Q2 2024 was a whirlwind in the SEO industry. Although no core updates were initiated during this period, Google’s March core update rolled out for a lengthy 45 days! On its completion in early May, the search engine giant began its pre-announced plan to review and penalise websites using their strong reputations to promote irrelevant content. AI Overview experiments also started being beta tested, sparking mixed reviews from SEOs and search engine users alike.

SEO Winners Q2 2024

SunGod

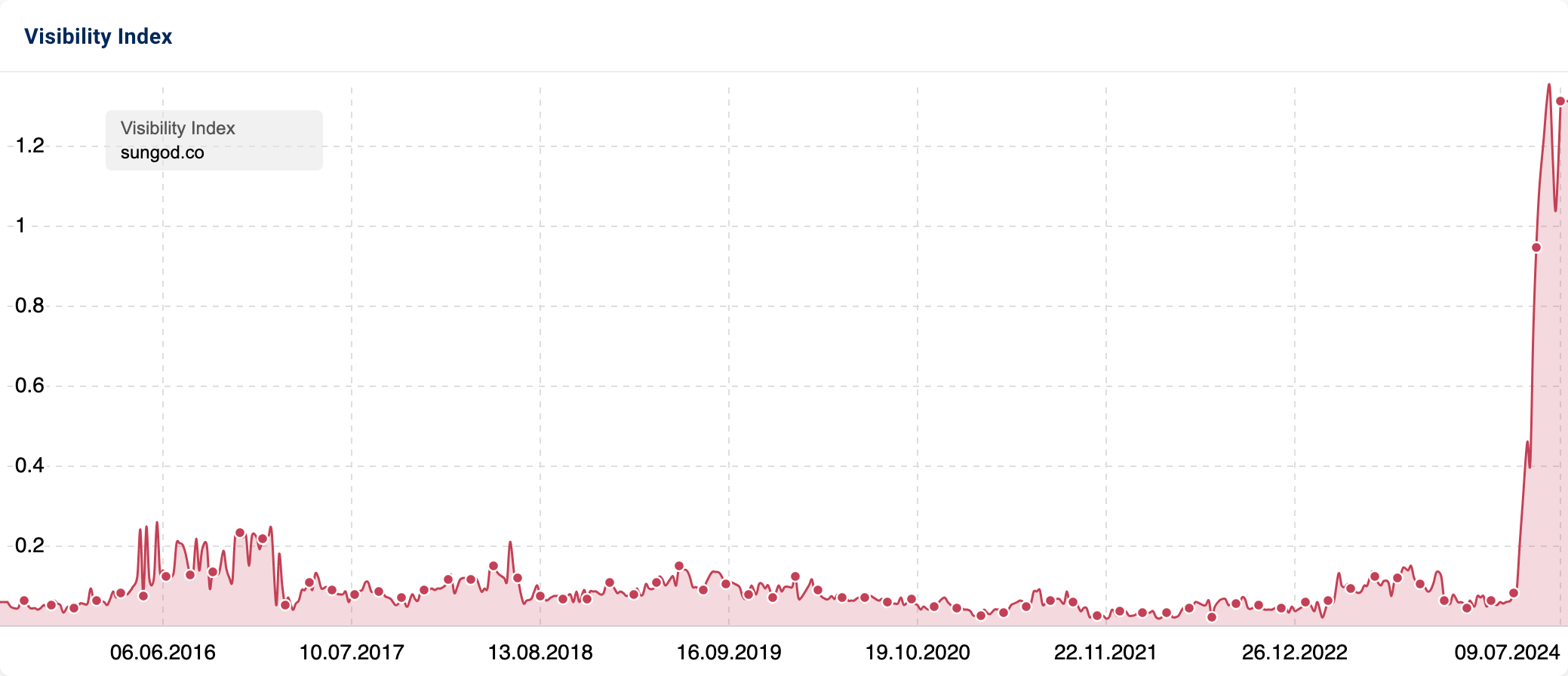

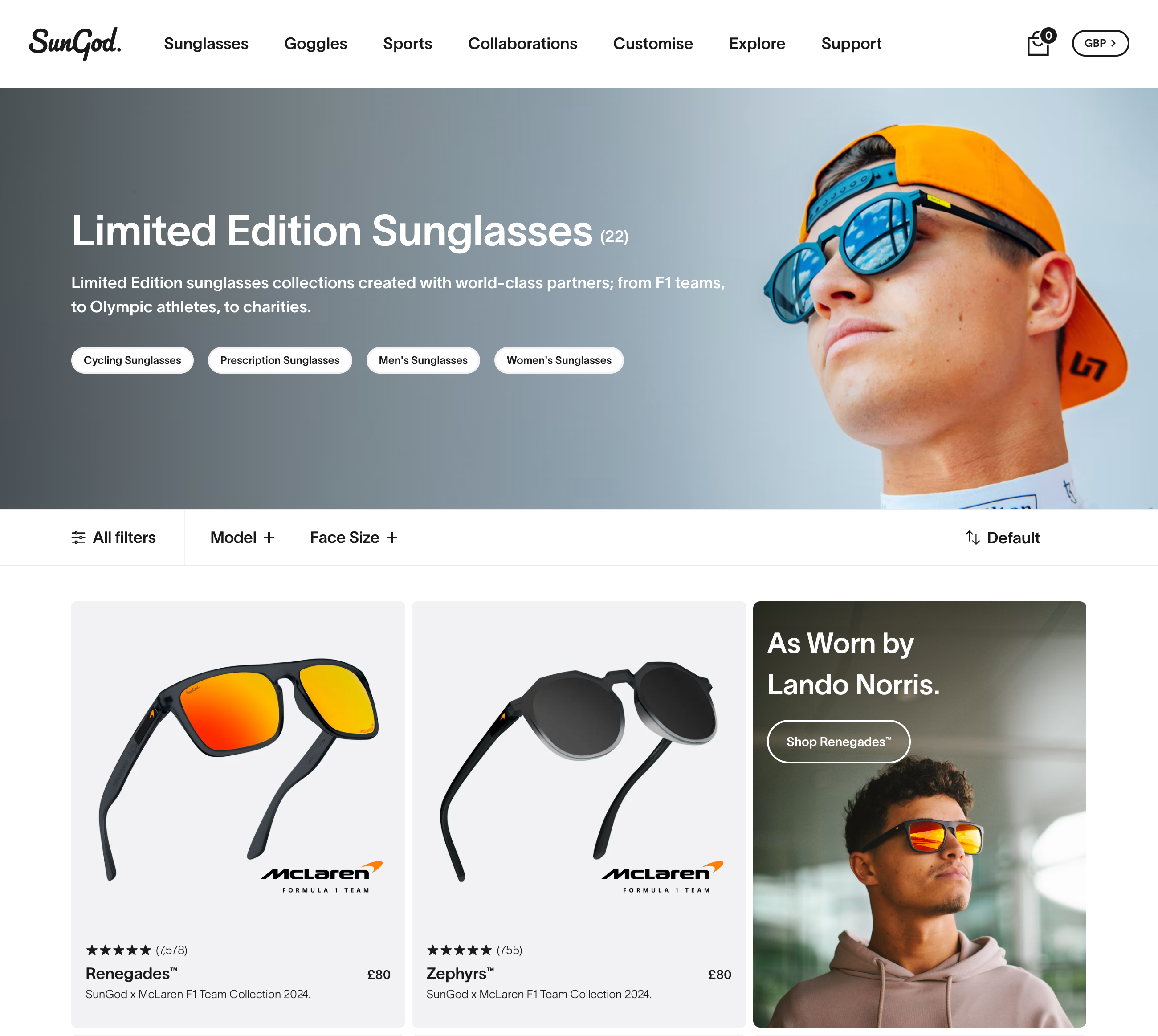

Sungod.co has experienced a massive increase in visibility. SunGod is a British eyewear brand specialising in high-performance sunglasses and goggles, suitable for both sporting activities and everyday wear.

Despite launching 11 years ago, SunGod’s organic visibility on the UK SERPs remained limited until April 2024, likely due to fierce industry competition. However, a combination of brand-building tactics and web changes in recent years has finally allowed SunGod to reap the rewards of their efforts.

One of the main ways SunGod has increased its brand awareness is through strategic collaborations with notable sporting associations and public figures, such as Geraint Thomas and his road cycling team (the INEOS Grenadiers), England Cricket, Williams Racing and McLaren F1. These partnerships have not only placed SunGod in front of new audiences but also enhanced the brand’s SEO status by leveraging the organic authority associated with these entities.

