For this SectorWatch, we are looking to get our finances in order as we dive into the search market for life insurance. We’re highlighting the winning domains and most effective content formats to reach those buying or researching life insurance topics – searches with huge commercial value. Who has got their content covered and whose efforts are getting rejected?

- Top 3 domains for ‘do‘ (transactional) searches - Life insurance:

- Top 3 domains for ‘know‘ (informational) searches - Life insurance:

- Keyword research in the life insurance sector

- What's Trending in the life insurance industry?

- The top domains for life insurance:

- Top 25 domains for life insurance: ‘Do’ intent

- Top 25 domains for life insurance: ‘Know’ intent

- Content examples: What type of content is performing?

- High-performance content examples:

- High-performance 'know' content

- Summary

- Our process:

- Curated keyword set and sector click potential

Not all of the important purchases we make are glamorous.

But few are more important than the financial well-being of our families. This is why the search market for life insurance is a fascinating and competitive sector to examine.

Around 18.6 million Brits had life insurance in 2022, which is about 35% of the adult population.

Together, those policies add up. The average insurance cost is £38.15 per month and the UK’s life insurance market will be worth an estimated £65.4 billion in 2023.

One notable trend is the rising demand for tailored insurance solutions. Consumers are increasingly looking for policies that adapt to their changing life stages and circumstances. There’s a growing interest in policies offering flexibility, such as adjustable premiums or coverage.

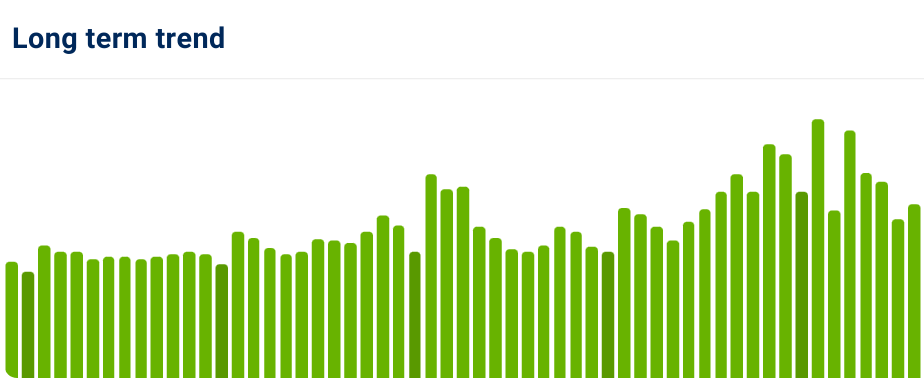

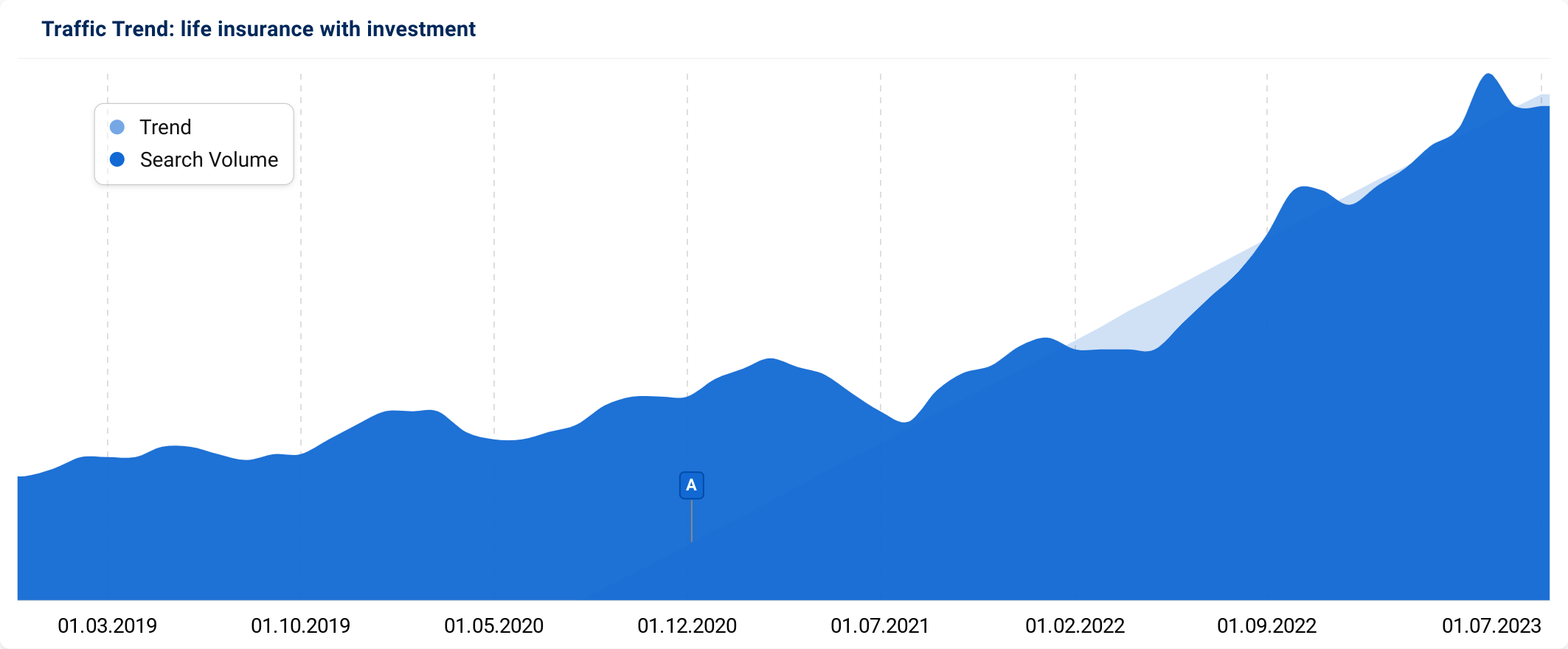

In fact, the overall search demand for ‘life insurance‘ topics is increasing. We can see this from the long-term trend for our keyword set, including peaks in interest each January.

As with any insurance topic, there’s a wide range of sites competing for searchers’ attention. We have direct suppliers, such as Aviva, Vitality, the Post Office, Zurich and Legal and General. There were 402 authorised insurance companies in the UK in 2022 – that’s a lot of potential suppliers.

Added to this are the hugely popular comparison sites, such as Go Compare, MoneySuperMarket, Compare the Market and Money.co.uk. There are also more focused insurance brokers like Reassured and Unbiased.

