To kick off 2025, SectorWatch is putting on its best face to explore the cosmetics search market in the UK. We’re uncovering which brands are nailing their search strategy and looking for content with a flawless finish. Who’s contouring their way to top rankings? And who’s missing the foundation for success? Let’s unbox the beauty winners and see who needs a little concealer!

- The top domains in the UK for cosmetics

- Top 20 domains for shopping (‘do’) searches for cosmetics:

- Top 20 domains for informational (‘know’) searches for cosmetics:

- What’s trending in the cosmetics search market?

- The top URLs for Cosmetics

- Content examples: What type of content is performing?

- High-performance content examples

- High performance know content

- Summary

- Keyword research in the cosmetics sector

- Our SectorWatch process

- Curated keyword set and sector click potential

The UK beauty market is truly a glowing powerhouse. Sales in 2023 were a remarkable £27.2 billion – a dazzling 11% rise compared to the previous year.

This growth isn’t just skin-deep; the sector now employs over 418,000 individuals and the UK market is set to overtake France’s.

The online market for beauty products was estimated to reach $5.71bn in 2024 and it is clear that the allure of online cosmetics is more than just a passing trend.

There are many players in the market. Omnichannel retailers such as Boots do well competing against brands, online powerhouses and specialists such as Cult Beauty.

The market is subject to innovation, with 64% of Gen Zs agreeing that using beauty ‘dupes’ is a good way to save money. These dupes are often found on platforms like TikTok, adding a further subsector boosting sales. This pushes designer brands to develop creative solutions and compete against cheaper alternatives.

From the growing demand for natural and organic products to the undeniable influence of social media, the cosmetics sector is not just a luxury; it’s a movement. With so much at stake, whose content is stealing the spotlight and whose content needs a makeover?

The top domains in the UK for cosmetics

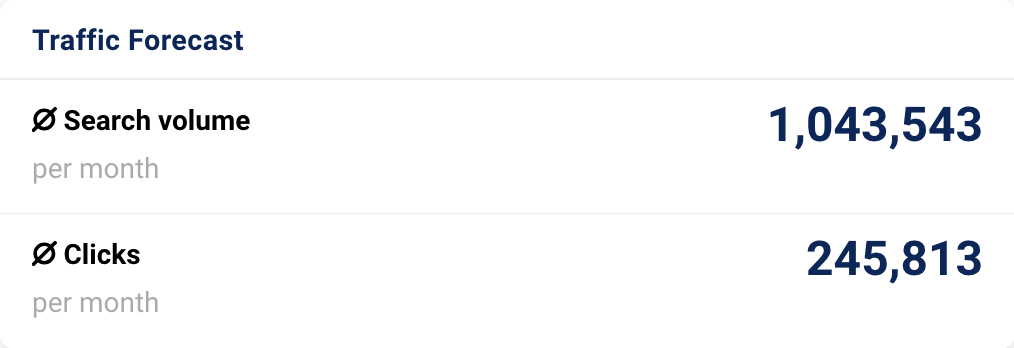

To research our winning domains, we created two keyword lists in SISTRIX. We curated one list of 1536 keywords for ‘do’ (commercial) searches and another for 1788 ‘know’ (informational) searches.

We chose non-branded keywords to remove navigational signals and unmask the winners when the UK searches for generic product queries. We likewise discounted any searches for specific retailers or product names.

So, who’s content is glowing up the rankings? Based on our sample of some of the most popular ‘do’ (action/transactional) searches and ‘know’ (informational) searches in the cosmetics market, here are the winning domains:

Do searches:

- amazon.co.uk

- boots.com

- superdrug.com

Know searches:

- reddit.com

- independent.co.uk

- byrdie.com

Top 20 domains for shopping (‘do’) searches for cosmetics:

| # | Domain | Project Visibility Index |

|---|---|---|

| 1 | amazon.co.uk | 953.21 |

| 2 | boots.com | 503.85 |

| 3 | superdrug.com | 466.01 |

| 4 | maccosmetics.co.uk | 258.35 |

| 5 | elfcosmetics.co.uk | 241.13 |

| 6 | charlottetilbury.com | 204.77 |

| 7 | independent.co.uk | 164.87 |

| 8 | reddit.com | 142.51 |

| 9 | lookfantastic.com | 107.74 |

| 10 | narscosmetics.co.uk | 103.63 |

| 11 | bobbibrown.co.uk | 102.59 |

| 12 | revolutionbeauty.com | 98.30 |

| 13 | ebay.co.uk | 95.52 |

| 14 | nyxcosmetics.co.uk | 92.20 |

| 15 | cosmopolitan.com | 88.46 |

| 16 | sephora.co.uk | 85.80 |

| 17 | beautyoutlet.co.uk | 84.30 |

| 18 | bareminerals.co.uk | 81.38 |

| 19 | barrym.com | 70.92 |

| 20 | byrdie.com | 69.85 |

Top 20 domains for informational (‘know’) searches for cosmetics:

| # | Domain | Project Visibility Index |

|---|---|---|

| 1 | reddit.com | 484.92 |

| 2 | independent.co.uk | 374.55 |

| 3 | byrdie.com | 293.46 |

| 4 | youtube.com | 290.06 |

| 5 | charlottetilbury.com | 282.91 |

| 6 | amazon.co.uk | 269.53 |

| 7 | cosmopolitan.com | 249.58 |

| 8 | glamourmagazine.co.uk | 199.48 |

| 9 | pinterest.com | 197.03 |

| 10 | lorealparisusa.com | 191.22 |

| 11 | boots.com | 165.70 |

| 12 | wikihow.com | 127.91 |

| 13 | allure.com | 121.36 |

| 14 | maccosmetics.co.uk | 112.70 |

| 15 | instyle.com | 106.53 |

| 16 | whowhatwear.com | 98.42 |

| 17 | goodhousekeeping.com | 95.96 |

| 18 | marieclaire.co.uk | 88.82 |

| 19 | maybelline.com | 86.69 |

| 20 | elfcosmetics.co.uk | 84.98 |

What’s trending in the cosmetics search market?