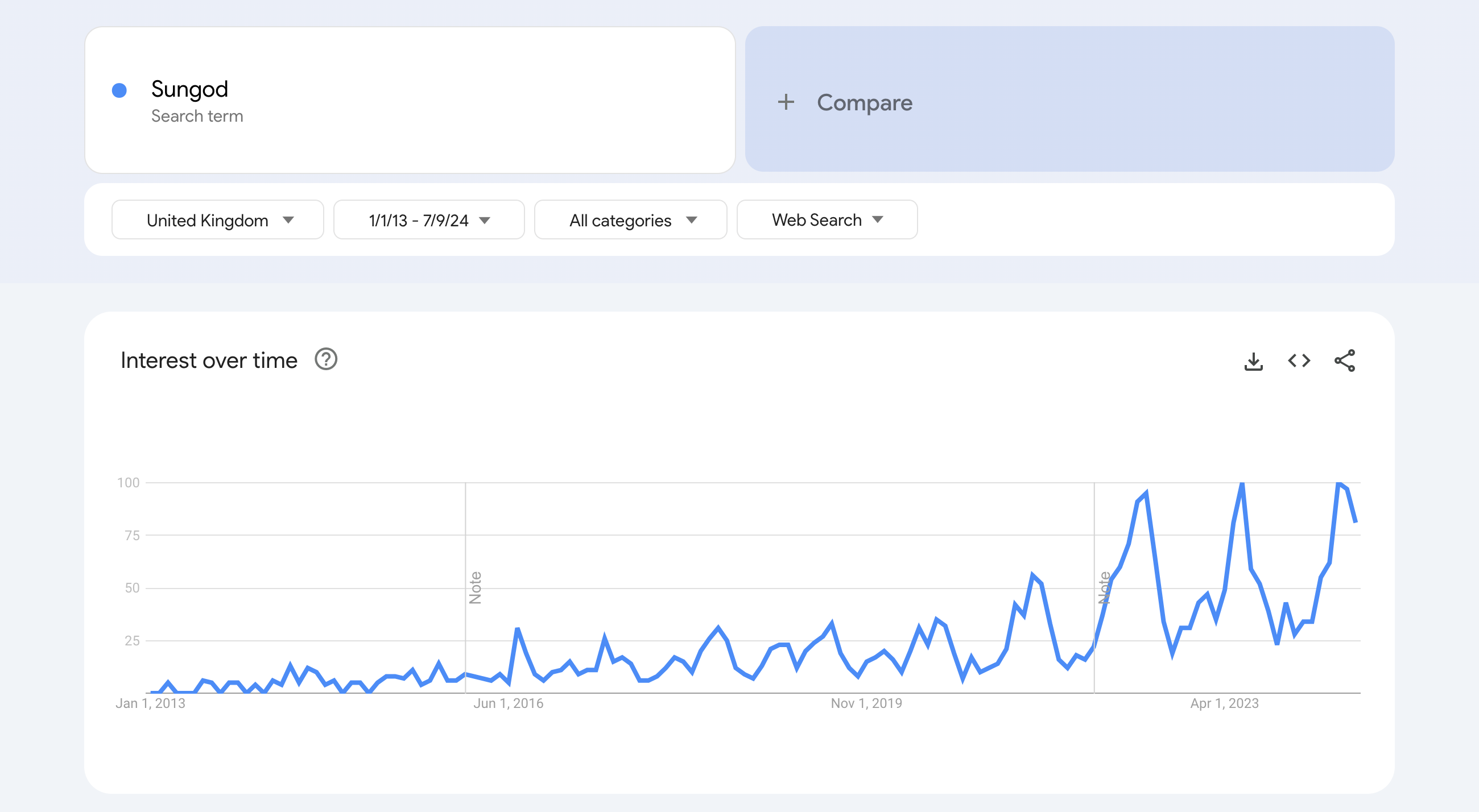

Searches for “Sungod” have increased significantly over time

From an on-page perspective, URL change data indicates that SunGod has previously experienced challenges relating to Hreflang implementation. Since May, various page versions intended for different English-speaking countries have been appearing in UK Google search results.

However, instances where “en-gb” URLs have appropriately gained rankings have been more frequent, suggesting a possible misconfiguration with the country flag selector previously used on their website. In 2023, this selector was removed, and the website was updated to enforce Hreflang settings based on user location.

BBC

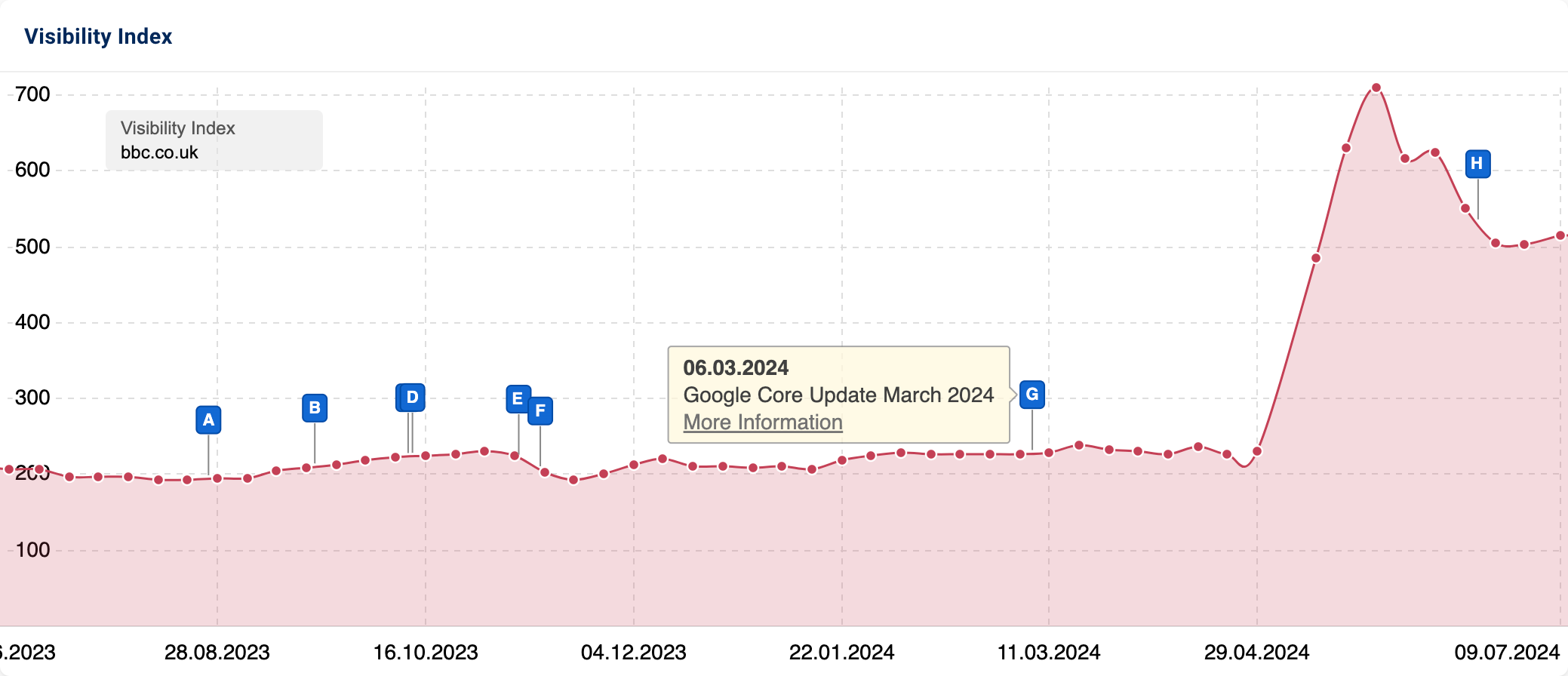

The British Broadcasting Corporation (BBC) UK-focused website’s Google visibility has risen by 273.75 Visibility Index (VI) points.

The domain contains a comprehensive range of broadcasting resources (e.g. iPlayer and TV guides) as well as additional content, inclusive of educational and lifestyle content, blogs and live event coverage.

