This month SectorWatch is tightening our straps and heading back to class as we unpack the UK search market for backpacks. We’re scouting out the brands and top content that’s heading out for adventure (or back to school) like seasoned trailblazers. Who’s scaling the heights of the top rankings? And whose site can’t carry the load? Grab your gear – or pencils and notebooks – as we explore the data to see who is carrying the day!

- The top domains in the UK for backpacks

- Top 20 domains for shopping (‘do’) searches for backpacks:

- Top 20 domains for informational (‘know’) searches for backpacks:

- What’s trending in the backpack search market?

- The top URLs for backpacks

- Commercial, 'Do' intent URLS

- Informational, 'Know' intent URLS

- Content examples: What type of content is performing?

- High-performance content examples

- High-performance know content

- Summary

- Keyword research in the backpack sector

- Our SectorWatch process

- Curated keyword set and sector click potential

This month, the UK went back to class at the beginning of a new school year. And many of those schoolkids will have gone into the new term with an essential – a backpack.

It’s not just students looking for backpacks – they are also widely used for business commuting and the increase in global travel has driven demand for backpacks of various sizes, as well as those with laptop compartments, anti-theft devices and more.

The adoption of “always-on-the-run” lifestyles has increased demand for performance-proven backpacks among students and commuters. And as more of us engage in outdoor activities, we also need more bags to take with us.

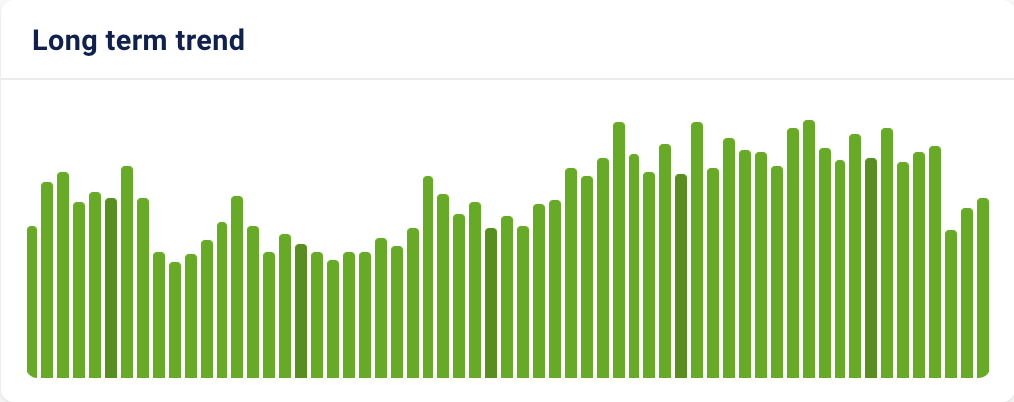

If we look at search trend data, we can see that more people are asking backpack questions or for shopping advice:

Some projections estimate that the UK market for backpacks will be worth almost £700m by 2032, up from £496.7m last year.

After our colleagues took a look at the German market for backpacks, we wanted to see who is winning the search market in the UK.

The market has a lot of traditional bag manufacturers, new challenger brands, retailers with their own lines and all the major sports kit manufacturers. Add all the online retailers who carry backpacks, and you have a sackful of backpack choices and a very competitive search landscape.

The top domains in the UK for backpacks

So, whose content has got performance in the bag and is top of the class? We’ve found the most successful domains for our representative samples of ‘do’ (action/transactional) searches and ‘know’ (informational) searches in the backpack sector:

‘Do‘ searches:

- amazon.co.uk

- johnlewis.com

- ebay.co.uk

‘Know‘ searches:

- reddit.com

- outdoorgearlab.com

- amazon.co.uk

Top 20 domains for shopping (‘do’) searches for backpacks:

| Domain | Project Visibility Index |

|---|---|

| amazon.co.uk | 1185.79 |

| johnlewis.com | 320.44 |

| ebay.co.uk | 219.28 |

| etsy.com | 182.11 |

| thenorthface.co.uk | 175.84 |

| sportsdirect.com | 147.58 |

| houseoffraser.co.uk | 139.01 |

| next.co.uk | 131.69 |

| tkmaxx.com | 114.5 |

| asos.com | 106.53 |

| nike.com | 103.29 |

| blacks.co.uk | 100.04 |

| samsonite.co.uk | 99.35 |

| fiorelli.com | 93.63 |

| argos.co.uk | 92.96 |

| lyst.co.uk | 82.45 |

| gooutdoors.co.uk | 80 |

| glamourmagazine.co.uk | 76.11 |

| mountainwarehouse.com | 73.03 |

| eastpak.com | 72.1 |

Top 20 domains for informational (‘know’) searches for backpacks:

| Domain | Project Visibility Index |

|---|---|

| reddit.com | 638.97 |

| outdoorgearlab.com | 454.2 |

| amazon.co.uk | 382.18 |

| nytimes.com | 371.92 |

| telegraph.co.uk | 371.45 |

| independent.co.uk | 274 |

| travelandleisure.com | 266.73 |

| livefortheoutdoors.com | 243.62 |

| packhacker.com | 240.93 |

| switchbacktravel.com | 159.59 |

| wired.com | 148.54 |

| indietraveller.co | 136.08 |

| gearjunkie.com | 131.07 |

| outdoorsmagic.com | 118.96 |

| glamourmagazine.co.uk | 84.43 |

| nymag.com | 84.11 |

| countryfile.com | 76.75 |

| forbes.com | 76.3 |

| johnlewis.com | 75.11 |

| goodhousekeeping.com | 74.69 |

What’s trending in the backpack search market?

