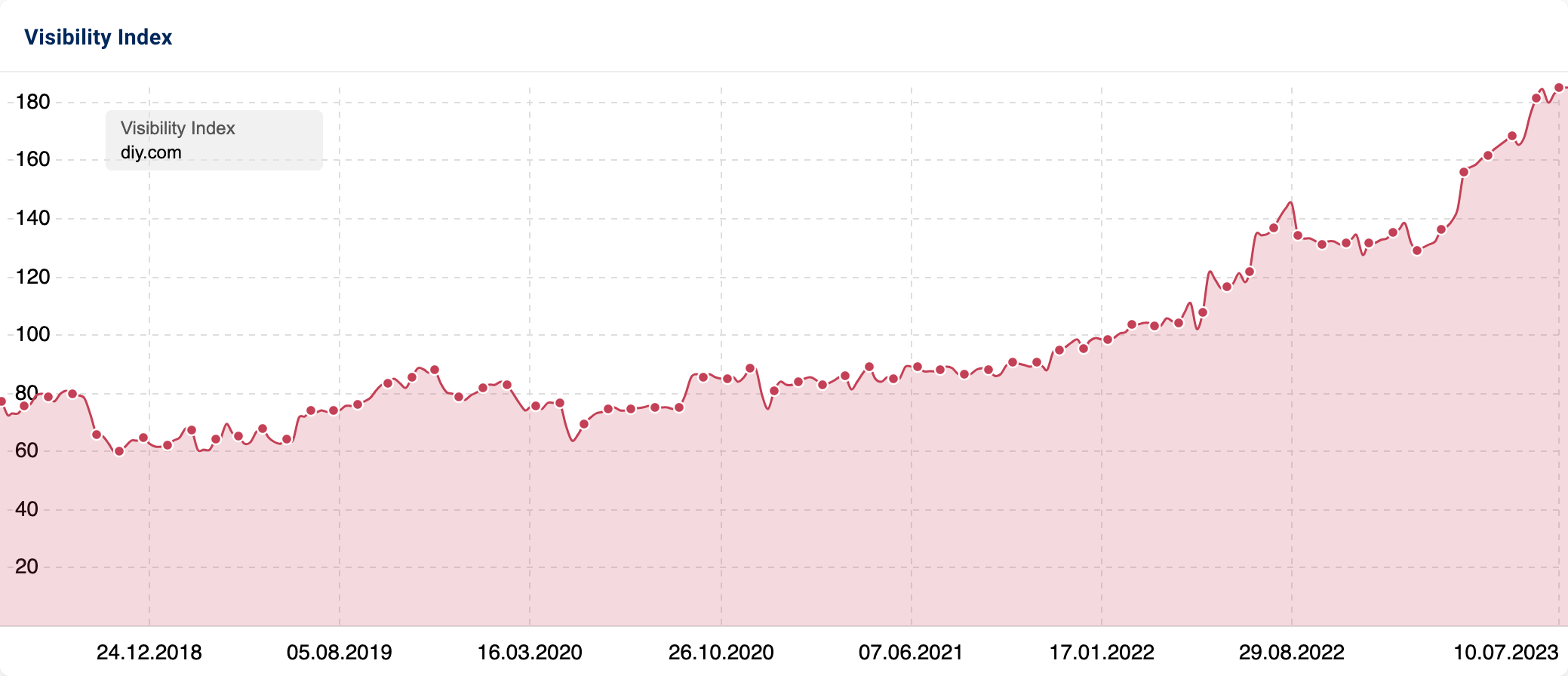

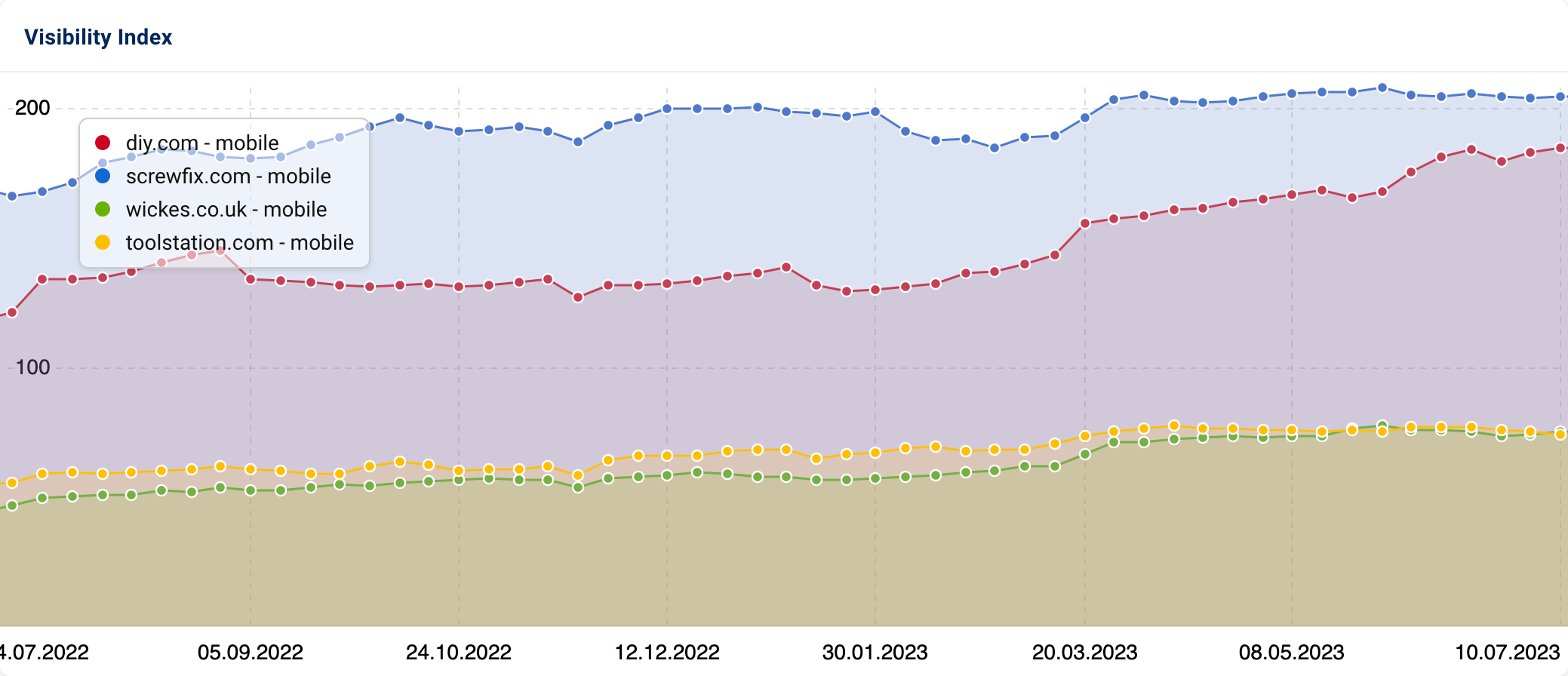

Diy.com, the online home of B&Q, has seen an absolute visibility increase of 24.17 VI points. B&Q is a home improvement retailer with over 300 stores across the UK.

