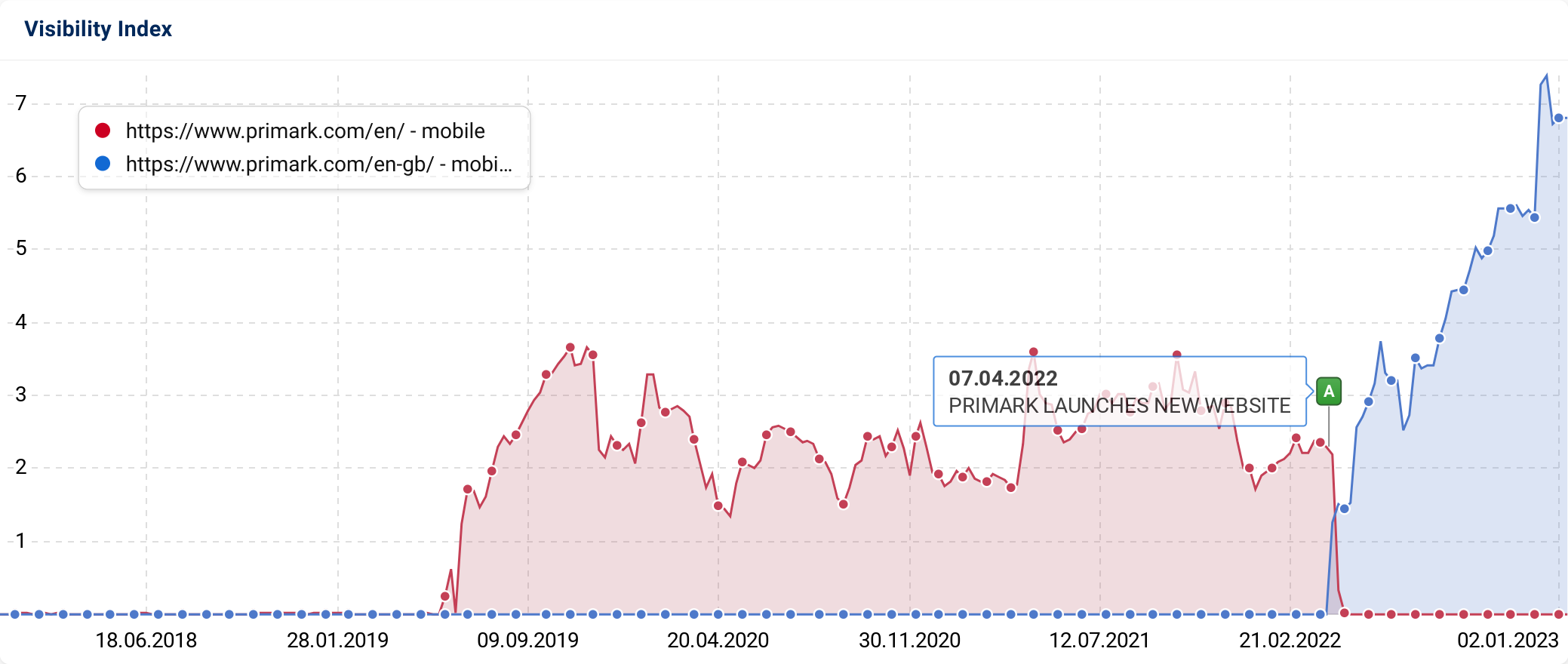

The new eCommerce website, launched in April 2022, was aimed at providing more informational content and encouraging more people to visit stores – the long-awaited Primark digital shopfront has arrived! You can look, you can view availability, you can click-and-collect, but you still can’t get products delivered. That’s what makes this website an interesting case. This article looks at the initial impact of the change, and the changes seen since then. Most recent update: Jan 2023.

