IndexWatch is our analysis of the top winning and losing domains. In this issue you can learn about the losers of 2024. Through SISTRIX’s Visibility Index, we have identified 200 websites with visibility drop-offs across the UK’s Google search results. 6 domains are analysed in detail.

You can assess live data from all domains and grow your own visibility with the Free SISTRIX Trial.

Domains analysed in this report:

Full lists of losing domains are listed below.

Social media

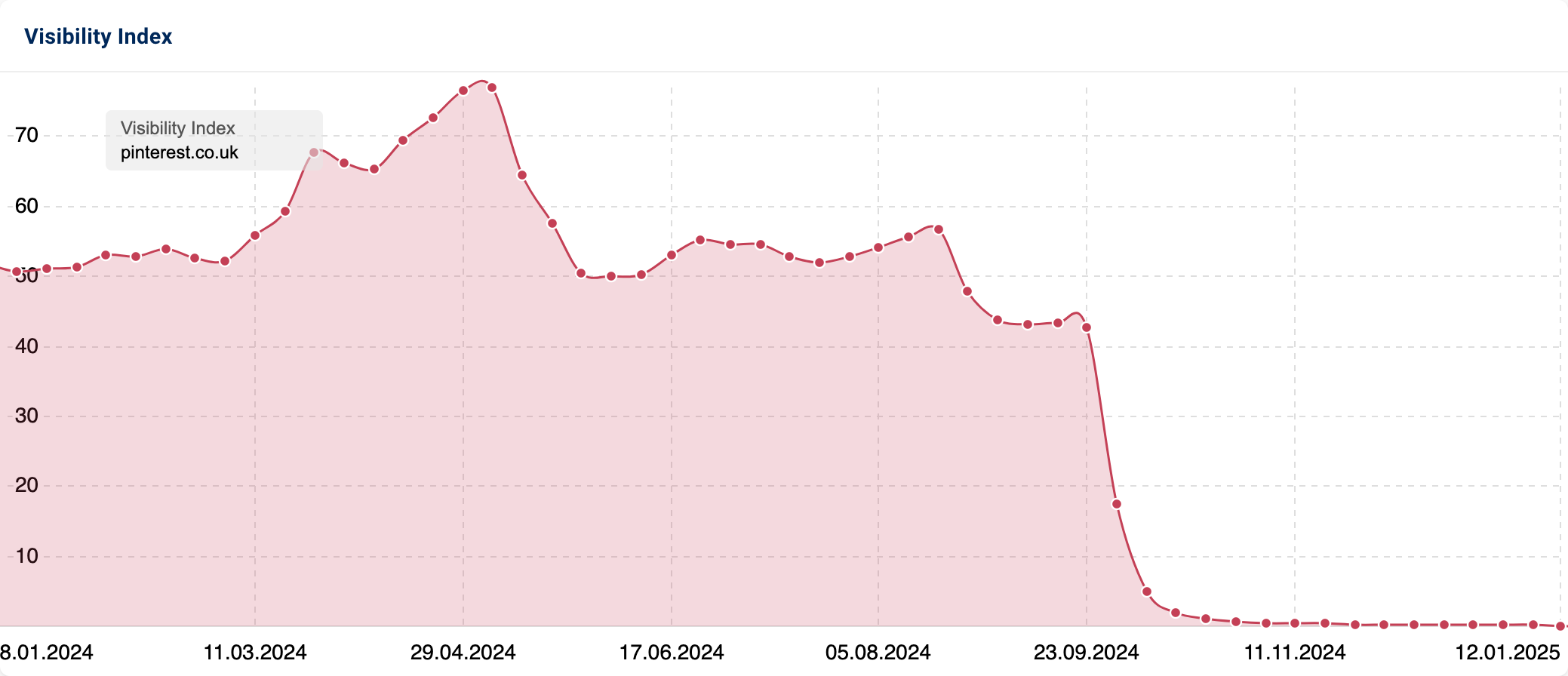

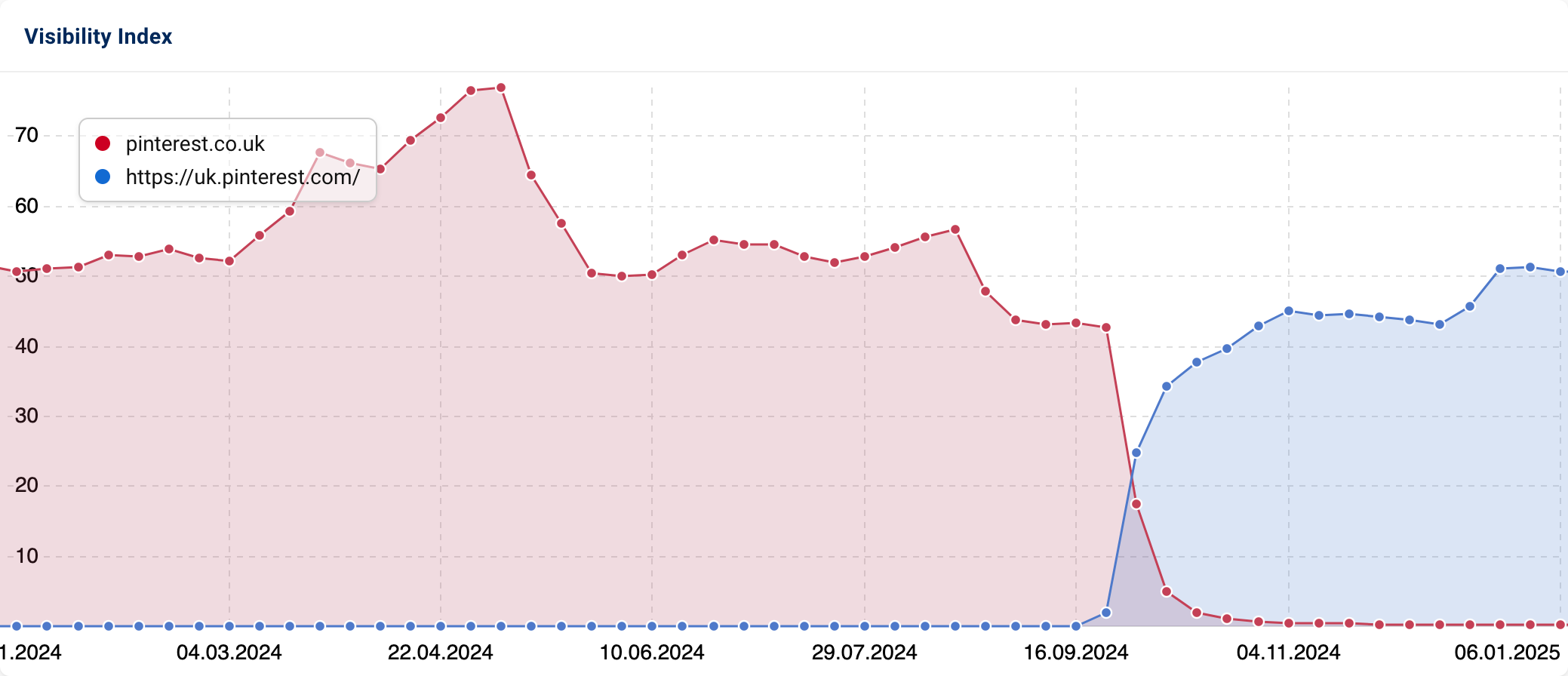

Image-based social media platform, Pinterest, has experienced a 99.7% decrease in Google visibility over the last 12 months. But what caused this significant and sudden decline?

Further exploration of the domain’s URL structure confirms that in September 2024, pinterest.co.uk was consolidated into the main .com domain through the creation of a dedicated subdomain: uk.pinterest.com.

Before the migration, pinterest.co.uk saw a brief and unsustained boost in visibility during the March core update. However, visibility had sharply fallen back to previous low levels by May.

There are numerous reasons why brands may pursue domain consolidation. Reasons include unifying brand identity, simplifying maintenance to futureproofing site structure and driving traffic to a single destination. However, if mishandled, this process can severely disrupt rankings and drastically reduce traffic.

On this occasion, the domain migration has been successful, with a less than 1% difference at the beginning of 2024 (.co.uk) vs the beginning of 2025 (uk.pinterest.com).