With our keyword list – and a look at our TrendWatch data – we can spot trending queries – those that are gaining in popularity over recent months:

- hiking backpacks

- travel backpack

- best travel backpack / best rucksack for travelling

- best hiking backpack

- rucksack vs backpack

- best backpack daypack

- best carry-on backpack for international travel

- airback backpack reviews

- patagonia backpack

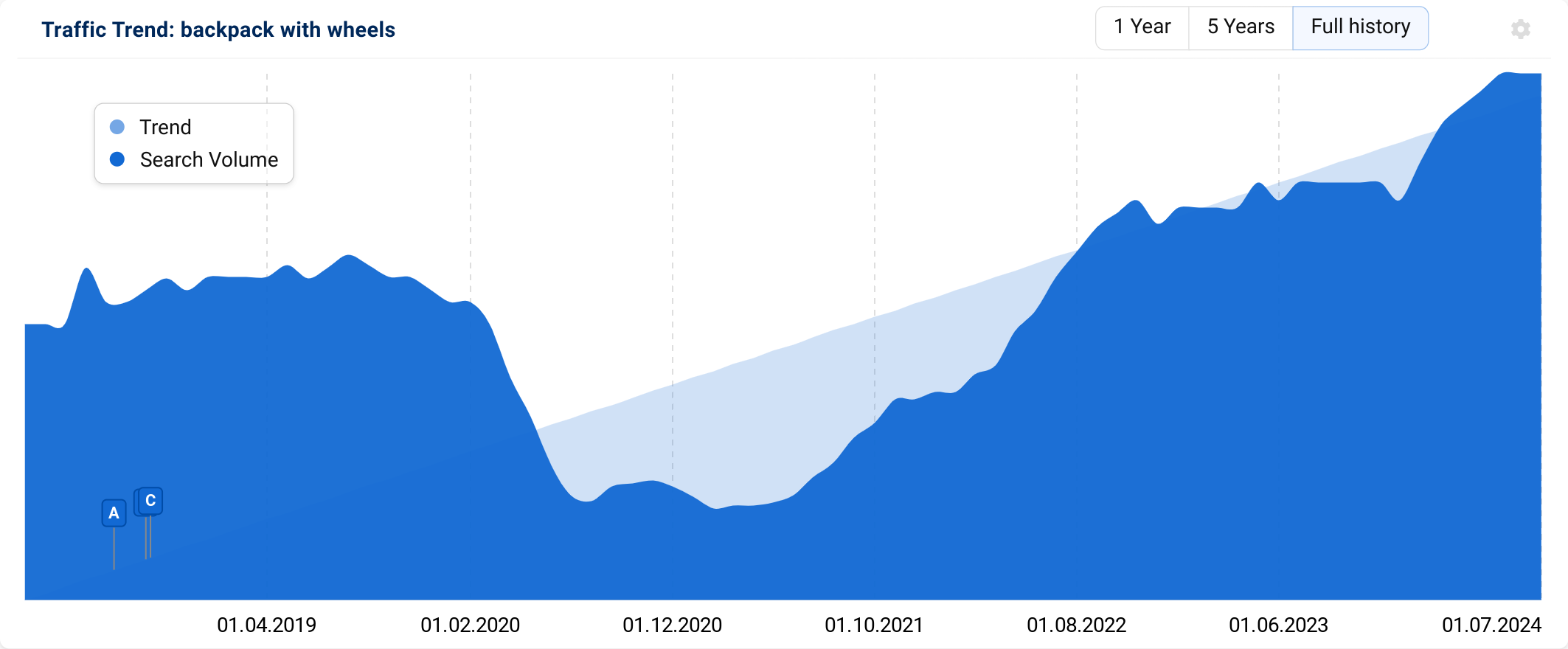

- backpack with wheels

- eurohike backpack

- back pack bag

- backpacks near me

- cabin backpack size

If you’d like insight into even more search trends, and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for backpacks

To research this article and find our winning domains, we build keyword lists in SISTRIX for each of our analysis keyword sets. One set of keywords for ‘do’ searches and for ‘know’ searches. When you build keyword sets, SISTRIX also provides data on the best-performing URLs. We’ve included both of our sets’ ten most successful pages in this table, so you can see some of the best-performing content.

Commercial, ‘Do‘ intent URLS

| URL | Top Keyword |

|---|---|

| https://www.telegraph.co.uk/recommended/leisure/best-backpacks/ | best backpacks |

| https://www.nytimes.com/wirecutter/reviews/best-carry-on-travel-bags/ | best backpacks |

| https://www.independent.co.uk/extras/indybest/travel-outdoors/best-travel-backpacks-b2305919.html | best backpacks |

| https://www.wired.com/gallery/the-best-backpacks-for-work/ | best backpacks |

| https://www.indietraveller.co/best-backpacks-for-travel/ | best backpacks |

| https://www.outdoorgearlab.com/topics/travel/best-backpack | best backpacks |

| https://packhacker.com/guide/best-travel-backpack/ | best backpacks |

| https://www.outdoorgearlab.com/topics/camping-and-hiking/best-backpacks-backpacking | backpack for backpackers |

| https://www.glamourmagazine.co.uk/gallery/laptop-backpacks | best backpacks |

| https://www.nytimes.com/wirecutter/reviews/our-favorite-laptop-backpacks/ | mens backpack best |