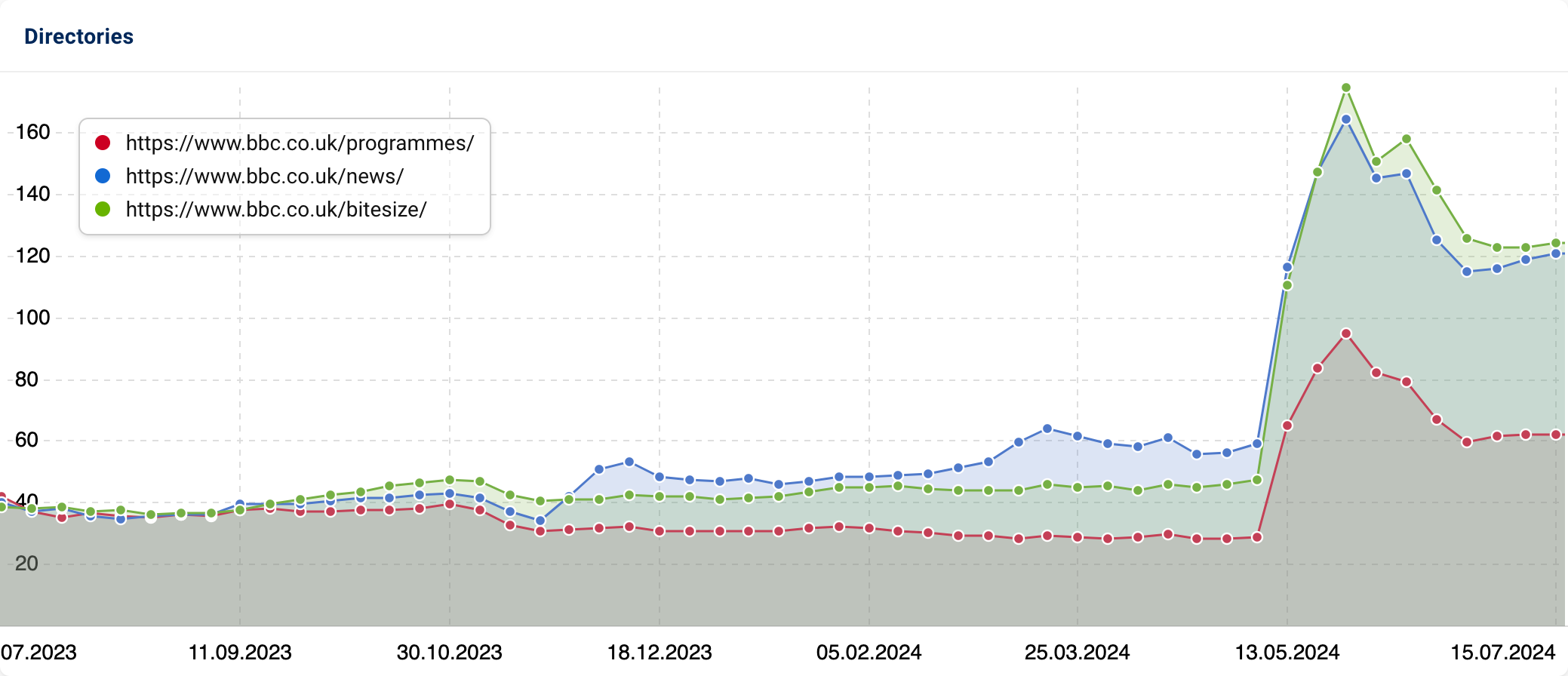

Notably, the subfolders “bitesize” and “news” have experienced significant growth over the past quarter. These visibility increases began approximately 3 weeks after the March 2024 Core Update began.

This core update, which lasted 45 days and concluded on 19th April, led to substantial fluctuations in the SERPs, downgrades initiated for unhelpful content, and increased visibility of Reddit content.

Amid varying quality in news-based content, several media outlets saw negative impacts on their SEO visibility. In contrast, BBC News excelled, affirming its reputation as a trustworthy and authoritative source based on E-E-A-T principles.

Similarly, the rise of BBC Bitesize, a learning hub designed for primary, secondary and further education students, underscores the brand’s commitment to delivering reliable and credible information that meets curriculum standards.

Many of bbc.co.uk’s recent ranking improvements have also coincided with URL changes, reflecting the prioritisation of time-sensitive content and topical coverage across different subfolders. This, in turn, has resulted in periodic keyword cannibalisation and ranking fluctuations.

In Q2, the BBC website acquired 48,326 new keywords and saw ranking increases for 102,945 existing terms.