And finally, you also have the home finance publications such as Money Saving Expert, review sites like Which, plus the government-backed financial guidance site MoneyHelper.

This is a fiercely competitive sector, with the cost for Google Ads for our commercial keywords regularly over £30 a click!

With all this competition, who has got themselves the most comprehensive coverage?

Top 3 domains for ‘do‘ (transactional) searches – Life insurance:

- aviva.co.uk

- comparethemarket.com

- legalandgeneral.com

Top 3 domains for ‘know‘ (informational) searches – Life insurance:

- legalandgeneral.com

- aviva.co.uk

- moneysupermarket.com

Keyword research in the life insurance sector

We’ve curated two lists of keywords used by UK searchers when they look to buy life insurance including common questions they ask when researching the topic. We always categorise our keyword lists by their search intent so we can find the best-performing content in our chosen niche. Read on about the background of keyword research in our detailed tutorial.

First up is our list of more commercial ‘do‘ searches. Do searches are where the searcher is looking to buy a product or ticket, hire a service or download something. Here, these are searches with a transactional intent, looking to buy some life insurance.

Our list includes keywords like life insurance (82,200 searches a month on average in the UK), life insurance quotes (17,800 searches on average, and a CPC cost of £42.20!), over 50 life insurance (7,600 searches and a CPC of £34.40) and cheap life insurance (1,600 searches and a CPC of £39.20).

Second is our list of ‘know‘ intent keywords. These are keywords with an informational intent where someone is looking to learn something or better understand a topic. This includes searches on the benefits of life insurance, whether you need it for a mortgage and commercial research around the best life insurance products and providers.

Our ‘know‘ keyword set includes best life insurance UK (4,350 searches a month on average in the UK and a CPC of £30.80), life insurance calculator (1,150) and benefits to life insurance (950).

A few keywords with mixed intent appear on both lists, such as policies for life insurance (searched 4,400 times a month on average in the UK).

We also excluded any searches including a specific provider or website brand name, so more navigational searches aren’t included.

You can find out more about the lists (including links to the full lists) at the end of this article.

What’s Trending in the life insurance industry?