Informational, ‘Know‘ intent URLS

| URL | Top Keyword |

|---|---|

| https://www.tkmaxx.com/uk/en/women/accessories/handbags/backpacks/c/01040202 | backpack |

| https://www.johnlewis.com/browse/women/handbags-bags-purses/backpack/_/N-fjgZ1z0roj8 | backpack for women |

| https://www.glamourmagazine.co.uk/gallery/laptop-backpacks | backpack for women |

| https://www.telegraph.co.uk/recommended/leisure/best-backpacks/ | laptop backpack |

| https://fiorelli.com/collections/backpacks | backpack for women |

| https://www.sportsdirect.com/luggage/backpacks-and-rucksacks | backpack |

| https://www.houseoffraser.co.uk/bags-and-luggage/backpacks | backpack for women |

| https://www.johnlewis.com/browse/men/mens-bags/backpack/_/N-ea3Z1z0roj8 | mens backpack |

| https://www.asos.com/men/bags/backpacks/cat/?cid=12888 | backpack |

| https://www.thenorthface.co.uk/shop/en-gb/tnf-gb/bags-equipment-backpacks-rucksacks | backpack |

Content examples: What type of content is performing?

Our list of winning domains is useful, but we start learning more when we analyse the types of sites Google is showing for each of our keyword sets:

- Huge, diverse ecommerce platforms, marketplaces and retailers dominate our ‘do’ keyword landscape for backpacks

- Leveraging their brand authority and massive inventories, we see huge marketplace names such as Amazon, eBay and Etsy from the online world, John Lewis, Sports Direct, TK Maxx, Next and House of Fraser from the retail world (the latter two huge marketplace sites in their own right) and online retailers like ASOS

- Some smaller, specialised retailers, such as Blacks, Mountain Warehouse and GoOutdoors, usually with a high street presence, also regularly rank, all making the top twenty domains

- Some manufacturers, such as The North Face, Samsonite and Nike are doing well, partly as a result of a lot of searches for these specific brands. With success for specific types of searches (outdoor gear, travel bags and athletic bags respectively), each gets a piece of the backpack pie. Some smaller manufacturers, from designer brands like Fiorelli, trusted names like Eastpak, Fjällräven and Herschel plus newer challenger brands like Stubble & Co are also earning some good traction

- Amazon is the clear leader, ranking on page one for an incredible 90.8% of our transactional keywords – if you do a search with buying intent for backpacks, Google wants to show you Amazon

- In fact, for 42.9% of our informational keywords, Google also shows Amazon on page one! With such a shopping ‘goal’ for many ‘best’ searches, Google thinks you might want to cut out the middle man and just buy straight away (whether that’s what people want or not we can’t comment)

- When it comes to our informational content, Reddit is almost as ubiquitous as Amazon is for commercial searches, appearing for 92.99% of queries, on page one 54% of the time

- Community-driven discussions and ‘real-world’ experience are Google’s logic for including Reddit results so often

- After this, authoritative news sites with well-regarded reviews do well, with The Telegraph, Independent and New York Times all in the top ten plus Wired, New York magazine, Good Housekeeping and more all doing well

- But after this, we see a lot of niche expert sites with a focus on a relevant area. Outdoor Gear Lab, Travel and Leisure, Live for the Outdoors, Packhacker and Switchback Travel round out the top ten, with others like Indie Traveller, Gear Junkie and more in the top twenty

High-performance content examples

Now that we’ve found the winning domains and seen the types of sites Google shows for backpack searches, we can drill further into our data to answer the question ‘What do we need to create to bag good rankings?’.

We are looking for high-performing content formats. We define those as pages, templates or sections which rank on page one for a good percentage of their keywords. Content that Google consistently wants to rank for their target terms.

Why focus on these? Because these are great examples we can learn from.

If our winning domains add a new page on a relevant subject using one of these high-performance formats, they can expect to rank competitively for many of their target keywords. If we find such examples, we can see what Google wants to reward.

As we’ve seen, our winning domains for ‘do’ content is a formidable list of the UK’s online retail heavyweights – Amazon, eBay, Etsy, Next, ASOS and SportsDirect.

A couple of other retailers pack a punch where we can learn from their structure and success.

First up is John Lewis, the venerable UK department store. John Lewis has enjoyed a recent upturn in financial fortunes, including putting greater emphasis on their ecommerce store.

