Q1 2024 has proven to be a dynamic period in the world of SEO. Over the past 3 months, Google launched two significant updates – the March Core Update and the March Spam Update – which have triggered substantial upheavals in the SERP landscape. The beneficiaries and the casualties give us great insights, and that’s what we’ve researched for this IndexWatch. 6 domains analysed, 100 domains listed.

SEO Winners Q1 2024

Made

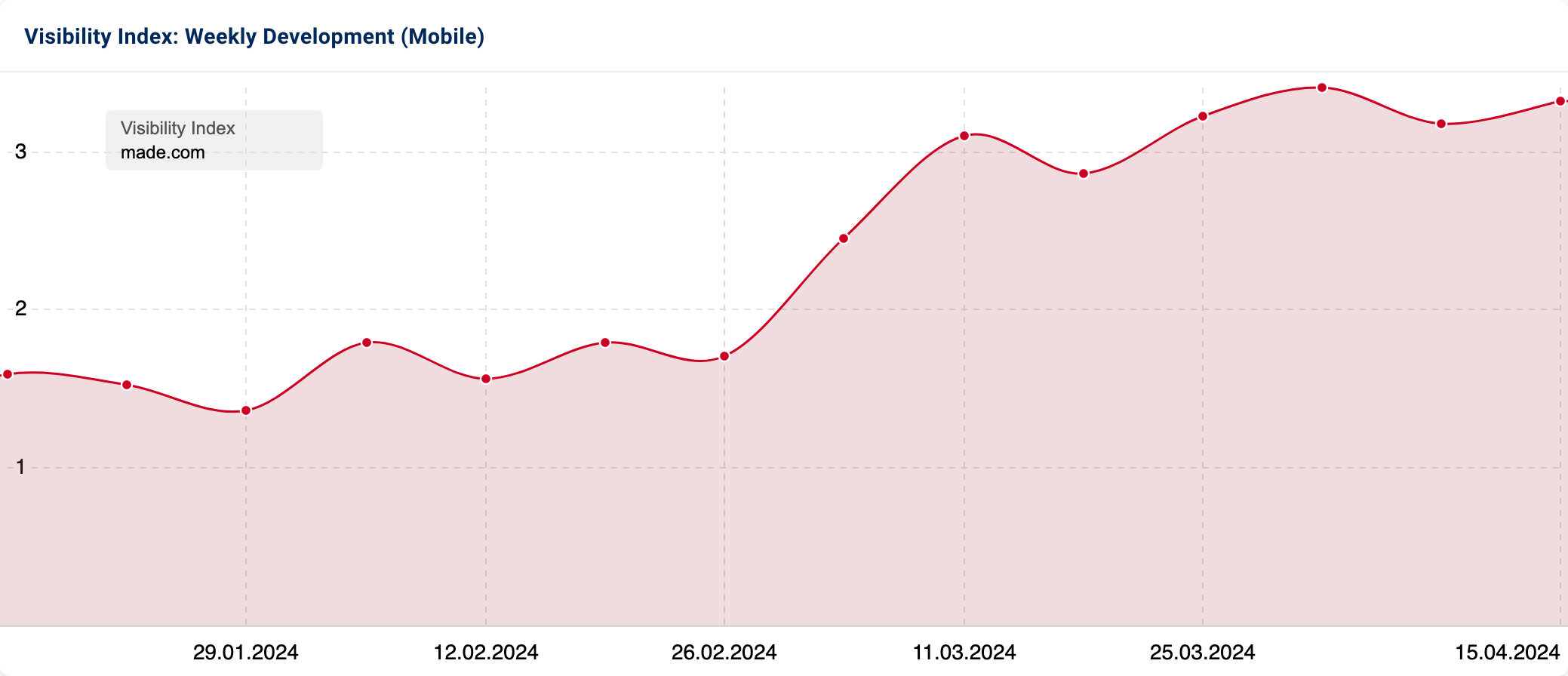

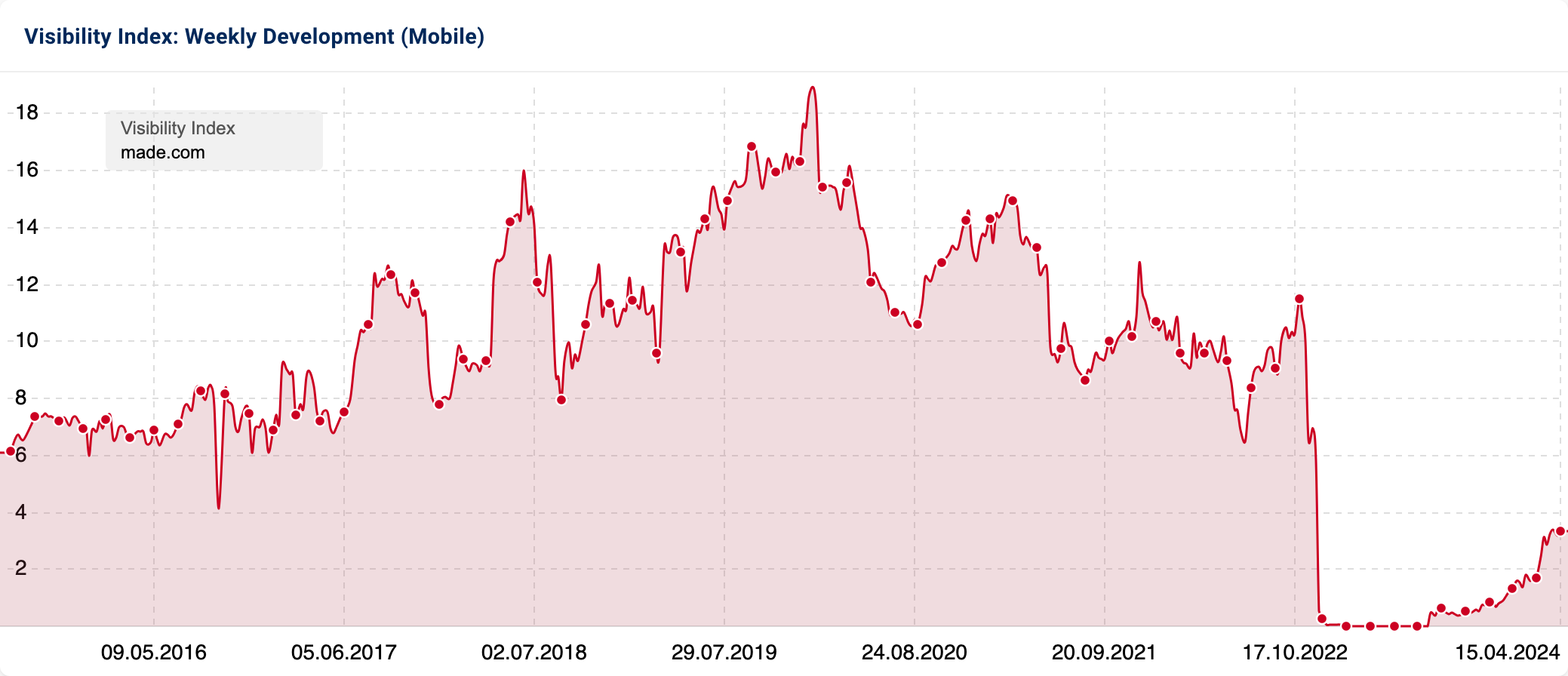

Online furniture retailer Made experienced a 178.6% increase in organic visibility over the quarter. Established in 2010, Made.com sells a vast range of high-quality furniture and home decoration products at an affordable price.

Previously, Made’s Google search visibility was exceptional. However, the brand has faced notable setbacks since late 2022.

In November 2022, Made.com entered into administration. Subsequently, British fashion and homeware retailer Next secured the brand, its domains and intellectual assets. However, as part of this deal, Next did not opt to take on the company’s workforce or inventory.

Prior to the acquisition, the website and its categories remained live. However, the company updated the homepage with a message about not taking orders and disabled purchasing. This suggests that Made’s SEO team understood how an acquiring party could benefit from the organic authority they’d built over time and did their utmost to ensure that the domain remained an attractive asset to potential buyers.

Despite this consideration and effort, the domain was blanket 301 redirected to Next’s brand page for Made. This ultimately resulted in the domain’s rapid decline in December 2022.

So, what happened in Q1 2024? Well…following the removal of the 301 redirects to the Next website and gradually reinstating categories and products in July 2023, Made.com is rebuilding its SEO footprint. Our URL change data confirms that the domain is reclaiming some of its previous rankings by recreating categories with new URL structures.