Since February 2022, the company’s website has seen notable organic growth. But, over the last quarter, their SEO visibility has reached an all-time peak of 183 VI points.

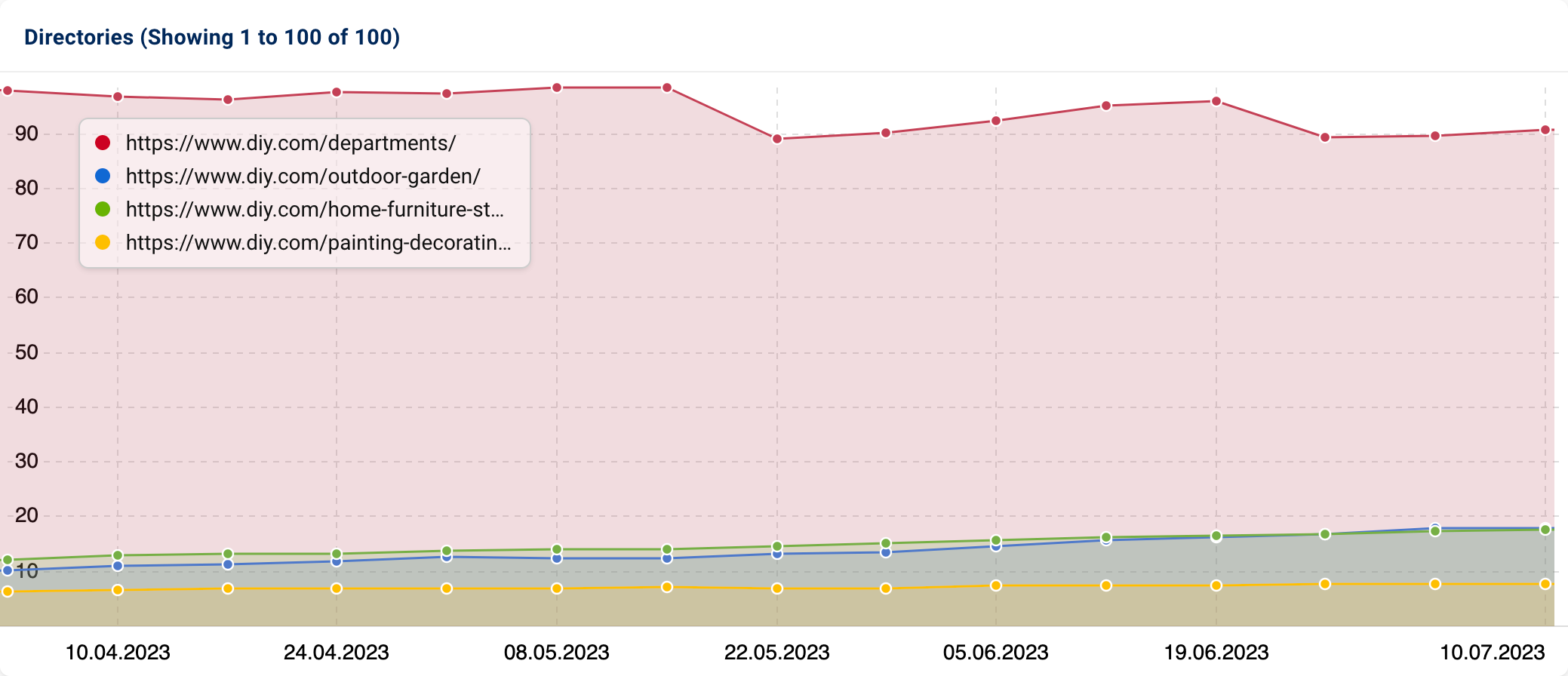

Despite a decrease in visibility for their “/departments” subfolder, their SEO prominence has been bolstered by growth in other sections. During Q2, the “/home-furniture-storage”, “/outdoor-garden” & “/painting-decorating” subfolders saw incremental visibility increases.

Alongside these improvements, B&Q has witnessed an increase in rankings for 948.2K queries, including 329.9K new ones.

We also examined competitors to see if B&Q took SERP real estate away from them. Delving into screwfix.com, wickes.co.uk & toolstation.com’s data highlights sector-wide success. The April Product Review Update also appears to have assisted Screwfix and B&Q’s visibility further.

As businesses who clearly know their stuff when it comes to E-E-A-T (Experience, Expertise, Authoritativeness & Trustworthiness), naturally, they have reaped some benefits, albeit small, from this particular update.

The domain also appeared as a winner in IndexWatch 2022

All Q2 2023 search visibility winners

Below are the top 25 winning domains by absolute change:

| # | Domain | VI 03.04.2023 | VI 03.07.2023 | VI Change |

|---|---|---|---|---|

| 1 | youtube.com | 1597.79 | 1637.98 | 40.19 |

| 2 | clevelandclinic.org | 180.36 | 207.09 | 26.74 |

| 3 | diy.com | 158.86 | 183.04 | 24.17 |

| 4 | tiktok.com | 78.17 | 98.53 | 20.35 |

| 5 | urbandictionary.com | 89.54 | 109.55 | 20.01 |

| 6 | freepik.com | 42.15 | 58.87 | 16.72 |

| 7 | oxfordlearnersdictionaries.com | 90.59 | 107.17 | 16.59 |

| 8 | asda.com | 66.62 | 82.88 | 16.26 |

| 9 | nytimes.com | 69.66 | 85.58 | 15.92 |

| 10 | soundcloud.com | 97.73 | 112.74 | 15.01 |

| 11 | therange.co.uk | 101.18 | 112.04 | 10.86 |

| 12 | wikihow.com | 122.38 | 133.22 | 10.84 |

| 13 | medicalnewstoday.com | 133.23 | 143.82 | 10.58 |

| 14 | company-information.service.gov.uk | 280.14 | 290.56 | 10.43 |

| 15 | webuy.com | 17.15 | 27.52 | 10.37 |

| 16 | linkedin.com | 274.59 | 284.07 | 9.48 |

| 17 | nidirect.gov.uk | 27.18 | 36.46 | 9.28 |

| 18 | ign.com | 50.24 | 59.42 | 9.18 |

| 19 | goodreads.com | 123.66 | 132.51 | 8.86 |

| 20 | goodhousekeeping.com | 118.33 | 127.14 | 8.81 |

| 21 | ikea.com | 95.82 | 104.21 | 8.39 |

| 22 | lovetoknow.com | 7.80 | 16.14 | 8.34 |

| 23 | next.co.uk | 207.28 | 215.52 | 8.24 |

| 24 | timeanddate.com | 34.19 | 42.35 | 8.16 |

| 25 | healthline.com | 309.82 | 317.54 | 7.72 |

| 26 | medium.com | 29.68 | 37.36 | 7.69 |

And the top 25 by percent change:

| # | Domain | VI 03.04.2023 | VI 03.07.2023 | VI Change |

|---|---|---|---|---|

| 1 | time.is | 3.27 | 7.66 | 134.2% |

| 2 | unitconverters.net | 4.05 | 9.10 | 124.6% |

| 3 | lovetoknow.com | 7.80 | 16.14 | 106.9% |

| 4 | zodiacsign.com | 3.13 | 6.36 | 103.0% |

| 5 | simplypsychology.org | 5.30 | 10.38 | 95.8% |

| 6 | metric-conversions.org | 5.46 | 10.17 | 86.1% |

| 7 | wikitravel.org | 5.11 | 9.07 | 77.5% |

| 8 | outlookindia.com | 5.02 | 8.61 | 71.6% |

| 9 | webuy.com | 17.15 | 27.52 | 60.5% |

| 10 | thecalculatorsite.com | 3.98 | 6.27 | 57.6% |

| 11 | freeimages.com | 3.21 | 5.04 | 57.3% |

| 12 | familydoctor.org | 7.41 | 11.49 | 55.1% |

| 13 | [adult] | 3.06 | 4.67 | 52.4% |

| 14 | kaspersky.com | 4.95 | 7.39 | 49.2% |

| 15 | scribd.com | 3.27 | 4.82 | 47.4% |

| 16 | rapidtables.com | 11.14 | 16.42 | 47.4% |

| 17 | marriott.com | 8.97 | 13.13 | 46.4% |

| 18 | thebalancemoney.com | 9.10 | 13.27 | 45.9% |

| 19 | weareteachers.com | 3.09 | 4.51 | 45.7% |

| 20 | savills.com | 3.62 | 5.26 | 45.3% |

| 21 | apnews.com | 4.65 | 6.71 | 44.4% |

| 22 | outdoorgearlab.com | 4.83 | 6.81 | 41.0% |

| 23 | loveholidays.com | 11.59 | 16.28 | 40.4% |

| 24 | movieweb.com | 7.70 | 10.81 | 40.4% |

| 25 | barnesandnoble.com | 3.88 | 5.43 | 39.8% |

