‘Tis the season to dig into the UK’s search landscape for Christmas trees! This month, SectorWatch is branching into the Christmas tree sector. We’re unwrapping the data to find which sites are rocking around the rankings. Whose content makes searchers click faster than Santa’s sleigh on Christmas Eve? And whose content is stuck tangled in fairy lights? Get ready to spruce up your SEO game as we find content with that little bit of sparkle.

- The top domains in the UK for Christmas trees

- Top 20 domains for shopping (‘do’) searches for Christmas trees:

- Top 20 domains for informational (‘know’) searches for Christmas trees:

- What’s trending in the Christmas tree search market?

- The top URLs for Christmas trees

- Content examples: What type of content is performing?

- High-performance content examples

- High-performance know content

- Summary

- Keyword research in the Christmas tree sector

- Our SectorWatch process

- Curated keyword set and sector click potential

Each year, the UK buys 6-8 million real Christmas trees, with a survey by the BCTGA (British Christmas Tree Growers Association) finding over 8 million real Christmas trees were bought in 2021.

Add in the fact that almost two-thirds of Britons celebrating Christmas use an artificial tree with 7% buying a new artificial tree in 2022 and 10 million sold in 2017, and this evergreen market gets even bigger.

With an average price of £47 for real trees and £30-£100 spent on artificial counterparts, going up to hundreds of pounds for premium models, it’s no wonder online competition is frosty.

With this much choice and so many retailers offering options to shoppers, let’s see whose rankings are topping the tree as we head into the festive season.

The top domains in the UK for Christmas trees

So, whose content is snowballing in popularity? We’ve compiled research on a sample of ‘do’ (action/transactional) searches and ‘know’ (informational) searches in the Christmas tree market:

Do searches:

- christmastreeworld.co.uk

- amazon.co.uk

- diy.com

Know searches:

- goodhousekeeping.com

- pinterest.com

- housebeautiful.com

Top 20 domains for shopping (‘do’) searches for Christmas trees:

| Domain | Project Visibility Index |

|---|---|

| christmastreeworld.co.uk | 677.98 |

| amazon.co.uk | 611.94 |

| diy.com | 444.93 |

| therange.co.uk | 390.75 |

| argos.co.uk | 349.41 |

| balsamhill.co.uk | 317.13 |

| werchristmas.co.uk | 307.36 |

| ebay.co.uk | 163.84 |

| sendmeachristmastree.co.uk | 154.03 |

| christmastreedirect.co.uk | 140.01 |

| whitestores.co.uk | 138.09 |

| asda.com | 118.46 |

| homebase.co.uk | 110.02 |

| wayfair.co.uk | 104.71 |

| dunelm.com | 95.81 |

| realchristmastrees.co.uk | 93.87 |

| pinesandneedles.com | 75.6 |

| tesco.com | 71.48 |

| pinterest.com | 70.25 |

| lights4fun.co.uk | 69.50 |

Top 20 domains for informational (‘know’) searches for Christmas trees:

| Domain | Project Visibility Index |

|---|---|

| goodhousekeeping.com | 489.65 |

| pinterest.com | 457.9 |

| housebeautiful.com | 429.79 |

| bhg.com | 386.7 |

| countryliving.com | 313.39 |

| balsamhill.co.uk | 288.35 |

| amazon.co.uk | 236.37 |

| wikipedia.org | 195.46 |

| english-heritage.org.uk | 188.52 |

| christmastreeworld.co.uk | 149.05 |

| diy.com | 140.76 |

| independent.co.uk | 123.65 |

| reddit.com | 113.55 |

| homesandgardens.com | 100.82 |

| elledecor.com | 86.15 |

| youtube.com | 83.4 |

| christmastreesdirect.co.uk | 75.01 |

| etsy.com | 69.34 |

| goodhomesmagazine.com | 69.03 |

| quora.com | 68.67 |

What’s trending in the Christmas tree search market?

