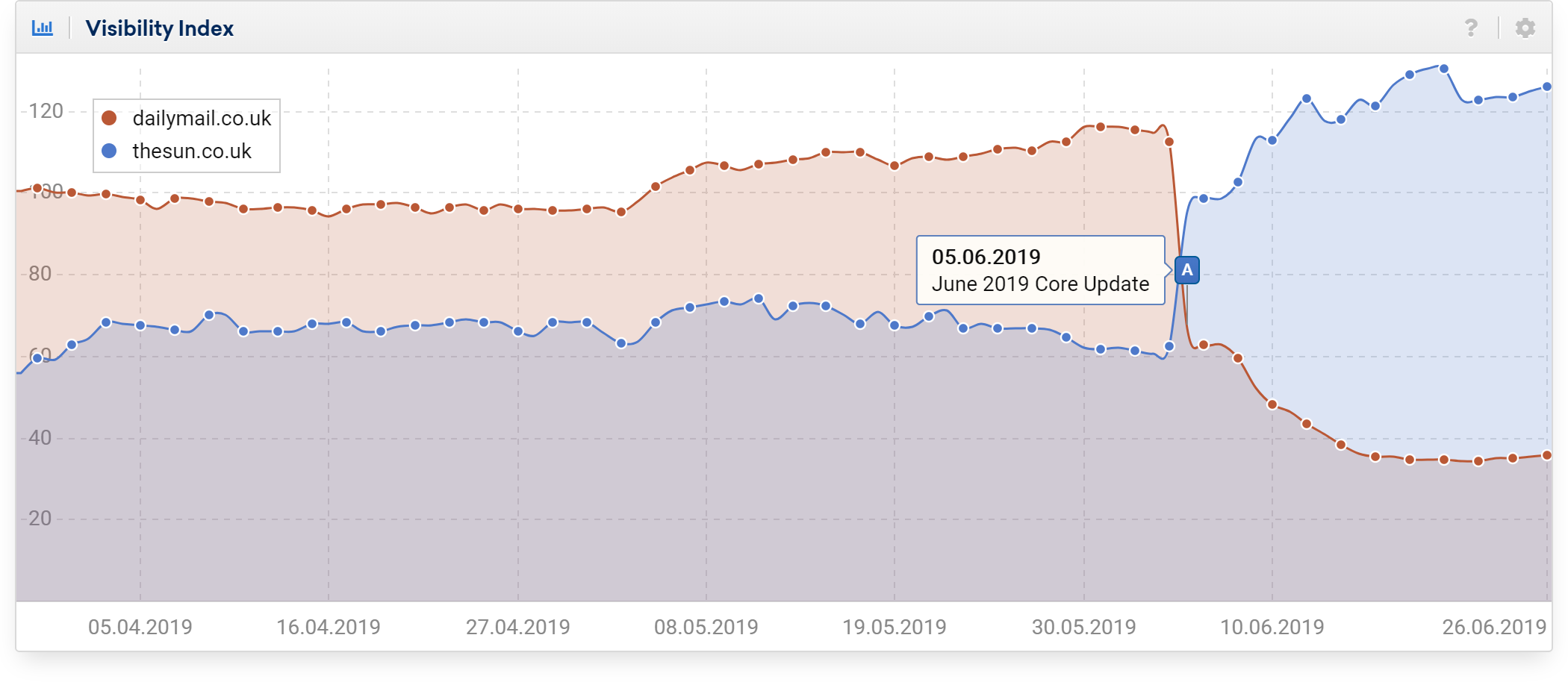

On the 5th of June 2019, dailymail.co.uk, the news media website run by Daily Mail Online, took a huge sideswipe from Google’s June Core Update in the UK. The resulting loss in organic visibility and Top Stories appearances were mirrored in public statements that confirmed a 50% loss in Google-driven traffic. More interesting is what happened with the competitors. When you remove domains from large numbers of search results, other domains always fill the gap and change the competitive environment

In the UK, more than in other countries, we saw big shifts across news media sites during the June Core Update. While dailymail.co.uk losses have been the talking point, the list of winners shows 5 news media sites in the list of top 20 winners. The Sun, a major business competitor, has benefited in a mirror-image visibility graph.

Domain-wide hit?