Primark migration started April 2022

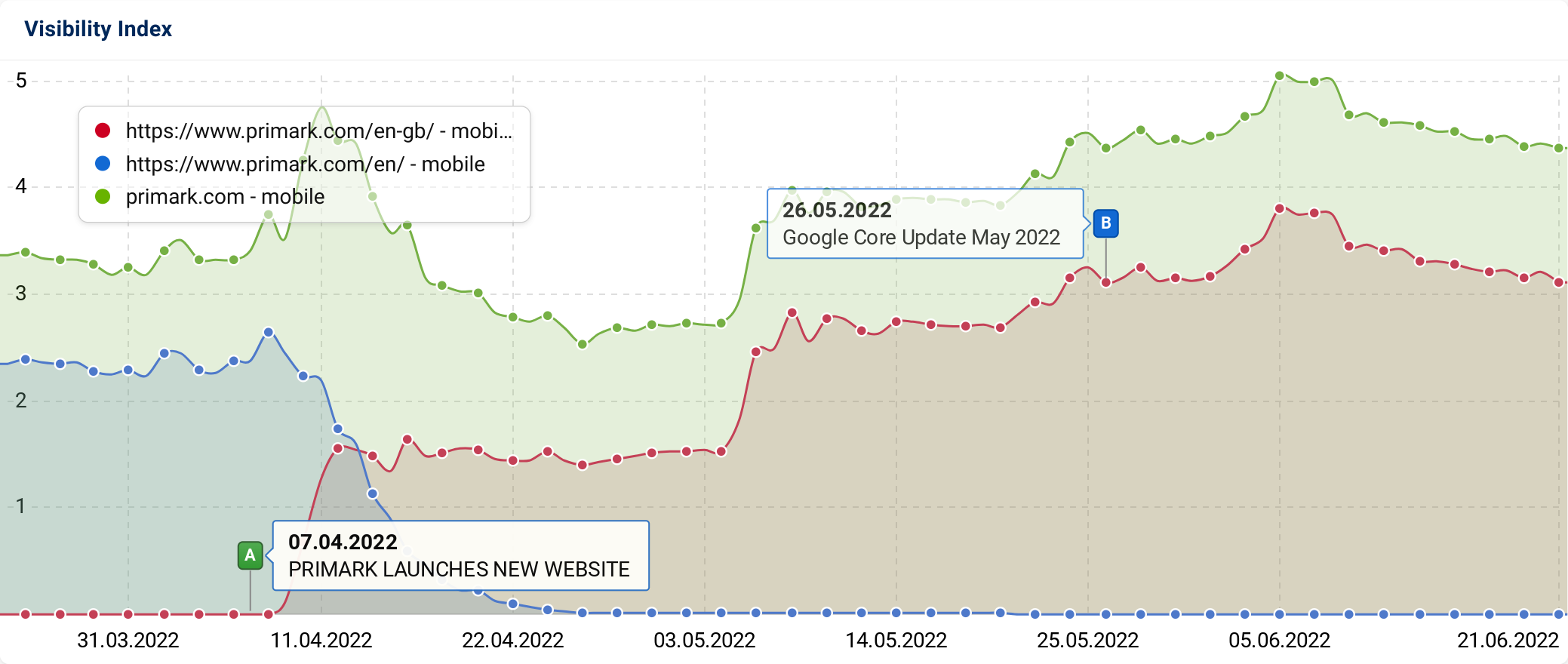

At 4 minutes past 7pm on the 6th April we captured the first keyword ranking on the new Primark website. The URL https://www.primark.com/en-gb/c/men/clothing/tops-and-t-shirts gained a position 61 ranking for “men s marvel t-shirts”. Since then, thousands of keyword rankings have been passed from one directory to another. Here’s the recent status of the overall domain (light green), the old web shop (blue) and the new web shop (red).

After nearly two months of development in the re-building of rankings through redirects it was clear that the migration was completed without any major loss in rankings. In the third month a slowly rising trend formed. The 6 month assesment is shown below.

