Search results on Amazon are too diverse and fast moving to provide a reliable impression of visibility. This is why we created the Visibility Index for Amazon.

Most product research on Amazon starts with a search, placed prominently in the upper area, that is well understood to be the first point of contact in the purchasing process.

Achieving the best possible visibility in search results is therefore important. In order to monitor this, it is not enough to check only individual keywords and rankings; the results are too anecdotal, fast-moving and dynamic to be a reliable basis for decisions.

To solve this issue, we have developed the SISTRIX Visibility Index for Amazon. This index value is based on regular measurement of rankings for millions of keywords. Weighted with search volume and the click probability on the respective position, the Visibility Index provides a reliable indicator for success in Amazon search results.

Calculation of the Visibility Index for Amazon

The calculation of the SISTRIX Visibility Index for Amazon starts with three easy-to-follow and transparent steps. In essence, the process corresponds to the calculation of the visibility index for Google . This has been the gold standard for measuring SEO success for years. In detail we proceed as follows:

- In the first step we determine the search results of the Amazon search for a million search terms. We selected these keywords in such a way that they represent a good, statistically relevant average of search behaviour in the respective country. We regularly exchange part of this keyword set in order to reflect changes and adjustments in search behaviour.

- In the second step, we weight the results with the search volume of the respective keywords and the expected click probability of the corresponding position. Position eight on a very traffic-heavy keyword such as “headphones” may give a higher value than position one for the low volume “headphones in-ear white” search, for example.

- These weighted values for each ranking are then added up in step three. The sum of all these values results in the respective Visibility Index for Amazon. In each Visibility Index, a million visibility points are distributed among all. This calculation is done every day so that you can always fall back on fresh visibility values.

Brand and dealer Visibility Index

With the products that rank for keywords in the Amazon search, two relevant pieces of information are linked: on the one hand, the dealers who currently offer this product and, on the other hand, the brand of the product. We therefore calculate separate visibility values for retailers and brands.

We have now found products from more than 300,000 different brands. Of these, around 140,000 brands are currently (in early 2020) active with products that can be found for at least one of the monitored keywords. The 100 largest brands combine around 18% of the available visibility. For the 1,000 largest, this increases to 43% and the 10,000 most successful brands occupy just over 80% of the available brand visibility on Amazon. The brands with the highest brand Visibility Index on Amazon.co.uk currently include Samsung , Adidas , Nike , Sony , Fruit of the Loom, Disney but also AmazonBasics (top 100 list is here).

Of the almost 200,000 retailers ever found on Amazon, 130,000 retailers are currently (in early 2020) still actively offering products. Not surprisingly, Amazon itself is one of the most visible retailers on its own platform: Amazon accounts for almost 23% of retailer visibility. The 100 largest retailers (including Amazon) combine around 30% of retailer visibility. With the 1,000 most visible retailers this reaches 45%, while the top 10,000 occupy 77% of the available visibility in Amazon search. View the top 100 list of the most visible retailers on Amazon.co.uk.

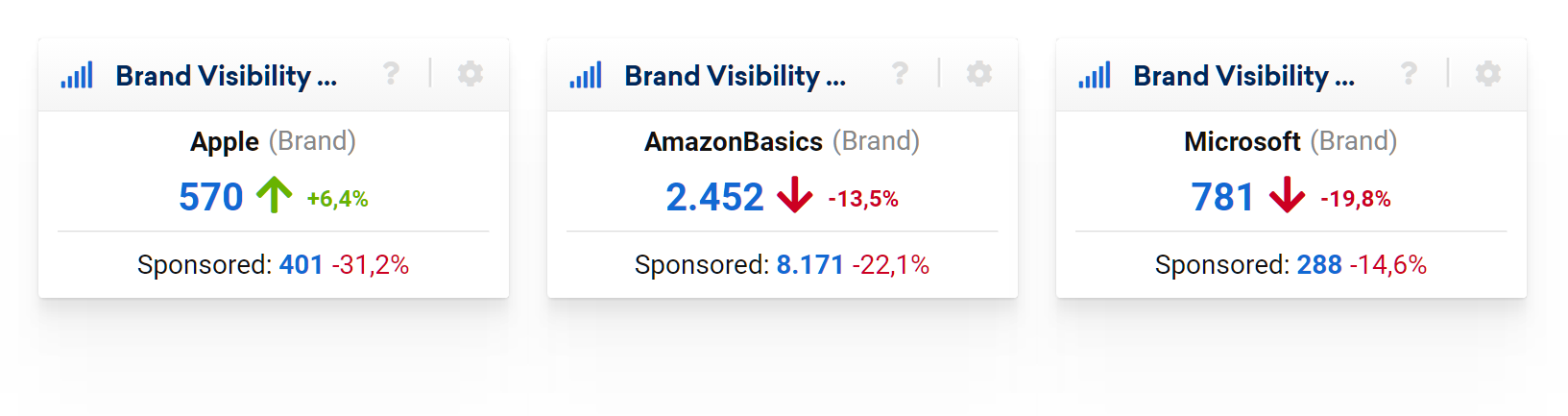

Organic, sponsored or combined

Amazon takes an opportunistic approach in regards to the distribution of places in search result lists; either the products found lead to revenue on Amazon via commissions or revenue is generated through the sale of advertising places.