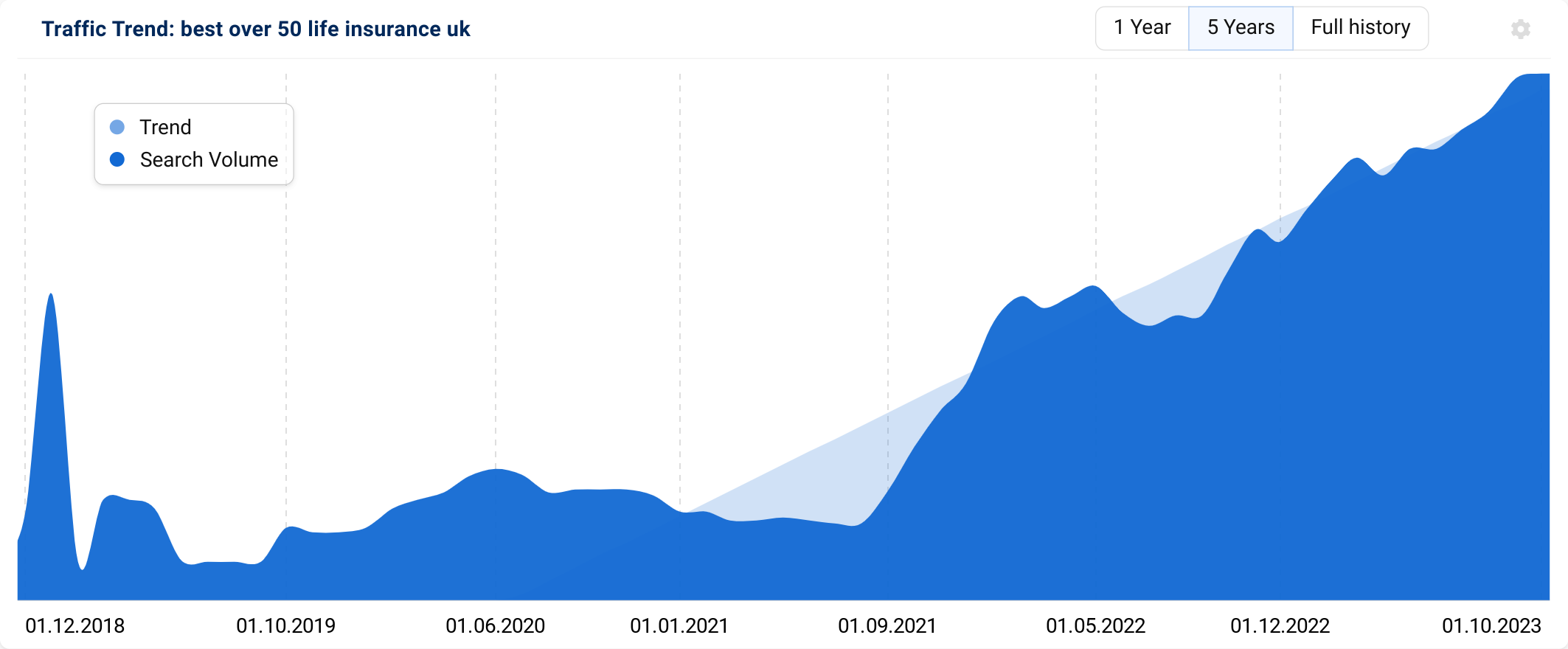

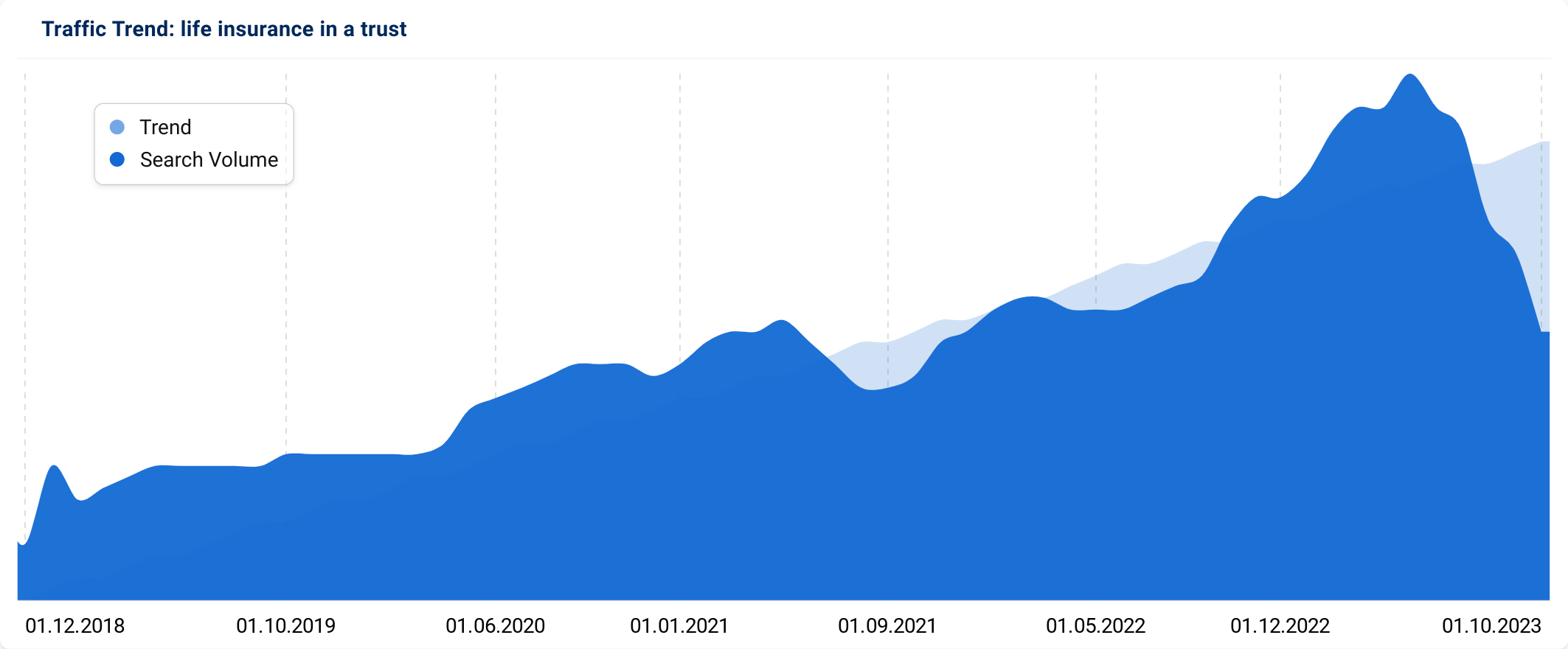

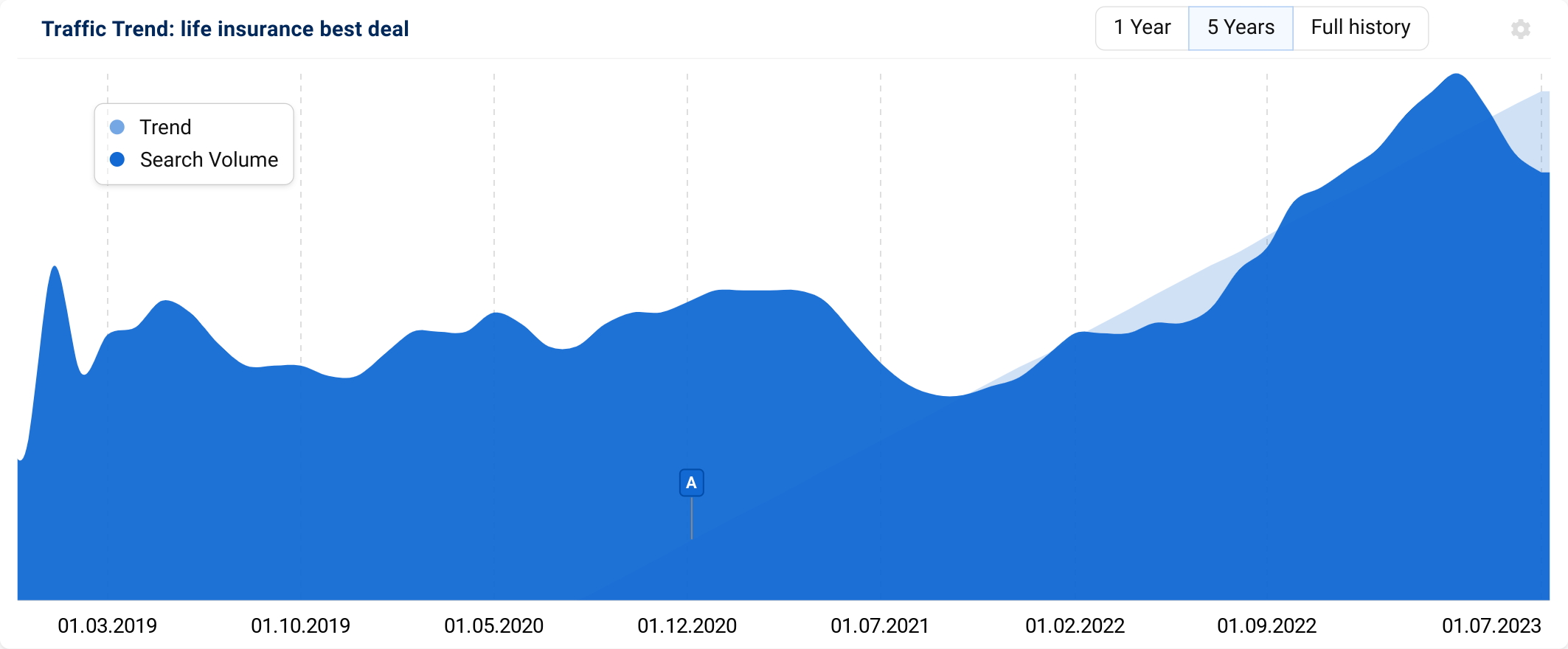

Using the keyword set and our TrendWatch data we have discovered a number of life-insurance-related trends.

For more search trends, and the back-story to those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top domains for life insurance:

Using our project of 427 ‘do‘ life insurance keywords and 423 ‘know‘ keywords, we processed the current SERPs (search engine results pages) and calculated the effective project visibility for the domains ranking for our keywords.