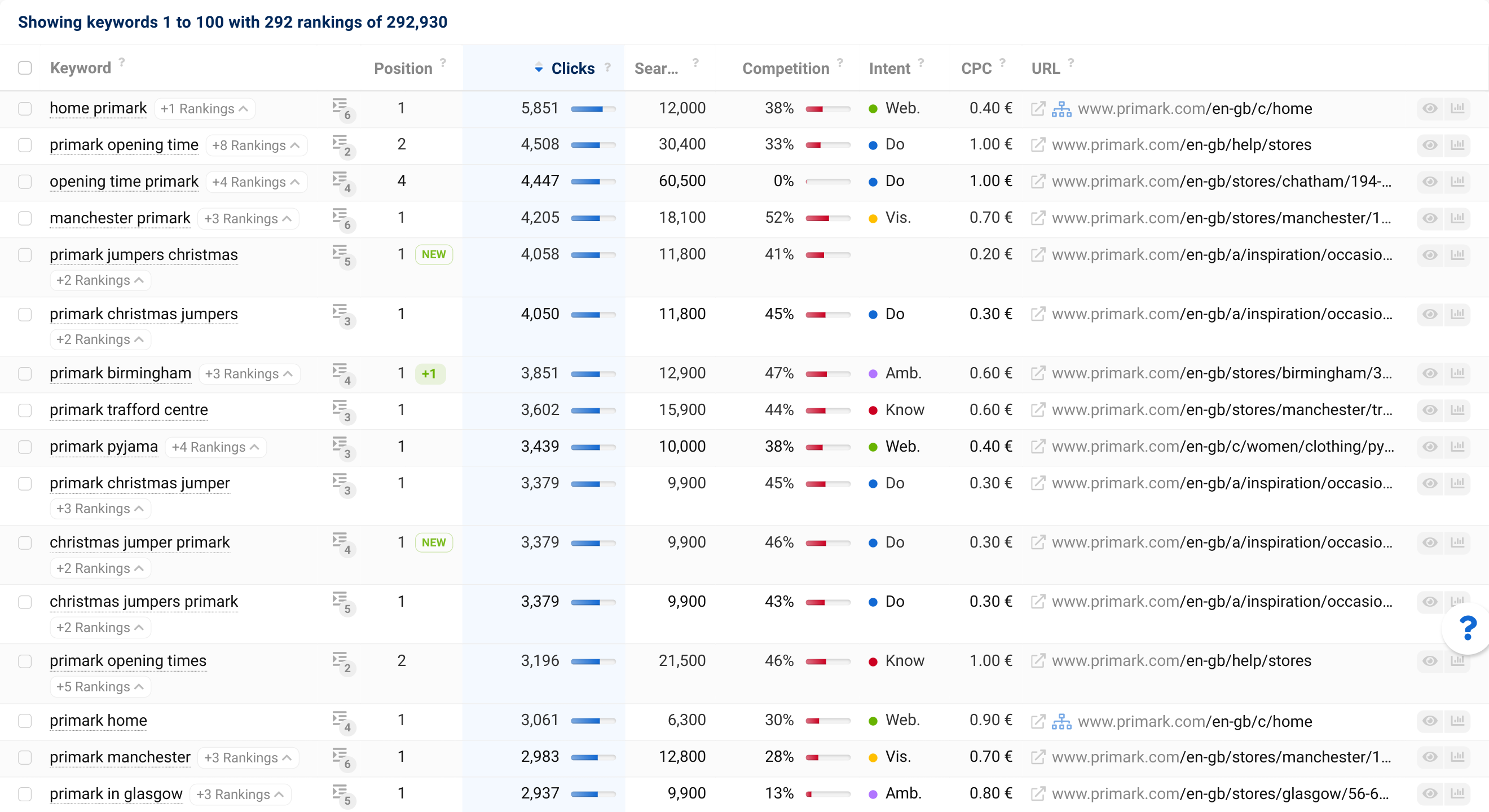

Analysis of ranking keywords at the migration shows that there were very few significant non-brand rankings.