Example of URL structure change

- Pre-acquisition: www.made.com/tables/desks

- Post-acquisition: www.made.com/shop/home-office/office-desk

Despite the existence of like-for-like categories across certain product types, the team at Next PLC has yet to create like-for-like redirects from the legacy URLs to the new ones; instead redirecting users to the homepage. It will be interesting to see whether this blanket rule is removed in the coming months.

YouGarden

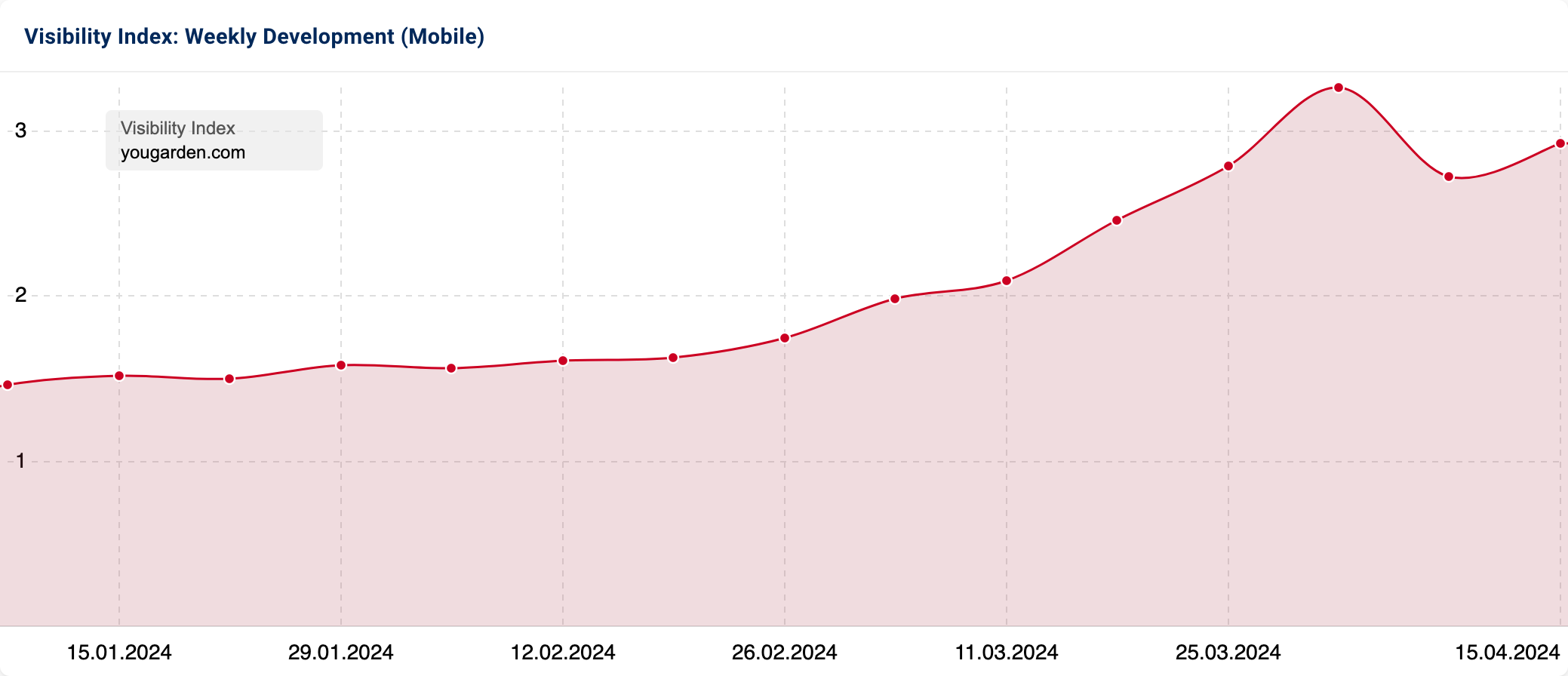

Yougarden.com is an online shop specialising in plants, outdoor living and gardening tools, equipment and accessories. In Q1, the site’s Google search visibility increased by 151.4%.

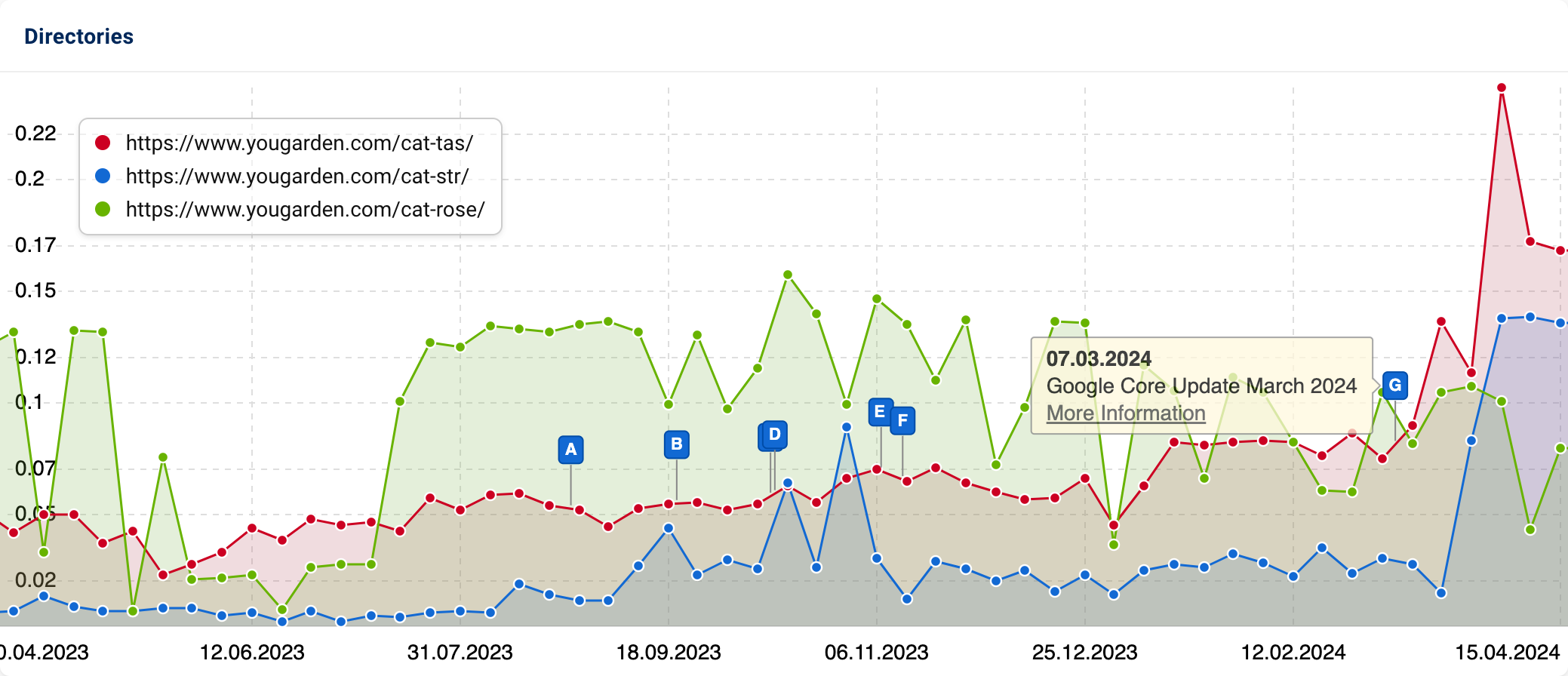

So, what caused this uplift? Digging into the directory-level data, we can see that two categories have seen significant growth over time, with their visibility being supercharged following the roll-out of the March 2024 Core Update: cat-tas (Trees & Shrubs) and cat-str (Strawberry Plants).

The Tree & Shrubs category experienced a 260.9% visibility uplift compared to 1st January 2024, with Strawberry Plants seeing a more impressive 826.7% improvement.

The organic growth associated with these categories and the website more broadly is due to the introduction of new products and the optimisation of existing ones. Since the beginning of 2024, the domain has obtained 14,529 new keywords and seen position improvements for a further 10,688.