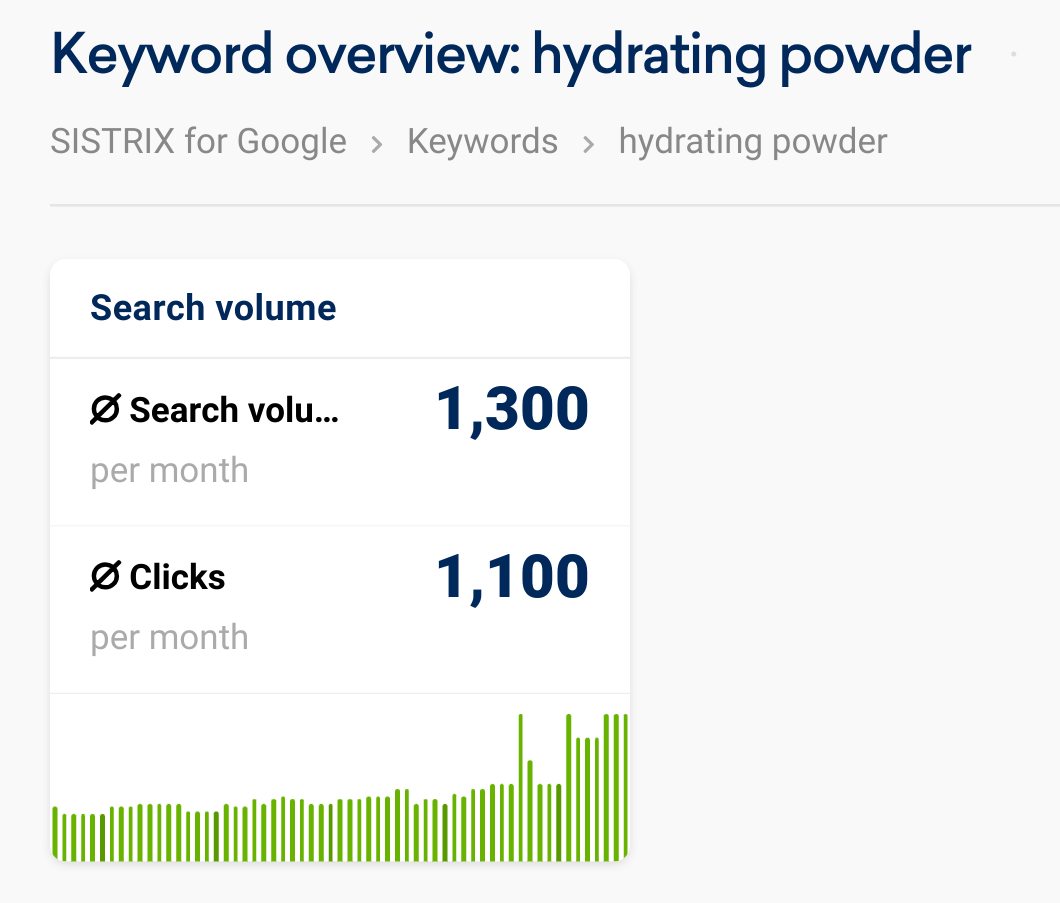

Using our keyword lists we can spot trending cosmetics and makeup searches. For trends, we are looking for topics growing in search popularity. Here are some cosmetic searches that are shaping the market in recent months:

- makeup

- concealer

- blush

- cluster lashes

- pressed powder

- powder and bronzer

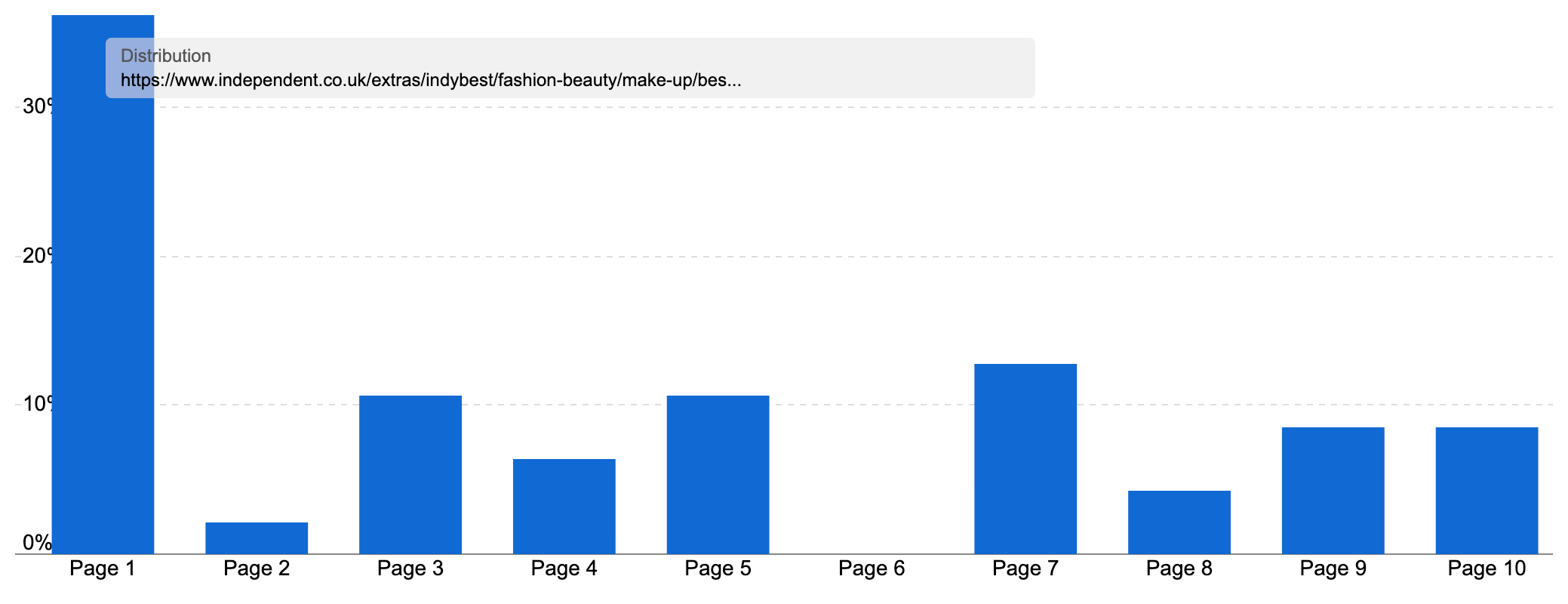

- hydrating powder (image above)

- waterproof mascara

- summer nails 2024 (start getting your 2025 version ready now!)

- best waterproof mascara

- trad goth makeup

- best bronzer

- how to remove lash extensions at home

- natural make up for bride

- bb cream vs cc cream

If you’d like insight into even more search trends, and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for Cosmetics

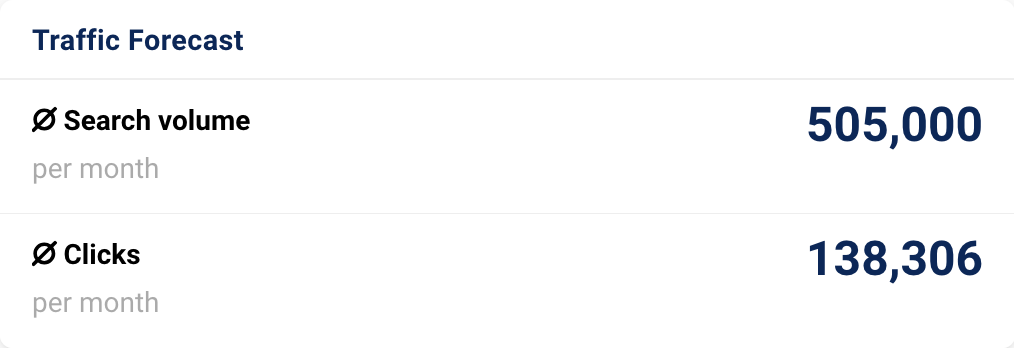

When you create keyword lists in SISTRIX, the toolbox offers a variety of reports to analyse your set of queries. These reports include the best-performing competitors (listed above), traffic forecasts (which we share at the end of this article) and the best-performing individual pages. Here are the most successful pages that are turning heads:

| URL | Top Keyword |

|---|---|

| www.beautyoutlet.co.uk/ | makeup |

| m.maccosmetics.co.uk/ | makeup |

| www.sephora.co.uk | cosmetics |

| https://www.boots.com/beauty/makeup/eyes/eye-palettes | eyeshadow palette |

| makeup.uk | makeup |

| https://www.maccosmetics.co.uk/products/13835/products/makeup/eyes/eye-palettes-kits | eyeshadow palette |

| www.cultbeauty.co.uk | cosmetics |

| https://uk.morphe.com/collections/eyeshadow-palettes | eyeshadow palette |

| https://www.spacenk.com/uk/home | cosmetics |

| www.feelunique.com | makeup |

Content examples: What type of content is performing?

Having found our winning domains, examples of the best-performing content and some trending topics, it is time to look at the domains that are making their mark in more detail.

- For our transactional ‘do’ searches, ecommerce sites dominate, with 21 out of the top 25 sites being retail domains

- As you’d expect, huge online retailers such as Amazon and eBay are present, but most of the list are specialists in the sector

- Boots and Superdrug represent the UK high street rounding out the top three domains. John Lewis also makes an appearance to represent department stores at 23. Sephora is a popular online beauty retailer that also makes the list of top domains

- Boots and Superdrug are both multi-category sites, expanding far beyond makeup into all types of beauty and health products. However, in the UK they are both known for the specific beauty market, rather than multi-category giants like Amazon

- Notably, there are many brand-specific sites or manufacturers on the list, with Mac, Elf, Charlotte Tilbury and NARS Cosmetics all in the top ten. Bobbi Brown, NYX, Too Faced and more are also all doing well

- Considering we’ve not included brand terms in our keyword set, to see who Google favours for more generic cosmetic searches, this is an excellent result

- For many makeup types, branded searches are incredibly popular. Consider mac cosmetics gets 38,100 searches a month on average, mac lipstick 6,200 searches and mac foundation 4.850

- When you combine the brand demand & loyalty these brands have created, it is perhaps not surprising to see Google rank them well for non-branded equivalent keywords

- It is rare for ecommerce sectors to have such a large percentage of direct suppliers or brands ranking well rather than retailers

- When it comes to our informational content, only two community-based sites are doing well, but they are big winners – Reddit & YouTube

- We’ve seen the relentless rise of Reddit in Google’s search results and it is currently the sixth-most visible domain in the UK overall

- Google shows Reddit for most ‘question’ searches or those where public expert advice could be helpful. Our ‘know’ keywords are full of searches looking for the best option, a guide on how to use a cosmetic product or advice for achieving different looks. This is exactly the type of query where Google currently loves to show Reddit

- Those searches for the best products or tutorials also explain YouTube’s success (fourth in our list). Any such search brings up a host of YouTube videos, including in video panels, image panels and standard listings

- Notably, publications also do well, with The Independent, Cosmopolitan, Glamour, In Style, Google Housekeeping, Marie Claire and Vogue all in the top twenty-five

- Two publications, Byrdie and Allure are specialist beauty publications/sites. They look a little different to the wider publications above but are part of the same group of sites

High-performance content examples

Having seen the sites with a polished performance, we can peel back their success further to see what we can learn from these winning content strategies.

