Following a quiet first quarter in the organic search world, Google’s May 2022 Core Update certainly provided some much-anticipated spice to the SERP. Some websites saw their visibility reach all-time highs whilst others experienced spectacular losses.

This round-up looks at ranking uplifts and downturns across the Google UK search landscape and unpicks the potential how and why.

Methodology

We have used the SISTRIX Visibility Index to analyse the 250 winning and losing domains in the UK Google SERPs to understand which have seen the most visibility change over the last quarter. Please note: The index scores provided do not consider external influences, such as seasonality.

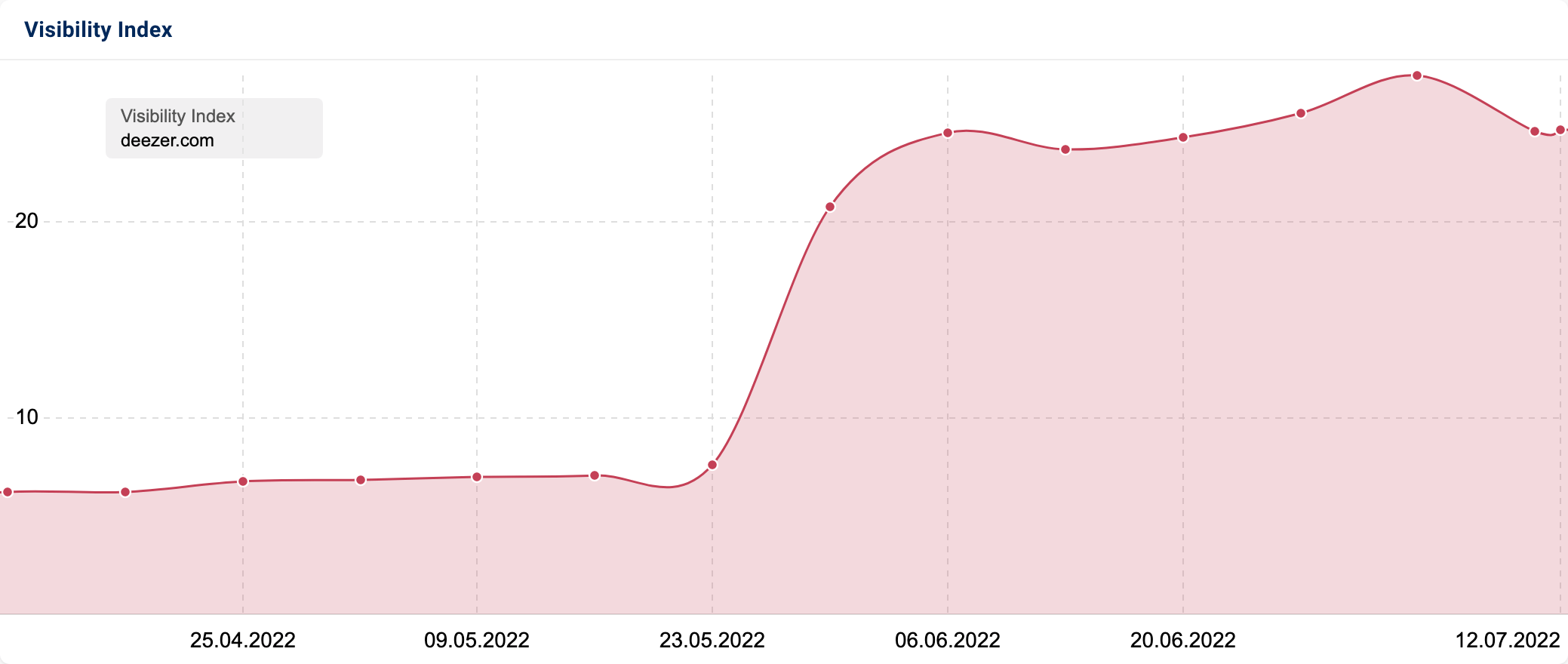

Directory success for Deezer

Parisian-based music streaming platform, Deezer, has experienced the biggest increase in its Google visibility index score from 1st April to 30th June 2022 (+498.1%).

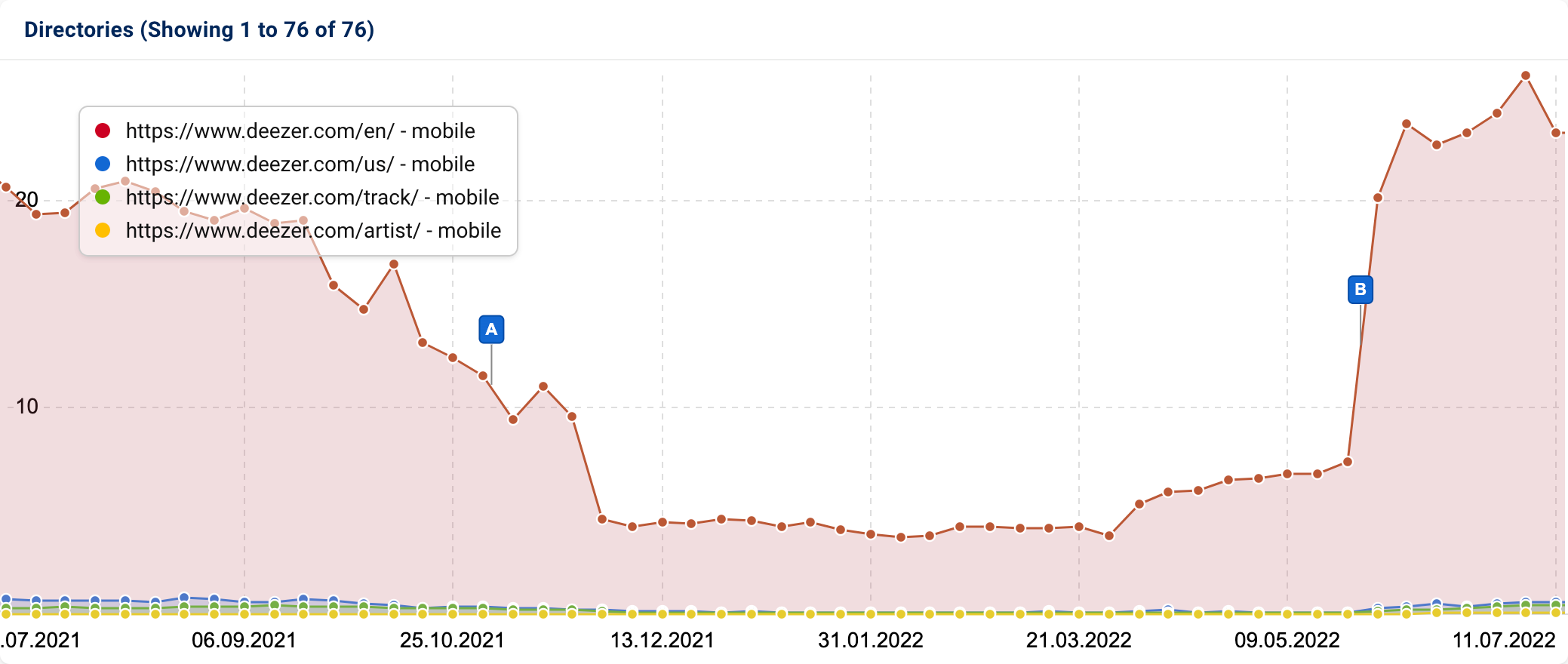

From closer examination of deezer.com’s directories, the most notable growth is associated with its /en/ directory.

In June 2021, the section’s SERP visibility started to tumble. The November 2021 Spam Update added further insult to injury, with visibility levels remaining low yet stable from late November until the end of March. However, at the beginning of April 2022, deezer.com/en/ saw an incremental increase in visibility, including a notable peak during the May 2022 Core Update.

Interestingly, Deezer’s increase in UK Google search prominence aligned with the company’s SPAC (Special Purpose Acquisition Company) merger with I2PO – headed by a former WarnerMedia executive – and its consequent publication on the Euronext Paris Stock Exchange.

The keyword ranking change data confirms that 286,312 ranking increases were recorded (inclusive of newly acquired keywords) for the /en/ directory from 4th April 2022 to 27th June 2022. The majority of keywords that experienced increased search ranking related to artists, such as “Fleetwood Mac” (+23 positions) and “Little Mix” (+18 positions).

The increase in online citations and diversity in referring domains relating to Deezer’s financial success over the last three years may have also influenced their recent organic success.