VisitBritain

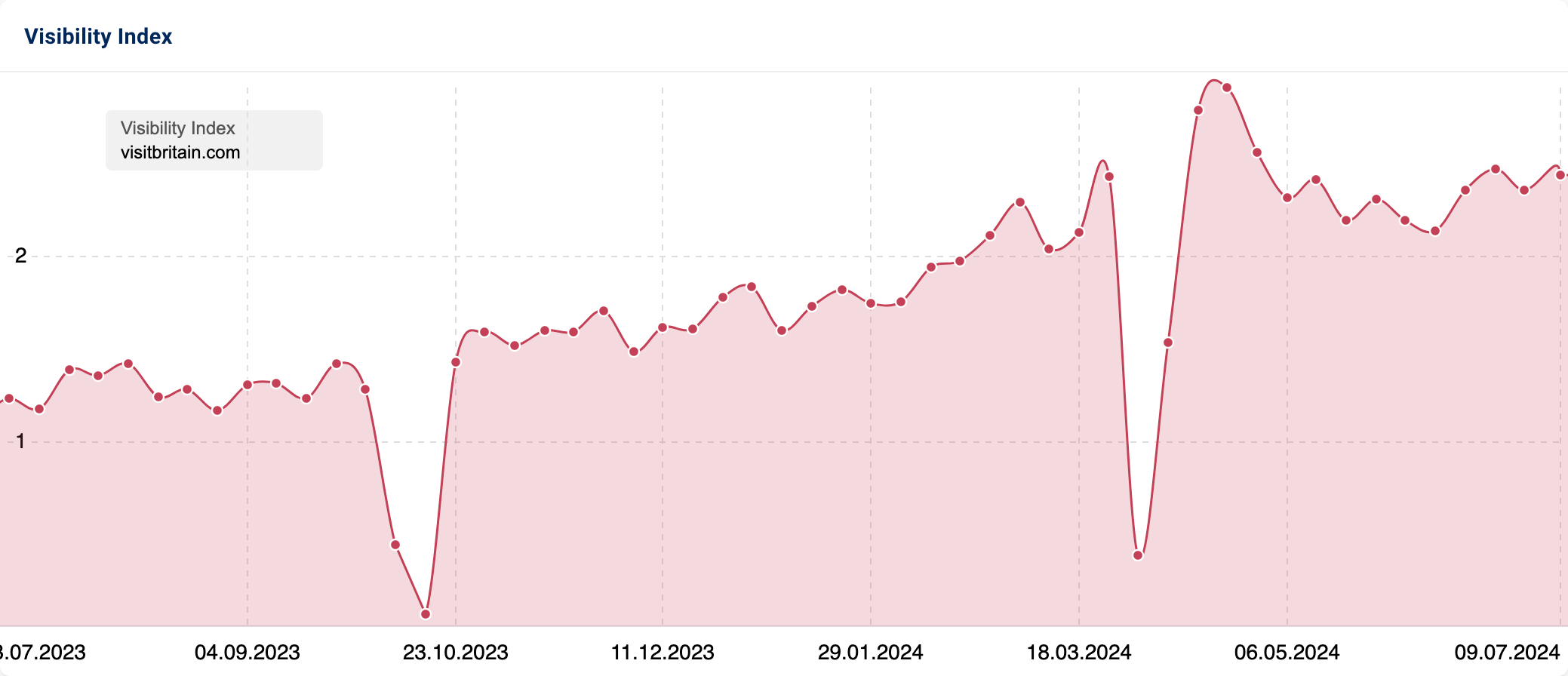

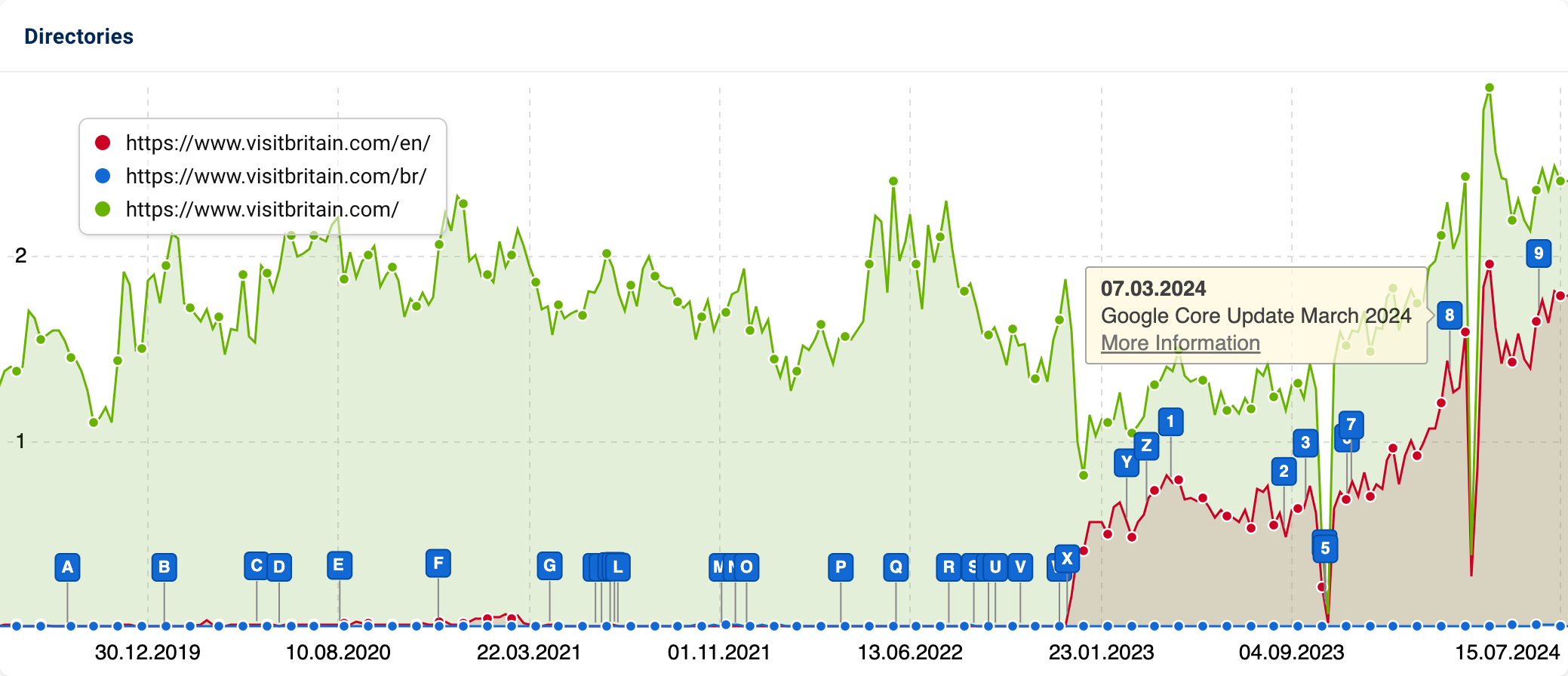

Visitbritain.com experienced an outstanding 539.65% increase in organic visibility. As the official tourism website for Great Britain, owned by the British Tourist Authority, VisitBritain provides comprehensive information about destinations, activities and attractions to explore.

In December 2022, VisitBritain implemented Hreflang; optimising the website for users browsing worldwide.

Naturally, in the UK SERPs, the “en” content is most visible. However, if we dive deeper into the data, we can see that the content that has seen the most organic growth over the quarter is destination guides (“destinations” subfolder), followed by “things-to-do”.

At the end of March, during the core update, these sections – as well as “plan-your-trip” – experienced a notable visibility decline. However, this dip was temporary, and these pages soon reached their peak visibility before dropping slightly again. Moving into June, their visibility started to gradually rise to levels comparable to the earlier peak.

Similarly to the BBC, this behaviour suggests that the algorithms have vetted the domain and its structural changes in recent years and deemed it as a useful source of information for its target terms (strong from an E-E-A-T perspective).

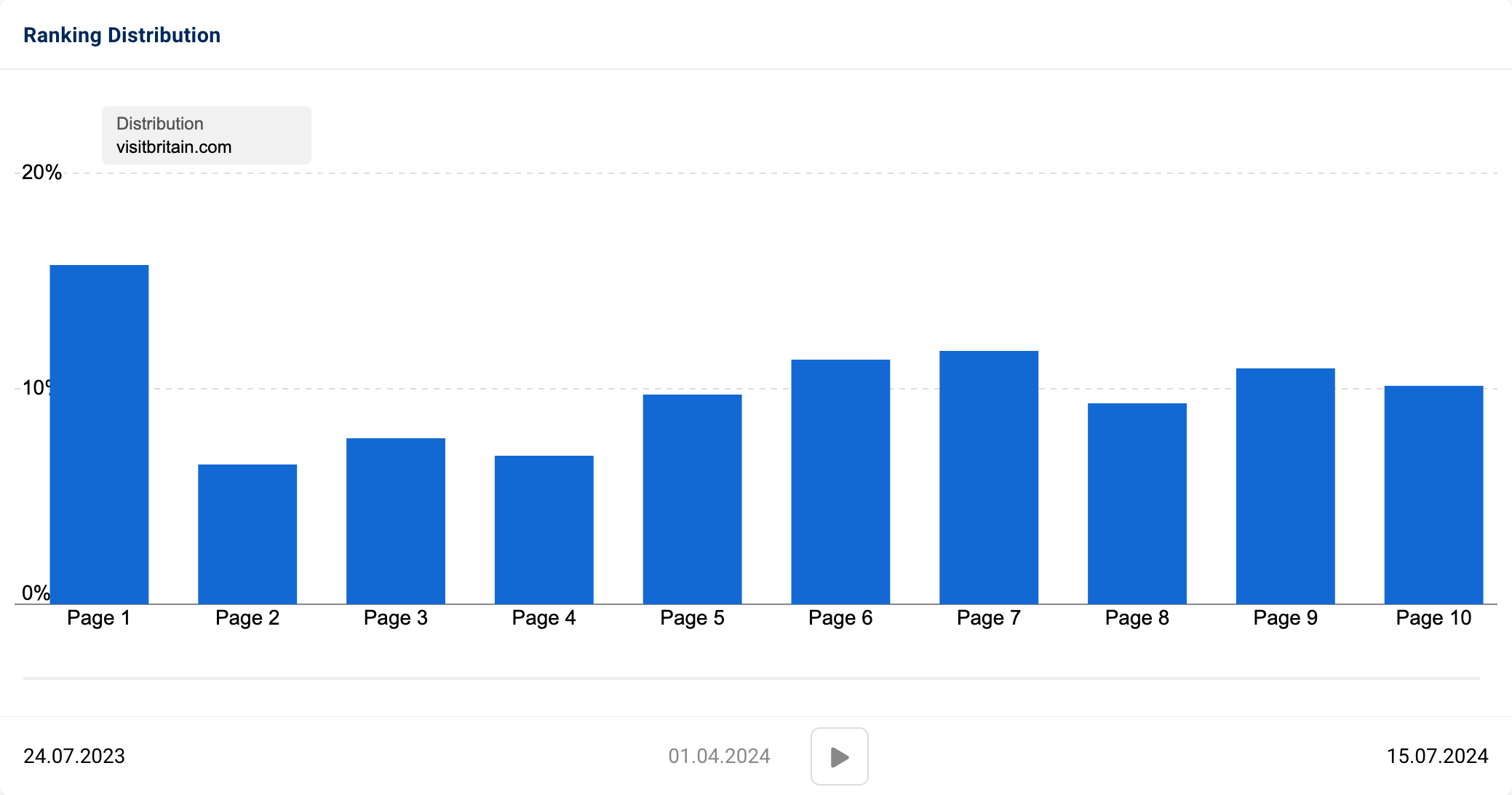

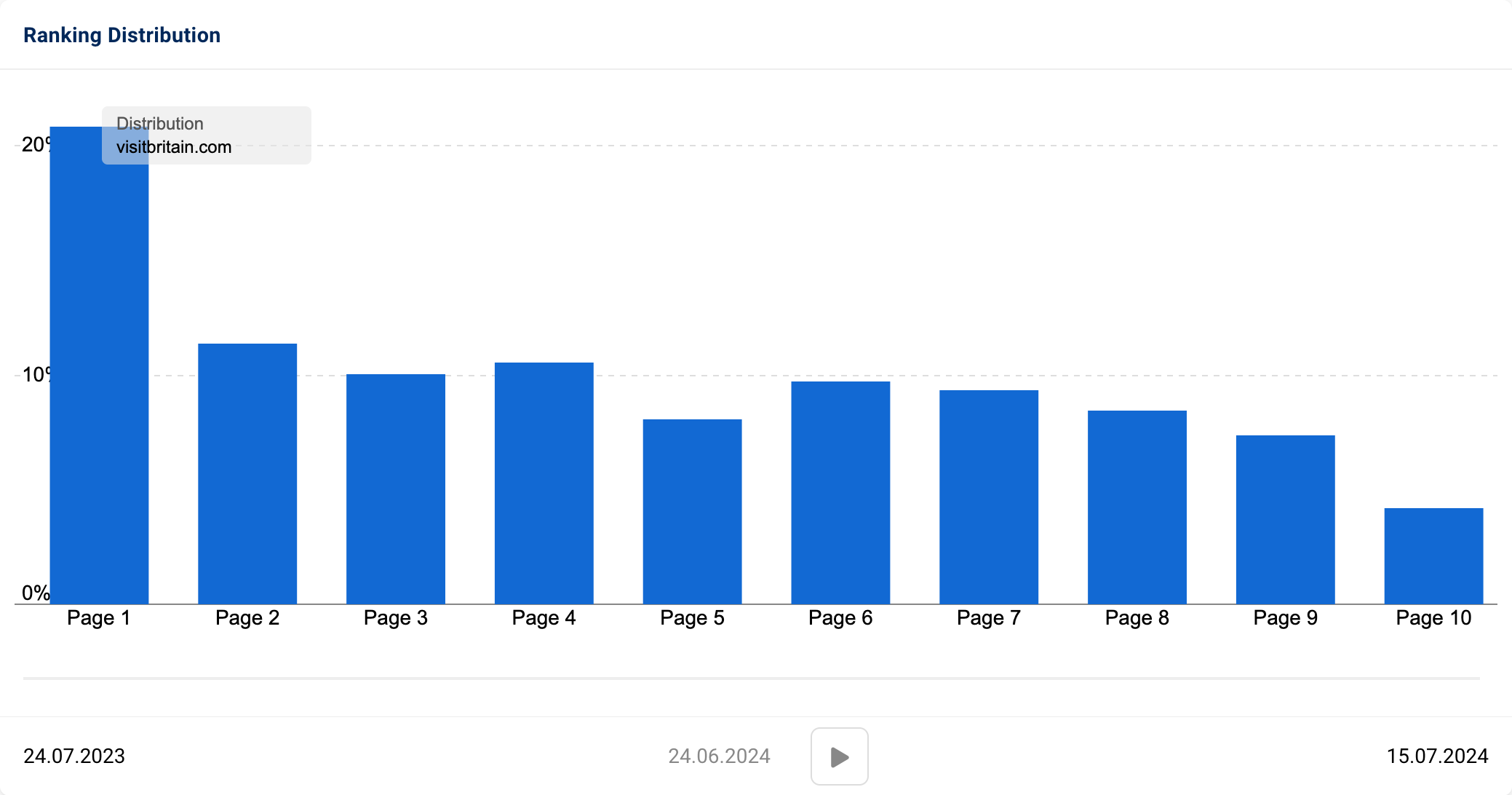

Compared to the beginning of April, the percentage of keywords ranking across Pages 1 (+5%), 2 (+5%) & 3 (+3%) of the SERPs have increased.