Top 25 domains for life insurance: ‘Do’ intent

| Domain | Relative visibility | Top 10 keywords |

|---|---|---|

| aviva.co.uk | 100 | 334 |

| comparethemarket.com | 97.95 | 325 |

| legalandgeneral.com | 85.35 | 344 |

| moneysupermarket.com | 68.4 | 318 |

| gocompare.com | 52.21 | 253 |

| postoffice.co.uk | 49.28 | 217 |

| reassured.co.uk | 35.04 | 163 |

| vitality.co.uk | 29.41 | 123 |

| moneysavingexpert.com | 14.74 | 76 |

| money.co.uk | 14.12 | 75 |

| forbes.com | 13.2 | 66 |

| unbiased.co.uk | 13.19 | 59 |

| zurich.co.uk | 13.05 | 69 |

| royallondon.com | 12.67 | 67 |

| confused.com | 11.56 | 65 |

| investopedia.com | 10.67 | 41 |

| iaminsured.co.uk | 10.1 | 50 |

| which.co.uk | 9.43 | 51 |

| moneyhelper.org.uk | 9.28 | 52 |

| barclays.co.uk | 8.91 | 49 |

| sunlife.co.uk | 8.59 | 51 |

| uswitch.com | 8.58 | 47 |

| lloydsbank.com | 8.43 | 45 |

| cavendishonline.co.uk | 7.91 | 36 |

| britishseniors.co.uk | 7.14 | 39 |

Top 25 domains for life insurance: ‘Know’ intent

| Domain | Relative Visibility | Top 10 keywords |

|---|---|---|

| legalandgeneral.com | 100 | 340 |

| aviva.co.uk | 85.68 | 273 |

| moneysupermarket.com | 67.9 | 258 |

| postoffice.co.uk | 59.82 | 203 |

| reassured.co.uk | 54.79 | 177 |

| comparethemarket.com | 52.86 | 184 |

| forbes.com | 38.05 | 167 |

| investopedia.com | 37.3 | 130 |

| unbiased.co.uk | 33 | 127 |

| which.co.uk | 28.81 | 122 |

| gocompare.com | 24.95 | 93 |

| moneyhelper.org.uk | 24.82 | 82 |

| independent.co.uk | 19.88 | 59 |

| nerdwallet.com | 19.29 | 86 |

| moneysavingexpert.com | 18.47 | 59 |

| iaminsured.co.uk | 16.73 | 57 |

| vitality.co.uk | 16.64 | 57 |

| abi.org.uk | 16.37 | 55 |

| mytribeinsurance.co.uk | 15.76 | 56 |

| zurich.co.uk | 14.45 | 57 |

| money.co.uk | 14.22 | 60 |

| cavendishonline.co.uk | 14.07 | 53 |

| moneytothemasses.com | 12.1 | 55 |

| royallondon.com | 11.83 | 50 |

| caspianinsurance.co.uk | 11.46 | 41 |

Content examples: What type of content is performing?

- We see many of the same domains doing well for both our informational and transactional keyword sets. Aviva, Legal and General, Compare the Market, MoneySuperMarket, Reassured, and The Post Office all appear in the top ten domains for both keyword sets

- In fact, 76% of the top 25 domains for both lists are the same, indicating a consistent set of ‘experts’ in the sector

- This might point to a common strategy of targeting all parts of the user journey within this sector

- As a result, sites which offer life insurance quotes dominate our keyword sets, with direct providers (such as Aviva), comparison sites, brokers (such as Reassured) and financial guidance sites (such as Money.com) all represented at the top of our winning domain lists

- While most of the top domains are well-known brands, there are some smaller specialists able to compete

- One example is iam INSURED, which has a VI score of 0.17 but appears in the top 25 for both our keyword sets

- Another is Cavendish Online, a life insurance broker with a VI score of 0.35 which is competing with domains with far larger organic footprints

- It is also worth noting that as a highly regulated product, UK-based sites almost exclusively make up the top 25 domains for both keyword sets

High-performance content examples:

We’re looking for high-performance content. That is content where a high percentage of its rankings are on page one, showing it is consistently valued by Google as good quality content likely to answer a searcher’s needs.

If a page or directory is high-performing in this way, then there’s a good chance it can rank for other new keywords the site decides to target.

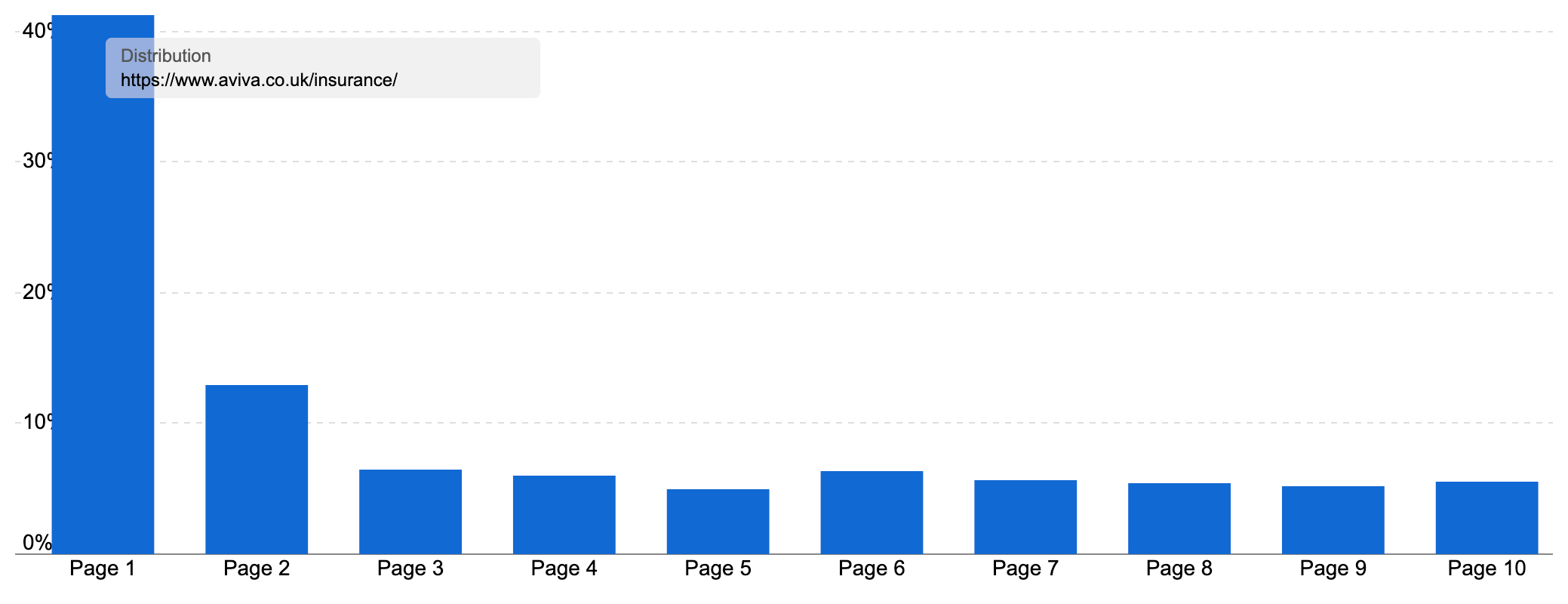

If we start with our ‘do’ keywords, our winner is Aviva, the UK’s largest general insurer.