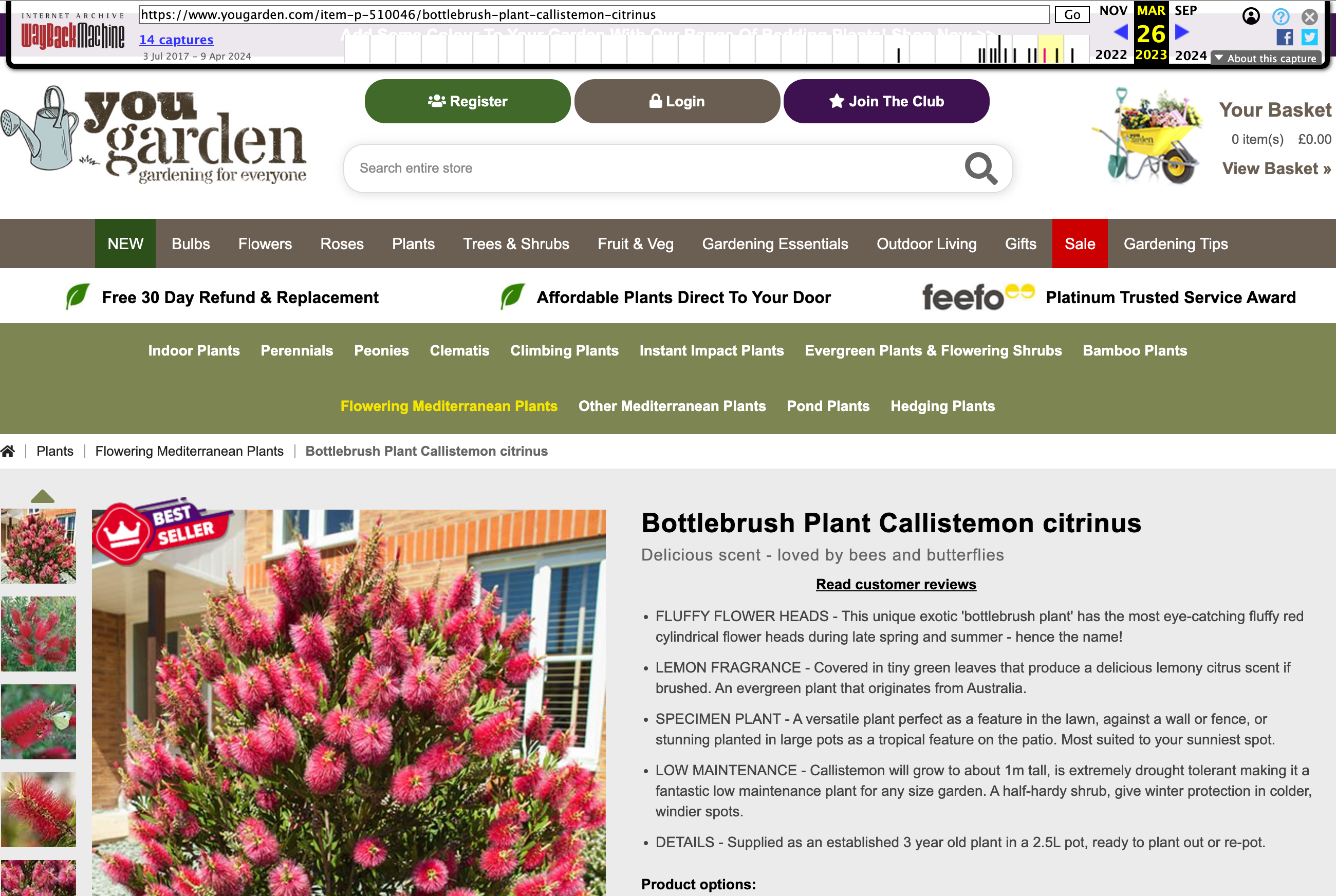

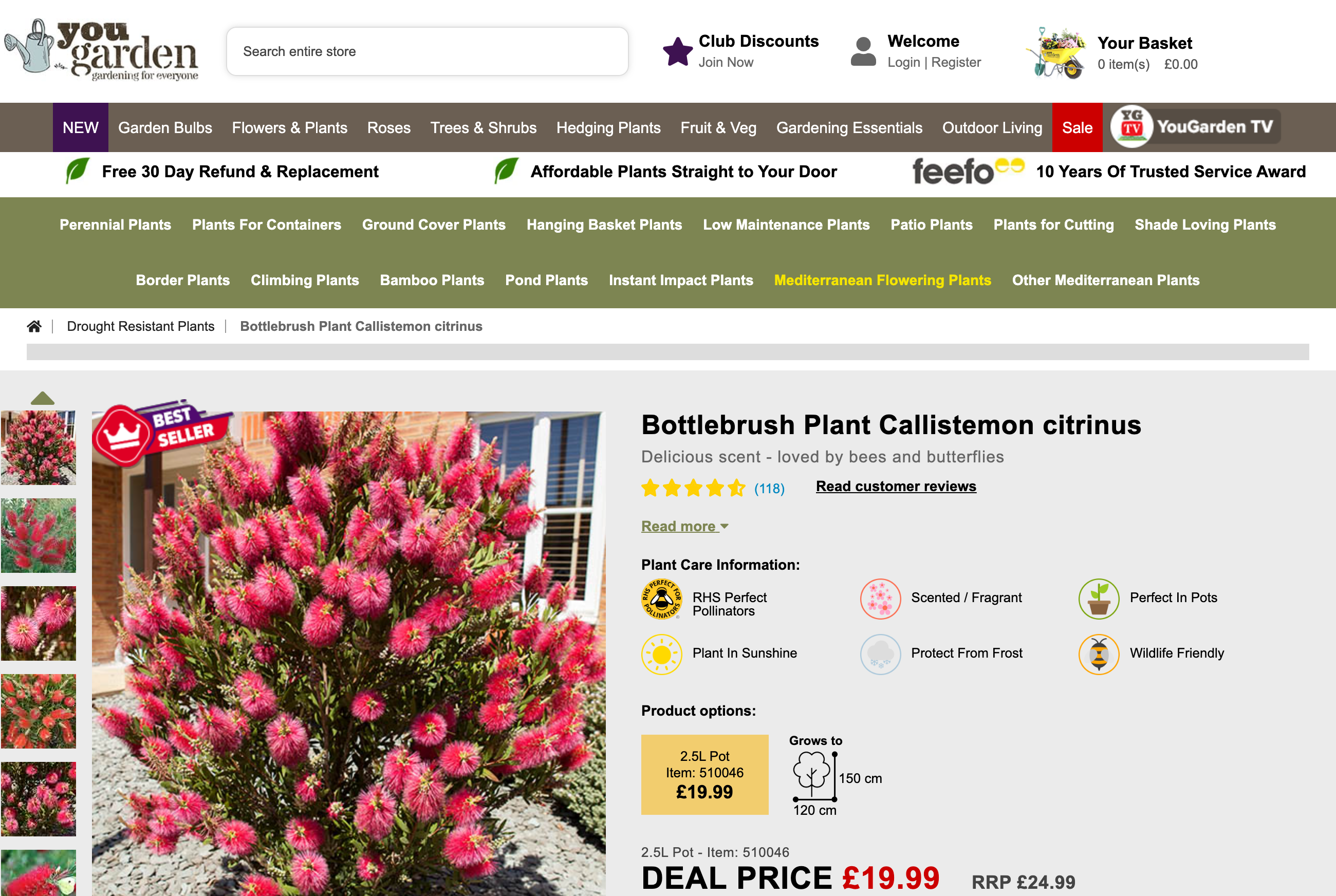

Examining the historical designs of a few of the site’s longstanding products verifies that the product information pages have undergone alterations in the last 12 or so months. Most notably, product descriptions have been rewritten, and certain content elements have been reprioritised to sit above the fold. Furthermore, horizontal internal linking has been facilitated through a “You Might Also Like” product carousel.

March 2023:

April 2024:

As we know, with every algorithm update, Google consistently endeavours to refine its search engine to enhance user experience, result relevance and quality. Judging by the most recent visibility data, it seems that the recent improvements made to yougarden.com’s product pages, paired with content expansion, have yielded a positive outcome.