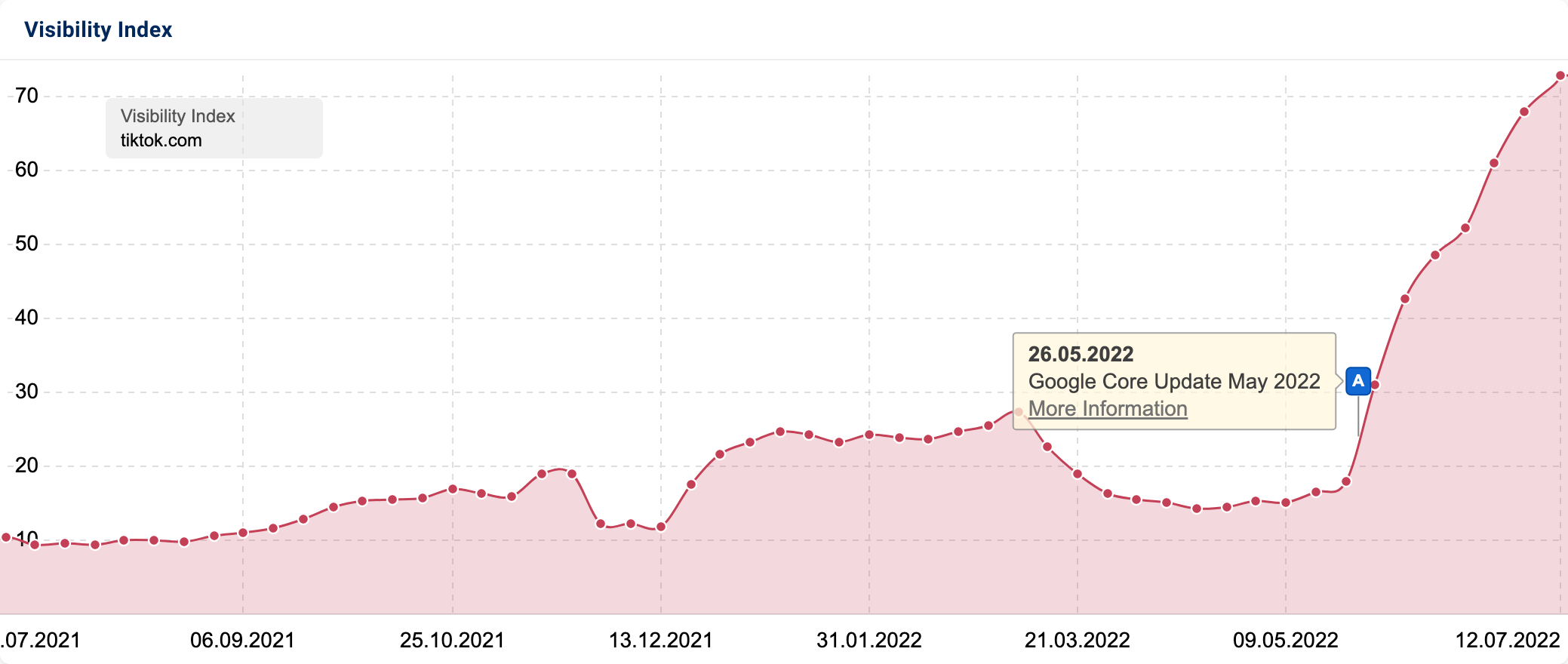

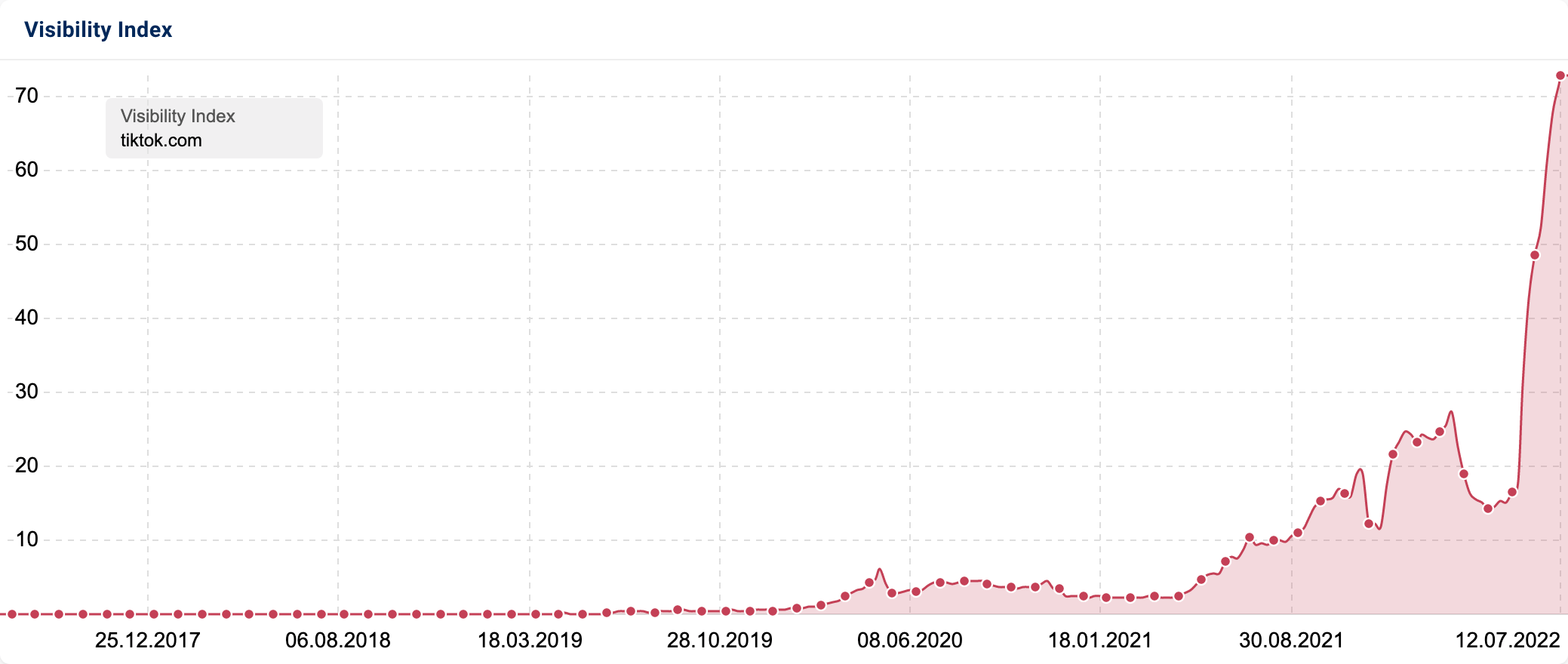

TikTok triumph

As the fastest-growing social media platform, it is hardly surprising that tiktok.com is featured within our list of top-performing domains for the quarter (+265.8%). For those who are unfamiliar, TikTok is a content paradise. It is full of creative, informative and relatable videos which leave users scrolling for hours on end and losing the concept of time in the process!

As of Q2 2022, it has also reached its all-time highest visibility on UK Google search, with the recent spike in growth initiated just days before the release of Google’s May Core Update.

Along with refining the mobile app, TikTok has also made gradual changes to the desktop version (available at tiktok.com). These include updates to the internal search experience to improve how users browse video content targeting specific topics and hashtags as well as the introduction of Discover in 2021. Discover served users random videos that may be of interest to them.

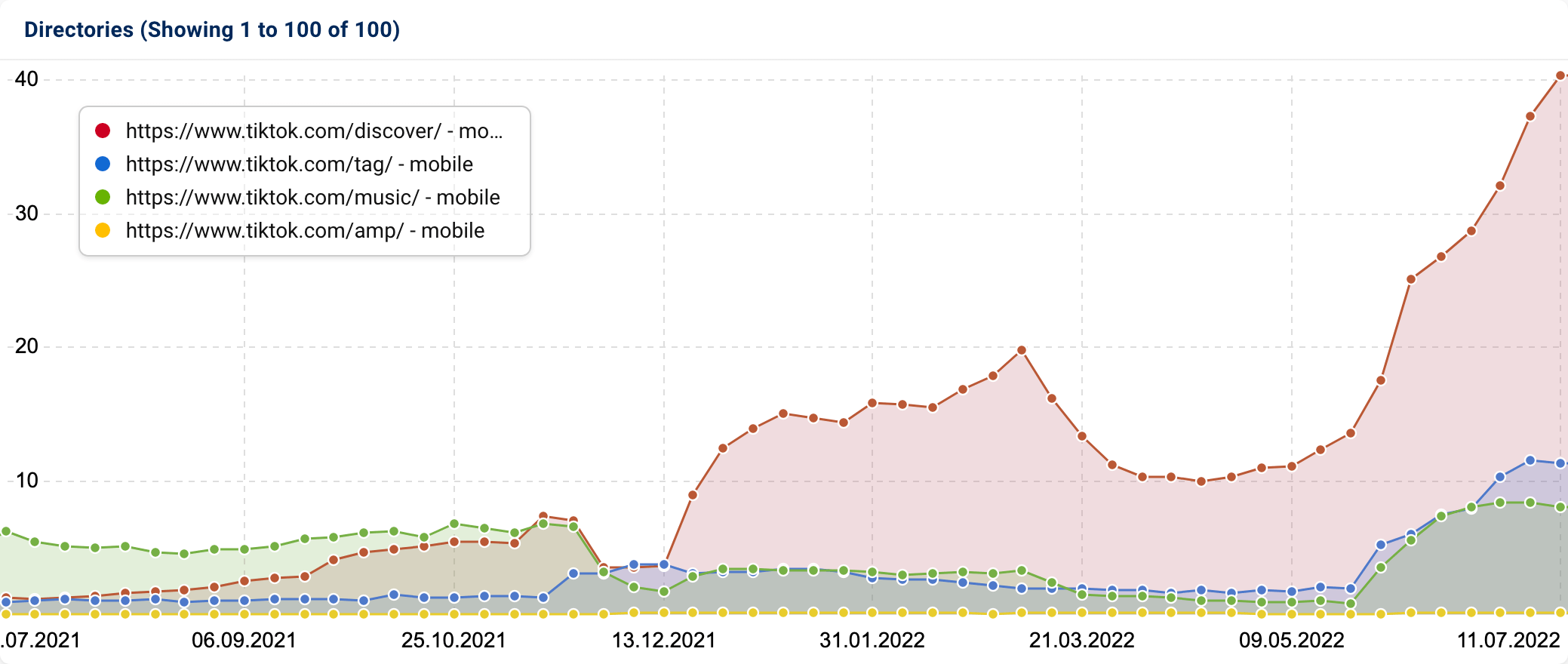

Since its launch in October 2021, the /discover/ directory has experienced the most significant growth in SERP visibility on UK Google, followed by /tag/ URLs; auto-generated URLs corresponding with hashtags users add to video descriptions.

As more sounds have been added to TikTok’s sound library, the /music/ section has also seen incremental growth in visibility.