| 26 | freepik.com | 42.15 | 58.87 | 39.7% |

Search losers in Q2 2023

American Cancer Society

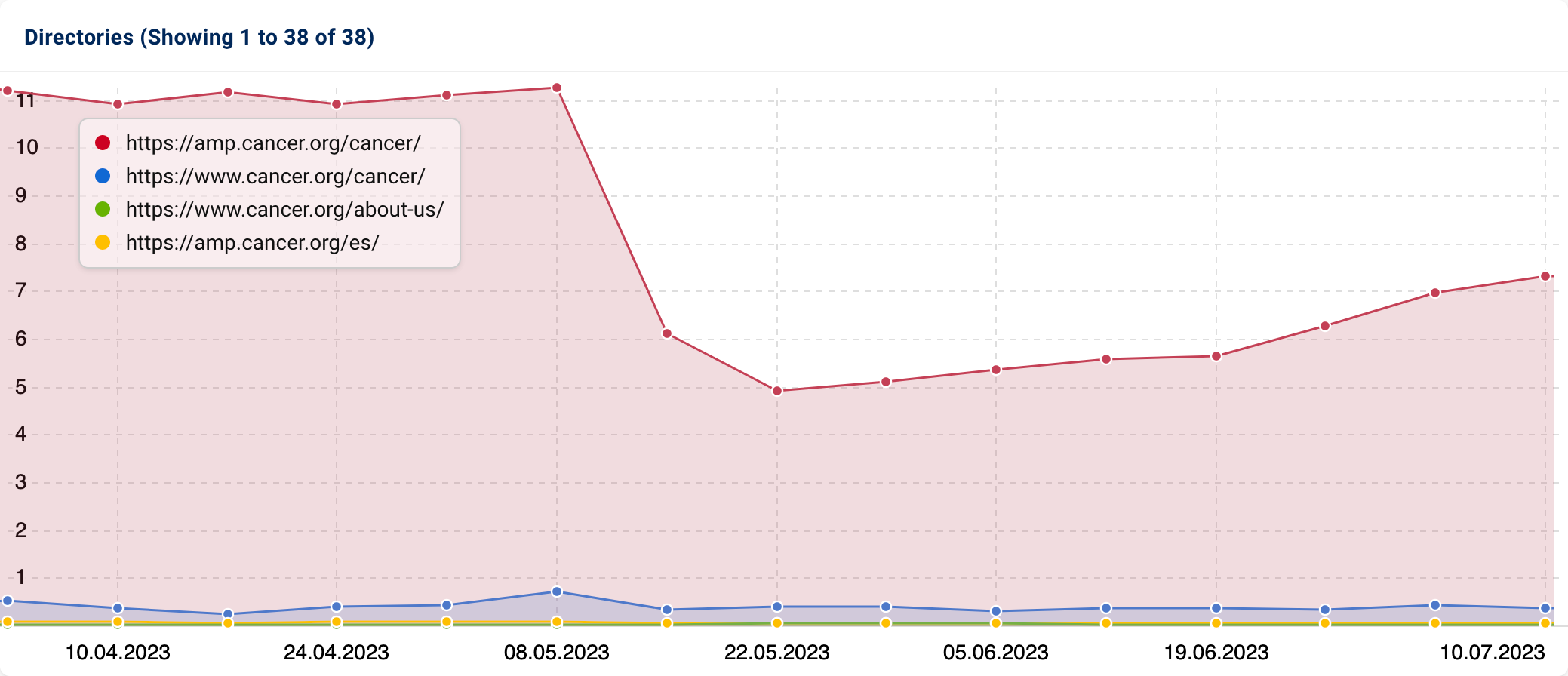

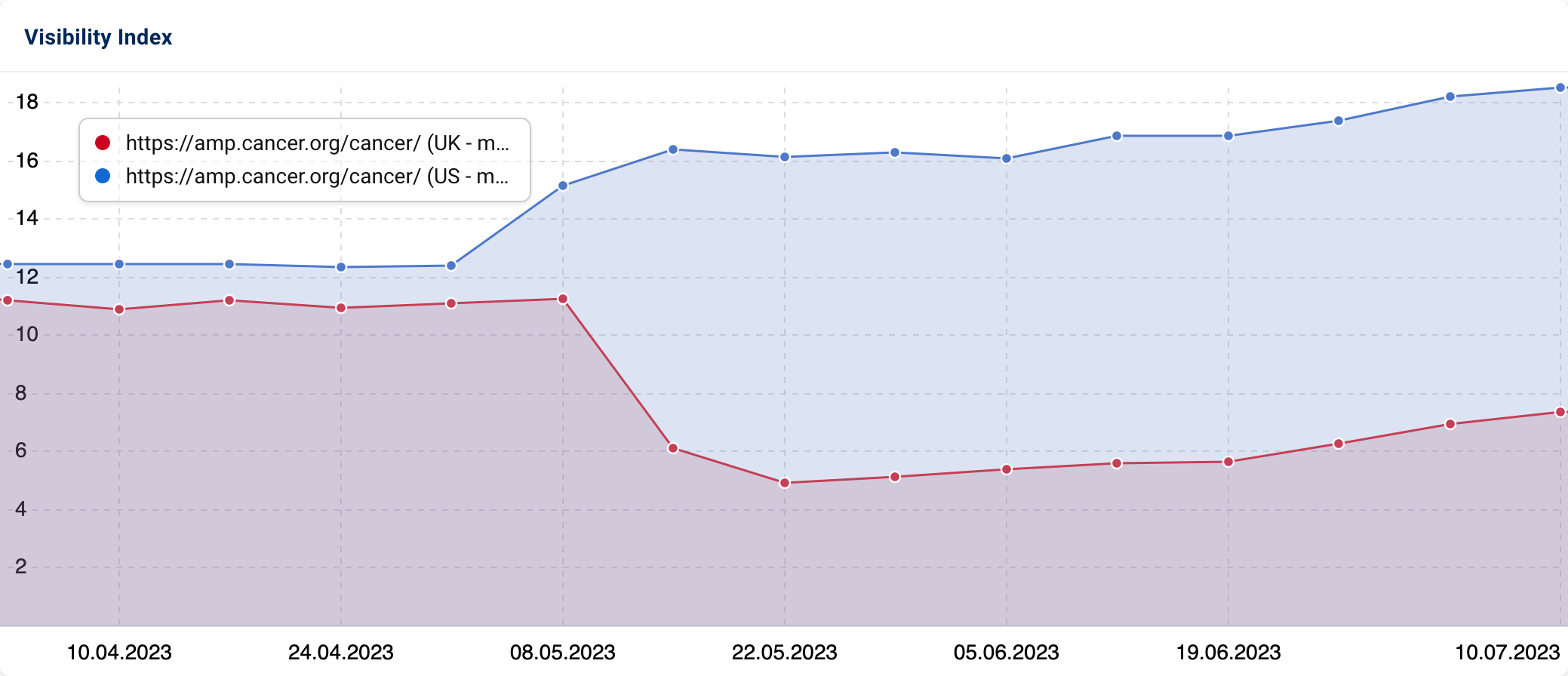

Cancer.org experienced the largest search visibility decrease of the websites analysed (-52.8%). This domain belongs to the American Cancer Society, an organisation dedicated to improving the lives of those diagnosed with cancer and their families.

Over the last almost 6 years, it has maintained stable visibility of between 11 & 16 VI points. But, in May, the website’s visibility rapidly declined. This took the site’s VI Points from 16.29 to a record low of 5.74.

On 3rd July, cancer.org’s visibility score had increased by 7.83, but this is far from a recovery. So why did it lose its strong standings in the UK SERPs?

Comparing the performance of “amp.cancer.org/cancer” in the UK & US confirms that there has been a shift in locational relevance. In alignment with the drop-off, its visibility rightful began to grow on the US SERPs.

Naturally, with this type of shift, significant changes in keyword rankings happen. Keyword-level analysis confirms “amp.cancer.org/cancer” has lost rankings for approx. 33.7K keywords and experienced ranking decreases for a further 73K.