We are highlighting any high-performing content formats. The pages, templates, or sections ranking on page one for a high percentage of their keywords. Google consistently ranks these sites and content formats for our curated list of keywords and the wider search market.

We can use these examples to hypothesise what Google wants to reward and then brush up our own content using these winning strategies.

The winning site for our ‘do’ (or transactional) keywords is Amazon. That won’t surprise anyone, especially if you’ve read our previous SectorWatch reports on ecommerce topics. Amazon is usually in the top three, and often at the top of the pile.

For our cosmetics sector, Amazon ranks for 95.9% of our 1,526 keywords. Showing how much Google wants to (or perhaps has to) show the retail giant, Amazon is on page one for 1,474, or 81%, of those keywords.

If you are looking to sell makeup products in the UK, you are going to face competition from Amazon on page one of the search results.

However, Amazon isn’t the only success story.

In second and third place are two UK high-street stalwarts, both of whom have smoothed their way into impressive online presence – Boots and Superdrug.

Boots is a British health and beauty retailer and pharmacy chain, established in 1849. It has been a consistent presence in high streets and retail parks throughout the UK but in recent years has faced plenty of financial challenges.

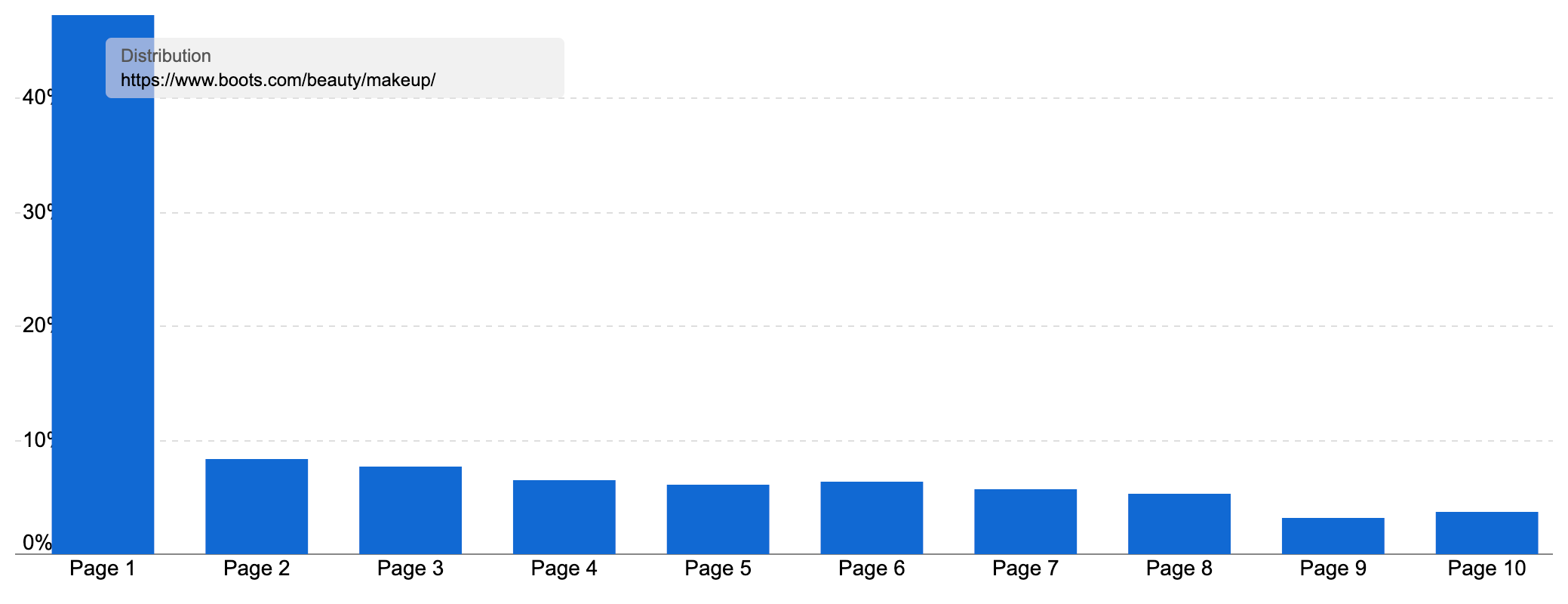

It certainly does something right online though, as it ranks for 91.3% (1403) of our ‘do’ keywords, and on page one 44.31% of the time.

The site has 31 pages in the top 200 most visible URLs for our keyword set, with 29 of them in the /beauty/makeup/ directory.

This directory is a great example of high-performance content. Overall it ranks for almost 28k keywords in the UK, with 47.32% of the rankings for the most popular keywords on page one.

Together, these rankings bring an estimated 234k organic visits a month, traffic worth £126k of you were to buy it via Google Ads.

The directory ranks with 177 different pages, covering just about every type of makeup you can shake a lipstick at.

Boots also uses smart subdirectories to break down their makeup product offering. There are lots of advantages to this from signalling site structure to offering opportunities for many hub pages specifically targeting different ways customers might shop.

Boots has directories for /makeup/eyes/, /makeup/face/, /makeup/nails/, /makeup/palettes/ and many more, plus pages at this level for one-off product types such as gift sets.

Within these, there are the individual pages, with the product listing pages (PLPs) for eye palettes, powder, blusher, primer and lip balms the most successful for our curated keyword set alongside the main makeup section page.

This granular approach gives Boots dedicated PLPs for every product type, making their store very relevant for each targeted keyword. Plus the structure gives excellent optimisation opportunities – The internal linking options are fantastic, for example.