Starting position and competitor analysis

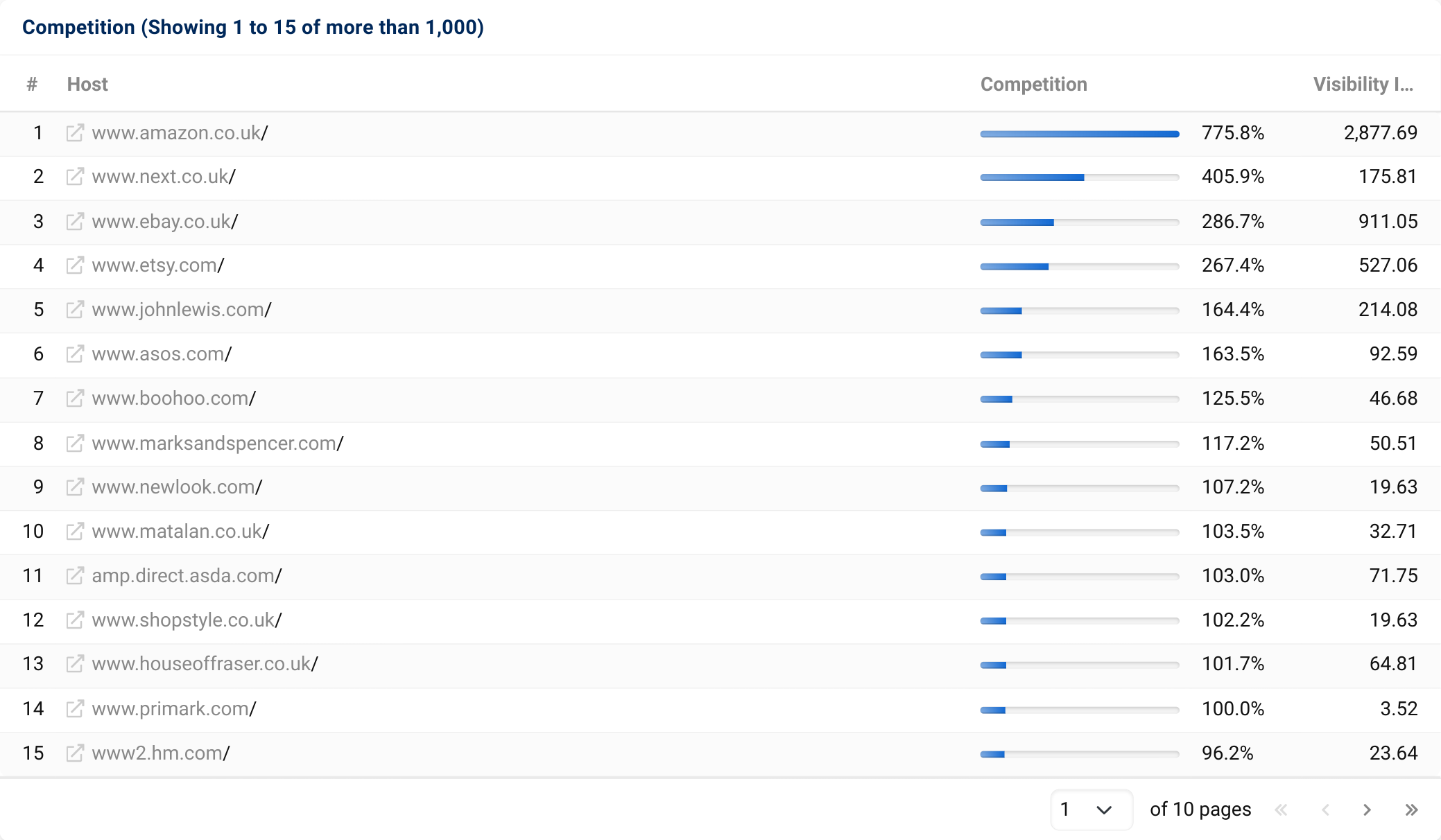

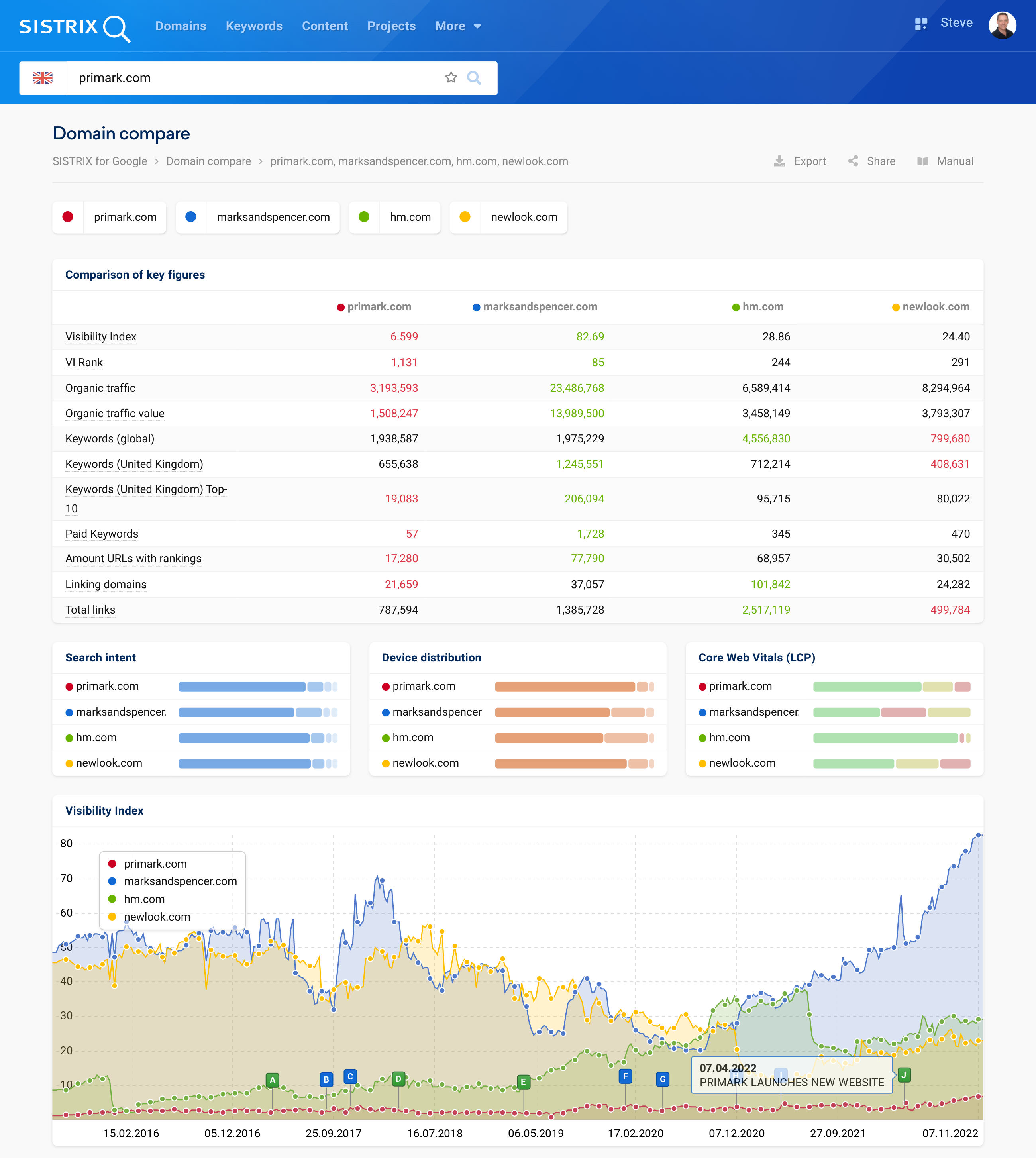

With a pre-launch Visibility Index of 3.412, primark.com is much less visible than most other high street fashion domains. Among Primark’s high-street competitors in the online world are: Next, John Lewis, Marks and Spencer, New Look and many more, all with much more visibility than Primark.