Corporate Finance Institute

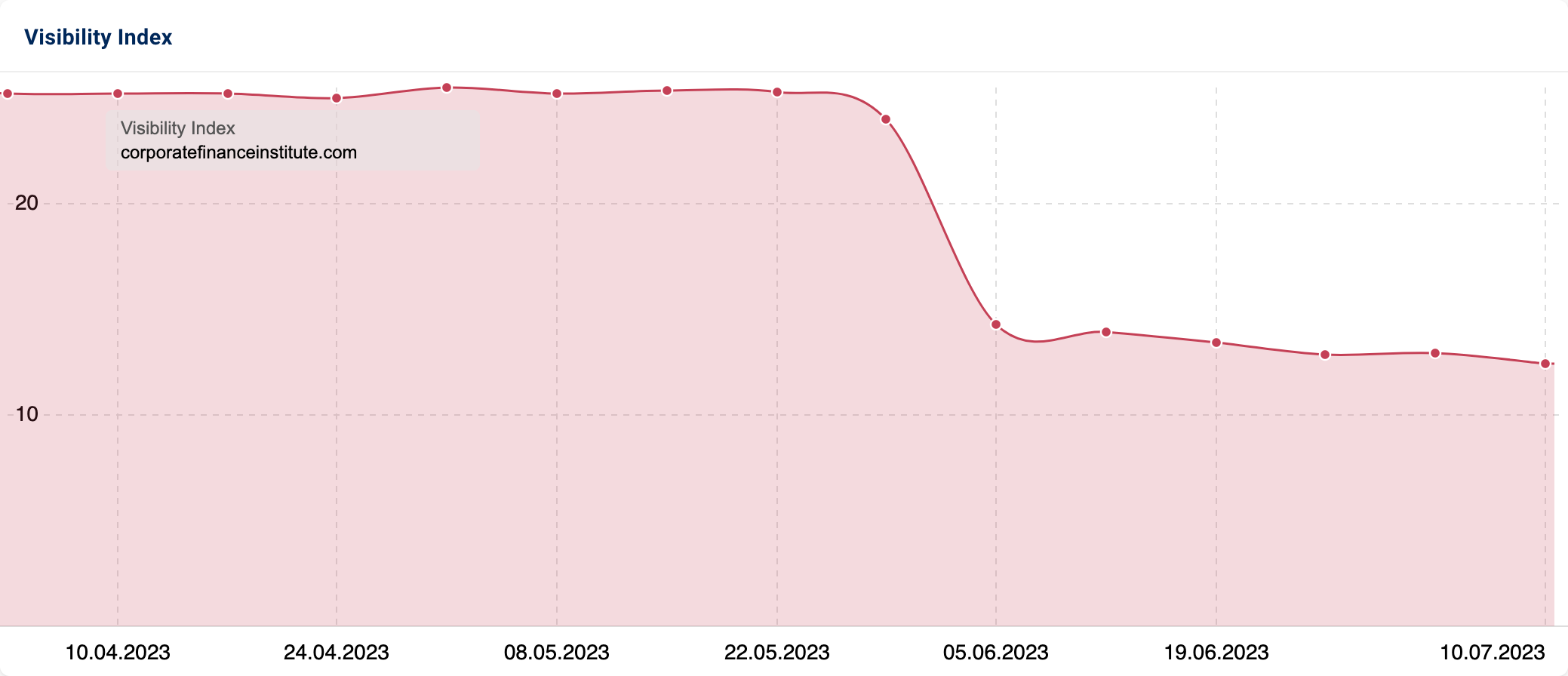

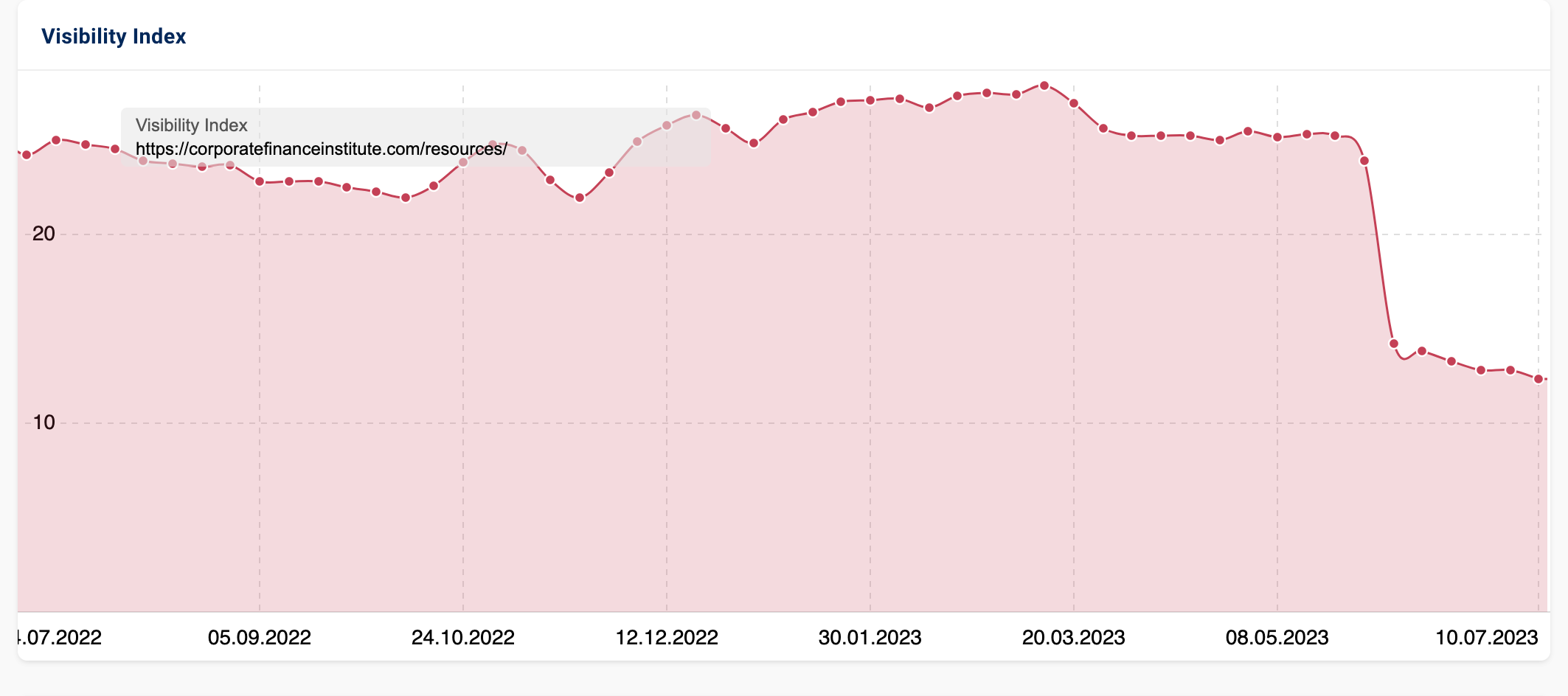

One of the top losers was Corporatefinanceinstitute.com (-48.91% visibility). The Corporate Finance Institute – also known as CFI – offer online training courses for banking & finance professionals worldwide

In 2020, like many other course providers, CFI’s visibility started to thrive. This continued to grow throughout the Coronavirus pandemic until early 2023. However, in more recent months, their visibility has dropped down to pre-pandemic levels.

On 5th June, the site’s visibility score decreased from 23.98 to 14.31. As of the beginning of July, this had dropped further to 12.9.

Delving into the directories, we can see that much of CFI’s visibility comes from “/resources”. This subfolder is a free library of articles, templates and tutorials that covers a vast array of finance-related topics.

Reviewing the section now vs the back end of 2022, we can see that CFI has updated its design. As part of this, they have also changed the approach to content categorisation. They have transitioned away from static topic-specific pages and now utilise parameters & pagination instead.

Before:

Now:

So what about those historic topic pages, you ask? They now redirect to transactional pages rather than a library of topic-specific resources. For example, “Excel Resources” has become “Learn Excel with CFI”. “Learn” pages do link to the relevant topic parameters on “/resources”, which is positive. But, some of the main keywords targeted have either informational or mixed intent.

As a result of the changes, the subfolder has seen lost rankings for approx. 82.9K keywords. There have also been position decreases for approx. 90K.