A quick check of Boots’ PLP template shows how it ticks all the boxes Google expects for a good shopping experience:

- An easy-to-use mobile experience (an estimated 79% of the section’s traffic is on mobile)

- Prominent links in the main navigation to the section’s key pages

- Easy-to-use filters (faceted navigation) with options for brand, rating, price, skin type, colour, format, finish and more, including clever options such as ‘recipient’

- Note that the faceted navigation is also implemented well technically to help prevent duplicate content

- Intro copy with opportunities for cross-merchandising or other internal linking

- Breadcrumbs for clues to where you are on the site plus internal links

- Clear product listings with name, price, ratings and special offers displayed, plus an option to quickly add to the basket

When you move up a level, the section pages expand this template by offering submenus to the different product type PLPs within the section. For example, the eye makeup page has a sub-menu linking to the specific mascara, eye palette, eyeliner, eyelash, eye primer, and eyelash serum PLPs, plus more. Whether it’s a customer or a search engine bot, Boots makes it easy to move through the site’s structure.

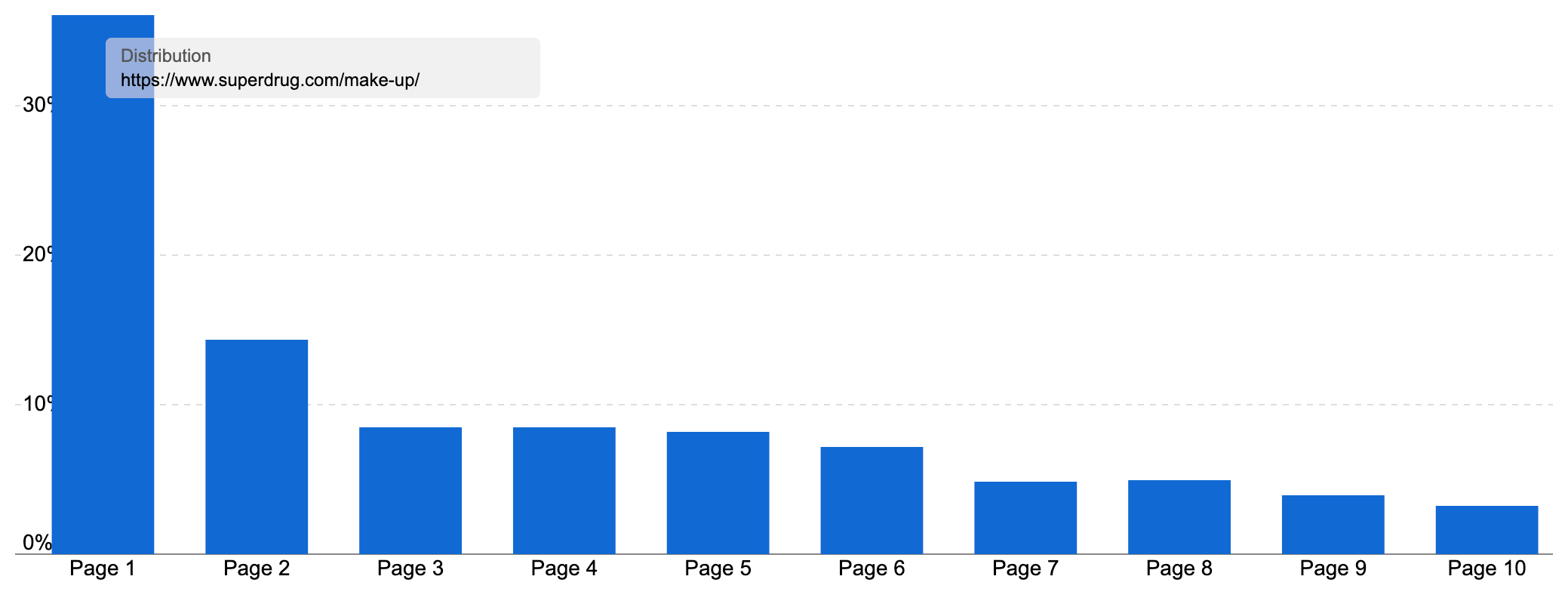

On the high street, Boots and Superdrug are fierce competitors, and in our research, we find them neck-and-neck.

Third in our list of winning domains, Superdrug ranks for 37.4% of our keywords, just behind Boots. However, they have slightly more keywords on page one (46.3%), showing they are not smudging their work.

Superdrug ranks with their /makeup/ and /skin/ directories for our keyword set. The /makeup/ directory overall ranks for a huge 95k keywords, with 36.12% of those on page one. If this page targets a makeup keyword, it will appear on page one over one-third of the time.

High performance know content

Moving to our ‘know’ keywords, we find Reddit in pole position.

Reddit ranks for 94.3% of our keywords and on page one almost half the time (48.2%).

The Independent and Byrdie rank in second and third place respectively and showcase the potential for well-researched publication content.

Byrdie is a digital beauty publication that offers a wide range of information and guidance on beauty products, trends and how-tos.

Started in 2013, Byrdie was acquired in 2019 by media powerhouse Dotdash Meredith, who also owns InStyle from our winners list.

This consolidation of ranking publications is common for popular informational terms. For example, Conde Nast owns Vogue, Glamour and Allure from our top twenty-five informational domains.