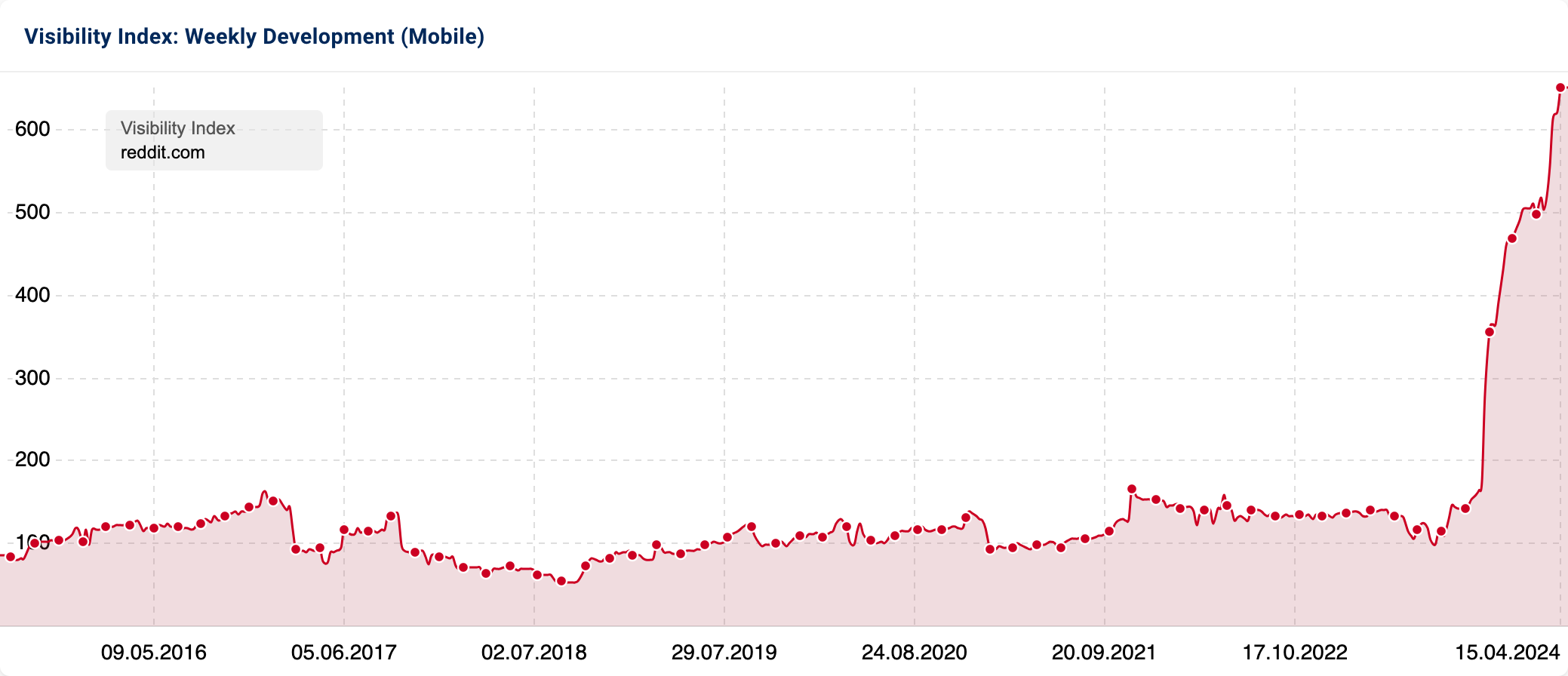

Popular online forum Reddit.com has also seen a significant increase in its SEO visibility. Over the quarter, its Visibility Index (VI) score has risen by 143 points.

Moving into Q2 2024, the domain has achieved its highest all-time level of Google SERP visibility. But why have we seen such a sharp uptick in more recent times?

In case you missed it, on 22nd February 2024, Google announced that they had deepened their long-standing partnership with Reddit.

For years, Reddit has been widely recognised by many for its vast amounts of user-generated content on different topics; with subreddits available that cover pretty much anything and everything. With Google’s ongoing mission to improve the search experience – particularly with the gradual rollout of the Search Generative Experience (SGE) – they have struck a deal with Reddit to train their Gemini AI technology. As a result, we have seen a gradual increase in the amount of Reddit results appearing across all Google search engines, including the UK.

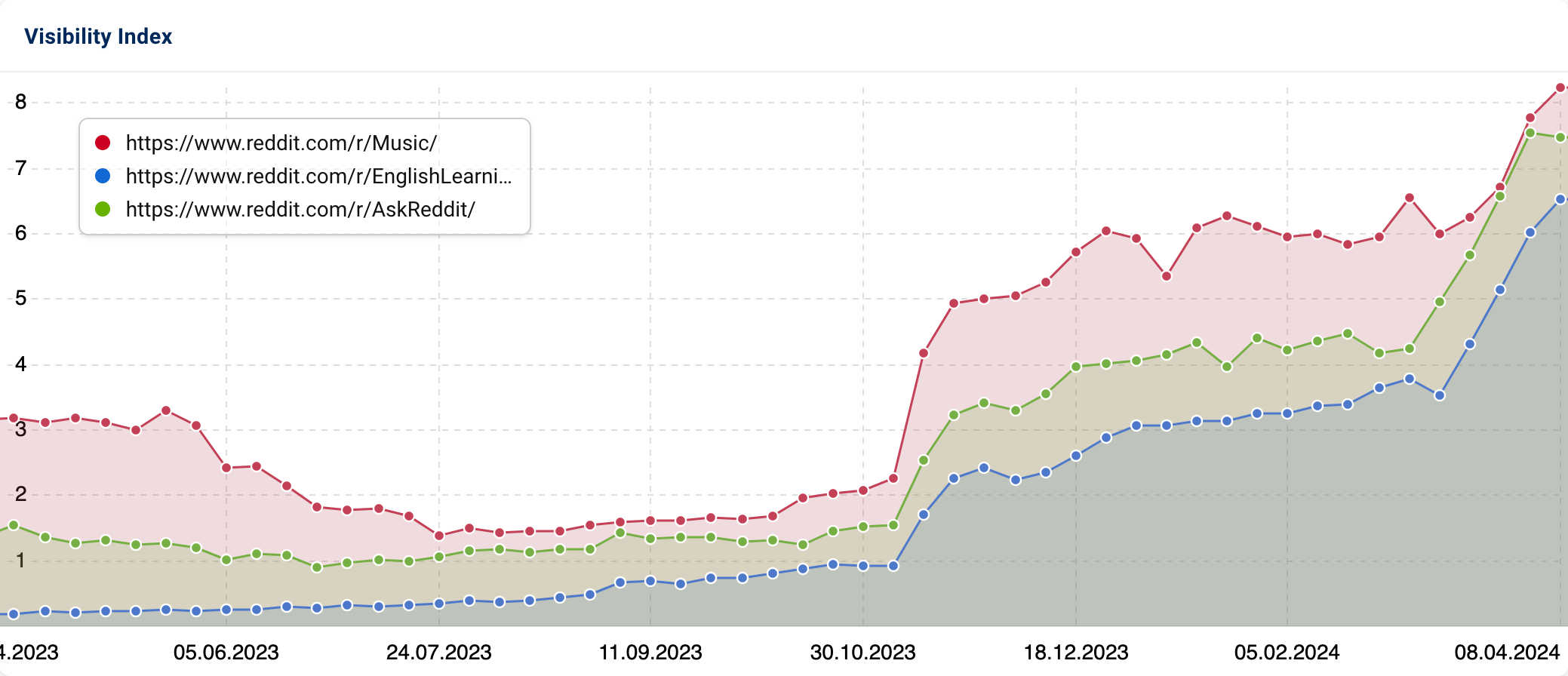

By analysing the domain’s directories, we’ve pinpointed the subreddits that have seen the most substantial surges in Google visibility since the announcement of the extended Google/Reddit collaboration. These are r/Music, r/EnglishLearning and r/AskReddit.

As SGE has only been released for a small set of Google UK users, it is very early days to fully understand the extent of Reddit/Google collaboration and how/how often Reddit’s content will be shown in the SERPs. However, since 1st January 2024, Reddit’s “/r” directory – which contains all the subreddits – has obtained 95,995 new keyword positions, with 170,511 existing keywords seeing ranking improvement.

Undoubtedly, given the “paid for” nature of Google & Reddit partnership – reportedly worth $60 million – all eyes will be on how Reddit’s organic prominence increases and evolves with the full release and refinement of SGE.

For more analysis on Reddit, see this data-led article on competitors, top subreddits and SEO economics.