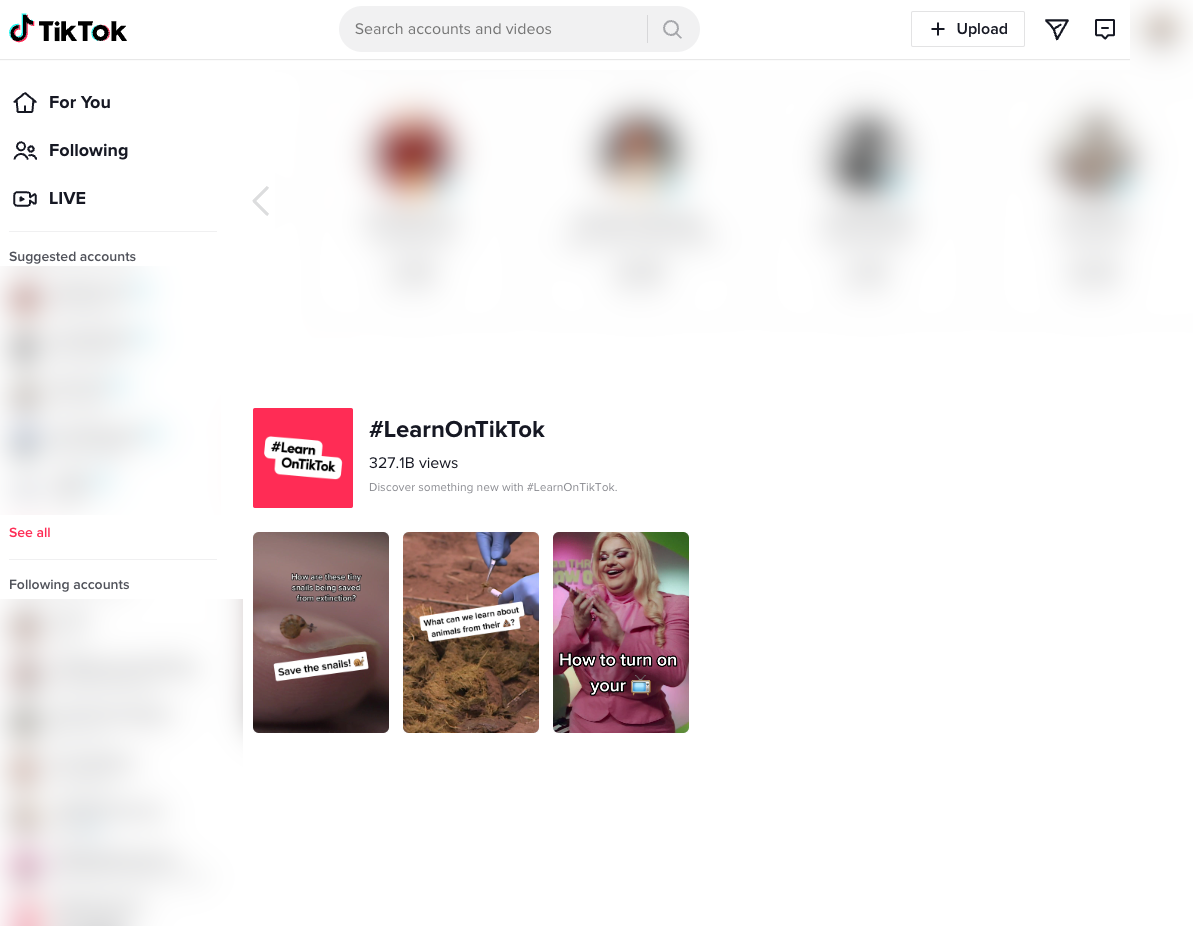

In late April/early May 2022, TikTok released an update resulting in the removal of the Discover. Whilst the Discover page is not entirely contentless for signed-in users, it only contains links to a few suggested videos, suggested accounts, accounts followed and their latest campaign: #LearnOnTikTok (which resides in /tag/ directory).

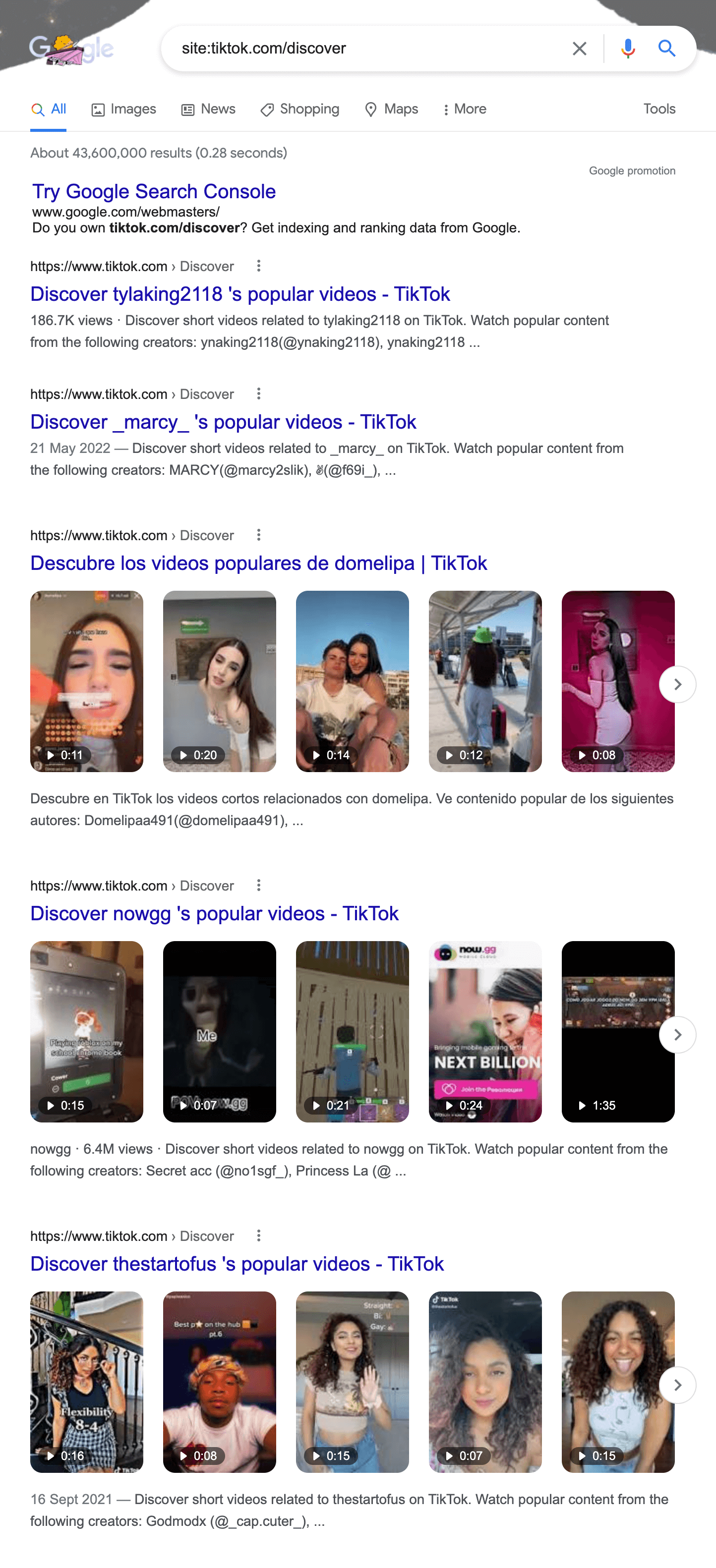

Manually searching for Discover pages using Google’s “site:” search command revealed that Discover pages for specific users are still available in the Google SERPs. However, from inspecting the cached versions of these, we can see that they were temporarily deactivated around 24th June.

SISTRIX’s link metrics also indicate that since its conception, the number of backlinks associated with the /discover/ directory has notably increased. The sources of those backlinks have also diversified over time too.

The reactivation of the Discover pages, which showcase the most popular videos from each user, explains why this section is still performing highly. However, it also highlights a discrepancy in content accessibility across the desktop and mobile app versions. For the best user experience, user content should be accessible regardless of device or platform.

Is it possible that TikTok is currently reworking Discover, ready for a relaunch on the app? We will have to wait and see.

