SectorWatch is heading onto the water this month as we jump into the UK search market for paddle boards. We’re looking for the winning domains and examples of high-performing content to see who is making a splash in the choppy waters of Google Search.

- Top 3 domains for paddle board searches:

- What’s trending in the paddle board search market?

- The top URLs for paddle boards

- The top domains in the UK for paddle boards

- Top 20 domains for paddle boards:

- Content examples: What type of content is performing?

- High-performance content examples

- Summary

- Keyword research in the paddle boards sector

- Our SectorWatch process

- Curated keyword set and sector click potential

One of the unexpected trends after the Covid-19 pandemic was the growth in outdoor activities, sports and pursuits, and one of the biggest winners was paddleboarding, with people taking up the sport in the wake of travel restrictions in 2021.

Accessible, easy to pick up and a relatively cheap form of boating, paddle boarding is also an option all over the UK, not just in coastal areas. The global market was valued at $1.52 billion in 2022 and is predicted to grow to $2.39 billion by 2030.

Another study found that the stand-up paddleboarding market saw over 500% growth over the last five years. This is a potentially lucrative search market with paddleboards selling for between £250 and £1,500, and general watersports participation growing in the UK.

As the weather begins to improve in our region, online searches for this seasonal product are set to pick up again. Who is in prime position to make waves?

Top 3 domains for paddle board searches:

The full winners’ list is shown below, but as a headline, here are the most visible sites for paddle board shopping searches:

- amazon.co.uk

- sup.co.uk

- red-equipment.co.uk

What’s trending in the paddle board search market?

By analysing our keyword list and our TrendWatch data, we are able to identify topics that are trending. As this is a highly seasonal sector, and as we move away from the Covid boost it’s fair to say that most clusters and keywords are falling in search volume. Here are a few examples of clusters returning to pre-covid levels of search.

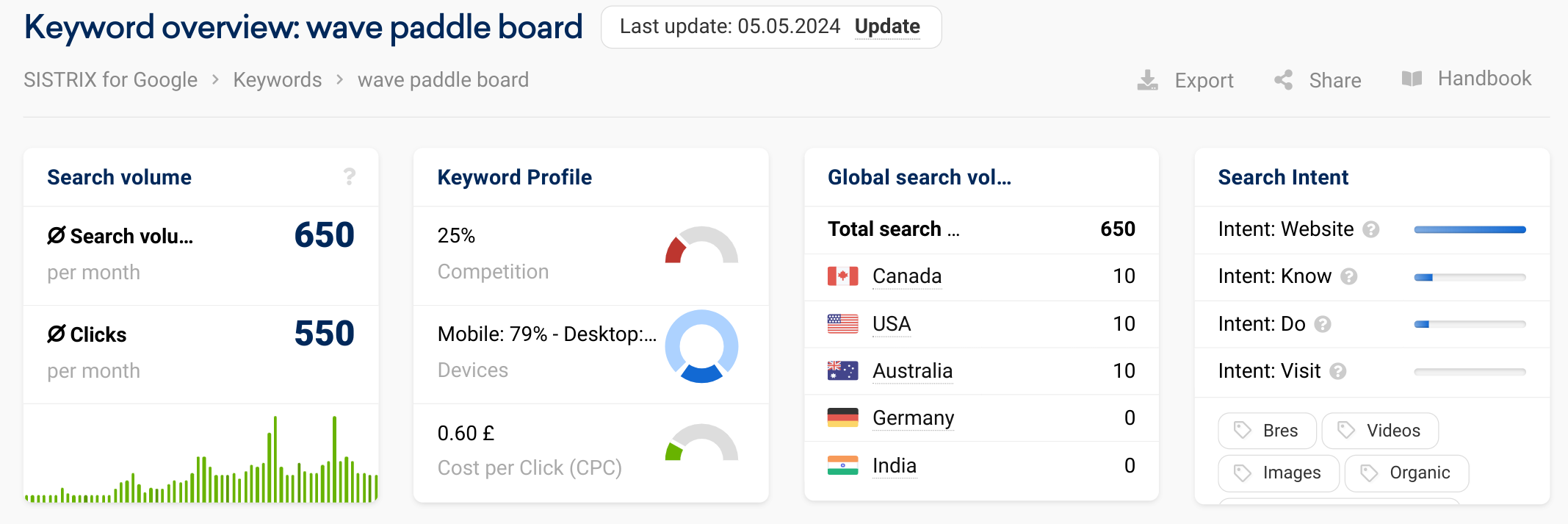

The only significant rises in search volume have been among brands such as the Wave paddleboard the The SUP Store.

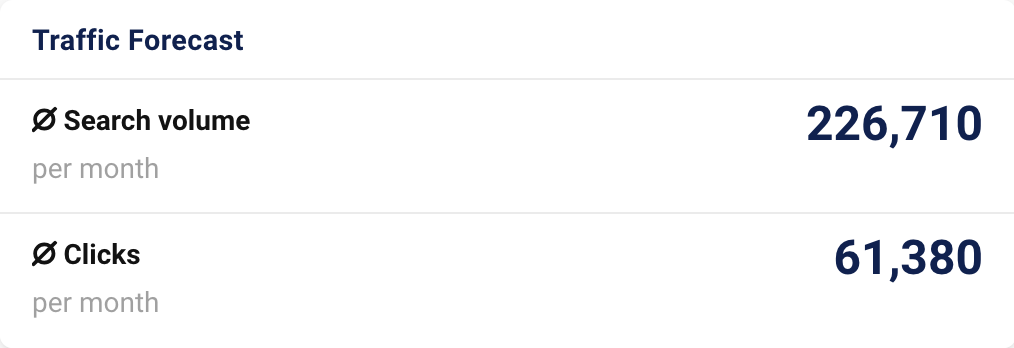

Our keyword set covers over 0.25 million searches per month in the UK so there’s a significant opportunity in search.