All Q1 2024 winners

Below are the biggest 25 gains by absolute change:

| # | Domain | 01.01.2024 | 01.04.2024 | Change |

|---|---|---|---|---|

| 1 | amazon.co.uk | 3188.56 | 3589.59 | 401.03 |

| 2 | youtube.com | 1465.44 | 1826.21 | 360.77 |

| 3 | reddit.com | 469.48 | 612.48 | 143.00 |

| 4 | facebook.com | 808.42 | 905.91 | 97.49 |

| 5 | quora.com | 160.35 | 250.19 | 89.83 |

| 6 | instagram.com | 708.50 | 758.26 | 49.76 |

| 7 | twitter.com | 317.78 | 367.17 | 49.39 |

| 8 | nih.gov | 442.54 | 485.76 | 43.22 |

| 9 | fandom.com | 569.87 | 606.40 | 36.53 |

| 10 | etsy.com | 469.17 | 505.18 | 36.01 |

| 11 | tiktok.com | 89.68 | 119.13 | 29.45 |

| 12 | vocabulary.com | 184.56 | 211.72 | 27.16 |

| 13 | cancer.gov | 18.30 | 44.60 | 26.30 |

| 14 | linkedin.com | 331.27 | 356.75 | 25.48 |

| 15 | diy.com | 149.15 | 173.51 | 24.37 |

| 16 | spotify.com | 292.39 | 315.38 | 22.99 |

| 17 | apple.com | 219.87 | 242.59 | 22.72 |

| 18 | bbc.co.uk | 208.83 | 230.44 | 21.61 |

| 19 | soundcloud.com | 120.45 | 140.68 | 20.24 |

| 20 | pornhub.com | 228.04 | 246.66 | 18.63 |

| 21 | company-information.service.gov.uk | 223.74 | 241.70 | 17.96 |

| 22 | webmd.com | 257.28 | 272.57 | 15.29 |

| 23 | asda.com | 41.51 | 56.54 | 15.03 |

| 24 | pinterest.co.uk | 51.12 | 66.14 | 15.02 |

| 25 | oed.com | 38.82 | 53.42 | 14.60 |

And the biggest gains by percent change:

| # | Domain | 01.01.2024 | 01.04.2024 | Change |

|---|---|---|---|---|

| 1 | warwick.ac.uk | 1.30 | 5.44 | 319.28% |

| 2 | made.com | 1.22 | 3.41 | 178.61% |

| 3 | savemyexams.com | 1.19 | 3.19 | 167.07% |

| 4 | yougarden.com | 1.30 | 3.26 | 151.44% |

| 5 | theknowledgeacademy.com | 1.21 | 3.00 | 147.66% |

| 6 | heavy-r.com | 4.30 | 10.59 | 146.14% |

| 7 | hmrc.gov.uk | 4.88 | 11.99 | 145.93% |

| 8 | cancer.gov | 18.30 | 44.60 | 143.73% |

| 9 | famousfix.com | 1.03 | 2.50 | 141.38% |

| 10 | phase-eight.com | 1.74 | 4.17 | 139.86% |

| 11 | xnxx.health | 3.00 | 7.06 | 135.44% |

| 12 | coxandcox.co.uk | 2.45 | 5.74 | 134.63% |

| 13 | brandonhirestation.com | 1.31 | 3.00 | 129.01% |

| 14 | simonandschuster.co.uk | 3.33 | 7.44 | 123.36% |

| 15 | lasertools.co.uk | 1.03 | 2.27 | 121.13% |

| 16 | tuasaude.com | 1.12 | 2.44 | 117.90% |

| 17 | jessops.com | 6.44 | 14.00 | 117.49% |

| 18 | itranslate.com | 1.49 | 3.23 | 116.87% |

| 19 | inthestyle.com | 1.24 | 2.69 | 116.84% |

| 20 | beatport.com | 3.46 | 7.44 | 114.98% |

| 21 | nigella.com | 2.86 | 6.10 | 113.14% |

| 22 | theweek.com | 1.31 | 2.72 | 108.50% |

| 23 | ck12.org | 1.18 | 2.44 | 106.23% |

| 24 | kingsseeds.com | 1.55 | 3.19 | 106.18% |

| 25 | charleskeith.co.uk | 2.09 | 4.27 | 104.11% |

SEO Losers – Q1 2024

Missguided

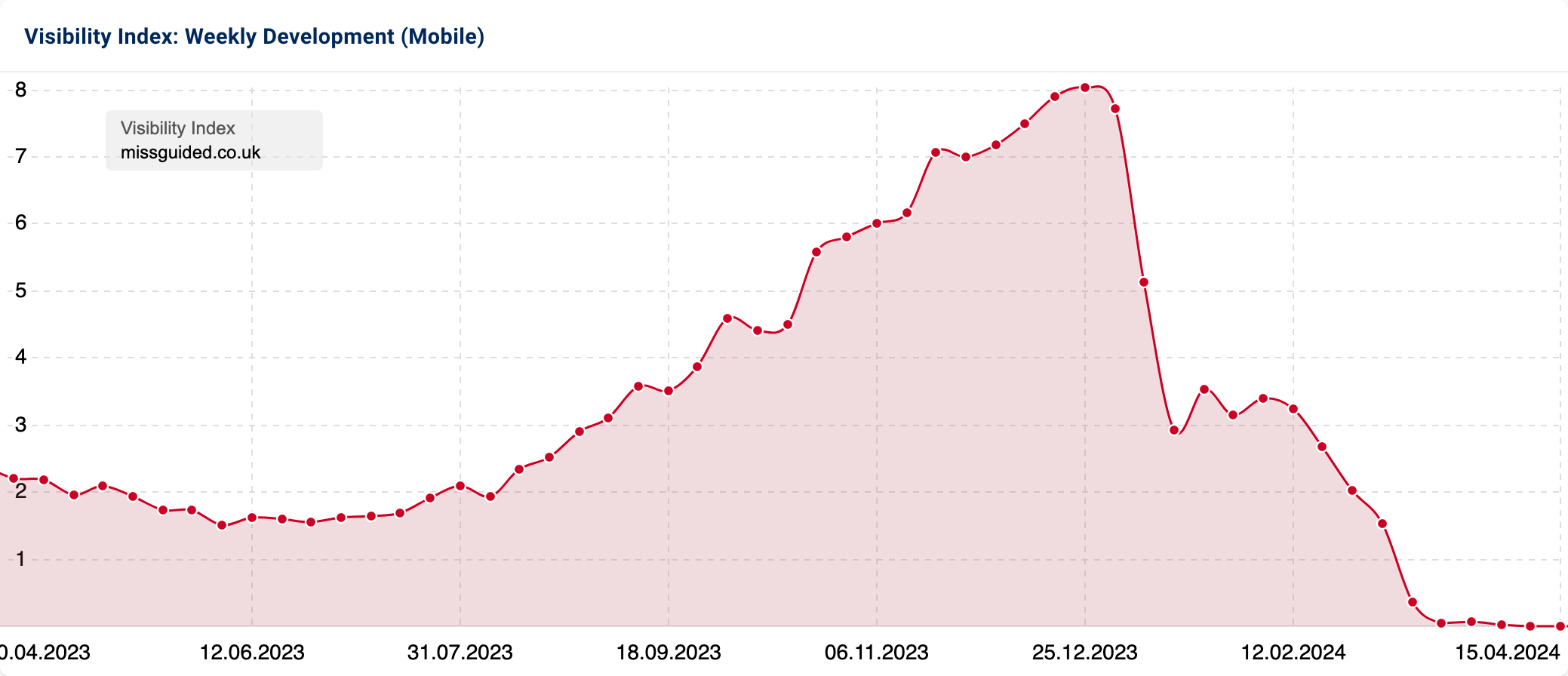

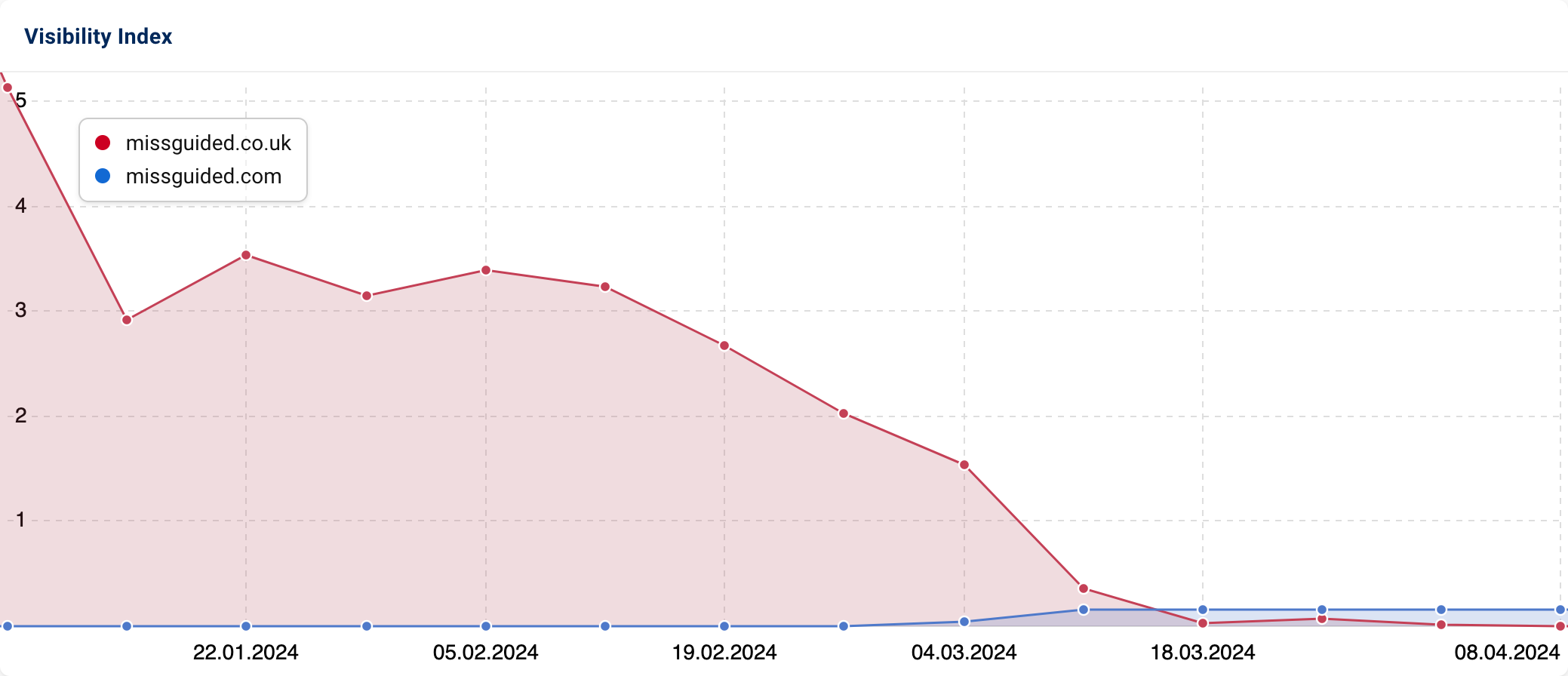

UK fashion retailer Missguided saw a significant downshift in its Google visibility in Q1 2024 (approximately -98%).

Founded in 2009, Missguided made a name for itself as a prominent player in the world of women’s fashion. However, akin to Made.com, it faced financial difficulties and entered administration in mid-2022. In August 2022, the brand found refuge under the Frasers Group (which also owns brands including House of Fraser, Sports Direct and Sofa.com) and in October 2023, it was announced that it was being sold to Chinese fast fashion brand, SHEIN.

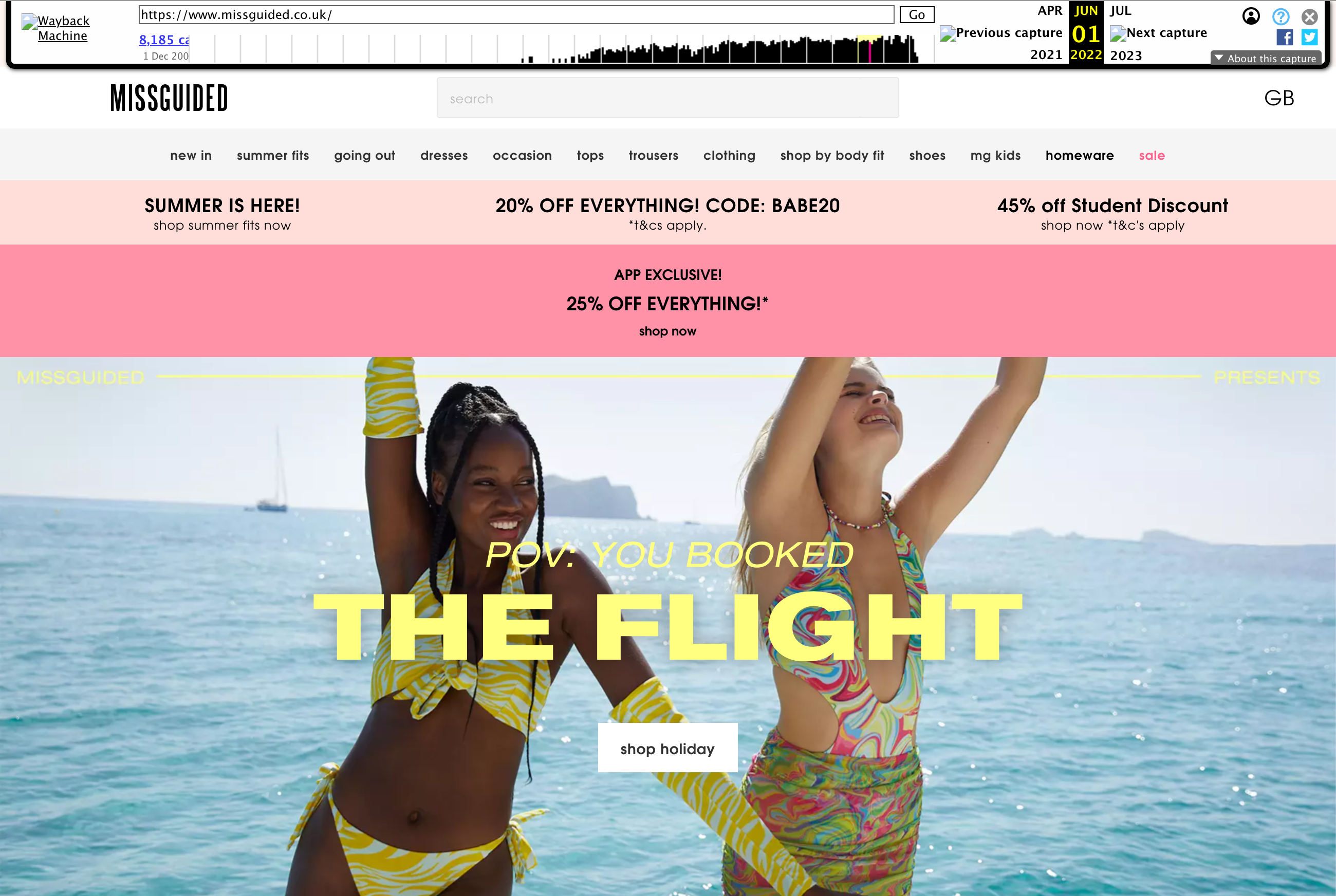

Following Missguided’s acquisition by Frasers Group, the domain’s visibility initially continued on a downward trajectory before starting to gain positive traction in June/July 2023. Once acquired, the site was reskinned to align with Frasers Group’s other fashion brands. The category and URL structures were also changed.

June 2022 (pre-Frasers Group acquisition):

September 2022 (post-Frasers Group acquisition):

Fast forward to April 2024 under the care of SHEIN, and we can see that missguided.co.uk is in the midst of a domain migration to missguided.com – which is currently under construction.

April 2024 (post-SHEIN acquisition):

As we progress into 2024, all eyes will be on missguided.com. The looming questions remain: Will the domain migration be executed smoothly? Can Missguided capitalise on historical link equity to enhance the domain’s SERP presence?

