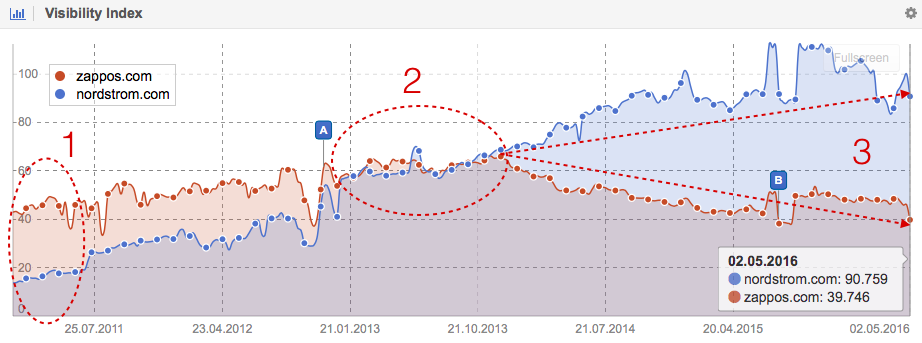

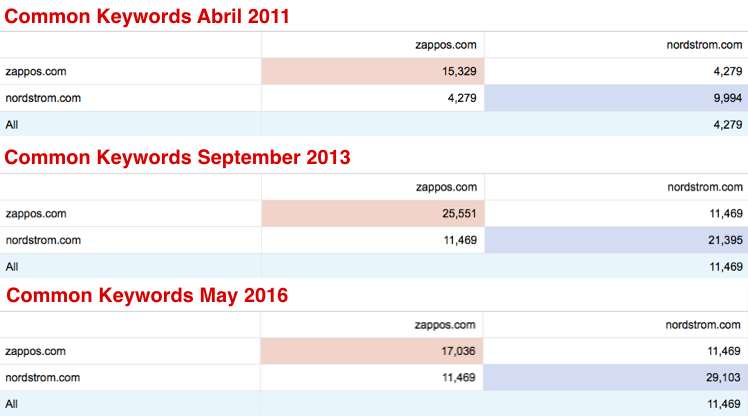

Five years ago, in April 2011, Zappos’ market share in Google was more that 3 times as large as Nordstrom‘s – in numbers: 43 visibility points for Zappos vs 13 points for Nordstrom. Today, Nordstrom has twice the market share on Google as Zappos.

During the time from April 2011 to December 2012, Zappos.com managed to increase their market share by 51% (going from a visibility score of 42.9 to 63.42 points), while Nordstrom increased their Visibility 13 points to 54.9. A huge jump in market share by 302%. At this point, they became a direct competitor to Zappos, with both domains having 50% of their keywords in Google in common.

In September 2013, Nordstrom.com unstoppably took off, leaving Zappos.com in the dust. Since then, Nordstrom.com has continuously increased its market share, climbing by 65% from September 2013 until today, with a visibility score of 90.78 points. During the same time, Zappos.com continuously lost market share and ended up at a -37.32% loss, dropping from 63.42 to 39.75 points.

What happened?

SEO at Zappos.com

If I see something like the above, I like to quickly compare both domains. You can run such a quick comparison in the Toolbox by simply typing the domains into the search bar, separated by a comma: zappos.com,nordstrom.com

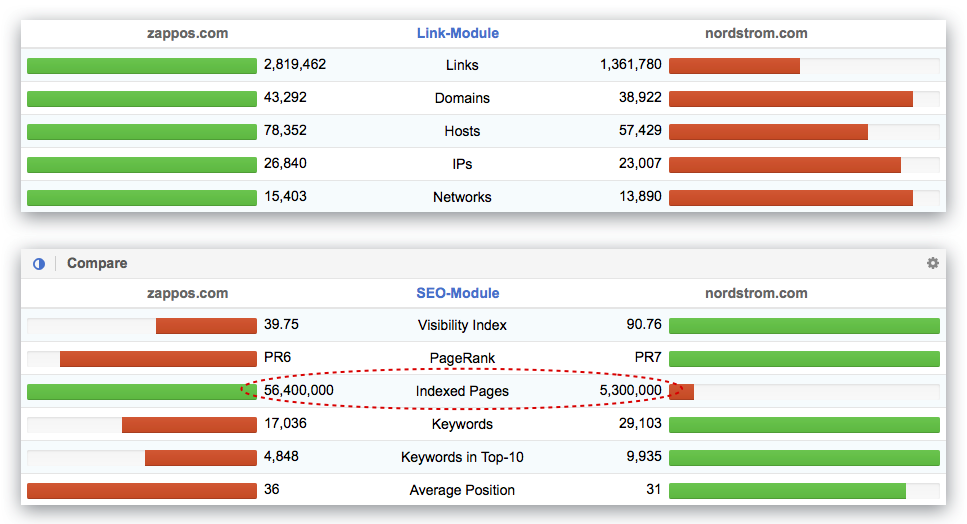

We can see that Links are not a problem for Zappos. They actually have nearly a million and a half links, from about 5,000 domains, more than Nordstrom.