If you’d like insight into even more search trends, and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for paddle boards

When you create a keyword list in SISTRIX, one of the reports you’ll find pinpoints the best-performing individual URLs. To help you review the highest-performing content, this table shows our keyword set’s most successful 10 URLs from a total of 29182 URLs ranking for one or more of the keywords in our list. If you click on the domain name the URL in question will open in a new tab.

| URL (Click to open in new tab) | Top Keyword | Share of Visibility |

|---|---|---|

| https://wavesupboards.com/ | paddle board | 1.20% |

| https://www.amazon.co.uk/Sailing-Stand-Up-Paddleboarding/b?ie=UTF8&node=3589863031 | paddle board | 1.18% |

| https://www.aquaplanetsports.com/collections/inflatable-paddle-boards | paddle board | 1.17% |

| https://fatstickboards.com/collections/inflatable-sups-kayaks | paddle board | 1.16% |

| https://red-equipment.co.uk/collections/paddleboards | paddle board | 1.05% |

| https://standuppaddleboarding.co.uk/ | paddle board | 0.89% |

| https://paddleco.co.uk/ | paddle board | 0.81% |

| https://www.decathlon.co.uk/sports/stand-up-paddle/sup-boards | paddle board | 0.79% |

| https://www.telegraph.co.uk/recommended/leisure/best-inflatable-stand-up-paddle-boards/ | paddle boards | 0.75% |

| https://wavesupboards.com/collections/sale | paddleboard on sale | 0.75% |

The top domains in the UK for paddle boards

We’ve seen our top three domains in this search market and the most popular URLs, but there’s a wider story to this research. To show what type of sites rank, here are the top 25 domains for our keyword set:

Top 20 domains for paddle boards:

| Domain | Project Visibility Index | Keywords in Top 10 |

|---|---|---|

| amazon.co.uk | 625.38 | 458 |

| sup.co.uk | 331.87 | 242 |

| red-equipment.co.uk | 306.15 | 260 |

| wavesupboards.com | 247.74 | 199 |

| supinflatables.co.uk | 244.22 | 231 |

| decathlon.co.uk | 240.56 | 218 |

| aquaplanetsports.com | 190.17 | 155 |

| thesupco.com | 182.37 | 180 |

| twobarefeet.co.uk | 173.05 | 136 |

| fatstickboards.com | 147.15 | 136 |

| thesupstore.co.uk | 146.13 | 131 |

| supboardguide.com | 132.11 | 109 |

| standuppaddleboarding.co.uk | 123.58 | 102 |

| sup-warehouse.com | 122.56 | 116 |

| ebay.co.uk | 115.3 | 90 |

| paddleco.co.uk | 102.46 | 92 |

| facebook.com | 101.85 | 85 |

| gilisports.com | 89.69 | 84 |

| star-board.com | 88.49 | 75 |

| h2o-sports.co.uk | 80.84 | 84 |

More domains listed in the project data Sheet, shared below.

Content examples: What type of content is performing?

Our list of winning domains offers immediate insight into the type of site performing well for paddle board sales searches.

- There’s more diversity in the business types ranking than we expected:

- We have some ecommerce giants in Amazon and eBay who sell everything under the sun. As with many of the ecommerce sectors we’ve analysed, seeing the near-ubiquitous Amazon at or near the top is no surprise. These are some of the biggest domains in the UK search market (as measured by our Visibility Index)

- What is perhaps more surprising is the types of business taking up the rest of the top twenty domains

- We have another ecommerce giant, Decathlon, though one that is sports-focussed and is a manufacturer of paddle board products. The site also works as a marketplace, listing products from other retailers using their platform, including others on this list of top-performing domains

- After this, the sector is dominated by specialists in the area

- In the top twenty domains, we have seven specialist retailers (such as SUP Inflatables, SUP Warehouse and Sup.co.uk), offering paddle boards and a supporting range of SUP products. Some of these appear to hold stock and others might dropship

- And then we have seven manufacturers on the list – eight if you include Decathlon – such as Aquaplanet, Red Paddle Co, Starboard and Wave, selling their products directly or acting as a catalogue with links for where to buy

- Some of these manufacturers are ranking with US sites, where you can’t buy a product and can’t see a price in pounds, leaving you to have to search again directly for their products

- Only two ‘guide’ sites, DIVEIN and SUPBoardGuide, offering reviews, comparisons and round-ups, complete with affiliate links, make our top twenty-five performing domains

- Most sites target the UK market. It makes sense Google would favour these with buying-intent keywords as it would frustrate searchers to be shown sites where they can’t purchase the products shown

- Decathlon gets two bites of the cherry, as they have created a microsite for their Itiwit brand that makes their SUPs and kayaks

- This microsite has little content and mostly serves to link to product and category pages on the main decathlon.co.uk site

- Despite this, it is the twenty-fifth most visible domain, perhaps powered by brand recognition alone!