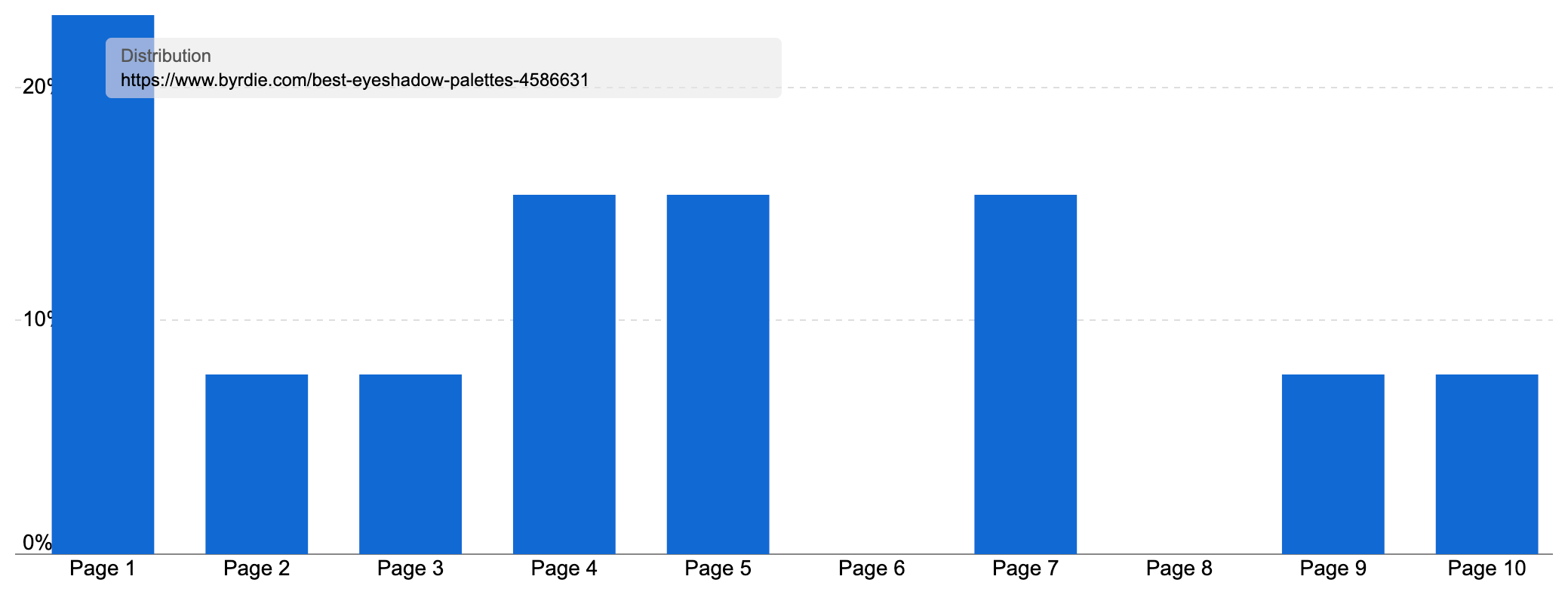

Byrdie ranks for 1404 of our 1788 informational keywords, and on page one 23.4% of the time (465 keywords). 11 of the top 200 URLs for the keyword set are from Byrdie, showing that the site’s goal of “to celebrate individuality and empower our readers to find confidence, community, and joy through beauty and style” is embodied in the wide range of articles and guides they create.

Byrdie’s articles all live in the root directory of the domain, so there isn’t a high-performance directory for these guides. However, a quick look at some of the individual articles shows their strength.

For example, let’s take Brydie’s most successful page for our ‘know’ keywords – their guide to the best eyeshadow palettes. This page ranks for 603 keywords in the UK, with 23.08% of them on page one.

Looking at this roundup, it’s clear to see why Google thinks this is useful content:

- There is clear evidence of first-hand experience with the products, including lots of original imagery

- We have expert authors, complete with links to their author pages showing lots of their other writing (and the author pages have Schema markup)

- There are useful subsections that build a complete picture for readers, and help the article rank for longer tail queries. These include:

- A TLDR summary at the beginning with links to the winning products

- What to Look for When Buying an Eyeshadow Palette

- FAQs such as What’s the best way to use an eyeshadow palette?

- The article has a section on ‘how we tested’ so readers can decide if it was thorough or not

- And the article offers a range of solutions, with winners for everything from best overall and best neutral tones to best mattes and best for beginners. Each section also has images showing those products in action on two testers with different skin tones

- For other reviews more medical in nature, articles are reviewed by medical professionals

Brydie also run regular offline events, no doubt helping boost its credentials and brand recognition. More brand searches means more trust.

While Byrdie doesn’t publish its articles within different topic directories, the site does make great use of information architecture to organise its content.

The main navigation puts the site’s focus front and centre. There are options for skin, makeup, hair, nails, style, news, and ‘what to buy’. Each of these has child pages, with the makeup section having options for eyes, face, lips and ‘tools and techniques’.

Go to the page for eye makeup, and Byrdie lists all the relevant articles in publication order with filters for popular subtopics such as brows and lashes. Filter for one of these subtopics and a link appears at the bottom of the article listing to see all the relevant news stories. For example, if you filter for brows a link to the (well-optimised) brow topic page appears.

Allure’s page on eye makeup is similar, though it makes the smart move of having direct links to all the child topic pages in a sub-menu at the top of the page.

Byrdie and Allure are interesting stories of success for our keyword sets, and overall. In their style and tone, these sites are different to most of the other publications ranking well.

They have a more direct consumer focus, a stronger focus on a core topic and lots of signs of proper first-hand experience with the products they rate and review.

Both are owned by huge publishing houses, however. This means they benefit from the experience these businesses have in both SEO and monetising content. This is reflected in their smart site structures, optimisation and sharp affiliate marketing.