Aviva ranks for 415 of our 427 commercial-intent keywords, and on page one for 334 of them (78.2%). 11 of our top 100 best-performing URLs for the keyword set are on aviva.co.uk, all in their /insurance/ directory.

The top overall page is their product page for life insurance, which appears for 163 of our keywords, and 133 in the top ten positions – that’s on page one for 31% of our entire keyword set.

While this is a sales page for a commercial topic, it still works incredibly hard to be a comprehensive resource on the subject:

- The page has almost 3,000 words

- There is a list of content including jump links to different sections of the page, helping users find what they want and search engines see what the page includes

- It’s easy to start a quote, with a CTA button at the top of the page so those looking just for a price can get started immediately

- The page is broken down into logical subsections, with subheadings and further information on popular searches on the subject such as:

- What is life insurance?

- The benefits of life insurance

- How does life insurance work?

- Why get life insurance?

- Choosing your cover

- What Aviva’s life insurance covers

- How do I get a quote?

- Why choose Aviva

- And articles on related subjects that could be of interest, such as whether to buy a single or joint policy

- Links to further reading scattered throughout, including a glossary, life insurance calculator and related products like over 50s life insurance

- And an FAQ with common questions about life insurance such as how long a payout takes and how to cancel (as well as a link to a full FAQ page)

It’s a story that is repeated across the section.

The /insurance/ directory is home to 161 pages that rank for at least one keyword. There are pages for car insurance travel insurance, landlord insurance, critical illness cover and all of Aviva’s insurance and products and related offerings.

Together, these pages rank for 56k keywords in the UK, driving an estimated 691,584 organic visits a month. We can see this reflected in the Visibility Index for the directory which has consistently grown, including some big jumps at around the time of major Google updates.

Even better, that traffic is for a lot of very commercial keywords that – as you’d expect – people are willing to bid a lot of money in Google Ads for.

That estimated traffic is worth £8.87m a month. It’s possibly the highest-value directory we’ve looked at in SectorWatch.

One of the ways it does so well is through its ranking distribution. The directory ranks on page one for over 40% of the high-value keywords it appears for. These consistently high rankings drive more of that high-value organic traffic.

High-performance ‘know’ content

It’s not only ‘do‘ content where Aviva is succeeding.

They are also our number two ranked domain for our ‘know‘ keyword set, showing that they have created plenty of informational content as well.

Seven of the top hundred URLs for our keywords are in the same /insurance/ directory that does so well for commercial keywords. This includes their life insurance calculator and articles on the difference between life insurance and assurance, how life insurance works and what happens after someone dies.

The key takeaway here is that Aviva has done a great job of creating a blend of content types to reach potential customers whether they are looking to buy right now or are still researching.