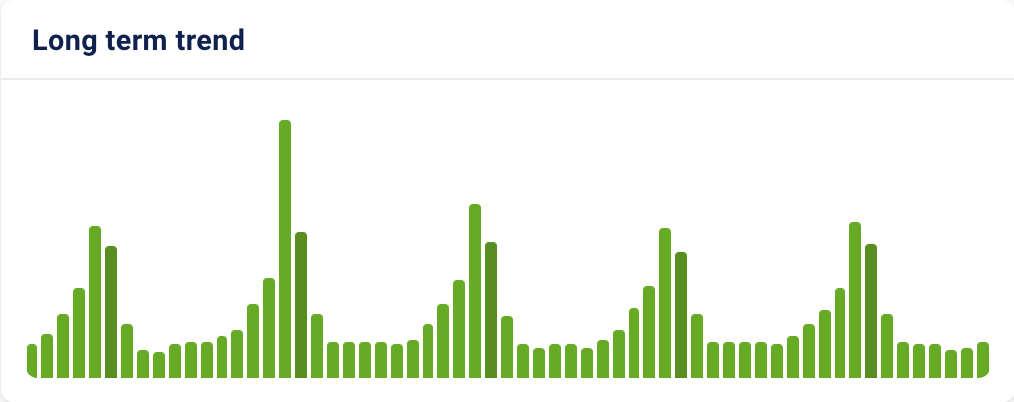

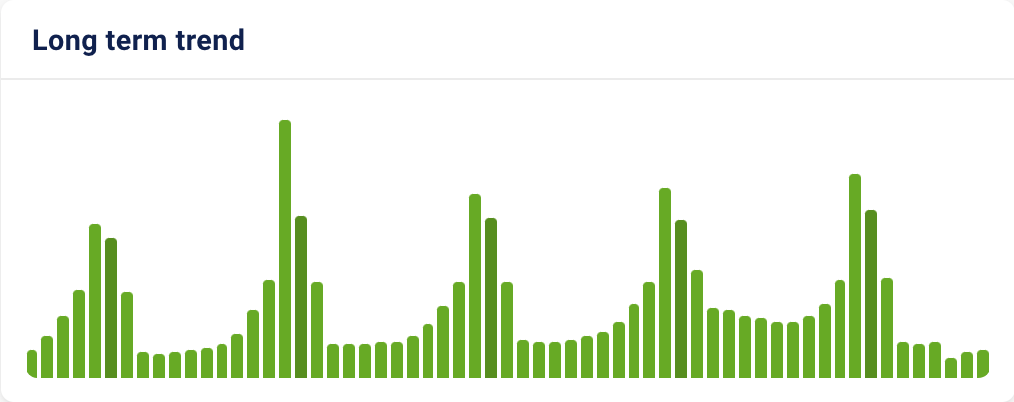

Within our keyword list – and our TrendWatch data – we can spot trending Christmas tree searches. As a predominantly seasonal search topic, we see a huge spike in demand each year. We see the keyword ‘Christmas tree’ has an average volume of 36,300 per month. However, we see that this jumps to over half a million searches in November and the same again in December.

If you take our two keyword sets, you can see the massive seasonal spikes in demand:

For trends, we are looking for any topics that are growing in popularity in recent years:

- prelit christmas tree

- candy cane christmas tree

- when should you take christmas decorations down

- ribbon ideas for christmas trees

- when does the christmas tree go up in new york

- christmas tree footprint

If you’d like insight into even more search trends, and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for Christmas trees

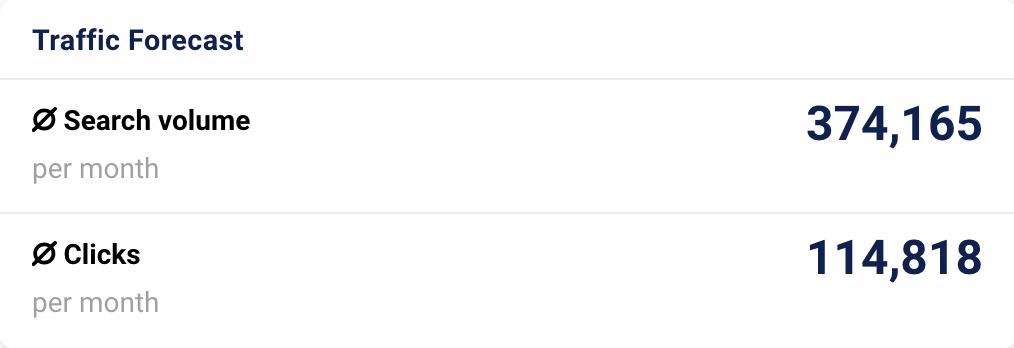

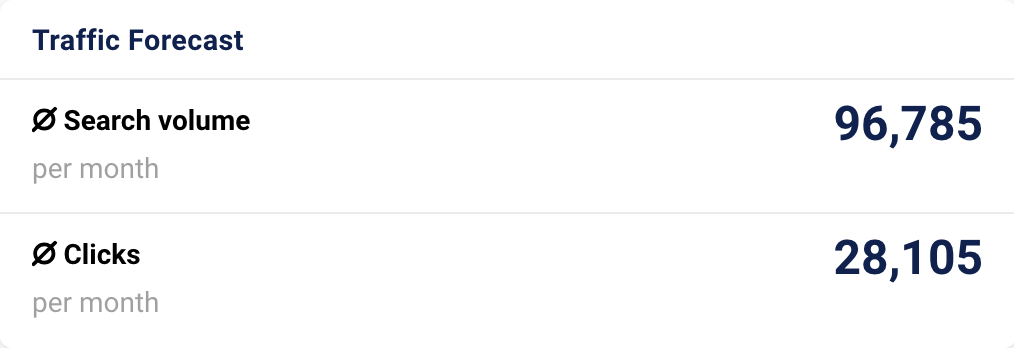

To research our winning domains, we created two keyword lists in SISTRIX. We curated one list of 909 keywords for ‘do’ (commercial) searches and another for 374 ‘know’ (informational) searches.

One of the great things about keyword lists in SISTRIX is the extra data insights you can get. These insights include the best-performing competitors (listed above), traffic forecasts (which we share at the end of this article) and the best-performing individual pages. Here are the ten most successful pages that are sleigh-ing the competition in each of our keyword sets:

Content examples: What type of content is performing?

It’s time to examine the data and see who is lighting up the search market like a Christmas tree. Looking at our winning domains for each search intent, we have some immediate takeaways:

- For transactional searches, we see a welcome blend of ranking sites:

- Online ecommerce giants such as Amazon, eBay and Wayfair

- Big-name UK retailers such as The Range, Argos, Asda, Dunelm and Tesco

- DIY and home stores such as B&Q (diy.com) and Homebase plus outdoor living retailers such as Whitestores

- Specialist online sites such as WeRChristmas

- And finally manufacturers of artificial Christmas trees such as Christmas Tree World and Balsam Hill plus direct suppliers of real Christmas trees such as Send Me A Chrismas Tree, Pines and Needles and Christmas Trees Direct who work with tree farms to send products right to your doorstep

- Whether big or small, reputation and authority clearly matter

- While well-established ecommerce platforms are as usual highly competitive for transactional-intent ‘do’ keywords, niche specialist retailers with a focus on Christmas trees are competing with larger brands

- The top-ranking sites have a big footprint over our range of ‘do’ keywords, such as Amazon ranking for a massive 87.7% of them, and on page one over half of the time (59.1%)

- Despite Amazon’s success, Christmas Tree World is at the top of the tree, ranking for fewer keywords than Amazon but with top-tier visibility for the highest-value searches – specialisation can serve you very well