- Facebook also ranks in the top twenty domains, primarily through a “SUP used boards for Sale England” group. This perhaps indicates that Google has determined that one of the secondary intents for our keywords is for second-hand stand-up paddle boards

- One result of so many smaller, industry-specific, businesses ranking well for our keywords is the tech stack they use. Nine of the top twenty domains use Shopify, with another two using Magento. 25% of the top 100 best-performing pages are Shopify product listing pages (PLPs, or category pages) in the classic Shopify /collections/ directory

High-performance content examples

The majority of our ranking domains are ecommerce experiences, so we know that shopping pages are the most common winning content format for our keyword set.

So, what can we learn from some of the most visible domains, especially those that aren’t powerhouses like Amazon which ranks for everything? What does it take to win in this sector?

We are looking for directories and content templates that consistently rank well for their target terms. We call these high-performing content formats and want to explore them further to find what we can learn and apply to our projects.

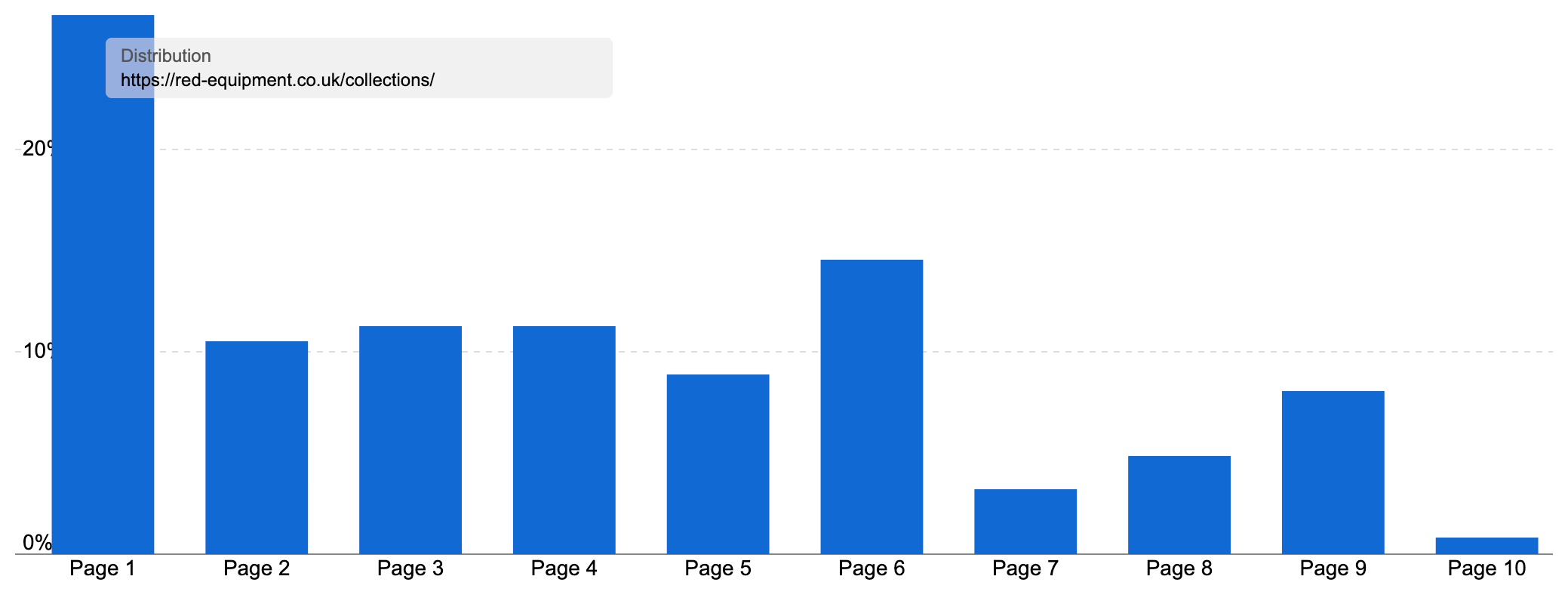

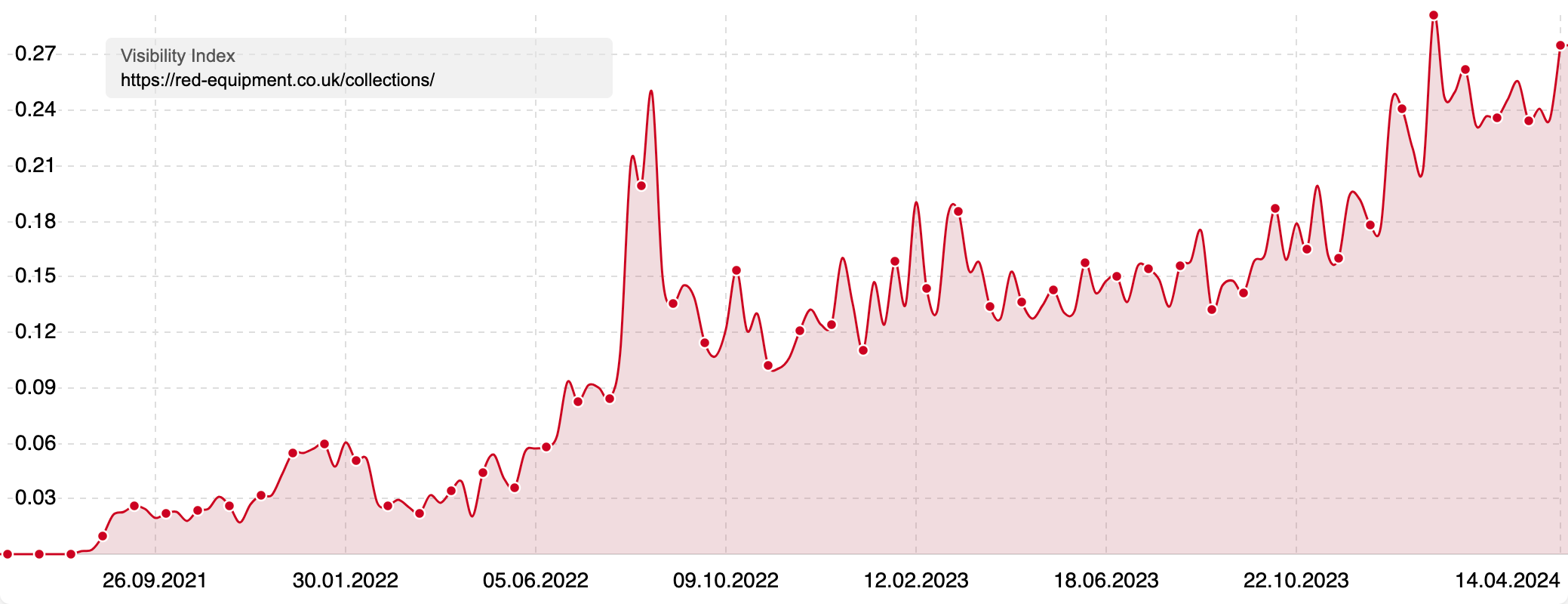

One of our biggest winners is the Red Paddle Co, a UK-based paddle board manufacturer. Despite the small business size (compared to the likes of Amazon and Decathlon), the site does very well for our keyword set, ranking for 591 of our 872 keywords (67.7%) and on page one for 267 (50.6%) of them.

Part of the domain’s success is thanks to demand for branded queries, such as red board paddle boards. This gives them very high visibility for a popular term and also a brand-plus-product association in Google’s eye which no doubts help them rank for non-branded searches.

And they do rank well.

Red Paddle Co also rank well for the most common searches in our keyword set, ranking on page one for paddle board, paddleboard, inflatable paddle board, stand-up paddle board and paddles for stand-up paddle board.

The site is built with Shopify and uses the standard /collections/ directory for its PLPs. This directory overall ranks for 2,628 keywords in the UK, with 26.6% of the most popular keywords ranking on page one.

The directory has also seen consistent growth over the past several years and now brings in an estimated 16,605 organic visits a month, worth £14k.