Due to the instances of mixed intent, it is possible that this subfolder may make an organic comeback. Only time will tell.

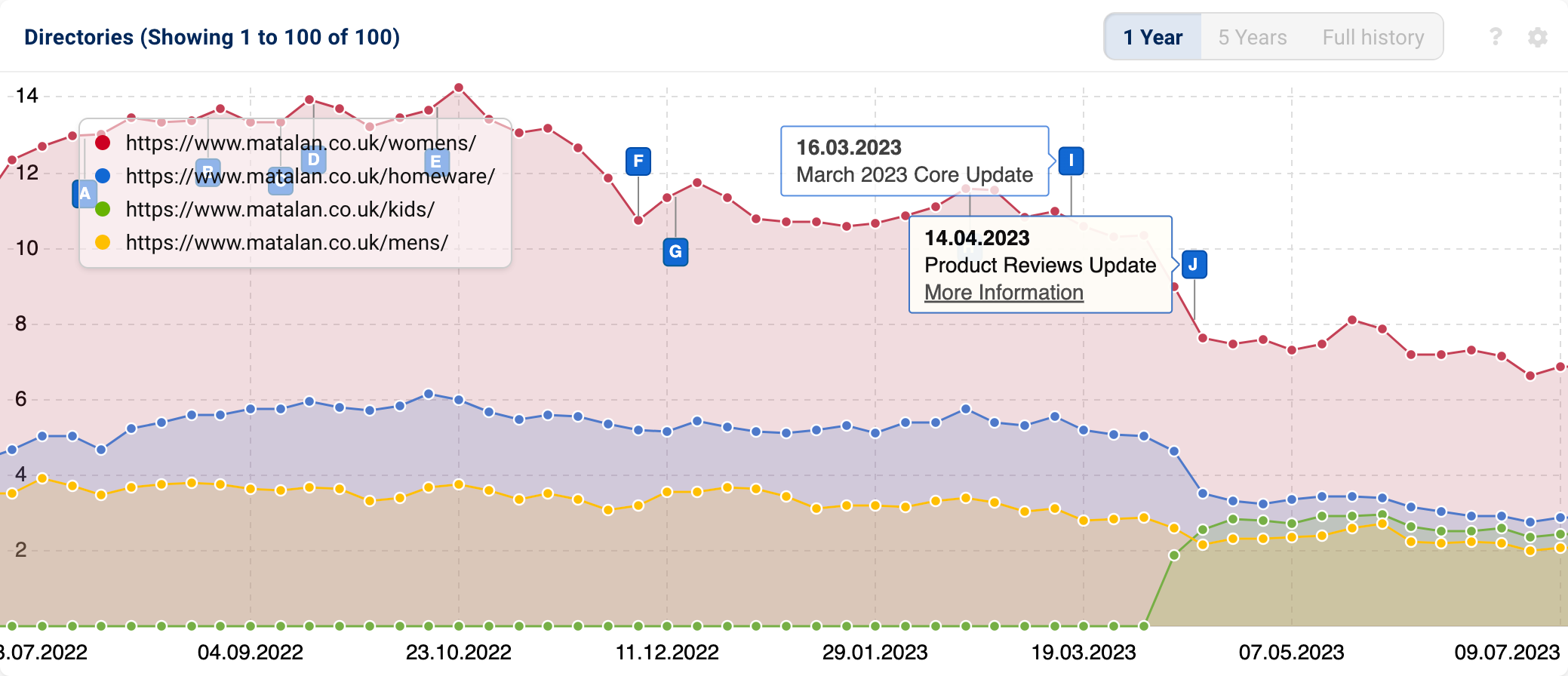

Matalan

In Q2, UK clothing & homeware brand Matalan experienced a 31.32% decline in Google search visibility.

We haven’t reflected on matalan.co.uk since February 2022’s Retail Winners & Losers. At this time, we observed Matalan’s visibility continue on a downward trend; seemingly initiated by the April 2021 Product Review Update.

The organic gloom didn’t last forever. In fact, around 24th January 2022, their visibility started to climb once again. Whilst it was not a full SERP recovery, things were looking rosier for approx. 15 months.

However, this positive stint ended in April 2023 and ironically, the drop-off seems to be connected to yet ANOTHER Product Review Update.

The section which saw the most impact and is the biggest contributor to matalan.co.uk’s visibility is “/womens”. Directory data for “/womens” shows that the Q1 Core Update started the ball rolling, with Q2’s Product Update adding to their woes.

Contrary to the update’s name, April’s Product Review Update did affect more than reviews. In fact, a mix of sites with and without a review system noted major fluctuation following its roll-out. This emphasises the update looked at E-E-A-T more broadly.

From browsing the PDPs (Product Detail Pages), we can see that customer reviews are present, but there are very few per product. This suggests this feature could be new or underutilised.

For an established retailer, it is unusual for reviews to be few and far between. Is this fact raising a red flag for Google’s algorithms? Either way, it’ll be interesting to see what happens to their VI points when the next update comes along.