- For informational ‘know’ searches, big-name publications with a focus on home decor & living dominate – Good Housekeeping, House Beautiful, Country Living and Better Homes & Gardens all make the top five most visible domains. These sites are in a great position to rank as trusted brands for advice, ideas and inspiration when it comes to the home

- We see other publications such as The Independent, Homes & Gardens, Elle Decor, Good Homes and The Telegraph in the top 25

- These sites are very good when it comes to SEO strategies for these types of searches, building large content machines designed to take advantage of search demand. In fact, many of these sites are owned by the same publishing houses, meaning the top spaces are not as varied as you might think

- House Beautiful ranks for 88% of our ‘know’ keywords, for example

- The exception in the top five is Pinterest, which reflects its position as the go-to source for visual inspiration (and is often used by those same publications). Pinterest’s reputation as a resource makes it a clear match for queries about Christmas tree decorating or colour-scheme ideas

- Eight domains rank for both top-25 lists, with ecommerce sites with strong information content (such as guide or blog sections) doing well, such as B&Q, Christmas Tree World and Balsam Hill

- Amazon ranks well for both despite not having much informational content, as Google continues to show it prominently for any shopping-adjacent queries

- Conversely, Pinterest does quite well for commercial queries, often appearing as shopping inspiration amongst retailers for any query that could have some research intent among searchers

High-performance content examples

Having seen the sites that shine like a star, we should unwrap their success further to see what we can learn from these winning content strategies.

We are looking under the tree for any high-performing content formats. These are pages, templates or sections ranking on page one for a high percentage of their keywords. This makes them content formats that Google consistently likes to show for our curated Christmas tree terms.

We can use these examples to hypothesise what Google wants to reward and then help make our content tree-mendous by applying those same principles.

