This month SectorWatch is getting set to party as we explore the spook-tacular Halloween search market. From frightful costumes to ghostly decor, we’re hunting the brands casting a spell on the rankings and enchanting searchers.

Whose search traffic is a treat? And whose content is scream-worthy? Grab your outfit, search for Thriller on Spotify, and let’s shine a flashlight on who is ghosting the competition.

- The top domains in the UK for Halloween

- Top 20 domains for shopping (‘do’) searches for Halloween:

- Top 20 domains for informational (‘know’) searches for Halloween:

- What’s trending in the Halloween search market?

- The top URLs for Halloween

- Content examples: What type of content is performing?

- High-performance content examples

- High-performance 'know' content

- Summary

- Keyword research in the Halloween sector

- Our SectorWatch process

- Curated keyword set and sector click potential

Halloween has turned from a traditional festival – and a US-centric celebration – to big business in the UK.

A quarter of those in the UK claim Halloween is their favourite holiday. And as we approach the end of the month, costumes, decorations, sweets, treats, party supplies and of course pumpkins are on many people’s agenda, with 58% of Brits planning to make a Halloween purchase this year.

That adds up to a monstrous expected spend of £776 million in 2024 – that’s big business and online retailers and publications are happy to fulfil this demand for ghoulish fare.

With countless online retailers, publishers and creators looking to cast spells on both search engines and consumers, this seasonal holiday is a competitive and increasingly popular search market.

The top domains in the UK for Halloween

So, who’s enchanting the search results and bewitching the competition? We’ve compiled research on a sample of ‘do’ (action/transactional) searches and ‘know’ (informational) searches in the Halloween market:

‘Do’ searches:

- amazon.co.uk

- halloweencostumes.co.uk

- smiffys.com

‘Know’ searches:

- pinterest.com

- goodhousekeeping.com

- amazon.co.uk

Top 20 domains for shopping (‘do’) searches for Halloween:

| Domain | Project Visibility Index |

|---|---|

| amazon.co.uk | 1180.8 |

| halloweencostumes.co.uk | 598.47 |

| smiffys.com | 505.48 |

| etsy.com | 441.75 |

| pinterest.com | 418.01 |

| partydelights.co.uk | 268.89 |

| ebay.co.uk | 268.69 |

| goodhousekeeping.com | 240.31 |

| fancydress.com | 168.19 |

| joke.co.uk | 163.89 |

| simplyfancydress.co.uk | 121.35 |

| cosmopolitan.com | 105.55 |

| escapade.co.uk | 94.28 |

| therange.co.uk | 93.37 |

| asda.com | 85.27 |

| megafancydress.co.uk | 83.03 |

| reddit.com | 80.77 |

| morphsuits.co.uk | 77.05 |

| lights4fun.co.uk | 73.54 |

| hitched.co.uk | 71,53 |

Top 20 domains for informational (‘know’) searches for Halloween:

| Domain | Project Visibility Index |

|---|---|

| pinterest.com | 733.94 |

| goodhousekeeping.com | 560.53 |

| amazon.co.uk | 306.67 |

| countryliving.com | 200.63 |

| cosmopolitan.com | 189.28 |

| thepioneerwoman.com | 173.61 |

| halloweencostumes.co.uk | 150.65 |

| bbcgoodfood.com | 141 |

| gathered.how | 135.27 |

| smiffys.com | 135.1 |

| youtube.com | 115.43 |

| etsy.com | 100.26 |

| buzzfeed.com | 99.15 |

| reddit.com | 98.6 |

| tiktok.com | 86.73 |

| womansday.com | 84.91 |

| instructables.com | 84.7 |

| housebeautiful.com | 83.67 |

| wikipedia.org | 78.41 |

| bestproducts.com | 72.54 |

What’s trending in the Halloween search market?

Within our keyword list – and our TrendWatch data – we can spot trending Halloween searches. Of course, as a major seasonal event, there is a yearly spike in demand each autumn, but we can spot those where the year-on-year demand is increasing. These often highlight cultural references that are currently popular.

- barbie halloween costume

- wednesday addams costume

- inflatables halloween decorations

- halloween costumes for 2

- girl group halloween costumes

- taylor swift halloween costume

- funny adult halloween costumes

- halloween party music for kids

- toddler girl halloween costumes diy

If you’d like insight into even more search trends, and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for Halloween