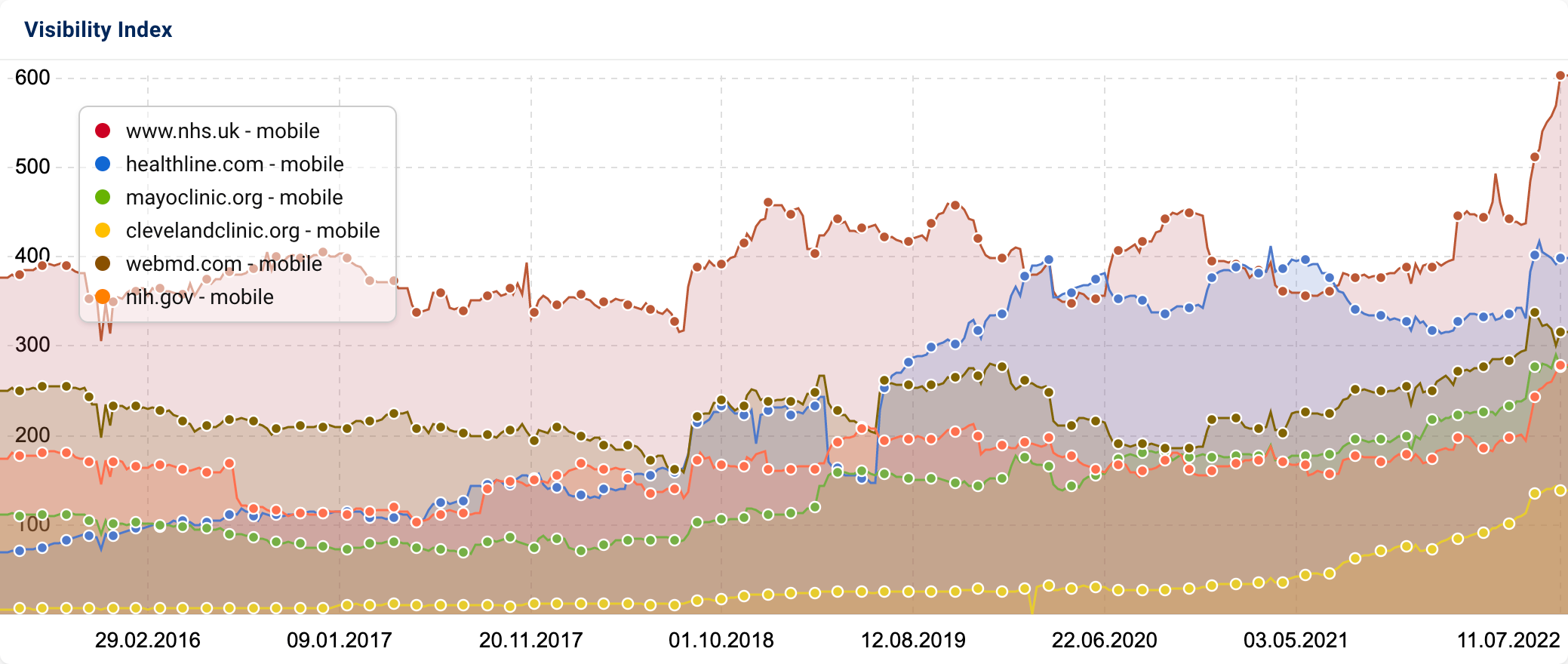

High performance for health sites

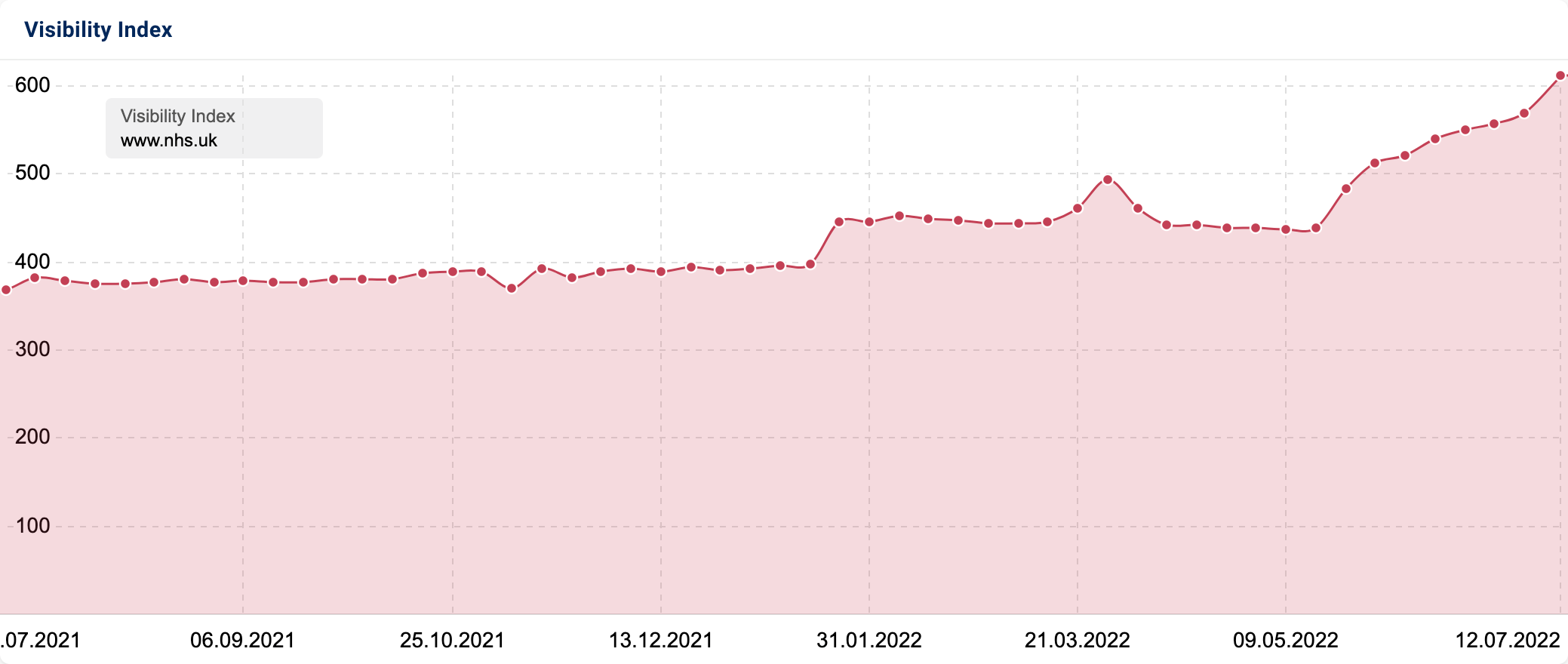

Several health websites have seen increased prominence on the UK SERPs, with nhs.uk being a top-performer for the quarter (+80.5 VI points).

- nhs.uk (+80.5 VI points)

- healthline.com (+69.1 VI points)

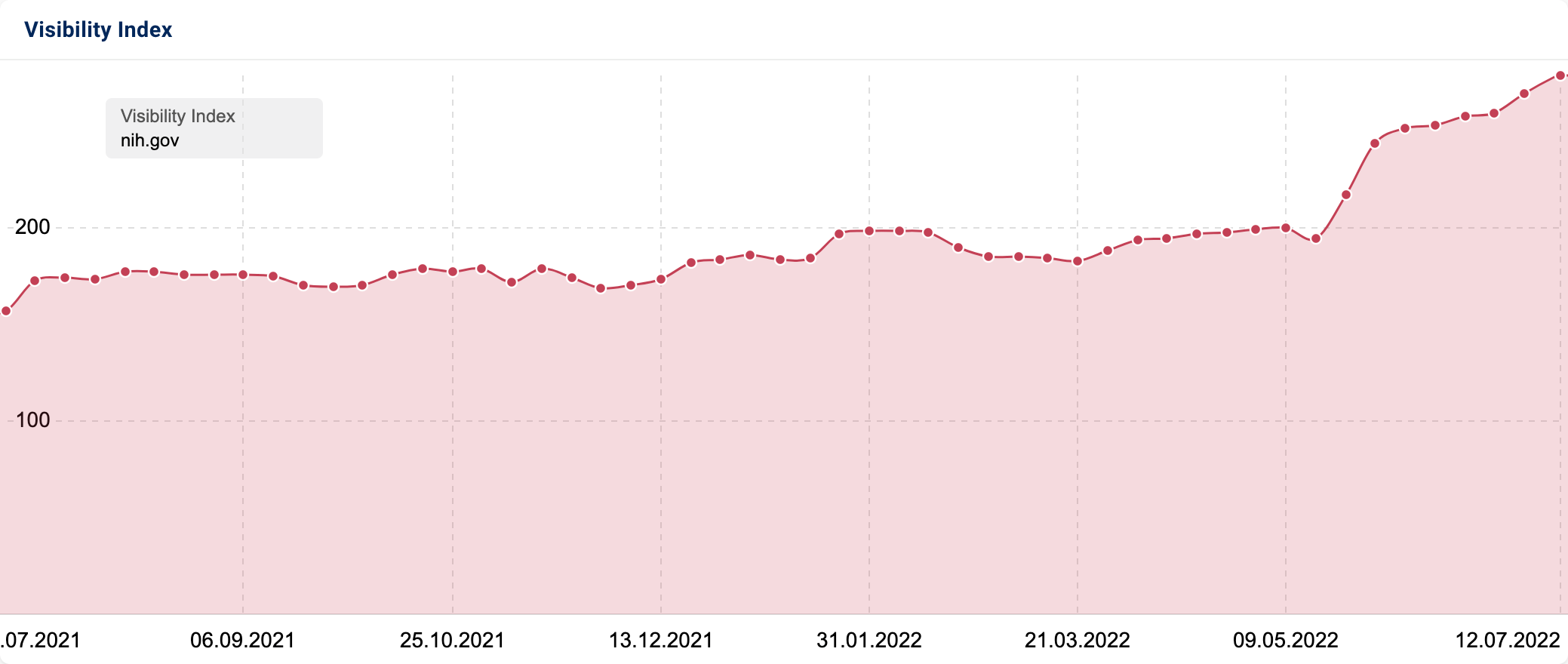

- nih.gov (+64.8 VI points)

- mayoclinic.org (+50.4 VI points)

- clevelandclinic.org (+42.5 VI points)

- webmd.com (+38.9 VI points)

All of these sites saw an incremental improvement in visibility from April onwards, further uplifting in the weeks after the rollout of the May 2022 Core Update. As a result, towards the end of the quarter, all six sites saw their highest peak in SISTRIX’s historical UK Google search visibility data (which dates back to July 2015).

After the extreme fluctuations that health sector sites have experienced following past core updates and of course, August 2018’s industry-specific Medic Update, it is refreshing to see that the May 2022 Core Update has been rewarding rather than just forgiving!

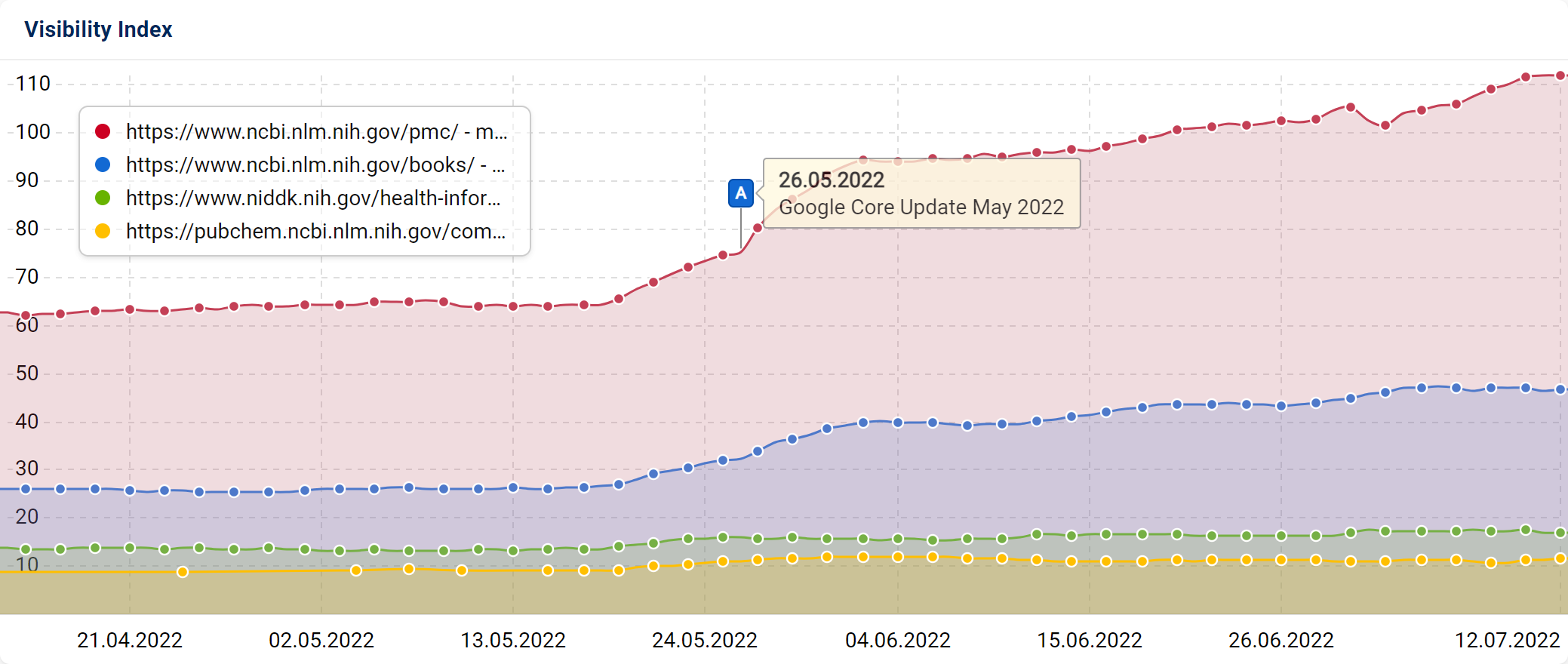

Venturing deeper into the data for The National Institutes of Health (part of the US Department of Health and Human Services), shows us that many directories have reaped the rewards of the recent update. The two top-performing NIH directories reside on the NIH’s subdomain for the National Center of Biotechnology Information’s National Library of Medicine.

These two directories are for their free PubMed Central® (PMC) archive (ncbi.nlm.nih.gov/pmc) and their Bookshelf resource (ncbi.nlm.nih.gov/books/), another free resource for life science and healthcare books and documentation.

From 4th April to 27th June 2022, the PMC archive saw an increase in rankings for 1.16M keywords (including new keywords), with Bookshelf also seeing enhanced visibility due to improved rankings for 159,570 terms.

As legitimate online medical sources, NHS, Healthline, NIH, Mayo Clinic, Cleveland Clinic and WebMD have faced many challenges. Despite these, they seem to have continued to enforce good SEO practices by investing time and energy into robust content strategies that tick the boxes from an E-A-T (Expertise, Authoritativeness & Trustworthiness) perspective.