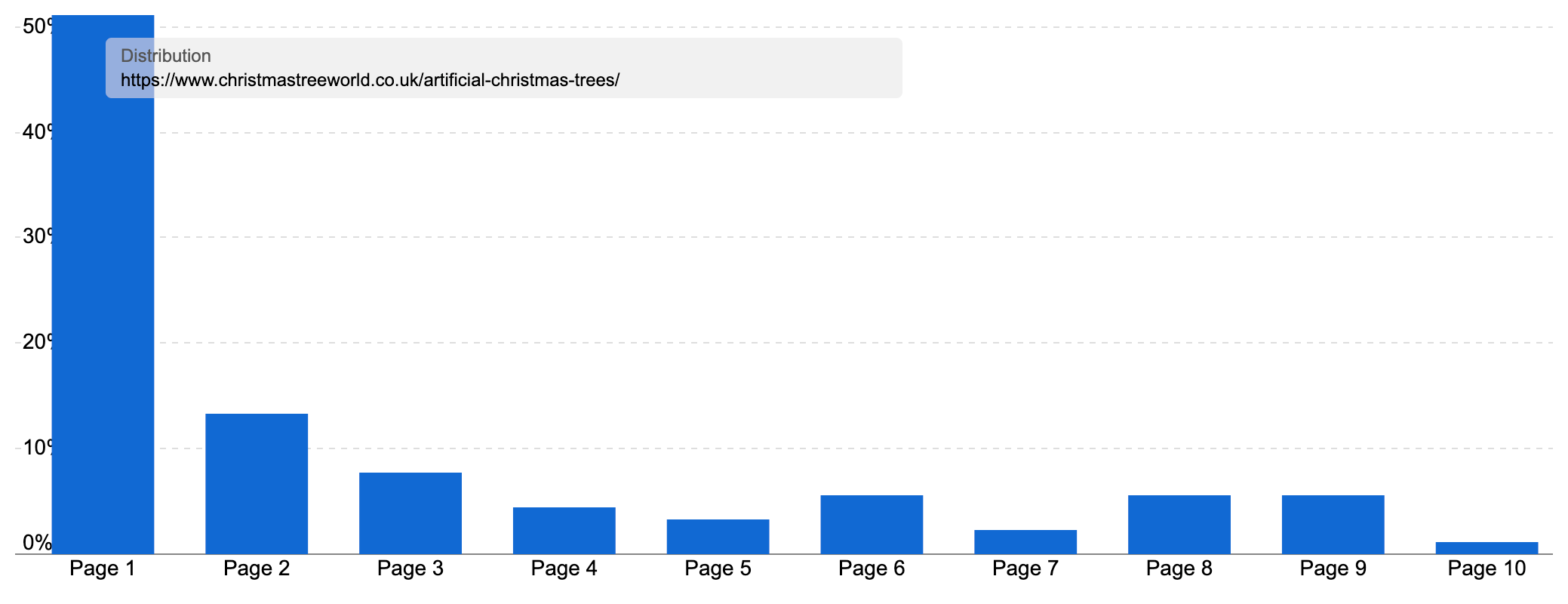

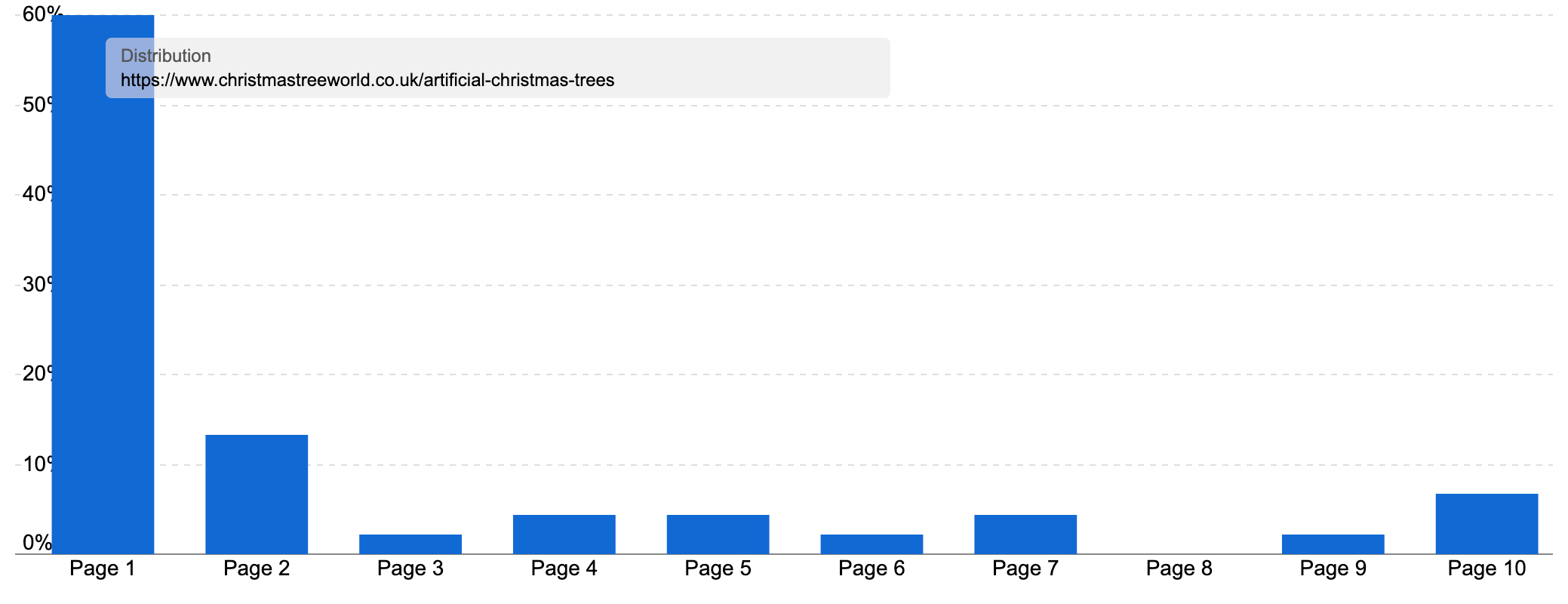

Sitting at the top of our rankings like the proverbial star on the tree is Christmas Tree World, an artificial Christmas tree supplier based in Wigan that designs its product range

Christmas Tree World ranks for 717 of our commercial keywords (78.9%), and on page one for 442 (48.6%).

They achieve this with a wide range of PLPs, many of which break down their offering in ways that match the mid-to-long tail queries we see in the sector.

The site has 27 pages in the top 200 most visible URLs for our ‘do’ keyword set, an impressive footprint. These are based on different Christmas tree types, such as /fibre-optic-christmas-trees.

However, it is their large section dedicated to artificial Christmas trees where they get the most visibility.

22 different pages from the christmastreeworld.co.uk/artificial-christmas-trees directory are in the most popular URLs.

This directory is bringing them plenty of Christmas cheer. The main page and directory rank for 5,853 keywords in the UK at the time of writing across 100 different URLs.

Even better, the directory ranks on page one for 51.1% of the biggest keywords they rank for, and you can see the success of the directory in recent months.

Meanwhile, the main artificial trees product listing page (PLP) ranks on page one for 60% of the keywords Google shows it for.

As we’ve seen this directory earns this footprint through a wide range of PLPs. Under the topic of artificial Christmas trees, Christmas Tree World has built targeted PLPs for all the different ways customers might want to shop – or search – for a Christmas tree.

The site splits this directory into sections based on common ways to choose a Christmas tree. We have PLPs for just about every artificial Christmas tree you can think of. You can choose to:

- Choose a tree by type, such as a pre-lit tree, an outdoor Christmas tree, a luxury Christmas tree or even a large commercial tree

- Or shop by height, with dedicated PLPs for 7-foot trees, 6-foot trees, 4-foot trees and so on

- Pick a tree by colour – we can see many searches for white Christmas trees in our keyword set, such as ‘white Christmas tree’ which has an average demand of 2050 searches a month

- Or shop by style, such as slim Christmas trees (2,300 searches a month for the main keyword), realistic Christmas trees or modern trees

- And Christmas Tree World takes this up a notch by allowing the next level of their faceted navigation to be indexed. For example, once you reach the page for slim Christmas trees, they’ve spotted there is demand for different heights, so we have the following sub-sub-category pages:

- /artificial-christmas-trees/shop-by-style/slim-christmas-trees/7-foot (ranks for 46 keywords)

- /artificial-christmas-trees/shop-by-style/slim-christmas-trees/6-foot (38)

- /artificial-christmas-trees/shop-by-style/slim-christmas-trees/5-foot (29)

- /artificial-christmas-trees/shop-by-style/slim-christmas-trees/8-foot (19)

- /artificial-christmas-trees/shop-by-style/slim-christmas-trees/9-foot (1)

- /artificial-christmas-trees/shop-by-style/slim-christmas-trees/10-foot (2)

Many of these keywords the sub-sub-category PLPs rank for are fairly long-tail, but each year they’ll see a significant boost in demand. This means these pages, which rank for nearly all their keywords on page one, have a shot at getting the site some extremely targeted traffic looking for exactly what this page sells each peak season.

The site repeats this formula for each of the ‘shop by’ types or styles where they have a deep enough product offering to segment the range by height.

The site helps search engines see these are relevant through a submenu in the ‘category’ filter, helping piece the structure together, and offering quick links for shoppers.

By creating this deep PLP catalogue, Christmas Tree World can target shoppers no matter how broad or specific a search they do to find their perfect tree.

Through catering to search demand in a manner their product range and customer knowledge allow, Christmas Tree World has built a site that makes it easy to shop and easy for search engines to show the most relevant content they have.