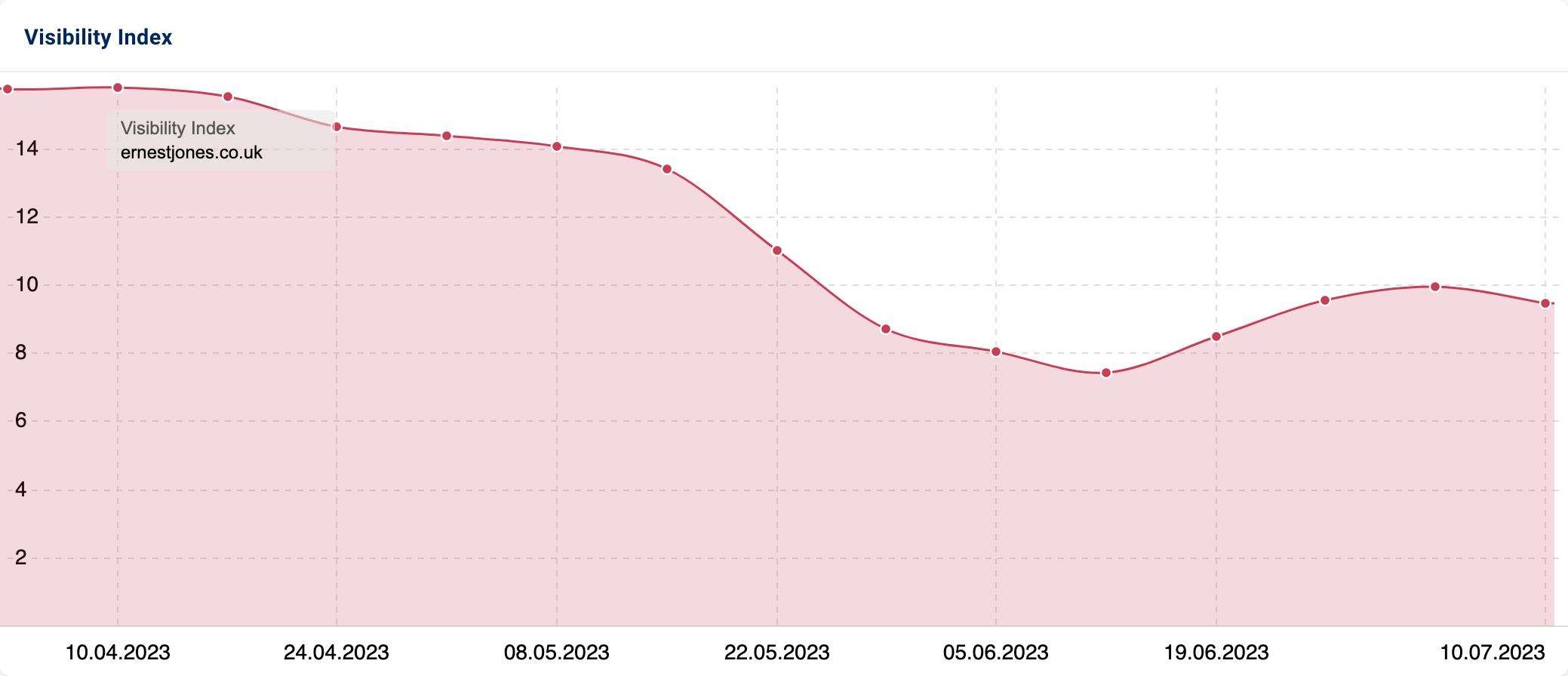

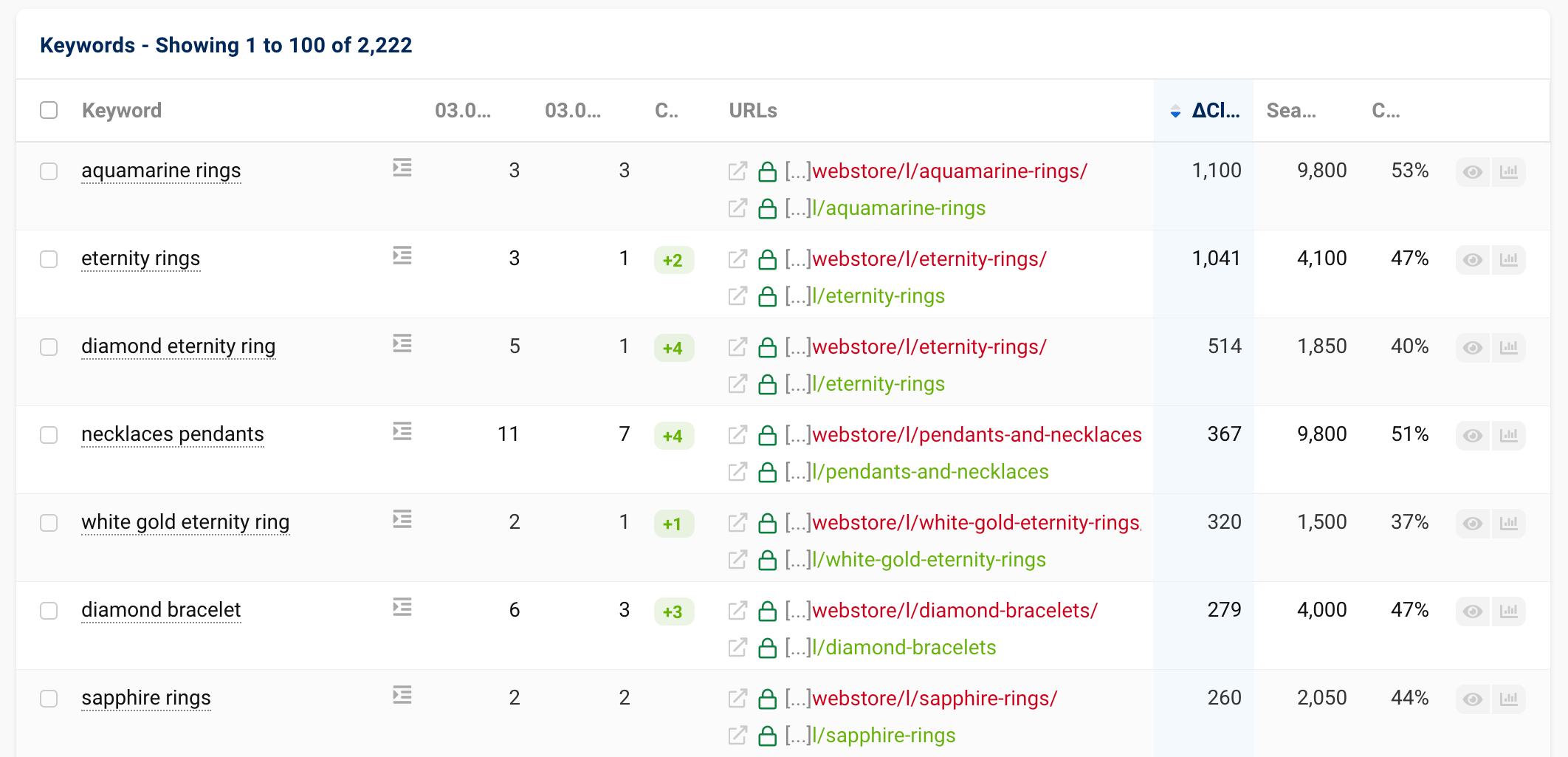

Ernest Jones

British jewellery and watchmaking brand Ernest Jones has also lucked out this quarter. Between 3rd April & 4th July, their Google SERP visibility decreased by 36.9%.

Exploring the domain’s ranking change data highlights significant changes to URL structure. Until recently, the main subfolder for product categories has been “/webstore”. This has now changed to “/l”, or to a specific product type, such as “/jewellery” & “/watches”.

Since the change, ernestjones.co.uk has lost rankings for 31.72K queries, and seen drops for 40.87K more.