Q2 2022 winners

Below are the top 25 winners by absolute change:

| Domain | Visibillity Index 01.04.2022 | Visibillity Index 24.06.2022 | Change |

|---|---|---|---|

| cambridge.org | 787.94 | 1011.31 | 223.37 |

| imdb.com | 988.17 | 1150.13 | 161.96 |

| google.co.uk | 166.13 | 325.30 | 159.18 |

| merriam-webster.com | 735.36 | 892.54 | 157.19 |

| www.gov.uk | 327.22 | 408.72 | 81.50 |

| www.nhs.uk | 474.62 | 555.16 | 80.54 |

| discogs.com | 180.81 | 260.63 | 79.81 |

| argos.co.uk | 438.51 | 513.78 | 75.27 |

| healthline.com | 330.42 | 399.61 | 69.20 |

| nih.gov | 193.81 | 258.02 | 64.21 |

| pinterest.co.uk | 55.52 | 109.43 | 53.91 |

| wiktionary.org | 305.41 | 356.84 | 51.43 |

| mayoclinic.org | 225.86 | 276.32 | 50.46 |

| goodreads.com | 82.10 | 129.82 | 47.72 |

| yourdictionary.com | 83.43 | 130.30 | 46.86 |

| wikihow.com | 63.44 | 109.95 | 46.51 |

| clevelandclinic.org | 97.32 | 139.86 | 42.55 |

| tiktok.com | 15.52 | 56.68 | 41.16 |

| microsoft.com | 206.81 | 247.60 | 40.79 |

| webmd.com | 284.21 | 323.14 | 38.93 |

| tripadvisor.co.uk | 264.20 | 300.30 | 36.10 |

| indeed.com | 172.15 | 204.78 | 32.63 |

| techtarget.com | 39.89 | 65.36 | 25.47 |

| rhs.org.uk | 31.42 | 54.30 | 22.88 |

| last.fm | 44.77 | 66.77 | 22.00 |

And by percent change:

| Domain | Visibillity Index 01.04.2022 | Visibillity Index 24.06.2022 | Percentage change |

|---|---|---|---|

| deezer.com | 4.06 | 24.28 | 498.15% |

| doheth.co.uk | 1.12 | 4.10 | 265.84% |

| tiktok.com | 15.52 | 56.68 | 265.22% |

| science.org | 2.33 | 8.08 | 247.35% |

| housingunits.co.uk | 1.03 | 3.57 | 246.11% |

| themoviedb.org | 6.34 | 20.71 | 226.57% |

| landsend.co.uk | 1.05 | 2.90 | 175.93% |

| filmaffinity.com | 1.11 | 3.06 | 175.02% |

| scribbr.co.uk | 1.83 | 4.65 | 154.23% |

| insanelygoodrecipes.com | 3.26 | 8.04 | 146.85% |

| cornwall.gov.uk | 1.26 | 3.02 | 138.73% |

| karafun.com | 1.06 | 2.40 | 126.13% |

| gardentoolbox.co.uk | 1.60 | 3.51 | 119.38% |

| hellomusictheory.com | 1.72 | 3.72 | 116.74% |

| marchofdimes.org | 1.71 | 3.64 | 112.86% |

| leekes.co.uk | 1.41 | 2.97 | 110.34% |

| wallstreetmojo.com | 2.89 | 6.04 | 109.16% |

| trolley.co.uk | 1.06 | 2.22 | 109.07% |

| bristol.gov.uk | 2.03 | 4.24 | 108.81% |

| currency.me.uk | 1.40 | 2.92 | 108.30% |

| savemyexams.co.uk | 2.09 | 4.33 | 107.35% |

| pethelpful.com | 1.61 | 3.33 | 106.95% |

| getapp.co.uk | 1.68 | 3.43 | 104.85% |

| movieweb.com | 1.55 | 3.17 | 104.54% |

| savers.co.uk | 3.43 | 6.84 | 99.82% |

Losers

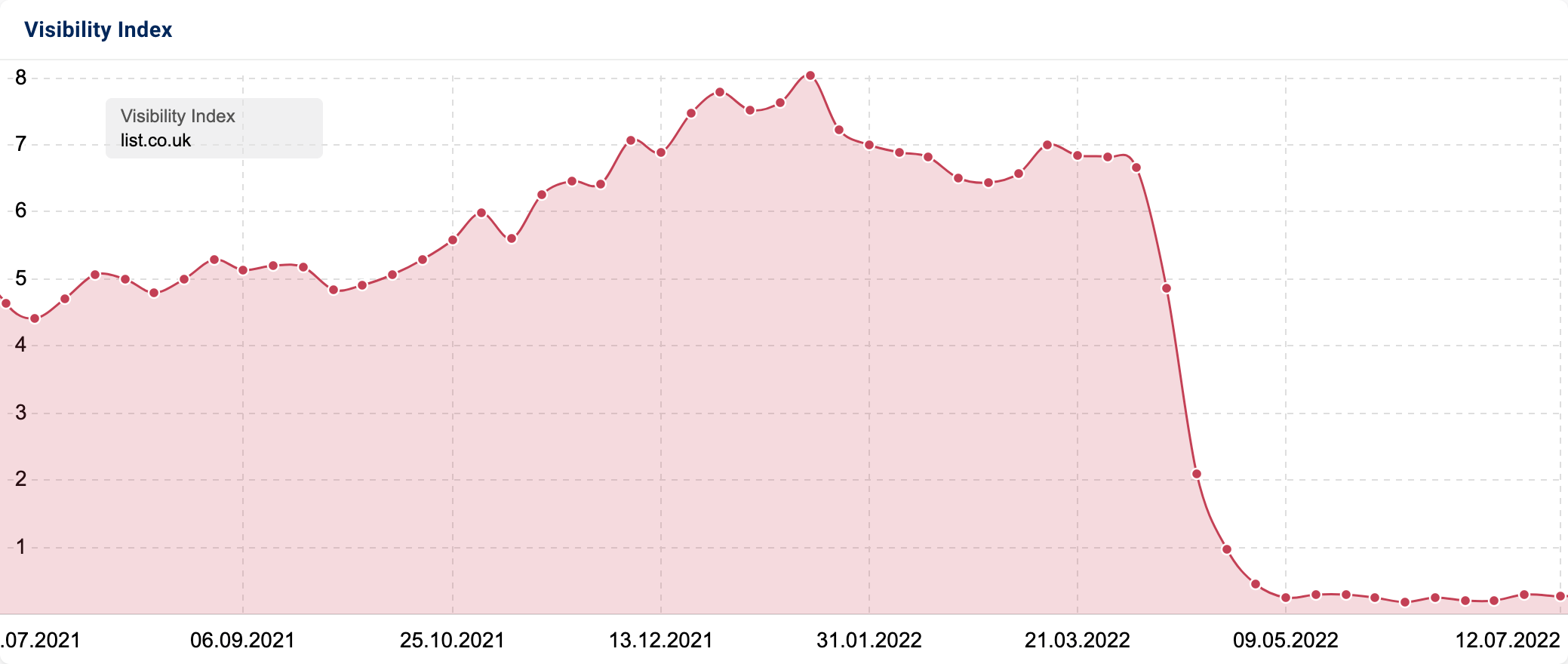

Significant loss for The List

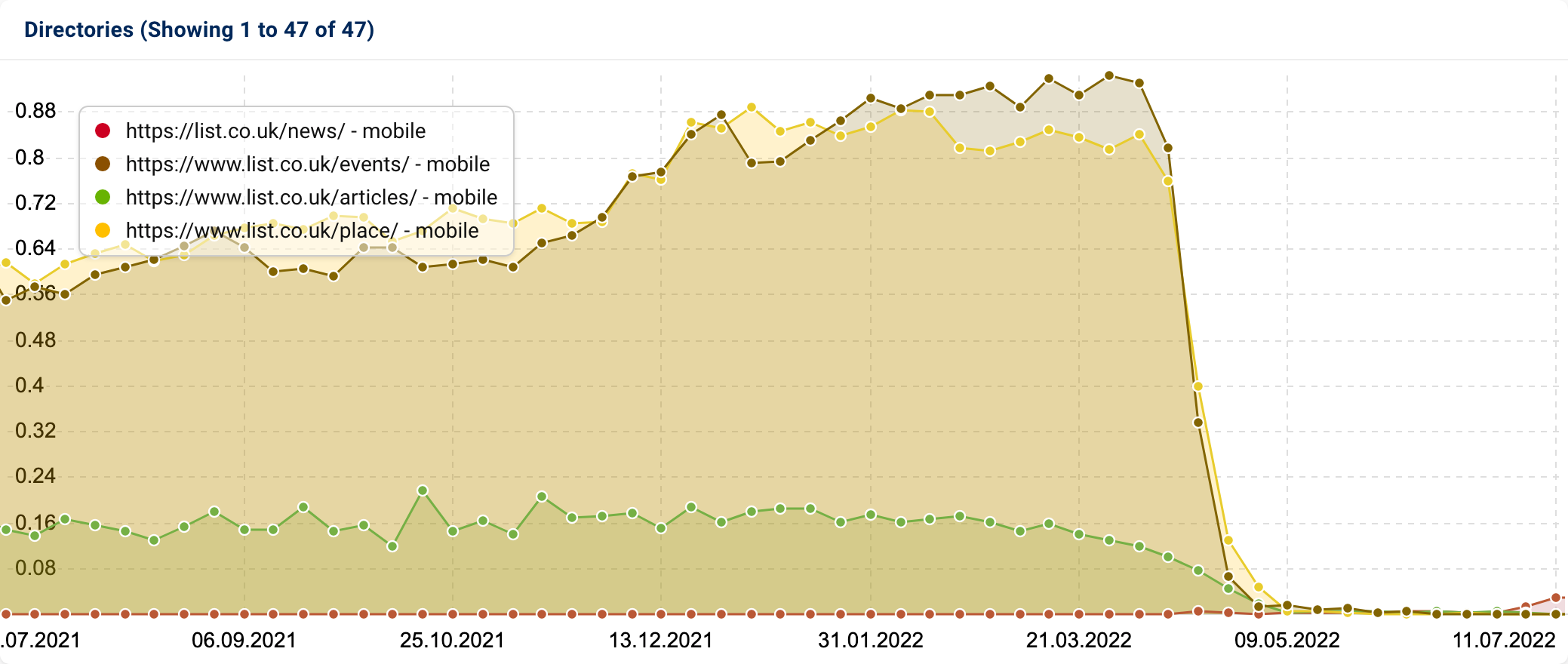

Over the last 3 months, events and entertainment publisher The List (list.co.uk), experienced the most notable organic loss (-97.1%). However, unlike other domains analysed, The List did not suffer at the hands of the May 2022 Core Update.

On 22nd March, Google rolled out the Product Review update. Although list.co.uk retained a stable visibility index score during the first week of the roll-out, the second week was not so kind. As of 4th April, their VI points started dropping and continued to do so after the update was completed on 11th April.