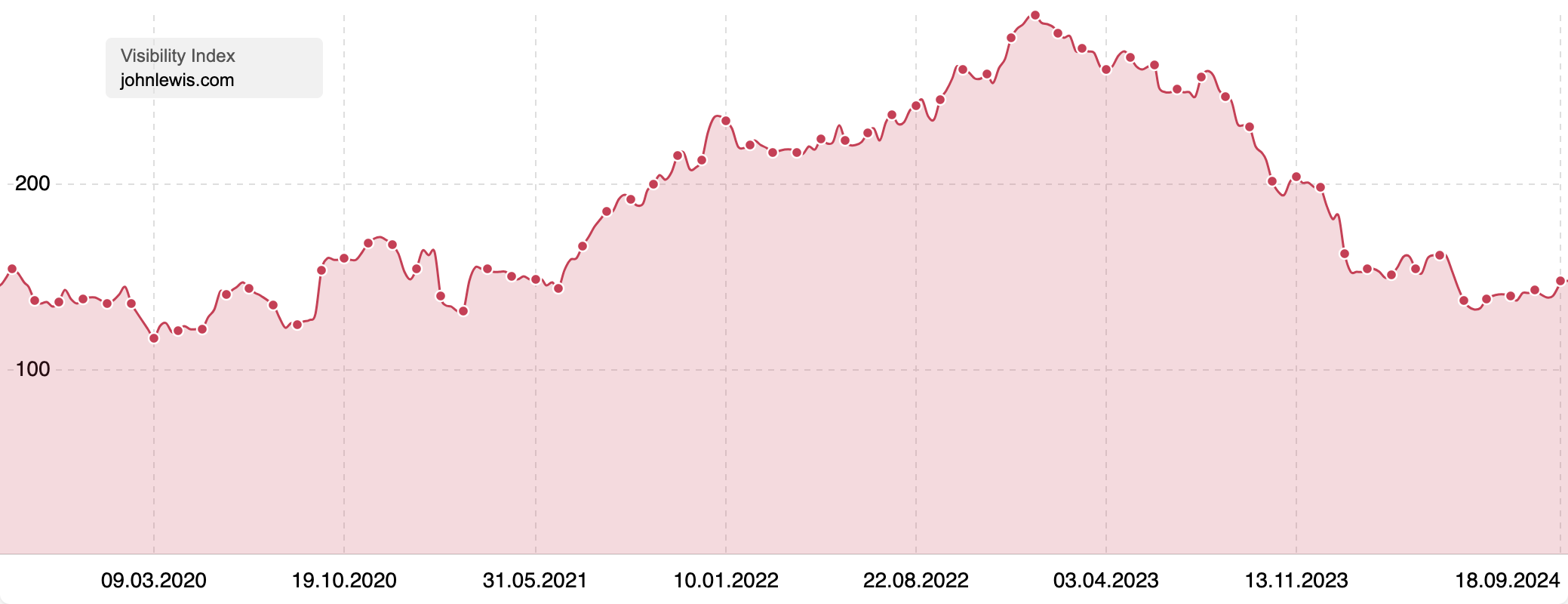

As a department store, they face increasing competition online and we can see their organic search performance has been under pressure

It’s still one of the biggest sites in the UK – 51st in our list of top domains by Visibility Index – but it’s down by over a third since a high in January 2023.

Despite this, it is still our second most visible domain for our ‘do’ keyword set, ranking for 78.5% of our keywords and on page one for 32.2% of them.

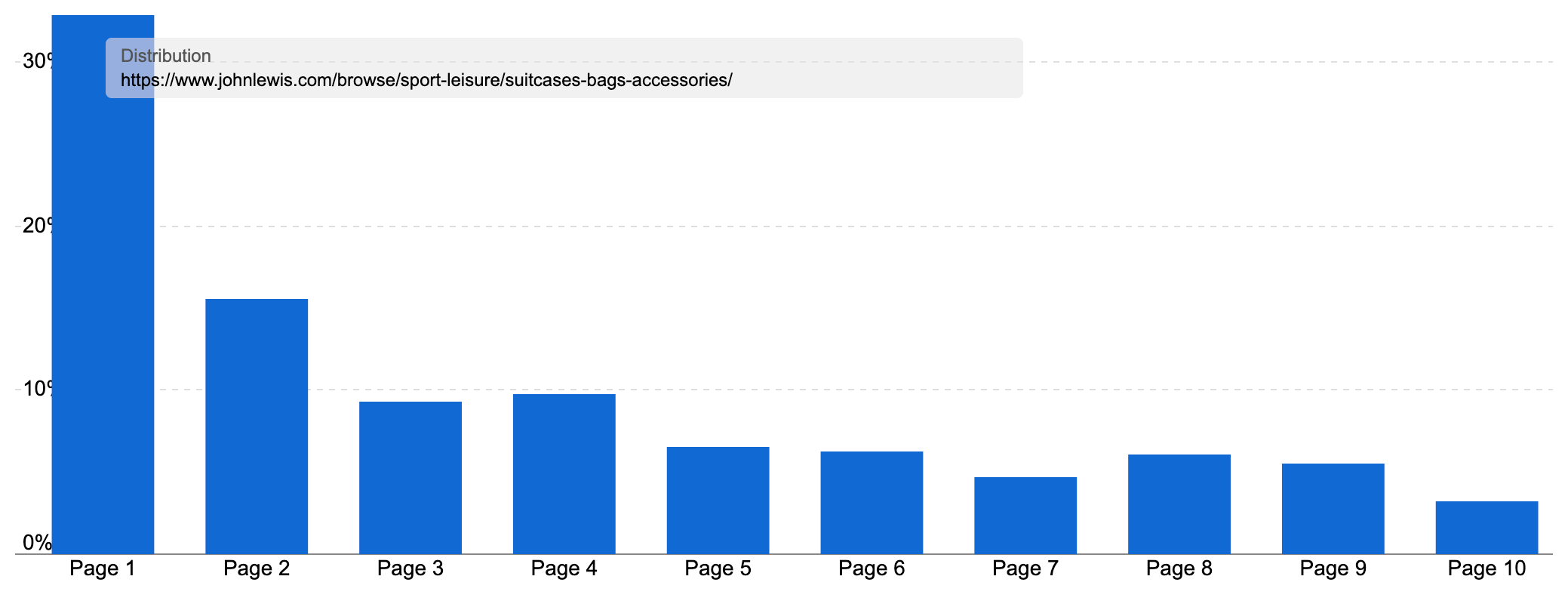

The John Lewis site has a highly granular structure, which combined with their detailed URLs can make analysis of winning content more complex, especially as for our keyword set the site has pages ranking from womens bags, mens bags and school bags, as well as a range from the sports & leisure bags section.