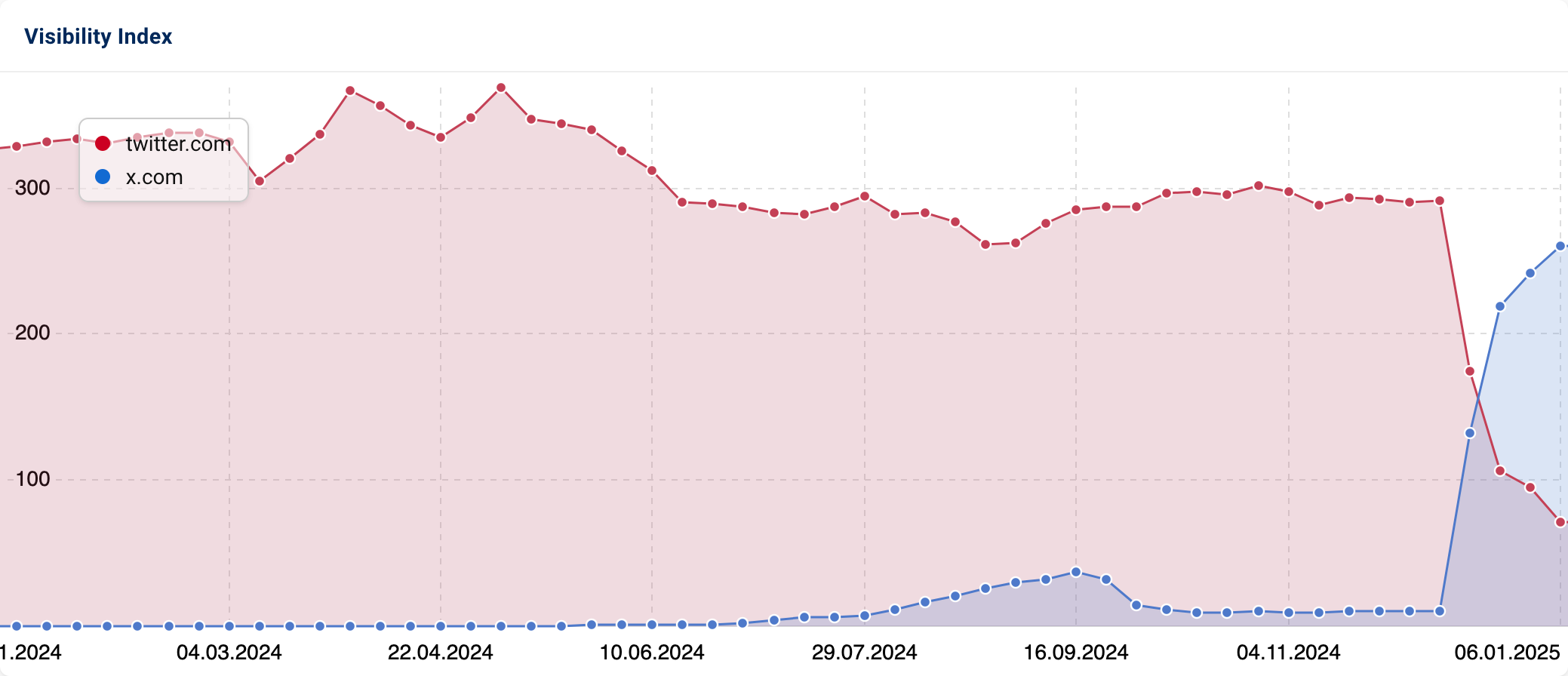

Like Pinterest, Twitter.com has seen a 70.2% drop-off in Google visibility following the initiation of a migration. However, the circumstances surrounding the migration differ.

In October 2022, Elon Musk acquired Twitter for a reported $44 billion. Nine months later, he announced the platform’s rebranding to X, reflecting his vision to transform it into an “everything app” and possibly nodding to his 1999 banking startup x.com – now better known as PayPal.

With the rebrand, a domain change was inevitable, and in late May 2024, it was reported that X fully migrated from twitter.com to x.com. However, SISTRIX’s Visibility Index shows that this shift didn’t appear on the Search Engine Results Page (SERPs) until mid-December 2024, suggesting a phased roll-out or technical challenges. Pre-domain migration, Twitter also temporarily used an “x” subfolder to house content.

The takeover of Twitter has not been without controversy. Following the acquisition and subsequent rebrand and the incremental changes made on the platform, X’s popularity has decreased. With engagement metrics, such as clicks, contributing to organic ranking, it is possible that the sudden wave of account deletions and consequently, reduced traffic, has prevented x.com from regaining 100% of twitter.com’s visibility. As of 30th December 2024, x.com had only obtained 90% of twitter.com’s organic presence.

As we move through 2025 and undoubtedly, more changes will occur, it will be interesting to see how this affects both platform use and search performance.

Ecommerce

Wiggle

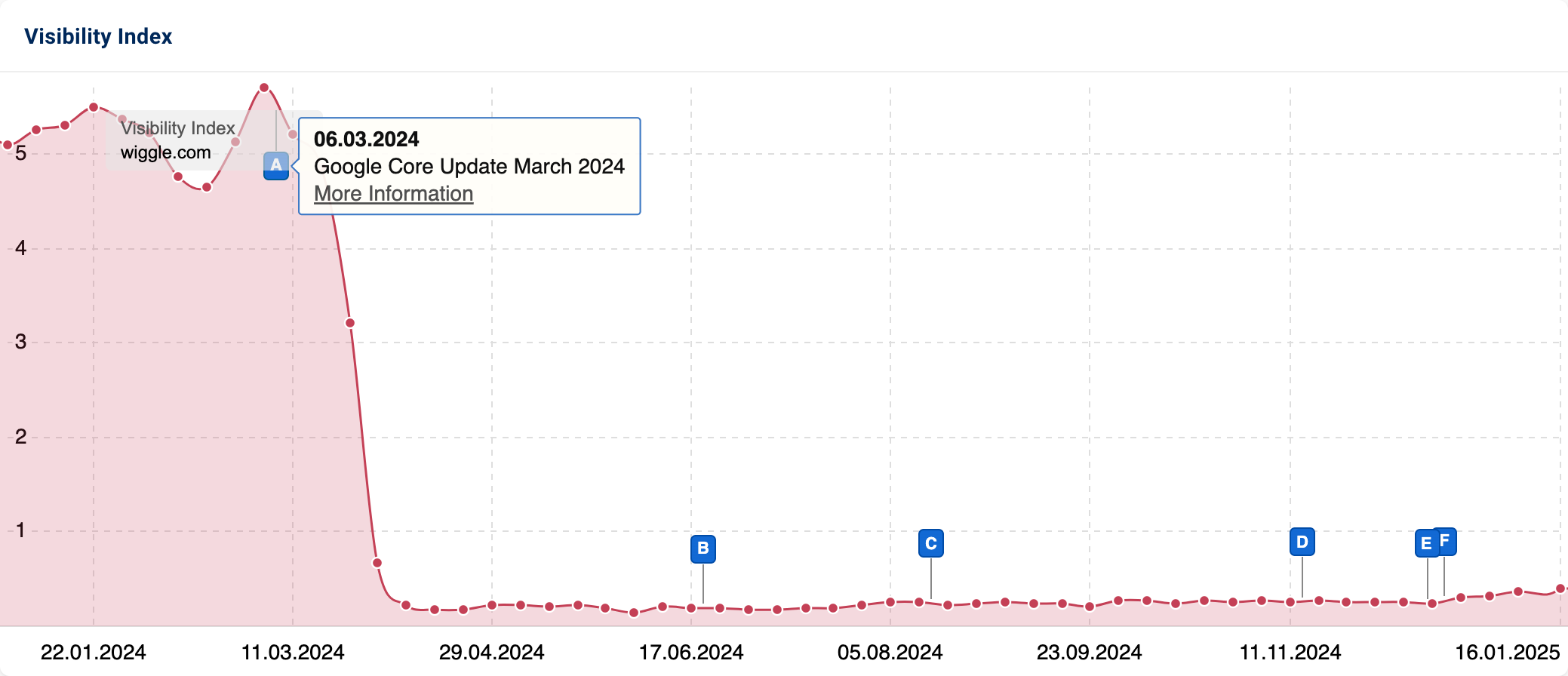

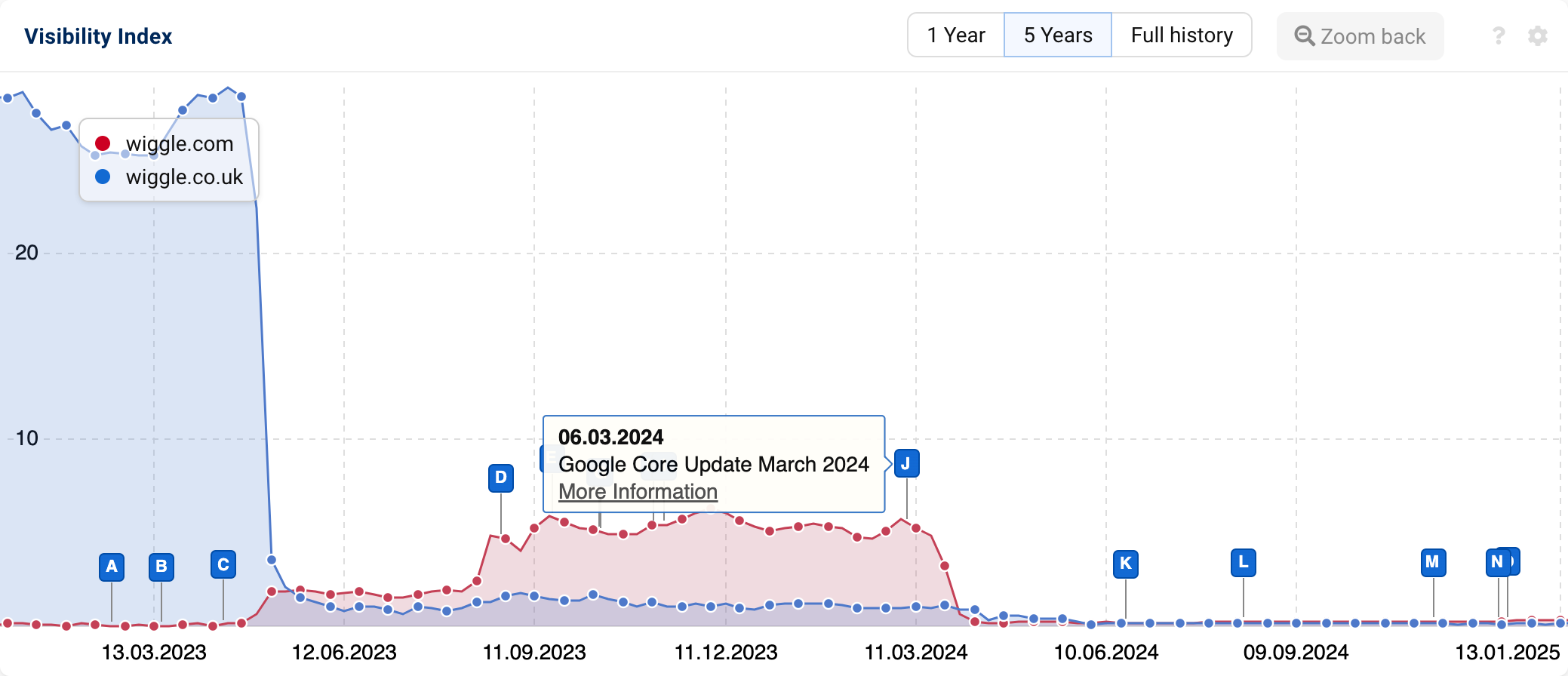

Outdoor sports store Wiggle.com has experienced a 93.8% decrease in UK Google search visibility.