One can’t compare apples to pears so we’ll leave Amazon out of this but next.co.uk with a VI of 175.81 (April 2022) is a comparable business with 51 times more organic visibility.

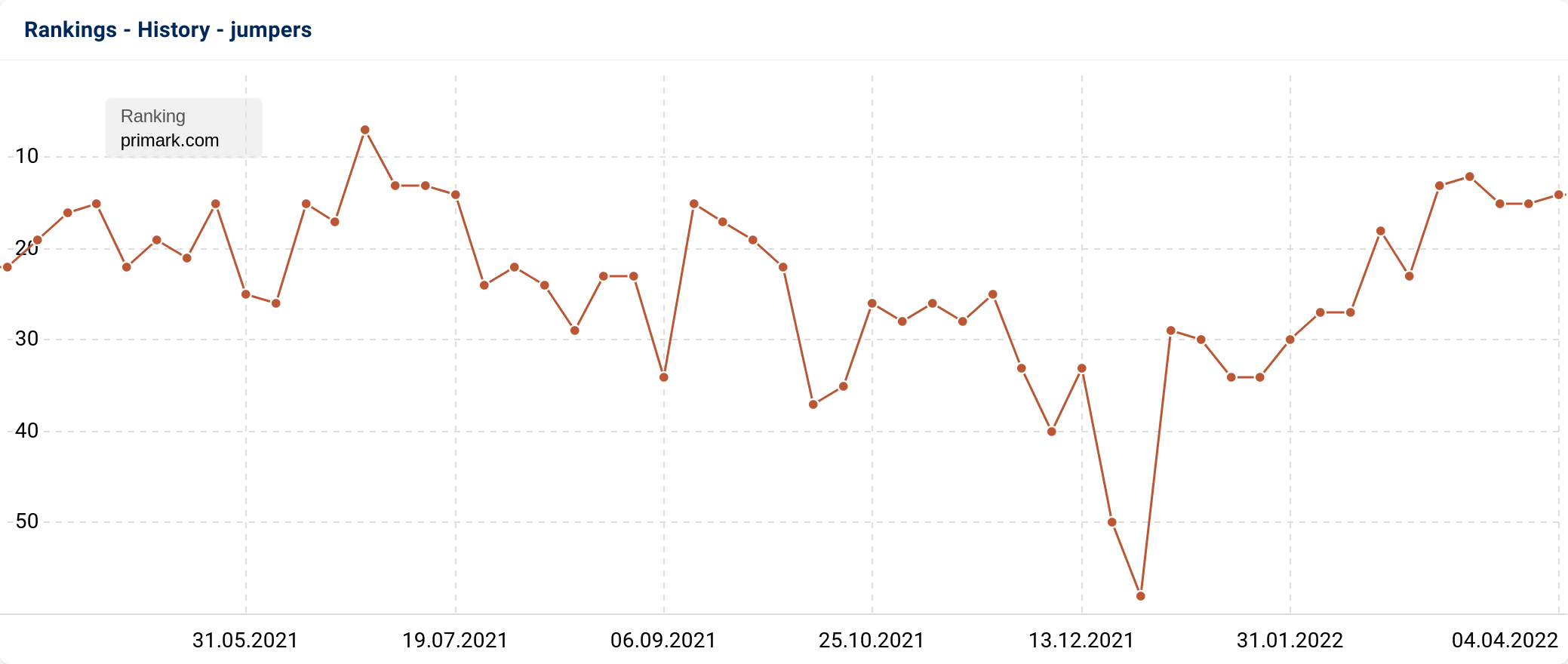

The problem with primark.co.uk is that it simply doesn’t rank well for anything other than its own brand. Only 3% of its ranking keywords are on page 1 and of those, the vast majority of the search volume is for Primark-related topics – so-called branded search. The most successful non-brand ranking is for fluffy socks. When you take a search with more search volume, like “jumpers”, the ranking success is typically page 2 and beyond – effectively invisible.

An important part of SEO, of increasing visibility in Google search, is targeting the correct user intent, and there’s a simple way to find that out – by understanding the organic search results, and the SERP features around them.

For example: Do people want to know how a jumper is made, or do they want to see some prices and buying options? The former query would be classed as a ‘know’ query. The latter, as a ‘do’ query and search results and features would typically match the users search intent.