This approach leads to the fact that, on the one hand, many paid search results can be found in the Amazon search and, on the other hand, these results are almost indistinguishable for many users from normal, organic results by their appearance. That’s why we decided to break down the Amazon visibility indices for retailers and brands in more detail:

- Organic : for this Visibility Index we only evaluate results that are organically displayed as normal, unpaid results from Amazon.

- Sponsored : Here we only rate results that were paid for, i.e. that represent an advertisement. Amazon marks these results with a small, mostly grey “Sponsored” note.

- Combined : for this Visibility Index we combine both types of results: organic as well as sponsored / paid results are evaluated and included in the calculation of the combined Visibility Index.

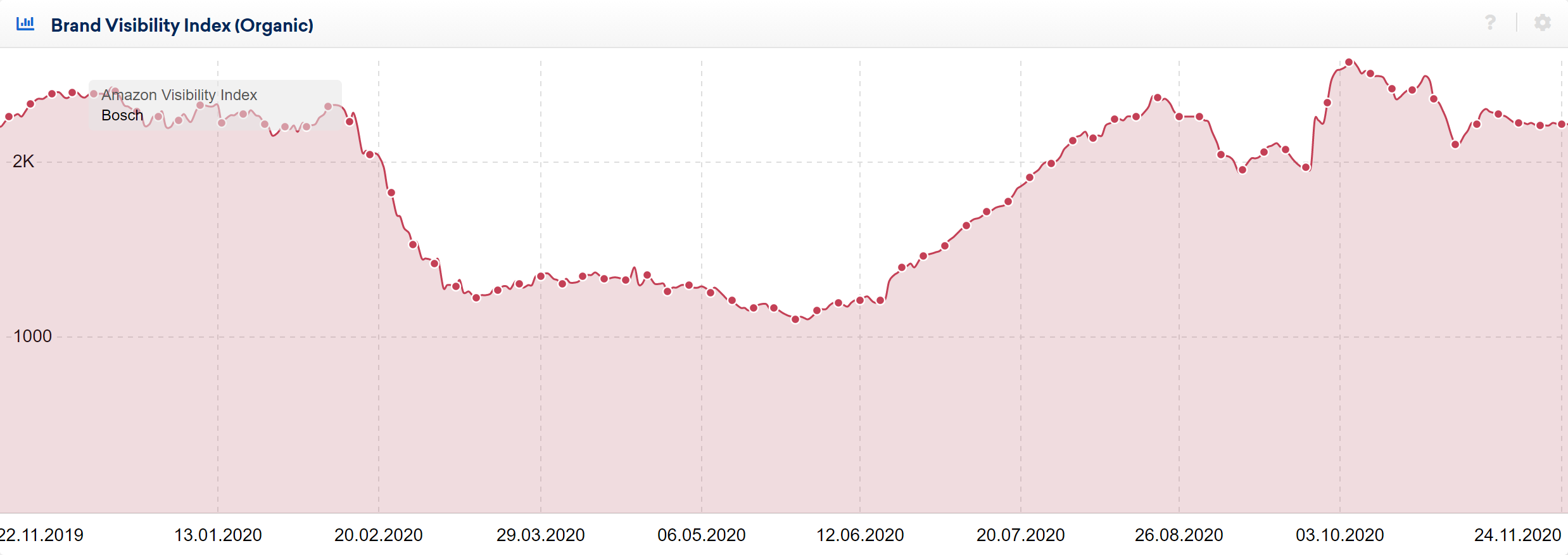

These three values are recalculated daily for both brands and retailers. You can find them in the Marketplace module of the Toolbox under the menu item “ Visibility Index ” in three diagrams with their respective historical progress.

Supported countries

While the marketplace module of the toolbox originally only started with data from the German Amazon.de marketplace, we now support the five big European countries :

England (amazon.co.uk), Germany (amazon.de), France (amazon .fr), Italy (amazon.it) and Spain (amazon.es). All functions of the module are available for all five markets. Historical data has been available for Germany since 2016 and for the other countries since 2019.

Strengths and Limits

As a key indicator, the SISTRIX Visibility Index for Amazon condenses the success of a brand or a retailer in the Amazon search to one value. The Visibility Index is ideal for measuring and comparing the success of Amazon SEO measures. It can also be used to examine changes in the Amazon A9 search algorithm.

Comparison with competitors is easy using the Visibility Index. Is Brand A or Brand B more visible on Amazon? The SISTRIX Visibility Index can answer this question without any doubt – without having to access the accounts of brands or dealers. The key figure is available for all brands and all retailers.

With a statistically clean approach, comparisons over time are easily possible. How has the Amazon visibility of individual retailers or brands developed in recent years – which measures have worked and how? This is where the SISTRIX Visibility Index for Amazon shows its strengths.

The Visibility Index is explicitly not designed as an indicator for traffic or visitor numbers. By using annual averages for search volumes and click distributions, short-term changes in demand or user behaviour have no effect on the Visibility Index. This is the only way to clearly separate the cause and effect of optimization measures.

The SISTRIX Visibility Index for Amazon is also not a key figure for the number of sales. It is true that products that are bought more often also rank better in the Amazon search – the visibility does not allow any direct conclusions about the number of sales. Key figures such as the bestseller rank are better suited for this.