If we focus on the sports & leisure bags section, it ranks overall for 12.5k keywords in the UK. These keywords carry in over an estimated 96k organic visits a month, traffic worth £57k in ad spend.

The keywords are so successful as they rank on page one 32.8% of the time for their most important search topics, marking this as high-performance content:

Much of that success is thanks to that granular structure.

John Lewis has 731 different URLs within its sports & leisure bags selection ranking for at least one keyword. The site breaks down the range by bag type (backpacks, holdalls, suitcases etc.) and then has a range of indexable pages for different facets of each of these bag types.

For example, there are facets for brands, sizes, weights, features, demographics and colour. This gives John Lewis dedicated pages for not only the main bag types, but also the popular ways customers choose, and search, within those types.

For example, John Lewis’ page on backpacks is the most visible page within the sports bag section, ranking for over 1,800 keywords, including top-five rankings for backpack, rucksack, backpacks, work backpack, nice backpacks and 150 more.

But below that page in site and URL structure the site has another 342 backpack variant URLs which rank for at least one keyword in the UK. This includes variants for:

- Leather backpacks

- Fjällräven backpacks

- Waterproof backpacks

- Black backpacks

- Roll-top backpacks

- Teenager backpacks

- Lightweight backpacks

- And many more!

You can see how John Lewis is using customer insight and search data to create hundreds of targeted pages, just for this one product type.

They are successfully using their extensive product range to create bespoke content journeys for their audience. For most medium and long-tail backpack searches with any search demand, they have a specific page showing customers exactly what they are looking for.

Of course, it helps that John Lewis has huge brand equity in the UK, and no doubt [john lewis] + [backpack] searches are common. But a look at the range of product listing pages (PLPs) the site has and the wide range of keywords it ranks for shows that building specific shopping experiences works well in this sector as many pages have a high page-one ratio for their rankings.

The PLPs themselves are carrying their weight when it comes to optimisation (though there’s always room for improvement!)

The main backpack PLP gets a spot in the main navigation has strong filters with 14 different options, and has a clear H1 and title tag, as well as a bespoke meta description. There are also image links to four popular brands at the top of the product listings: Fjällräven, Eastpak, Samsonite and Osprey.

Importantly, it is also stuffed with 348 different products. This is key when it has to compete with giant ecommerce stores like Amazon or eBay plus retailers like Next, which have a marketplace allowing listings from many retailers.

There is a section of intro copy including links to popular subcategories, presumably Lewis’ priority pages (which is great for moving those pages higher in the site structure), though the copy is below the products, so likely rarely read and it is generic information that doesn’t aid the shopping experience.

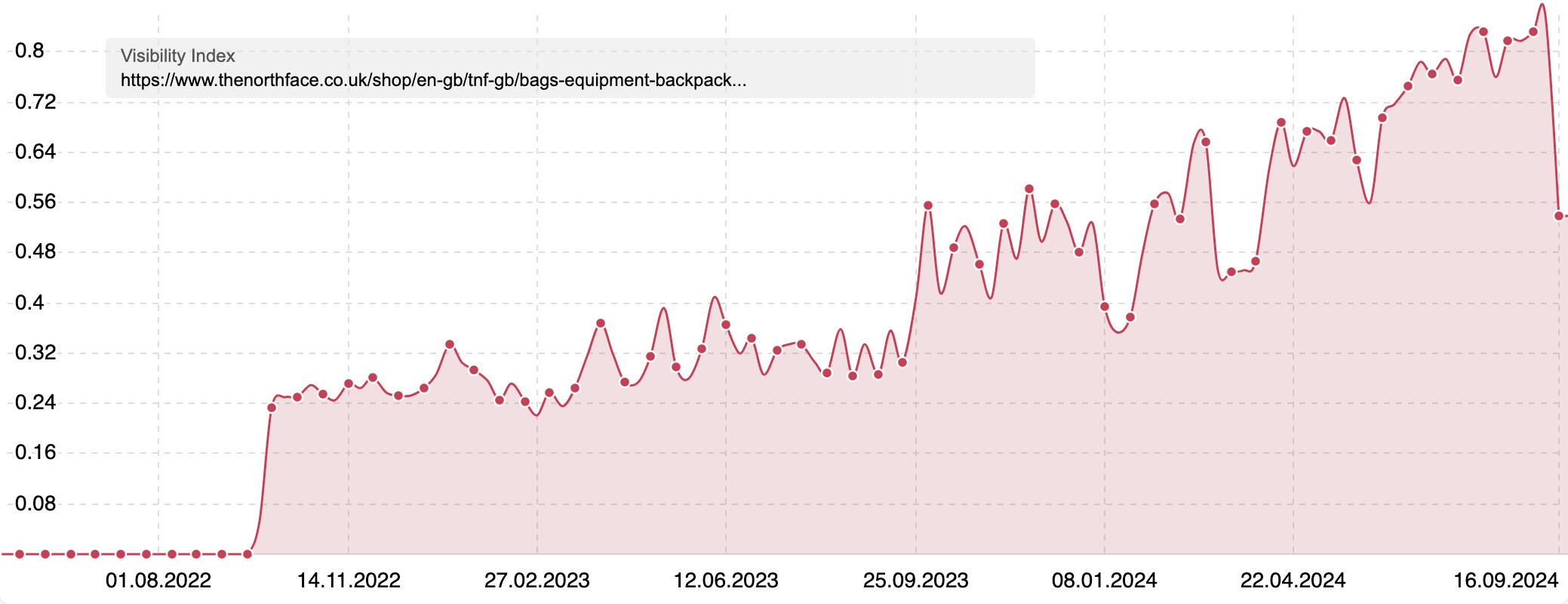

Another interesting success story is a manufacturer, The North Face.