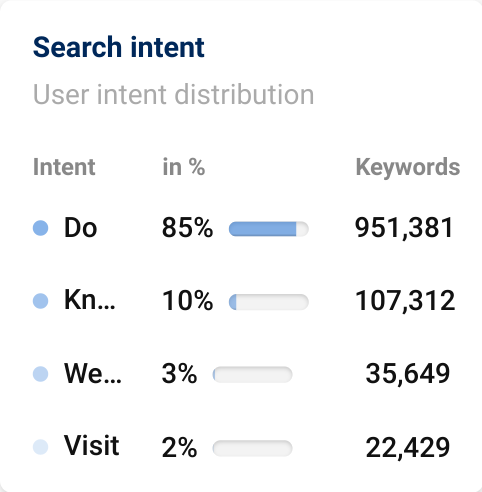

Let’s take a look at where a competing website is get their keyword rankings, and visitors. This is the summary SISTRIX analysis on search intent across the domain next.co.uk:

85% of the keywords ranking for next.co.uk are in SERPs that can be classed as ‘do’, which means, Google thinks the searcher wants to take action. Next overlaps nearly all of Primark’s non-brand rankings. In page 1, non-brand keyword rankings, Next is ahead of Primark in all but about 1% of keyword rankings.

There’s a high chance that the ‘do’ intent, the buy option, is the reason that primark.co.uk is not reaching searchers.

The domain next.co.uk is a blueprint for success in this market and to beat them, Primark needs to be better.