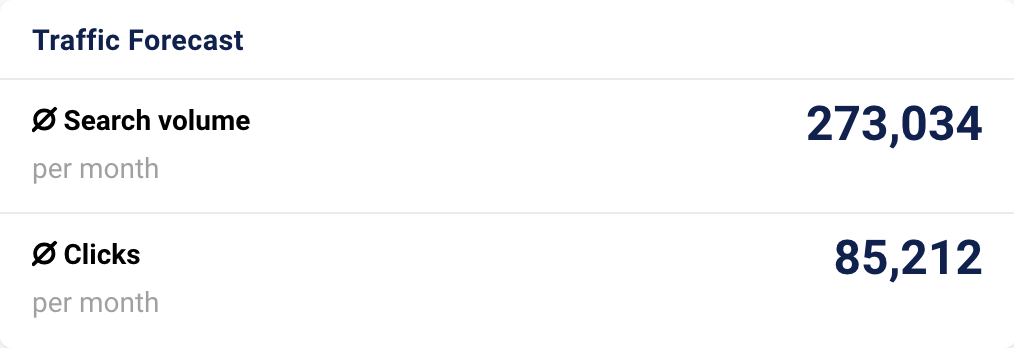

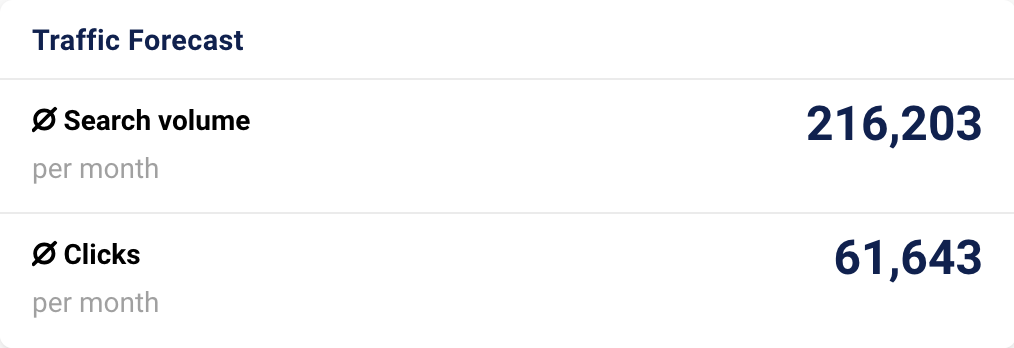

To find our winning domains, we created two keyword lists in Sistrix. We curated one list of 568 keywords for ‘do’ (commercial) searches and another for 704 ‘know’ (informational) searches.

One of the advantages of building a keyword list is the extra data insights the toolbox gives, as well as information on each keyword. These insights include the best-performing competitors (which you have just seen), traffic forecasts (which we share at the end of this article) and the best-performing individual pages. Here are the ten most successful pages for each of our keyword sets, so you can see some of the best-performing content in the Halloween sector.

| URL | Top Keyword |

|---|---|

| https://www.hitched.co.uk/wedding-planning/fun/couples-halloween-costumes/ | halloween costumes |

| https://www.prettylittlething.com/shop-by/halloween.html | halloween costumes |

| https://tuclothing.sainsburys.co.uk/events/halloween | halloween costume |

| www.halloweencostumes.co.uk | halloween costumes |

| https://www.smiffys.com/collections/couples-halloween-costumes | couples halloween costumes |

| https://www.smiffys.com/collections/scary-costumes | scary halloween costumes |

| https://www.goodhousekeeping.com/uk/halloween/g62563957/halloween-costumes-for-couples/ | couples halloween costumes |

| https://www.smiffys.com/collections/womens-halloween-costumes | womens halloween costumes |

| https://www.boohoo.com/womens/halloween | halloween costumes |

| https://www.smiffys.com/pages/halloween-costumes | halloween costumes |

| URL | Top Keyword |

|---|---|

| https://www.goodhousekeeping.com/uk/halloween/g62680440/easy-last-minute-halloween-costumes-diy/ | a halloween costume ideas |

| https://www.buzzfeed.com/laurafrustaci/easy-last-minute-halloween-costumes | a halloween costume ideas |

| https://en.wikipedia.org/wiki/Halloween | halloween |

| https://www.thepioneerwoman.com/holidays-celebrations/g33862207/last-minute-halloween-costume-ideas/ | a halloween costume ideas |

| https://www.instructables.com/Ultimate-Halloween-Decorations/ | halloween decorating ideas |

| https://www.bestproducts.com/lifestyle/news/g1715/easy-diy-last-minute-costumes-for-halloween/ | funny halloween costumes |

| https://www.britannica.com/topic/Halloween | when is halloween |

| https://www.awarenessdays.com/awareness-days-calendar/halloween-2024/ | halloween |

| https://www.goodhousekeeping.com/uk/halloween/g62563957/halloween-costumes-for-couples/ | couples halloween costumes |

| https://www.gq-magazine.co.uk/gallery/best-last-minute-easy-halloween-costumes-for-men | a halloween costume ideas |

Content examples: What type of content is performing?