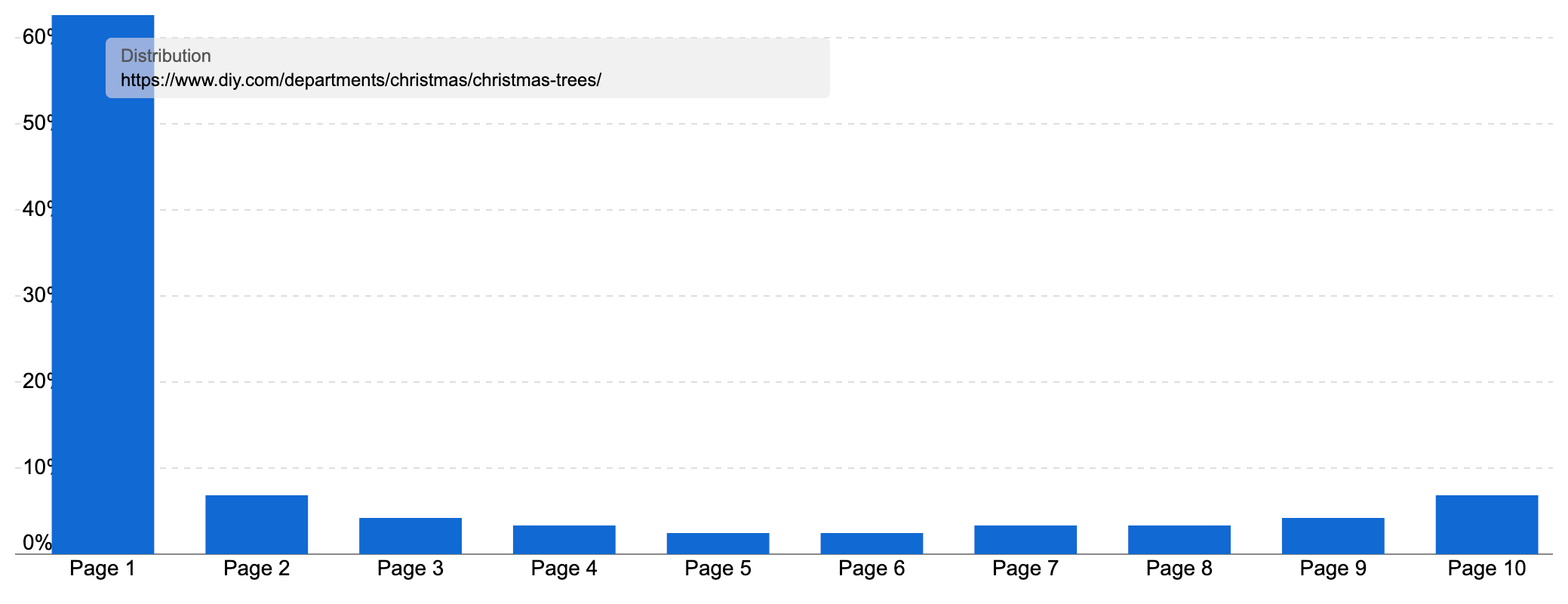

Another growing winner for our ‘do’ keywords is the DIY stores, such as B&Q and Homebase.

B&Q are third in our rankings, appearing for 86.9% of keywords, including on page one 45.6% of the time. 10 different PLPs appear in our top 100 URLs, all in a dedicated /departments/christmas/christmas-trees/ directory.

Overall, this directory is highly successful. After a rocky period several years ago, the directory has seen excellent growth and now ranks for over 8.5k keywords, with a massive 62.7% of those rankings on page one for the biggest queries:

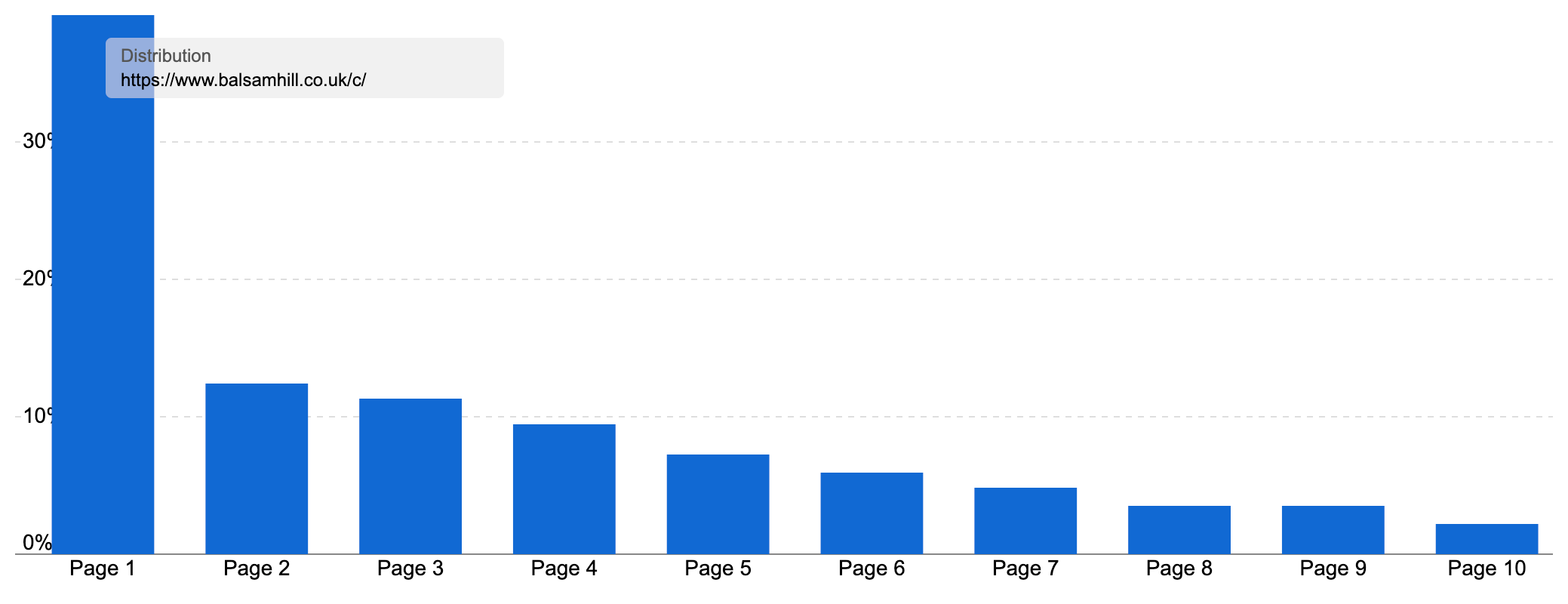

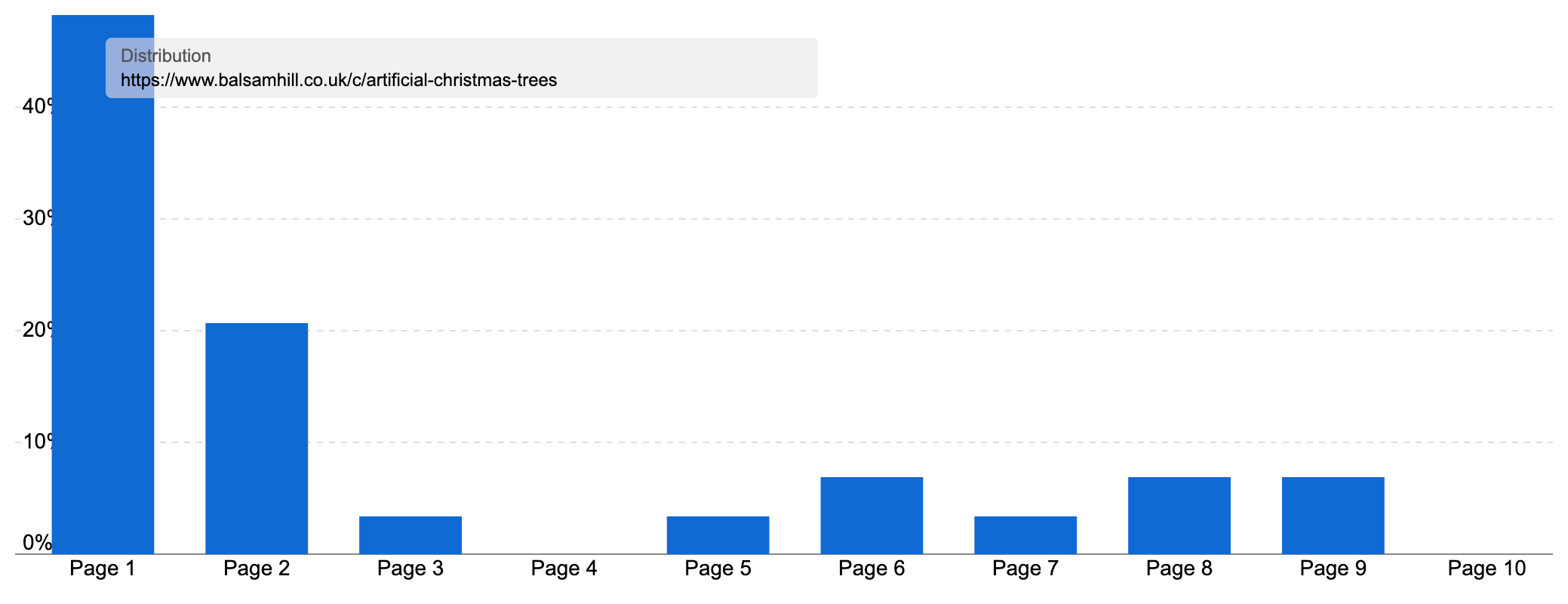

Another manufacturer doing well in competing with the online and high-street retail giants is Balsam Hill, a US-based manufacturer that specialises in realistic-looking artificial trees.

The site ranks for 61% of our ‘do’ keywords, and on page one for 31.1%, putting it sixth in our competitor list, just behind Argos, The Range, B&Q and Amazon – pretty good company.

The site has 14 pages in our top-200 URLs, another great spread, all in their /c/ directory which is home to their PLPs.

This /c/ directory ranks for 12924 keywords, and on page one for 39.3% of them.

Together, these PLPs bring in an estimated 43.3k visits a month on average, worth £16k but again likely to experience a huge surge at this time of year. The directory saw some good gains in autumn 2023 into early 2024, both during and after Google updates.

All the PLPs live at the same level within the directory, so there isn’t the same clear hierarchy as Christmas Tree World. However, Balsam Hill have followed a similar playbook in that they have many indexable PLPs, with 107 ranking for at least one keyword in the UK.

While there isn’t quite the granularity of Christmas Tree World, they do have 50 ‘tree’ PLPs ranking based on styles, heights and types.

The most successful for our keyword set, and overall, is their headline page for artificial Christmas trees. This page ranks for 67 of our target keywords, and for 753 overall, with 48.3% of those on page one.

High-performance know content

Notably, Balsam Hill also rank sixth for our ‘know’ keyword, primarily thanks to the success of their Inspiration directory.

Four different articles rank in the top 50 ‘know’ pages, all based on the key themes we found in our keyword set:

- Christmas tree decorating ideas

- The best time to put up your tree

- Professional decorating tips

- And how to decorate a tree with a ribbon

- As well as other successful articles on topics such as getting lights on your tree

This shows that specialist retailers can compete for informational queries on their area of expertise when the content is strong enough and your reputation in the sector warrants hearing from you.

Ecommerce businesses can reach more potential customers through writing, even if it is increasingly competitive in most sectors. This is great for reaching customers at different points in the buying cycle and can also build a brand’s reputation when done well, which we know is vitally important to stand out to Google.