The new Primark website

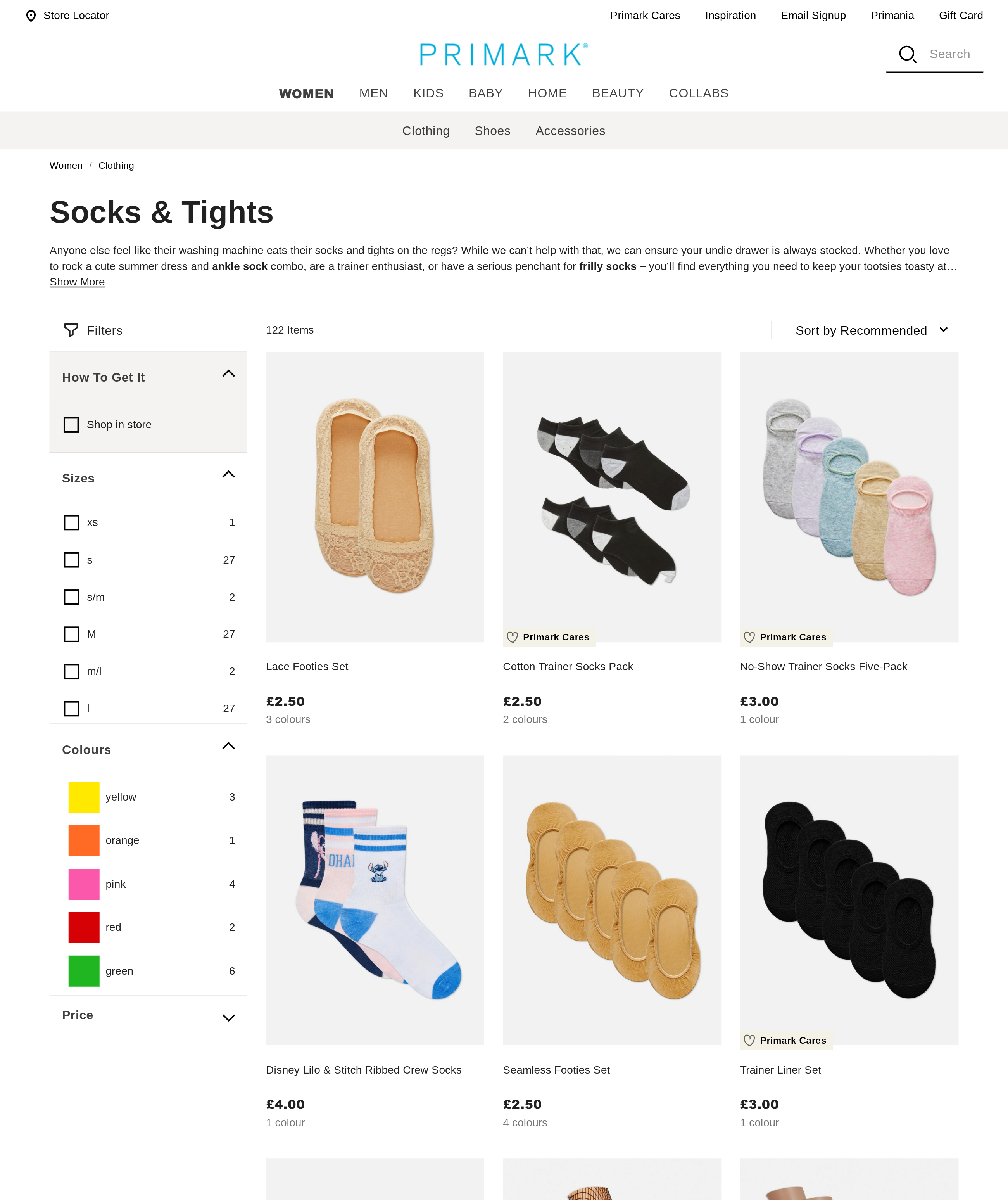

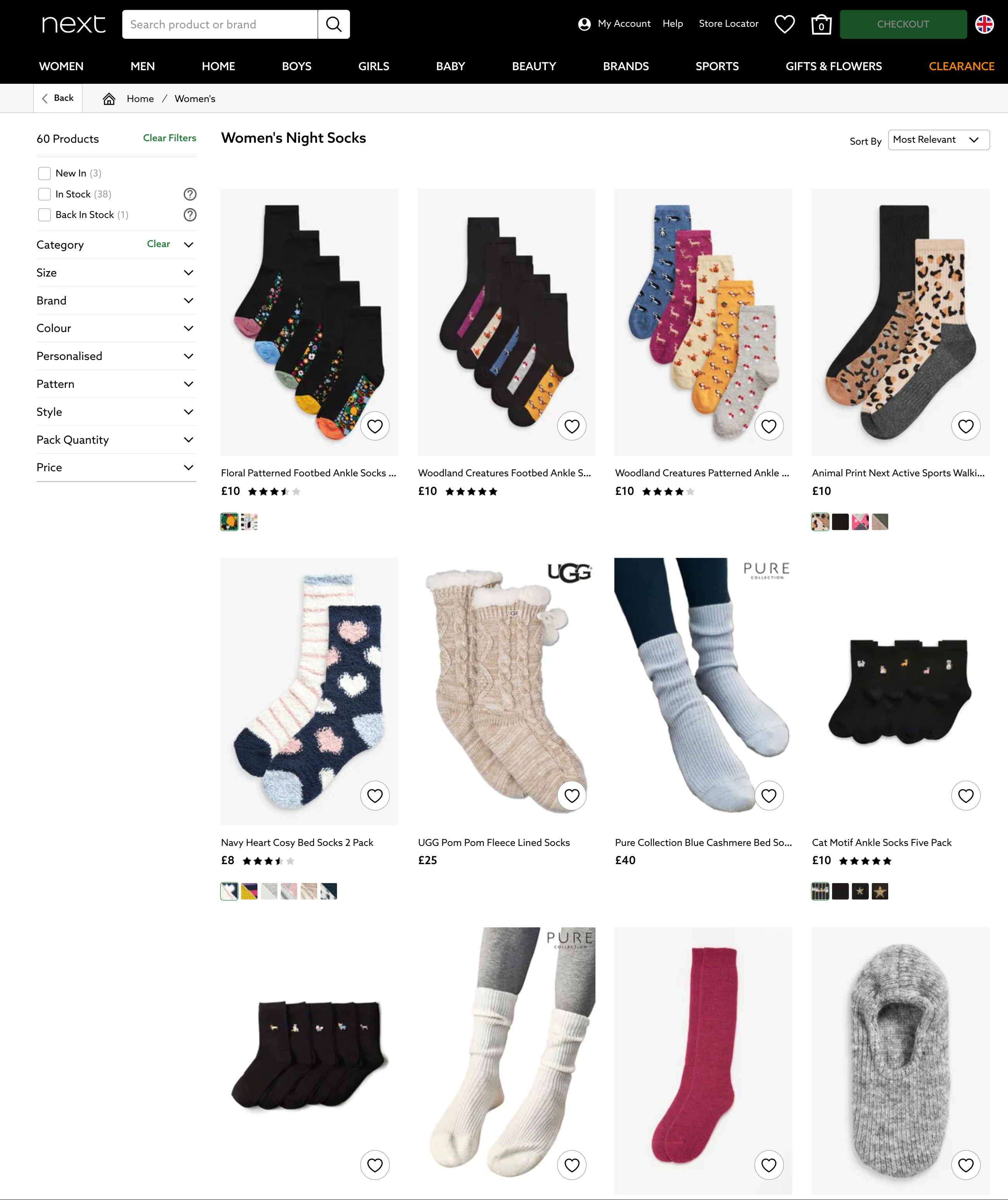

The new website was announced last year and Primark clearly stated that it would be non-transnational. A look at the user interface shows similarities with its competitor. Next.

The Primark page ranking for “fluffy socks” above, compared with the Next page ranking for “fluffy socks”, below. There’s little difference in the look and feel, but some differences in the features available.

Update: 14 Nov: Primark says that click and collect is now on trial in 25 stores in England and Wales. We’ll continue to track developments as the personal account features roll out.

In terms of structure, we know that the new product website for the UK (the first of a number of country rollouts) has been created under

https://www.primark.com/en-gb/

We know, via company statements, that the new site is going to hold more products. By looking at the site itself, and looking at some of the current redirects, we can also see that it’s probably going to have a different structure and hand-crafted redirects, which makes it challenging for the engineers working on it, and challenging for Google. Here’s an example of one of the redirects.

https://www.primark.com/en/all-products/womenswear/clothing/socks-tights/socks-ankle-fluffy/c/womens-socks-tights-socks

Now redirects to…

https://www.primark.com/en-gb/c/women/clothing/socks-and-tights

There’s a clear structure change there. Is Google going to have to spend a lot of watts and dollars trying to understand the new structure? If that’s the case then, as we’ve seen before, this migration could take a long time. 3 months is common. [Latest update and analysis included below.]