From our list of winning domains, we start learning more about the types of sites Google is showing for each of both commercial and informational Halloween searches:

- For transactional searches, we find specialised Halloween or fancy dress retailers mixing it up with major ecommerce sites like Amazon and Etsy

- Niche retailers such as Smiffys and HalloweenCostumes.co.uk are in our top three domains, along with Party Delights, Fancydress.com and Jokers’ Masquerade in the top ten

- These sites have a sturgeon visibility for our keywords by focussing specifically on Halloween-related products. This perhaps signals that with effective ecommerce optimisation and enough brand power, smaller speciality stores can compete effectively against the biggest online names

- We can’t, however, ignore the fact that Amazon dominates our ‘do’ keywords. The world’s biggest retailer ranks for 95% of our keywords, and on page one for a huge 88% of them!

- With Etsy and eBay also in the top ten, it’s clear that for clearly commercial searches of a mass-market nature, well-established platforms with extensive listings dominate the traditional keyword space

- Interestingly, Pinterest appears at number five, despite not offering the same clear shopping focus as the rest of our top-performing domains. This likely highlights the platform’s role in shopping inspiration, suggesting Google thinks many of those making our ‘do’ keyword searches are still browsing for ideas and not always immediately purchasing

- Pinterest offers an extra way for brands to rank for those earlier in the shopping process with creative content or product suggestions

- Speaking of Pinterest, it leads the way for our informational ‘know’ keywords, ranking for 90.5%, and on page one for 75% of them

- Google likes Pinterest when it comes to visual shopping categories such as costumes or decorations when people are searching for ideas (such keyword variants are common in our keyword set)

- Google knows we like visual platforms for inspirational content when it comes to shopping, home decor and fashion, and Pinterest is one of the main beneficiaries

- Content-heavy publications such as Cosmopolitan, Good Housekeeping, and Country Living perform well in this sector, indicating that Google trusts these sites for seasonal content, tutorials, and trend-driven articles

- These sites benefit from well-established brands and likely strong trust signals for how-to and idea articles inspiring readers

- They also use a variety of article formats, with galleries, DIY guides and ‘best of’ lists

- Despite its commercial nature, Amazon does well for our ‘know’ keywords, as any query about costumes has potential commercial intent, and Google clearly thinks Amazon (as well as its own product listings) is the right way to target any searchers looking to buy now

High-performance content examples

Having seen the sites that are ghosting the competition, it’s time to answer the question ‘How do these sites get these monstrous metrics?’.

We are looking for any high-performing content formats. These are pages, templates or sections that rank on page one for a high percentage of their keywords. This makes them content formats that Google consistently wants to show for their target Halloween terms. We can assume that if the site adds new pages using this format, it could well rank competitively with them

We can use these examples to hypothesise what Google wants to reward and then help make our content scream-worthy by applying those same principles.