Outdoor recreation products producer The North Face was established in 1968 to supply climbers but is now a UK fashion favourite. No doubt its rankings are boosted by this brand affinity, with 90% of UK customers recognising the logo.

Nonetheless, the brand has a long history of producing high-quality bags, with its top-end products appearing in many roundup lists and getting good review scores. Add this to demand due to the brand’s general popularity, and it’s perhaps not surprising to see them as the fifth most visible domain for our ‘do’ keywords, despite also being sold by most of the other retailers.

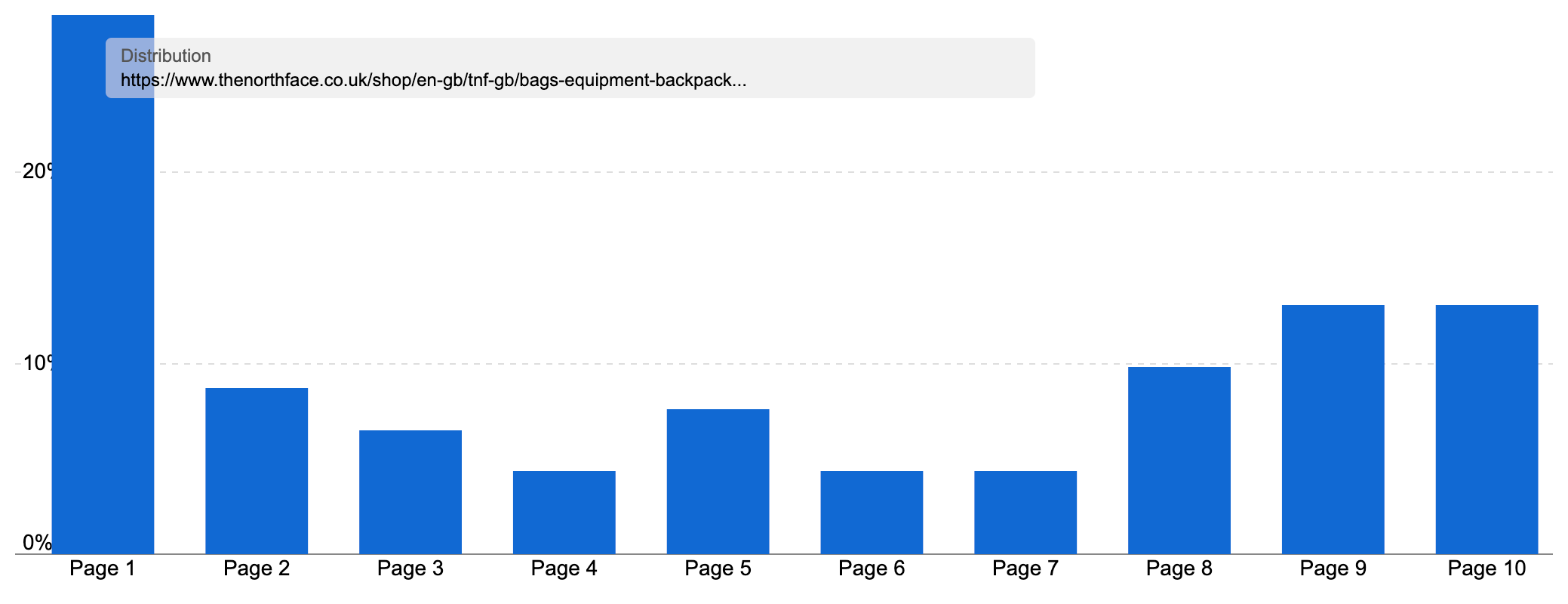

The North Face site ranks for 46.8% (595) of our keywords, thanks to the presence of many ‘North Face’ backpack queries, ranking on page one for 13% (167) of them.

The site also does well for many of the non-branded queries, including top-five rankings for rucksack, hiking backpacks and men’s backpack/backpacks for men/men’s rucksack.

The site uses individual PLPs rather than a backpack section, but its pages on backpacks, mens backpacks, womens backpacks, laptop backpacks and hiking backpacks all feature in the top 150 most visible URLs.

If we look at their general backpacks page, it ranks for 171 of our ‘do‘ keywords, and on page one for 43 of them. Overall, it ranks for almost 2,000 keywords, and on page one for 28.26% of them.

High-performance know content

The clear winner for our ‘know’ keywords is Reddit.

Following its continued growth during the August 2024 Core Update, Reddit is in an incredible position in Google’s search results, with an unparalleled increase in visibility.

Our ‘know’ keyword set contains many queries around finding the best option or answering specific questions about backpacks. These are exactly the types of queries where Google is adding Reddit to the mix to get ‘real experience’ from wider audiences.

After the latest update, Reddit ranks for 92.99% of our 470 ‘know’ keywords, and on page one for a remarkable 54.1%.

If we move beyond Reddit, there are pockets of success for others.

Outdoor Gear Lab, focused on producing the “world’s best outdoor gear reviews” is in second place, with a top ten ranking for 38.6 (182) of our ‘know’ keywords. There are also strong showings for big newspapers such as The Telegraph, New York Times and Independent.

Other specialist sites make up the rest of the top ten. Smaller publishers focus on specific topics, such as outdoor pursuits and gear (Live for the Outdoors) or reviews and guides to help you travel more efficiently (Packhacker).