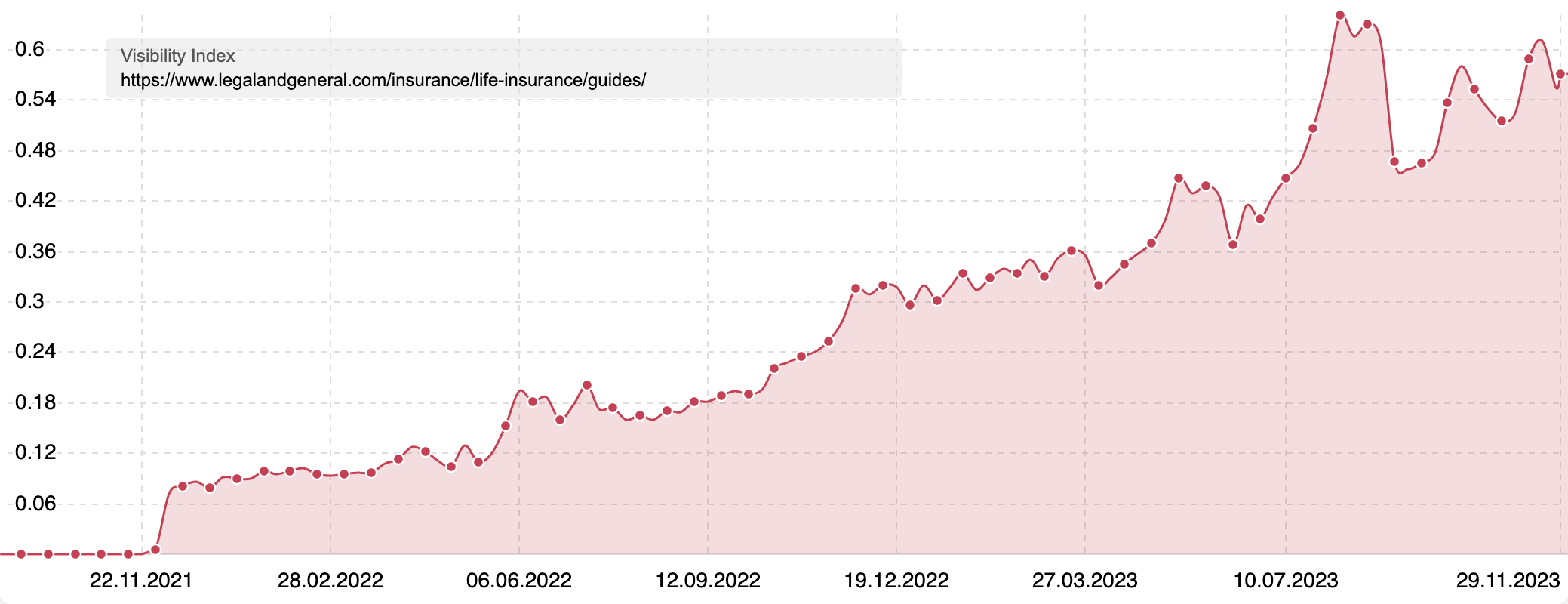

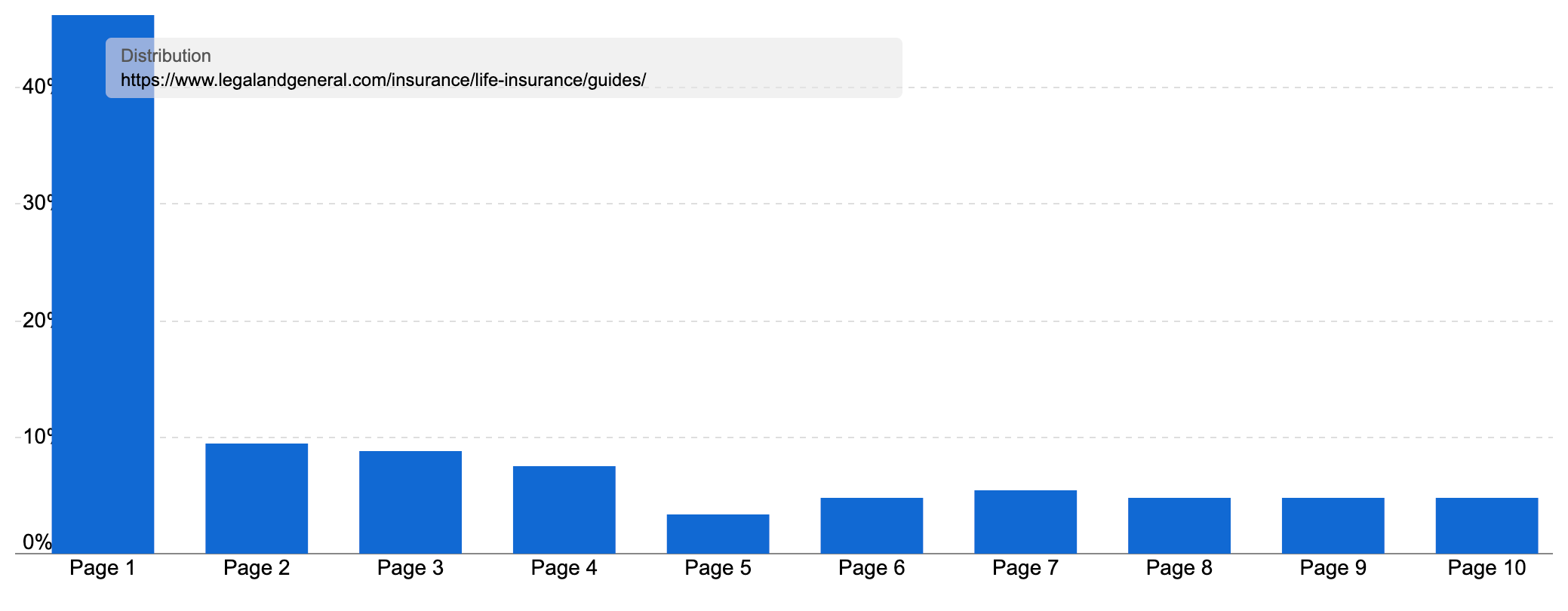

Our top domain for ‘know‘ content is another provider, Legal and General.

Their domain ranks for 416 of the 423 keywords in our sample set, with 340, or 80% of those rankings, on page one. They certainly have high-performing content for our keywords. But how does this content stack up overall?

They have a similar /insurance/life-insurance/ directory powering both their commercial and informational content. There’s a similar mix of product pages, guidance and a life insurance calculator.

What Legal and General does have though is distinct subdirectories for their different informational content, and we can see these are high-performing content.

Take their guides section. This houses a good range of guides on common insurance questions, from insurance for young adults to how much critical illness coverage you need and how to cancel a life insurance policy. There are 46 guides ranking for at least one keyword in the UK at the time of writing.

This section has gained a good amount of traction since its introduction two years ago. It now ranks for 3.2k keywords in the UK, and on page one for 42.6% of them.

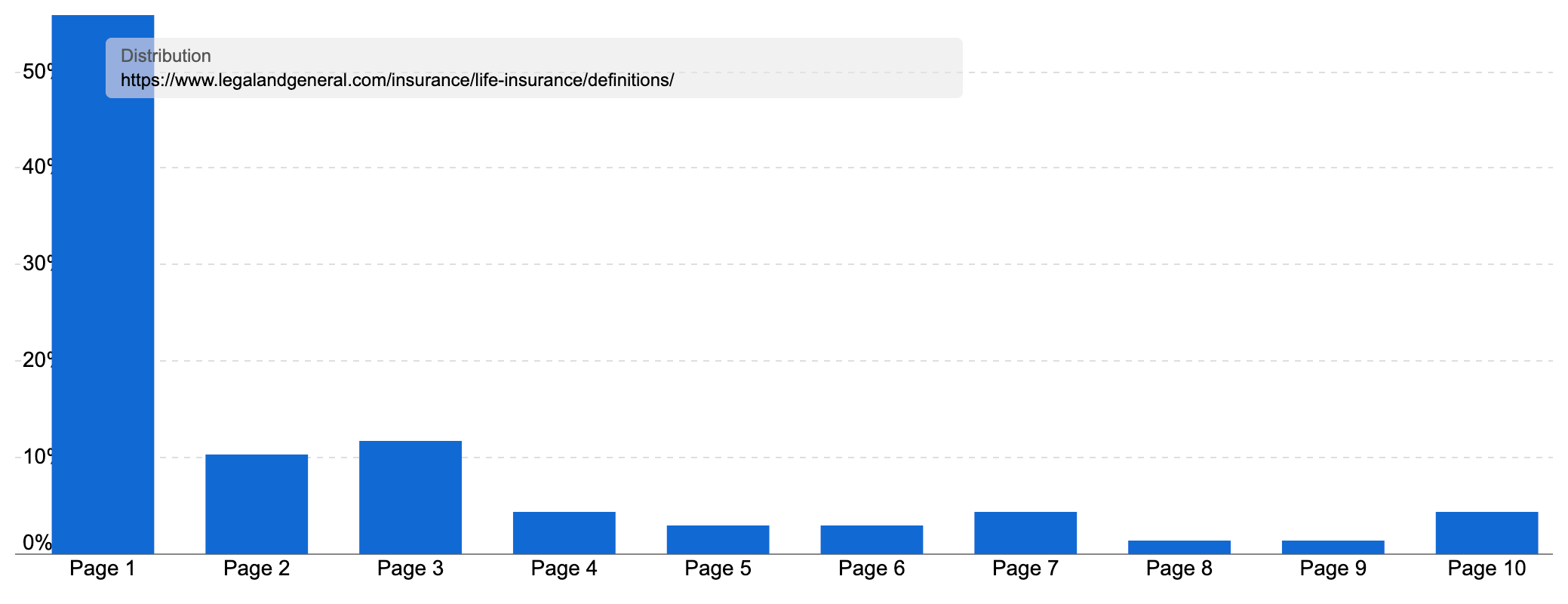

Another part of their insurance content is on definitions. This includes content on the types of life insurance you can get and even what life insurance means amongst ten guides ranking for at least one keyword in the UK.