So what makes them do so well? Why does Google like this shopping experience?

Let’s take their most popular page in our analysis, their paddleboards page, as an example:

- As noted above, there is a clear brand association, with many longer tail searches looking for this manufacturer – more than many of the other manufacturers we saw keyword demand around

- The site offers 28 different paddle boards – not a huge amount, but a decent number on a direct manufacturer site

- The product listing page (PLP) itself is fairly well-optimised with a strong title tag, enticing meta description to stand out in the search results and a clear H1 tag

- The PLP also uses a small piece of intro copy, which helps set the scene plus makes it clear to customers, and search engines, exactly what you’ll find on the page

- The intro also finishes with a CTA to ‘Help Me Pick!’ which takes you through to the product selection page. This handy tool asks you questions about what you are after to help you find the perfect model

- There are sections on everything from how many people will use your board to your weight and what you’ll be doing with your board

- Not only could this tool rank in its own right, but with a bigger purchase like this many buying journeys have a ‘messy middle’ stage where customers want to see products, and then be guided on what they are looking at before going back to a list of potential products

- This tool front and centre on the PLP could help encourage not only conversions through guiding customers on what to buy but also longer site visits

- The site adds to this by having a series of guide pages, including one on finding the right SUP for you and overviews of each range. The site is working hard to help you make a good buying decision, which again has the additional benefit of keeping you on the site for longer

- This informational content is boosted further by a blog

- The PLP is the first linked to in the site’s main menu, offering sitewide links, and is also linked to in the main content on many other pages

- There is also some additional copy at the bottom of the PLP, though this potentially has less SEO value as it isn’t in a position where many customers will read it

- The site also offers clear ‘about us’ and ‘contact us’ information, including phone numbers, email addresses and postal addresses, as well as links to active social media profiles