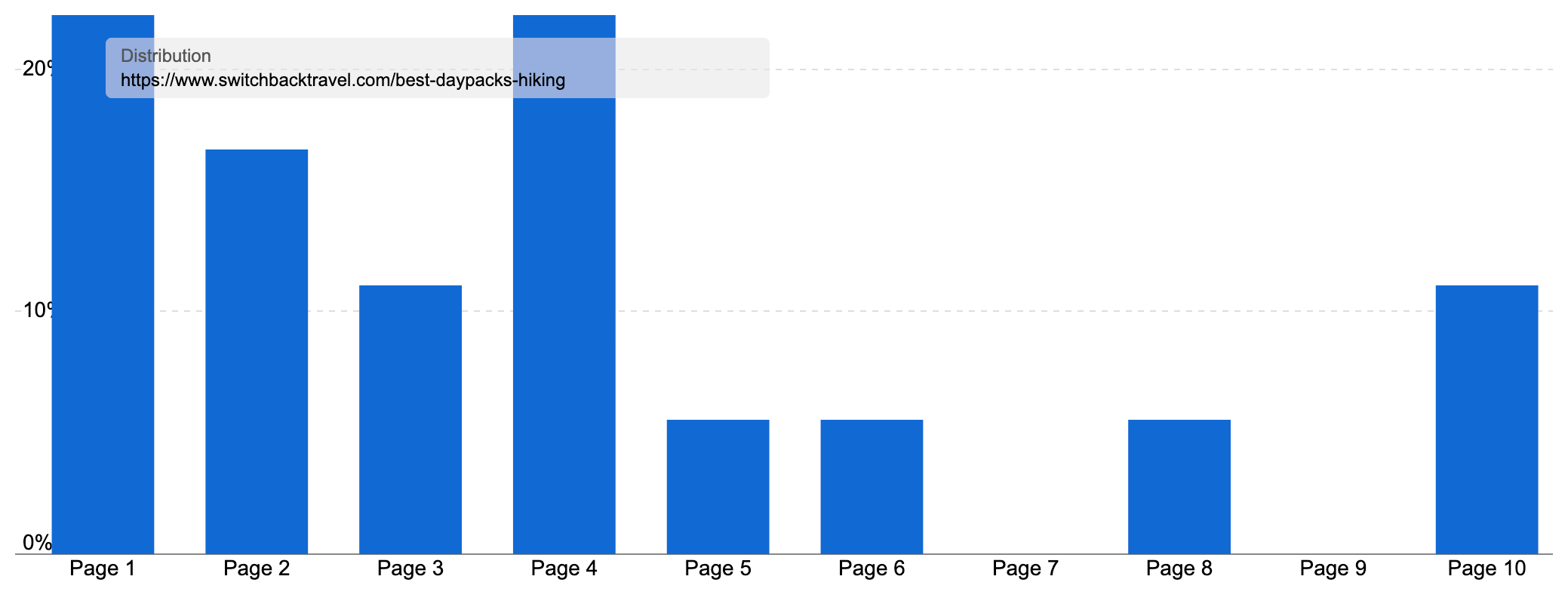

One such example is Switchback Travel, a publication that reviews outdoor gear and offers guides on places to visit. It’s the tenth most visible site for our keyword set.

As you’d expect, they have plenty of thoughts on backpacks and rucksacks for outdoor adventures. This includes pages on the best backpacks for hiking, backpacking, skiing, for women and the top ultralight backpacks which all appear in our top 150 URLs for our ‘know’ keyword set.

Take their guide to the best hiking backpacks – it ranks for 46 of our keywords and on page one for 26 (56%) of them. This includes appearing at number 1 for some of its main target keywords such as best hiking daypacks (450 searches a month).

Overall, it ranks for 621 keywords in the UK. 22.2% are on page one, bringing in 1.2k organic visits a month. Not bad considering the niche topic within our sector and the level of competition.

It’s successful despite being a US-based website, with some of the important stats and characteristics of each backpack – from cost to weight – being in US metrics.

The roundup does include many of the useful features we see Google rewarding as ‘helpful’:

- With 19 different backpacks featured, there is something for everyone

- A comparison table makes it easy to see the difference at a glance

- Author bio links so you can see who is behind the review (and what else they have written)

- The latest update date and a note on what changed

- Clear (and optimised) headings and other elements like the title tag and meta description

- Their testing process, including how this list of recommendations has evolved since 2015

- Perhaps most importantly, as well as product recommendations, half of this huge article is actually a guide to buying a daypack. There’s a set of jump links to 13 different aspects to consider, no doubt many based on common questions we can see online as People Also Ask options in Google’s results:

- Types of daypacks

- Fit and sizing

- Pockets and organisation

- Closure systems and access

- What’s the ideal size?