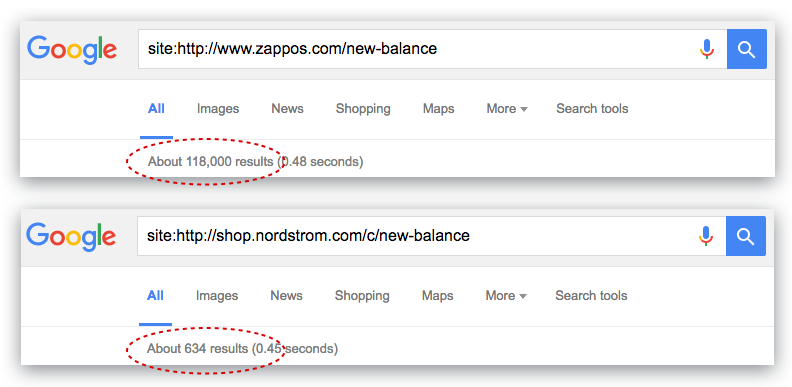

The thing that quickly catches the eye is the large discrepancy in the amount of indexed pages for both domains. Zappos has a whopping 56 million pages indexed and that can be a huge problem.

If we look at the number of keywords for which Zappos has a Top 100 ranking, which are 17,000, and compare it to the number of indexed pages, we get a ratio of 3,310 indexed pages for every keyword in the Top 100. If we compare this number to some other domains, we see how inefficient this is:

- Wikipedia has a ratio of 107

- Walmart has a ratio of 135

- Nordstrom has a ratio of 182

- Amazon has a ratio of 250

- Zappos has a ratio of 3,310

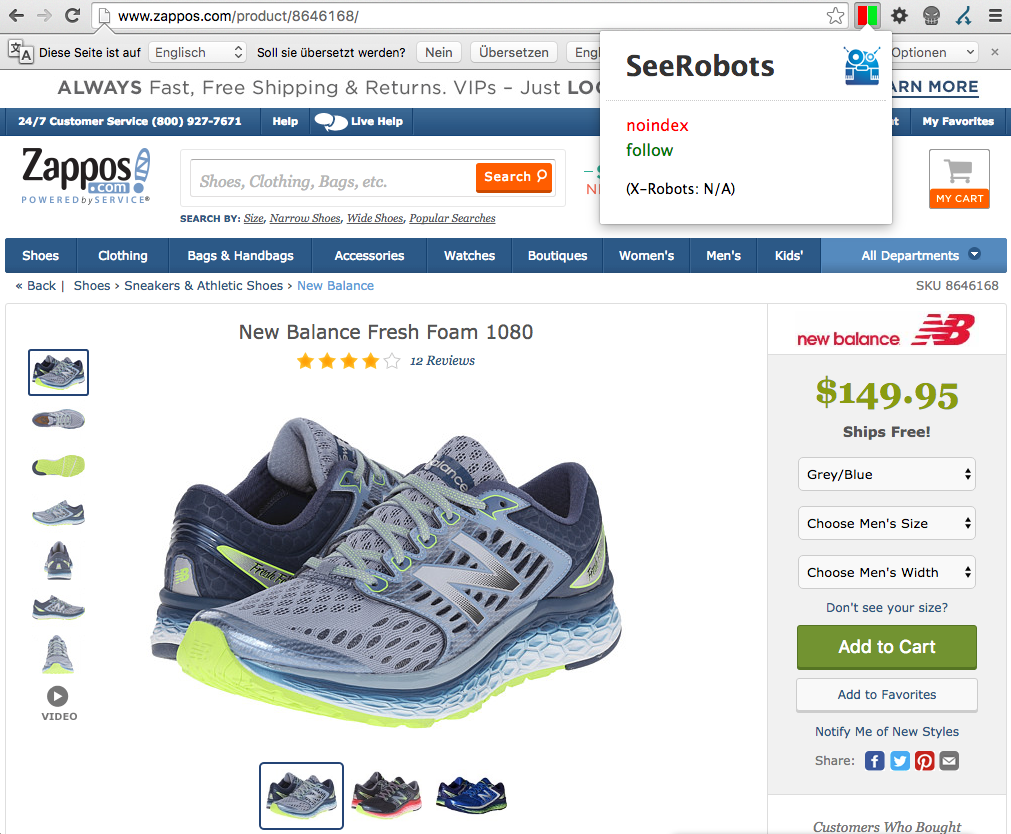

Take a look at this:

This huge number of indexed pages is a big problem for Zappos’ crawling- and indexing budget. The real enemies of both the crawling and indexing of large websites are web developers, JavaScript and chaos in general. Let me show you some additional examples:

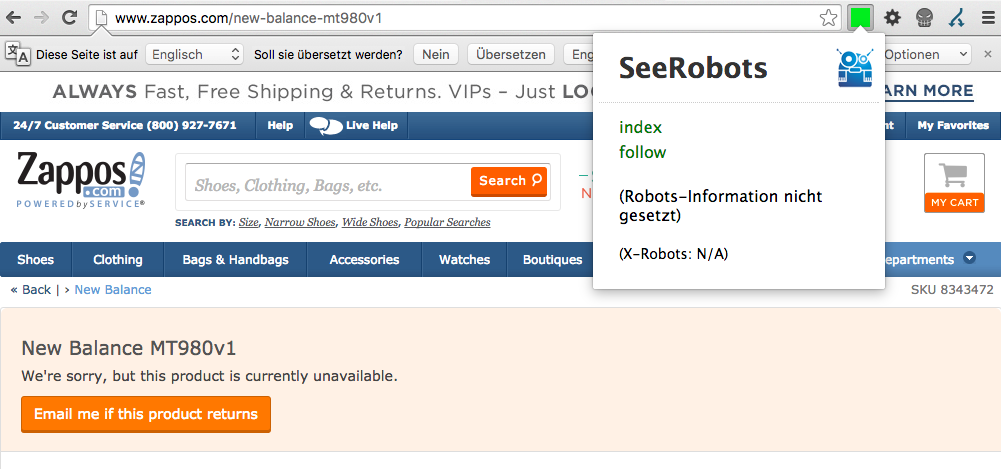

Zappos has quite a large number of product pages in the Google index which are not available anymore. At the same time, these pages are set to index/follow.

Ironically, they also have popular products, which are available, set to noindex/follow.

All these problems together will cause Google to crawl unnecessary URLs, which will deplete the crawl-budget for the domain. And this crawling power will then be sorely missed, especially for such extensive projects. Additionally, this crawling budget will define how often Googlebot crawls the first few levels of the domain and how often a deep crawl will take place.

We see something similar with the indexing budget: this budget decides on the maximum number of URLs which will be added to the Google index. It is important to keep in mind that only URLs which are crawled regularly will stay within the index.

It all could be so easy. In theory, every piece of content you have should have a unique, logical, easy to understand URL, which stays exactly the same over the next decades.

Sadly, this utopia does not hold up to the real world: web developers decide on creating the third print version of a page, Googlebot learns a bit more JavaScript and suddenly invents completely new URLs and the website gets its third CMS-relaunch in two years, which leaves the original URL-concept in tatters. All of this will end the same way: Google will crawl unnecessary URLs and waste the domain’s crawling budget.

Conclusion

We can see that Nordstrom decided to compete with Zappos on about 50% of their keywords. For quite a while, both domains competed directly at the same level of Visibility. Though, in the end, Zappos’ onpage problems and a change in user behaviour has let to a stark contrast in Visibility for both Domains.

If we look at which keywords both domains rank for, we notice that, in the beginning, Nordstrom only ranked for 23% of the Keywords which Zappos had. Only 3 years later, Nordstrom already managed to rank for 50% of Zappos’ keywords. This change shows us that Nordstrom actually decided to actively work on competing with Zappos. Today the tables have turned and Nordstrom directly competes on 67% of Zappos’ keywords.

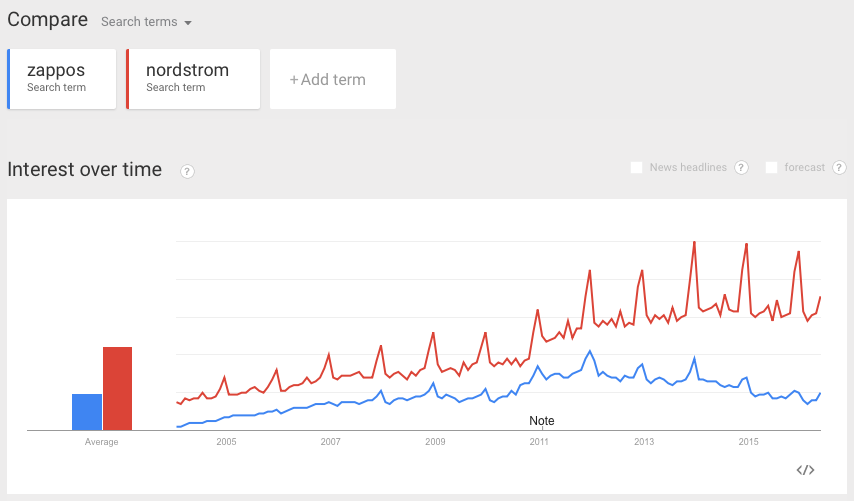

When we talk about the user behavior, we mean that, if the user has a choice between both a result on Nordstrom and Zappos, they will decide to go to Nordstrom.com. We can nicely see this thanks to Google Trends. The user interest for both domains parts ways in Mid 2012, just as direct competition started.

I hope you like it!