For the second year in a row, Wiggle has made it into our annual losers analysis. At the end of 2023, wiggle.co.uk encountered challenges when migrating to wiggle.com. But what has happened since?

Although the .com domain started to gain traction in Q1 2024, it was unable to reach the previous visibility heights of .co.uk. However, at the beginning of March, following the core update, wiggle.com’s Google presence declined rapidly.

Since the start of the year, Wiggle has updated their website design and branding to better align with Evans Cycles, another cycling brand under the Frasers Group umbrella. In March, Wiggle’s website was temporarily replaced with a holding page, directing users to shop at Evans Cycles during the transition. Although the changeover was relatively quick, redirecting all the domain’s pages to the homepage appears to have had a lasting impact on Wiggle’s organic visibility.

Year over year, wiggle.com lost 2,336 keyword rankings and saw position drops for another 425.

WatchShop

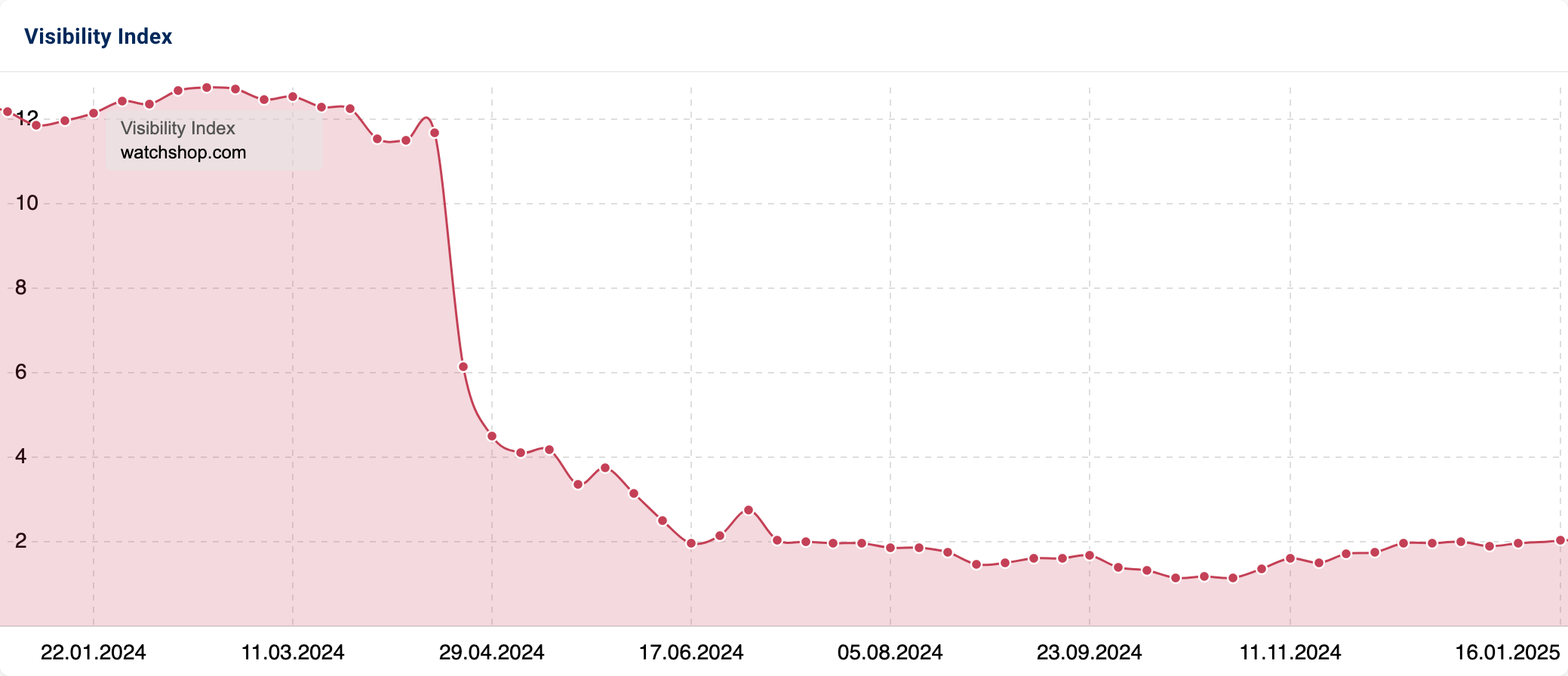

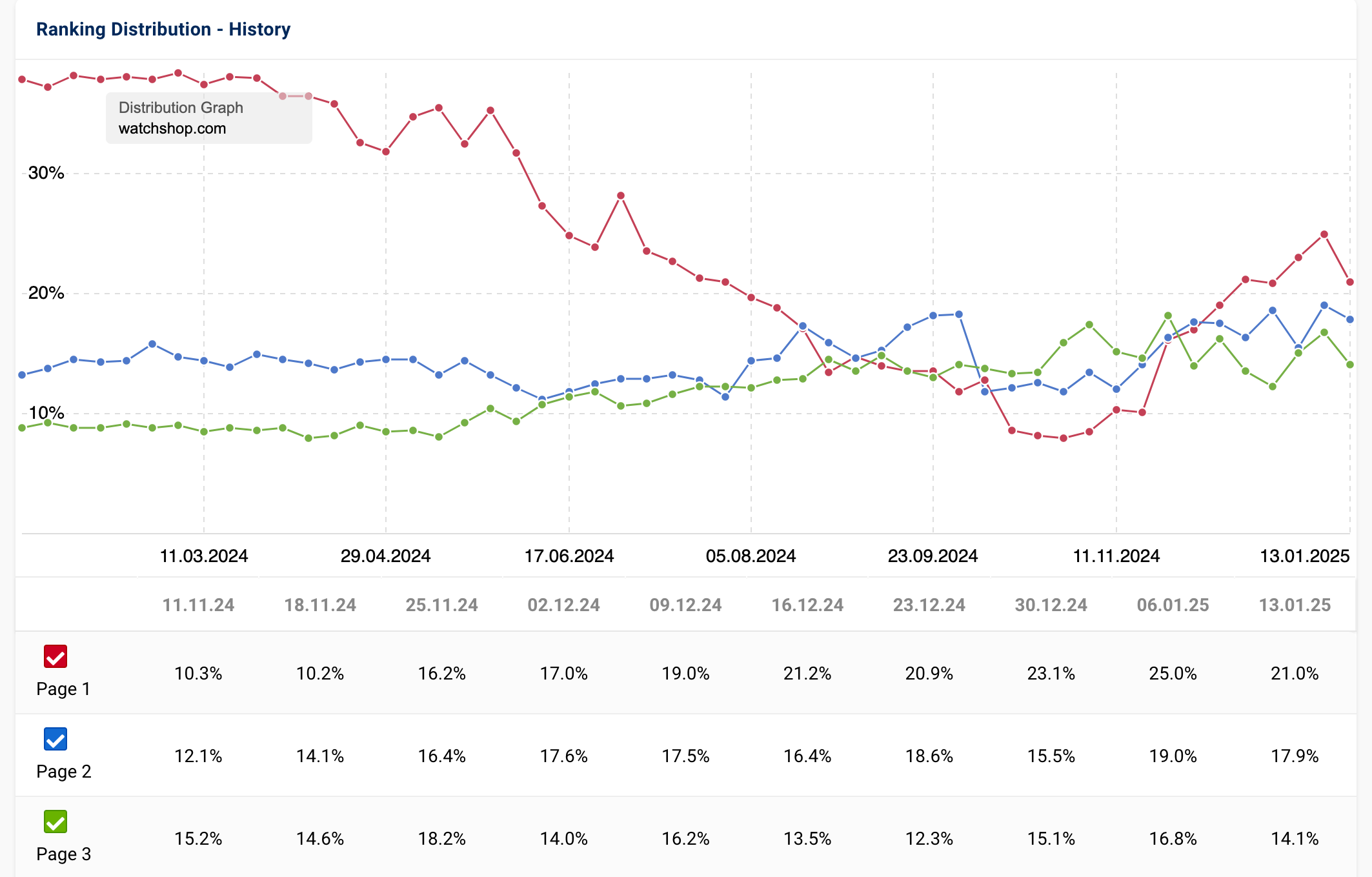

Watchshop.com, a designer watch online retailer, has seen an 84.3% decline in organic search prominence compared to January 2024.