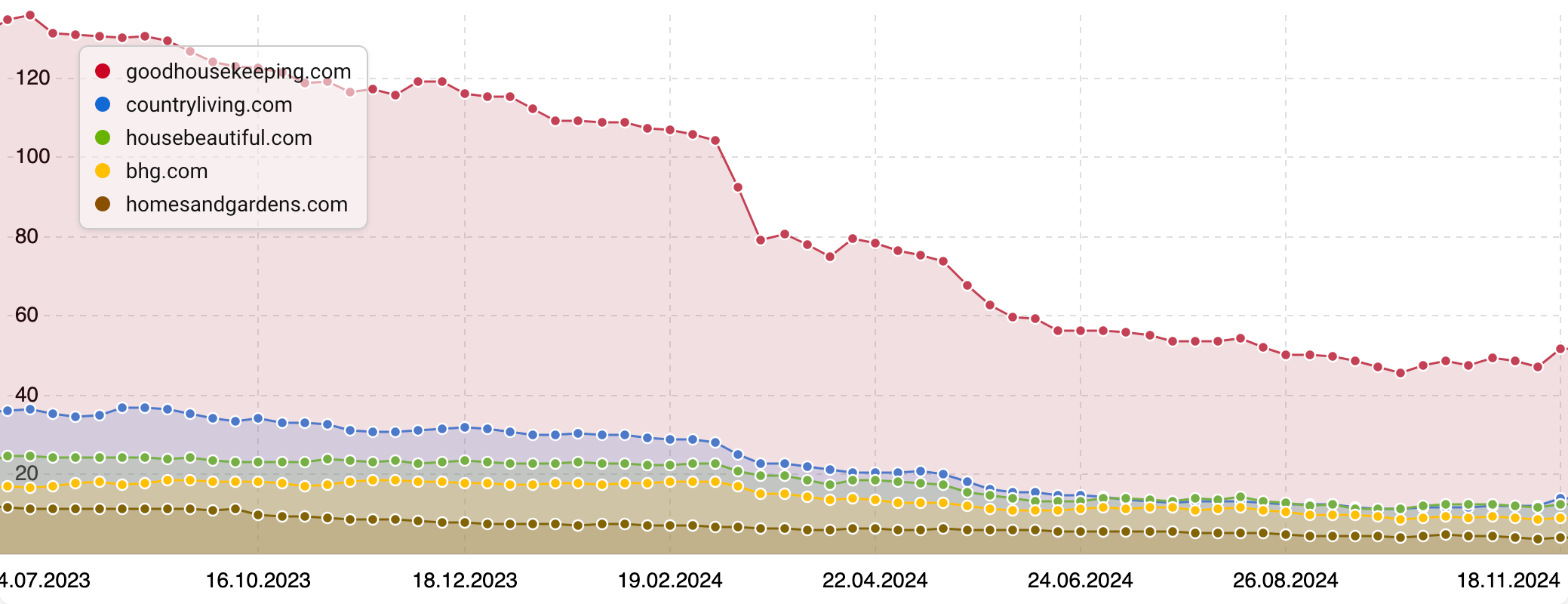

However, beyond this success and the usual inclusion of Amazon for any ecommerce adjacent topics, it is large publications that dominate our ‘know’ keyword rankings.

We’ve seen that Good Housekeeping, House Beautiful, Country Living and Better Homes & Gardens all make the top five most visible domains.

All are part of large publishing houses:

- Hearst owns Good Housekeeping, Country Living, House Beautiful and Elle Decor

- Dotdash Meredith owns Better Homes & Gardens

- Future owns Homes & Gardens and Ideal Home

Hearst runs the publications that rank 1, 3 and 5 in our winner list. All use similar formulas for their site and article structure, and no doubt SEO strategy. In fact, you only have to take a quick look at the sites to see that they are built with the same tech stack and have the same navigation, even if the topics within it differ slightly.

These sites focus on home living and decor, which makes Christmas a big topic, and Christmas decorations a perfect subject.

It gets even more interesting when you note the different country versions of each site, with both US and UK-focused content able to rank.