This directory ranks for over 1k keywords in the UK, with 55.8% of the rankings for the most important keywords ranking on page one.

Why does Google like this content so much?

Some of the pages don’t have the most comprehensive detail, but many do offer a great user experience. We can take their guide to the types of life insurance as an example.

It has:

- Over 2,000 words of content, offering good depth

- Sections on each type of life insurance so readers can compare the options

- A table for each type with the pros and cons helps the reader assimilate how the different options might suit them

- Links to further reading, such as the guide to how critical illness cover works and how much you might need

- Advice on the question of single vs joint life insurance

- An excellent summary table under the subheading Who can benefit from different types of life insurance? which spells out who each type of cover is aimed at – this is possibly the most helpful part and you might consider having such at the top as the key information, with further depth on each type below

- A final section on ‘What life insurance should I get?’, which while they can’t answer (as circumstances dictate the right option), does mean they address the obvious next thought for the reader of ‘what do I do now?’ and trying to direct them to speak to an advisor (though they could do with a button or CTA on the easiest way to do this!)

- Related articles at the bottom for further reading

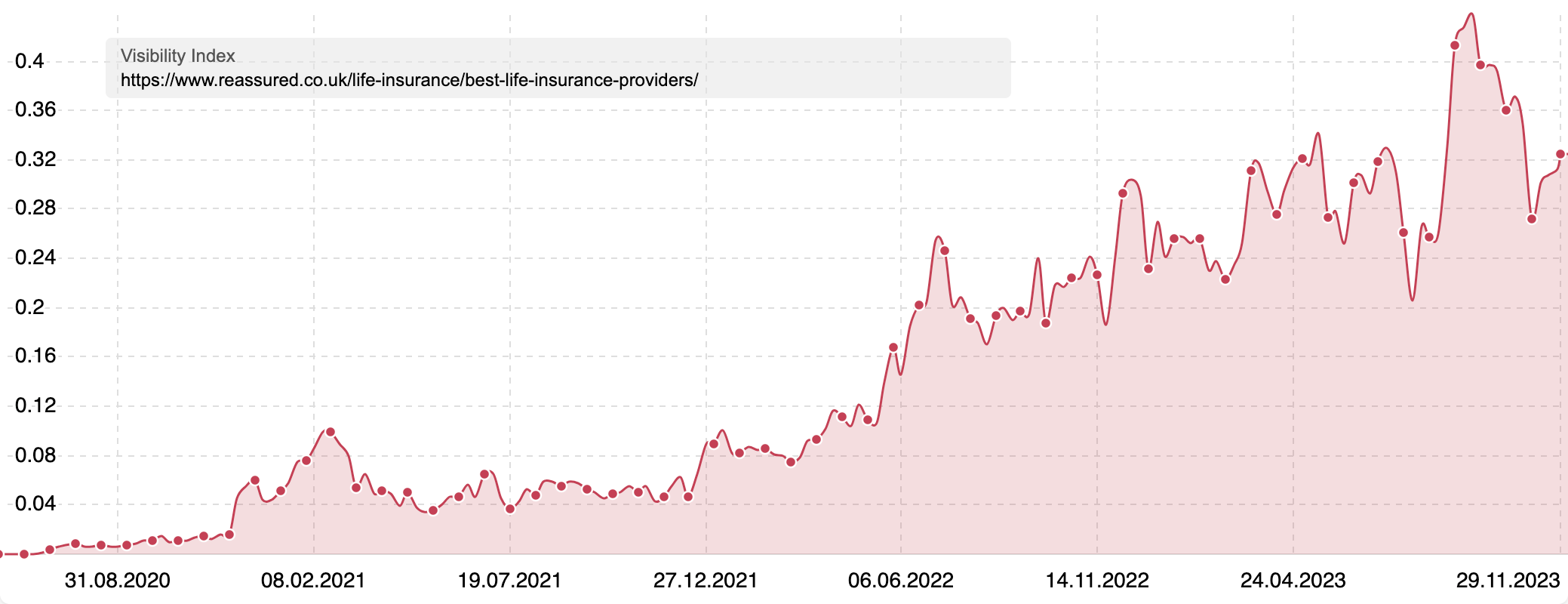

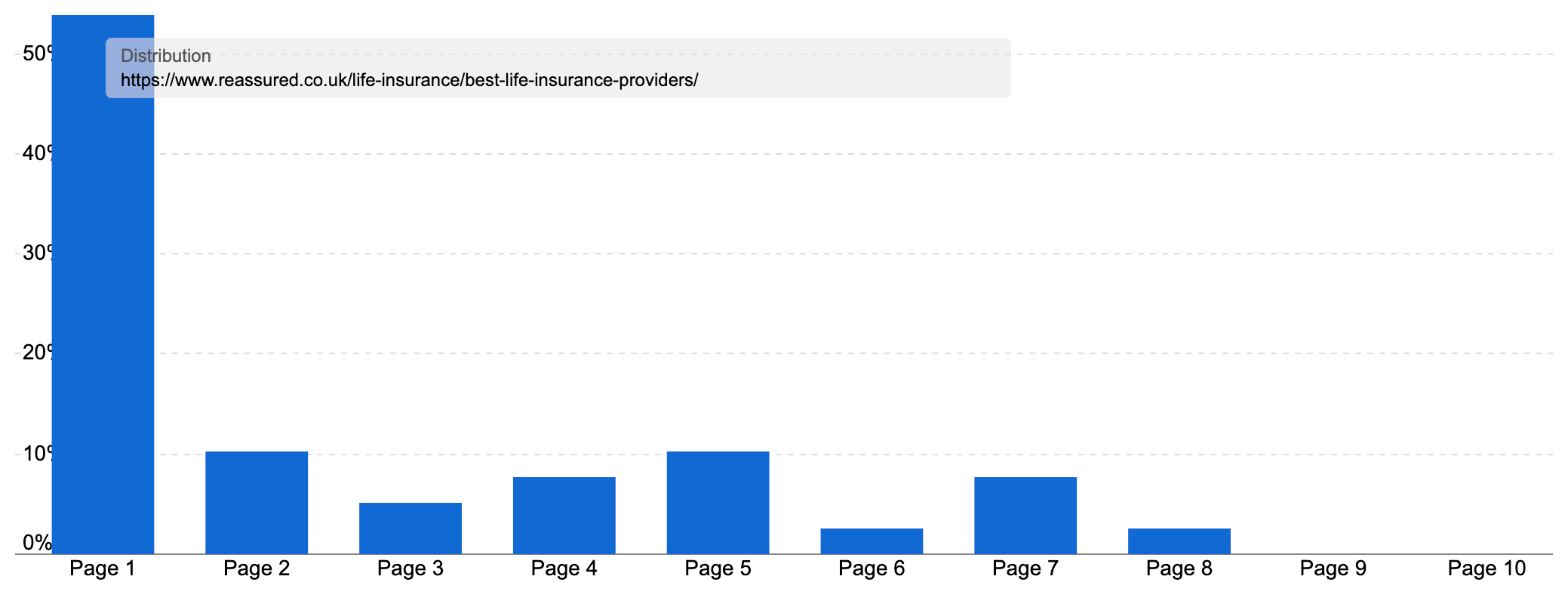

We noted earlier how a smaller site like Reassured is able to compete with the major brands in the sector.