Examining WatchShop’s keyword ranking distribution shows a 15% year-on-year drop in Page 1 rankings, while Page 2 and 3 rankings have each increased by 5%.

Further exploration of WatchShop’s domain data reveals that the drop in Page 1 rankings aligns with a URL restructure aimed at futureproofing site expansion, including rearranging folders.

For example:

- /jewellery/thomas-sabo/ changed to /thomas-sabo/jewellery/

- /watches/ladies/ changed to /womens/watches/

A manual review of the website now vs the beginning of 2024 also reveals that the site has undergone a redesign, comprising a mixture of appearance and functionality changes.

January 2024:

January 2025:

However, one common observation across both designs is a lack of reviews to promote brand trust, credibility and showcase product quality. With an ever-increasing emphasis on E-E-A-T (Experience, Expertise, Authoritativeness & Trustworthiness), online businesses must do their utmost to instil consumer confidence to maximise sales and revenue.

It will be interesting to see how WatchShop’s SEO strategy evolves throughout the next year. Is redemption on the horizon?

Technology publications

Techopedia

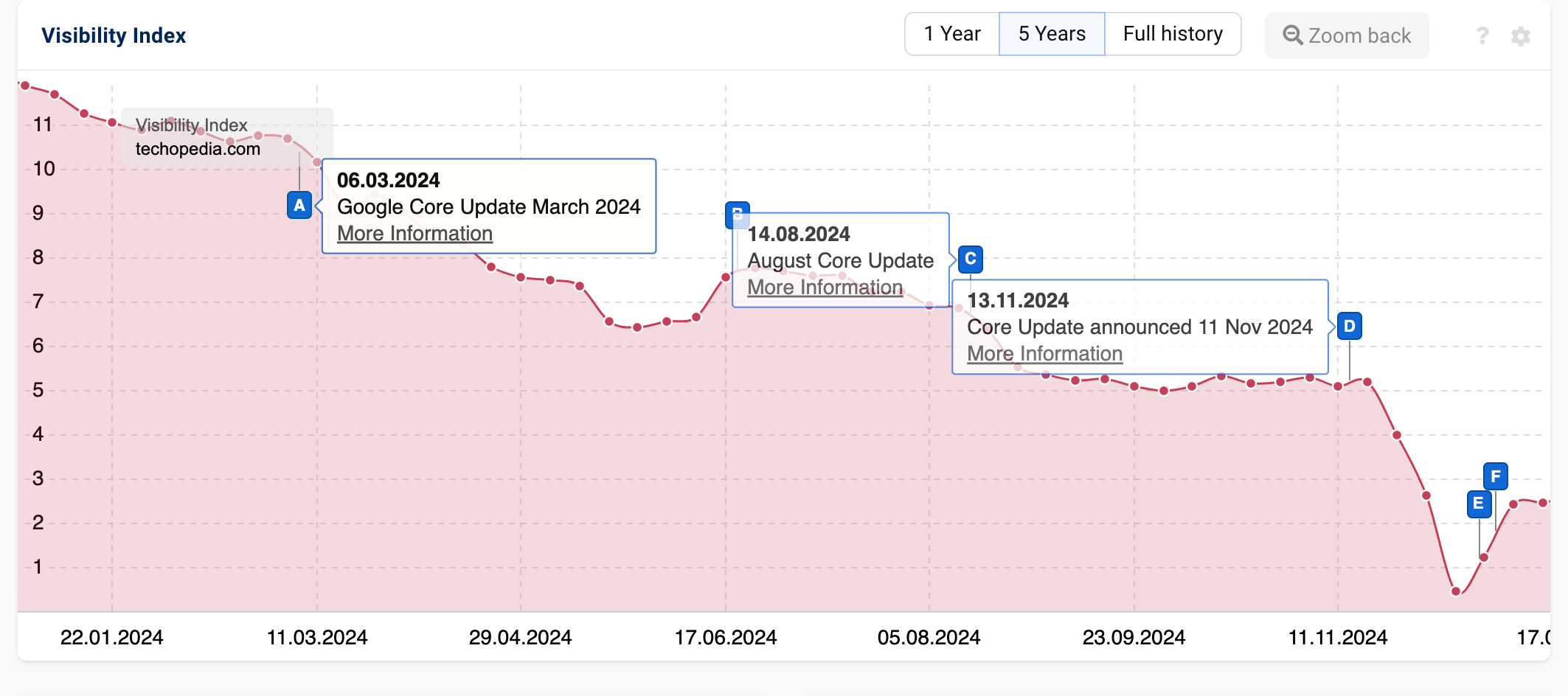

Techopedia.com has experienced a significant 79.35% decline in organic search visibility, dropping by 9.44 VI points.

Techopedia publishes content on popular technology topics, including Artificial Intelligence (AI), Cryptocurrency, Data Management, Cybersecurity and Computer Networks.

A glance at techopedia.com’s Visibility Index graph shows that its SEO presence was consistently hit by Google core updates throughout 2024, with the November update causing the most damage.

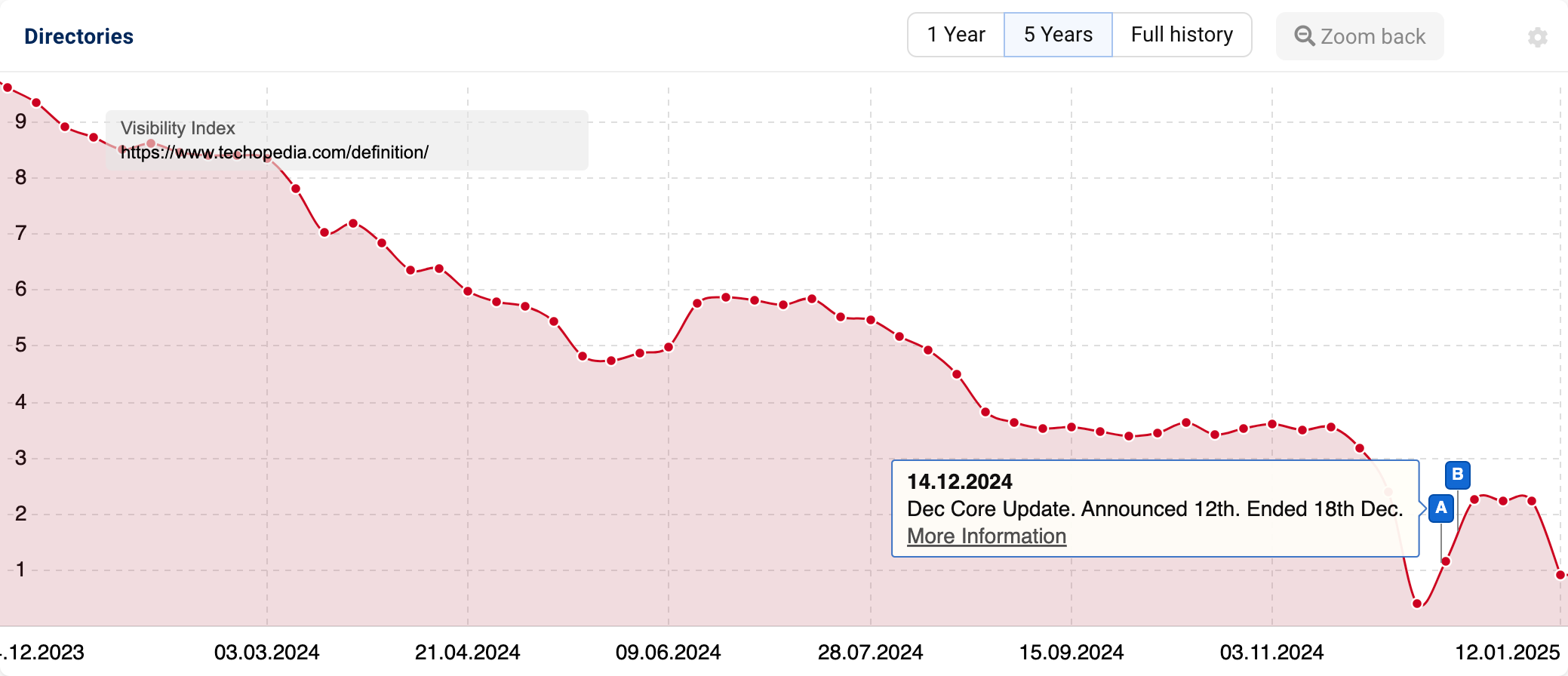

Delving deeper into the domain’s directory data, we can understand which section was most negatively impacted by the algorithm updates. This revealed that a subfolder called “definition” has suffered the most.