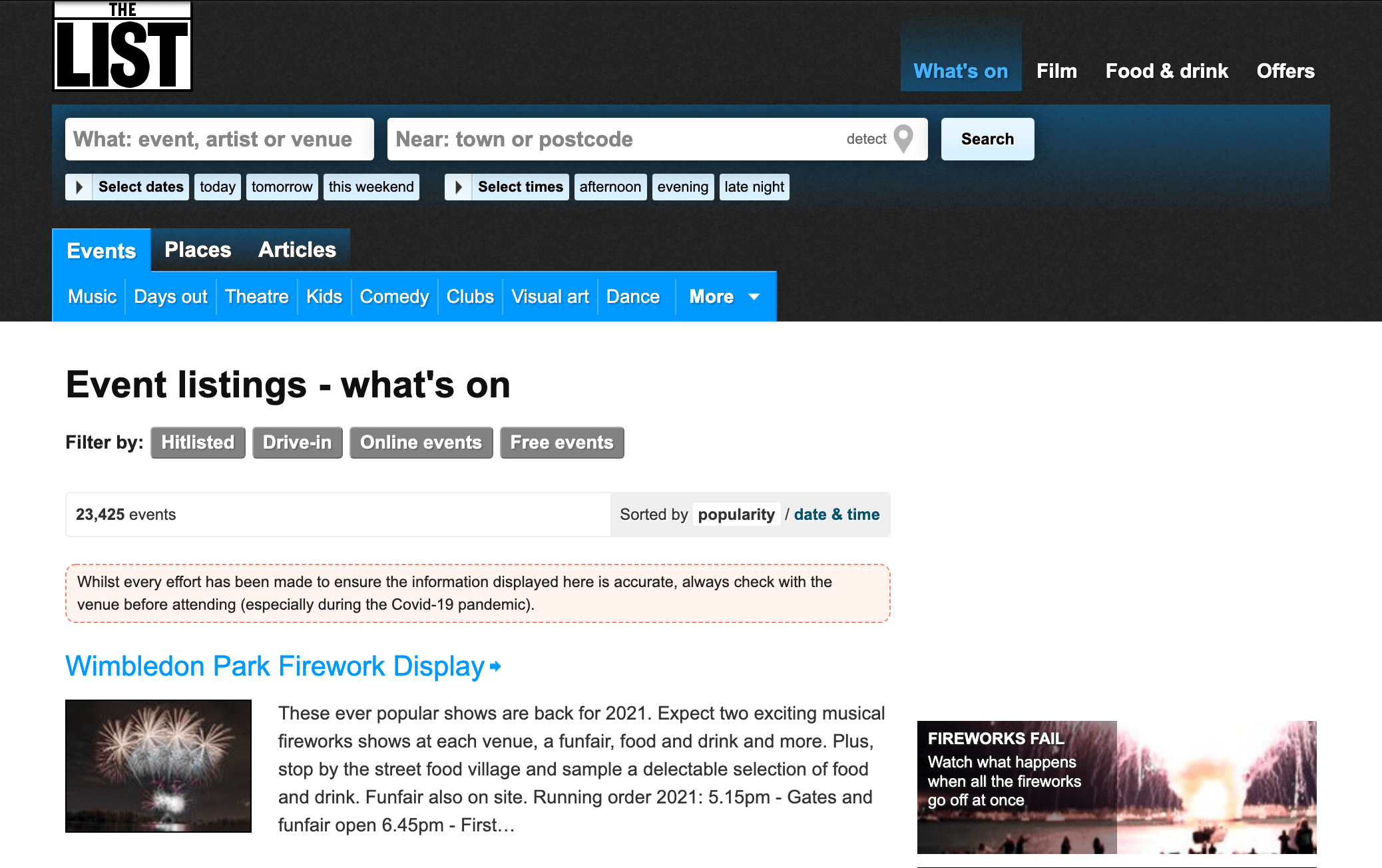

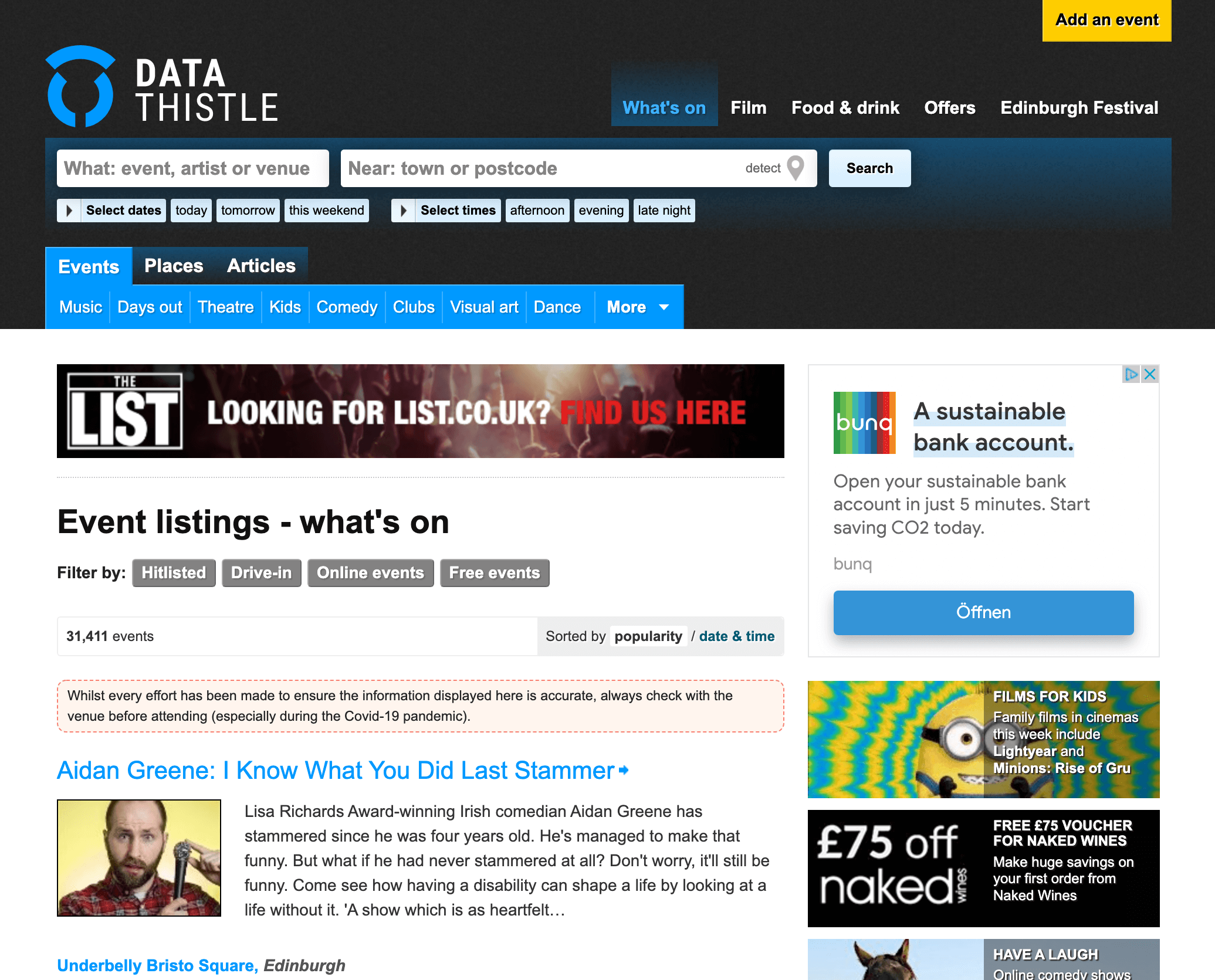

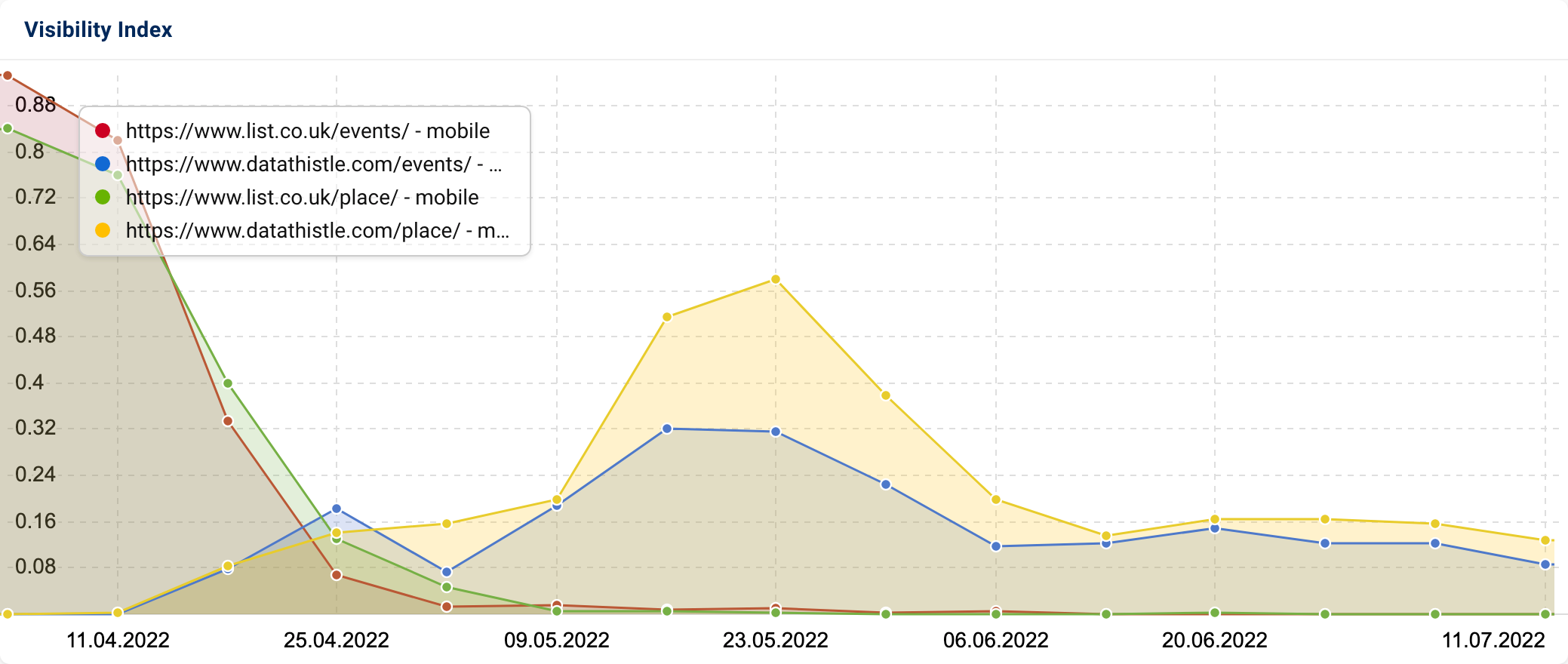

A closer examination of the directories also revealed that in the last 6 months, The List has migrated their /events & /places directory content to datathistle.com, keeping their /articles and /news content on list.co.uk.