1st April 2024:

24th June 2024:

All Q2 winners

Below are the winners by absolute change:

| Domain | Visibillity Index 01.04.2024 | Visibillity Index 24.06.2024 | Change |

|---|---|---|---|

| amazon.co.uk | 3589.59 | 3981.01 | 391.42 |

| wikipedia.org | 7324.69 | 7646.37 | 321.68 |

| reddit.com | 612.48 | 896.79 | 284.31 |

| bbc.co.uk | 230.44 | 504.19 | 273.75 |

| www.gov.uk | 374.50 | 486.43 | 111.93 |

| instagram.com | 758.26 | 859.32 | 101.06 |

| webmd.com | 272.57 | 352.36 | 79.79 |

| www.nhs.uk | 564.79 | 644.37 | 79.58 |

| clevelandclinic.org | 254.12 | 331.58 | 77.47 |

| merriam-webster.com | 1030.07 | 1101.33 | 71.25 |

| mayoclinic.org | 317.46 | 382.16 | 64.70 |

| nih.gov | 485.76 | 537.09 | 51.33 |

| google.co.uk | 101.48 | 145.33 | 43.85 |

| microsoft.com | 285.13 | 328.21 | 43.08 |

| genius.com | 272.60 | 314.02 | 41.42 |

| healthline.com | 318.17 | 356.18 | 38.01 |

| cambridge.org | 1079.06 | 1115.36 | 36.30 |

| spotify.com | 315.38 | 346.35 | 30.97 |

| diy.com | 173.51 | 203.65 | 30.13 |

| indeed.com | 260.34 | 288.75 | 28.41 |

| archive.org | 22.09 | 48.72 | 26.63 |

| wiktionary.org | 231.61 | 257.28 | 25.67 |

| oed.com | 53.42 | 75.96 | 22.55 |

| company-information.service.gov.uk | 241.70 | 263.86 | 22.16 |

| tiktok.com | 119.14 | 140.15 | 21.01 |

And percent change:

| Domain | Visibillity Index 01.04.2024 | Visibillity Index 24.06.2024 | Percentage change |