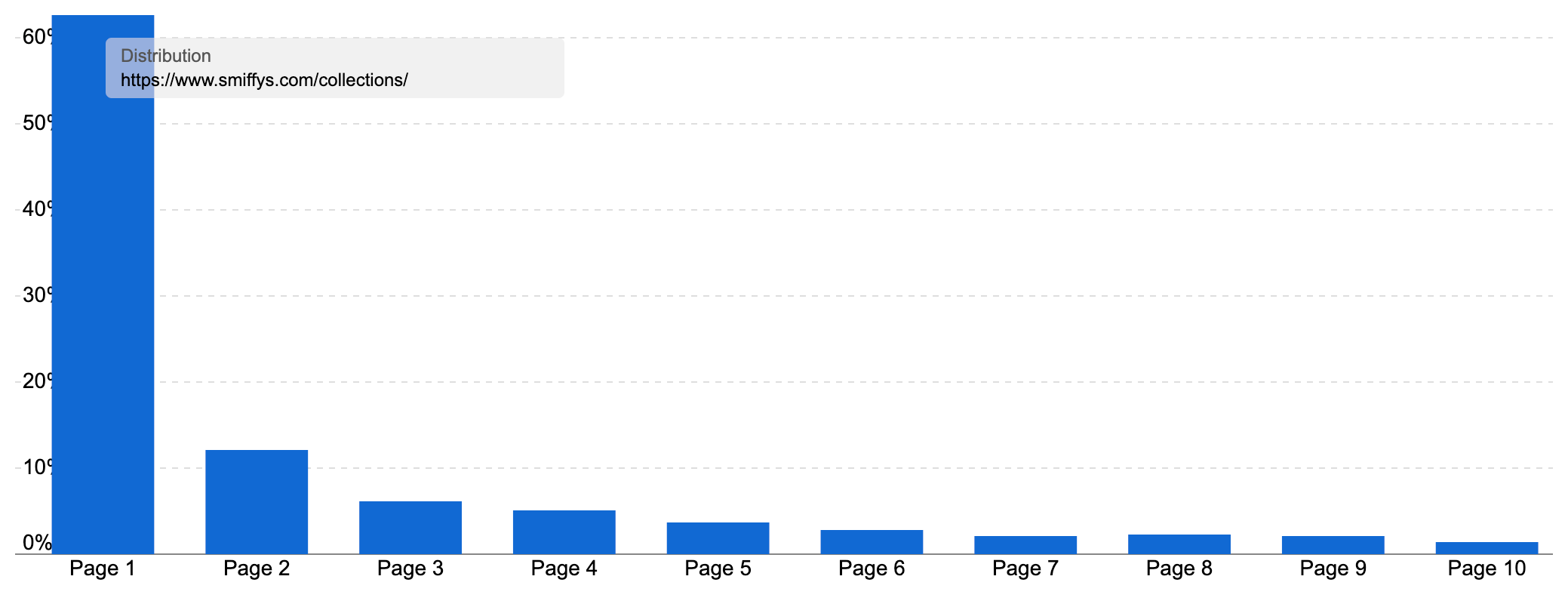

In third place in our domains list for ‘do’ keywords is Smiffys, a wholesale, fancy dress manufacturer established as a wigmaker in 1894 (as RH Smith & Sons) and based in Gainsborough, Lincolnshire.

Smiffys ranks for 358 of our commercial keywords (62.9%), and on page one for 223 (39.2%).

Their site is built using Shopify, so it uses the standard Shopify convention of having all its product listing pages (PLPs or category pages) in the /collections/ directory. Most of their top pages for our ‘do’ keywords are in this directory – Smiffys has 11 pages in our top 100 URLs for ‘do’ keywords, with 9 being PLPs.

Overall, Smiffys’ PLPs are doing a great job for them. They rank for almost 40k keywords in the UK across 893 different URLs. Of those rankings, a remarkable 62.59% are on page one for the most important keywords.

Together, these rankings mean the directory gets an average of 250k organic visitors each month, worth an estimated £74k in organic traffic value. The directory has grown its organic presence consistently, with some big increases around the time of major Google updates.

As you’d expect, the site has a big focus on Halloween, especially at this time of the year. Smiffys put their Halloween section at the forefront of their navigation in the build-up to the big day, including links to over 60 sub-categories from different themes, characters and accessories as well as target audiences.

This Halloween section is an extra option in the navigation, a space Smiffys regularly uses to highlight seasonal products.

For our keyword set, Smiffy’s PLPs on scary costumes, women’s Halloween costumes and kids’ Halloween costumes all rank well, as do more general fancy dress subcategories such as 80’s fancy dress or funny costumes.

A quick look at their PLPs shows they are well optimised, featuring:

- Clear, optimised title tags and main headings (H1 tags)

- Good internal links from the main navigation to major categories

- Sub menus on PLPs to child subcategories or even sub-sub-categories. For example, the page on 80’s fancy dress has a submenu linking to further options such as 80s music costumes and related categories such as Top Gun costumes. The scary costumes PLP links to 17 related options, all based on scary costume types from aliens to zombies

- Most PLPs have a good section of intro copy adding context and contextual internal links to other PLPs

- Clear preview images and a price for each product listing

- There are filters to refine your choices (standard ecommerce fare, but important)

- And often Smiffys has a wide range of options, such as 210 80s fancy dress costumes to choose from

- Many products also feature lots of reviews, often including pictures – because, of course, customers are happy to show off photos of their outfits! – which no doubt gives customers more confidence when shopping

It’s not perfect.

The meta descriptions just take the first 300-odd characters of the intro copy, meaning they are too long to appear whole in the search results and often just cut out mid-sentence, for example. But, you can see this is a specialist site putting in a good effort to create a good shopping experience following ecommerce best practices and axioms.

Much of the site’s success is due to its range of PLP options. With so many costumes to choose from, Smiffys can create PLPs for any subcategory or theme they, or their SEO team, can think of. This range of dedicated pages to exactly what customers are searching for helps them offer a super-relevant shopping experience.

And as a manufacturer, they are used to creating new costumes as fresh cultural trends emerge. This means they can move fast to create new PLPs as they see or predict a rise in demand. This agile nature is no doubt a big help in gaining first mover advantage in these cases.