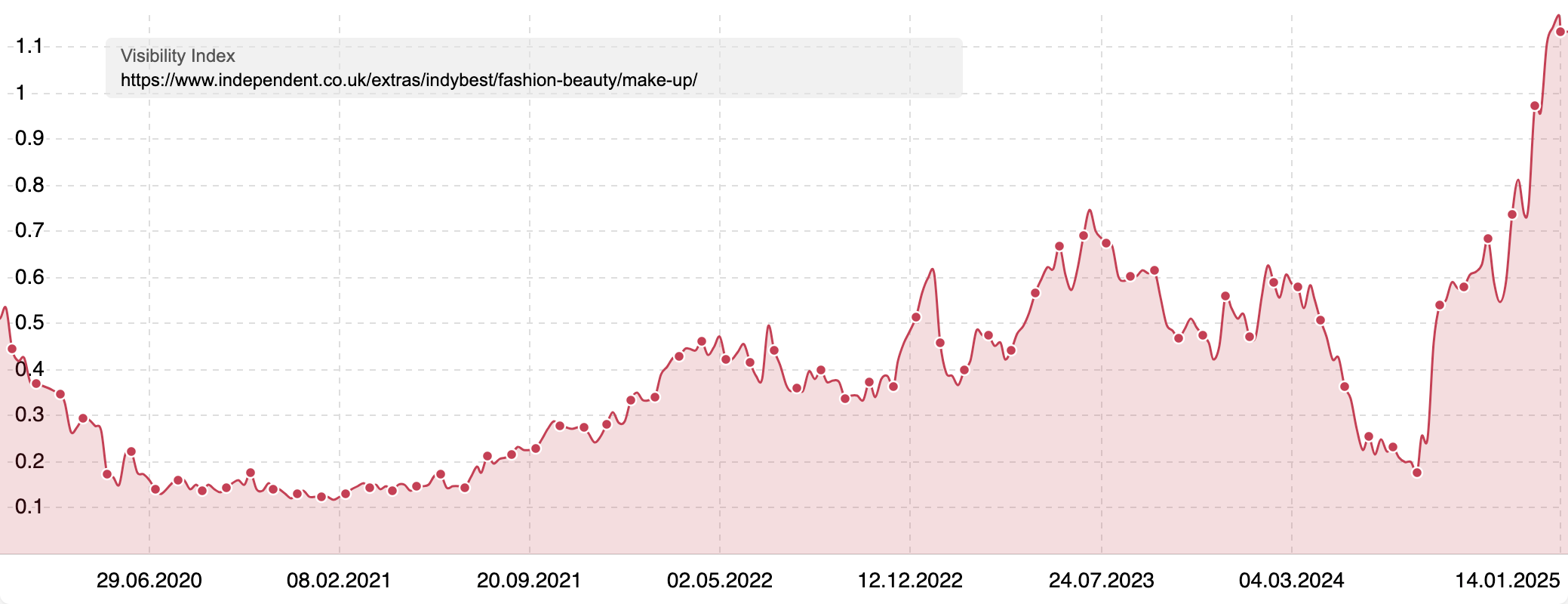

In second place is The Independent, an online UK newspaper that has become noted for its reviews, and its changes in fortune with Google’s product review and helpful content updates as a result.

The Independent ranks for 888 (49.64%) of our ‘know’ keywords and on page one 25.99% of the time. Most of the ranking articles for our keywords come from the /extras/indybest/fashion-beauty/make-up/ directory.

This directory overall ranks for over 21k keywords, and while it only ranks on page one 14.5% of the time, we can see from the Visibility Index data that the directory has seen a big recovery over recent Google updates & might become high-performing overall once again.

Indeed, if we look at the performance of some of the articles for our informational cosmetics keywords, such as their guide to the best mascara, we see examples of high performance. In this case, the guide ranks 2.6k keywords and on page one 36.2% of the time.

Finally, we need to acknowledge the success of Charlotte Tilbury, the fifth most popular site for our know keywords.

This is more impressive considering Charlotte Tilbury is a highly popular brand, so the site is primarily an ecommerce proposition.

The site has taken a content marketing approach as well as a commercial one, publishing a range of guides on how to make the most of your makeup.