|---|---|---|---|

| yelp.co.uk | 0.07 | 8.99 | 999.0% |

| laura-james.co.uk | 0.39 | 5.82 | 999.0% |

| sungod.co | 0.08 | 1.16 | 999.0% |

| supplychain.nhs.uk | 0.23 | 1.87 | 700.9% |

| musicstore.com | 0.20 | 1.36 | 567.7% |

| visitbritain.com | 0.39 | 2.47 | 539.7% |

| awwwards.com | 0.28 | 1.80 | 533.2% |

| magnettrade.co.uk | 0.28 | 1.76 | 521.9% |

| trail.co.uk | 0.24 | 1.46 | 514.9% |

| selectfashion.co.uk | 0.81 | 4.18 | 414.5% |

| durite.co.uk | 0.23 | 1.09 | 367.7% |

| shopontv.co.uk | 0.25 | 1.06 | 331.8% |

| aqualung.com | 0.29 | 1.19 | 309.8% |

| legrand.co.uk | 0.40 | 1.60 | 294.7% |

| ukbabycentre.com | 0.54 | 2.06 | 281.2% |

| britishgardencentres.com | 0.43 | 1.55 | 256.3% |

| tanners-wines.co.uk | 0.37 | 1.30 | 256.1% |

| onepeloton.co.uk | 0.64 | 2.23 | 247.1% |

| taylorandfrancis.com | 0.75 | 2.57 | 244.6% |

| apcstore.co.uk | 0.31 | 1.03 | 236.3% |

| nintendo.com | 3.90 | 12.85 | 229.4% |

| whitestores.co.uk | 0.50 | 1.65 | 228.5% |

| steveneagell.co.uk | 0.33 | 1.05 | 223.9% |

| directwoodflooring.co.uk | 0.66 | 2.14 | 222.1% |

| zen.co.uk | 0.60 | 1.90 | 217.6% |

SEO Losers Q2 2024

Nintendo

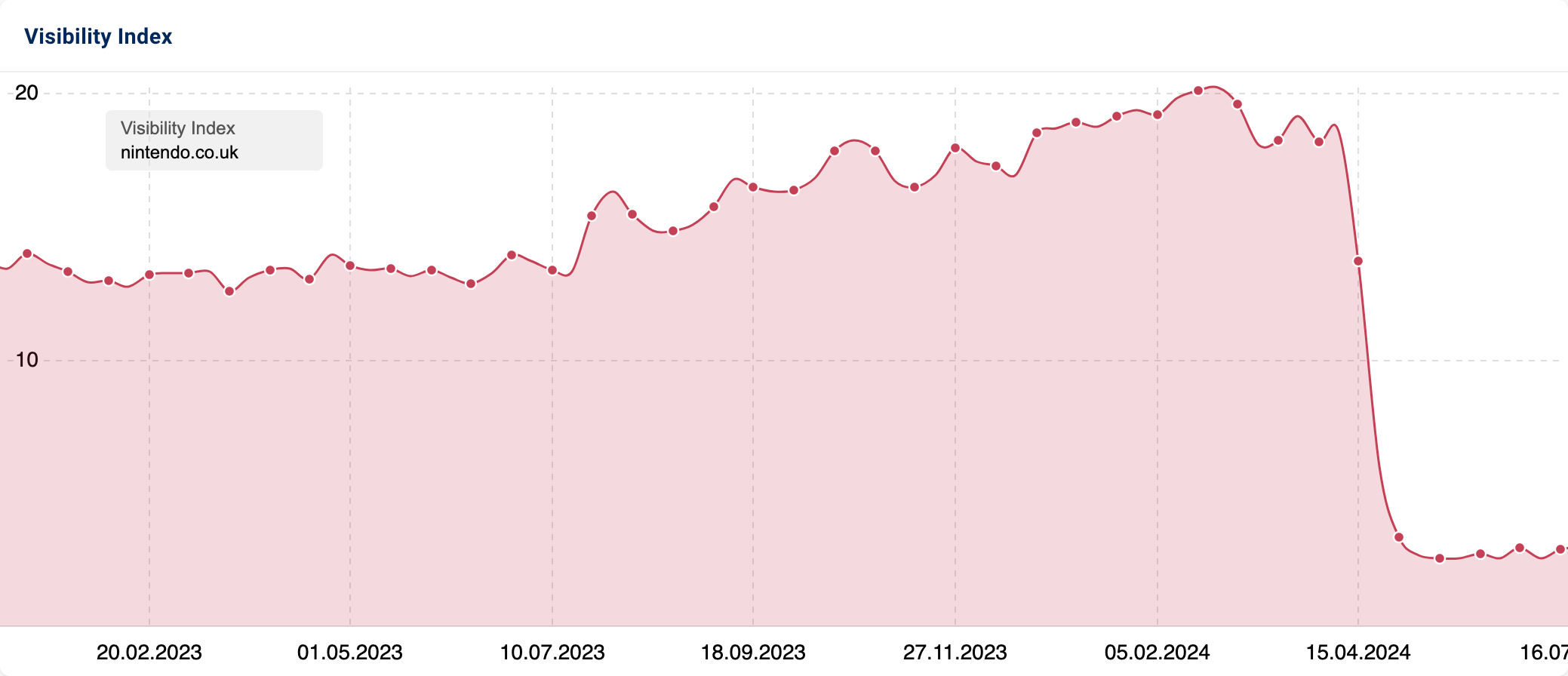

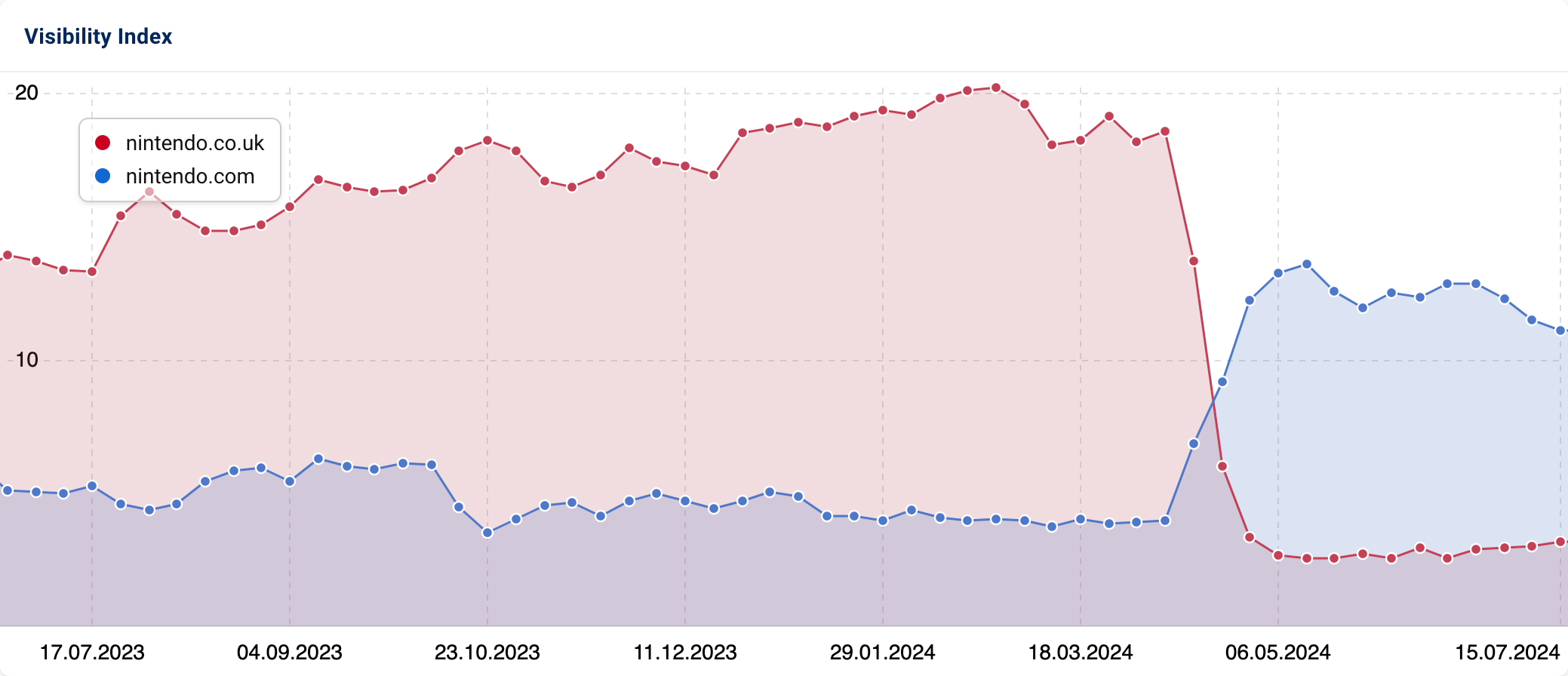

The UK’s official Nintendo website, nintendo.co.uk, saw a visibility drop-off of 84.06% between April & June 2024.

Analysing the decline reveals that visibility loss is the result of a change in internationalisation strategy and subsequent migration work. While this might sound straightforward, the consequences of this work have actually brought a third domain into the mix!

Around 8th April, nintendo.com saw a notable uptick in organic visibility (from 3.96 to 13.27), coinciding with nintendo.co.uk’s visibility decline. This increase represented 71% of the Visibility Index score held by nintendo.co.uk pre-decline.

During Q2, the Nintendo team started implementing redirects to like-for-like content on nintendo.com/en-gb. However, when UK users visit the nintendo.com homepage directly, they are served the nintendo.com/us version by default.

Despite nintendo.com having dedicated pages for games and consoles, data from Q2 shows 137 terms from nintendo.co.uk starting to rank for store.nintendo.co.uk/en instead.

Based on this combination of occurrences, we can assume that retiring nintendo.co.uk was an authority-centric decision, particularly as much of the game-based content was migrated from .co.uk prior to the migration itself.

The acquisition of new rankings by store.nintendo.co.uk/en also suggests that Google deems these particular queries to be more transactional and, therefore, sending them to the store subdomain over the .com makes more sense from a user intent perspective.

Informational (nintendo.com/en-gb):

Transactional (store.nintendo.co.uk/en):

Whilst keyword cannibalisation across similar domains is not ideal, having both of these page types is better for user experience – they capture users at different stages of the overall marketing funnel.

As for serving the US subfolder to GB users, this seems to be a technical error.

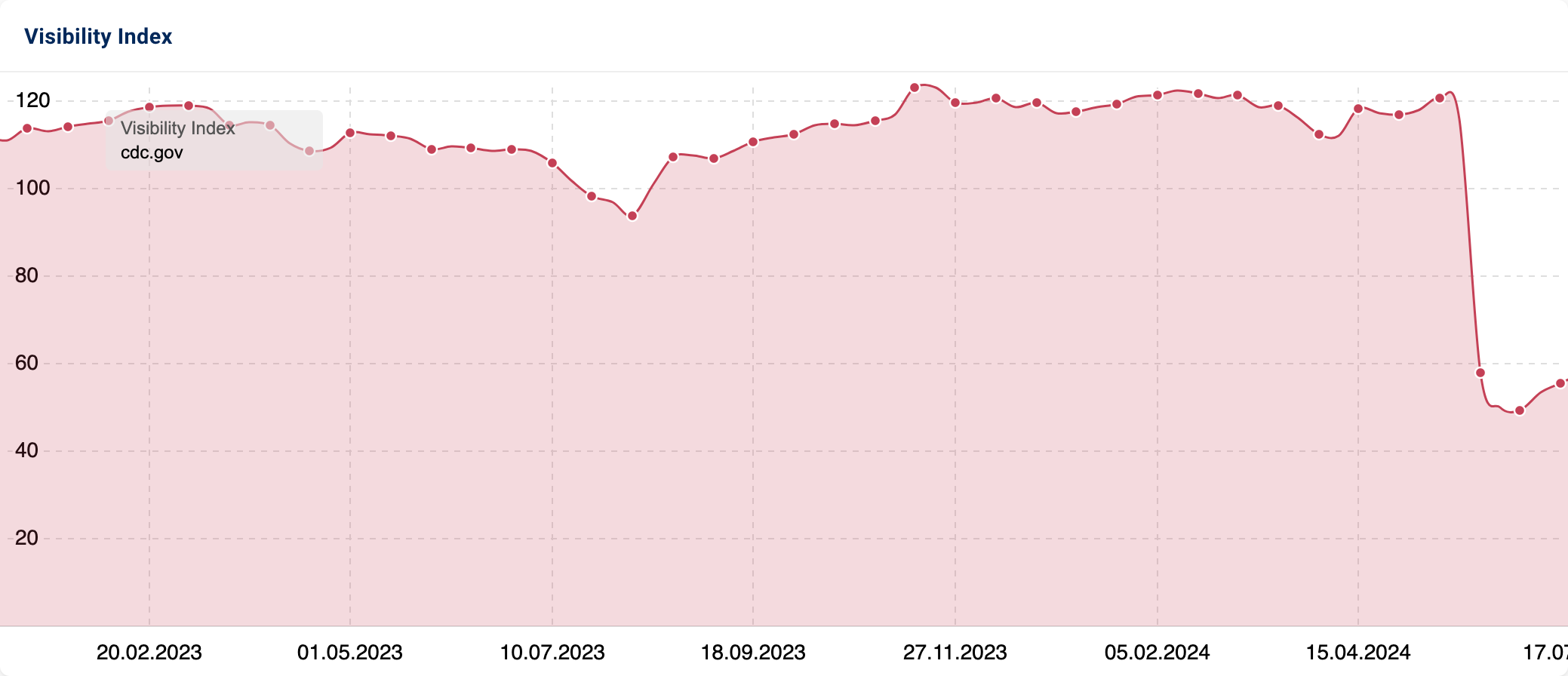

Centers for Disease Control and Prevention (CDC)

The CDC’s website (cdc.gov) visibility on Google UK has decreased by 56.77 VI (Visibility Index) points over the quarter. The Centers for Disease Control and Prevention is a national health institute in the USA. Their website provides information and data on various health topics, including disease prevention content, public health data and research.