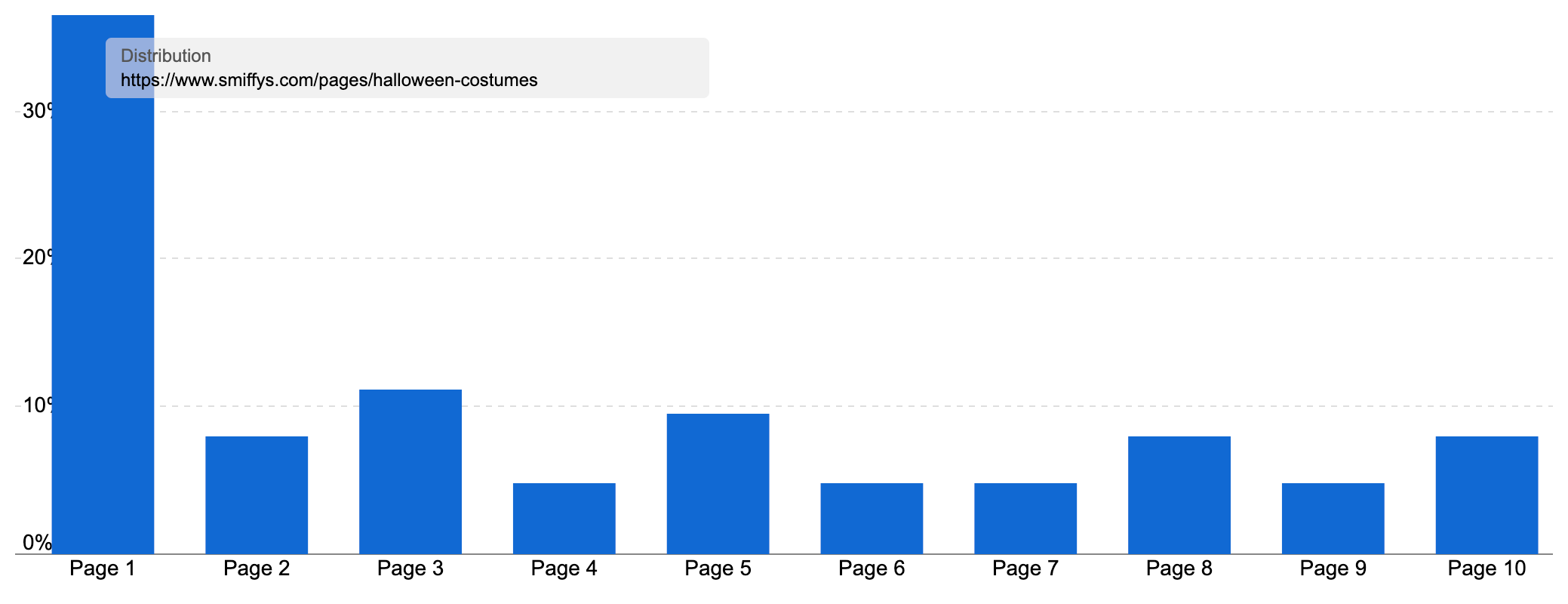

We should also note the success of their Halloween costumes page.

Set in the /pages/ directory, this is more of a department page, or a category-listing page (CLP). It has a large, colourful display of different themed costume options, each linking to the relevant PLP.

As well as the popular costume ‘types’, there are also links for official licensed costumes such as from Disney or Ghostbusters. Finally, there are product options with a gallery of ‘new in’ products.

This isn’t a traditional PLP, but it forms a great way to start shopping for those looking for inspiration. The page ranks for 23 of our ‘do’ keywords with an estimated 29.5k organic visits a month on average and is the 10th most visible page for our keyword set. Overall, the page ranks for 596 keywords in the UK, including on page one 36.5% of the time.

What’s also interesting is that as a piece of inspiration, it also ranks for a selection of our ‘know’ keywords.