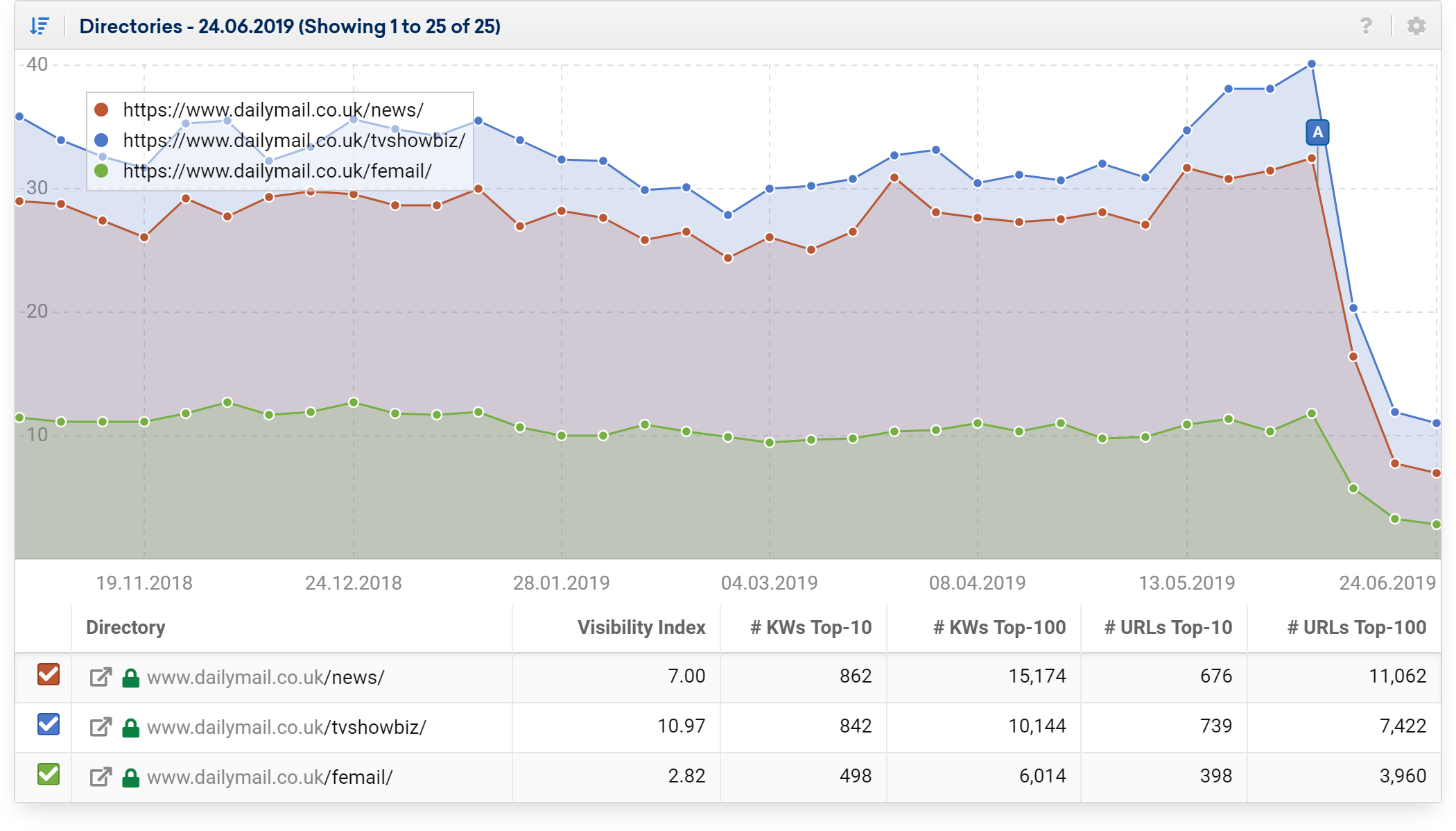

Google algorithm updates can have effects on a domain, hosts and even a URL level so it’s important to analyse data at these levels before deciding what has happened and what action to take.

At dailymail.co.uk the change were spread across key news directories.

Example directory losses range between 63% (sports and travel) and 71% (news).