Before:

Now:

Although the migration was like-for-like where content and design are concerned, there has been a continual loss in organic authority over the quarter for these directories on datathistle.com. This suggests that some technical SEO elements need addressing.

The domain registration information also confirms that datathistle.com was only registered in October 2021. However, despite this, SISTRIX’s link data confirms that datathistle.co.uk has inherited a significant number of backlinks from a diverse range of domains from the list.co.uk, which will be helpful to the domain’s organic ranking.

In the league of migrations, this one is still relatively young, and as we know, it can take time for SEO changes to come to light in the search results. Nevertheless, it’ll be interesting to see how things develop moving forward for both thelist.co.uk and datathistle.com.

Google Search judders for journalism

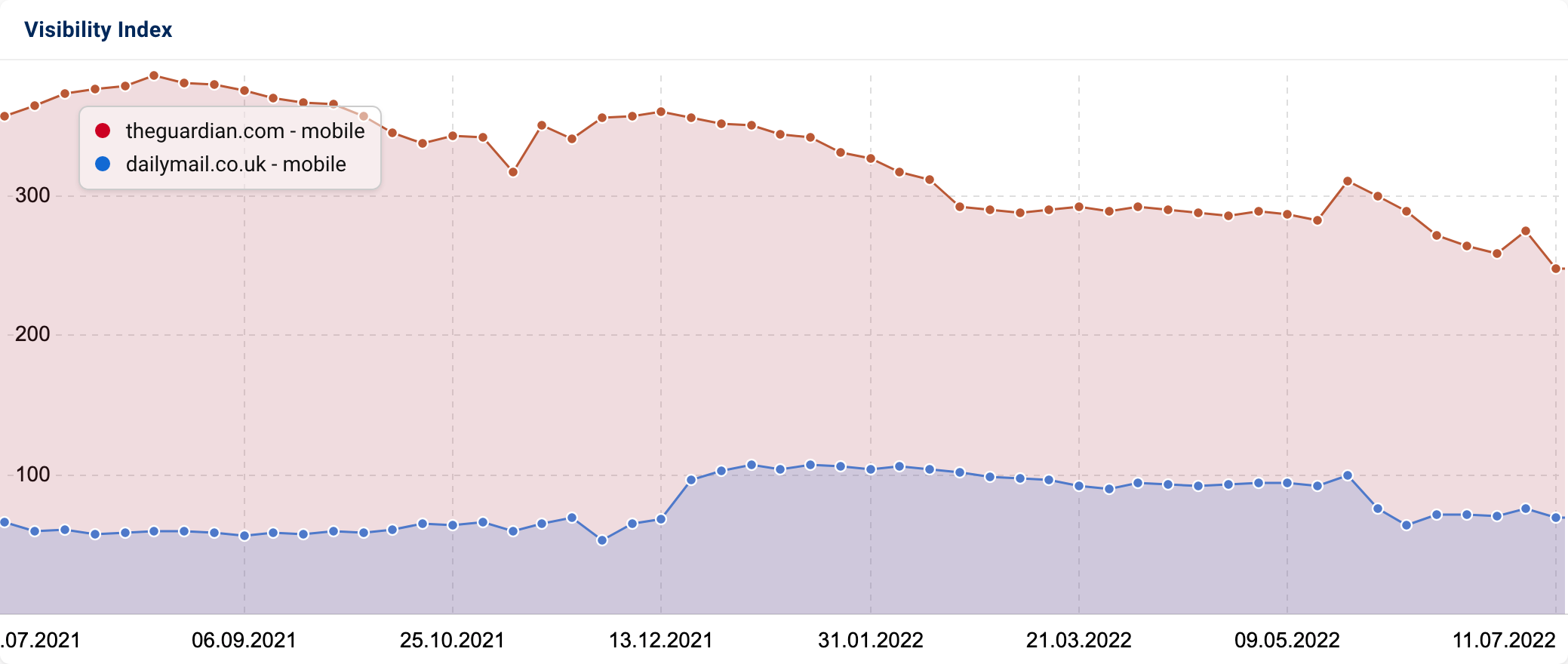

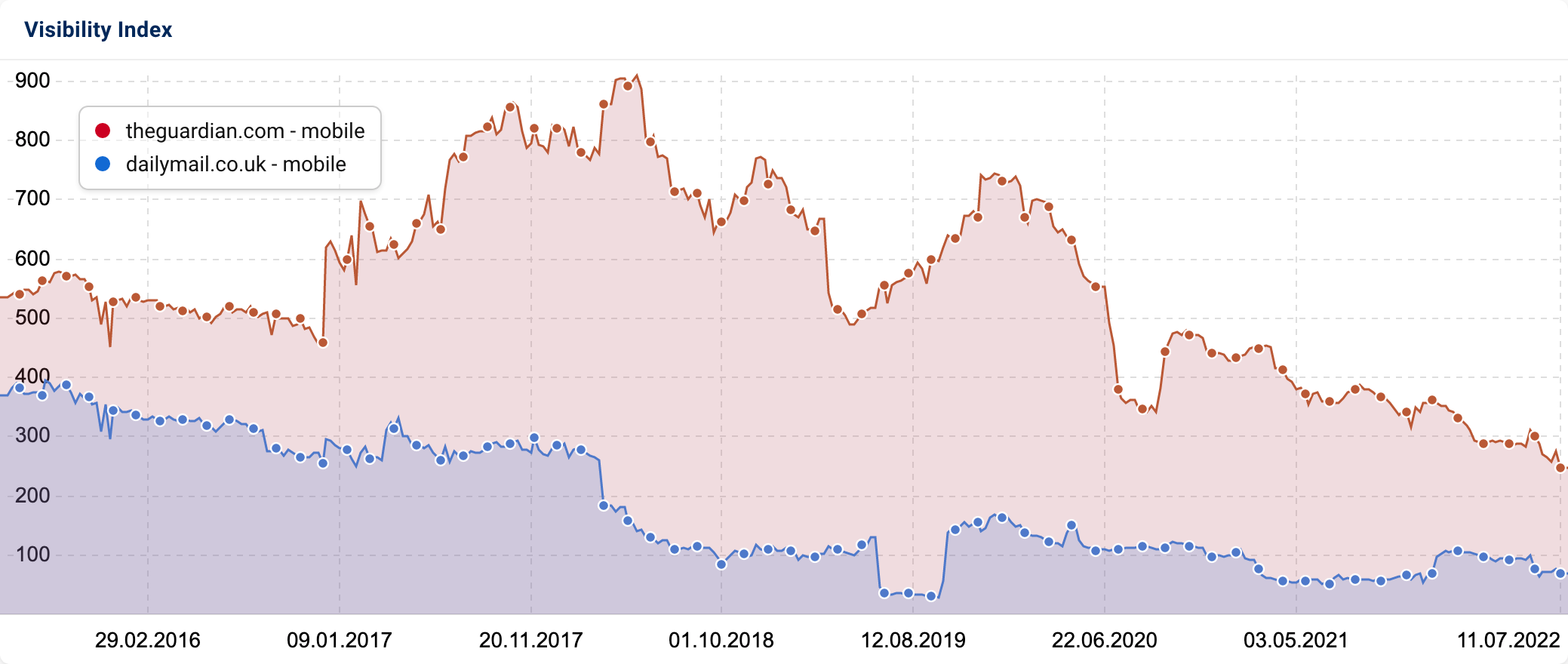

Two of the websites that saw the biggest quarterly downshift in absolute figures were theguardian.com (-31.2 points) and dailymail.co.uk (-22.3 points).

Recent research conducted by SISTRIX’s Johannes Beus confirms that since 2019, journalistic content is served less and less in European Google search engines. Based on the gradual decline in rankings for these high authority media outlets, this could be applicable to the UK.

SISTRIX’s historical visibility index shows that The Guardian and Mail Online’s Google SERP visibility for the most popular and competitive keywords searched by UK users has reached its lowest level in the last 7 years.

With the ancillary EU copyright law being less relevant to the UK, and the country yet to decide whether to strike deals with Big Tech and publishing firms regarding content use, Google could still be honouring existing EU law on the UK SERPs.