High-performance ‘know‘ content

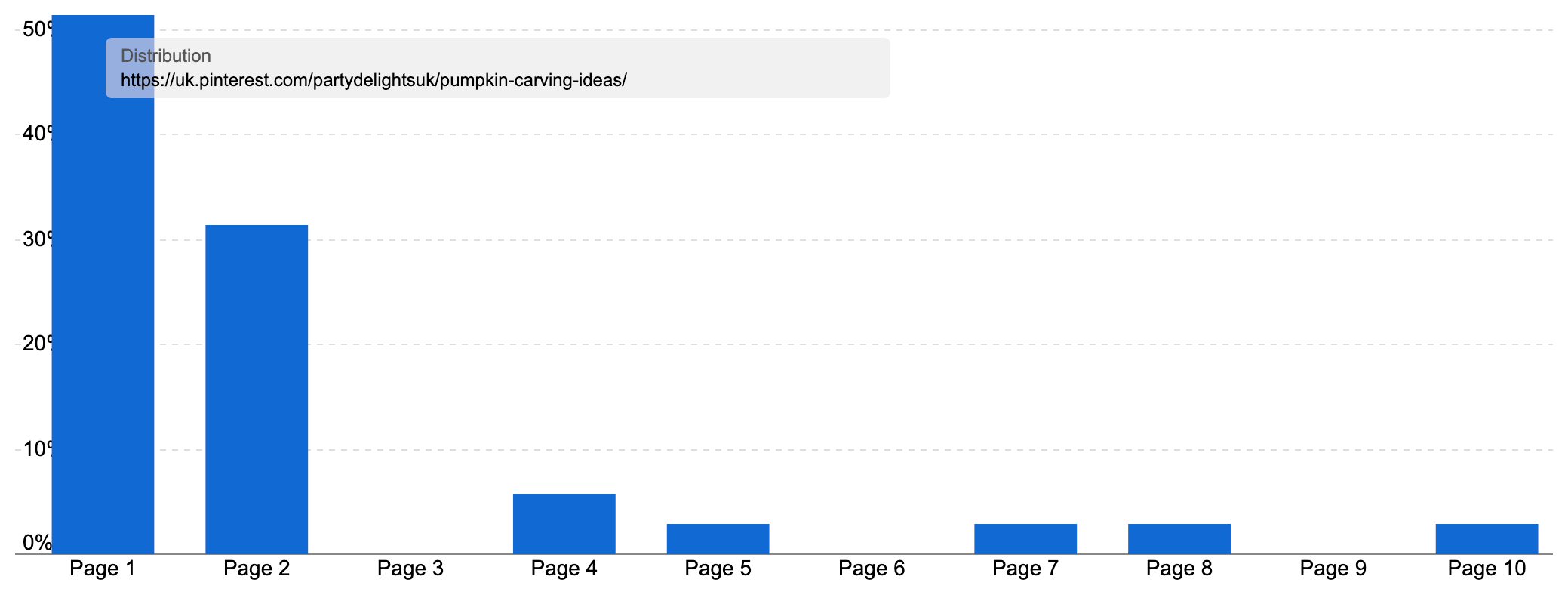

Moving over to our ‘know’ content, the clear winner is Pinterest.

The social media platform for sharing and discovering pinboards is the 33rd most visible site in the UK at the time of writing, ranking for 15.49m keywords and pulling in an estimated 18.2m organic visits each month.

Pinterest ranks for 638 of our 704 informational keywords (90.5%), and on page one for 75% of them. Of course, there is no single directory ranking well, as Pinterest’s pages are sorted by user. However, the spread of pinboards is the site’s strength, and we see that here with 18 different listings in the top 200 most visible pages for our sample keyword set.

Our most popular page is from Party Delights, a UK retailer who we saw ranking 7th for our commercial keywords.

This page is an excellent example of both how brands can use platforms like Pinterest to reach their audience and also how curating inspirational content can prove an effective means of getting brand attention.

The single page with 161 ‘pins’ ranks for 587 keywords in the UK, and remarkably on page one 51.43% of the time. When Google thinks it’s a useful resource on a subject like carving pumpkins, they’re happy to show it for all relevant queries.