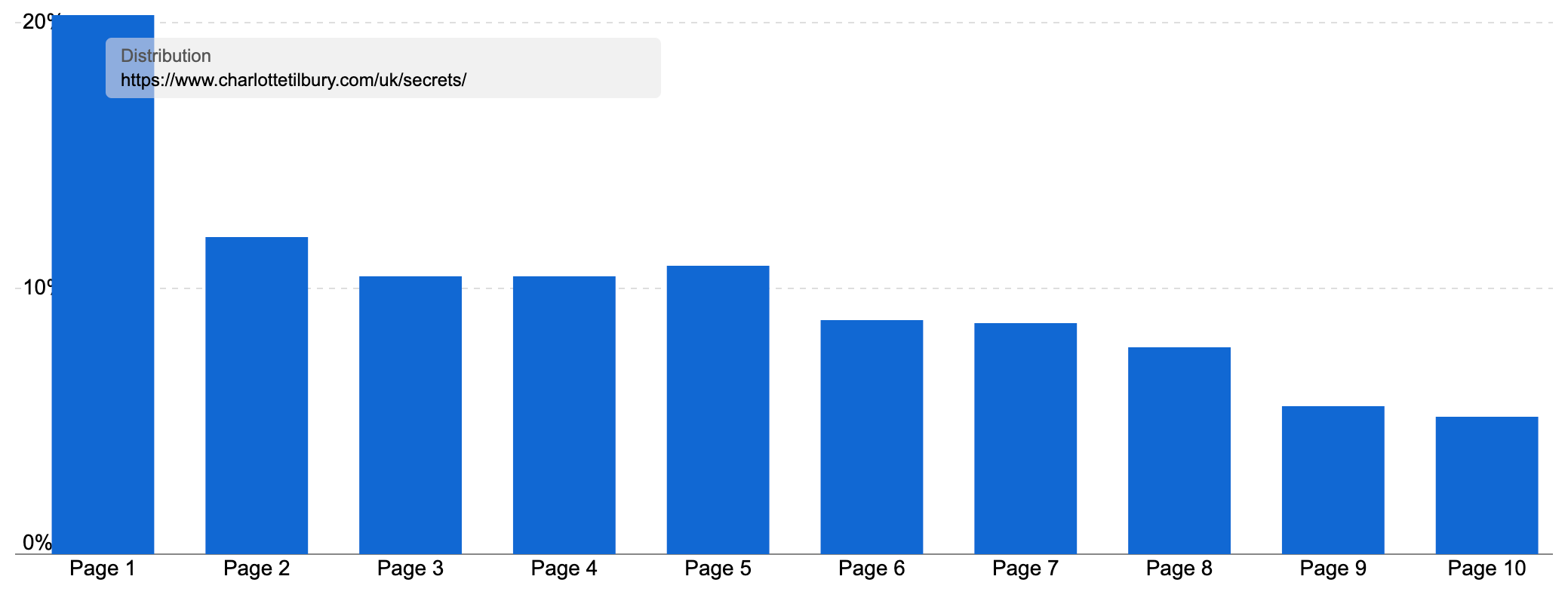

The site ranks for 55% of our list of keywords, and on page one for 29.1% of them. It primarily does this through the /uk/secrets/ directory, home of “magic makeup tutorials and expert supercharged skincare tips, plus the latest news, events and beauty guides”.

This directory ranks for over 23k keywords in the UK, bringing in an impressive 47.9k of organic traffic each month on average (traffic work £29k). The directory has 844 articles ranking for at least one keyword in the UK, showing the long-term dedication to producing helpful content. These rank on page one 20.3% of the time.

This is an excellent example of how a brand or manufactuer can reach a much wider audience by creating content designed to answering their questions or guide them through useful techniques. It is also an extension of the concession stands they run in many stores in the UK. By creating content on how to use their products, Charlotte Tilbury are getting in front of many more potential customers.

Summary

- The cosmetics search market reflects a blend of loyalty to well-known brands, innovation in digital strategies, and responsiveness to social media-driven trends. To compete effectively, businesses must focus on delivering exceptional user experiences, from granular site structures to engaging, informative content

- Retail heavyweights dominate “do” searches, leveraging their broad product range, strong SEO setup, and brand popularity

- This is true for online giants like Amazon and sector powerhouses such as Boots, and Superdrug. All three also benefit from plenty of searches using their names outside of our keyword set

- Boots, Superdrug and Sephora use focused makeup directories and stand out for their granular, well-optimized ecommerce content that’s easy for both customers and search egnines to navigate

- These sites boast targeted directories, faceted navigation, and optimised templates

- Brand loyalty shines bright in this sector, and brands like MAC, Charlotte Tilbury, and NARS show that consumer trust added to a good website can significantly influence search rankings, even for generic terms

- The success of branded searches, in this case queries like “MAC lipstick” or “MAC foundation” not only reflect the enduring power of established names, they can be signals of the chance of ranking for the non-branded versions of those keywords

- For popular visual product topics such as makeup, sites like Reddit & YouTube are an increasing presence

- These sites are hugely prevelant for any “know” searches by providing authentic user-driven advice and tutorials. By catering to searchers looking for expertise or inspiration, Google will show them for most product-related searches with an informational intent

- These platforms offer a chance for smaller players to rank for popular searches and for the big names to offer a new content format

- Sometimes SEO tools aren’t enough. If you want to know what’s coming up next in topics like cosmetics, you also need to read the pulse of social media

- Platforms like TikTok are driving the rise of “dupes” and trending cosmetics searches, so if you want to create your next PLP or guide ahead of demand, you need to be monitoring these platforms as well as Google’s search results and keyword volume. Searches such as “trad goth makeup” and “natural makeup for brides” show how diverse and niche trends shape the market, driven by cultural, seasona and use-case demand

Keyword research in the cosmetics sector

To find the best-performing cosmetics sites, pages and content, we curated two sets of non-branded keywords. These form a representative sample of popular cosmetic searches by the UK public.

We always categorise our keyword research into lists, split by their search intent. This allows us to compare content aimed at the same type of searches rather than comparing content designed to answer questions to shopping pages.

Just as Google matches content to the intent of each search query, we cluster the keywords we find with the same intent so we discover the content that Google wants to reward for each stage of the search cycle in this sector.

Our first list is ‘do’ keywords. These represent searches where someone is looking to buy, hire, download or convert in some way. When it comes to cosmetics, these are ‘shopping’ searches with a transactional intent.

Our ‘do’ keywords represent over a million searches on average each month. And this is just the tip of the cosmetic iceberg, as branded searches for brands like Mac, Benefit, Charlotte Tilbury, Bobbi Brown, No7, YSL and many more, plus searches containing retailer names like Boots and Superdrug account for millions more searches each month.

Our list includes popular searches like keywords like foundation (67,900 searches a month on average in the UK), lip gloss (37,400 searches a month), primer (15,600), concealer (12,600) and bb cream (7,150).

The second keyword list contains the many ‘know’ queries we found, representing common informational searches. For cosmetics, we see a lot of searches around several key themes:

- The best options for a type of makeup

- How to use a type of cosmetic

- How to achieve certain looks

- How to clean makeup

Examples include goth makeup (5,300 searches a month in the UK on average), best foundation (4,500 on average), tutorial on makeup (4,450), eyeliner with wing (3,100), what is bb cream (2,550), where to put bronzer (1,800) and how do you clean makeup sponge (1,700).

We have a detailed step-by-step article on keyword research with SISTRIX tools and data where you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of cosmetics and makeup keyword discovery tables. We selected highly targeted keywords with either a ‘do‘ intent or a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

Curated keyword set and sector click potential

Core keywords: makeup, cosmetics, foundation, concealer, lipstick, blush, bronzer, eyeliner, lip gloss, mascara.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and traffic forecasts.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.

You can assess live data from all domains and grow your visibility with the Free SISTRIX Trial.