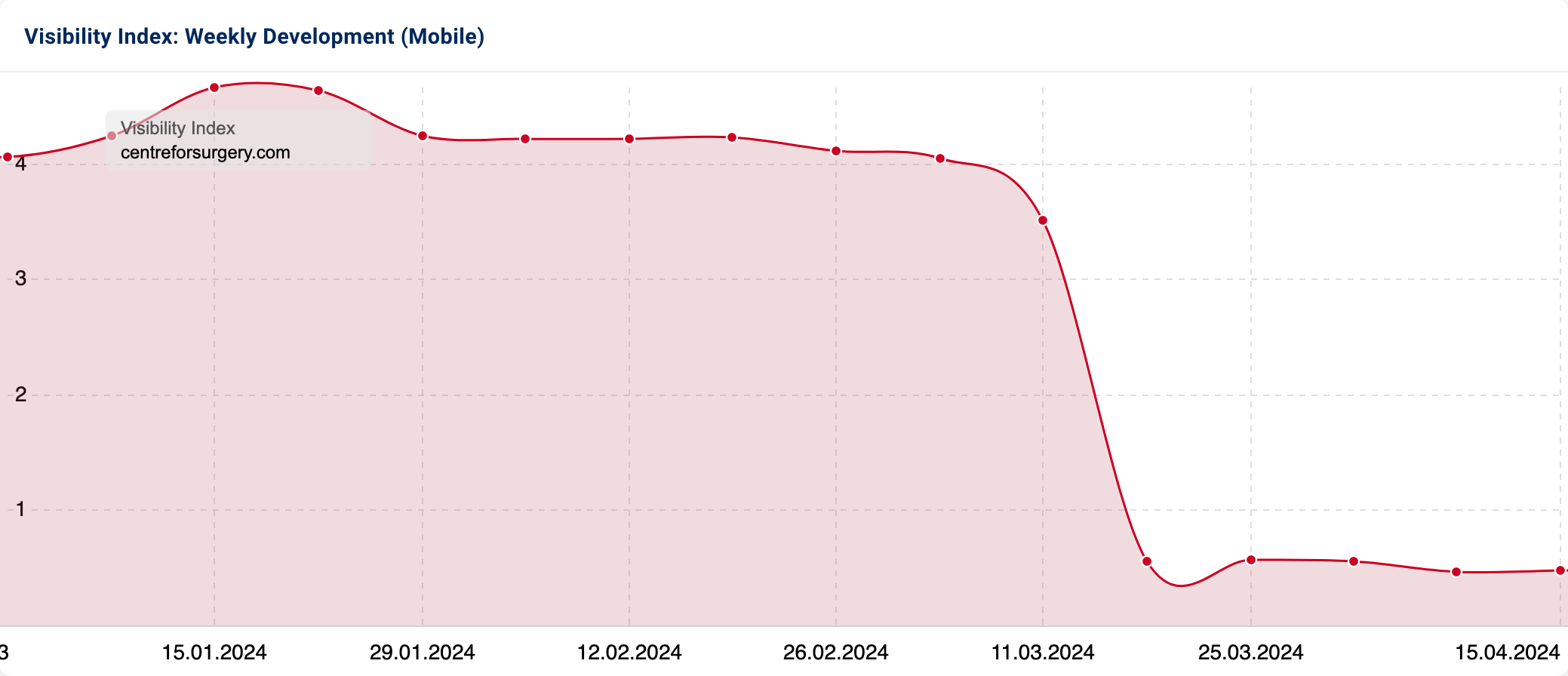

Centre For Surgery

Centre For Surgery is a London-based cosmetic surgery clinic offering both aesthetic and reconstructive procedures. From January to April, their domain, centreforsurgery.com, experienced an 86.2% visibility decline on UK Google.

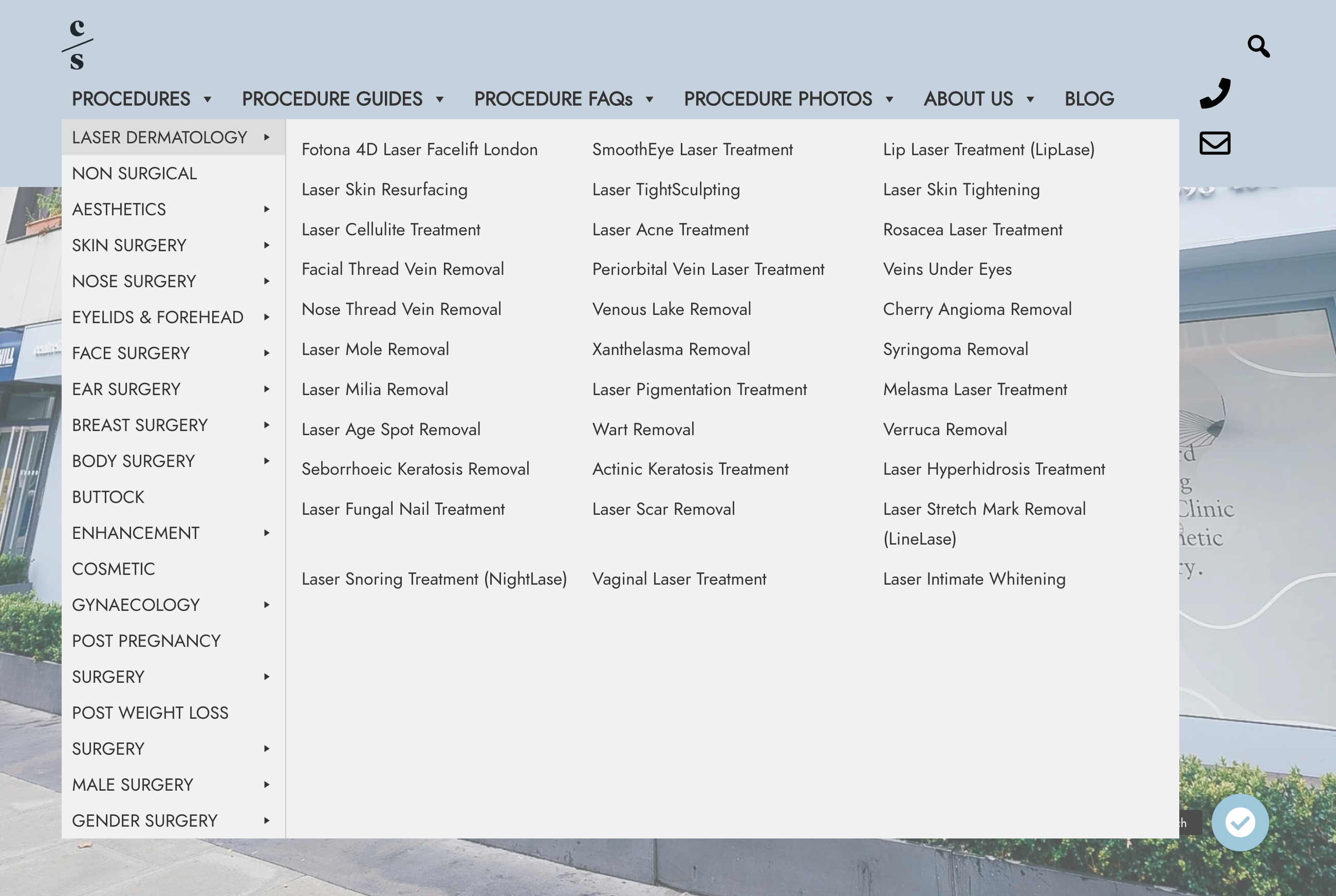

Centreforsurgery.com’s sudden drop in SERP prominence coincides with the commencement of the March Core & Spam Updates. While Google typically keeps the specifics of updates under wraps, they made an exception with the March Spam Policy Update, revealing the types of practices they were addressing. Upon scrutinising the Centre For Surgery website, it became quickly evident why this particular domain experienced losses vs its close competitors.

Considering that Centre For Surgery is a service-oriented website, its header menu structure resembles that of an e-commerce platform. The abundance of links and the design of the menu also contribute to a suboptimal user experience. Furthermore, the site’s Information Architecture appears disjointed and lacks depth, with most pages not organised into subfolders and minimal horizontal and vertical linking within the body content.

The extensive list of available procedures and the content on procedure pages also suggests that the Centre For Surgery may have created pages to appease the search engine bots rather than users, using AI to generate content for specific page sections.

These factors, combined with generic customer reviews on procedure pages and a lack of topical hubs, leave much to be desired from an E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) perspective. As a brand that falls into the Your Money Your Life (YMYL) category, it is not putting these elements at the forefront, which will affect user trust and therefore, consultation bookings.