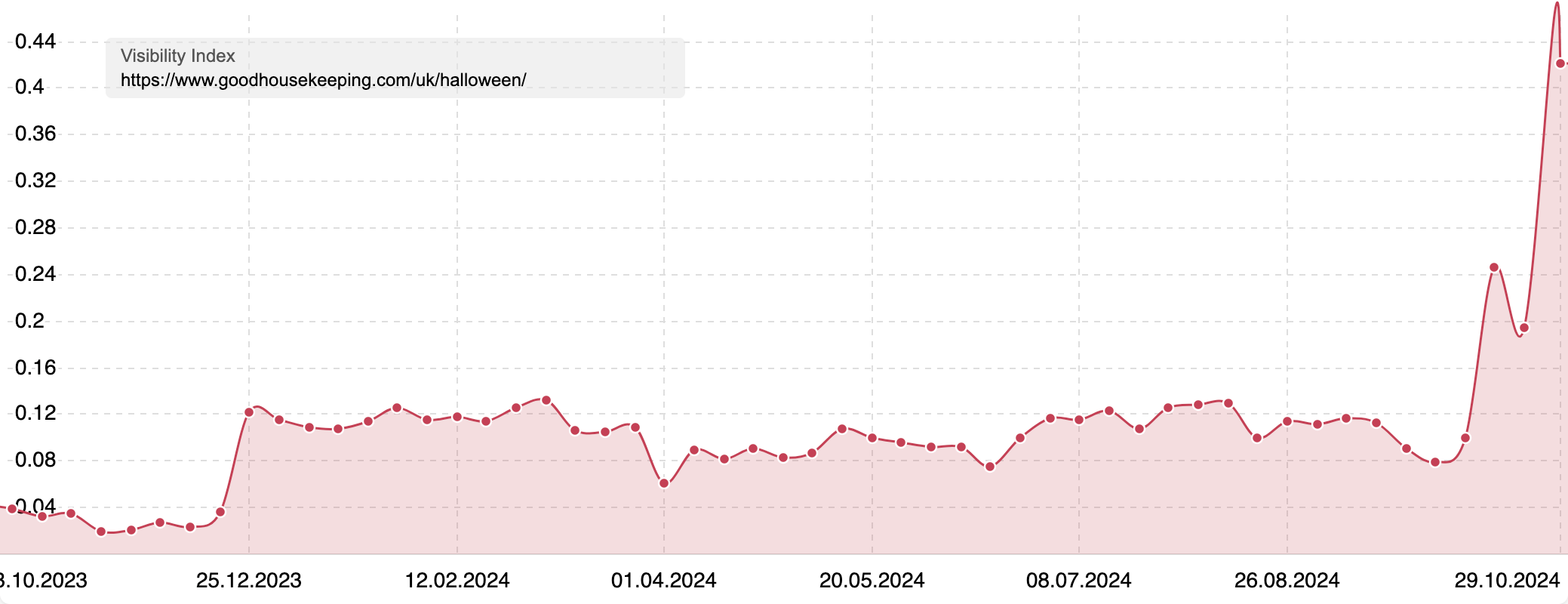

In second place for our ‘know’ content is Good Housekeeping, the US lifestyle brand and magazine owned by the major publishing house Hearst.

Good Housekeeping ranks for 623 (88.4%) of our informational keywords, with 340 rankings (48.2%) on page one.

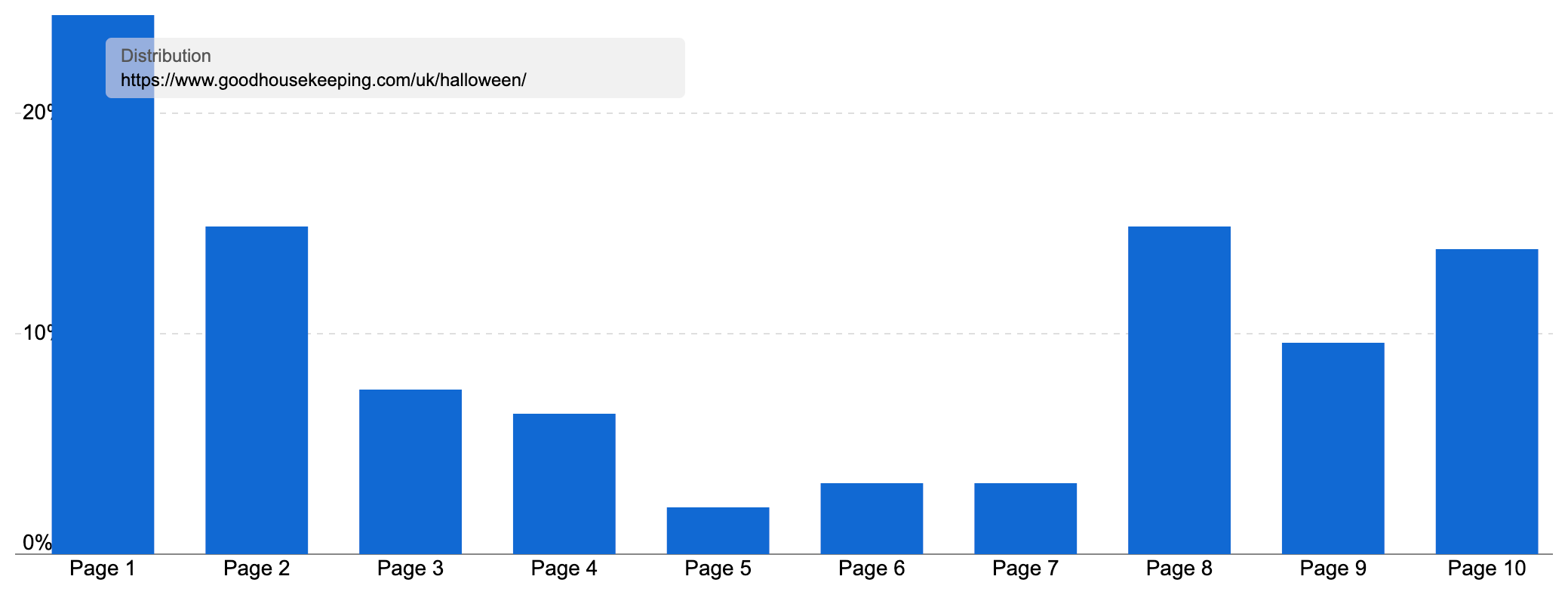

The /uk/halloween section ranks for 4k keywords in the UK, pulling in an estimated 10.6k visits on average each month, with no doubt a huge spike each October. Google definitely appears to show it more often at this time of year as well, which we can see when we look at the Visibility Index graph for the section.

24.47% of its rankings in the UK are on page one, firmly marking it as high-performing content.