- Each of these includes a paragraph or two of help, some examples (or example products) plus original imagery

Summary

- The backpack sector is extremely competitive. Backpacks are a common purchase with a lot of manufacturers and retailers and with a lot of sites selling them, competition is very high

- Google clearly favours large ecommerce platforms, marketplaces and well-established retailers. The mixture of product range, trust signals and brand authority means it’s a tight fit in the market with little room for new players without significant brand investment

- But it’s not just about brand size – Thinking about how your shoppers define their needs will help you build an excellent shopping experience, and widen your keyword net, by building landing pages for all the different ways customers buy your product type

- By following how your audience wants to segment the product, you can build pages around common attributes, such as demographic, purpose, colour, material, brand and more

- Don’t just build more pages, build the right pages

- Google loves showing Amazon if the query is even slightly commercial

- However, smaller, specialised retailers and manufacturers can still do well, through close association with the topic (such as Blacks, The North Face or Go Outdoors)

- The reports of Google showing Reddit for most ‘question’ searches are true in this case

- But, as we’ve seen before, it is possible to rank for a competitive ‘know’ topic if you buckle down in producing the highest possible content with truly useful insight if you work hard at your brand, your experience and your offering. That same first-hand experience which Google rewards Reddit for, can also be used to create truly helpful shopping guidance or to answer common questions

Keyword research in the backpack sector

To create useful data for this article, we curated two sets of keywords that are a representative sample of how the UK public searches for backpacks. Our research includes many popular searches by those in the UK looking to buy a watch, investigating what good options there are for sale or asking common questions about backpacks, such as the difference between a backpack and a rucksack or how to pack one efficiently.

When compiling our research, we always categorise keywords by their search intent. We do this to build a picture of the common types of searches done, and the content Google likes to show for each of these query types – what types of pages Google shows when you ask it different questions.

By grouping similar searches and what ranks, we compare content aiming to solve the same problem and appeal to the same audience. We’re able to establish who is doing the best job for each type of backpack search.

We have two lists – what we call ‘do’ keywords and ‘know’ keywords.

‘Do’ searches are those where someone is looking to buy, hire, download or convert in some way. Here, the ‘do’ is buying a backpack, so you might call these transactional or ‘shopping’ searches that represent a conversion intent. In search, we often consider these amongst the most valuable keywords to rank for.

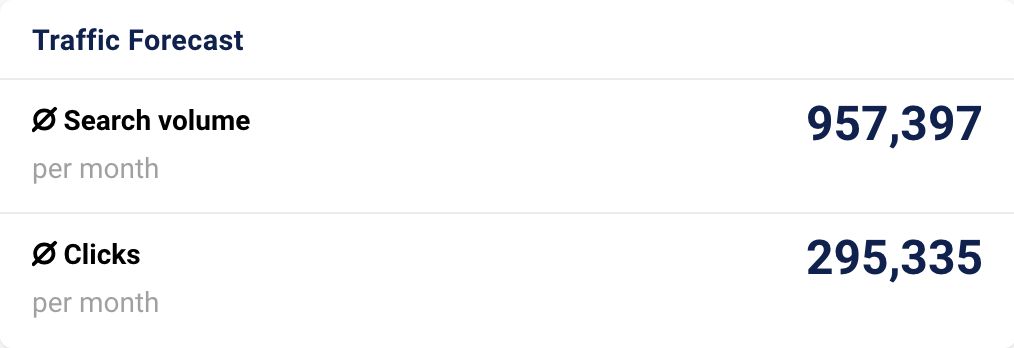

We have over 1,200 ‘do’ keywords, which represent over 957k searches a month on average, with those peaks each August.

We’ve included keywords like backpack (53,900 searches a month on average in the UK, rucksack (28,700 searches a month), laptop backpack (10,900), hiking backpacks (9,900) and black backpack (8,000).

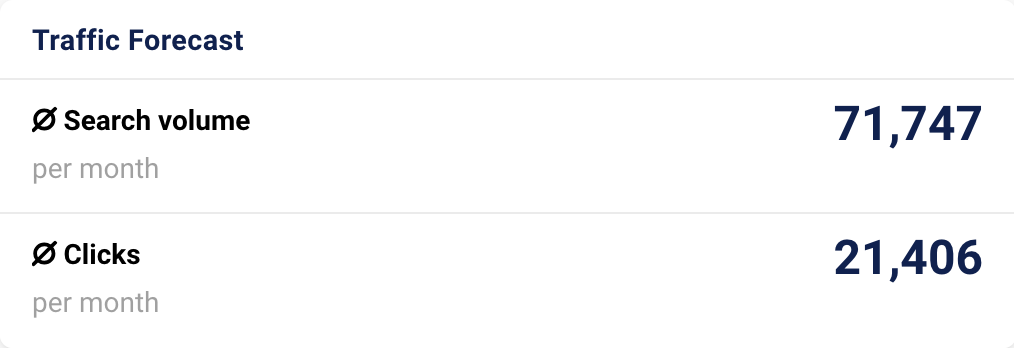

Next, we have our ‘know’ keywords, where someone is making an informational search. For backpacks, we have a lot of searches around finding the ‘best’ option in the market according to experts, product reviews or asking common questions about how to clean a backpack or pack one. We have 470 keywords in this set, representing an average of over 71k searches a month.

Examples include best backpacks for men (1,800 searches a month in the UK on average) and best travel backpack (1,500). We’ve also included common questions such as backpack brands (500 searches a month), rucksack vs backpack (500), how to clean a backpack (550) and how to pack a rucksack (350).

We excluded searches with a retailer’s name as these are navigational searches and not a level playing field to rank for. We also didn’t include searches for ‘sports backpacks’ to keep our research focussed on work, school, every day and walking/hiking products.

We have a detailed step-by-step article on keyword research with SISTRIX tools and data where you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of backpack and rucksack keyword discovery tables. We chose selections of highly targeted keywords with a ‘do‘ intent and a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

Curated keyword set and sector click potential

Core keywords: backpack, rucksack, mens backpack, womens backpack, travel backpack, school backpack, laptop backpack, best backpacks, best rucksack, backpack brands, rucksack vs backpack.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and the traffic forecast you can see below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.

You can assess live data from all domains and grow your visibility with the Free SISTRIX Trial.