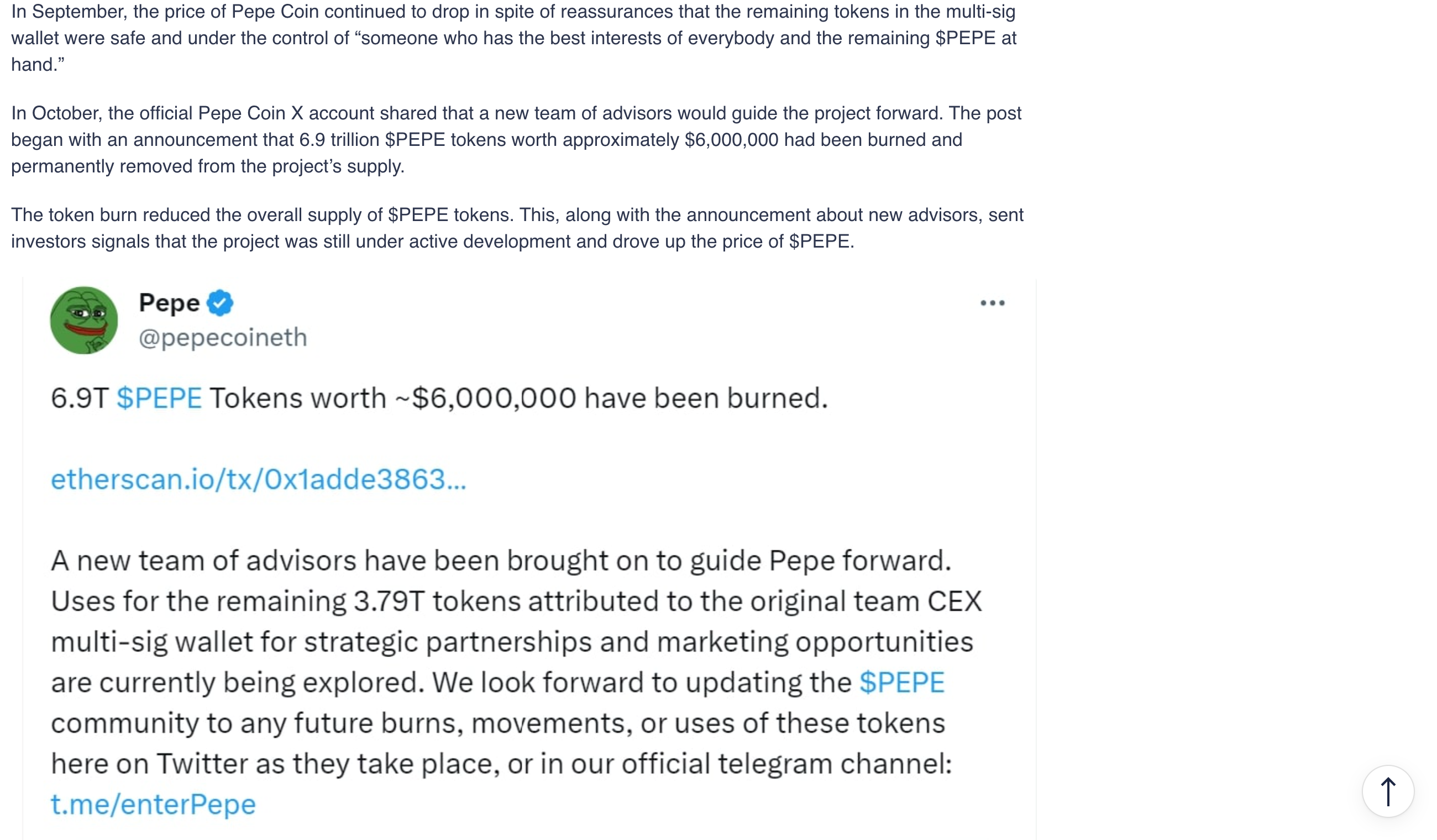

As the name suggests, the “definition” subfolder makes up Techopedia’s technology dictionary, which contains definitions and information for everyday tech terms, such as “Analytics” along with more unusual, industry-specific ones, such as “BONK” and “Pepe Coin ($PEPE)”.

Despite offering in-depth and valuable content, the “definition” pages have experienced 3,113 ranking decreases and completely disappeared from the SERPs for an additional 5,138 queries. So what has gone wrong?

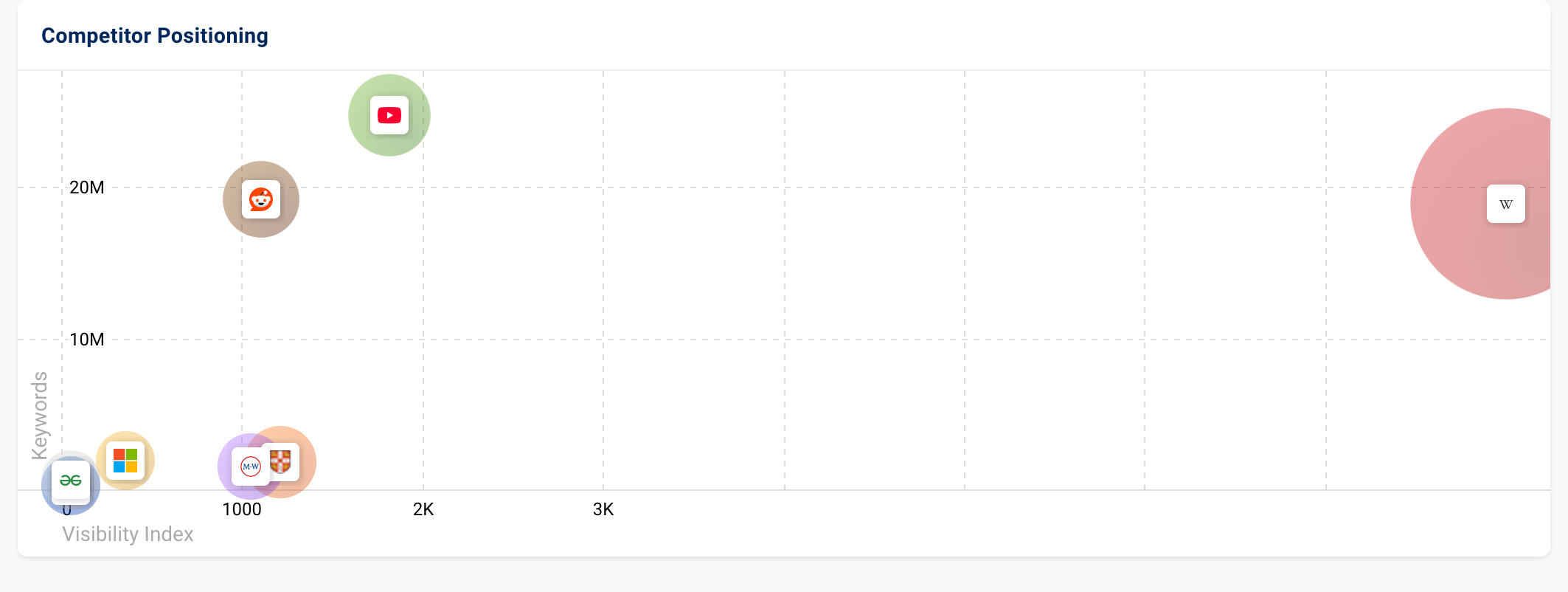

From analysing SERP competitors, we can see exactly why techopedia.com is losing out. Popular platforms such as Wikipedia, Reddit and YouTube, and trusted English language resources, like Merriam-Webster and Cambridge University Press are dominating these keyword types due to their strong organic authority.

Computerworld

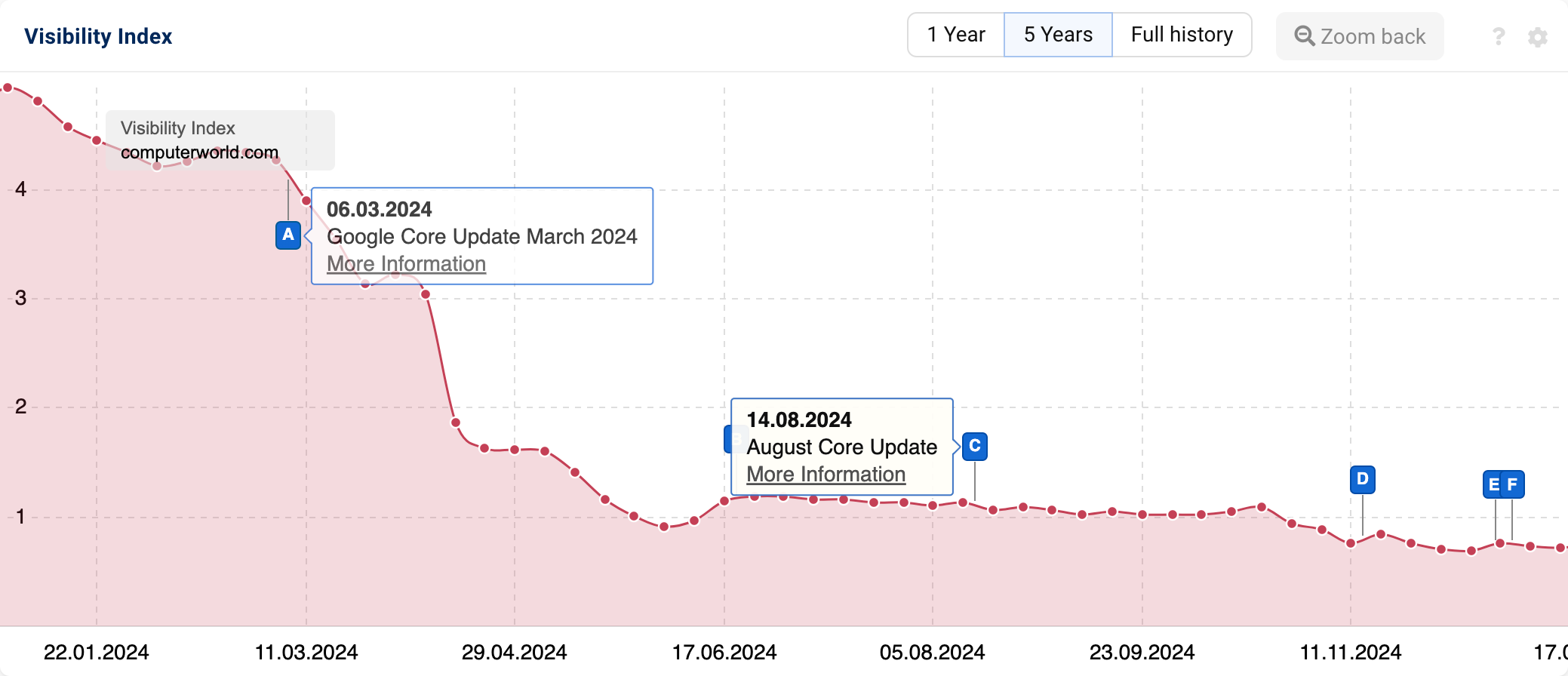

Tech publication, Computerworld, saw an 85.42% year-on-year drop in its SISTRIX Visibility Index score. Like Techopedia, Computerworld.com offers technological insights, but its content is broader and more geared towards business and enterprise technology.