- news 31.7 – 9.2 (71% loss)

- heath 3.7 – 1.2 (68% loss)

- female: 11.1 – 3.7 (67% loss)

- tvshowbiz: 38.8 – 13.65 (65% loss)

- sport 9.1 – 3.0 (63% loss)

- travel 1.6 – 0.6 (63% loss)

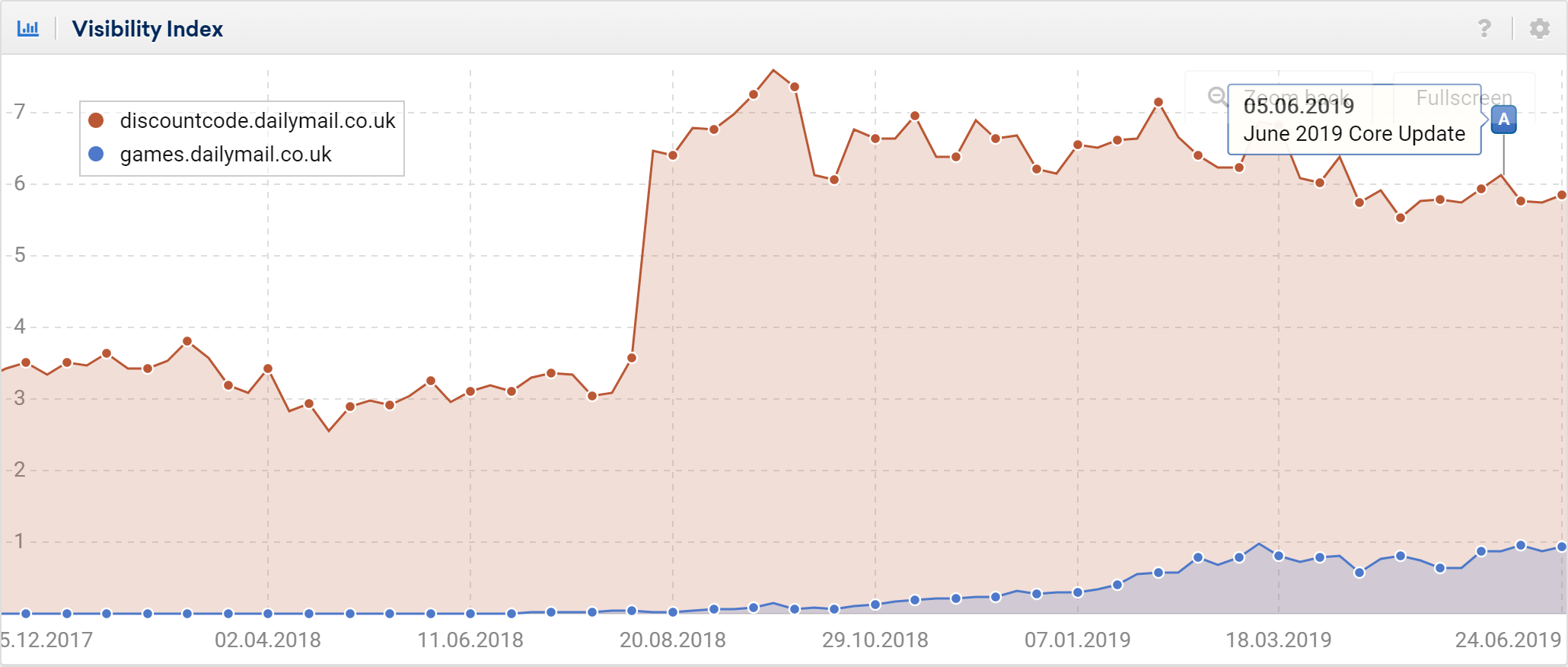

At the host level, there’s a very different story when we look outside the main news website.

It’s clear that only www.dailymail.co.uk got hit by the core algorithm update:

- discountcode.dailymail.co.uk, at 5.86 VI points, was not affected by the June core update

- games.dailymail.co.uk is still on an upward trend

- discountcode.dailymail.co.uk now represents 13% of the total domain visibility.