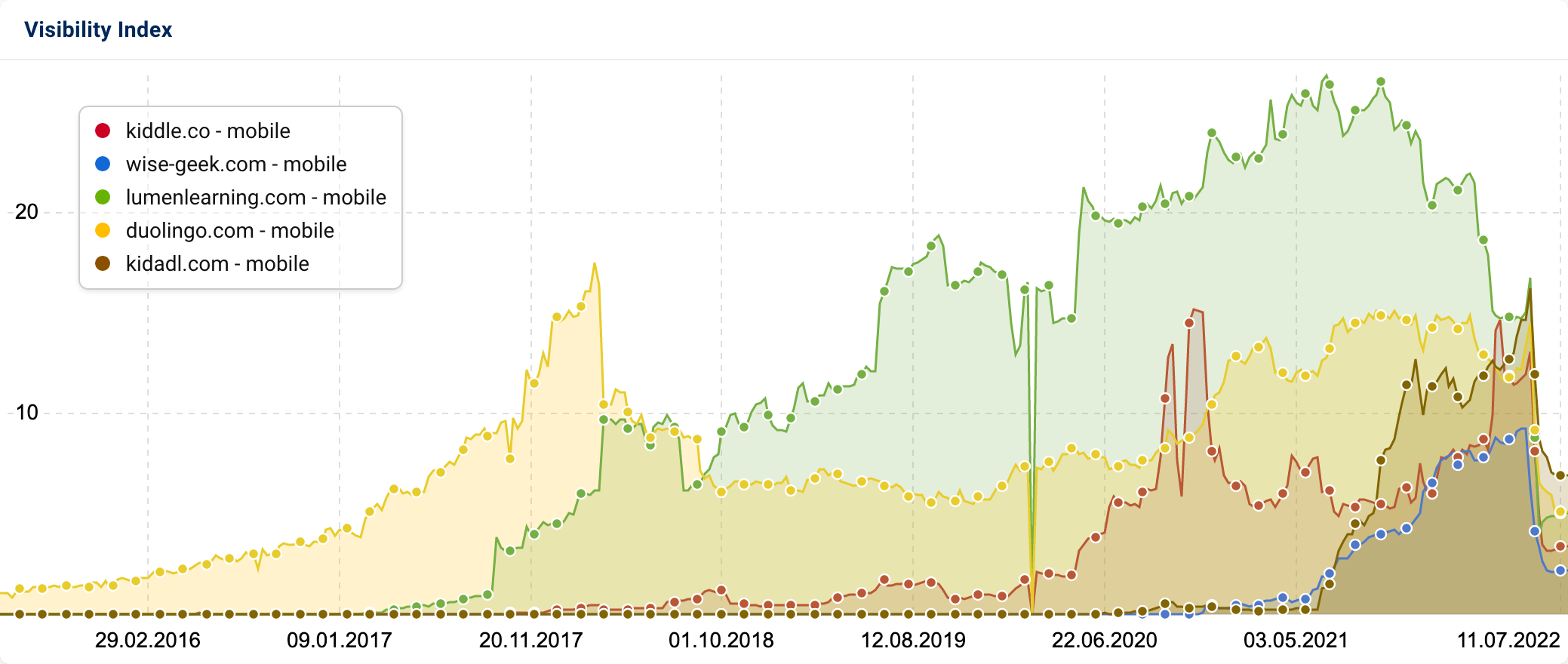

Losses for online learning resources

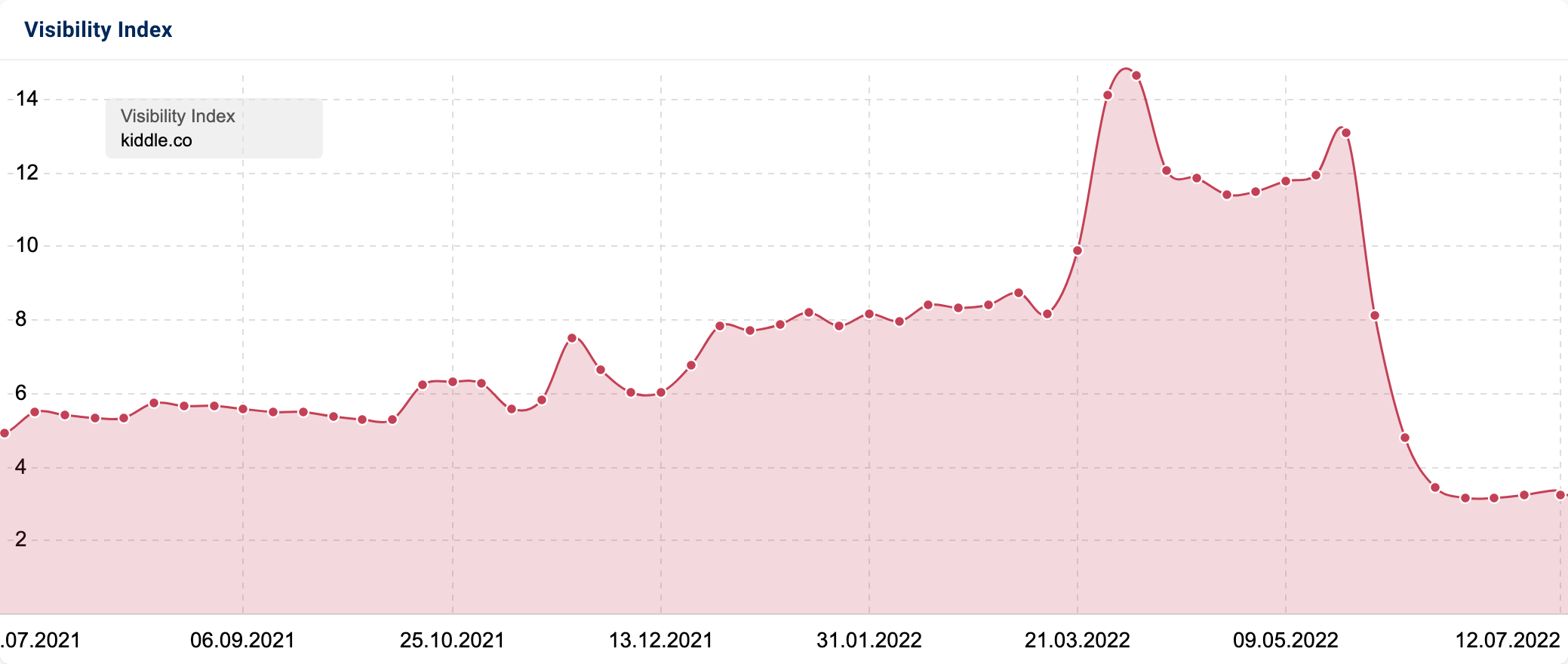

A number of education websites fell victim to Google’s algorithmic changes over the last quarter. The site which saw the most significant loss was Kiddle (kiddle.co), a safe and visual search engine for children powered by Google’s Safe Search, which saw a quarterly visibility decrease of 79%.

- kiddle.co (-79%)

- wise-geek.com (-75.4%)

- lumenlearning.com (-66.7%)

- duolingo.com (-49.9%)

- kidadl.com (-40.8%)

Following the November 2021 Core Update, Lumen Learning and Duo Lingo’s website began their downward trajectory. However, the sharp decline experienced across all sites does align with the timing of the May 2020 Core Update.

As a result, the visibility of these learning resources is now comparable to the visibility lows they experienced back in 2015 & 2016.

Like health, education is classed as a Your Money or Your Life (YMYL) topic and consequently, E-A-T is of great importance. Is it possible that these websites are not hitting the mark when it comes to key E-A-T assessment criteria?

Understandably, Kiddle.co will struggle more than other websites to control information accuracy and quality. However, in the case of the other sites examined, it is easier to demonstrate expertise, trust and authority through endorsing accreditations, industry partnerships and customer feedback.

Except for customer testimonials, these elements are lacking across key pages on lumenlearning.com, which will be unhelpful when it comes to Google shaping an accurate picture of the business, its quality and legitimacy.

This is also the case with duolingo.com, whose internal research which references authoritative industry sources and potential backlink opportunities resides in a PDF which is 3 clicks away from the homepage and is also hosted externally on AWS, diluting its influence on organic ranking.

Q2 2022 losers

Below are the top 25 losers by absolute change:

| Domain | Visibillity Index 01.04.2022 | Visibillity Index 24.06.2022 | Change |

|---|---|---|---|

| theguardian.com | 291.00 | 259.74 | -31.27 |

| dailymail.co.uk | 92.77 | 70.37 | -22.39 |

| lyrics.com | 60.45 | 41.93 | -18.52 |

| kiddle.co | 15.00 | 3.15 | -11.85 |

| lumenlearning.com | 14.68 | 4.89 | -9.79 |

| gettyimages.co.uk | 48.51 | 39.03 | -9.48 |

| sky.com | 38.46 | 29.96 | -8.50 |

| dunelm.com | 81.96 | 73.47 | -8.49 |

| vulture.com | 17.85 | 9.66 | -8.19 |

| songmeanings.com | 43.69 | 36.43 | -7.25 |

| pnas.org | 12.27 | 5.12 | -7.15 |

| dnb.com | 10.57 | 3.52 | -7.04 |

| list.co.uk | 6.83 | 0.20 | -6.63 |

| wise-geek.com | 8.64 | 2.12 | -6.52 |

| cylex-uk.co.uk | 17.78 | 11.45 | -6.33 |

| duolingo.com | 12.16 | 6.08 | -6.08 |

| vox.com | 18.91 | 13.03 | -5.89 |

| homebase.co.uk | 24.36 | 18.95 | -5.41 |

| theverge.com | 19.67 | 14.34 | -5.33 |

| blackwells.co.uk | 13.81 | 8.61 | -5.20 |

| reuters.com | 18.41 | 13.27 | -5.14 |

| metacritic.com | 29.91 | 24.81 | -5.10 |

| kidadl.com | 12.35 | 7.30 | -5.05 |

| shopstyle.co.uk | 19.09 | 14.05 | -5.05 |

| screenrant.com | 23.72 | 18.69 | -5.03 |

And percent change:

| Domain | Visibillity Index 01.04.2022 | Visibillity Index 24.06.2022 | Percentage change |

|---|---|---|---|

| list.co.uk | 6.83 | 0.20 | -97.12% |

| kiddle.co | 15.00 | 3.15 | -79.00% |

| wise-geek.com | 8.64 | 2.12 | -75.47% |

| wikidiff.com | 6.44 | 2.12 | -67.03% |

| lumenlearning.com | 14.68 | 4.89 | -66.70% |

| dnb.com | 10.57 | 3.52 | -66.67% |

| adl.org | 3.03 | 1.19 | -60.87% |

| muckrack.com | 5.11 | 2.06 | -59.74% |

| pnas.org | 12.27 | 5.12 | -58.26% |

| companycheck.co.uk | 3.91 | 1.66 | -57.42% |

| forebears.io | 3.94 | 1.91 | -51.45% |

| duolingo.com | 12.16 | 6.08 | -49.97% |

| universal-lighting.co.uk | 3.89 | 1.96 | -49.63% |

| rocketreach.co | 4.01 | 2.03 | -49.30% |

| vulture.com | 17.85 | 9.66 | -45.87% |

| shpock.com | 10.57 | 5.79 | -45.25% |

| campaignlive.co.uk | 4.08 | 2.28 | -44.22% |

| thbaker.co.uk | 3.41 | 1.94 | -43.25% |

| wealthygorilla.com | 4.18 | 2.40 | -42.56% |

| gettyimages.com | 7.43 | 4.39 | -40.97% |

| kidadl.com | 12.35 | 7.30 | -40.88% |

| simonandschuster.co.uk | 5.34 | 3.23 | -39.65% |

| fatherly.com | 6.25 | 3.79 | -39.35% |

| plos.org | 5.36 | 3.29 | -38.65% |

| onhealth.com | 5.62 | 3.46 | -38.46% |

Conclusion

It has been an exciting quarter, and the May 2022 Core Update certainly served up some surprises. Following our analysis, we have concluded that:

Following this quarterly analysis, we have concluded that:

- Backlinks and brand citations are as crucial for organic ranking as high-quality content which targets non-brand terms. Also, with backlinks, domain diversification, authority and relevance are paramount for success.

- An increase in organic visibility on Google and search engines more broadly can stem from something as simple as content expansion as well as content optimisation.

- Content parity is important in a mobile-first world. With all websites now subject to mobile-first indexing by Google, it is essential that, for both ranking and user experience, content is accessible regardless of the device used to access it.

- E-A-T (Expertise, Authoritativeness & Trustworthiness) is here to stay. If not already doing so, site owners should do their utmost to ensure that content and information to promote expertise, authority and trust are prominently displayed/accessible from key webpages. This is particularly important for industries or content that impacts user health, safety, well-being or finances (YMYL pages).

- PDF content can be crawled and indexed by search engines, but it will have little benefit if not hosted on the same domain. If PDF content is hosted externally and contains authoritative and relevant backlinks, it is more valuable to migrate the content and the links to an HTML page where it can have more influence on the domain’s SEO performance.

- Migrations, even partial ones, are not to be taken lightly. Although we cannot 100% guarantee the success of like-for-like migration, it is vital to check all the technical SEO fundamentals before proceeding to maximise the chance of maintaining SERP visibility.

- Not all downward trends indicate a company is a poor quality result for a keyword. Google and other search engine giants can and will tweak their algorithms to adhere to local laws and regulations in the UK and beyond. This is possibly happening in light of recent conversation around publisher content use.