If the new website is faster and if the store-availability feature satisfies the average searcher, primark.co.uk could increase visibility for searchers, but the intent and competitiveness is not obviously better than before. If it fails to satisfy new searchers, the website simply continues to serves existing primark fans.

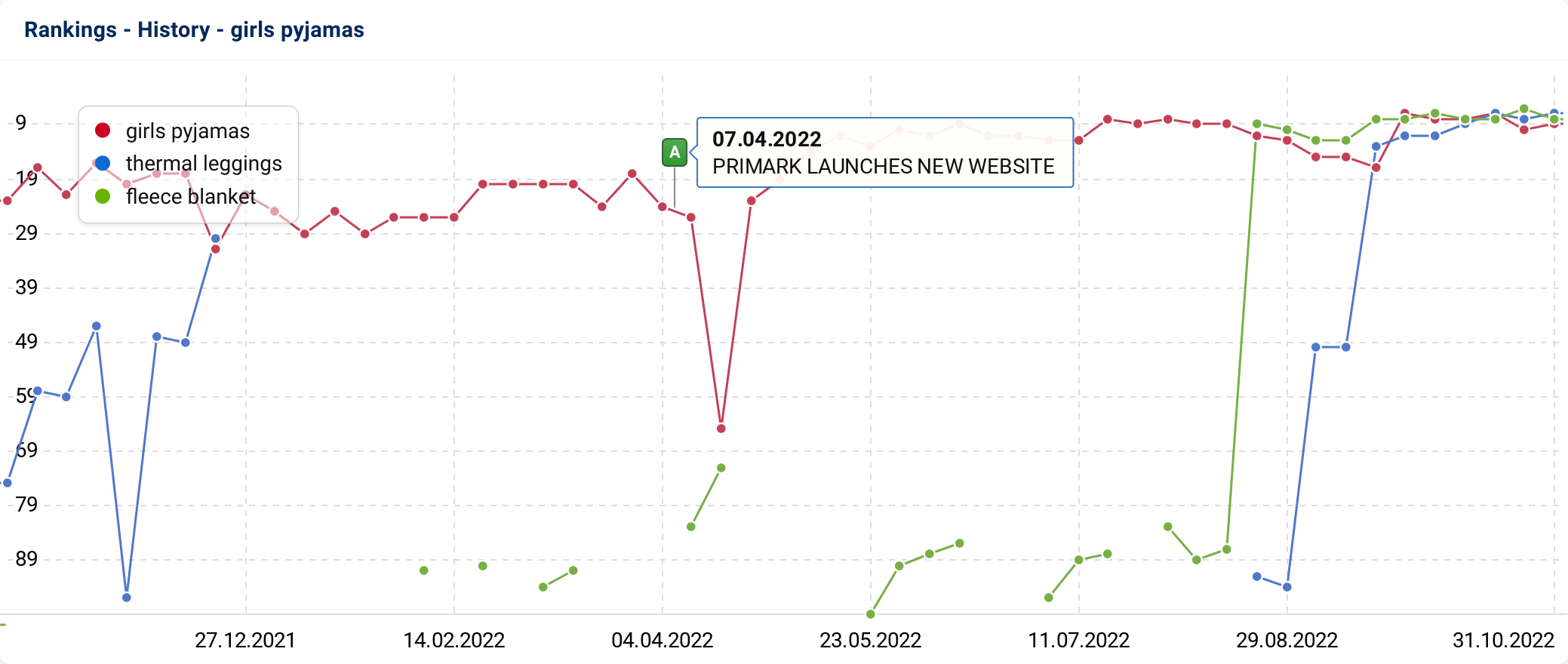

Signs of a rising trend

After eight months, there are signs of success, and Primark have confirmed this in their annual report.

In absolute terms there’s still a lot of work to be done with only 2% of ranking keywords appearing on page 1, but the trend is clear to see, and it’s important to note that it hasn’t been effected by any Google updates during the period.

Primark is no stranger to moving directories around, but it’s clear that the 2022 change has but them on a new trajectory. There are 6,733 examples of non-Primark keywords that have entered Page 1 positions.

Most of the most page 1 results are taken by product pages, but category pages are also showing success. We note that Primark have not yet launched personal logins and wishlists, as announced previously.

At 1/25th the visibility of next.co.uk, they remain a minnow, but it’s important growth when compared to where they were in April 2022, the trajectory is good and there’s a lot of potential.

Here are the latest figures for some key competitors. (Nov 2022)

Latest SISTRIX data for primark.co.uk

If you have SISTRIX access, the day-by-day visibility graphic is available here. The live keyword data is available here.

Find out more about the SISTRIX live data.