Rank like a news organisation

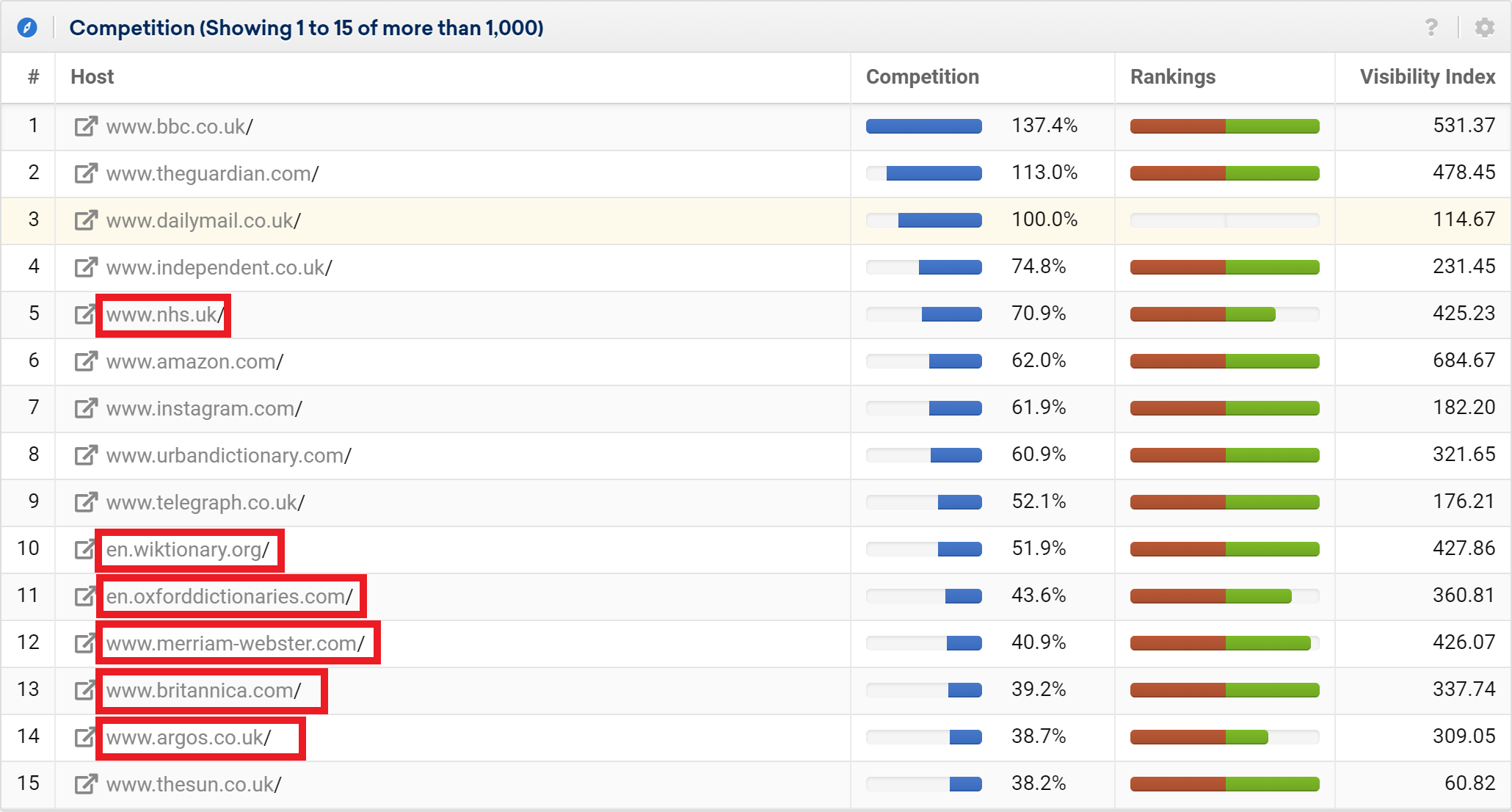

Company owners need to understand what digital competition is. Never believe that your competitors are simply your business peers because when it comes to search terms, Google has its own ideas. Take a look at the competitors for www.dailymail.co.uk before the core update.

Note the very significant, and close relationship to the NHS (the UK health service) domain and the 5 dictionaries in the top 15. Competitor thesun.co.uk is at position 15. Only 40% are news publications.