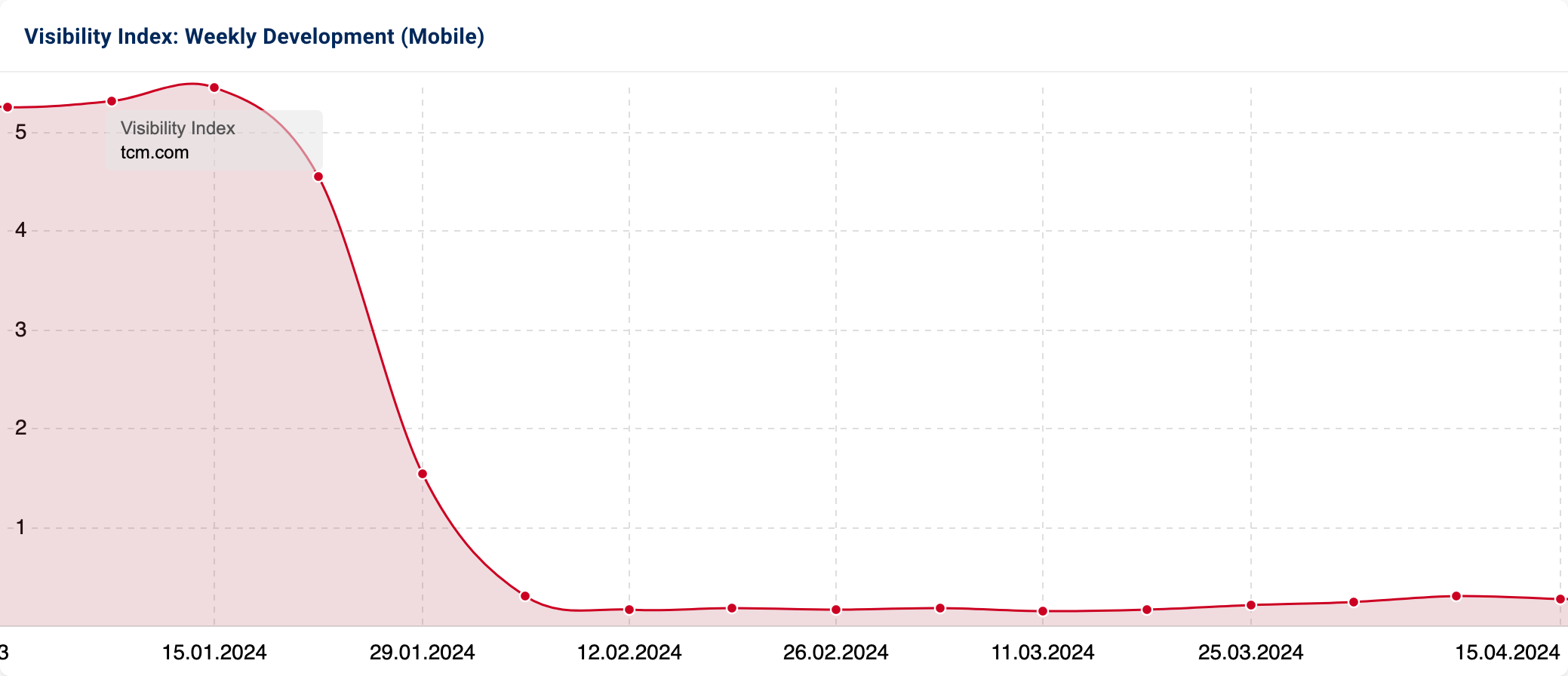

Turner Classic Movies

In the first quarter of 2024, tcm.com, the online home of Turner Classic Movies (TCM) experienced a significant decrease in its Google visibility (-95.2%). Owned by Warner Bros. Discovery, TCM was brought to the UK in 1993 and broadcasts a wide range of movies and shows; from Hollywood classics and foreign films to cinematic history documentaries.

The fate of Turner Classic Movies was a much-discussed topic in 2023. On 20th June 2023, news broke that TCM had made a number of layoffs, including the entire executive leadership team, many of whom had been long-time employees of the channel. Ultimately, this decision was made as part of a Warner Bros. Discovery cost-cutting exercise.

This announcement in itself initiated a handful of prominent figures in Hollywood – inclusive of Steven Spielberg – to meet with the company’s CEO, David Zaslav, to press importance on TCM’s survival. However, to the dismay of British fans and in parallel with the cost concerns, Warner Bros. Discovery confirmed that they would be shutting down TCM Movies UK the following month (July 2023).

Whilst we are unable to determine exactly when geoblocking was implemented, the Visibility Index graph suggests that this was initiated at the end of 2023, leading to the large drop-off that we can see across Q1 2024.

All Q1 2024 losers

Below are the biggest 25 losers by absolute change:

| # | Domain | 01.01.2024 | 01.04.2024 | Change |

|---|---|---|---|---|

| 1 | wikipedia.org | 7799.04 | 7324.69 | -474.35 |

| 2 | xnxx.com | 139.49 | 35.95 | -103.54 |

| 3 | cambridge.org | 1174.86 | 1079.06 | -95.80 |

| 4 | indeed.com | 341.17 | 260.34 | -80.83 |

| 5 | collinsdictionary.com | 527.50 | 470.18 | -57.32 |

| 6 | www.nhs.uk | 615.54 | 564.79 | -50.75 |

| 7 | genius.com | 316.21 | 272.60 | -43.61 |

| 8 | goodhousekeeping.com | 115.44 | 78.11 | -37.33 |

| 9 | merriam-webster.com | 1066.21 | 1030.07 | -36.13 |

| 10 | imdb.com | 1273.34 | 1241.71 | -31.63 |

| 11 | johnlewis.com | 182.51 | 154.54 | -27.97 |

| 12 | thesaurus.com | 158.20 | 132.21 | -25.99 |

| 13 | bbc.com | 64.85 | 40.03 | -24.82 |

| 14 | discogs.com | 145.75 | 121.88 | -23.87 |

| 15 | healthline.com | 341.72 | 318.17 | -23.55 |

| 16 | mayoclinic.org | 340.44 | 317.46 | -22.98 |

| 17 | rottentomatoes.com | 227.28 | 205.47 | -21.81 |

| 18 | wayfair.co.uk | 96.36 | 74.58 | -21.79 |

| 19 | google.co.uk | 120.87 | 101.48 | -19.38 |

| 20 | urbandictionary.com | 60.55 | 42.22 | -18.33 |

| 21 | microsoft.com | 302.47 | 285.13 | -17.34 |

| 22 | azlyrics.com | 46.08 | 30.12 | -15.97 |

| 23 | insider.com | 15.89 | 0.00 | -15.89 |

| 24 | a-z-animals.com | 17.95 | 2.85 | -15.10 |

| 25 | techtarget.com | 82.28 | 67.50 | -14.78 |

Here are the biggest 25 losers by percent:

| # | Domain | 01.01.2024 | 01.04.2024 | Change |

|---|---|---|---|---|

| 1 | insider.com | 15.89 | 0.00 | -100.00% |

| 2 | shopdisney.co.uk | 11.61 | 0.01 | -99.94% |

| 3 | whowhatwear.co.uk | 3.79 | 0.00 | -99.88% |

| 4 | missguided.co.uk | 7.71 | 0.02 | -99.75% |

| 5 | songtell.com | 10.39 | 0.06 | -99.45% |

| 6 | ace.co.uk | 4.14 | 0.12 | -97.01% |

| 7 | tcm.com | 5.26 | 0.25 | -95.25% |

| 8 | box.co.uk | 5.34 | 0.29 | -94.61% |

| 9 | wired.co.uk | 6.81 | 0.52 | -92.41% |

| 10 | drtroublesauce.co.uk | 11.05 | 0.85 | -92.29% |

| 11 | wiggle.com | 5.10 | 0.67 | -86.79% |

| 12 | centreforsurgery.com | 4.06 | 0.56 | -86.24% |

| 13 | a-z-animals.com | 17.95 | 2.85 | -84.12% |

| 14 | xnxx2.com | 3.16 | 0.51 | -83.93% |

| 15 | oakley.com | 5.53 | 0.94 | -83.10% |

| 16 | insanelygoodrecipes.com | 3.37 | 0.63 | -81.28% |

| 17 | buoyhealth.com | 3.51 | 0.88 | -74.85% |

| 18 | hellomusictheory.com | 3.91 | 1.00 | -74.55% |

| 19 | everand.com | 3.55 | 0.91 | -74.35% |

| 20 | xnxx.com | 139.49 | 35.95 | -74.23% |

| 21 | stylecraze.com | 5.90 | 1.69 | -71.39% |

| 22 | lkbennett.com | 5.10 | 1.47 | -71.24% |

| 23 | primrose.co.uk | 10.24 | 3.20 | -68.78% |

| 24 | pornkai.com | 4.72 | 1.51 | -68.10% |

| 25 | meshki.co.uk | 3.17 | 1.02 | -67.77% |

Conclusion

So there we have it! Our Q1 2024 winners and losers. But, what useful insights can we take away to support our strategic choices over the coming months?

- Broader business decisions can quickly and easily filter down to SEO success. The historic performance of Made.com, the more recent downfall of Missguided and the discontinuation of Turner Classic Movies in the UK are prime examples of this.

- The power of 301 redirects shouldn’t be underestimated. Whilst not the only consideration during a domain takeover or migration, redirecting legacy URLs to newer counterparts can help domains to benefit from historic authority, in turn, assisting SERP visibility moving forward.

- User-centricity is becoming more and more pivotal to SERP success. For those who’ve seen a decrease in visibility since the roll out the Core and Spam Policy Updates in March, it is time to put your site(s) under the microscope to understand where you are missing the mark from a relevance, usefulness and experience perspective. How well is your domain really accounting for the different E-E-A-T elements?

- The true definition of “organic” has been somewhat diluted by Google’s paid partnership with Reddit. It will be interesting to see how this evolves over time and as more users begin to see Google switch to the Search Generative Experience (SGE).

Methodology

We’ve utilised SISTRIX’s Visibility Index to analyse Google UK’s top 250 winners and losers. These sites experienced the most significant shifts in visibility between 1st January and 1st April 2024.

Please note: The Visibility Index (VI) scores do not account for external variables like seasonality.