These hierarchical changes could have a positive influence on future UX, crawlability and indexability. It is still early days for Ernest Jones and these site architecture updates. It’ll definitely be one to keep an eye on.

All Q2 2023 search visibility losers

Below are the top 25 losers by absolute change:

| # | Domain | 03.04.2023 | 03.07.2023 | Change |

|---|---|---|---|---|

| 1 | wikipedia.org | 7219.10 | 6956.74 | -262.37 |

| 2 | google.co.uk | 278.69 | 175.02 | -103.67 |

| 3 | amazon.co.uk | 3688.16 | 3590.21 | -97.95 |

| 4 | ebay.co.uk | 1536.83 | 1453.68 | -83.15 |

| 5 | thesaurus.com | 233.00 | 162.09 | -70.91 |

| 6 | facebook.com | 1025.24 | 964.07 | -61.17 |

| 7 | spotify.com | 426.41 | 371.58 | -54.82 |

| 8 | merriam-webster.com | 841.73 | 793.72 | -48.02 |

| 9 | dictionary.com | 465.18 | 429.11 | -36.07 |

| 10 | imdb.com | 1169.93 | 1134.81 | -35.12 |

| 11 | www.nhs.uk | 597.94 | 563.78 | -34.17 |

| 12 | collinsdictionary.com | 523.99 | 489.90 | -34.09 |

| 13 | quora.com | 88.46 | 54.81 | -33.65 |

| 14 | [adult] | 180.23 | 149.00 | -31.23 |

| 15 | instagram.com | 698.17 | 667.08 | -31.09 |

| 16 | www.gov.uk | 465.43 | 434.69 | -30.75 |

| 17 | microsoft.com | 283.56 | 260.67 | -22.89 |

| 18 | vocabulary.com | 188.47 | 165.82 | -22.65 |

| 19 | wiktionary.org | 418.79 | 396.54 | -22.25 |

| 20 | nih.gov | 349.84 | 329.35 | -20.49 |

| 21 | wayfair.co.uk | 145.44 | 125.54 | -19.90 |

| 22 | [adult] | 187.50 | 169.04 | -18.46 |

| 23 | argos.co.uk | 515.80 | 497.46 | -18.35 |

| 24 | google.com | 305.34 | 287.51 | -17.83 |

| 25 | bbcgoodfood.com | 202.65 | 185.84 | -16.82 |

| 26 | amazon.com | 138.10 | 121.56 | -16.54 |

Here are the top 25 losing domains by percent change:

| # | Domain | 03.04.2023 | 03.07.2023 | Change | |

|---|---|---|---|---|---|

| 1 | cancer.org | 16.62 | 7.83 | -52.9% | -0.5% |

| 2 | wikiwand.com | 10.47 | 5.31 | -49.3% | -0.5% |

| 3 | corporatefinanceinstitute.com | 25.25 | 12.90 | -48.9% | -0.5% |

| 4 | mobygames.com | 12.45 | 6.57 | -47.2% | -0.5% |

| 5 | quora.com | 88.46 | 54.81 | -38.0% | -0.4% |

| 6 | google.co.uk | 278.69 | 175.02 | -37.2% | -0.4% |

| 7 | ernestjones.co.uk | 15.77 | 9.95 | -36.9% | -0.4% |

| 8 | ebay.com | 32.70 | 21.33 | -34.8% | -0.3% |

| 9 | office.com | 7.62 | 5.03 | -34.0% | -0.3% |

| 10 | letterboxd.com | 18.26 | 12.41 | -32.0% | -0.3% |

| 11 | matalan.co.uk | 30.09 | 20.66 | -31.3% | -0.3% |

| 12 | [adult] | 7.40 | 5.11 | -31.0% | -0.3% |

| 13 | thesaurus.com | 233.00 | 162.09 | -30.4% | -0.3% |

| 14 | hsamuel.co.uk | 33.36 | 23.35 | -30.0% | -0.3% |

| 15 | chainreactioncycles.com | 8.59 | 6.08 | -29.3% | -0.3% |

| 16 | absolute-snow.co.uk | 8.05 | 5.70 | -29.2% | -0.3% |

| 17 | lifehack.org | 7.24 | 5.16 | -28.7% | -0.3% |

| 18 | shazam.com | 9.27 | 6.68 | -28.0% | -0.3% |

| 19 | tunefind.com | 7.07 | 5.17 | -26.9% | -0.3% |

| 20 | self.com | 8.36 | 6.16 | -26.3% | -0.3% |

| 21 | shopstyle.co.uk | 8.18 | 6.14 | -25.0% | -0.3% |

| 22 | selfridges.com | 43.38 | 32.86 | -24.3% | -0.2% |

| 23 | babycenter.com | 14.71 | 11.28 | -23.3% | -0.2% |

| 24 | nintendolife.com | 8.11 | 6.22 | -23.3% | -0.2% |

| 25 | animenewsnetwork.com | 6.72 | 5.16 | -23.1% | -0.2% |

| 26 | history.com | 63.32 | 48.90 | -22.8% | -0.2% |

Conclusion

Based on our Q2 2023 winners & losers, what golden nuggets can we take forward in Q3?

- Even the simplest websites, like Time.is, can achieve impressive organic search success with the right strategy.

- When it comes to pleasing users and building brand trust, keeping E-A-T (Expertise, Authoritativeness, Trustworthiness) in mind is crucial. Failing to meet these criteria can seriously hurt your search visibility over time.

- It seems Google may be giving more weight to location when serving websites without Hreflang tags. For example, prioritising serving information about the American healthcare system to Americans, regardless of domain authority.

- Don’t assume that increases in visibility are solely due to competitor disadvantage. Sometimes, the algorithm favours entire industry sectors, affecting related industries that share similar topics.

- When you update your website’s design and functionality, remember to consider the impact on SEO, not just user experience. This is something which the Corporate Finance Institute has overlooked by underestimating the performance of their topic-specific resource pages and removing them, leading to significant drops in visibility.

- If you’re considering restructuring your website’s hierarchy, keep in mind that whilst it can be a good long-term move, it may affect performance in the short-term. Make sure to use 301 redirects to maintain as much page authority as possible between like-for-like content. However, be aware that there is no guarantee you’ll retain your previous rankings.

Methodology

Using the SISTRIX Visibility Index, we have examined the 250 winning & losing domains in UK Google Search. These domains have witnessed the most significant fluctuations in visibility between the 3rd April and 4th July 2023.

Visibility Index (VI) scores show domain visibility in Google’s organic search results for 40 countries, free of traffic fluctuations and updated daily.