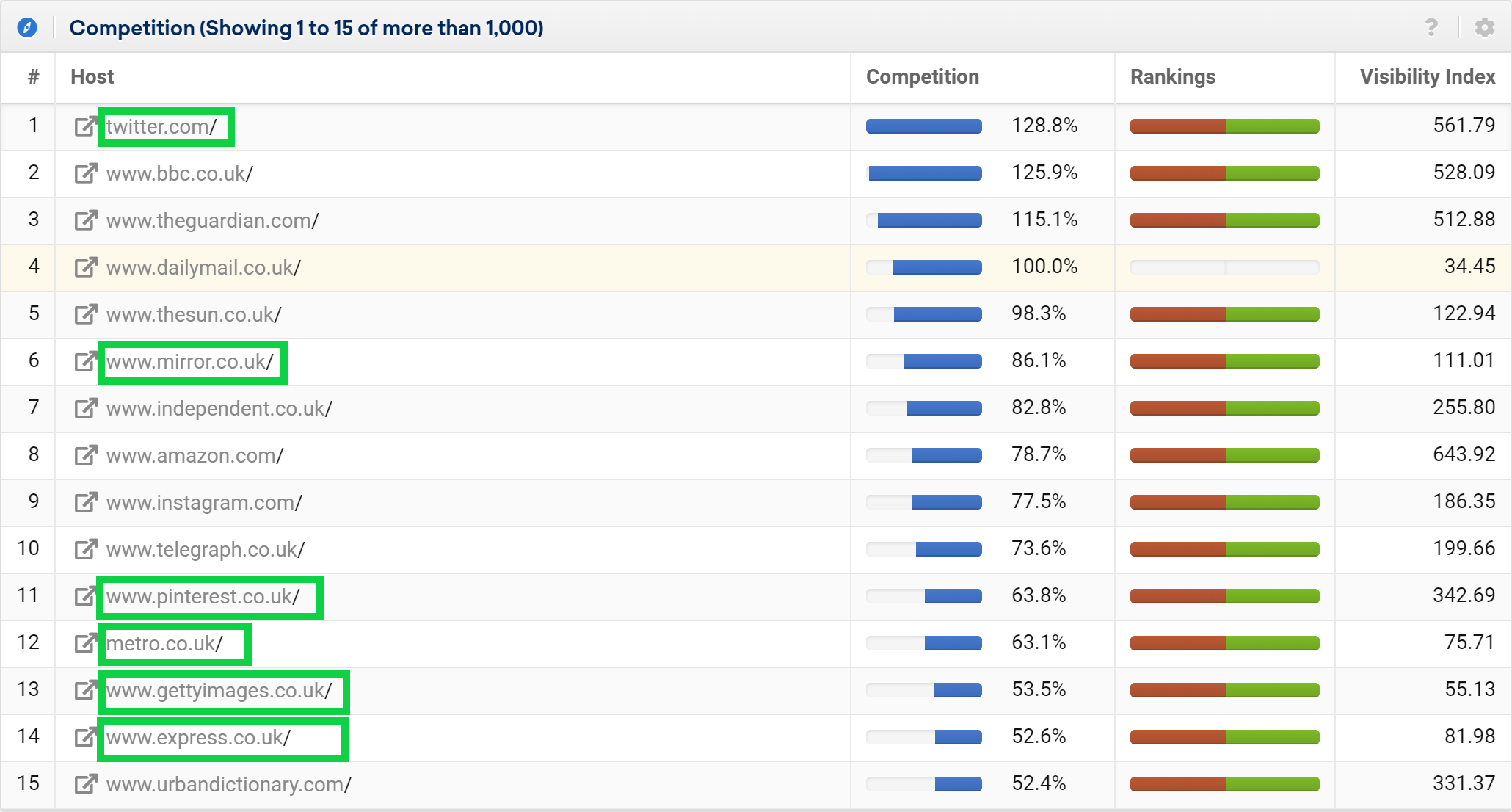

Now look at the competitors after the update.

After the Core algorithm update we see just one dictionary site, nhs.uk is no longer a close competitor and there’s a much closer relationship with thesun.co.uk and other UK newspapers. 60% of competing domains after the June Core Update are now news publications.

Where did the losses go?

We’ve seen above how www.dailymail.co.uk and thesun.co.uk have moved closer together in terms of competition but the next question is, where did the lost rankings go? Who filled the gap?

A full analysis requires taking a look at all the lost keyword rankings and SERPs to find the domains that improved. There is always a spread of winners but if we keep the focus on thesun.co.uk, we can visualise the change in relationship between the two domains.

Summary

The news website www.dailymail.co.uk lost significant amounts of visibility during the June Core Update. The losses seen in the Visibility Index have also been seen in reported traffic losses and this is likely to affect revenues for this part of the MailOnline business.

The second most-visible domain, discountcode.dailymail.com, was left largely unaffected and now represents 13% of the total visibility for the domain.

The most important change is the new list of competitors for www.dailymail.co.uk. The update places the domain much closer to business competitors in the UK news media market.

We’ll leave the full analysis of keyword losses for another time but it’s clear to see that close competitors from before the update, have gained.

To call this disciplinary action by Google might be a little strong. We don’t wish to dwell on any potential revenue losses either because the main story for SEOs to be aware of is the re-positioning that has occurred. www.dailymail.co.uk now operates in a very different competitive environment.