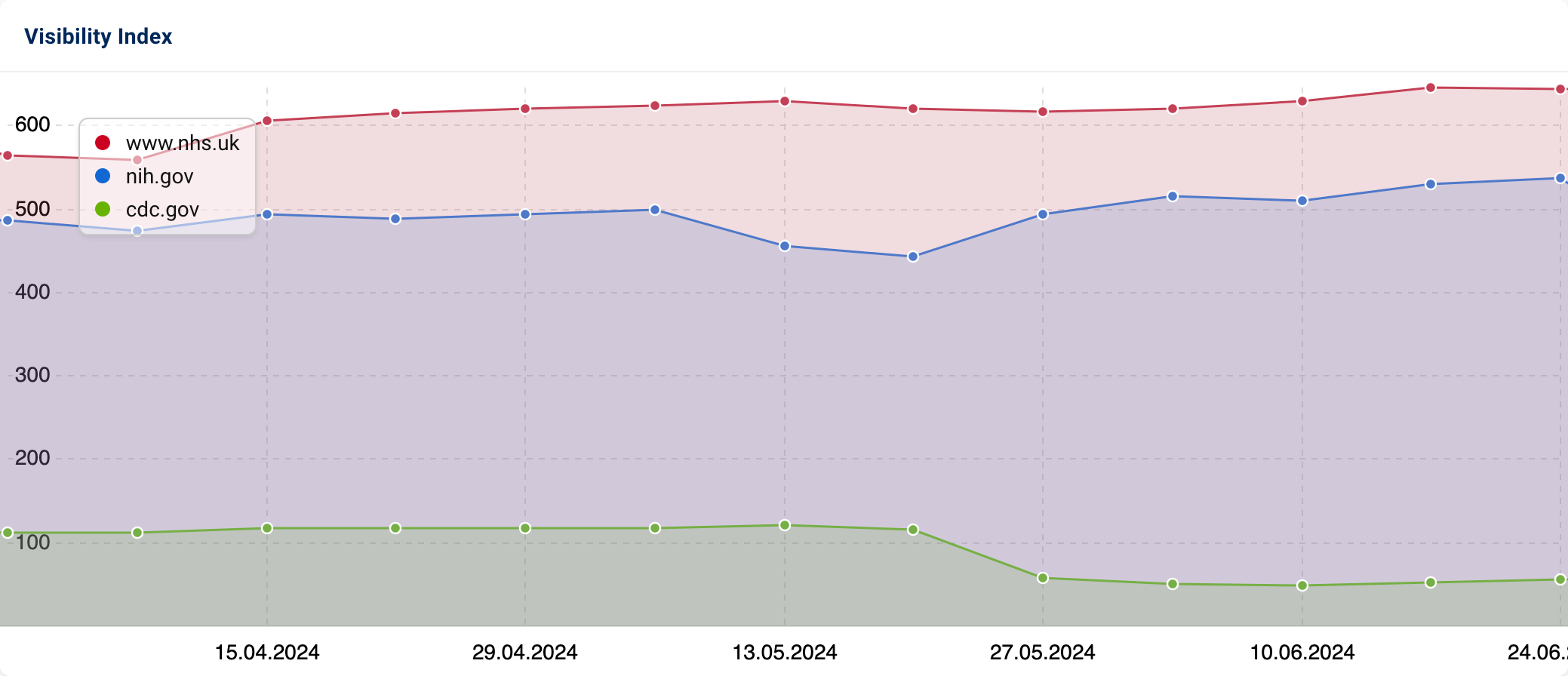

Although Google started AI Overview testing in April, it has been limited to a small group of logged-in users and queries, so its impact on the CDC has been minimal. However, between 1st April and 24th June, the CDC saw a significant drop in regular SERP listings (-37%) and featured snippets (-38%).

During the same period, organic competitors like the NHS (UK’s National Health Service) and the NIH (National Institutes of Health) experienced growth. This trend indicates that recent algorithm updates have prioritised these sources as more relevant and useful compared to the CDC.

It is worth noting that these high-performing competitors have also experienced fluctuations. Despite overall performance improvements, both nhs.uk and nih.gov saw a 3% decline in featured snippets and a 4% to 6% visibility loss in core result listings.

This suggests that previously less authoritative medical sources are gaining organic traction, while these 2 more established domains might be shifting their visibility gains across to different types of SERP features. The continually evolving SERP landscape makes this highly plausible.