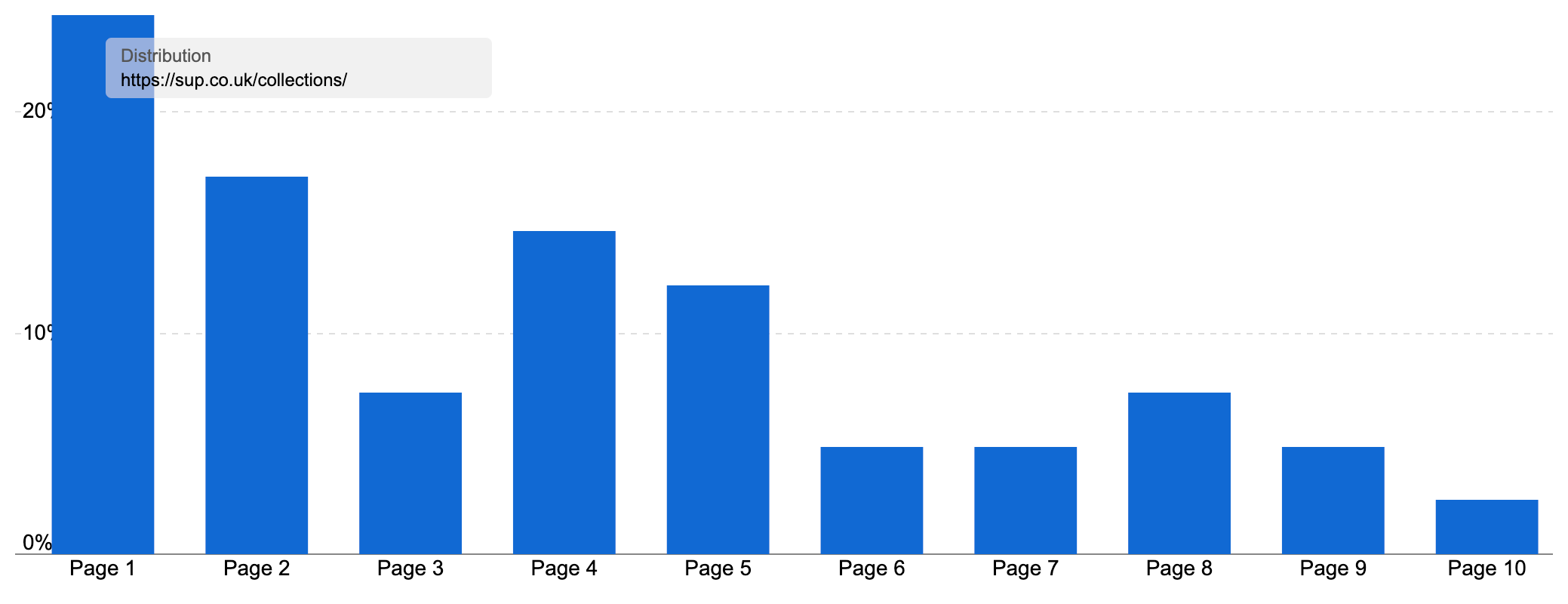

Another Shopify-based site that’s done very well is Sup.co.uk. It is the second-most visible domain for our keyword set, ranking for 52% of our keywords and on page one for 27.6, including many of the most popular queries.

Nine pages from the site rank in the top 100 URLs for our sample keywords, all in the /collections/ directory except for the homepage.

Sup.co.uk PLPs are well categorised, with different PLPs for all the product subcategories we’ve seen in our keyword list. This includes PLPs for surfing SUPs, pumps, buoyancy aids, leashes, bags and more. The site’s comprehensive array of products with clear pages for each are paying dividends.

Overall, the site’s PLPs rank for over a thousand keywords, and on page one for 24.4%. 73 different PLPs rank for at least one keyword, bringing in over 7k organic visits a month.

Interestingly, the site appears to have migrated to Shopify only recently. Using the keyword history report in Sistrix we see that the ranking page for many of the PLP keywords changed in mid-March to a URL in the /collections/ directory.

The site has seen a downturn in organic performance since mid-March, but whether this is due to fluctuations after a CMS migration or a result of the March 2024 Core Update – or both! – we can’t tell yet. We can also see plenty of room for better optimisation so further organic success is definitely possible for the site.