Computerworld’s Google visibility began declining more rapidly after the March core update. However, unlike Techopedia, its visibility stayed stable during the algorithm updates from mid to late 2024.

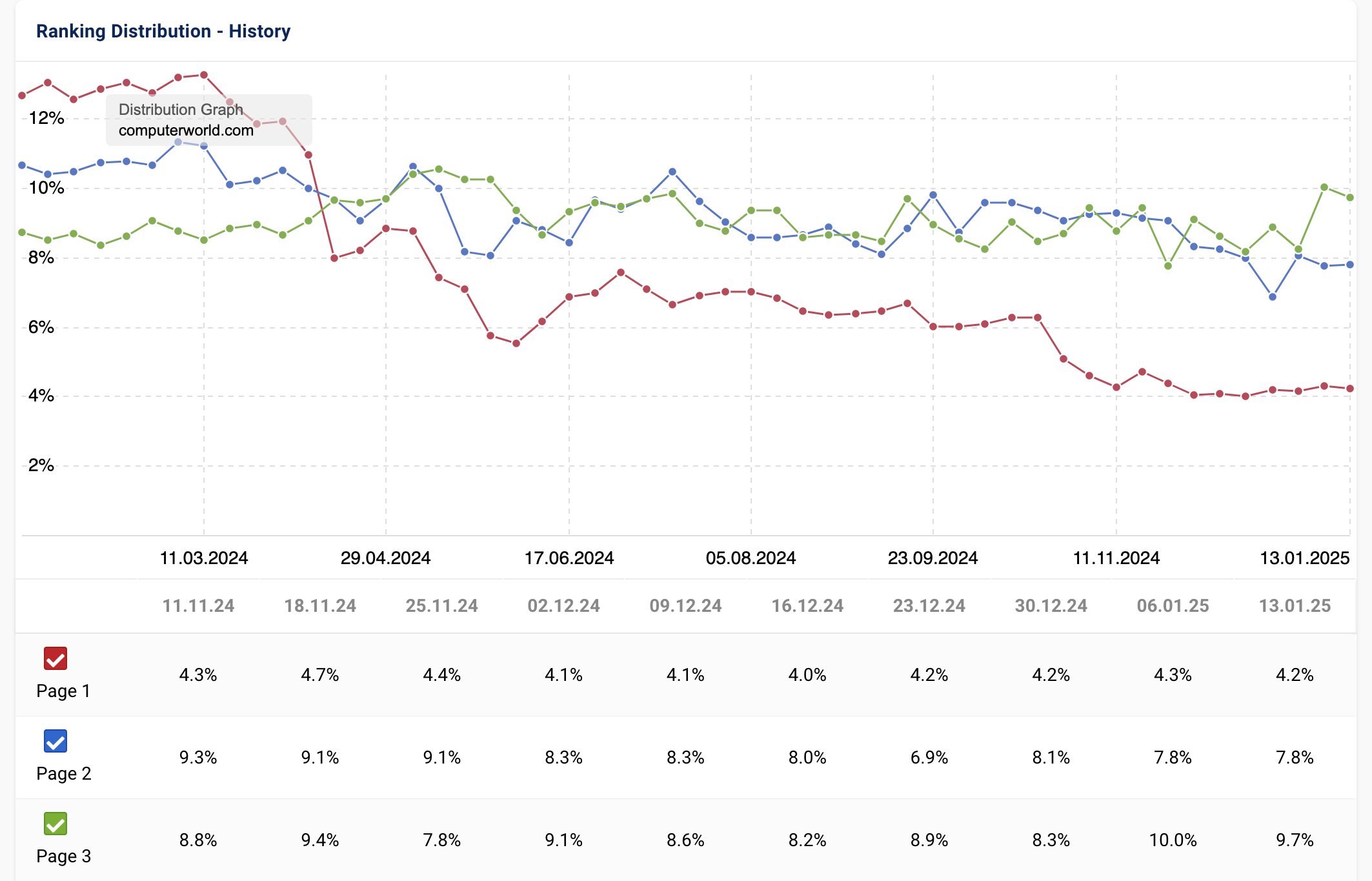

Despite a more recent period of stability, Page 1 & 2 rankings have sharply declined over the past 12 months. Page 1 rankings fell by 9% (from 13% to 4%), and Page 2 by 3% (from 11% to 8%). A slight 1% increase on Page 3 (from 9% to 10%) suggests that a small amount of keyword rankings shifted here, but for the most part, these have shifted considerably, now featuring for Page 4 onwards or not at all.

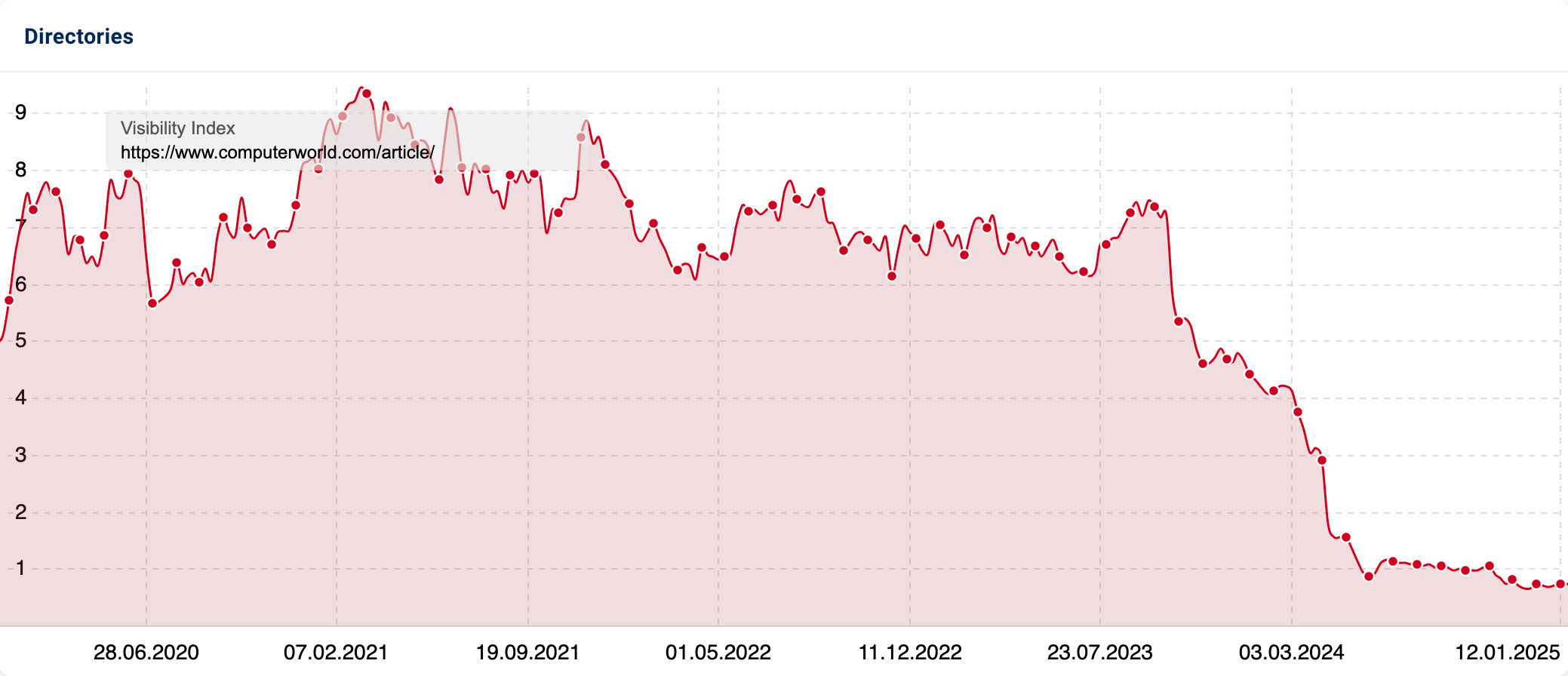

Looking at the domain’s directories, we can see that the directory with the most notable visibility decline was “article” (approx. -85% vs January 2024).

A review of the SERP snippet data for URLs containing the “article” slug revealed a 53.5% decline in the amount of SERP features displayed for this content, falling from 4,406 to 2,04 year-on-year.

Additionally, Computerworld’s rankings dropped for 1,007 keywords and completely disappeared for another 2,871 in the main search results.

In their announcement about the core update, Google confirmed that they had made changes to their ranking systems to reduce unoriginal, low-quality and spammy content, prioritising original and high-quality sources in the search results. In this same article, G also made a point of referencing “low-value, third-party content” (site reputation abuse) and “ automation to generate low-quality or unoriginal content at scale with the goal of manipulating search rankings” (scaled content abuse). With Computerworld’s privacy policy confirming that it is one domain of many operated by IDG Communications Publishing Network (IDGC), it is plausible that the domain’s downfall relates to one or both of these spam policies.