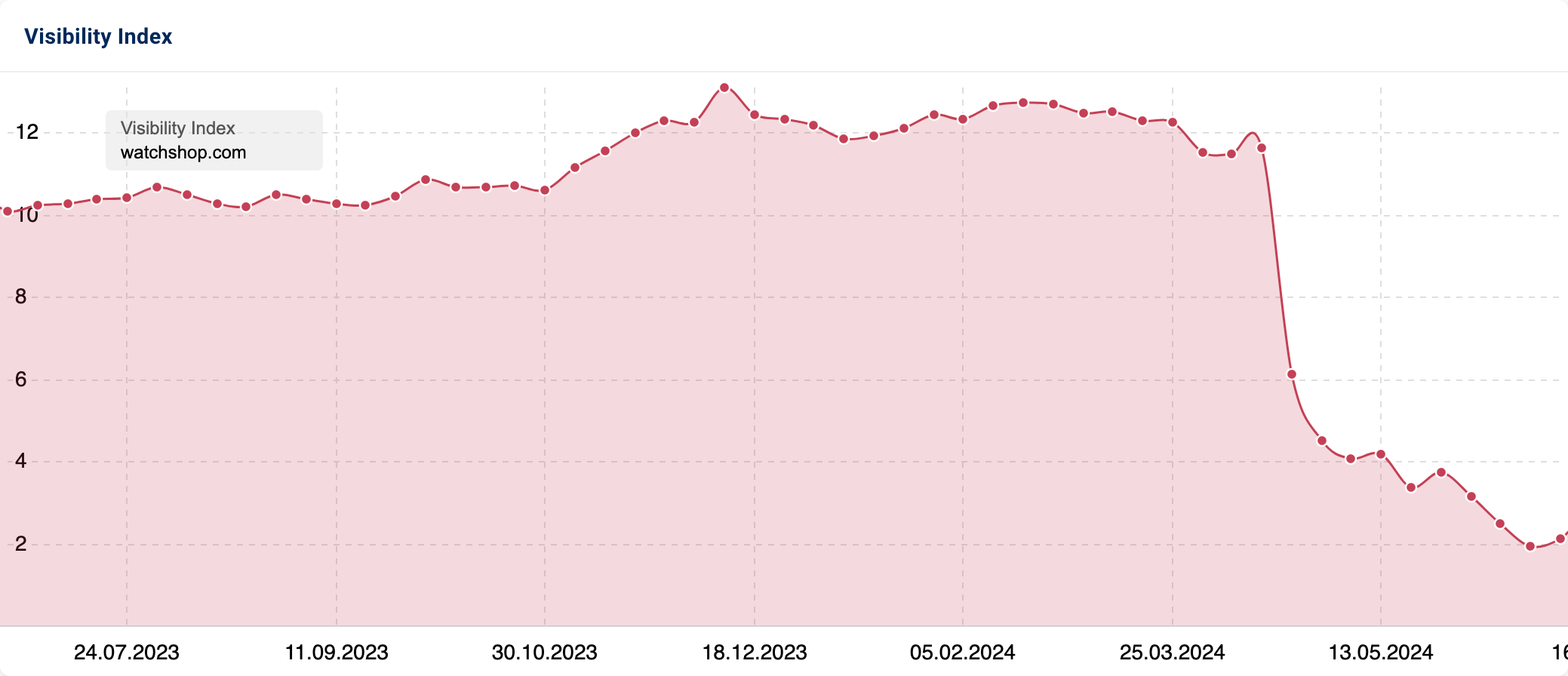

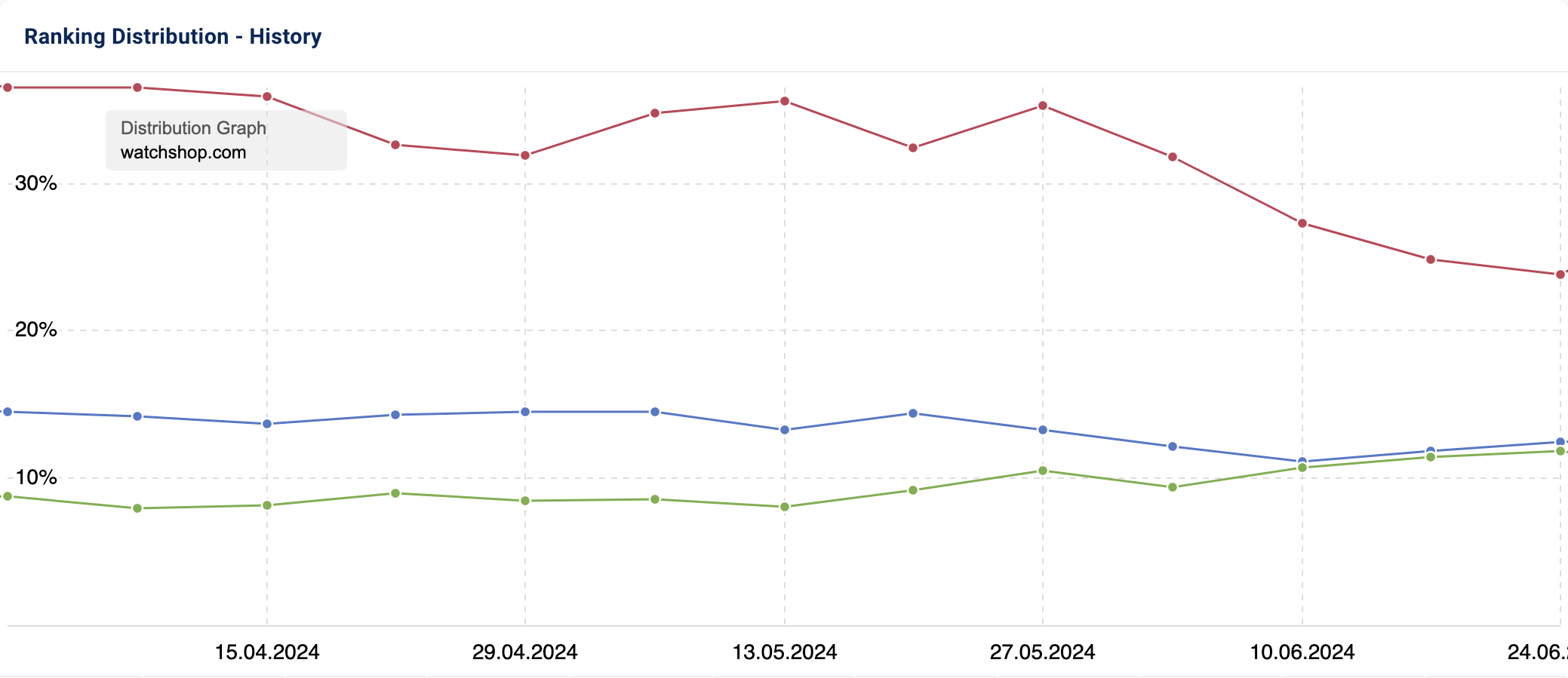

WatchShop

Online watch retailer WatchShop (watchshop.com) saw an 81.51% decline in its Google SERP visibility in Q2.

Acquired by Frasers Group in January 2023 from previous owners JD Sports, WatchShop is an independently run company boasting an extensive range of wristwatches in a range of styles, brands and price points.

WatchShop’s directory data confirms that the visibility decreases were not caused by performance declines in specific areas. The downfall was widespread.

Comparing the distribution of rankings across the search result pages at the beginning of the quarter vs the end, we can see that there have been losses across page 1 (-12%) & page 2 (-2%). A contrasting uplift in rankings on page 3 (+2%) and the latter SERP pages affirms that WatchShop has lost out of organic ranking for a number of popular and more competitive search queries.

Similar to Nintendo, analysing the domain’s URL changes reveals several website modifications. A significant change involved moving brand pages (e.g. Guess) from the “watches” subfolder (/watches/guess) to the root directory (/guess). At the start of Q3, most gender-specific brand pages were also removed and redirected to these new brand pages (/watches/michael-kors/ladies.plp redirected to /michael-kors).

This restructuring, along with the removal of other URLs targeting long-tail queries, led to a shift in the page types that are ranking for specific queries. For instance, keywords like “casio rose gold watch women” began to serve a product page rather than a category. Consequently, these changes impacted content relevance and contributed to position decreases for 3,803 terms.

As 2024 progresses, it will be interesting to see how this situation evolves, what other changes are planned and whether WatchShop can regain their SERP prominence.

All Q2 losers

Below are the losers by absolute change:

| Domain | Visibillity Index 01.04.2024 | Visibillity Index 24.06.2024 | Change |

|---|---|---|---|

| youtube.com | 1826.207 | 1317.624 | -508.5834 |

| twitter.com | 367.169 | 289.807 | -77.3612 |

| facebook.com | 905.911 | 835.336 | -70.5755 |

| pinterest.com | 294.644 | 227.678 | -66.9666 |

| britannica.com | 899.441 | 840.323 | -59.1178 |

| cdc.gov | 112.269 | 55.496 | -56.7738 |

| collinsdictionary.com | 470.178 | 417.021 | -53.157 |

| dictionary.com | 442.9 | 397.52 | -45.3795 |

| apple.com | 242.591 | 205.373 | -37.2174 |

| linkedin.com | 356.749 | 319.727 | -37.0221 |

| vocabulary.com | 211.722 | 178.16 | -33.5625 |

| last.fm | 92.818 | 59.424 | -33.394 |

| wikihow.com | 118.844 | 92.928 | -25.9163 |

| sciencedirect.com | 228.519 | 202.772 | -25.7466 |

| dailymail.co.uk | 69.864 | 45.616 | -24.2475 |

| goodhousekeeping.com | 78.109 | 56.236 | -21.8731 |

| thetimes.co.uk | 23.882 | 2.095 | -21.7874 |

| etsy.com | 505.181 | 484.078 | -21.1028 |

| pcmag.com | 90.604 | 69.628 | -20.976 |

| soundcloud.com | 140.684 | 119.851 | -20.833 |

| mirror.co.uk | 50.994 | 31.49 | -19.5048 |

| goodreads.com | 126.85 | 107.681 | -19.1688 |

| oxfordlearnersdictionaries.com | 106.085 | 88.229 | -17.8561 |

| telegraph.co.uk | 73.129 | 55.539 | -17.5899 |

| argos.co.uk | 320.472 | 302.981 | -17.4907 |

And percent change:

| Domain | Visibillity Index 01.04.2024 | Visibillity Index 24.06.2024 | Percentage change |

|---|---|---|---|

| nintendo.co.uk | 18.217 | 2.903 | -84.06% |

| watchshop.com | 11.547 | 2.135 | -81.51% |

| hadviser.com | 5.559 | 1.401 | -74.79% |

| biomedcentral.com | 14.244 | 3.623 | -74.57% |

| newworldencyclopedia.org | 7.978 | 2.122 | -73.40% |

| hotelmix.co.uk | 3.452 | 1.132 | -67.20% |

| fleetnews.co.uk | 5.662 | 1.921 | -66.07% |

| glasgow.gov.uk | 2.823 | 1.006 | -64.37% |

| computerworld.com | 3.226 | 1.188 | -63.17% |

| songlyrics.com | 4.734 | 1.769 | -62.63% |

| toysrus.co.uk | 3.625 | 1.473 | -59.37% |

| temu.com | 4.636 | 1.913 | -58.73% |

| genome.gov | 9.402 | 3.942 | -58.07% |

| sonypictures.com | 3.006 | 1.306 | -56.57% |

| oberlo.com | 4.219 | 1.868 | -55.72% |

| startech.com | 6.131 | 2.772 | -54.79% |

| tvinsider.com | 5.448 | 2.473 | -54.61% |

| momjunction.com | 5.33 | 2.455 | -53.95% |

| blackwells.co.uk | 6.328 | 2.93 | -53.70% |

| lovepanky.com | 4.362 | 2.04 | -53.24% |

| sitejabber.com | 3.066 | 1.454 | -52.59% |

| verywellfamily.com | 5.86 | 2.799 | -52.23% |

| educative.io | 2.555 | 1.244 | -51.29% |

| educba.com | 2.21 | 1.078 | -51.23% |

| viamichelin.co.uk | 4.559 | 2.227 | -51.16% |

Conclusion

We’ve explored some interesting wins and losses, but what can we take away from the latest SERP fluctuation to support our own SEO endeavours?

- Off-page activity should never be underestimated. SEO is continuing to evolve, and in more recent times, it has become more important than ever to engage in activities that increase brand awareness and, consequently, brand discoverability and authority. In combination with non-brand targeting, this makes for a powerful strategy.

- Keyword cannibalisation isn’t ideal across similar domains and with similar content. However, sometimes, it occurs naturally or is necessary to provide appropriate topic coverage and cater to users with differing intents and at different stages of the purchase journey. In the case of Nintendo, this makes complete sense.

- Recent updates have penalised irrelevant and low-quality content. With this in mind, it is even more important to put E-E-A-T (Experience, Expertise, Authoritativeness & Trustworthiness) at the forefront of your optimisation plans. Think like a user, not like a bot.

- For brands with an international audience, Hreflang is a no-brainer to maximise user experience, content relevance and accessibility. However, if implemented incorrectly, it can lower user confidence and cause frustration.

- Updating URL structures at scale can be risky. In the case of WatchShop, this refresh seems to have negatively impacted their Google SERP visibility.

- Visibility losses aren’t always due to poor-quality content. Sometimes, the information may not be as relevant to the audience (for example: CDC, a US public health service).

- The SERP landscape is ever-changing. Sometimes, this results in brand-new gains and losses. However, sometimes visibility is maintained but may take a different form.

- While information generated by Artificial Intelligence (AI) can be useful, it should not be fully trusted for accuracy. Human intervention is still necessary for content quality, relevance and precision.

Methodology

We’ve leveraged SISTRIX’s Visibility Index to analyse Google UK’s top 250 winners and losers. These domains have experienced the most significant shifts in visibility between 1st April and 24th June 2024.

Please note: The Visibility Index (VI) scores do not account for external variables, like seasonality.

You can assess live data from all domains and grow your visibility with the Free SISTRIX Trial.