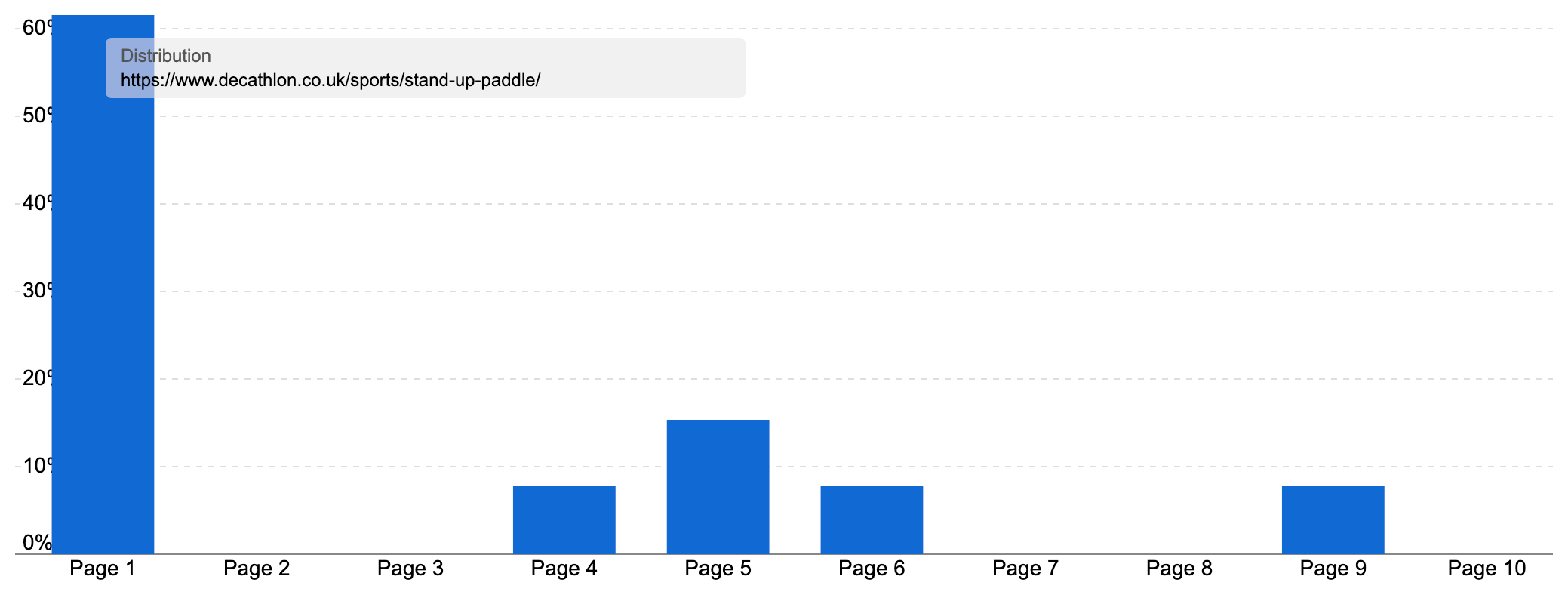

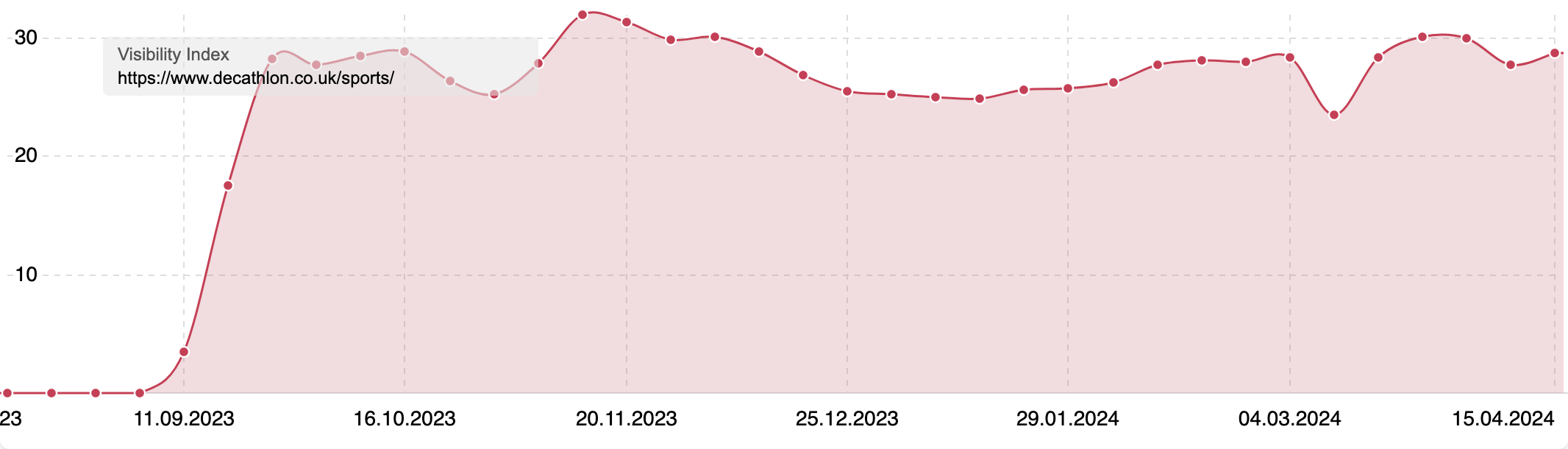

Our final interesting winner is a big ecommerce name – Decathlon.

Decathlon has a dedicated directory for SUPs, and within it, you find a department page (or category-listing-page or CLP) introducing the subject, PLPs for all the major categories within the department such as inflatable paddle boards, spare parts, paddles, wetsuits and more.

This directory is effective and ranks for 1,243 keywords in the UK at the time of writing. The directory ranks on page one for an impressive 61.5% of the most popular keywords, bringing in 17.7k organic visits a month – traffic you’d have to pay an estimated £19k for via PPC.

The department page also links to relevant help content, such as pages on finding the right stand-up paddle, choosing the right board and how to protect your belongings.

These all live in Decathlon’s huge /htc/ directory, which has 425 different guides that rank for at least one keyword, supporting buying journeys across the site.