2024 list of losing domains

Below, we have included two tables containing the top 100 losing domains (absolute and percent).

Percentage decreases:

| # | Domain | 01.01.2024 | 30.12.2024 | Change % |

|---|---|---|---|---|

| 1 | pinterest.co.uk | 51.12 | 0.15 | -99.71% |

| 2 | thomann.de | 14.68 | 0.17 | -98.87% |

| 3 | theathletic.com | 8.09 | 0.15 | -98.21% |

| 4 | autodesk.co.uk | 5.53 | 0.10 | -98.12% |

| 5 | (adult) | 4.72 | 0.12 | -97.39% |

| 6 | timesofindia.com | 11.50 | 0.33 | -97.10% |

| 7 | thetimes.co.uk | 23.95 | 0.81 | -96.61% |

| 8 | wob.com | 3.05 | 0.10 | -96.61% |

| 9 | hadviser.com | 10.41 | 0.37 | -96.47% |

| 10 | hotelmix.co.uk | 4.46 | 0.20 | -95.51% |

| 11 | wiggle.com | 5.10 | 0.32 | -93.83% |

| 12 | tubesafari.com | 14.29 | 1.02 | -92.84% |

| 13 | naturespot.org.uk | 5.18 | 0.38 | -92.73% |

| 14 | insanelygoodrecipes.com | 3.37 | 0.26 | -92.16% |

| 15 | bestlifeonline.com | 3.73 | 0.31 | -91.81% |

| 16 | direct4baby.co.uk | 4.99 | 0.43 | -91.47% |

| 17 | (adult) | 3.16 | 0.31 | -90.24% |

| 18 | softwaretestinghelp.com | 7.14 | 0.75 | -89.48% |

| 19 | mtv.com | 4.68 | 0.50 | -89.35% |

| 20 | stylecraze.com | 5.90 | 0.68 | -88.52% |

| 21 | capterra.com | 6.34 | 0.77 | -87.91% |

| 22 | cazoo.co.uk | 12.64 | 1.59 | -87.41% |

| 23 | newworldencyclopedia.org | 9.49 | 1.25 | -86.81% |

| 24 | wynk.in | 5.55 | 0.73 | -86.77% |

| 25 | planetradio.co.uk | 7.79 | 1.05 | -86.57% |

| 26 | wikiwand.com | 17.04 | 2.42 | -85.82% |

| 27 | dfa.ie | 3.91 | 0.56 | -85.74% |

| 28 | expertphotography.com | 3.26 | 0.47 | -85.50% |

| 29 | computerworld.com | 4.93 | 0.72 | -85.43% |

| 30 | depositphotos.com | 3.96 | 0.60 | -84.97% |

| 31 | virginholidays.co.uk | 15.20 | 2.29 | -84.93% |

| 32 | watchshop.com | 12.18 | 1.90 | -84.37% |

| 33 | wallstreetmojo.com | 5.21 | 0.84 | -83.85% |

| 34 | guru99.com | 8.52 | 1.48 | -82.66% |

| 35 | everand.com | 3.55 | 0.62 | -82.58% |

| 36 | secondhandsongs.com | 17.77 | 3.19 | -82.05% |

| 37 | cylex-uk.co.uk | 15.58 | 2.82 | -81.90% |

| 38 | fruugo.co.uk | 3.11 | 0.57 | -81.55% |

| 39 | tcm.com | 5.26 | 0.97 | -81.51% |

| 40 | reviewcentre.com | 5.34 | 1.03 | -80.78% |

| 41 | theculturetrip.com | 4.57 | 0.89 | -80.45% |

| 42 | oberlo.com | 5.53 | 1.08 | -80.45% |

| 43 | womansday.com | 11.19 | 2.28 | -79.60% |

| 44 | techopedia.com | 11.90 | 2.46 | -79.35% |

| 45 | cafedelites.com | 7.84 | 1.63 | -79.27% |

| 46 | a-z-animals.com | 17.95 | 3.73 | -79.21% |

| 47 | caraudiodirect.co.uk | 5.59 | 1.19 | -78.66% |

| 48 | toysrus.co.uk | 4.74 | 1.03 | -78.26% |

| 49 | momjunction.com | 8.31 | 1.83 | -77.91% |

| 50 | dior.com | 3.61 | 0.80 | -77.88% |

| 51 | expertreviews.co.uk | 11.38 | 2.54 | -77.70% |

| 52 | fluentu.com | 5.61 | 1.26 | -77.60% |

| 53 | lyrics.com | 25.26 | 5.71 | -77.40% |

| 54 | dealchecker.co.uk | 4.16 | 0.95 | -77.24% |

| 55 | songlyrics.com | 5.07 | 1.16 | -77.12% |

| 56 | mirror.co.uk | 56.22 | 13.03 | -76.82% |

| 57 | aans.org | 3.13 | 0.73 | -76.81% |

| 58 | travelsupermarket.com | 17.74 | 4.20 | -76.32% |

| 59 | hootsuite.com | 3.35 | 0.80 | -76.05% |

| 60 | animalia.bio | 3.59 | 0.86 | -76.04% |

| 61 | nokia.com | 4.86 | 1.16 | -76.02% |

| 62 | songtell.com | 10.39 | 2.51 | -75.88% |

| 63 | feedspot.com | 3.57 | 0.87 | -75.76% |

| 64 | allthatsinteresting.com | 5.89 | 1.44 | -75.53% |

| 65 | thumbzilla.com | 3.06 | 0.75 | -75.50% |

| 66 | sarahmaker.com | 3.94 | 0.97 | -75.32% |

| 67 | g2.com | 15.18 | 3.77 | -75.18% |

| 68 | ever-pretty.co.uk | 5.07 | 1.27 | -74.94% |

| 69 | seventeen.com | 7.18 | 1.81 | -74.74% |

| 70 | oprahdaily.com | 9.22 | 2.34 | -74.59% |

| 71 | townandcountrymag.com | 7.19 | 1.84 | -74.43% |

| 72 | theparking-cars.co.uk | 5.15 | 1.32 | -74.31% |

| 73 | chron.com | 9.30 | 2.43 | -73.86% |

| 74 | nintendo.co.uk | 18.71 | 4.94 | -73.62% |

| 75 | theatlantic.com | 10.69 | 2.85 | -73.39% |

| 76 | ace.co.uk | 4.14 | 1.12 | -72.88% |

| 77 | mowdirect.co.uk | 4.82 | 1.33 | -72.33% |

| 78 | fortune.com | 5.36 | 1.48 | -72.33% |

| 79 | clutch.co | 5.17 | 1.44 | -72.11% |

| 80 | zety.com | 3.10 | 0.87 | -71.90% |

| 81 | lkbennett.com | 5.10 | 1.45 | -71.64% |

| 82 | makeuseof.com | 17.32 | 4.92 | -71.57% |

| 83 | google.co.uk | 120.87 | 34.65 | -71.34% |

| 84 | everydayhealth.com | 19.47 | 5.62 | -71.14% |

| 85 | delicious.com.au | 5.69 | 1.64 | -71.10% |

| 86 | encyclopedia.com | 20.16 | 5.89 | -70.78% |

| 87 | oldgamesdownload.com | 3.73 | 1.09 | -70.78% |

| 88 | grammarist.com | 7.30 | 2.15 | -70.56% |

| 89 | thestudentroom.co.uk | 10.71 | 3.16 | -70.53% |

| 90 | picclick.co.uk | 4.07 | 1.20 | -70.50% |

| 91 | lovetoknow.com | 9.23 | 2.74 | -70.34% |

| 92 | motherless.com | 3.83 | 1.14 | -70.33% |

| 93 | twitter.com | 317.78 | 94.64 | -70.22% |

| 94 | (adult) | 5.10 | 1.52 | -70.22% |

| 95 | movieweb.com | 4.57 | 1.37 | -70.02% |

| 96 | (adult) | 139.49 | 42.75 | -69.35% |

| 97 | songfacts.com | 47.94 | 14.77 | -69.18% |

| 98 | digitaltrends.com | 11.25 | 3.47 | -69.18% |

| 99 | accountingtools.com | 4.47 | 1.38 | -69.17% |

| 100 | weareteachers.com | 4.47 | 1.38 | -69.15% |

Absolute decreases:

| # | Domain | 01.01.2024 | 30.12.2024 | Change |

|---|---|---|---|---|

| 1 | twitter.com | 317.78 | 94.64 | -223.14 |

| 2 | collinsdictionary.com | 527.50 | 351.97 | -175.53 |

| 3 | etsy.com | 469.17 | 311.25 | -157.91 |

| 4 | dictionary.com | 429.99 | 274.09 | -155.90 |

| 5 | britannica.com | 905.86 | 778.83 | -127.02 |

| 6 | (adult) | 139.49 | 42.75 | -96.74 |

| 7 | nih.gov | 442.54 | 346.81 | -95.73 |

| 8 | google.co.uk | 120.87 | 34.65 | -86.22 |

| 9 | indeed.com | 341.17 | 262.72 | -78.45 |

| 10 | forbes.com | 120.83 | 45.85 | -74.98 |

| 11 | cdc.gov | 117.34 | 48.44 | -68.89 |

| 12 | linkedin.com | 331.27 | 263.52 | -67.75 |

| 13 | goodhousekeeping.com | 115.44 | 49.21 | -66.23 |

| 14 | webmd.com | 257.28 | 194.04 | -63.23 |

| 15 | amazon.com | 133.84 | 73.83 | -60.01 |

| 16 | healthline.com | 341.72 | 283.55 | -58.18 |

| 17 | investopedia.com | 259.66 | 202.03 | -57.63 |

| 18 | pinterest.co.uk | 51.12 | 0.15 | -50.97 |

| 19 | wayfair.co.uk | 96.36 | 48.75 | -47.61 |

| 20 | mirror.co.uk | 56.22 | 13.03 | -43.19 |

| 21 | wikihow.com | 125.67 | 82.50 | -43.16 |

| 22 | hubspot.com | 65.14 | 23.17 | -41.97 |

| 23 | imdb.com | 1273.34 | 1233.78 | -39.56 |

| 24 | theguardian.com | 284.79 | 248.63 | -36.16 |

| 25 | songfacts.com | 47.94 | 14.77 | -33.17 |

| 26 | asos.com | 98.11 | 66.41 | -31.70 |

| 27 | techtarget.com | 82.28 | 51.11 | -31.16 |

| 28 | independent.co.uk | 138.40 | 107.91 | -30.49 |

| 29 | metacritic.com | 45.58 | 16.68 | -28.90 |

| 30 | thesaurus.com | 158.20 | 131.46 | -26.74 |

| 31 | thesun.co.uk | 48.77 | 23.25 | -25.52 |

| 32 | screwfix.com | 188.68 | 163.36 | -25.32 |

| 33 | last.fm | 97.90 | 73.44 | -24.46 |

| 34 | dailymail.co.uk | 69.50 | 45.06 | -24.44 |

| 35 | delish.com | 38.87 | 14.76 | -24.10 |

| 36 | lifewire.com | 42.60 | 18.53 | -24.07 |

| 37 | merriam-webster.com | 1066.21 | 1042.48 | -23.73 |

| 38 | songmeanings.com | 45.14 | 21.77 | -23.37 |

| 39 | ft.com | 47.02 | 23.76 | -23.26 |

| 40 | pcmag.com | 98.38 | 75.15 | -23.23 |

| 41 | thetimes.co.uk | 23.95 | 0.81 | -23.14 |

| 42 | nationalgeographic.org | 41.27 | 18.41 | -22.86 |

| 43 | ldoceonline.com | 38.96 | 16.65 | -22.31 |

| 44 | reed.co.uk | 66.05 | 43.79 | -22.27 |

| 45 | nationalgeographic.com | 73.97 | 52.00 | -21.98 |

| 46 | allmusic.com | 60.23 | 38.53 | -21.70 |

| 47 | manomano.co.uk | 36.84 | 15.24 | -21.61 |

| 48 | urbandictionary.com | 60.55 | 39.25 | -21.30 |

| 49 | boohoo.com | 50.92 | 30.56 | -20.35 |

| 50 | history.com | 57.61 | 37.42 | -20.19 |

| 51 | azlyrics.com | 46.08 | 26.45 | -19.64 |

| 52 | lyrics.com | 25.26 | 5.71 | -19.55 |

| 53 | genius.com | 316.21 | 297.31 | -18.90 |

| 54 | countryliving.com | 30.88 | 12.43 | -18.45 |

| 55 | which.co.uk | 51.00 | 32.77 | -18.24 |

| 56 | rd.com | 29.23 | 11.07 | -18.16 |

| 57 | timeout.com | 34.50 | 16.45 | -18.05 |

| 58 | themoviedb.org | 31.64 | 14.48 | -17.16 |

| 59 | medicalnewstoday.com | 164.48 | 148.23 | -16.26 |

| 60 | cosmopolitan.com | 45.46 | 29.41 | -16.04 |

| 61 | time.com | 24.40 | 8.59 | -15.81 |

| 62 | telegraph.co.uk | 70.82 | 55.53 | -15.29 |

| 63 | masterclass.com | 31.53 | 16.34 | -15.19 |

| 64 | wordpress.com | 60.82 | 45.79 | -15.03 |

| 65 | tvguide.com | 40.00 | 25.10 | -14.90 |

| 66 | parkers.co.uk | 31.22 | 16.52 | -14.70 |

| 67 | wikiwand.com | 17.04 | 2.42 | -14.62 |

| 68 | secondhandsongs.com | 17.77 | 3.19 | -14.58 |

| 69 | thomann.de | 14.68 | 0.17 | -14.51 |

| 70 | encyclopedia.com | 20.16 | 5.89 | -14.27 |

| 71 | a-z-animals.com | 17.95 | 3.73 | -14.22 |

| 72 | hotels.com | 35.74 | 21.53 | -14.21 |

| 73 | nerdwallet.com | 26.13 | 11.99 | -14.14 |

| 74 | vocabulary.com | 184.56 | 170.44 | -14.12 |

| 75 | rollingstone.com | 29.52 | 15.53 | -13.98 |

| 76 | everydayhealth.com | 19.47 | 5.62 | -13.85 |

| 77 | halfords.com | 85.87 | 72.03 | -13.84 |

| 78 | nintendo.co.uk | 18.71 | 4.94 | -13.77 |

| 79 | unsplash.com | 72.75 | 58.99 | -13.76 |

| 80 | people.com | 36.15 | 22.59 | -13.55 |

| 81 | travelsupermarket.com | 17.74 | 4.20 | -13.54 |

| 82 | tubesafari.com | 14.29 | 1.02 | -13.26 |

| 83 | verywellhealth.com | 49.62 | 36.54 | -13.08 |

| 84 | virginholidays.co.uk | 15.20 | 2.29 | -12.91 |

| 85 | housebeautiful.com | 22.87 | 9.98 | -12.89 |

| 86 | prospects.ac.uk | 52.82 | 40.05 | -12.77 |

| 87 | cylex-uk.co.uk | 15.58 | 2.82 | -12.76 |

| 88 | pitchfork.com | 23.94 | 11.26 | -12.67 |

| 89 | cnet.com | 49.21 | 36.57 | -12.64 |

| 90 | nytimes.com | 81.16 | 68.63 | -12.53 |

| 91 | jstor.org | 30.04 | 17.53 | -12.50 |

| 92 | makeuseof.com | 17.32 | 4.92 | -12.40 |

| 93 | kayak.co.uk | 47.44 | 35.07 | -12.36 |

| 94 | standard.co.uk | 28.48 | 16.32 | -12.16 |

| 95 | rateyourmusic.com | 28.32 | 16.18 | -12.13 |

| 96 | autoexpress.co.uk | 27.30 | 15.37 | -11.93 |

| 97 | ebay.co.uk | 809.37 | 797.47 | -11.90 |

| 98 | bloomberg.com | 28.31 | 16.42 | -11.89 |

| 99 | crunchbase.com | 26.48 | 14.75 | -11.73 |

| 100 | oxfordreference.com | 28.70 | 17.09 | -11.60 |

Conclusion

With algorithm updates occurring often and Google’s standards ever-rising, there is no time to dwell on what could or should have happened in 2024. We must learn from the data available and drive our strategies forward.

- Not all visibility declines are problematic. In the case of Pinterest, migrating UK content from .co.uk to a dedicated .com subdomain has been successful and their visibility loss minimal. However, all migrations carry risks and there is no guarantee that 100% of the organic authority obtained pre-migration will transfer across to the new destination.

- Keyword rankings and consequently, SERP visibility, rely on a multitude of factors – a mixture of ones that can AND cannot be controlled. Whilst the Visibility Index does not directly take non-algorithmic occurrences into account, it is possible that outside factors could cause a ripple effect on SEO metrics that contribute to organic presence. For example, changes to how users interact with X’s listings on Google.

- Short-term solutions have the potential to cause long-term issues. Wiggle’s SEO status was already following the Frasers Group acquisition, however, temporarily redirecting all the pages to the homepage has worsened its performance.

- Never overlook E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness), especially for YMYL (Your Money or Your Life) websites. While WatchShop is less YMYL than health or financial sites, its high-value products, often bought as long-term investments, place it in this category. This makes demonstrating trust and credibility crucial for success.

- Competing for popular, high-competition keywords in both written and visual formats is tough for smaller sites. While Techopedia’s definition pages are detailed and helpful, dominating these search queries is nearly impossible against major video platforms and dictionary sites without significant Digital PR investment.

- Quantity does not necessarily correlate with quality or organic ranking success. For example, Computerworld has seen a significant decrease in performance in alignment with Google updating their spam policies; cracking down on spam, scaled and deceptive content. It will be interesting to see what the search engine giant has in store for publishers in 2025 and beyond.

Al IndexWatch 2024 reports

Winners 2024

- 🇪🇸 Spain (by Arturo Marimón)

- 🇫🇷 France (by Nicolas Audemar)

- 🇮🇹 Italy (by Elisa Paesante)

- 🇩🇪 Germany (Jolle Lahr-Eigen)

- 🇬🇧 UK (Luce Rawlings)

- 🇺🇲 US (Lily Ray)

Losers 2024

- 🇪🇸 Spain (by Arturo Marimón)

- 🇫🇷 France (by Nicolas Audemar)

- 🇮🇹 Italy (by Elisa Paesante)

- 🇩🇪 Germany (Jolle Lahr-Eigen)

- 🇬🇧 UK (Luce Rawlings)

- 🇺🇲 US (Lily Ray)

You can assess live data from all domains and grow your visibility with the Free SISTRIX Trial.