This broker has a dedicated /life-insurance/ directory, with 155 pages ranking for 11.4k keywords in the UK. Of those rankings, they are on page one for over 20% of the most important keywords. Together, these pages bring in an estimated 31k organic visits a month from Google, with a value of £478k.

Their guide to the best life insurance providers is the third most visible page for our ‘know’ keyword set, ranking on page one for 59 of them. Overall, it ranks for 484 keywords, with over 50% of those page-one rankings.

This includes ranking at the top spot for keywords like best life insurance (2,550 searches a month on average) and best life insurance companies (2,200).

This is a great example of a smaller brand competing with bigger players through targeted, high-quality content in a niche they’ve dedicated to becoming seen as an expert within.

The guide breaks down the best providers for a variety of different life insurance types and scenarios, includes a calculator to show how much coverage you might need and links to a plethora of related articles with more in-depth help.

It also has sections answering popular questions such as “How do I choose the best life insurance plan?” and “Which is the best life insurance?“. The main “Best type of life insurance” section includes breakdowns of the different options.

Notably, Reassured does have reviews of many insurance providers, and they link to them when mentioned. This adds depth to the experience and also shows Reassured knows a lot about these insurers (there is a lot of information in each ‘review’).

Interestingly, they’ve also cited the various sources they’ve used – sites that have attempted to quantify who the best insurer is. So rather than answering the question themselves, Reassured has curated advice based on the research of others, gathering insight from many sources in one place.

Whether that’s what the reader wants, we can’t say, but Google certainly seems to think so.

Summary

- This sector shows that for financial products, a robust site structure based on creating clusters of related content, both commercial and informational, works extremely well. It creates sections of high-performance content

- No need to segregate your guides from your products into different sides of the site

- One section of a site can do well for both types of intent we’re looking at here, and a mix of commercial and informational content can power a potent section of your site dedicated to covering the entire buying cycle

- As we often see, even amongst some huge brands, smaller players can do well if they can build relevancy and E-E-A-T signals

- But the top of the pile is still reserved for the biggest providers and comparison sites. No doubt brand signals and external backlinks play a big part in this

- In this sector, guides can do well even when they don’t have some classic E-E-A-T signals such as authors and bios. Being a renowned site on insurance means it has enough expertise on its own

- But the biggest takeaway is that to succeed in this sector, you need to offer both aspects. You must have content that guides users but also allows customers to easily get a quote, whether directly or through partnership/affiliate relationships

Our process:

For this SectorWatch, we used relevant keywords from a selection of keyword discovery tables.

We chose a selection of highly targeted keywords with a ‘do‘ or ‘know‘ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

Curated keyword set and sector click potential

Core keywords: life insurance, life insurance quote, life insurance comparison, compare life insurance, life insurance cover, best life insurance, what is life insurance, life insurance calculator, types of life insurance.

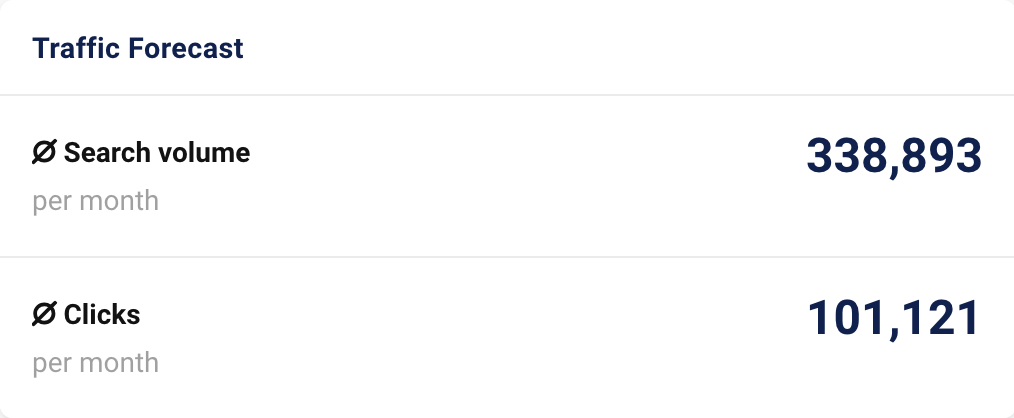

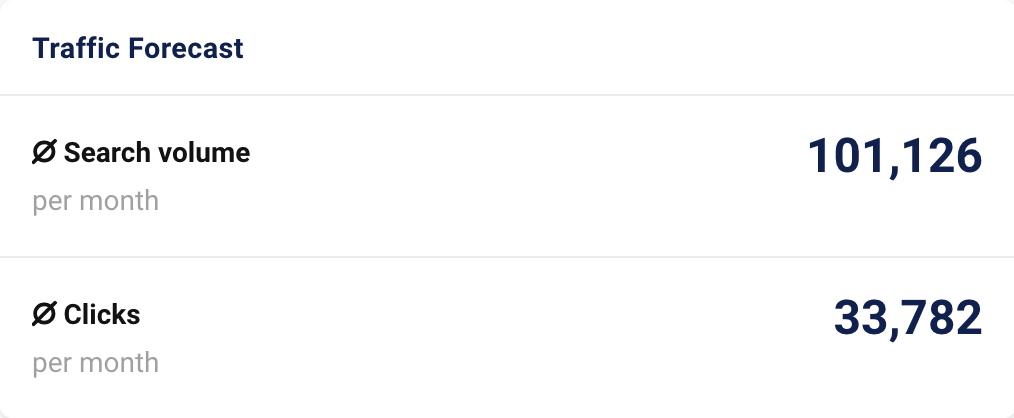

The full keyword set and leading domain data is available as a Google Sheet and further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and the traffic forecast shown below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here.

Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through Twitter and Facebook.