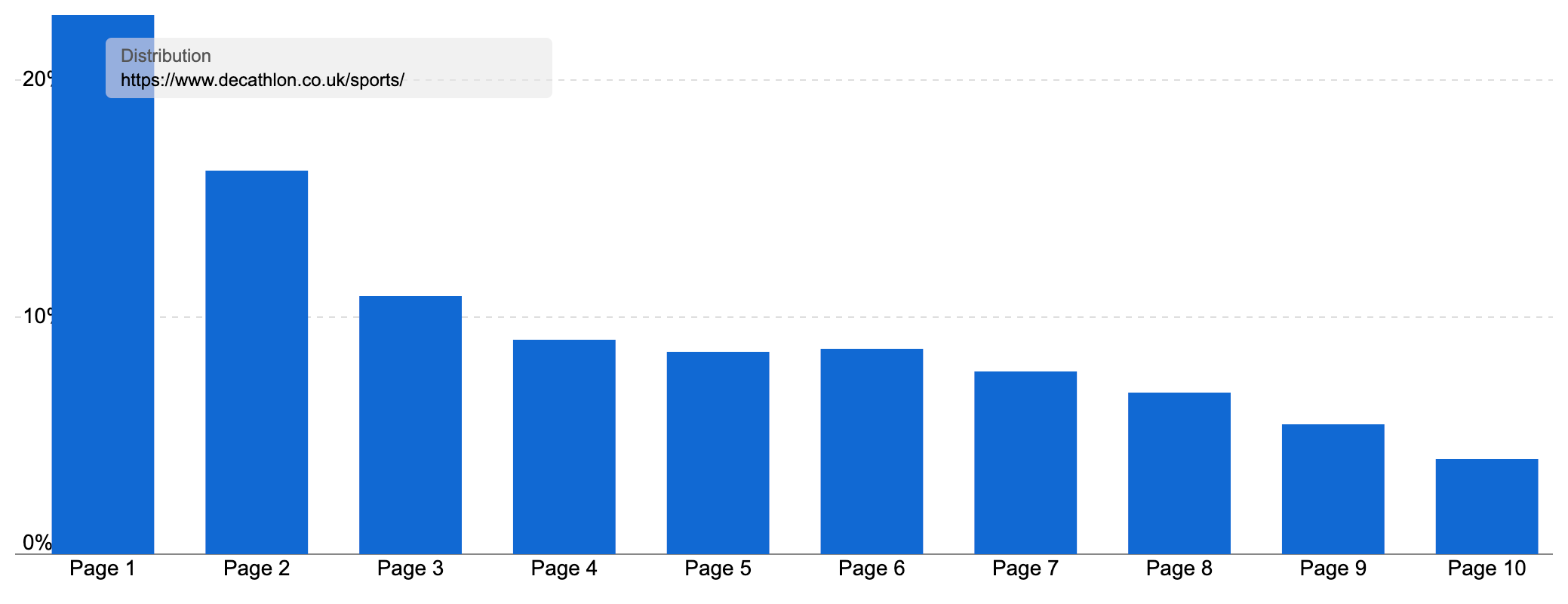

The stand-up paddle board directory is part of Decathlon’s biggest overall directory, /sports/. This directory houses all of Decathlon’s PLPs (though not its product pages), ranking for over 219k keywords and bringing in an estimated 576k organic visits a month.

Decathlon has over 4,000 different PLPs, covering every product type for all the sports they cater for. Over 22.7% of their rankings are on page one, so if Decathlon moves into a new sports sector, they can expect to compete for valuable keywords.

(Note: Decathlon changed their URL structure in late 2023)

While its brand reputation plus authority from backlinks are critical, Decathlon is no couch potato when it comes to its shopping experience.

The site has recently been revamped, and offers a clean, modern content experience, with all the optimisations and options you’d expect of a modern retailer.

The PLPs are well-optimised – and potentially over-optimised with a title tag of “Stand Up Paddle Boards UK – SUP Boards | Decathlon” and an extra section of copy at the foot of the page in a small font – and feature useful intro copy, a sub-menu to child and related categories plus a wide range of filters.

As noted before, Decathlon has also made its site a marketplace, meaning other retailers can sell their products alongside Decatlon’s products (for a fee). The upshot of this for Decathlon, apart from the extra revenue, is that it greatly expands the number of products the site sells. This helps it compete against other retailers with huge marketplace mechanics.

For example, on the PLP for stand-up paddle boards, Decathlon offers 154 products, far more than anyone else in our winners list apart from the ecommerce giants.

Summary

- The paddleboarding market is an example of a sector where niche, dedicated specialists can compete against the ecommerce giants

- But, everyone ranking offers a useful aspect, whether its manufacturers selling their own products, paddleboard shops offering a wider selection of products (and potentially neutral opinion) or famous retailers with their brand recognition and product range

- To compete at the top for the most competitive shopping keywords, you need to offer an excellent retail experience, often with supporting content for those still looking to make up their mind or understand their options – catering to this ‘messy middle’ is something the biggest name likes Amazon cannot do

- More and more large retailers are opening up their websites as marketplaces. We see Decathlon doing that here, and many top-ranking specialist retailers or manufacturers offer their boards through Decathlon. Whether this cuts into margins or offers an extra revenue stream (through barnacle SEO) is for those retailers to decide!