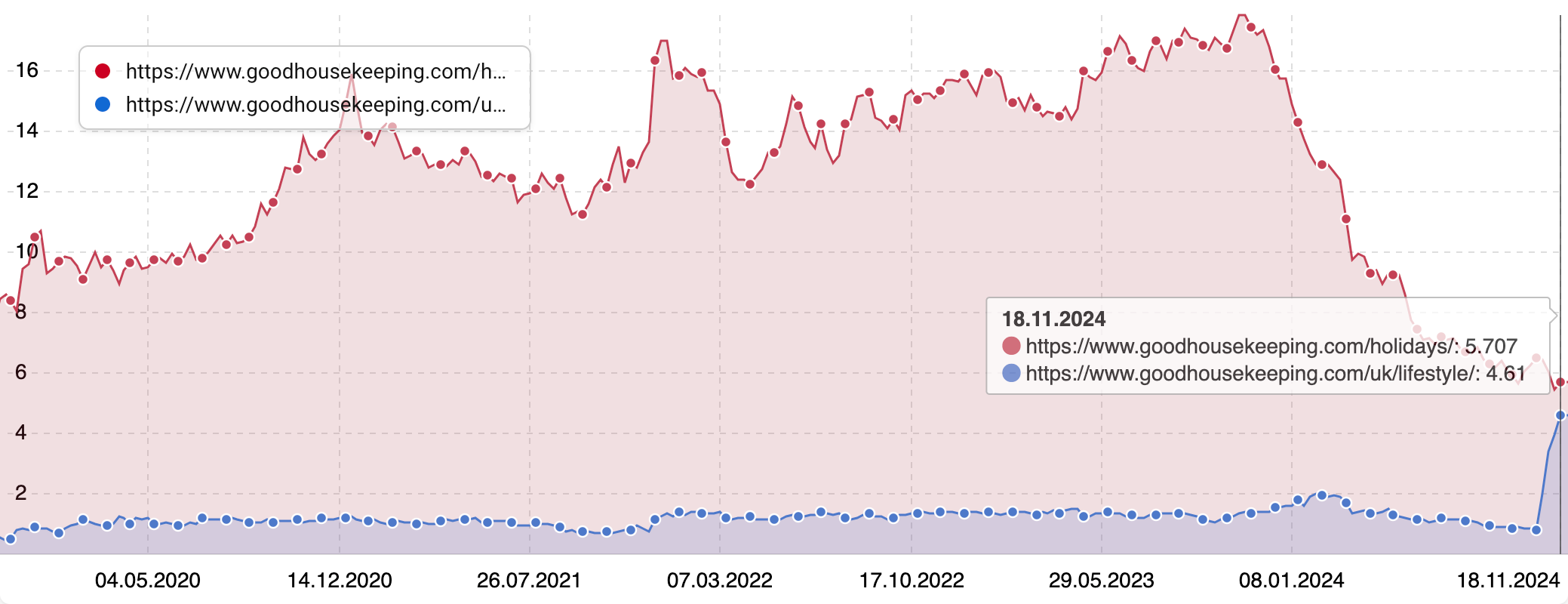

For example, Good Housekeeping has 10 articles of our top 100 ‘know’ URLs – taking up 10% of the most visible content. The top two pages are both on the subject of when to take your Christmas tree down, one from the main (US) section, and one from the UK section.

Most of their ranking articles come from that US-based /holidays/ directory, but we can see that this has lost a lot of visibility over the past year, including during Google’s March 2024 Core Update, to then point that the UK lifestyle directory is almost at the same level.

We see this pattern repeated across many of these sites, with formally powerful directories losing a lot of traffic over the past 12 months. While these famous publications are still powerful, they are not doing as well as they were.

Despite this overall decline, we see these articles still dominate our ‘know’ informational keywords around decorating for Christmas.

It is also worth noting Pinterest’s success. Just as with our look at the Halloween sector last month, Google clearly likes showing visual content for searches looking for decorating or holiday inspiration.

Summary

- For clearly transactional ‘do’ topics such as Christmas trees, ecommerce stores reign supreme

- Giants from Amazon to Argos leverage their huge product inventories and well-established reputation with Google to rank for the majority of our representative sample keywords

- Specialisation and structured content pay off – Sector specialists such as Christmas Tree World and Balsam Hill get wins through focused, tailored content, primarily through building smart PLP structures that cater to both head and long-tail terms plus keyword-focused blog articles

- Christmas Tree World’s organised and granular PLP directory is an excellent example of how you can build a structure that’s good for search engines and users alike

- Retailers effectively compete by building curated Christmas sections, which makes it easier to optimise and highlight seasonally

- A clear content hierarchy allows you to dominate both broad and niche search queries. A useful, segmented shopping experience based on how audiences want to search for or choose products is a winning tactic

- Content & lifestyle focused publications dominate for ‘know’ keywords when the theme is right for them. While we’ve seen the reach of these big publications slightly melt away as Google looks to redress the balance of brand power and specialist knowledge, when it comes to the core topics associated with the brand name, famous publications such as Country Living can still dominate

- Data drives content – for both our commercial and informational keywords, we see content demonstrating the power of building around search demand. Whether its having granular PLPs, or the fact that every major publication has an article on when to take Christmas decorations down, using search data as consumer insight is still a highly effective strategy

- If you can’t rank well for your target terms, see if you can rank via images by using platforms such as Pinterest

Keyword research in the Christmas tree sector

To uncover the best-performing Christmas tree content & sites, we curated two sets of keywords to form a representative sample of popular related searches by the UK public.

We always categorise our research into lists, split by their search intent. We do this to compare content aimed at the same type of searches and the pages targeting the same buying cycle stage. As Google matches content to the intent of each query we ask, we want to group queries with the same intent together so we know the content types and formats that Google wants to reward for each aspect of this sector.

We have one keyword list for our ‘do’ keywords and another for our ‘know’ keywords.

‘Do’ keywords represent searches where someone is looking to buy, hire, download or convert in some way. For Christmas trees, these are transactional or ‘shopping’ searches with a conversion intent. Searches where someone is looking to buy a Christmas tree. For many sites such transactional searches are among the most important to rank for.

Our ‘do’ keywords represent almost 375k searches on average each month, with a peak each November of over 4 million searches and another ~3.5 million in December.

Our list includes popular searches like keywords like christmas tree (36,300 searches a month on average in the UK, with over 500k searches each November), potted christmas tree (4,650 searches a month), pre lit christmas tree (3,700) and artificial christmas trees (2,950).

Unlike many of our SectorWatch reports, in this case we included searches with a retailer or brand name, such as asda christmas tree as we wanted to see if big retailers received a big boost in the sector from brand recognition or reputation for selling Christmas trees.

The second keyword set covers ‘know’ queries, representing common informational searches. For Christmas, we see a lot of searches around several key themes:

- When can Christmas trees go up?

- When should we take them down?

- How should we decorate or top our Christmas tree?

- How many lights or baubles do I need for my tree?

Examples include when do christmas decorations come down 2023 (7,700 searches a month in the UK on average), christmas tree decorations ideas (1,450 on average), christmas tree topping ideass (950), how much is a real tree christmas (550) and best tree for christmas (500).

We have a detailed step-by-step article on keyword research with SISTRIX tools and data where you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of Christmas tree keyword discovery tables. We selected highly targeted keywords with either a ‘do‘ intent or a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

Curated keyword set and sector click potential

Core keywords: christmas tree, christmas trees, artificial christmas trees, real christmas tree, pre lit christmas tree, 7ft christmas tree.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and traffic forecasts.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.

You can assess live data from all domains and grow your visibility with the Free SISTRIX Trial.