We also see a lot of their US-based content from the /holidays/halloween-ideas/ directory ranking for our keywords set. 16 different pages from this section rank in our top 200 URLs for the informational keyword set.

However, the top three most visible pages are from the UK section of the site, perhaps indicative of Google wanting to show culturally relevant content from local writers where possible. Those three most successful pages are on ‘30 easy last-minute DIY Halloween costumes’, ‘Halloween costumes for couples’ and ‘pumpkin carving ideas’.

These all play to the strengths of Good Housekeeping and are very much on brand.

In the example of the 30 easy DIY costumes, we’re looking at a large listicle article that’s deceptively simple.

It is just a list of 30 ideas with several sentences written for each. However, there are original images/photography for each, occasional links to templates Good Housekeeping have created plus the expected links to many more articles for further inspiration.

Perhaps what is more shocking is that as well as Good Housekeeping, Hearst publications also rank 4th (Country Living) and 5th (Cosmopolitan), giving them 3 of the top 5 domains for our ‘know’ keyword set, plus House Beautiful at 18 and no doubt more – clearly Hearst’s SEO team know how to leverage a brand and a keyword strategy!

Summary

- In a mass-market sector like Halloween, ecommerce giants dominate transactional keywords, and Google is also keen to show Amazon (and product listing panels) for any query that they think has slightly commercial intent, even if the rest of the main rankings are informational content

- Amazon are haunting the ecommerce side of Halloween, demonstrating how major ecommerce platforms with vast inventories retain a strong grip over mass-market, purchase-focused searches

- However, specialisation can drive success. For both commercial and informational searches, specialists can compete with the biggest brands on the internet, if they can offer a strong content or shopping experience

- With strong, focused product ranges, especially in themed niches such as fancy dress or holiday-specific events, smaller sites can do well for highly relevant, intent-driven keywords

- Creating useful, segmented shopping pages based on how audiences want to search for or choose products is a tried and tested tactic – build relevant PLPs to target the mid-to-long-tail as Smiffys has done with its mass subcategories

- Brands that can capitalise quickly on new trends, especially with product lines or guides, do well

- Pinterest leverages its platform’s visual nature to capture searchers seeking ideas and inspiration. Perhaps SEOs can learn from this and make their inspirational content visually rich and curated for discovery, especially in seasonal sectors where inspiration-driven searches are common

- Google trusts established lifestyle brands to deliver useful ‘how’ or ‘ideas’ content, which can be tricky for smaller or newer sites to match. However, what we can take from this is how well-formatted articles like DIY guides, listicles, and trend-driven pieces resonate, and how we need to establish our ‘brand’ as a publisher

- The informational space is full of content from general lifestyle publications, but there is a lot of US-based content doing well, which suggests there might be room for more localised guides from UK sites that offer culturally specific guidance or inspiration

Keyword research in the Halloween sector

To understand who are the best-performing sites in the sector, we curated two sets of keywords to build a representative sample of popular Halloween searches by the UK public.

We always categorise the keyword lists in our research by their search intent. This means we compare the winning domains and content aimed at the same type of searches, the pages targeting the same customer intent and stage of the buying cycle. We’re not comparing one site’s pages aimed at helping those wanting ideas for Halloween party snacks with the success of another page selling fancy dress costumes.

As usual for SectorWatch, we have two lists. One for our ‘do’ keywords and another for our ‘know’ keywords.

‘Do’ keywords represent searches where someone is looking to buy, hire, download or convert in some way. For Halloween, that’s someone buying Halloween supplies, such as costumes, party decorations or treats. These are transactional or ‘shopping’ searches with a conversion intent. For many sites in the sector, these are among the most desirable to rank for.

Our ‘do’ keywords represent over 250k searches on average each month, with huge peaks each October.

We’ve included keywords like halloween costumes (78,100 searches a month on average in the UK, with 915k searches in October 2023)), halloween decorations (7,800 searches a month), and halloween sweets (1,450).

Our second set is our ‘know’ keywords, which represent informational searches. For Halloween, we see a lot of searches around costume ideas, pumpkin carving and asking Google when exactly it is Halloween.

Examples include Halloween (9,000 searches a month in the UK on average), couples halloween costumes (3,650 on average, with 165k in October 2023), funny halloween costumes (2,000), easy pumpkin carving designs (900 on average, and 8,100 searches in October 2023) and when is Halloween (4,650).

We have a detailed step-by-step article on keyword research with SISTRIX tools and data where you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of backpack and rucksack keyword discovery tables. We chose selections of highly targeted keywords with a ‘do‘ intent and a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

Curated keyword set and sector click potential

Core keywords: halloween, when is halloween, halloween costumes, halloween decorations, halloween ideas, halloween outfits.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and the traffic forecast you can see below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.