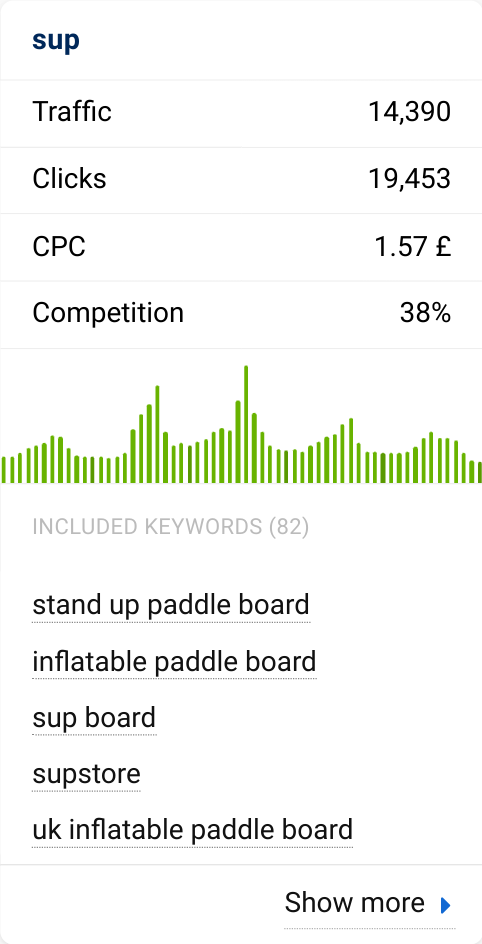

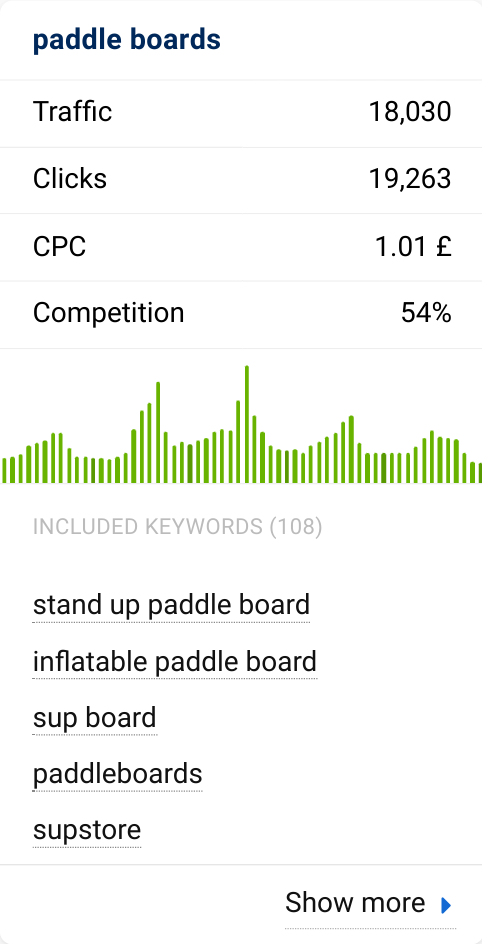

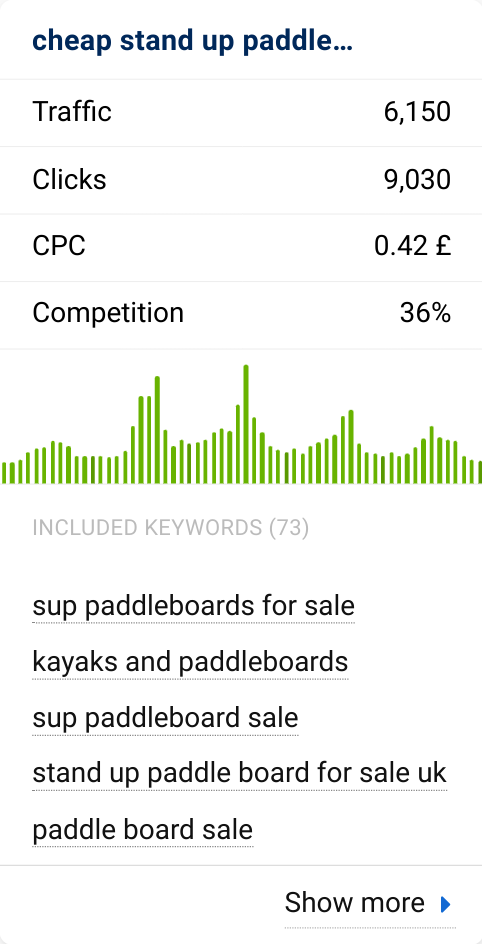

Keyword research in the paddle boards sector

We’ve curated a comprehensive keyword set to build an accurate picture of the search market for paddle boards, including the most visible domains. The set is a representative sample of many common searches made in the UK by those buying a paddle board or finding a good option.

We always categorise our keyword lists by the search intent. We do this to compare the sites competing for the same types of searches. This is how we find the best-performing content in the sector.

For this analysis, we’re looking exclusively at ‘do’ keywords – those searches where someone is looking to buy, hire, download or purchase in some way. We are often very interested in these keywords in SEO as they represent a high conversion intent. These represent ‘bottom-of-the-funnel’ (BOFU) searches or ‘transactional’ intent queries.

What does this look like in practice? We have a selection of over 850 keywords which indicate someone in the process of buying a paddle board.

We begin with more basic generic keywords such as paddle board (searched for 37,700 times a month on average in the UK, with peaks each summer) and stand up paddle board (2,050 searches a month).

Then we also include more specific queries based around brands such as red board paddle boards (an impressive 4,400 searches a month on average), searches for kit like pumps for sup (1,500 searches) and searches which represent shopping research such as best paddle boards uk (800 searches a month).

Our keyword set represents almost a quarter of a million searches a month in the UK.

We’ve excluded searches for kayaks (though we see searches looking for the difference between the craft types), searches for paddle board hire and navigational searches which include a retailer name.

You can learn more about our lists (including links to the full keyword set) and search intent at the end of this article. We also have a detailed step-by-step article on keyword research with SISTRIX tools and data where you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a selection of paddle board keyword discovery tables.

We chose a selection of highly targeted keywords with a ‘do‘ or ‘know‘ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

Curated keyword set and sector click potential

Core keywords: paddle board, stand up paddle board, sup, best paddle boards, paddle board accessories.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and the traffic forecast you can see below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.